TIDMRKH

RNS Number : 8377Z

Rockhopper Exploration plc

16 December 2014

16 December 2014

Rockhopper Exploration plc

("Rockhopper" or the "Company")

Interim Results for the Six Months Ended 30 September 2014

Rockhopper Exploration plc (AIM: RKH), the oil and gas

exploration and production company with interests in the North

Falkland Basin and the Greater Mediterranean region, is pleased to

announce its interim results for the six months ended 30 September

2014.

Operational and Financial Highlights

-- Phased, lower cost development solution adopted for the Sea Lion field

-- Revised commercial arrangements agreed with Premier Oil

(subject to documentation and board approvals)

-- Rig secured for four well exploration drilling campaign in

North Falkland Basin - targeting spud on first well in early March

2015

-- Completion of recommended offer for Mediterranean Oil & Gas plc

-- Progressing recently acquired Greater Mediterranean portfolio

o Plans advancing to increase production at Guendalina gas

field

o Civita onshore gas development project sanctioned

o Participation in Montenegro and Croatian licence rounds

-- Cash resources at 30 September 2014 of $205 million

As previously announced, the Company's accounting reference date

is being changed from 31 March to 31 December and as a result the

next audited financial statements to be published will be for the 9

month period to 31 December 2014.

Pierre Jungels, Chairman of Rockhopper, commented:

"Adoption of a phased lower cost development solution for Sea

Lion, together with revised commercial arrangements with Premier,

significantly de-risks the development and allows us to move

towards project sanction without the need to bring in a third

party. While the expected date for project sanction has been

delayed to mid 2016, we continue to target first oil during

2019.

With the multi-operator drilling programme in the North Falkland

Basin expected to start in the first quarter next year, the four

firm wells in which Rockhopper has an equity interest will target a

total of approximately 160 mmbbls of prospective resources (Pmean)

net to Rockhopper with further upside in the Isobel/Elaine

region.

Since completion of the MOG takeover in August, encouraging

progress has been made in our recently acquired Mediterranean

portfolio - we will continue to grow that business in a low-cost,

value accretive manner."

For further information, please contact:

Rockhopper Exploration plc

Tel: (via Vigo Communications) - 020 7016 9571

Sam Moody - Chief Executive

Stewart MacDonald - Chief Financial Officer

Canaccord Genuity Limited (NOMAD and Joint Broker)

Tel: 020 7523 8000

Henry Fitzgerald-O'Connor

Liberum Capital (Joint Broker)

Tel: 020 3100 2227

Clayton Bush

Vigo Communications

Tel: 020 7016 9571

Peter Reilly

Patrick d'Ancona

CHAIRMAN'S AND CHIEF EXECUTIVE OFFICER'S REVIEW

When we last wrote to you in June, we remarked that the year

ahead had the potential to be transformational for your company.

Since that time, and despite a material fall in the global price

for oil, the company continues to make significant progress on the

delivery of its strategy.

Phased, lower cost development concept for Sea Lion

In response to the fall in oil prices, Rockhopper and Premier

have agreed to adopt a phased, lower cost development solution for

the Sea Lion field with the initial phase targeting the

commercialisation of approximately 160 mmbbls in the North East

segment of the field, located in licence PL032.

The concept is likely to consist of 10-15 wells in total with

production via a leased floating, production, storage and

offloading vessel ("FPSO") and will target a gross plateau of

approximately 50,000 to 60,000 barrels of oil per day. Cost to

first oil for the initial phase is anticipated at less than $2

billion, significantly less than previous estimates for the TLP

concept.

Importantly, Premier has confirmed that a project of this size

can be funded from existing facilities and cash flows and that a

farm-out is no longer a pre-requisite to sanction the project. As a

result of the change in concept, sanction for Sea Lion has been

delayed to mid 2016 although Rockhopper continues to target first

oil in 2019.

Subsequent phases of the development, which will require

separate project sanction, will then target the remaining resources

in PL032, the already discovered resources in PL004 and any

potential additional resources discovered during the 2015

exploration campaign.

In light of the move to a phased development, Rockhopper and

Premier have agreed to amend their commercial arrangements. Details

are outlined below, but most importantly, Rockhopper remains fully

funded through a combination of Development Carry and amended loan

from Premier.

Proposed revised commercial terms (subject to documentation and

respective board approvals)

-- Rockhopper to access the full $48 million Exploration Carry

for the 2015 drilling campaign

-- Rockhopper to contribute 40% of pre sanction costs, currently

estimated at $100 million gross

-- Rockhopper to retain $337 million Development Carry for the

initial phase; a further $337 million Development Carry deferred to

the next phase of development

-- Existing Standby Finance arrangements to be simplified to a

more traditional loan structure of up to $750 million from

Premier

Rockhopper's anticipated net cash outflow for Falklands

activities during 2015 remains in line with previous guidance at

approximately $50-70 million.

As a consequence of the move to a phased development, Rockhopper

and Premier are seeking an extension to the licence term from

FIG.

North Falkland exploration campaign imminent

On the exploration front, we are very excited that a rig has

been contracted to drill four high impact exploration wells in the

North Falkland Basin during 2015. The rig is currently due to

arrive in the Falklands as early as March 2015 with the first well

in the programme targeting the Zebedee prospect.

Recently acquired Mediterranean portfolio

Outside of the Falklands, in August we completed the acquisition

of AIM listed Mediterranean Oil & Gas plc ("MOG"). Through MOG,

Rockhopper acquired a portfolio of production, development and

exploration interests in Italy, Malta and France with a combined 2C

contingent resource of over 32 mmboe at an acquisition price of

less than $1 per barrel.

Since the acquisition of MOG, Rockhopper has made good progress

in advancing the portfolio including progressing options to

increase production at the offshore Guendalina gas field,

sanctioning the Civita onshore gas development and the application

for licences in Montenegro and Croatia.

In November the Italian government passed new legislation

through the Parliament which should accelerate planning processes

and allow development projects in the country to progress.

Outlook

Adoption of a phased lower cost development solution for Sea

Lion, together with revised commercial arrangements with Premier,

significantly de-risks the development and allows us to move

towards project sanction without the need to bring in a third

party. While the expected date for project sanction has been

delayed to mid 2016, we continue to target first oil during

2019.

With the multi-operator drilling programme in the North Falkland

Basin expected to start in the first quarter next year, the four

firm wells in which Rockhopper has an equity interest will target a

total of approximately 160 mmbbls of prospective resources (Pmean)

net to Rockhopper with further upside in the Isobel/Elaine

region.

Since completion of the MOG takeover in August, encouraging

progress has been made in our recently acquired Mediterranean

portfolio - we will continue to grow that business in a low-cost,

value accretive manner.

DR PIERRE JUNGELS CBE SAMUEL MOODY

CHAIRMAN CHIEF EXECUTIVE OFFICER

15 DECEMBER 2014

CHIEF OPERATING OFFICER'S REVIEW

Overview

In addition to the exciting high impact four well exploration

programme in the North Falkland Basin which has the potential to

double our net resources, Rockhopper will also have a busy year in

its Greater Mediterranean region as we build our presence in our

second core area in line with our strategy.

Italy

Onshore Italy in the 100% operated Aglavizza production

concession we now have the final regional approvals enabling

commencement of procurement and construction of the production

facilities and pipeline from the Civita-1 wellhead through to the

main gas pipeline entry point. First production from the Civita

field is expected in H2 2015.

Technical work for this licence area is now focused on

identification of additional drilling locations within the

development concession allowing further low cost, high return

activity.

Elsewhere in Italy we are working closely with ENI to sidetrack

one of the two gas production wells on the Guendalina Field located

offshore in the Northern Adriatic that has been shut in following

damage to the wellbore experienced in 2012. The sidetrack is

anticipated to restore production to close to the pre-damage levels

(possibly to more than double the production rates today) and is

currently scheduled to commence in Q4 2015.

The Ombrina Mare project offshore Italy in the Abruzzo region is

still anticipating determination of the AIA (Integrated

Environmental Assessment) submission in January 2015. In the case

of a successful outcome we will be commencing the final award

process of the production concession with the Ministry of Economic

Development in Q1 2015.

Malta

In Malta we have informed the Ministry that we will be

withdrawing from the Area 4 licence at the end of the first

exploration phase on the 18th January 2015 following the

integration of the results of the Hagar Qim well drilled in Q2/Q3

2014.

Elsewhere, in Area 3 the processing of the 2D broadband survey

is nearing completion and its interpretation will enable a decision

on whether an extension to the Exploration Study Agreement with a

3D survey commitment will be made.

Croatia and Montenegro

Rockhopper has applied for acreage in the first offshore

licencing rounds in Croatia and Montenegro. The outcomes of such

applications are expected later this month in the case of Croatia

and early 2015 for Montenegro.

Asset Integration

We are delighted with the progress achieved in our review and

integration of the assets since the completion of the acquisition

of MOG in August and 2015 will be an important year to consolidate

activities in the region.

FIONA MACAULAY

CHIEF OPERATING OFFICER

15 DECEMBER 2014

CHIEF FINANCIAL OFFICER'S REVIEW

Overview

From an accounting perspective, the main event during the period

was the acquisition of Mediterranean Oil & Gas Plc ("the

Acquisition"), an AIM listed exploration and production company

with operations in the Greater Mediterranean region. This has had a

material impact on the balance sheet of the group, particularly

with the addition of production assets, goodwill arising on

acquisition as well as a long term decommissioning provision in

relation to the production assets.

Income Statement

The loss before tax for the period remained level at $3

million.

The revenue of $1 million reflects the gas sales since

acquisition from the former MOG group's production assets. After

cost of sales, the gross profit largely covers the incremental

administrative expenses of the now enlarged group.

Exploration and evaluation expenses remained broadly level with

the prior period.

Administrative expenses have increased by $3 million to $6

million. This primarily relates to non-recurring advisory and legal

fees in relation to the Acquisition in the period as well as the

aforementioned incremental administrative costs of the acquired

Mediterranean operations based in Rome.

The share based payment charge has reduced slightly in the

period, but additional share based incentives were awarded after

the period end under the company's Long Term Incentive Plan and so

the charge is expected to increase in future periods.

Foreign exchange translation gave rise to a $3 million gain in

the period and this is almost entirely due to the tax liability,

arising from the farm out in 2012, being a sterling denominated

balance. Whilst this liability is partially offset by sterling

denominated cash balances, following the Acquisition in the period

the majority of the group's balances are dollar denominated.

Finance income has decreased significantly during the period.

This is due to a decline in deposit rates as well as the average

cash balances held during the current period being reduced. Returns

on deposits are expected to be similarly flat during the remainder

of the period to 31 December 2014.

There has been no tax charge during the period.

Statement of Comprehensive Income

The functional currency of the newly acquired MOG group is

euros. As such the assets and liabilities are translated at the

exchange rate at the end of the reporting period and income and

expenses are translated at exchange rates at the dates of the

relevant transactions. The resulting exchange differences, $3

million loss during the period, are recognised in the Statement of

Comprehensive Income and taken to the Foreign Currency Translation

Reserve.

Balance Sheet

The main movements during the period relate to the Acquisition

and the provisional fair value of the assets and liabilities

assumed as disclosed in note 6 Acquisition of subsidiaries.

As well as the acquired exploration and evaluation assets, the

group capitalised $8 million of expenditure relating to the

Falkland Island licences. Of this, $7 million related to

Rockhopper's share, net of carry, of long lead items for the 2015

exploration campaign. Rockhopper's share of costs in relation to

the Sea Lion development during the period was covered by the

development carry from Premier, however $1 million was spent on

independent validation studies and capitalised staff costs.

The increase in property, plant and equipment almost entirely

relates to the fair value of the acquired production assets.

Inventories relate to wellheads and casing acquired as part of

the Acquisition, with the majority of it being earmarked for a

potential exploration well on the Monte Grosso licence.

Other receivables have increased by $3 million. Again the

increase is in relation to the newly acquired Mediterranean

business. As operator in the Mediterranean region of a number of

production assets the increase in receivables is expected to be

consistent going forward.

Other payables, for the same reason as other receivables, have

increased by $4 million.

Current tax payable remains at GBP64 million although in dollar

terms this has reduced to $105 million from $107 million at the

year end. This movement is entirely due to a foreign exchange gain

on the tax liability which is a sterling denominated balance. The

company continues to engage in active and constructive dialogue

with the Falkland Islands Government on the CGT position.

Documentation of the agreement in principle in relation to this has

progressed and is expected to be agreed in the near future.

Resources available are $205 million consisting of term deposits

of $130 million and cash and cash equivalents of $75 million. This

is a reduction of $42 million from the position at 31 March 2014

with the majority of this being the $24 million of net cash outflow

on acquisition of MOG, $8 million in relation to intangible

additions described above, $5 million of operating cash outflows

including the $2 million of fees in relation to the Acquisition and

$5 million in working capital adjustments.

The Acquisition was partly funded through a new issue of

Rockhopper ordinary shares. The premium on these shares of $11

million, based on the market value at the closing market price on

the last trading day before the deal became effective, has been

credited to the Merger Reserve. Other movements relate to share

options exercised during the period as well as shares awarded as

part of the staff Share Incentive Plan.

As previously announced, the Company's accounting reference date

is being changed from 31 March to 31 December and as a result the

next audited financial statements to be published will be for the 9

month period to 31 December 2014.

OUTLOOK

With $205 million of cash on our balance sheet, we have the

resources to fund the near term expenditure required for our share,

after carries, of the upcoming 2015 Falkland exploration campaign

and Sea Lion pre-sanction costs, which in aggregate are estimated

at $50-70 million. Whilst Rockhopper is fully funded post project

sanction through the development carry and the replacement loan

from Premier, work continues investigating the merits of reserve

based lending to potentially improve on the terms available through

these existing agreements. In addition, we have the resources and

technical ability to maximise the value in the portfolio of assets

acquired as part of the MOG acquisition.

STEWART MACDONALD

CHIEF FINANCIAL OFFICER

15 DECEMBER 2014

Group income statement

for the six months ended 30 september 2014

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2014 2013 2014

Unaudited Unaudited Audited

Notes $'000 $'000 $'000

--------------------------------------------------------------------- ------ ------------- ------------- ---------

Revenue 821 - -

Cost of sales (286) - -

--------------------------------------------------------------------- ------ ------------- ------------- ---------

Gross Profit 535 - -

--------------------------------------------------------------------- ------ ------------- ------------- ---------

Exploration and evaluation expenses (795) (623) (1,461)

--------------------------------------------------------------------- ------ ------------- ------------- ---------

Costs in relation to acquisition (1,899) - -

Other administrative costs (3,860) (3,003) (12,341)

--------------------------------------------------------------------- ------ ------------- ------------- ---------

Total administrative expenses (5,759) (3,003) (12,341)

Charge for share based payments (335) (288) (797)

Foreign exchange movement 2,723 (315) (2,631)

--------------------------------------------------------------------- ------ ------------- ------------- ---------

Results from operating activities (3,631) (4,229) (17,230)

Finance income 411 836 1,499

--------------------------------------------------------------------- ------ ------------- ------------- ---------

Loss before tax (3,220) (3,393) (15,731)

Tax 3 - (54,430) (62,542)

--------------------------------------------------------------------- ------ ------------- ------------- ---------

Loss for the period/year attributable to the equity shareholders of

the parent company (3,220) (57,823) (78,273)

--------------------------------------------------------------------- ------ ------------- ------------- ---------

Loss per share: cents (basic & diluted) 4 (1.12) (20.34) (27.54)

--------------------------------------------------------------------- ------ ------------- ------------- ---------

All operating income and operating gains and losses relate to

continuing activities.

Group statement of comprehensive income

for the six months ended 30 September 2014

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2014 2013 2014

Unaudited Unaudited Audited

Notes $'000 $'000 $'000

------------------------------------------------ ------- ------------- ------------- ---------

Loss for the period/year (3,220) (57,823) (78,273)

Other comprehensive income for the period/year (2,563) -- -

------------------------------------------------ ------- ------------- ------------- ---------

TOTAL COMPREHENSIVE INCOME FOR THE period/YEAR (5,783) (57,823) (78,273)

--------------------------------------------------------- ------------- ------------- ---------

Group balance sheet

as at 30 September 2014

As at As at As at

30 September 30 September 31 March

2014 2013 2014

Unaudited Unaudited Audited

-------------------------------------------------------- ------ ------------- ------------- ----------

Notes $'000 $'000 $'000

NON CURRENT Assets

Intangible exploration and evaluation assets 5 191,075 152,215 153,656

Property, plant and equipment 15,077 463 353

Goodwill 6 11,419 - -

Other receivables 591 - -

CURRENT Assets

Inventories 2,537 - -

Other receivables 5,064 1,826 1,932

Restricted cash 556 300 309

Term deposits 130,000 150,000 185,000

Cash and cash equivalents 75,463 108,782 62,482

-------------------------------------------------------- ------ ------------- ------------- ----------

Total assets 431,782 413,586 403,732

-------------------------------------------------------- ------ ------------- ------------- ----------

CURRENT Liabilities

Other payables 4,803 1,226 3,084

Tax payable 7 104,501 3,109 107,056

NON-CURRENT Liabilities

Tax payable 7 - 95,731 -

Provisions 22,553 - -

Deferred tax liability 39,137 39,137 39,137

-------------------------------------------------------- ------ ------------- ------------- ----------

Total liabilities 170,994 139,203 149,277

-------------------------------------------------------- ------ ------------- ------------- ----------

Equity

Share capital 4,845 4,711 4,711

Share premium 491 55 170

Share based remuneration 4,710 4,287 4,597

Shares held by SIP trust (383) (252) (354)

Merger reserve 11,112 (243) (243)

Foreign currency translation reserve 1,560 4,123 4,123

Special reserve 541,964 578,759 541,964

Retained losses (303,511) (317,057) (300,513)

-------------------------------------------------------- ------ ------------- ------------- ----------

Attributable to the equity shareholders of the company 260,788 274,383 254,455

-------------------------------------------------------- ------ ------------- ------------- ----------

Total liabilities and equity 431,782 413,586 403,732

-------------------------------------------------------- ------ ------------- ------------- ----------

These financial statements were approved by the directors and

authorised for issue on 15 December 2014 and are signed on their

behalf by:

StEWART MAcDONALD

CHIEF FINANCIAL OFFICER

Group statement of changes in equity

for the six months ended 30 september 2014

Foreign

Currency

Shares

Share Share Share based held Merger Translation Special Retained Total

---------------

by SIP

capital premium remuneration trust reserve Reserve reserve losses equity

For the six

months ended

30 September

2014 $'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

--------------- -------- -------- ------------- ---------- -------- ------------ -------- ---------- --------

Balance at 1

April 2014 4,711 170 4,597 (354) (243) 4,123 541,964 (300,513) 254,455

Total

comprehensive

income for

the period - - - - - (2,563) - (3,220) (5,783)

Acquisition of

subsidiary 126 - - - 11,355 - - - 11,481

Share based

payments - - 335 - - - - - 335

Shares issues

in relation

to SIP 1 48 - (29) - - - - 20

Exercise of

share options 7 273 (222) - - - - 222 280

--------------- -------- -------- ------------- ---------- -------- ------------ -------- ---------- --------

Total

contributions

by owners 134 321 113 (29) - - - - 539

--------------- -------- -------- ------------- ---------- -------- ------------ -------- ---------- --------

Balance at 30

September

2014 4,845 491 4,710 (383) 11,112 1,560 541,964 (303,511) 260,788

--------------- -------- -------- ------------- ---------- -------- ------------ -------- ---------- --------

Foreign

currency

Shares

Share Share Share based held Merger translation Special Retained Total

---------------

by SIP

capital premium remuneration trust reserve reserve reserve losses equity

For the six

months ended

30 September

2013 $'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

--------------- -------- ---------- ------------- ------- -------- ------------ -------- ---------- ---------

Balance at 1

April 2013 4,710 578,754 3,999 (212) (243) 4,123 - (259,234) 331,897

Total

comprehensive

income for

the period - - - - - - - (57,823) (57,823)

Share based

payments - - 288 - - - - - 288

Shares issues

in relation

to SIP 1 60 - (40) - - - - 21

Cancellation

of share

premium

account - (578,759) - - - - 578,759 - -

--------------- -------- ---------- ------------- ------- -------- ------------ -------- ---------- ---------

Total

contributions

by owners 1 60 288 (40) - - - - 309

--------------- -------- ---------- ------------- ------- -------- ------------ -------- ---------- ---------

Balance at 30

September

2013 4,711 55 4,287 (252) (243) 4,123 578,759 (317,057) 274,383

--------------- -------- ---------- ------------- ------- -------- ------------ -------- ---------- ---------

Foreign

currency

Shares

Share Share Share based held Merger translation Special Retained Total

---------------

by SIP

capital premium remuneration trust reserve reserve reserve losses equity

For the year

ended

31 March 2014 $'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

--------------- -------- ---------- ------------- ------- -------- ------------ -------- ---------- ---------

Balance at 1

April 2013 4,710 578,754 3,999 (212) (243) 4,123 - (259,234) 331,897

Total

comprehensive

loss for the

year - - - - - - - (78,273) (78,273)

Share based

payments - - 797 - - - - - 797

Share issues

in relation

to SIP 1 175 - (142) - - - - 34

Cancellation

of share

premium

account - (578,759) - - - - 541,964 36,795 -

Exercise of

SARs - - (199) - - - - 199 -

--------------- -------- ---------- ------------- ------- -------- ------------ -------- ---------- ---------

Total

contributions

by owners 1 175 598 (142) - - - 199 831

--------------- -------- ---------- ------------- ------- -------- ------------ -------- ---------- ---------

Balance at 31

March 2014 4,711 170 4,597 (354) (243) 4,123 541,964 (300,513) 254,455

--------------- -------- ---------- ------------- ------- -------- ------------ -------- ---------- ---------

Group cash flow statement

for the six months ended 30 September 2014

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2014 2013 2014

Unaudited Unaudited Audited

Notes $'000 $'000 $'000

------------------------------------------------------------------- ------- ------------- ------------- ----------

Cash OUTflows from operating activities

Net loss after tax (3,220) (3,393) (15,731)

Adjustments to reconcile net losses to cash utilised

Depreciation 319 148 282

Share based payment charge 335 288 797

Exploration impairment expenses - 2 2

Loss on disposal of tangible fixed assets - 13 13

Interest (276) (517) (1,003)

Foreign exchange (2,618) 329 2,672

---------------------------------------------------------------------------- ------------- ------------- ----------

Operating cash flows before movements in working capital (5,460) (3,130) (12,968)

Changes in:

Other receivables 1,246 172 (325)

Payables (6,010) (1,386) 459

---------------------------------------------------------------------------- ------------- ------------- ----------

Cash utilised by operating activities (10,224) (4,344) (12,834)

---------------------------------------------------------------------------- ------------- ------------- ----------

Cash OUTflows from investing activities

Capitalised expenditure on exploration and evaluation assets (7,735) (1,047) (2,485)

Purchase of equipment (231) (41) (65)

Acquisition of subsidiary (24,037) - -

Proceeds on disposal of exploration and evaluation assets - 655 665

Interest 343 78 955

Taxation - (37,206) (40,382)

---------------------------------------------------------------------------- ------------- ------------- ----------

Investing cash flows before movements in capital balances (31,660) (37,561) (41,312)

Changes in:

Payments on account - - -

Restricted cash (128) - -

Term deposits 55,000 (69,623) (104,623)

---------------------------------------------------------------------------- ------------- ------------- ----------

Cash utilised by investing activities 23,212 (107,184) (145,935)

---------------------------------------------------------------------------- ------------- ------------- ----------

Cash INflows from financing activities

Share options exercised 280 - -

Share incentive plan 20 21 34

---------------------------------------------------------------------------- ------------- ------------- ----------

Cash generated from financing activities 300 21 34

---------------------------------------------------------------------------- ------------- ------------- ----------

Currency translation differences relating to cash and cash equivalents (307) 2,925 3,853

Net cash inflow/(outflow) 13,288 (111,507) (158,735)

Cash and cash equivalents brought forward 62,482 217,364 217,364

---------------------------------------------------------------------------- ------------- ------------- ----------

Cash and cash equivalents carried forward 75,463 108,782 62,482

---------------------------------------------------------------------------- ------------- ------------- ----------

Notes to the condensed group financial statements

for the six months ended 30 september 2014

1 Accounting policies

1.1 Group and its operations

Rockhopper Exploration plc ('the company'), a public limited

company quoted on AIM, incorporated and domiciled in the United

Kingdom ('UK'), together with its subsidiaries (collectively, 'the

group') holds certain exploration licences granted in 2004 and 2005

for the exploration and exploitation of oil and gas in the Falkland

Islands. During the period it diversified its portfolio through the

acquisition of an exploration and production company with

operations principally in Italy. The registered office of the

company is Hilltop Park, Devizes Road, Salisbury, SP3 4UF.

1.2 Statement of compliance

These condensed consolidated interim financial statements of the

group, as at and for the six months ended 30 September 2014,

include the results of the company and all subsidiaries over which

the company exercises control.

The condensed interim consolidated financial statements have

been prepared in accordance with International Accounting Standard

("IAS") 34 Interim Financial Reporting as adopted by the European

Union ("EU"). They do not include all information required for full

annual financial statements, and should be read in conjunction with

the consolidated financial statements of the company and all its

subsidiaries as at the year ended 31 March 2014.

The comparative figures for the financial year ended 31 March

2014 are not the company's statutory accounts for that financial

year. Those accounts have been reported on by the company's auditor

and delivered to the registrar of companies. The report of the

auditor was: (i) unqualified; (ii) did not include a reference to

any matters to which the auditor drew attention by way of emphasis

without qualifying his report; and (iii) did not contain a

statement under section 498 (2) or (3) of the Companies Act

2006.

The condensed interim consolidated financial statements were

approved by the Board on 15 December 2014.

1.3 Basis of preparation

The results upon which these financial statements have been

based were prepared using the accounting policies set out below.

These policies have been consistently applied unless otherwise

stated.

These consolidated financial statements have been prepared under

the historical cost convention except, as set out in the accounting

policies below, where certain items are included at fair value.

Items included in the results of each of the group's entities

are measured in the currency of the primary economic environment in

which that entity operates (the "functional currency"). The

functional currency of the group acquired during the period is

euros. All other members of the group have a functional currency of

US$.

All values are rounded to the nearest thousand dollars ($'000)

or thousand pounds (GBP'000), except when otherwise indicated.

1.4 Going concern

These condensed group interim financial statements have been

prepared on a going concern basis as the directors are confident

that the group has sufficient funds in order to continue in

operation for the foreseeable future.

1.5 period end exchange rates

The period end rates of exchange actually used were:

30 September 2014 30 September 2013 31 March 2014

----------- ------------------ ------------------ --------------

GBP : US$ 1.62 1.61 1.66

EUR: US$ 1.27 1.35 1.38

----------- ------------------ ------------------ --------------

2 Revenue and segmental information

Six months ended 30 September 2014

Falkland Greater

Islands Mediterranean Corporate Total

$'000 $'000 $'000 $'000

--------------------------------------------- --------- -------------- ---------- --------

Revenue - 821 - 821

Cost of sales - (286) - (286)

--------------------------------------------- --------- -------------- ---------- --------

Gross profit - 535 - 535

Exploration and evaluation expenses (507) - (288) (795)

--------------------------------------------- --------- -------------- ---------- --------

Costs in relation to acquisition - - (1,899) (1,899)

Other administrative costs (82) (618) (3,860) (1,899)

--------------------------------------------- --------- -------------- ---------- --------

Total administrative expenses (82) (618) (5,059) (5,759)

Charge for share based payments - - (335) (335)

Foreign exchange movement 2,556 78 89 2,723

--------------------------------------------- --------- -------------- ---------- --------

Results from operating activities 1,967 (5) (5,593) (3,631)

Finance income - - 411 411

--------------------------------------------- --------- -------------- ---------- --------

Loss before tax 1,967 (5) (5,182) (3,220)

Tax - - - -

--------------------------------------------- --------- -------------- ---------- --------

Loss for period 1,967 (5) (5,182) (3,220)

--------------------------------------------- --------- -------------- ---------- --------

Reporting segments assets 161,906 70,006 199,870 431,782

Reporting segments liabilities 143,638 25,395 1,961 170,994

Six months ended 30 September 2013

Falkland Greater

Islands Mediterranean Corporate Total

$'000 $'000 $'000 $'000

------------------------------------- --------- -------------- ---------- ---------

Revenue - - - -

Cost of sales - - - -

------------------------------------- --------- -------------- ---------- ---------

Gross profit - - - -

Exploration and evaluation expenses (573) - (50) (623)

Administrative expenses - - (3,003) (3,003)

Charge for share based payments - - (288) (288)

Foreign exchange movement (3,272) - 2,957 (315)

------------------------------------- --------- -------------- ---------- ---------

Results from operating activities (3,845) - (384) (4,229)

Finance income - - 836 836

------------------------------------- --------- -------------- ---------- ---------

Loss before tax (3,845) - 452 (3,393)

Tax (54,430) - - (54,430)

------------------------------------- --------- -------------- ---------- ---------

Loss/profit for period (58,275) - 452 (57,823)

------------------------------------- --------- -------------- ---------- ---------

Reporting segments assets 152,215 - 261,371 413,586

Reporting segments liabilities 137,977 - 1,226 139,203

3 Taxation

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2014 2013 2014

$'000 $'000 $'000

-------------------------------------- -------------- ------------- ---------

Current tax:

Overseas tax - - -

Adjustment in respect of prior years - 54,430 62,542

--------------------------------------- ------------- ------------- ---------

Total current tax - 54,430 62,542

--------------------------------------- ------------- ------------- ---------

Deferred tax:

Overseas tax - - -

-------------------------------------- -------------- ------------- ---------

Total deferred tax - - -

-------------------------------------- -------------- ------------- ---------

Tax on loss on ordinary activities - 54,430 62,542

--------------------------------------- ------------- ------------- ---------

4 Basic and diluted loss per share

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2014 2013 2014

Number Number Number

------------------------------------------------------- ------------- ------------- ------------

Shares in issue brought forward 284,316,698 284,224,774 284,224,774

Shares issued

- Issued on 1 April 2014 400,000 - -

- Issued in relation to acquisition on 12 August 2014 7,481,816 - -

- Issued under the SIP 31,514 32,760 91,924

-------------------------------------------------------- ------------- ------------- ------------

Shares in issue carried forward 292,230,028 284,257,534 284,316,698

-------------------------------------------------------- ------------- ------------- ------------

Weighted average shares in issue 286,773,957 284,232,815 284,251,566

-------------------------------------------------------- ------------- ------------- ------------

$'000 $'000 $'000

---------------------------------------------- -------- --------- ---------

Net loss after tax (3,220) (57,823) (78,273)

Basic and diluted net loss per share - cents (1.12) (20.34) (27.54)

----------------------------------------------- -------- --------- ---------

The calculation of the basic loss per share is based upon the

loss for the period and the weighted average shares in issue. At

the period end the group had the following unexercised options and

share appreciation rights in issue.

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2014 2013 2014

Number Number Number

--------------------------- ------------- ------------- ----------

Share options 4,090,840 4,490,840 4,490,840

Long term incentive plan 1,761,535 - 1,761,535

Share appreciation rights 1,420,531 3,671,966 1,454,434

---------------------------- ------------- ------------- ----------

However as the group is reporting a loss for all periods then in

accordance with IAS33 the share options are not considered dilutive

because the exercise of the share options would have the effect of

reducing the loss per share.

5 intangible exploration and evaluation assets

Additions during the period predominantly relate to the fair

value of acquired assets as disclosed in note 6.Other movements are

principally in relation to the group's interests in the Falkland

Islands, with $7 million being in relation to long lead items and

infrastructure for the 2015 exploration campaign and $1 million

relating to work undertaken on the Sea Lion development.

6 acquisition of subsidiaries

In August 2014 Rockhopper completed the acquisition of the

entire issued share capital of Mediterranean Oil & Gas Plc

("MOG").

MOG was an AIM quoted exploration and production company with

operations in Italy, Malta and France. The acquisition of MOG

provides Rockhopper with a low cost entry into the Greater

Mediterranean region as well as providing established production

and revenue. MOG produces natural gas onshore and offshore in Italy

and has a balanced portfolio of exploration, appraisal and

development opportunities with reserves and contingent resources of

32 mmboe.

Under the terms of the agreement announced on 23 May 2014,

shareholders of MOG received 4.875 pence in cash and 0.0172 shares

of the company per MOG share.

The transaction has been accounted for by the purchase method of

accounting with an effective date of 11 August 2014 being the date

on which the group gained control of MOG. Information in respect of

the assets and liabilities acquired and the fair value allocation

to the MOG assets in accordance with the provisions of "IFRS3 -

Business Combinations" has been determined on a provisional basis

and is as follows:

Provisional recognised values

on acquisition

$'000

------------------------------------------------------ ------------------------------

Intangible exploration and appraisal assets 30,288

Property, plant and equipment 15,663

Long term other receivables 625

Inventories 2,683

Trade and other receivables 4,634

Restricted cash 268

Trade and other payables (6,845)

Long-term provisions (23,872)

------------------------------------------------------ ------------------------------

Net identifiable assets and liabilities 23,444

Goodwill 12,074

------------------------------------------------------ ------------------------------

Satisfied by:

Cash ($35,700,000 less $11,663,000 of cash acquired) 24,037

Equity instruments 7,481,816 ordinary shares 11,481

------------------------------------------------------ ------------------------------

Total consideration 35,518

------------------------------------------------------ ------------------------------

All balances with the exception of cash have been valued on a

provisional basis pending completion of independent

verification.

The fair value of equity instruments has been determined by

reference to the closing share price on the trading day immediately

prior to the completion of the acquisition.

In addition there was a contingent consideration of up to a

maximum amount of 3.550 pence in cash for each MOG Share. The

availability of the contingent consideration, and the amount of

cash which would ultimately be payable was to be determined by the

success of an exploration well targeting the Hagar Qim prospect in

Offshore Malta Area 4, Block 7. As the Hagar Qim well was proved a

dry hole during the measurement period the fair value of this

contingent consideration was nil.

Goodwill arises due to the difference between the fair value of

the net assets and the consideration transferred and relates to the

portfolio of intangible exploration and appraisal assets, which

together have the optionality and potential to provide value far in

excess of this fair value as well as the strategic premium

associated with a significant presence in a new region. The

functional currency of MOG is euros. As such the goodwill is also

expressed in the same functional currency and subject to

retranslation at each reporting period end. The reduction in the

period from acquisition to the period end of $655,000 is entirely

due to this foreign currency difference. None of the goodwill

recognised is expected to be deductible for tax purposes.

Acquisition costs of $1,899,000 arose as a result of the

transaction. These have been recognised as part of administrative

expenses in the statement of comprehensive income.

Since the acquisition date, MOG has contributed $821,000 to

group revenues and $5,000 to group profit. If the acquisition had

occurred on 1 April 2014, group revenue would have been $2,678,000

and group loss for the period would have been $5,093,000.

7 Tax payable

Six months ended Six months ended Year ended

30 September 30 September 31 March

2014 2013 2014

$'000 $'000 $'000

------------------------- ----------------- ----------------- -----------

Current tax payable 104,501 3,109 107,056

Non current tax payable - 95,731 -

------------------------- ----------------- ----------------- -----------

104,501 98,840 107,056

------------------------- ----------------- ----------------- -----------

Current tax payable remains at GBP64 million although at the

period end exchange rate in dollar terms this equates to $105

million, a reduction from $107 million.

8 reserves

Set out below is a description of each of the reserves of the

group:

Share premium Amount subscribed for share capital in excess of its nominal value.

------------------------------------- -------------------------------------------------------------------------------

Share based remuneration The share incentive plan reserve captures the equity related element of the

expenses recognised

for the issue of options, comprising the cumulative charge to the income

statement for IFRS2

charges for share based payments less amounts released to retained earnings

upon the exercise

of options.

------------------------------------- -------------------------------------------------------------------------------

Shares held by SIP trust Shares held by the Share Incentive Plan ("SIP") trust represent the issue

value of shares

held on behalf of participants by Capita IRG Trustees Limited, the trustee of

the SIP.

------------------------------------- -------------------------------------------------------------------------------

Merger reserve The difference between the nominal value of shares issued with the nominal

value of the shares

received on the reversal of Rockhopper Resources Limited into Rockhopper

Exploration Plc on

23 February 2005. As well as the difference between the fair value and nominal

value of shares

issued as part of the acquisition of subsidiaries.

------------------------------------- -------------------------------------------------------------------------------

Foreign currency translation reserve Exchange differences arising on consolidating the assets and liabilities of

the group's subsidiaries

are classified as equity and transferred to the group's translation reserve.

------------------------------------- -------------------------------------------------------------------------------

Special reserve The reserve is non distributable and was created following the cancellation of

the share premium

on the 4 July 2013. It can be distributed or used to acquire the share capital

of the company

subject to receiving court approval.

------------------------------------- -------------------------------------------------------------------------------

Retained losses Cumulative net gains and losses recognised in the financial statements.

------------------------------------- -------------------------------------------------------------------------------

9 Post balance sheet events

SEA LION DEVELOPMENT UPDATE

On the 13 November Rockhopper and Premier Oil announced that

they had agreed to adopt a phased, lower cost development solution

for the Sea Lion field. In light of the move to a phased

development Rockhopper and Premier have agreed amendments to their

commercial arrangements (subject to documentation and internal

approvals). Highlights of the phased development concept and

amended commercial terms are disclosed in the Chairman and CEO

review.

INDEPENDENT REVIEW REPORT TO ROCKHOPPER EXPLORATION PLC

Introduction

We have been engaged by the company to review the condensed set

of financial statements in the Interim Report for the six months

ended 30 September 2014 which comprises the group income statement,

the group statement of comprehensive income, the group balance

sheet, the group statement of changes in equity, the group cash

flow statement and the related explanatory notes. We have read the

other information contained in the Interim Report and considered

whether it contains any apparent misstatements or material

inconsistencies with the information in the condensed set of

financial statements.

This report is made solely to the company in accordance with the

terms of our engagement. Our review has been undertaken so that we

might state to the company those matters we are required to state

to it in this report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the company for our review work, for this

report, or for the conclusions we have reached.

Directors' responsibilities

The Interim Report is the responsibility of, and has been

approved by, the directors. The directors are responsible for

preparing the Interim Report in accordance with the AIM Rules.

As disclosed in note 1, the annual financial statements of the

group are prepared in accordance with IFRSs as adopted by the EU.

The condensed set of financial statements included in this Interim

Report has been prepared in accordance with IAS 34 Interim

Financial Reporting as adopted by the EU.

Our responsibility

Our responsibility is to express to the company a conclusion on

the condensed set of financial statements in the interim report

based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Auditing Practices Board for use in

the UK. A review of interim financial information consists of

making enquiries, primarily of persons responsible for financial

and accounting matters, and applying analytical and other review

procedures. A review is substantially less in scope than an audit

conducted in accordance with International Standards on Auditing

(UK and Ireland) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the Interim Report for the six months ended 30 September 2014 is

not prepared, in all material respects, in accordance with IAS 34

as adopted by the EU and the AIM Rules.

LYNTON RICHMOND

for and on behalf of KPMG LLP

Chartered Accountants

8 Salisbury Square

London

EC4Y 8BB

15 December 2014

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR DGBDDLBBBGSU

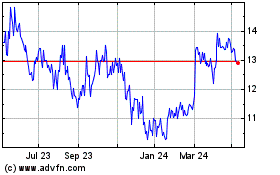

Rockhopper Exploration (LSE:RKH)

Historical Stock Chart

From Mar 2024 to Apr 2024

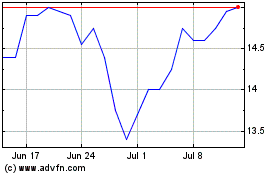

Rockhopper Exploration (LSE:RKH)

Historical Stock Chart

From Apr 2023 to Apr 2024