Riverview Bancorp, Inc. (Nasdaq:RVSB) ("Riverview" or the

"Company") today reported net income of $1.6 million, or $0.07 per

diluted share, in its fiscal first quarter ended June 30, 2013.

This compares to net income of $1.6 million, or $0.07 per diluted

share, in the preceding quarter and a net loss of $1.8 million, or

$0.08 per diluted share, in the first quarter a year ago.

"Our strategic plan remains on schedule. We have strengthened

the overall health of the company with improved credit quality

metrics and sound capital ratios, and we were profitable for the

fourth consecutive quarter," said Pat Sheaffer, Chairman and CEO.

"Going forward we will continue to work on improving our asset

quality while looking for growth opportunities in the Portland and

Vancouver market areas."

First Quarter Highlights (at or for the period ended

June 30, 2013)

- Net income was $1.6 million, or $0.07 per diluted share

- Net interest margin was 3.51% for the quarter

- Nonperforming assets decreased $2.2 million during the quarter

to $34.6 million (6.0% decline)

- Classified assets decreased $7.8 million during the quarter to

$59.8 million (11.6% decline)

- Net recoveries for the first quarter totaled $554,000 compared

to net charge-offs of $390,000 in the preceding quarter; marking

the fifth consecutive quarter of declining charge-offs

- Core deposits were strong and accounted for 95% of total

deposits

- Capital levels continue to exceed the regulatory requirements

to be categorized as "well capitalized" with a total risk-based

capital ratio of 15.81% and a Tier 1 leverage ratio of 10.27%

Credit Quality

"We continued to make meaningful progress in reducing our level

of problem assets, with nonperforming assets, REO and net

charge-offs all declining during the current quarter," said Ron

Wysaske, President and COO.

Classified assets decreased $7.8 million during the quarter to

$59.8 million at June 30, 2013 compared to $67.6 million at March

31, 2013 and $109.6 million at June 30, 2012. The classified asset

ratio decreased to 66.4% at June 30, 2013.

Nonperforming loans were $21.4 million, or 4.07% of total loans,

at June 30, 2013 compared to $21.1 million, or 3.94% of total loans

at March 31, 2013 and $36.8 million, or 5.95% of total loans a year

ago. The slight increase was due to a $4.0 million loan on an

office building in Portland that was moved to nonaccrual status

during the quarter. This loan is fully collateralized and has a

pending sale on one of the two pieces of collateral that would

payoff approximately $2.5 million of the outstanding loan

balance.

REO balances decreased $2.5 million during the quarter to $13.2

million, the lowest level in over four years. During the quarter,

REO sales totaled $3.0 million with write-downs of $1.3 million and

additions of $1.8 million. Riverview also has several additional

properties under sales contracts which are expected to close in the

September quarter.

The Bank had a provision recapture of $2.5 million during the

first quarter. The provision recapture during the current quarter

reflects the continued improvement in credit quality as well as the

decline in net loan charge-offs. Riverview recorded a $3.6 million

provision recapture in the preceding quarter and made a $4.0

million provision for loan losses in the first quarter a year

ago.

The allowance for loan losses was $13.7 million at June 30,

2013, representing 2.61% of total loans and 64.03% of nonperforming

loans. Net charge-offs declined for the fifth consecutive quarter

as the Bank's problem credits continued to decline and the

recoveries on prior loan charge-offs increased. As a result,

Riverview had net recoveries of $554,000 in the fiscal first

quarter, compared to net charge-offs of $390,000 in the preceding

quarter and net charge-off of $2.9 million in the fiscal first

quarter a year ago.

Balance Sheet Review

Net loan balances declined $8.7 million during the quarter,

primarily due to the Bank's continued focus on reducing classified

loan balances. Net loans were $511.7 million at June 30, 2013

compared to $520.4 million at March 31, 2013 and $597.1 million at

June 30, 2012. "Over the past year our focus has been on reducing

classified loan balances," said Wysaske. "As classified loan

balances continue to decrease, we are focusing more of our

attention on increasing loan production. We have two full service

lending teams that are working both the Vancouver and Portland

market areas looking for new relationships and quality loans. We

remain optimistic for our loan growth potential in fiscal year 2014

as our loan pipeline has been growing in recent quarters."

The commercial real estate ("CRE") loan portfolio totaled $292.2

million at June 30, 2013, of which 29% was owner-occupied and 71%

was investor-owned. The CRE portfolio contained eight loans

totaling $13.4 million that were nonperforming, representing 4.6%

of the total CRE portfolio and 62.7% of total nonperforming

loans.

Total deposits were $659.5 million at June 30, 2013 compared to

$663.8 million at March 31, 2013 and $705.9 million a year ago. The

Company's focus remains on growing low cost customer deposits. At

June 30, 2013, non-interest checking accounts were $117.5 million,

an increase of 4.4% from the prior quarter.

In fiscal 2012, Riverview established a valuation allowance

against its deferred tax asset. At June 30, 2013, the total

valuation allowance was $15.8 million. Management and Riverview's

outside advisors will review the deferred tax asset on a quarterly

basis to determine the appropriate valuation allowance. Any future

reversals of the deferred tax asset valuation allowance would

decrease Riverview's income tax expense, increase its after tax net

income and shareholders' equity.

Income Statement

Riverview's net interest margin was 3.51% for the first quarter

compared to 3.64% for the preceding quarter and 4.22% in the first

quarter a year ago. The decrease from prior year was primarily due

to an increase in cash balances along with a corresponding decrease

in loan balances and the re-pricing of loans in the loan portfolio.

Loan yields have continued to contract as existing loans in the

portfolio re-price and new loans are originated in the current low

interest rate environment.

Non-interest income increased to $2.2 million in the first

quarter of fiscal 2014 compared to $2.0 million in the preceding

quarter. Mortgage banking activity remained higher than normal with

a total of $20.8 million in new mortgage loans originated during

the quarter, resulting in a $317,000 gain on sale of loans held for

sale. Asset management fees increased to $736,000 during the

quarter compared to $604,000 in the same quarter a year ago due to

an increase in assets under management as well as an increase in

investment activity.

Non-interest expense decreased to $9.2 million in the first

quarter of fiscal 2014 compared to $10.2 million in the preceding

quarter. Data processing expenses in the first quarter included

$275,000 in conversion expenses related to the Company's change in

its core operating system during June 2013. REO expenses decreased

from prior quarter to $1.6 million. The decrease was primarily

attributable to a reduction in total write-downs. REO

write-downs during the quarter totaled $1.3 million compared to

$2.6 million in the prior quarter.

"We continue to be aggressive in the pricing of our existing REO

properties in an attempt to liquidate these properties more

quickly," Wysaske concluded. "Based on sales activity during the

quarter as well as pending sales activity, the updated pricing

strategy appears to be working successfully."

Capital and Liquidity

Riverview continues to maintain capital levels in excess of the

regulatory requirements to be categorized as "well capitalized"

with a total risk-based capital ratio of 15.81% and a Tier 1

leverage ratio of 10.27% at June 30, 2013.

At June 30, 2013, the Bank had available total and contingent

liquidity of more than $485 million, including over $225 million of

borrowing capacity from the Federal Home Loan Bank of Seattle and

the Federal Reserve Bank of San Francisco. The Bank also has more

than $150 million of cash and short-term investments.

Non-GAAP Financial Measures

In addition to results presented in accordance with generally

accepted accounting principles in the United States of America

(GAAP), this press release contains certain non-GAAP financial

measures. Riverview believes that certain non-GAAP financial

measures provide investors with information useful in understanding

the company's financial performance; however, readers of this

report are urged to review these non-GAAP financial measures in

conjunction with GAAP results as reported.

Financial measures that exclude intangible assets are non-GAAP

measures. To provide investors with a broader understanding of

capital adequacy, Riverview provides non-GAAP financial measures

for tangible common equity, along with the GAAP measure. Tangible

common equity is calculated as shareholders' equity less goodwill

and other intangible assets. In addition, tangible assets are total

assets less goodwill and other intangible assets.

The following table provides a reconciliation of ending

shareholders' equity (GAAP) to ending tangible shareholders' equity

(non-GAAP), and ending assets (GAAP) to ending tangible assets

(non-GAAP).

| (Dollars in thousands) |

June 30, 2013 |

March 31, 2013 |

June 30, 2012 |

| |

|

|

|

| Shareholders' equity |

$ 80,144 |

$ 78,442 |

$ 73,820 |

| Goodwill |

25,572 |

25,572 |

25,572 |

| Other intangible assets, net |

455 |

454 |

566 |

| |

|

|

|

| Tangible shareholders' equity |

$ 54,117 |

$ 52,416 |

$ 47,682 |

| |

|

|

|

| Total assets |

$ 774,578 |

$ 777,003 |

$ 814,730 |

| Goodwill |

25,572 |

25,572 |

25,572 |

| Other intangible assets, net |

455 |

454 |

566 |

| |

|

|

|

| Tangible assets |

$ 748,551 |

$ 750,977 |

$ 788,592 |

About Riverview

Riverview Bancorp, Inc. (www.riverviewbank.com) is headquartered

in Vancouver, Washington – just north of Portland, Oregon on the

I-5 corridor. With assets of $775 million, it is the parent company

of the 90 year-old Riverview Community Bank, as well as Riverview

Asset Management Corp. The Bank offers true community banking

services, focusing on providing the highest quality service and

financial products to commercial and retail customers. There are 18

branches, including thirteen in the Portland-Vancouver area and

three lending centers.

"Safe Harbor" statement under the Private Securities Litigation

Reform Act of 1995: This press release contains forward-looking

statements that are subject to risks and uncertainties, including,

but not limited to: the Company's ability to raise common capital,

the amount of capital it intends to raise and its intended use of

that capital; the credit risks of lending activities, including

changes in the level and trend of loan delinquencies and write-offs

and changes in the Company's allowance for loan losses and

provision for loan losses that may be impacted by deterioration in

the housing and commercial real estate markets; changes in general

economic conditions, either nationally or in the Company's market

areas; changes in the levels of general interest rates, and the

relative differences between short and long term interest rates,

deposit interest rates, the Company's net interest margin and

funding sources; fluctuations in the demand for loans, the number

of unsold homes, land and other properties and fluctuations in real

estate values in the Company's market areas; secondary market

conditions for loans and the Company's ability to sell loans in the

secondary market; results of examinations of us by the Office of

Comptroller of the Currency or other regulatory authorities,

including the possibility that any such regulatory authority may,

among other things, require us to increase the Company's reserve

for loan losses, write-down assets, change Riverview Community

Bank's regulatory capital position or affect the Company's ability

to borrow funds or maintain or increase deposits, which could

adversely affect its liquidity and earnings; the Company's

compliance with regulatory enforcement actions we have entered into

with the OCC and the possibility that our noncompliance could

result in the imposition of additional enforcement actions and

additional requirements or restrictions on our

operations; legislative or regulatory changes that adversely

affect the Company's business including changes in regulatory

policies and principles, or the interpretation of regulatory

capital or other rules; the Company's ability to attract and retain

deposits; further increases in premiums for deposit insurance; the

Company's ability to control operating costs and expenses; the use

of estimates in determining fair value of certain of the Company's

assets, which estimates may prove to be incorrect and result in

significant declines in valuation; difficulties in reducing risks

associated with the loans on the Company's balance sheet; staffing

fluctuations in response to product demand or the implementation of

corporate strategies that affect the Company's workforce and

potential associated charges; computer systems on which the Company

depends could fail or experience a security breach; the Company's

ability to retain key members of its senior management team; costs

and effects of litigation, including settlements and judgments; the

Company's ability to successfully integrate any assets,

liabilities, customers, systems, and management personnel it may in

the future acquire into its operations and the Company's ability to

realize related revenue synergies and cost savings within expected

time frames and any goodwill charges related thereto; increased

competitive pressures among financial services companies; changes

in consumer spending, borrowing and savings habits; the

availability of resources to address changes in laws, rules, or

regulations or to respond to regulatory actions; the Company's

ability to pay dividends on its common stock; and interest or

principal payments on its junior subordinated debentures; adverse

changes in the securities markets; inability of key third-party

providers to perform their obligations to us; changes in accounting

policies and practices, as may be adopted by the financial

institution regulatory agencies or the Financial Accounting

Standards Board, including additional guidance and interpretation

on accounting issues and details of the implementation of new

accounting methods; other economic, competitive, governmental,

regulatory, and technological factors affecting the Company's

operations, pricing, products and services and the other risks

described from time to time in our filings with the SEC.

Such forward-looking statements may include projections. Any

such projections were not prepared in accordance with published

guidelines of the American Institute of Certified Public

Accountants or the Securities Exchange Commission regarding

projections and forecasts nor have such projections been audited,

examined or otherwise reviewed by independent auditors of the

Company. In addition, such projections are based upon many

estimates and inherently subject to significant economic and

competitive uncertainties and contingencies, many of which are

beyond the control of management of the Company. Accordingly,

actual results may be materially higher or lower than those

projected. The inclusion of such projections herein should not be

regarded as a representation by the Company that the projections

will prove to be correct.

The Company cautions readers not to place undue reliance on any

forward-looking statements. Moreover, you should treat these

statements as speaking only as of the date they are made and based

only on information then actually known to the Company. The Company

does not undertake and specifically disclaims any obligation to

revise any forward-looking statements to reflect the occurrence of

anticipated or unanticipated events or circumstances after the date

of such statements. These risks could cause our actual results for

fiscal 2014 and beyond to differ materially from those expressed in

any forward-looking statements by, or on behalf of, us, and could

negatively affect the Company's operating and stock price

performance.

| RIVERVIEW BANCORP, INC. AND

SUBSIDIARY |

|

|

|

| Consolidated Balance

Sheets |

|

|

|

| (In thousands, except share

data) (Unaudited) |

June 30, 2013 |

March 31, 2013 |

June 30, 2012 |

| ASSETS |

|

|

|

| |

|

|

|

| Cash (including interest-earning accounts

of $96,110, $100,093 and $58,539) |

$ 111,878 |

$ 115,415 |

$ 71,362 |

| Certificate of deposits |

42,652 |

44,635 |

40,975 |

| Loans held for sale |

1,258 |

831 |

100 |

| Investment securities held to maturity,

at amortized cost |

-- |

-- |

487 |

| Investment securities available for sale,

at fair value |

14,590 |

6,216 |

6,291 |

| Mortgage-backed securities held to

maturity, at amortized |

122 |

125 |

168 |

| Mortgage-backed securities available for

sale, at fair value |

6,068 |

431 |

813 |

| Loans receivable (net of allowance for

loan losses of $13,697, $15,643 and $20,972) |

511,692 |

520,369 |

597,138 |

| Real estate and other pers. property

owned |

13,165 |

15,638 |

22,074 |

| Prepaid expenses and other assets |

2,800 |

3,063 |

4,550 |

| Accrued interest receivable |

1,751 |

1,747 |

2,084 |

| Federal Home Loan Bank stock, at

cost |

7,089 |

7,154 |

7,350 |

| Premises and equipment, net |

17,708 |

17,693 |

17,887 |

| Deferred income taxes, net |

498 |

522 |

612 |

| Mortgage servicing rights, net |

406 |

388 |

448 |

| Goodwill |

25,572 |

25,572 |

25,572 |

| Core deposit intangible, net |

49 |

66 |

118 |

| Bank owned life insurance |

17,280 |

17,138 |

16,701 |

| |

|

|

|

| TOTAL ASSETS |

$ 774,578 |

$ 777,003 |

$ 814,730 |

| |

|

|

|

| LIABILITIES AND EQUITY |

|

|

|

| |

|

|

|

| LIABILITIES: |

|

|

|

| Deposit accounts |

$ 659,495 |

$ 663,806 |

$ 705,892 |

| Accrued expenses and other

liabilities |

8,966 |

8,006 |

8,675 |

| Advance payments by borrowers for taxes

and insurance |

237 |

1,025 |

605 |

| Junior subordinated debentures |

22,681 |

22,681 |

22,681 |

| Capital lease obligation |

2,420 |

2,440 |

2,495 |

| Total liabilities |

693,799 |

697,958 |

740,348 |

| |

|

|

|

| EQUITY: |

|

|

|

| Shareholders' equity |

|

|

|

| Serial preferred stock, $.01 par value;

250,000 authorized, issued and outstanding, none |

-- |

-- |

-- |

| Common stock, $.01 par value; 50,000,000

authorized, |

|

|

|

| June 30, 2013 – 22,471,890 issued and

outstanding; |

225 |

225 |

225 |

| March 31, 2013 – 22,471,890 issued and

outstanding; |

|

|

|

| June 30, 2012 – 22,471,890 issued and

outstanding; |

|

|

|

| Additional paid-in capital |

65,541 |

65,551 |

65,593 |

| Retained earnings |

15,809 |

14,169 |

9,756 |

| Unearned shares issued to employee stock

ownership trust |

(464) |

(490) |

(567) |

| Accumulated other comprehensive loss |

(967) |

(1,013) |

(1,187) |

| Total shareholders' equity |

80,144 |

78,442 |

73,820 |

| |

|

|

|

| Noncontrolling interest |

635 |

603 |

562 |

| Total equity |

80,779 |

79,045 |

74,382 |

| |

|

|

|

| TOTAL LIABILITIES AND EQUITY |

$ 774,578 |

$ 777,003 |

$ 814,730 |

| |

|

|

|

| RIVERVIEW BANCORP, INC. AND

SUBSIDIARY |

|

|

|

| Consolidated Statements of

Operations |

|

|

|

| |

Three Months

Ended |

| (In thousands, except share

data) (Unaudited) |

June 30, 2013 |

March 31, 2013 |

June 30, 2012 |

| INTEREST INCOME: |

|

|

|

| Interest and fees on loans

receivable |

$ 6,605 |

$ 6,690 |

$ 9,045 |

| Interest on investment

securities-taxable |

39 |

54 |

53 |

| Interest on investment securities-non

taxable |

-- |

-- |

8 |

| Interest on mortgage-backed

securities |

16 |

4 |

8 |

| Other interest and dividends |

171 |

157 |

129 |

| Total interest income |

6,831 |

6,905 |

9,243 |

| |

|

|

|

| INTEREST EXPENSE: |

|

|

|

| Interest on deposits |

527 |

550 |

823 |

| Interest on borrowings |

150 |

150 |

349 |

| Total interest expense |

677 |

700 |

1,172 |

| Net interest income |

6,154 |

6,205 |

8,071 |

| Less provision (recapture) for loan

losses |

(2,500) |

(3,600) |

4,000 |

| |

|

|

|

| Net interest income after provision for loan

losses |

8,654 |

9,805 |

4,071 |

| |

|

|

|

| NON-INTEREST INCOME: |

|

|

|

| Fees and service charges |

1,030 |

1,083 |

1,057 |

| Asset management fees |

736 |

547 |

604 |

| Gain on sale of loans held for sale |

317 |

245 |

727 |

| Bank owned life insurance income |

142 |

142 |

149 |

| Other |

21 |

15 |

(97) |

| Total non-interest income |

2,246 |

2,032 |

2,440 |

| |

|

|

|

| NON-INTEREST EXPENSE: |

|

|

|

| Salaries and employee benefits |

3,870 |

4,051 |

3,793 |

| Occupancy and depreciation |

1,244 |

1,259 |

1,234 |

| Data processing |

688 |

379 |

314 |

| Amortization of core deposit intangible |

17 |

17 |

19 |

| Advertising and marketing expense |

204 |

153 |

219 |

| FDIC insurance premium |

411 |

418 |

287 |

| State and local taxes |

126 |

130 |

148 |

| Telecommunications |

68 |

74 |

121 |

| Professional fees |

338 |

307 |

421 |

| Real estate owned expenses |

1,612 |

2,882 |

939 |

| Other |

665 |

566 |

781 |

| Total non-interest expense |

9,243 |

10,236 |

8,276 |

| |

|

|

|

| INCOME (LOSS) BEFORE INCOME TAXES |

1,657 |

1,601 |

(1,765) |

| PROVISION FOR INCOME TAXES |

17 |

6 |

15 |

| NET INCOME (LOSS) |

$ 1,640 |

$ 1,595 |

$ (1,780) |

| |

|

|

|

| Earnings (loss) per common share: |

|

|

|

| Basic |

$ 0.07 |

$ 0.07 |

$ (0.08) |

| Diluted |

$ 0.07 |

$ 0.07 |

$ (0.08) |

| Weighted average number of shares

outstanding: |

|

|

|

| Basic |

22,357,962 |

22,351,804 |

22,333,329 |

| Diluted |

22,358,633 |

22,352,229 |

22,333,329 |

| |

|

|

|

| (Dollars in thousands) |

At or for the three

months ended |

| |

June 30, 2013 |

March 31, 2013 |

June 30, 2012 |

| AVERAGE BALANCES |

|

|

|

| Average interest–earning assets |

$ 702,926 |

$ 691,793 |

$ 768,156 |

| Average interest-bearing liabilities |

568,246 |

574,763 |

636,132 |

| Net average earning assets |

134,680 |

117,030 |

132,024 |

| Average loans |

531,427 |

543,906 |

671,798 |

| Average deposits |

657,136 |

662,978 |

732,812 |

| Average equity |

79,997 |

78,370 |

76,483 |

| Average tangible equity |

53,974 |

52,321 |

50,506 |

| |

|

|

|

| |

|

|

|

| ASSET QUALITY |

June 30, 2013 |

March 31, 2013 |

June 30, 2012 |

| |

|

|

|

| Non-performing loans |

21,390 |

21,133 |

36,782 |

| Non-performing loans to total loans |

4.07% |

3.94% |

5.95% |

| Real estate/repossessed assets owned |

13,165 |

15,638 |

22,074 |

| Non-performing assets |

34,555 |

36,771 |

58,856 |

| Non-performing assets to total assets |

4.46% |

4.73% |

7.22% |

| Net loan charge-offs in the quarter |

(554) |

390 |

2,949 |

| Net charge-offs (recoveries) in the

quarter/average loans |

(0.42)% |

0.29% |

1.76% |

| |

|

|

|

| Allowance for loan losses |

13,697 |

15,643 |

20,972 |

| Average interest-earning assets to average

interest-bearing liabilities |

123.70% |

120.36% |

120.75% |

| Allowance for loan losses to non-performing

loans |

64.03% |

74.02% |

57.02% |

| Allowance for loan losses to total loans |

2.61% |

2.92% |

3.39% |

| Shareholders' equity to assets |

10.35% |

10.10% |

9.06% |

| |

|

|

|

| |

|

|

|

| CAPITAL RATIOS |

|

|

|

| Total capital (to risk weighted assets) |

15.81% |

15.29% |

13.18% |

| Tier 1 capital (to risk weighted assets) |

14.54% |

14.02% |

11.91% |

| Tier 1 capital (to leverage assets) |

10.27% |

9.99% |

9.35% |

| Tangible common equity (to tangible

assets) |

7.23% |

6.98% |

6.05% |

| |

|

|

|

| |

|

|

|

| DEPOSIT MIX |

June 30, 2013 |

March 31, 2013 |

June 30, 2012 |

| |

|

|

|

| Interest checking |

$ 93,058 |

$ 91,754 |

$ 81,064 |

| Regular savings |

55,716 |

54,316 |

47,596 |

| Money market deposit accounts |

213,239 |

217,091 |

230,695 |

| Non-interest checking |

117,498 |

112,527 |

132,231 |

| Certificates of deposit |

179,984 |

188,118 |

214,306 |

| Total deposits |

$ 659,495 |

$ 663,806 |

$ 705,892 |

| |

|

|

|

|

| COMPOSITION OF COMMERCIAL AND

CONSTRUCTION LOANS |

|

|

|

|

| |

|

|

|

|

| |

|

Commercial |

|

Commercial |

| |

|

Real Estate |

Real Estate |

& Construction |

| |

Commercial |

Mortgage |

Construction |

Total |

| June 30, 2013 |

(Dollars in thousands) |

| Commercial |

$ 69,175 |

$ -- |

$ -- |

$ 69,175 |

| Commercial construction |

-- |

-- |

6,885 |

6,885 |

| Office buildings |

-- |

85,620 |

-- |

85,620 |

| Warehouse/industrial |

-- |

40,671 |

-- |

40,671 |

| Retail/shopping centers/strip malls |

-- |

65,600 |

-- |

65,600 |

| Assisted living facilities |

-- |

7,691 |

-- |

7,691 |

| Single purpose facilities |

-- |

92,589 |

-- |

92,589 |

| Land |

-- |

19,238 |

-- |

19,238 |

| Multi-family |

-- |

38,713 |

-- |

38,713 |

| One-to-four family |

-- |

-- |

3,907 |

3,907 |

| Total |

$ 69,175 |

$ 350,122 |

$ 10,792 |

$ 430,089 |

| |

|

|

|

|

| March 31, 2013 |

(Dollars in thousands) |

| Commercial |

$ 71,935 |

$ -- |

$ -- |

$ 71,935 |

| Commercial construction |

-- |

-- |

5,719 |

5,719 |

| Office buildings |

-- |

86,751 |

-- |

86,751 |

| Warehouse/industrial |

-- |

41,124 |

-- |

41,124 |

| Retail/shopping centers/strip malls |

-- |

67,472 |

-- |

67,472 |

| Assisted living facilities |

-- |

13,146 |

-- |

13,146 |

| Single purpose facilities |

-- |

89,198 |

-- |

89,198 |

| Land |

-- |

23,404 |

-- |

23,404 |

| Multi-family |

-- |

34,302 |

-- |

34,302 |

| One-to-four family |

-- |

-- |

3,956 |

3,956 |

| Total |

$ 71,935 |

$ 355,397 |

$ 9,675 |

$ 437,007 |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| LOAN MIX |

June 30, 2013 |

March 31, 2013 |

June 30, 2012 |

|

| Commercial and construction |

|

|

|

|

| Commercial |

$ 69,175 |

$ 71,935 |

$ 79,795 |

|

| Other real estate mortgage |

350,122 |

355,397 |

415,320 |

|

| Real estate construction |

10,792 |

9,675 |

15,447 |

|

| Total commercial and construction |

430,089 |

437,007 |

510,562 |

|

| Consumer |

|

|

|

|

| Real estate one-to-four family |

93,341 |

97,140 |

105,298 |

|

| Other installment |

1,959 |

1,865 |

2,250 |

|

| Total consumer |

95,300 |

99,005 |

107,548 |

|

| |

|

|

|

|

| Total loans |

525,389 |

536,012 |

618,110 |

|

| |

|

|

|

|

| Less: |

|

|

|

|

| Allowance for loan losses |

13,697 |

15,643 |

20,972 |

|

| Loans receivable, net |

$ 511,692 |

$ 520,369 |

$ 597,138 |

|

| |

|

|

|

|

|

|

| DETAIL OF NON-PERFORMING

ASSETS |

| |

|

|

|

|

|

|

| |

Northwest |

Other |

Southwest |

Other |

|

|

| |

Oregon |

Oregon |

Washington |

Washington |

Other |

Total |

| June 30, 2013 |

(Dollars in thousands) |

| Non-performing assets |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Commercial |

$ -- |

$ 404 |

$ 811 |

$ -- |

$ -- |

$ 1,215 |

| Commercial real estate |

5,581 |

-- |

7,600 |

224 |

-- |

13,405 |

| Land |

-- |

800 |

668 |

-- |

-- |

1,468 |

| Multi-family |

-- |

2,465 |

-- |

-- |

-- |

2,465 |

| Commercial construction |

-- |

-- |

-- |

-- |

-- |

-- |

| One-to-four family construction |

-- |

168 |

-- |

-- |

-- |

168 |

| Real estate one-to-four family |

349 |

394 |

1,376 |

550 |

-- |

2,669 |

| Consumer |

-- |

-- |

-- |

-- |

-- |

-- |

| Total non-performing loans |

5,930 |

4,231 |

10,455 |

774 |

-- |

21,390 |

| |

|

|

|

|

|

|

| REO |

-- |

4,327 |

7,120 |

1,718 |

-- |

13,165 |

| |

|

|

|

|

|

|

| Total non-performing assets |

$ 5,930 |

$ 8,558 |

$ 17,575 |

$ 2,492 |

$ -- |

$ 34,555 |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| DETAIL OF SPEC

CONSTRUCTION AND LAND DEVELOPMENT LOANS |

| |

|

|

|

|

|

|

| |

Northwest |

Other |

Southwest |

Other |

|

|

| |

Oregon |

Oregon |

Washington |

Washington |

Other |

Total |

| June 30, 2013 |

(Dollars in thousands) |

| Land and Spec Construction Loans |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Land Development Loans |

$ 3,918 |

$ 1,326 |

$ 13,994 |

$ -- |

$ -- |

$ 19,238 |

| Spec Construction Loans |

-- |

168 |

3,397 |

138 |

-- |

3,703 |

| |

|

|

|

|

|

|

| Total Land and Spec Construction |

$ 3,918 |

$ 1,494 |

$ 17,391 |

$ 138 |

$ -- |

$ 22,941 |

| |

|

|

|

| |

At or for the

three months ended |

| SELECTED OPERATING DATA |

June 30, 2013 |

March 31, 2013 |

June 30, 2012 |

| |

|

|

|

| Efficiency ratio (4) |

110.04% |

124.27% |

78.74% |

| Coverage ratio (6) |

66.58% |

60.62% |

97.52% |

| Return on average assets (1) |

0.85% |

0.83% |

-0.85% |

| Return on average equity (1) |

8.22% |

8.25% |

-9.33% |

| |

|

|

|

| NET INTEREST SPREAD |

|

|

|

| Yield on loans |

4.99% |

4.99% |

5.40% |

| Yield on investment securities |

1.44% |

2.81% |

3.04% |

| Total yield on interest earning

assets |

3.90% |

4.05% |

4.83% |

| |

|

|

|

| Cost of interest bearing deposits |

0.39% |

0.41% |

0.54% |

| Cost of FHLB advances and other

borrowings |

2.40% |

2.42% |

5.56% |

| Total cost of interest bearing

liabilities |

0.48% |

0.49% |

0.74% |

| |

|

|

|

| Spread (7) |

3.42% |

3.56% |

4.09% |

| Net interest margin |

3.51% |

3.64% |

4.22% |

| |

|

|

|

| PER SHARE DATA |

|

|

|

| Basic earnings (loss) per share (2) |

$ 0.07 |

$ 0.07 |

$ (0.08) |

| Diluted earnings (loss) per share (3) |

0.07 |

0.07 |

(0.08) |

| Book value per share (5) |

3.57 |

3.49 |

3.28 |

| Tangible book value per share (5) |

2.41 |

2.33 |

2.12 |

| Market price per share: |

|

|

|

| High for the period |

$ 2.67 |

$ 2.76 |

$ 2.29 |

| Low for the period |

2.27 |

1.66 |

1.08 |

| Close for period end |

2.51 |

2.64 |

1.25 |

| |

|

|

|

| Average number of shares outstanding: |

|

|

|

| Basic (2) |

22,357,962 |

22,351,804 |

22,333,329 |

| Diluted (3) |

22,358,633 |

22,352,229 |

22,333,329 |

| |

|

|

|

| (1) Amounts for the

quarterly periods are annualized. |

| (2) Amounts exclude ESOP

shares not committed to be released. |

| (3) Amounts exclude ESOP

shares not committed to be released and include common stock

equivalents. |

| (4) Non-interest expense

divided by net interest income and non-interest income. |

| (5) Amounts calculated

based on shareholders' equity and include ESOP shares not committed

to be released. |

| (6) Net interest income

divided by non-interest expense. |

| (7) Yield on

interest-earning assets less cost of funds on interest bearing

liabilities. |

CONTACT: Pat Sheaffer or Ron Wysaske,

Riverview Bancorp, Inc. 360-693-6650

The Cereghino Group

IR CONTACT: 206-388-5785

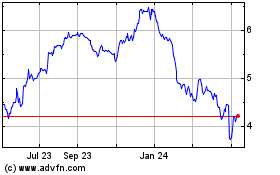

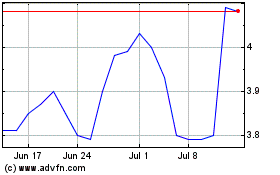

Riverview Bancorp (NASDAQ:RVSB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Riverview Bancorp (NASDAQ:RVSB)

Historical Stock Chart

From Apr 2023 to Apr 2024