Riverview Bancorp, Inc. (Nasdaq:RVSB) (“Riverview” or the

“Company”), the parent company of Riverview Community Bank (the

“Bank”) today announced that it has increased its provision for

loan losses an additional $3.2 million for its fourth fiscal

quarter ended March 31, 2012. As a result, the Company’s net loss

was $16.0 million, or $0.71 per share, for the quarter ended March

31, 2012, compared to a net loss of $16.6 million, or $0.74 per

share in the preceding quarter and net income of $854,000, or $0.04

per share, in its fourth fiscal quarter a year ago. For the fiscal

year, Riverview’s net loss was $31.7 million, or $1.42 per share,

compared to net income of $4.3 million, or $0.24 per share, for

fiscal year 2011.

“The increase in the provision for loan losses was necessary as

a result of updated information received by the Bank on three

commercial properties as well as the current regulatory guidance

for these individual properties,” said Pat Sheaffer, Chairman and

CEO. “This additional provision for loan losses increases the

Bank’s reserves as we remain diligent in our efforts to reduce our

non-performing assets.”

Credit Quality

Riverview’s provision for loan losses totaled $17.5 million for

the fourth quarter of fiscal year 2012, compared to $8.1 million in

the preceding quarter and $500,000 in the fourth quarter of fiscal

year 2011. The allowance for loan losses increased to $19.9 million

at March 31, 2012, representing 2.91% of total loans and 45.11% of

non-performing loans (NPLs). NPLs decreased to $44.2 million, or

6.45% of total loans at March 31, 2012, as a result of an

additional charge-off of $867,000 on a nonperforming commercial

real estate loan.

The additional provision for loan losses was primarily related

to three individual properties. The first was a $2.7 million

commercial real estate property located in Portland, Oregon. The

second was a $992,000 commercial real estate loan to a related

borrower located in Portland, Oregon. The Company increased its

provision for loan losses $926,000 and charged-off a total of $1.9

million for these two properties. Both of these loans have

continued to pay as agreed and have not missed any of their

required payments. An additional provision of $600,000 was for a

land development project located in southwest Washington. The

Company also bolstered its general allowance by an additional $1.7

million.

The Company’s non-performing assets totaled to $62.9 million at

March 31, 2012. At March 31, 2012, Riverview’s non-performing

assets were 7.35% of total assets, compared to 6.11% at the end of

the preceding quarter and 4.65% a year ago. Additionally, as

previously reported, the Company sold several additional

non-performing assets subsequent to March 31, 2012. These asset

sales have totaled more than $7 million, resulting in a net loss of

$218,000.

Capital and Liquidity

“From a capital standpoint, the Bank remains sound and strong,”

said Ron Wysaske, President and COO. “Additionally, the positive

movements we have seen in REO and land sales during the last

several months should prove beneficial to the Bank over the next

several quarters.”

The Bank continues to maintain capital levels in excess of the

regulatory requirements to be categorized as “well capitalized”

with a total risk-based capital ratio of 12.11% and a Tier 1

leverage ratio of 8.76% at March 31, 2012. To be considered “well

capitalized” a bank has to have a total risk-based capital ratio of

10% and a Tier 1 leverage ratio of 5%. Subsequent to March 31,

2012, the Company invested an additional $2.7 million into the

Bank, increasing the Bank’s total risk-based capital ratio to

approximately 12.78% and its Tier 1 leverage ratio to 9.25%.

At March 31, 2012, the Bank had available total and contingent

liquidity of over $500 million, including over $300 million of

borrowing capacity from the Federal Home Loan Bank of Seattle and

the Federal Reserve Bank of San Francisco, and more than $80

million of cash and short-term investments.

About Riverview

Riverview Bancorp, Inc. (www.riverviewbank.com) is headquartered

in Vancouver, Washington – just north of Portland, Oregon on the

I-5 corridor. With assets of $856 million, it is the parent company

of the 89 year-old Riverview Community Bank, as well as Riverview

Asset Management Corp. The Bank offers true community banking

services, focusing on providing the highest quality service and

financial products to commercial and retail customers. There are 17

branches, including twelve in the Portland-Vancouver area and three

lending centers, with a new branch scheduled to open in the rapidly

growing metropolitan area of Gresham, Oregon in the summer of

2012.

“Safe Harbor” statement under the Private Securities Litigation

Reform Act of 1995: This press release contains forward-looking

statements that are subject to risks and uncertainties, including,

but not limited to: the Company’s ability to raise common capital,

the amount of capital it intends to raise and its intended use of

that capital. The credit risks of lending activities, including

changes in the level and trend of loan delinquencies and write-offs

and changes in the Company’s allowance for loan losses and

provision for loan losses that may be impacted by deterioration in

the housing and commercial real estate markets; changes in general

economic conditions, either nationally or in the Company’s market

areas; changes in the levels of general interest rates, and the

relative differences between short and long term interest rates,

deposit interest rates, the Company’s net interest margin and

funding sources; fluctuations in the demand for loans, the number

of unsold homes, land and other properties and fluctuations in real

estate values in the Company’s market areas; secondary market

conditions for loans and the Company’s ability to sell loans in the

secondary market; results of examinations of us by the Office of

Comptroller of the Currency (OCC) or other regulatory authorities,

including the possibility that any such regulatory authority may,

among other things, require us to increase the Company’s reserve

for loan losses, write-down assets, change Riverview Community

Bank’s regulatory capital position or affect the Company’s ability

to borrow funds or maintain or increase deposits, which could

adversely affect its liquidity and earnings; the Company’s

compliance with regulatory enforcement actions we have entered into

with the OCC as successor to the Office of Thrift Supervision and

the possibility that our noncompliance could result in the

imposition of additional enforcement actions and additional

requirements or restrictions on our operations; legislative or

regulatory changes that adversely affect the Company’s business

including changes in regulatory policies and principles, or the

interpretation of regulatory capital or other rules; the Company’s

ability to attract and retain deposits; further increases in

premiums for deposit insurance; the Company’s ability to control

operating costs and expenses; the use of estimates in determining

fair value of certain of the Company’s assets, which estimates may

prove to be incorrect and result in significant declines in

valuation; difficulties in reducing risks associated with the loans

on the Company’s balance sheet; staffing fluctuations in response

to product demand or the implementation of corporate strategies

that affect the Company’s workforce and potential associated

charges; computer systems on which the Company depends could fail

or experience a security breach; the Company’s ability to retain

key members of its senior management team; costs and effects of

litigation, including settlements and judgments; the Company’s

ability to successfully integrate any assets, liabilities,

customers, systems, and management personnel it may in the future

acquire into its operations and the Company’s ability to realize

related revenue synergies and cost savings within expected time

frames and any goodwill charges related thereto; increased

competitive pressures among financial services companies; changes

in consumer spending, borrowing and savings habits; the

availability of resources to address changes in laws, rules, or

regulations or to respond to regulatory actions; the Company’s

ability to pay dividends on its common stock; and interest or

principal payments on its junior subordinated debentures; adverse

changes in the securities markets; inability of key third-party

providers to perform their obligations to us; changes in accounting

policies and practices, as may be adopted by the financial

institution regulatory agencies or the Financial Accounting

Standards Board, including additional guidance and interpretation

on accounting issues and details of the implementation of new

accounting methods; other economic, competitive, governmental,

regulatory, and technological factors affecting the Company’s

operations, pricing, products and services and the other risks

described from time to time in our filings with the Securities and

Exchange Commission.

The Company cautions readers not to place undue reliance on any

forward-looking statements. Moreover, you should treat these

statements as speaking only as of the date they are made and based

only on information then actually known to the Company. The Company

does not undertake and specifically disclaims any obligation to

revise any forward-looking statements to reflect the occurrence of

anticipated or unanticipated events or circumstances after the date

of such statements. These risks could cause our actual results for

fiscal 2012 and beyond to differ materially from those expressed in

any forward-looking statements by, or on behalf of, us, and could

negatively affect the Company’s operating and stock price

performance.

RIVERVIEW BANCORP, INC. AND SUBSIDIARY

Consolidated Balance Sheets (In thousands, except share

data) (Unaudited) March 31, 2012

December 31, 2011 March 31, 2011 ASSETS

Cash (including interest-earning accounts

of $33,437, $23,146 and $37,349)

$ 46,393 $ 36,313 $ 51,752 Certificate of deposits 41,473 42,718

14,900 Loans held for sale 480 659 173 Investment securities held

to maturity, at amortized cost 493 493 506 Investment securities

available for sale, at fair value 6,314 6,337 6,320 Mortgage-backed

securities held to maturity, at amortized 171 177 190

Mortgage-backed securities available for sale, at fair value 974

1,146 1,777

Loans receivable (net of allowance for

loan losses of $19,921, $15,926 and $14,968)

664,888 678,626 672,609 Real estate and other pers. property owned

18,731 20,667 27,590 Prepaid expenses and other assets 6,362 6,087

5,887 Accrued interest receivable 2,158 2,378 2,523 Federal Home

Loan Bank stock, at cost 7,350 7,350 7,350 Premises and equipment,

net 17,068 16,351 16,100 Deferred income taxes, net 603 594 9,447

Mortgage servicing rights, net 278 299 396 Goodwill 25,572 25,572

25,572 Core deposit intangible, net 137 157 219 Bank owned life

insurance 16,553 16,406 15,952

TOTAL ASSETS $ 855,998 $ 862,330 $

859,263

LIABILITIES AND EQUITY

LIABILITIES: Deposit accounts $ 744,455 $ 735,046 $ 716,530 Accrued

expenses and other liabilities 9,398 9,574 9,396 Advance payments

by borrowers for taxes and insurance 800 409 680 Junior

subordinated debentures 22,681 22,681 22,681 Capital lease

obligation 2,513 2,531 2,567

Total liabilities 779,847 770,241 751,854 EQUITY:

Shareholders' equity

Serial preferred stock, $.01 par value;

250,000 authorized, issued and outstanding, none

- - - Common stock, $.01 par value; 50,000,000 authorized, March

31, 2012 – 22,471,890 issued and outstanding; 225 225 225 December

31, 2011 - 22,471,890 issued and outstanding; March 31, 2011 –

22,471,890 issued and outstanding; Additional paid-in capital

65,610 65,621 65,639 Retained earnings 11,536 27,493 43,193

Unearned shares issued to employee stock ownership trust (593 )

(619 ) (696 ) Accumulated other comprehensive loss (1,171 )

(1,153 ) (1,417 ) Total shareholders’ equity 75,607

91,567 106,944 Noncontrolling interest 544

522 465 Total equity 76,151

92,089 107,409 TOTAL

LIABILITIES AND EQUITY $ 855,998 $ 862,330 $ 859,263

RIVERVIEW BANCORP, INC. AND SUBSIDIARY

Consolidated Statements of Operations Three Months

Ended Twelve Months Ended (In thousands,

except share data) (Unaudited) March 31, 2012

Dec. 31, 2011 March 31, 2011

March 31, 2012 March 31, 2011 INTEREST INCOME:

Interest and fees on loans receivable $ 9,130

$ 9,669 $ 10,239 $ 38,894 $ 42,697 Interest on investment

securities-taxable 36 28 49 145 164 Interest on investment

securities-non taxable 7 11 12 42 55 Interest on mortgage-backed

securities 10 12 18 51 88 Other interest and dividends 127

109 70 400

210

Total interest income

9,310 9,829 10,388 39,532 43,214 INTEREST EXPENSE: Interest

on deposits 908 1,061 1,337 4,357 6,569 Interest on borrowings

387 381 364

1,508 1,483 Total interest expense

1,295 1,442 1,701

5,865 8,052 Net interest income 8,015 8,387

8,687 33,667 35,162 Less provision for loan losses 17,500

8,100 500 29,350

5,075 Net interest income (loss) after

provision for loan losses (9,485 ) 287 8,187 4,317 30,087

NON-INTEREST INCOME: Fees and service charges 914 962 916 3,996

4,047 Asset management fees 604 568 546 2,367 2,079 Gain on sale of

loans held for sale 87 29 54 160 393 Bank owned life insurance

income 146 151 150 601 601 Other (190 ) (180 )

73 (297 ) 769 Total non-interest

income 1,561 1,530 1,739 6,827 7,889 NON-INTEREST EXPENSE:

Salaries and employee benefits 3,850 4,014 4,601 15,889 16,716

Occupancy and depreciation 1,253 1,211 1,180 4,793 4,677 Data

processing 285 306 293 1,421 1,067 Amortization of core deposit

intangible 20 20 24 82 96 Advertising and marketing expense 184 286

172 998 749 FDIC insurance premium 288 289 400 1,136 1,640 State

and local taxes 139 150 136 549 638 Telecommunications 110 109 111

434 428 Professional fees 283 334 352 1,254 1,310 Real estate owned

expenses 1,130 2,781 634 5,097 1,817 Other 687

692 663 2,770

2,358 Total non-interest expense 8,229

10,192 8,566 34,423

31,496 INCOME (LOSS) BEFORE INCOME TAXES

(16,153 ) (8,375 ) 1,360 (23,279 ) 6,480 PROVISION (BENEFIT) FOR

INCOME TAXES (196 ) 8,220

506 8,378 2,165 NET INCOME (LOSS) $

(15,957 ) $ (16,595 ) $ 854 $ (31,657 ) $

4,315 Earnings (loss) per common share: Basic $ (0.71 ) $

(0.74 ) $ 0.04 $ (1.42 ) $ 0.24 Diluted $ (0.71 ) $ (0.74 ) $ 0.04

$ (1.42 ) $ 0.24 Weighted average number of shares outstanding:

Basic 22,327,171 22,321,011 22,302,538 22,317,933 18,341,191

Diluted 22,327,171 22,321,011 22,302,538 22,317,933 18,341,308

(Dollars in thousands)

At or for the three months

ended At or for the twelve months ended March

31, 2012 Dec. 31, 2011 March 31,

2011 March 31, 2012 March 31, 2011

AVERAGE

BALANCES

Average interest–earning assets $ 788,488 $ 790,922 $

748,907 $ 777,864 $ 758,847 Average interest-bearing liabilities

652,607 651,368 639,503 645,369 649,342 Net average earning assets

135,881 139,554 109,404 132,495 109,505 Average loans 695,973

694,205 685,507 694,382 703,861 Average deposits 741,320 742,899

705,456 731,089 708,169 Average equity 91,171 109,301 108,114

104,869 100,643 Average tangible equity 65,156 83,238 81,896 78,779

74,337

ASSET

QUALITY

March 31, 2012 Dec. 31, 2011 March 31,

2011 Non-performing loans 44,163 32,037 12,323

Non-performing loans to total loans 6.45 % 4.61 % 1.79 % Real

estate/repossessed assets owned 18,731 20,667 27,590 Non-performing

assets 62,894 52,704 39,913 Non-performing assets to total assets

7.35 % 6.11 % 4.65 % Net loan charge-offs in the quarter 13,505

6,846 2,995 Net charge-offs in the quarter/average net loans 7.80 %

3.91 % 1.77 % Allowance for loan losses 19,921 15,926 14,968

Average interest-earning assets to average

interest-bearing liabilities

120.82 % 121.42 % 117.11 %

Allowance for loan losses to

non-performing loans

45.11 % 49.71 % 121.46 % Allowance for loan losses to total loans

2.91 % 2.29 % 2.18 % Shareholders’ equity to assets 8.83 % 10.62 %

12.45 %

CAPITAL

RATIOS

Total capital (to risk weighted assets) 12.11 % 13.14 % 14.61 %

Tier 1 capital (to risk weighted assets) 10.84 % 11.89 % 13.35 %

Tier 1 capital (to leverage assets) 8.76 % 9.74 % 11.24 % Tangible

common equity (to tangible assets) 5.98 % 7.84 % 9.69 %

DEPOSIT

MIX

March 31, 2012 Dec. 31, 2011 March 31,

2011 Interest checking $ 106,904 $ 96,757 $ 77,399

Regular savings 45,741 42,453 37,231 Money market deposit accounts

244,919 235,902 236,321 Non-interest checking 116,882 116,854

102,429 Certificates of deposit 230,009

243,080 263,150 Total deposits $ 744,455

$ 735,046 $ 716,530

COMPOSITION OF

COMMERCIAL AND CONSTRUCTION LOANS

Commercial

Commercial

Real Estate

Mortgage

Real Estate

Construction

Commercial

& Construction

Total

March 31,

2012

(Dollars in thousands) Commercial $ 87,238 $ - $ - $ 87,238

Commercial construction - - 13,496 13,496 Office buildings - 94,541

- 94,541 Warehouse/industrial - 48,605 - 48,605 Retail/shopping

centers/strip malls - 80,595 - 80,595 Assisted living facilities -

35,866 - 35,866 Single purpose facilities - 93,473 - 93,473 Land -

38,888 - 38,888 Multi-family - 42,795 - 42,795 One-to-four family

- - 12,295 12,295 Total $ 87,238 $

434,763 $ 25,791 $ 547,792

March 31,

2011

(Dollars in thousands) Commercial $ 85,511 $ - $ - $ 85,511

Commercial construction - - 8,608 8,608 Office buildings - 95,529 -

95,529 Warehouse/industrial - 49,627 - 49,627 Retail/shopping

centers/strip malls - 85,719 - 85,719 Assisted living facilities -

35,162 - 35,162 Single purpose facilities - 98,651 - 98,651 Land -

55,258 - 55,258 Multi-family - 42,009 - 42,009 One-to-four family

- - 18,777 18,777 Total $ 85,511 $

461,955 $ 27,385 $ 574,851

LOAN

MIX

March 31, 2012 Dec. 31, 2011 March 31, 2011

Commercial and construction Commercial $ 87,238 $ 86,759 $ 85,511

Other real estate mortgage 434,763 448,288 461,955 Real estate

construction 25,791 27,544 27,385 Total

commercial and construction 547,792 562,591 574,851 Consumer Real

estate one-to-four family 134,975 129,780 110,437 Other installment

2,042 2,181 2,289 Total consumer 137,017

131,961 112,726 Total loans 684,809 694,552

687,577 Less: Allowance for loan losses 19,921

15,926 14,968 Loans receivable, net $ 664,888 $ 678,626 $

672,609

DETAIL OF

NON-PERFORMING ASSETS

Northwest

Oregon

Other

Oregon

Southwest

Washington

Other

Washington

Other Total

March 31,

2012

(Dollars in thousands) Non-performing assets Commercial $

194 $ 746 $ 2,990 $ - $ - $ 3,930 Commercial real estate 1,867 -

9,735 - 2,348 13,950 Land - 1,902 6,383 - 4,700 12,985 Multi-family

627 1,000 - - - 1,627 Commercial construction - - - - - -

One-to-four family construction 1,246 6,117 393 - - 7,756 Real

estate one-to-four family 678 189 3,048 - - 3,915 Consumer -

- - - - - Total non-performing

loans 4,612 9,954 22,549 - 7,048 44,163 REO 2,477

5,863 6,825 3,566 - 18,731

Total non-performing assets $ 7,089 $ 15,817 $ 29,374 $

3,566 $ 7,048 $ 62,894

DETAIL OF SPEC

CONSTRUCTION AND LAND DEVELOPMENT LOANS

Northwest

Oregon

Other

Oregon

Southwest

Washington

Other

Washington

Other Total

March 31,

2012

(Dollars in thousands) Land and spec construction loans Land

development loans $ 6,044 $ 3,672 $ 24,472 $ - $ 4,700 $ 38,888

Spec construction loans 1,246 6,117 3,006

392 - 10,761 Total land and spec

construction $ 7,290 $ 9,789 $ 27,478 $ 392 $ 4,700 $ 49,649

At or for the three months ended At or for

the twelve months ended

SELECTED OPERATING

DATA

March 31, 2012 Dec. 31,

2011 March 31, 2011

March 31, 2012 March 31,

2011 Efficiency ratio (4) 85.93 % 102.77 % 82.16

% 85.01 % 73.16 % Coverage ratio (6) 97.40 % 82.29 % 101.41 % 97.80

% 111.64 % Return on average assets (1) -7.40 % -7.42 % 0.41 %

-3.64 % 0.51 % Return on average equity (1) -70.39 % -60.24 % 3.20

% -30.19 % 4.29 %

NET INTEREST

SPREAD

Yield on loans 5.32 % 5.53 % 6.06 % 5.60 % 6.07 % Yield on

investment securities 2.36 % 2.66 % 3.12 % 2.63 % 2.96 % Total

yield on interest earning assets 4.79 % 4.93 % 5.63 % 5.08 % 5.70 %

Cost of interest bearing deposits 0.59 % 0.67 % 0.88 % 0.70

% 1.06 % Cost of FHLB advances and other borrowings 6.23 % 5.99 %

5.83 % 5.97 % 4.59 % Total cost of interest bearing liabilities

0.80 % 0.88 % 1.08 % 0.91 % 1.24 % Spread (7) 3.99 % 4.05 %

4.55 % 4.17 % 4.46 % Net interest margin 4.12 % 4.21 % 4.71 % 4.33

% 4.64 %

PER SHARE

DATA

Basic earnings per share (2) $ (0.71 ) $ (0.74 ) $ 0.04 $ (1.42 ) $

0.24 Diluted earnings per share (3) (0.71 ) (0.74 ) 0.04 (1.42 )

0.24 Book value per share (5) 3.36 4.07 4.76 3.36 4.76 Tangible

book value per share (5) 2.21 2.92 3.59 2.21 3.59 Market price per

share: High for the period $ 2.46 $ 2.50 $ 3.21 $ 3.18 $ 3.81 Low

for the period 2.03 2.11 2.69 2.03 1.73 Close for period end 2.26

2.37 3.04 2.26 3.04 Cash dividends declared per share - - - - -

Average number of shares outstanding: Basic (2) 22,327,171

22,321,011 22,302,538 22,317,933 18,341,191 Diluted (3) 22,327,171

22,321,011 22,302,538 22,317,933 18,341,308 (1) Amounts for

the quarterly periods are annualized. (2) Amounts exclude ESOP

shares not committed to be released. (3) Amounts exclude ESOP

shares not committed to be released and include common stock

equivalents. (4) Non-interest expense divided by net interest

income and non-interest income. (5) Amounts calculated based on

shareholders’ equity and include ESOP shares not committed to be

released. (6) Net interest income divided by non-interest expense.

(7) Yield on interest-earning assets less cost of funds on interest

bearing liabilities.

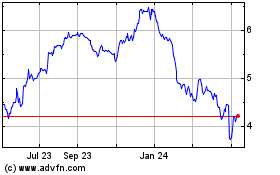

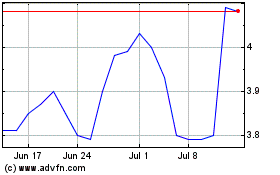

Riverview Bancorp (NASDAQ:RVSB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Riverview Bancorp (NASDAQ:RVSB)

Historical Stock Chart

From Apr 2023 to Apr 2024