Riverview Bancorp, Inc. (NASDAQ:RVSB) (“Riverview” or the

“Company”) today reported a net loss of $1.8 million, or $0.08 per

share, in its first fiscal quarter ended June 30, 2012, compared to

a net loss of $16.0 million, or $0.71 per share in the preceding

quarter and net income of $714,000, or $0.03 per share, in its

first fiscal quarter a year ago.

“Identifying and resolving problem credits and maintaining an

adequate reserve balance remains a top priority,” said Pat

Sheaffer, Chairman and CEO. “We continue to aggressively make

progress in these areas and our non-performing loan balances and

net charge-offs are steadily being reduced.”

Credit Quality

Riverview recorded a $4.0 million provision for loan losses in

the first quarter of fiscal year 2013, compared to $17.5 million in

the preceding quarter and $1.6 million in the first quarter of

fiscal year 2012. The total allowance for loan losses increased to

$21.0 million at June 30, 2012, compared to $19.9 million at March

31, 2012. The allowance for loan losses represented 3.39% of total

loans and 57.02% of non-performing loans (NPLs) at June 30, 2012.

NPLs decreased to $36.8 million, or 5.95% of total loans at June

30, 2012, compared to $44.2 million, or 6.45% of total loans at

March 31, 2012.

Net charge-offs in the first quarter of fiscal 2013 totaled $2.9

million, compared to $13.5 million in the fourth quarter of fiscal

2012 and $459,000 in the first quarter a year ago.

“We continue to maintain elevated levels of reserves while

working our way through this difficult credit cycle,” said Ron

Wysaske, President and COO. “The local and regional economy remains

challenging and our top priority is to focus our diligent efforts

on reducing and resolving nonperforming assets. Riverview remains

an important economic participant as one of the few community banks

in the region and the only community bank headquartered in Clark

County.”

Riverview’s real estate owned (REO) increased $3.3 million

during the quarter to $22.1 million at June 30, 2012 due to the

transfer of $8.5 million in loans to REO during the quarter. REO

sales during the quarter totaled $4.4 million with write-downs of

$787,000. Despite the increase in REO during the quarter, the

Company remains optimistic that it will be able to decrease REO

over the remainder of the year due to the accelerating sales during

the past several quarters. Specifically, the Company has seen a

rise in sales activity for land and building lots.

Non-performing assets (NPAs) declined to $58.9 million at June

30, 2012 compared to $62.9 million at March 31, 2012 and $40.3

million a year ago. At June 30, 2012, Riverview’s NPAs were 7.22%

of total assets, compared to 7.35% at the end of the preceding

quarter and 4.55% a year ago.

Balance Sheet Review

“During the first quarter we sold $31.4 million in single-family

mortgage loans to the Federal Home Loan Mortgage Corporation

(FHLMC),” said Wysaske. “We were able to take advantage of the

favorable interest rates to sell a block of loans for a gain of

$650,000. The sale of these loans resulted in a reduction in the

Bank’s interest rate risk and increased our overall capital and

liquidity positions.” Net loans totaled $597.1 million at June 30,

2012 compared to $664.9 million at March 31, 2012 and $677.3

million a year ago.

Riverview has continued to focus on reducing its concentration

in land development and speculative construction loans. The balance

of these portfolios declined to $34.0 million at June 30, 2012

compared to $49.6 million three months earlier. Land development

loans totaled $29.1 million, and speculative construction loans

totaled $4.9 million, representing a combined 5.5% of the total

loan portfolio at June 30, 2012 compared to 7.3% of the total loan

portfolio three months earlier. “This steady reduction has

significantly reduced our exposure to these market segments,”

stated Wysaske.

The Company currently has identified 21% of the land development

portfolio as impaired and has charged these loans down to their

estimated fair value, less selling costs, based on updated third

party appraisals. Additionally, the Company currently has a $4.0

million allowance on the outstanding land development

portfolio.

The commercial real estate (“CRE”) loan portfolio totaled $346.2

million as of June 30, 2012, of which 28% was owner-occupied and

72% was investor-owned. At June 30, 2012, the CRE portfolio

contained nine loans totaling $16.7 million that were

non-performing, representing 4.8% of the total CRE portfolio and

45.4% of total nonperforming loans.

Deposits decreased $38.6 million as a result of the Company’s

targeted efforts to reduce its higher cost deposits, using the

$31.4 million loan sale to FHLMC while also increasing the Bank’s

capital. The deposit reduction was comprised of an $8.8 million

reduction in Internet deposits, an $11.4 million reduction in other

non-branch deposits and a planned $14.9 million reduction in the

Bank’s only deposit concentration to its largest corporate

depositor.

Total deposits stood at $705.9 million at June 30, 2012 compared

to $744.5 million at March 31, 2012 and $742.9 million a year ago.

Core deposits, which include checking accounts, savings accounts,

money market deposit accounts and retail CDs, accounted for 94.8%

of total deposits at June 30, 2012 compared to 92.5% at March 31,

2012 and 90.7% a year ago. The loan to deposit ratio is currently

at 88% as of June 30, 2012.

Net Interest Margin

Riverview’s net interest margin was 4.22% for the first fiscal

quarter compared to 4.12% for the preceding quarter. The increase

in net interest margin from the preceding quarter was primarily due

to fewer interest income reversals due to the slowdown of new loans

placed on non-accrual status during the quarter. The reversal of

interest on non-accrual loans decreased the net interest margin by

three basis points during the first quarter. The cost of interest

bearing deposits during the current quarter was 0.54%, a decrease

of five basis points from the preceding quarter and a decrease of

27 basis points from the first quarter a year ago. The reductions

in high cost deposits should also help to improve the Bank’s

overall cost of deposits in future quarters.

Income Statement

Net interest income was $8.1 million in the first fiscal

quarter, compared to $8.0 million in the preceding quarter and $8.8

million in the first quarter a year ago. Non-interest income was

$2.4 million in the first fiscal quarter compared to $1.6 million

in the preceding quarter and $1.9 million in the first fiscal

quarter a year ago. The increase in non-interest income this

quarter was driven by the sale of $31.4 million in single-family

mortgages to the FHLMC, which resulted in a $650,000 gain on sale

of loans. The increase was also due partially to an increase in

mortgage banking activity during the quarter.

Non-interest expense, or operating expense, was $8.3 million in

the first fiscal quarter compared to $8.2 million in the preceding

quarter and $8.2 million in the first quarter a year ago.

In fiscal 2012, the Company established a valuation allowance

against its deferred tax asset. At June 30, 2012, the total

valuation allowance was $17.6 million. Management will review the

deferred tax asset on a quarterly basis to determine the

appropriate valuation allowance, if needed. Any future reversals of

the deferred tax asset valuation allowance would decrease the

Company’s income tax expense and increase its after tax net income

in the period of reversal.

Capital and Liquidity

The Bank continues to maintain capital levels in excess of the

regulatory requirements to be categorized as “well capitalized”

with a total risk-based capital ratio of 13.18% and a Tier 1

leverage ratio of 9.35% at June 30, 2012.

At June 30, 2012, the Bank had available total and contingent

liquidity of over $500 million, including over $300 million of

borrowing capacity from the Federal Home Loan Bank of Seattle and

the Federal Reserve Bank of San Francisco, and more than $100

million from cash and short-term investments.

Gresham Branch

In June 2012, Riverview opened its eighteenth branch and its

fourth in Oregon. This new full service branch will fill a

long-standing need for community banking in the Gresham market

area.

Non-GAAP Financial

Measures

In addition to results presented in accordance with generally

accepted accounting principles in the United States of America

(GAAP), this press release contains certain non-GAAP financial

measures. Riverview believes that certain non-GAAP financial

measures provide investors with information useful in understanding

the company’s financial performance; however, readers of this

report are urged to review these non-GAAP financial measures in

conjunction with GAAP results as reported.

Financial measures that exclude intangible assets are non-GAAP

measures. To provide investors with a broader understanding of

capital adequacy, Riverview provides non-GAAP financial measures

for tangible common equity, along with the GAAP measure. Tangible

common equity is calculated as shareholders’ equity less goodwill

and other intangible assets. In addition, tangible assets are total

assets less goodwill and other intangible assets.

The following table provides a reconciliation of ending

shareholders’ equity (GAAP) to ending tangible shareholders’ equity

(non-GAAP), and ending assets (GAAP) to ending tangible assets

(non-GAAP).

June 30, March

31, June 30, (Dollars in thousands)

2012 2012

2011 Shareholders’ equity $ 73,820 $ 75,607 $ 107,818

Goodwill 25,572 25,572 25,572 Other intangible assets, net 566 415

561 Tangible shareholders’ equity $ 47,682 $ 49,620 $ 81,685

Total assets $ 814,730 $ 855,998 $ 885,625 Goodwill 25,572

25,572 25,572 Other intangible assets, net 566 415 561

Tangible assets $ 788,592 $ 830,011 $ 859,492

About Riverview

Riverview Bancorp, Inc. (www.riverviewbank.com) is headquartered

in Vancouver, Washington – just north of Portland, Oregon on the

I-5 corridor. With assets of $815 million, it is the parent company

of the 89 year-old Riverview Community Bank, as well as Riverview

Asset Management Corp. The Bank offers true community banking

services, focusing on providing the highest quality service and

financial products to commercial and retail customers. There are 18

branches, including thirteen in the Portland-Vancouver area and

three lending centers.

“Safe Harbor” statement under the Private Securities Litigation

Reform Act of 1995: This press release contains forward-looking

statements that are subject to risks and uncertainties, including,

but not limited to: the Company’s ability to raise common capital,

the amount of capital it intends to raise and its intended use of

that capital. The credit risks of lending activities, including

changes in the level and trend of loan delinquencies and write-offs

and changes in the Company’s allowance for loan losses and

provision for loan losses that may be impacted by deterioration in

the housing and commercial real estate markets; changes in general

economic conditions, either nationally or in the Company’s market

areas; changes in the levels of general interest rates, and the

relative differences between short and long term interest rates,

deposit interest rates, the Company’s net interest margin and

funding sources; fluctuations in the demand for loans, the number

of unsold homes, land and other properties and fluctuations in real

estate values in the Company’s market areas; secondary market

conditions for loans and the Company’s ability to sell loans in the

secondary market; results of examinations of us by the Office of

Comptroller of the Currency or other regulatory authorities,

including the possibility that any such regulatory authority may,

among other things, require us to increase the Company’s reserve

for loan losses, write-down assets, change Riverview Community

Bank’s regulatory capital position or affect the Company’s ability

to borrow funds or maintain or increase deposits, which could

adversely affect its liquidity and earnings; the Company’s

compliance with regulatory enforcement actions we have entered into

with the OCC as successor to the OTS and the possibility that our

noncompliance could result in the imposition of additional

enforcement actions and additional requirements or restrictions on

our operations; legislative or regulatory changes that adversely

affect the Company’s business including changes in regulatory

policies and principles, or the interpretation of regulatory

capital or other rules; the Company’s ability to attract and retain

deposits; further increases in premiums for deposit insurance; the

Company’s ability to control operating costs and expenses; the use

of estimates in determining fair value of certain of the Company’s

assets, which estimates may prove to be incorrect and result in

significant declines in valuation; difficulties in reducing risks

associated with the loans on the Company’s balance sheet; staffing

fluctuations in response to product demand or the implementation of

corporate strategies that affect the Company’s workforce and

potential associated charges; computer systems on which the Company

depends could fail or experience a security breach; the Company’s

ability to retain key members of its senior management team; costs

and effects of litigation, including settlements and judgments; the

Company’s ability to successfully integrate any assets,

liabilities, customers, systems, and management personnel it may in

the future acquire into its operations and the Company’s ability to

realize related revenue synergies and cost savings within expected

time frames and any goodwill charges related thereto; increased

competitive pressures among financial services companies; changes

in consumer spending, borrowing and savings habits; the

availability of resources to address changes in laws, rules, or

regulations or to respond to regulatory actions; the Company’s

ability to pay dividends on its common stock; and interest or

principal payments on its junior subordinated debentures; adverse

changes in the securities markets; inability of key third-party

providers to perform their obligations to us; changes in accounting

policies and practices, as may be adopted by the financial

institution regulatory agencies or the Financial Accounting

Standards Board, including additional guidance and interpretation

on accounting issues and details of the implementation of new

accounting methods; other economic, competitive, governmental,

regulatory, and technological factors affecting the Company’s

operations, pricing, products and services and the other risks

described from time to time in our filings with the Securities and

Exchange Commission.

Such forward-looking statements may include projections. Any

such projections were not prepared in accordance with published

guidelines of the American Institute of Certified Public

Accountants or the Securities Exchange Commission regarding

projections and forecasts nor have such projections been audited,

examined or otherwise reviewed by independent auditors of the

Company. In addition, such projections are based upon many

estimates and inherently subject to significant economic and

competitive uncertainties and contingencies, many of which are

beyond the control of management of the Company. Accordingly,

actual results may be materially higher or lower than those

projected. The inclusion of such projections herein should not be

regarded as a representation by the Company that the projections

will prove to be correct.

The Company cautions readers not to place undue reliance on any

forward-looking statements. Moreover, you should treat these

statements as speaking only as of the date they are made and based

only on information then actually known to the Company. The Company

does not undertake and specifically disclaims any obligation to

revise any forward-looking statements to reflect the occurrence of

anticipated or unanticipated events or circumstances after the date

of such statements. These risks could cause our actual results for

fiscal 2012 and beyond to differ materially from those expressed in

any forward-looking statements by, or on behalf of, us, and could

negatively affect the Company’s operating and stock price

performance.

RIVERVIEW BANCORP, INC. AND

SUBSIDIARY Consolidated Balance Sheets (In thousands,

except share data) (Unaudited)

June 30, 2012 Mar. 31,

2012 June 30, 2011

ASSETS

Cash (including interest-earning accounts

of $58,539, $33,437 and $58,044)

$ 71,362 $ 46,393 $ 70,010 Certificates of deposit held for

investment 40,975 41,473 18,875 Loans held for sale 100 480 190

Investment securities held to maturity, at amortized cost 487 493

499 Investment securities available for sale, at fair value 6,291

6,314 6,506 Mortgage-backed securities held to maturity, at

amortized 168 171 185 Mortgage-backed securities available for

sale, at fair value 813 974 1,545

Loans receivable (net of allowance for

loan losses of $20,972, $19,921 and $16,059)

597,138 664,888 677,310 Real estate and other pers. property owned

22,074 18,731 27,213 Prepaid expenses and other assets 4,550 6,362

5,973 Accrued interest receivable 2,084 2,158 2,494 Federal Home

Loan Bank stock, at cost 7,350 7,350 7,350 Premises and equipment,

net 17,887 17,068 15,864 Deferred income taxes, net 612 603 9,375

Mortgage servicing rights, net 448 278 364 Goodwill 25,572 25,572

25,572 Core deposit intangible, net 118 137 197 Bank owned life

insurance 16,701 16,553 16,103

TOTAL ASSETS $ 814,730 $ 855,998 $

885,625

LIABILITIES AND EQUITY

LIABILITIES: Deposit accounts $ 705,892 $ 744,455 $ 742,859 Accrued

expenses and other liabilities 8,675 9,398 8,824 Advance payments

by borrowers for taxes and insurance 605 800 406 Junior

subordinated debentures 22,681 22,681 22,681 Capital lease

obligation 2,495 2,513 2,556

Total liabilities 740,348 779,847 777,326 EQUITY:

Shareholders' equity

Serial preferred stock, $.01 par value;

250,000 authorized, issued and outstanding, none

- - - Common stock, $.01 par value; 50,000,000 authorized, June 30,

2012 – 22,471,890 issued and outstanding; 225 225 225 March 31,

2012 – 22,471,890 issued and outstanding;

-

-

-

June 30, 2011 – 22,471,890 issued and outstanding;

-

-

-

Additional paid-in capital 65,593 65,610 65,634 Retained earnings

9,756 11,536 43,907 Unearned shares issued to employee stock

ownership trust (567 ) (593 ) (670 ) Accumulated other

comprehensive loss (1,187 ) (1,171 ) (1,278 )

Total shareholders’ equity 73,820 75,607 107,818

Noncontrolling interest 562 544

481 Total equity 74,382 76,151

108,299 TOTAL LIABILITIES AND EQUITY $ 814,730

$ 855,998 $ 885,625

RIVERVIEW BANCORP, INC. AND SUBSIDIARY Consolidated

Statements of Operations Three Months Ended

(In thousands, except share data)

(Unaudited)

June 30, 2012

March 31, 2012 June

30, 2011 INTEREST INCOME: Interest and fees on loans receivable

$ 9,045 $ 9,130 $ 10,280 Interest on investment securities-taxable

53 36 45 Interest on investment securities-non taxable 8 7 12

Interest on mortgage-backed securities 8 10 16 Other interest and

dividends 129 127

75 Total interest income 9,243 9,310

10,428 INTEREST EXPENSE: Interest on deposits 823 908 1,230

Interest on borrowings 349

387 368 Total interest

expense 1,172 1,295

1,598 Net interest income 8,071

8,015 8,830 Less provision for loan losses 4,000

17,500

1,550 Net interest income (loss) after provision for

loan losses 4,071 (9,485 ) 7,280 NON-INTEREST INCOME: Fees

and service charges 1,057 914 1,042 Asset management fees 604 604

625 Gain on sale of loans held for sale 727 87 23 Bank owned life

insurance income 149 146 151 Other (97 )

(190 ) 63 Total

non-interest income 2,440 1,561 1,904 NON-INTEREST EXPENSE:

Salaries and employee benefits 3,793 3,850 4,511 Occupancy and

depreciation 1,234 1,253 1,163 Data processing 314 285 288

Amortization of core deposit intangible 19 20 22 Advertising and

marketing expense 219 184 245 FDIC insurance premium 287 288 273

State and local taxes 148 139 179 Telecommunications 121 110 107

Professional fees 421 283 339 Real estate owned expenses 939 1,130

430 Other 781 687

600 Total non-interest expense

8,276 8,229

8,157 INCOME (LOSS) BEFORE INCOME TAXES (1,765

) (16,153 ) 1,027 PROVISION (BENEFIT) FOR INCOME TAXES 15

(196 )

313 NET INCOME (LOSS) $ (1,780 ) $

(15,957 ) $ 714 Earnings (loss) per

common share: Basic $ (0.08 ) $ (0.71 ) $ 0.03 Diluted $ (0.08 ) $

(0.71 ) $ 0.03 Weighted average number of shares outstanding: Basic

22,333,329 22,327,171 22,308,696 Diluted 22,333,329 22,327,171

22,309,353

(Dollars in thousands)

At or for the three months ended June 30, 2012

March 31, 2012 June 30, 2011

AVERAGE

BALANCES

Average interest-earning assets

$ 768,156 $ 788,488 $ 761,194 Average interest-bearing liabilities

636,132 652,607 636,935 Net average earning assets 132,024 135,881

124,259 Average loans 671,798 695,973 691,394 Average deposits

732,812 741,320 715,610 Average equity 76,483 91,171 109,178

Average tangible equity 50,506 65,156 83,011

ASSET

QUALITY

June 30, 2012 March 31, 2012 June 30, 2011

Non-performing loans 36,782 44,163 13,110 Non-performing

loans to total loans 5.95% 6.45% 1.89% Real estate/repossessed

assets owned 22,074 18,731 27,213 Non-performing assets 58,856

62,894 40,323 Non-performing assets to total assets 7.22% 7.35%

4.55% Net loan charge-offs in the quarter 2,949 13,505 459 Net

charge-offs in the quarter/average net loans 1.76% 7.80% 0.27%

Allowance for loan losses 20,972 19,921 16,059

Average interest-earning assets to average

interest-bearing liabilities

120.75% 120.82% 119.51%

Allowance for loan losses to

non-performing loans

57.02% 45.11% 122.49% Allowance for loan losses to total loans

3.39% 2.91% 2.32% Shareholders’ equity to assets 9.06% 8.83% 12.17%

CAPITAL

RATIOS

Total capital (to risk weighted assets) 13.18% 12.11% 14.72% Tier 1

capital (to risk weighted assets) 11.91% 10.84% 13.46% Tier 1

capital (to leverage assets) 9.35% 8.76% 11.02% Tangible common

equity (to tangible assets) 6.05% 5.98% 9.50%

DEPOSIT

MIX

June 30, 2012 March 31, 2012 June 30, 2011

Interest checking $ 81,064 $ 106,904 $ 105,363 Regular

savings 47,596 45,741 37,855 Money market deposit accounts 230,695

244,919 229,994 Non-interest checking 132,231 116,882 113,780

Certificates of deposit 214,306 230,009

255,867 Total deposits $ 705,892 $ 744,455 $ 742,859

COMPOSITION OF

COMMERCIAL AND CONSTRUCTION LOANS

Commercial Commercial Real Estate Real

Estate & Construction Commercial

Mortgage Construction Total

June 30,

2012

(Dollars in thousands) Commercial $ 79,795 $ - $ - $ 79,795

Commercial construction - - 10,321 10,321 Office buildings - 94,602

- 94,602 Warehouse/industrial - 48,563 - 48,563 Retail/shopping

centers/strip malls - 76,467 - 76,467 Assisted living facilities -

30,484 - 30,484 Single purpose facilities - 96,124 - 96,124 Land -

29,131 - 29,131 Multi-family - 39,949 - 39,949 One-to-four family

- - 5,126 5,126 Total $ 79,795 $

415,320 $ 15,447 $ 510,562

March 31,

2012

(Dollars in thousands) Commercial $ 87,238 $ - $ - $ 87,238

Commercial construction - - 13,496 13,496 Office buildings - 94,541

- 94,541 Warehouse/industrial - 48,605 - 48,605 Retail/shopping

centers/strip malls - 80,595 - 80,595 Assisted living facilities -

35,866 - 35,866 Single purpose facilities - 93,473 - 93,473 Land -

38,888 - 38,888 Multi-family - 42,795 - 42,795 One-to-four family

- - 12,295 12,295 Total $ 87,238 $

434,763 $ 25,791 $ 547,792

LOAN

MIX

June 30, 2012 March 31, 2012 June 30, 2011

Commercial and construction Commercial $ 79,795 $ 87,238 $ 84,158

Other real estate mortgage 415,320 434,763 465,391 Real estate

construction 15,447 25,791 25,924 Total

commercial and construction 510,562 547,792 575,473 Consumer Real

estate one-to-four family 105,298 134,975 115,578 Other installment

2,250 2,042 2,318 Total consumer 107,548

137,017 117,896 Total loans 618,110 684,809

693,369 Less: Allowance for loan losses 20,972

19,921 16,059 Loans receivable, net $ 597,138 $ 664,888 $

677,310

DETAIL OF

NON-PERFORMING ASSETS

Northwest Other Southwest Other Oregon Oregon Washington

Washington Other Total

June 30,

2012

(Dollars in thousands) Non-performing assets Commercial $ -

$ 176 $ 1,960 $ - $ - $ 2,136 Commercial real estate 4,222 - 9,001

- 3,478 16,701 Land - 800 3,384 - - 4,184 Multi-family - 4,177

3,030 - - 7,207 Commercial construction - - - - - - One-to-four

family construction 1,018 603 393 - - 2,014 Real estate one-to-four

family 440 447 3,653 - - 4,540 Consumer - - -

- - - Total non-performing loans 5,680 6,203

21,421 - 3,478 36,782 REO 2,123 6,829

10,072 3,050 - 22,074 Total

non-performing assets $ 7,803 $ 13,032 $ 31,493 $ 3,050 $ 3,478 $

58,856

DETAIL OF SPEC

CONSTRUCTION AND LAND DEVELOPMENT LOANS

Northwest Other Southwest Other Oregon Oregon Washington

Washington Other Total

June 30,

2012

(Dollars in thousands) Land and Spec Construction Loans Land

Development Loans $ 5,909 $ 2,426 $ 20,796 $ - $ - $ 29,131 Spec

Construction Loans 1,018 604 3,038 243

- 4,903 Total Land and Spec Construction $

6,927 $ 3,030 $ 23,834 $ 243 $ - $ 34,034

At or for the three months ended

SELECTED OPERATING

DATA

June 30, 2012

March 31, 2012

June 30, 2011 Efficiency ratio (4)

78.74% 85.93% 75.99% Coverage ratio (6) 97.52% 97.40% 108.25%

Return on average assets (1) -0.85% -7.40% 0.33% Return on average

equity (1) -9.33% -70.39% 2.62%

NET INTEREST

SPREAD

Yield on loans 5.40% 5.32% 5.96% Yield on investment securities

3.04% 2.36% 2.93% Total yield on interest earning assets 4.83%

4.79% 5.50% Cost of interest bearing deposits 0.54% 0.59%

0.81% Cost of FHLB advances and other borrowings 5.56% 6.23% 5.85%

Total cost of interest bearing liabilities 0.74% 0.80% 1.01%

Spread (7) 4.09% 3.99% 4.49% Net interest margin 4.22% 4.12% 4.66%

PER SHARE

DATA

Basic earnings per share (2) $ (0.08) $ (0.71) $ 0.03 Diluted

earnings per share (3) (0.08) (0.71) 0.03 Book value per share (5)

3.28 3.36 4.80 Tangible book value per share (5) 2.12 2.21 3.63

Market price per share: High for the period $ 2.29 $ 2.46 $ 3.18

Low for the period 1.08 2.03 2.80 Close for period end 1.25 2.26

3.07 Average number of shares outstanding: Basic (2)

22,333,329 22,327,171 22,308,696 Diluted (3) 22,333,329 22,327,171

22,309,353

(1) Amounts for the quarterly

periods are annualized.

(2) Amounts exclude ESOP shares

not committed to be released.

(3) Amounts exclude ESOP shares

not committed to be released and include common stock

equivalents.

(4) Non-interest expense

divided by net interest income and non-interest income.

(5) Amounts calculated based on

shareholders’ equity and include ESOP shares not committed to be

released.

(6) Net interest income divided

by non-interest expense.

(7) Yield on interest-earning

assets less cost of funds on interest bearing liabilities.

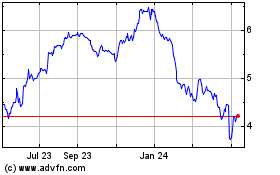

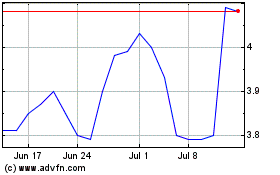

Riverview Bancorp (NASDAQ:RVSB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Riverview Bancorp (NASDAQ:RVSB)

Historical Stock Chart

From Apr 2023 to Apr 2024