Roche Unfazed by Trump's Drug-Price Comments as Profit Rises -- 2nd Update

February 01 2017 - 5:27AM

Dow Jones News

By Denise Roland

BASEL, Switzerland-- Roche Holding AG said profit climbed in

2016, as several of its top-selling drugs continued to prosper in

the absence of cheaper competitors, while its chief executive

shrugged off U.S. President Donald Trump's criticism of high drug

prices.

The company posted net profit of 9.6 billion Swiss francs ($9.7

billion) for 2016, 8% higher than a year earlier. Revenue increased

5% to 50.6 billion francs. Those figures missed analyst

expectations of 10.7 billion and 50.7 billion Swiss francs,

respectively.

Basel, Switzerland-based Roche has to date suffered less than

its pharmaceutical peers from the launch of cheap copycats to its

drugs, in part because its biggest medicines are manufactured with

living cells rather than by chemical processes, making them more

complex to imitate.

That is likely to shift later this year, when cheaper copycats

of two of Roche's biggest-selling treatments--cancer drugs

Herceptin and Mabthera--are expected to be launched in Europe in

the second half of the year.

Chief Executive Severin Schwan said Roche was prepared for this

onset of new competition with a lineup of new drugs that he said

would offset a decline in its older medicines.

Mr. Schwan also said he remained bullish on the U.S. market,

where Roche generates nearly half of its total drug pharmaceuticals

revenue, despite Mr. Trump's comments to a group of drug company

bosses Tuesday that "we have to get the prices way down."

One reason for Mr. Schwan's confidence, he said, was that the

U.S. is one of the biggest beneficiaries of investment by the

pharmaceutical industry. He said Roche invested

"over-proportionally" in the U.S., where it employs more than

25,000 people, in part through its California-based Genentech

division.

Mr. Schwan has also long argued that Roche is less exposed to

pricing pressure than some other companies because its drugs aren't

easily substitutable with those from rivals. "If you have true

innovation, with true added value, the U.S. will be the first

country to honor that innovation," he said.

Roche said it expects sales and core earnings per share to grow

by a low-to-mid single-digit percentage in 2017, at constant

exchange rates.

The company proposed a full-year dividend of 8.20 Swiss francs,

up from 8.10 francs last year.

Roche said sales of its medicines increased to 39.1 billion

Swiss francs, a 5% increase from 37.3 billion francs a year

earlier.

That growth was driven in part by Perjeta and Herceptin, both

for the HER2-positive form of breast cancer. Perjeta, a newer drug,

has boosted sales of the well-established Herceptin because taken

together, they prolong survival, lengthening treatment.

Actemra, for rheumatoid arthritis, also contributed strongly to

revenue growth, with sales up 16%.

Roche's smaller diagnostics division notched higher growth

still, with revenue up 6% to 11.5 billion francs. That was driven

by Roche's point-of-care business, which provides tools for

diagnosing patients in the clinic or hospital.

Core operating profit, a measure that strips out certain items

such as impairments, tax and financing costs, rose 5% to 18.4

billion Swiss francs. Analysts expected core operating profit of

18.6 billion francs.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

February 01, 2017 05:12 ET (10:12 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

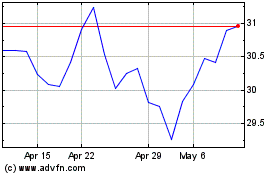

Roche (QX) (USOTC:RHHBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

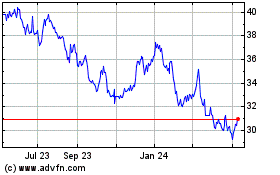

Roche (QX) (USOTC:RHHBY)

Historical Stock Chart

From Apr 2023 to Apr 2024