TIDMRKH

RNS Number : 5525V

Rockhopper Exploration plc

10 August 2015

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, IN OR INTO OR FROM ANY RESTRICTED JURISDICTION OR WHERE IT

WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF ANY SUCH

JURISDICTION

10 August 2015

Rockhopper Exploration plc

"Rockhopper" or the "Company"

Acquisition of non-operated production and exploration assets in

Egypt

Rockhopper Exploration plc (AIM: RKH), the oil and gas

exploration and production company with interests in the North

Falkland Basin and the Greater Mediterranean and North Africa

region, is pleased to announce the acquisition of a portfolio of

non-operated production and exploration interests in Egypt (the

"Interests") from Beach Energy Limited ("Beach Energy") (the

"Acquisition") for a headline consideration of US$22.0 million.

Highlights

-- Rockhopper to acquire the entire issued share capital of

Beach Petroleum (Egypt) Pty Limited ("Beach Egypt") which on

completion will hold:

o 22% interest in the Abu Sennan concession; and

o 25% interest in the El Qa'a Plain concession

-- Current working interest production from Abu Sennan of

approximately 1,300 boepd, net to Rockhopper (based on average H1

2015 production levels)

-- 2P plus 2C reserves and resources at the effective date of 1

July 2015 are estimated at 4.5 mmboe (management estimate), net to

Rockhopper

-- Headline consideration of US$22.0 million to be satisfied:

o Approximately US$11.5 million in cash; and

o The issue of new fully-paid Rockhopper shares to the value of

US$10.5 million, priced based on the volume weighted average price

of Rockhopper shares during the 30 days prior to completion,

subject to a maximum of 5% of the Company's issued share capital

(the "Rockhopper Consideration Shares")

-- Implied transaction multiple of less than US$4.50 per barrel

of oil equivalent (adjusting for estimated financial assets being

acquired)

-- Rockhopper retains balance sheet strength post acquisition -

forecast cash at end 2015 estimated at US$110 - 120 million

-- Transaction represents the continuation of Rockhopper's

strategy to build a full cycle E&P company focused on its two

core areas and represents the Company's entry into Egypt, a

prolific hydrocarbon province

-- Acquisition anticipated to complete in late 2015 / early 2016

(subject to satisfaction of certain conditions), with consideration

adjusted for net cash flow attributable to the assets since the

effective date of 1 July 2015

Abu Sennan concession

The Abu Sennan concession is located in the Abu Gharadig basin

in the Western Desert. The concession was signed in June 2007 with

first commercial production achieved during 2012 and cumulative oil

production to date of approximately 1.9 million barrels. The

concession remains underexplored with significant exploration and

appraisal upside providing opportunities for near-term production

additions. The concession partners are Kuwait Energy (50% and

operator) and Dover Investments (28%).

El Qa'a Plain concession

The El Qa'a Plain concession is located on the eastern shore of

the Gulf of Suez and contains a number of oil leads identified on

existing 2D seismic data. The concession was signed in January 2014

and the forward plan is to acquire 450 sq km of 3D seismic in 2015

followed by the drilling of one or more exploration wells in 2016.

The concession partners are Dana Petroleum (37.5% and operator) and

Petroceltic (37.5%).

Financial information

The headline consideration for the Acquisition is US$22.0

million payable to Beach Energy through a combination of cash and

the issue of the Rockhopper Consideration Shares. The cash element

will be funded from the Company's existing cash resources. The

precise number of Rockhopper Consideration Shares issued will be

based on the volume weighted average price of Rockhopper shares

during the 30 days prior to completion, subject to a maximum of

14.8 million new Rockhopper shares (adjustable for new shares

issued prior to completion), representing up to 5% of the Company's

issued share capital.

The actual sum payable at completion will be adjusted to take

into account net cash flow attributable to the Interests from the

effective date of 1 July 2015.

Unaudited revenue, EBITDA and profit after tax of $8.1 million,

$6.3 million and $0.3 million respectively are attributable to the

Interests in the 12 month period to 30 June 2015.

The Acquisition is expected to complete in late 2015 / early

2016 and is subject to the satisfaction of certain conditions

precedent including completion of limited confirmatory due

diligence, divestment by Beach Egypt of certain non-core assets,

standard joint venture consents including pre-emption and Egyptian

regulatory approvals.

Sam Moody, CEO, commented:

"This transaction represents another significant milestone as we

continue to build Rockhopper into a full cycle, exploration led,

E&P company focused on our two core areas of the North Falkland

Basin and the Greater Mediterranean and North Africa region.

"We expect this portfolio to be net cash flow positive

immediately and upon completion of the transaction expect operating

cash flows from Egypt and our existing Italian assets to cover

Group overheads going forward.

"Through the acquisition we have added 2P plus 2C reserves and

resources at a net acquisition price of less than $4.50 per boe

(after financial adjustments) whilst preserving our balance sheet

and limiting dilution to shareholders to less than 5%."

A presentation with further details of the transaction will be

made available on the Company's website.

For further information, please contact:

Rockhopper Exploration plc

Tel: (via Vigo Communications) - 020 7016 9571

Sam Moody - Chief Executive

Fiona MacAulay - Chief Operating Officer

Stewart MacDonald - Chief Financial Officer

Canaccord Genuity Limited (NOMAD and Joint Broker)

Tel: 020 7523 8000

Henry Fitzgerald-O'Connor

Liberum Capital (Joint Broker)

Tel: 020 3100 2227

Clayton Bush

Vigo Communications

Tel: 020 7016 9571

Peter Reilly

Patrick d'Ancona

Further information

This announcement is for information only and is not intended to

and does not constitute, or form part of any offer to sell or

invitation to purchase or subscribe for any securities, or any

solicitation of any vote or approval in any jurisdiction pursuant

to the Acquisition or otherwise. This announcement does not

constitute a prospectus or a prospectus equivalent document.

Note regarding Rockhopper oil and gas disclosure

This announcement has been approved by Rockhopper's geological

staff who include Fiona MacAulay (Chief Operating Officer), who is

a Fellow of the Geological Society of London and a Member of the

Petroleum Exploration Society of Great Britain and American

Association of Petroleum Geologists with over 25 years of

experience in petroleum exploration and management, and who is the

qualified person as defined in the Guidance Note for Mining, Oil

and Gas Companies issued by the London Stock Exchange in respect of

AIM companies. In compiling its resource estimates, Rockhopper has

used the definitions and guidelines as set forth in the 2007

Petroleum Resources Management System approved by the Society of

Petroleum Engineers.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQGRGDISDBBGUG

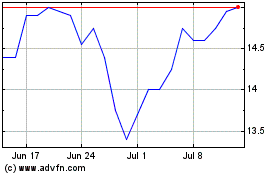

Rockhopper Exploration (LSE:RKH)

Historical Stock Chart

From Mar 2024 to Apr 2024

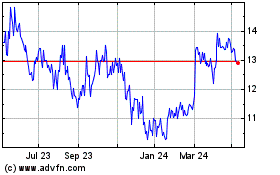

Rockhopper Exploration (LSE:RKH)

Historical Stock Chart

From Apr 2023 to Apr 2024