First Quarter 2017 Sales Increased

9.6%

First Quarter Diluted EPS Improved to

$0.20

Funded Debt Decreased 75.8% Year-over-Year

to $5.2 Million

Rocky Brands, Inc. (NASDAQ:RCKY) today announced financial

results for its first quarter ended March 31, 2017.

First Quarter 2017 Sales and

Income

First quarter net sales increased 9.6% to $63.1 million compared

to $57.5 million in the first quarter of 2016. The Company reported

first quarter net income of $1.5 million, or $0.20 per diluted

share compared to a net loss of $0.2 million, or ($0.03) per

diluted share in the first quarter of 2016.

Mike Brooks, Chairman and Chief Executive Officer, commented,

“Our first quarter results represent a solid start to 2017. We

achieved approximately 10% top-line growth by more than doubling

our military segment sales to a quarterly record $12 million.

Importantly, we were able to fulfill this significant increase in

military footwear demand at margins well above the last half of

2016 due to improved efficiencies at our company-operated

production facility in Puerto Rico. At the same time, sales trends

in our wholesale segment have stabilized, particularly in Work and

Western, our two largest categories. On top of this, wholesale

gross margins improved meaningfully year-over-year driven by a

higher mix of full priced selling. The actions we have taken over

the past six months to better position the company for profitable

growth are clearly gaining traction. While there is still work

ahead of us in order to maximize shareholder value over the

long-term, we are confident we are heading in the right

direction.”

First Quarter Review

Net sales for the first quarter increased 9.6% to $63.1 million

compared to $57.5 million a year ago. Wholesale sales for the first

quarter were $39.2 million compared to $40.2 million for the same

period in 2016. Retail sales for the first quarter were $11.9

million compared to $11.5 million for the same period last year.

Military segment sales for the first quarter increased 107% to

$12.0 million compared to $5.8 million in the first quarter of

2016.

Gross margin in the first quarter of 2017 increased to $19.7

million, or 31.3% of sales, compared to $18.9 million, or 32.9% of

sales, for the same period last year. The 160 basis point decrease

was driven by the increase in military segment sales which carry

lower gross margins than our wholesale and retail segments.

Selling, general and administrative (SG&A) expenses

decreased to $17.4 million, or 27.6% of net sales, for the first

quarter of 2017 compared to $19.1 million, or 33.3% of net sales, a

year ago. The $1.7 million decrease in SG&A expenses was

primarily related to lower compensation expense following the

workforce reductions in the second half of 2016.

Income from operations was $2.4 million, or 3.8% of net sales

compared to a loss from operations of $0.2 million a year ago.

Interest expense was $90,000 for the first quarter of 2017,

versus $136,000 for the same period last year.

The Company’s funded debt decreased $16.4 million, or 75.8% to

$5.2 million at March 31, 2017 versus $21.6 million at March 31,

2016.

Inventory at March 31, 2017 decreased 18.6% to $68.8 million

compared to $84.5 million on the same date a year ago.

Conference Call

Information

The Company’s conference call to review first quarter 2017

results will be broadcast live over the internet today, Thursday,

April 20, 2017 at 4:30 pm Eastern Time. The broadcast will be

hosted at http://www.rockybrands.com.

About Rocky Brands, Inc.

Rocky Brands, Inc. is a leading designer, manufacturer and

marketer of premium quality footwear and apparel marketed under a

portfolio of well recognized brand names including Rocky®, Georgia

Boot®, Durango®, Lehigh®, Creative Recreation®, and the licensed

brand Michelin®.

Safe Harbor Language

This press release contains certain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities and Exchange Act of

1934, as amended, which are intended to be covered by the safe

harbors created thereby. Those statements include, but may not be

limited to, all statements regarding intent, beliefs, expectations,

projections, forecasts, and plans of the Company and its

management. These forward-looking statements involve numerous risks

and uncertainties, including, without limitation, the various risks

inherent in the Company’s business as set forth in periodic reports

filed with the Securities and Exchange Commission, including the

Company’s annual report on Form 10-K for the year ended December

31, 2016 (filed March 9, 2017). One or more of these factors have

affected historical results, and could in the future affect the

Company’s businesses and financial results in future periods and

could cause actual results to differ materially from plans and

projections. Therefore there can be no assurance that the

forward-looking statements included in this press release will

prove to be accurate. In light of the significant uncertainties

inherent in the forward-looking statements included herein, the

Company, or any other person should not regard the inclusion of

such information as a representation that the objectives and plans

of the Company will be achieved. All forward-looking statements

made in this press release are based on information presently

available to the management of the Company. The Company assumes no

obligation to update any forward-looking statements.

Rocky Brands, Inc. and

SubsidiariesCondensed Consolidated Balance Sheets

March 31, 2017

December 31, 2016 March 31, 2016 Unaudited Audited Unaudited

ASSETS: CURRENT ASSETS: Cash and cash equivalents $

2,693,078 $ 4,480,505 $ 3,716,716 Trade receivables – net

39,131,277 40,844,583 38,253,999 Other receivables 768,729 688,251

597,343 Inventories 68,819,390 69,168,442 84,502,529 Income tax

receivable - 1,243,678 1,214,755 Prepaid expenses 2,619,898

2,354,107 3,073,814 Total current assets 114,032,372

118,779,566 131,359,156 FIXED ASSETS – net 25,633,199 26,511,493

28,103,995 IDENTIFIED INTANGIBLES 33,383,261 33,415,694 36,514,458

OTHER ASSETS 225,670 232,509 253,621 TOTAL

ASSETS $ 173,274,502 $ 178,939,262 $ 196,231,230

LIABILITIES AND SHAREHOLDERS' EQUITY: CURRENT LIABILITIES:

Accounts payable $ 14,620,330 $ 11,589,040 $ 15,044,942 Accrued

other expenses: 6,931,149 6,130,871 6,085,947

Total current liabilities 21,551,479 17,719,911 21,130,889

LONG TERM DEBT 5,240,000 14,584,008 21,649,319 DEFERRED INCOME

TAXES 10,464,436 11,365,800 11,968,791 DEFERRED LIABILITIES

176,219 176,219 265,262 TOTAL LIABILITIES

37,432,134 43,845,938 55,014,261 SHAREHOLDERS' EQUITY:

Common stock, no par value;

25,000,000 shares authorized; issued and

outstandingMarch 31, 2017 - 7,435,467; December 31, 2016

-7,421,455; March 31, 2016 - 7,583,901

69,362,641

69,291,637

71,004,499

Retained earnings 66,479,727 65,801,687

70,212,470 Total shareholders' equity 135,842,368

135,093,324 141,216,969 TOTAL LIABILITIES AND

SHAREHOLDERS' EQUITY $ 173,274,502 $ 178,939,262 $ 196,231,230

Rocky Brands, Inc. and

SubsidiariesCondensed Consolidated Statements of

Operations

Three Months Ended March 31, 2017

2016 Unaudited Unaudited NET SALES $

63,072,954 $ 57,529,945 COST OF GOODS SOLD 43,324,874

38,619,053 GROSS MARGIN 19,748,080

18,910,892 SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

17,381,909 19,131,894 INCOME

(LOSS) FROM OPERATIONS 2,366,171 (221,002 ) OTHER INCOME AND

(EXPENSES): Interest expense (90,466 ) (135,976 ) Other – net

(9,764 ) 67,528 Total other - net (100,230 )

(68,448 ) INCOME (LOSS) BEFORE INCOME TAXES 2,265,941

(289,450 ) INCOME TAX EXPENSE (BENEFIT) 770,000

(98,000 ) NET INCOME (LOSS) $ 1,495,941

$ (191,450 ) INCOME (LOSS) PER SHARE Basic $ 0.20 $ (0.03 )

Diluted $ 0.20 $ (0.03 ) WEIGHTED AVERAGE NUMBER OF COMMON

SHARES OUTSTANDING Basic 7,435,000 7,583,170

Diluted 7,436,788 7,583,170

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170420006243/en/

Rocky Brands, Inc.Tom Robertson, 740-753-1951Chief

Financial OfficerorInvestor Relations:ICR, Inc.Brendon Frey,

203-682-8200

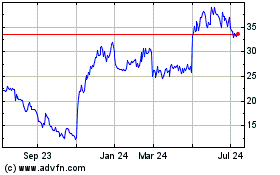

Rocky Brands (NASDAQ:RCKY)

Historical Stock Chart

From Mar 2024 to Apr 2024

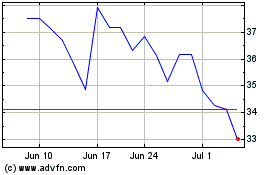

Rocky Brands (NASDAQ:RCKY)

Historical Stock Chart

From Apr 2023 to Apr 2024