Riverview Bancorp Upped to Strong Buy - Analyst Blog

February 25 2013 - 5:20AM

Zacks

On Feb 23, Zacks Investment Research upgraded Riverview

Bancorp Inc. (RVSB) to a Zacks Rank #1 (Strong Buy).

Why the Upgrade?

Riverview Bancorp has been witnessing rising earnings estimates on

the back of strong fiscal third-quarter 2013 results. Moreover,

this well-known commercial banking services provider delivered

positive earnings for the second consecutive quarter.

Riverview Bancorp reported fiscal third-quarter results (ended on

Dec 31, 2012) on Jan 30. Earnings per share came in at 5 cents,

significantly surpassing the Zacks Consensus Estimate of 1 cent and

prior-year quarter’s loss of 74 cents.

Earnings were primarily aided by prudent expense management, which

yielded a 17.6% fall in non-interest expenses and a 47.9% decrease

in interest expense.

Results marked a substantial improvement in credit quality for

Riverview Bancorp. With declining net charge-offs, non-performing

loan balances also reduced.

The Zacks Consensus Estimate for fiscal 2013 more than tripled to

10 cents per share over the last 30 days. For fiscal 2014, the

Zacks Consensus Estimate more than doubled to 22 cents per share

over the same time frame.

Other Stocks to Consider

Besides Riverview Bancorp, other stocks in the same sector with a

Zacks Rank #1 include First Financial Holdings

Inc. (FFCH), Meta Financial Group Inc.

(CASH) and Center Bancorp Inc. (CNBC).

META FINL GRP (CASH): Get Free Report

CENTER BANCORP (CNBC): Free Stock Analysis Report

FIRST FINL HLDG (FFCH): Free Stock Analysis Report

RIVERVIEW BANCP (RVSB): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

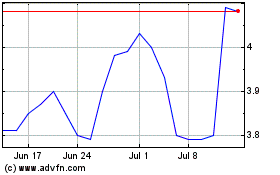

Riverview Bancorp (NASDAQ:RVSB)

Historical Stock Chart

From Mar 2024 to Apr 2024

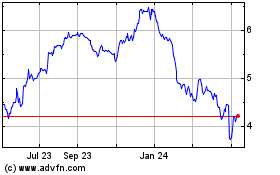

Riverview Bancorp (NASDAQ:RVSB)

Historical Stock Chart

From Apr 2023 to Apr 2024