Riverview Bancorp, Inc. (Nasdaq:RVSB) (“Riverview” or the

“Company”) today reported net income of $1.7 million, or $0.08 per

diluted share, in the third fiscal quarter ended December 31, 2015.

This compares to $1.7 million, or $0.07 per diluted share, in the

preceding quarter and $1.1 million, or $0.05 per diluted share, in

the third fiscal quarter a year ago. In the first nine months of

fiscal 2016, net income increased to $5.0 million, or $0.22 per

diluted share, compared to $3.0 million, or $0.13 per diluted

share, in the first nine months of fiscal 2015.

“We continue to successfully execute on our

business plan and strategic initiatives,” said Pat Sheaffer,

chairman and chief executive officer. “We were able to capitalize

on the strength of the economy in the Portland-Vancouver

marketplace with improved profitability, strong capital and

continued loan growth.”

Third Quarter Highlights (at or for the

period ended December 31, 2015)

- Net income increased to $1.7 million, or $0.08 per diluted

share.

- Net interest margin improved to 3.69% compared to 3.64% in the

preceding quarter.

- Total loans increased $14.8 million during the quarter and

$31.6 million year-over-year to $610.7 million.

- Total deposits decreased $9.4 million during the quarter but

have increased $58.2 million from a year ago.

- Classified assets decreased to $7.1 million, or 6.7% of total

capital.

- Non-performing assets declined to 0.49% of total assets.

- Total risk-based capital ratio was 16.08% and Tier 1 leverage

ratio was 11.11%.

- Increased quarterly cash dividend to $0.0175 per share.

Balance Sheet Review

“Loan activity remained strong during the

quarter,” said Ron Wysaske, president and chief operating officer.

“Our loan pipeline increased during the quarter as our lenders have

continued expanding relationships with businesses throughout the

greater Portland and Vancouver market. At December 31, 2015, our

loan pipeline grew to $72.7 million from $64.8 million at the end

of September.”

Loan originations totaled $75.4 million during

the third quarter compared to $77.4 million in the preceding

quarter. At December 31, 2015, there was an additional $34.6

million in undisbursed construction loans, the majority of which

are expected to fund over the next several quarters.

Deposits were $747.6 million at December 31,

2015 compared to $757.0 million at September 30, 2015 and $689.3

million a year ago. The decrease in deposit balances during the

quarter was primarily a result of timing of customer transactions.

Average deposit balances, which eliminates some of the daily

volatility in balances, increased $15.6 million during the quarter

and were $59.7 million higher than the third quarter a year ago.

The Company continues to focus on growing its core customer

deposits balances. Checking account balances represented 41.2% of

total deposits at December 31, 2015.

At December 31, 2015, shareholders’ equity was

$106.0 million compared to $106.4 million at September 30, 2015.

Tangible book value per share was $3.56 at December 31, 2015

compared to $3.57 at September 30, 2015. A quarterly cash dividend

of $0.0175 per share was paid on January 19, 2016, generating a

current yield of 1.6% based on the recent stock price.

Income Statement

“Our core profitability improved again this

quarter reflecting the increased revenue growth with contributions

from both the loan portfolio and noninterest income,” said Wysaske.

“Core earnings (defined as earnings before taxes and provision for

loan losses) increased $460,000 during the quarter compared to the

preceding quarter.” Net interest income for the third fiscal

quarter increased to $7.5 million compared to $7.2 million in the

preceding quarter and $6.7 million in the third fiscal quarter a

year ago.

The third quarter net interest margin expanded

five basis points to 3.69% compared to 3.64% in the preceding

quarter and improved 11 basis points compared to the third quarter

a year ago. “Our net interest margin improved during the quarter as

we increased our loan-to-deposit ratio and deployed a portion of

our cash balances into more productive loans and investment

securities,” said Kevin Lycklama, executive vice president and

chief financial officer.

Non-interest income increased $201,000 during

the quarter compared to linked quarter. The increase was primarily

attributable to an increase of $172,000 in the collection of

prepayment penalties on loan payoffs in the third quarter along

with an increase in gain on sale of loans held for sale. In the

first nine months of fiscal 2016, non-interest income increased to

$7.2 million compared to $6.7 million for the same period in the

prior year.

Asset management fees increased to $830,000

during the third fiscal quarter compared to $718,000 in the third

quarter a year ago. Riverview Asset Management and Trust Company’s

assets under management were $394.6 million at December 31, 2015

compared to $376.7 million a year ago.

Non-interest expense was $7.3 million in the

third quarter, an increase of $65,000 compared to the preceding

quarter and a decrease to $297,000 from a year ago. The

year-over-year decrease was the result of a decrease in data

processing expenses, state and local taxes and professional

fees.

Credit Quality

“Maintaining high-level credit quality remains a

top priority,” said Dan Cox, executive vice president and chief

credit officer. “We have continued to reduce both our nonperforming

and classified asset totals.” Total nonperforming assets (“NPA”)

decreased to $4.3 million at December 31, 2015 compared to $4.7

million three months earlier.

Nonperforming loans (“NPL”) were $3.9 million,

or 0.65% of total loans, at December 31, 2015 compared to $3.8

million, or 0.63% of total loans, at September 30, 2015 and $7.7

million, or 1.33% of total loans, a year ago. Loans past due 30-89

days were 0.11% of total loans at December 31, 2015 compared to

0.14% at September 30, 2015.

REO balances declined to $388,000 at December

31, 2015 compared to $909,000 three months earlier. Sales of REO

properties totaled $460,000 during the quarter, with $61,000 in

write-downs and no new additions.

Classified assets decreased to $7.1 million at

December 31, 2015 compared to $7.5 million at September 30, 2015.

The classified asset to total capital ratio was 6.7% at December

31, 2015 compared to 7.2% three months earlier. During the past

twelve months, Riverview has reduced its classified assets by $15.8

million, or 68.9%.

Riverview recorded no provision for loan losses

during the third fiscal quarter compared to a $300,000 recapture of

loan losses during the preceding quarter. In the first nine months,

the Company recorded an $800,000 recapture of loan losses compared

to $1.1 million in the first nine months a year ago. The recapture

of loan losses reflects the improvement in credit quality and the

decline in loan charge-offs during the past few years.

Net loan recoveries were $60,000 during the

quarter compared to net loan recoveries of $76,000 in the preceding

quarter. The allowance for loan losses at December 31, 2015 totaled

$10.2 million, representing 1.67% of total loans and 258.1% of

nonperforming loans.

Capital

Riverview continues to maintain capital levels

well in excess of the regulatory requirements to be categorized as

“well capitalized” with a total risk-based capital ratio of 16.08%,

Tier 1 leverage ratio of 11.11% and tangible common equity to

tangible assets of 9.30% at December 31, 2015.

Non-GAAP Financial

Measures

In addition to results presented in accordance with generally

accepted accounting principles (“GAAP”), this press release

contains certain non-GAAP financial measures. Riverview believes

that certain non-GAAP financial measures provide investors with

information useful in understanding the Company’s financial

performance; however, readers of this report are urged to review

these non-GAAP financial measures in conjunction with GAAP results

as reported.

Financial measures that exclude intangible

assets are non-GAAP measures. To provide investors with a broader

understanding of capital adequacy, Riverview provides non-GAAP

financial measures for tangible common equity, along with the GAAP

measure. Tangible common equity is calculated as shareholders’

equity less goodwill and other intangible assets. In addition,

tangible assets are total assets less goodwill and other intangible

assets.

The following table provides a reconciliation of

ending shareholders’ equity (GAAP) to ending tangible shareholders’

equity (non-GAAP), and ending total assets (GAAP) to ending

tangible assets (non-GAAP).

| (Dollars in

thousands) |

|

December 31, 2015 |

|

September 30, 2015 |

|

December 31, 2014 |

|

March 31, 2015 |

| |

|

|

|

|

|

|

|

|

| Shareholders' equity |

|

$ |

105,993 |

|

|

$ |

106,362 |

|

|

$ |

101,912 |

|

|

$ |

103,801 |

|

| Goodwill |

|

|

25,572 |

|

|

|

25,572 |

|

|

|

25,572 |

|

|

|

25,572 |

|

| Other intangible assets,

net |

|

|

386 |

|

|

|

392 |

|

|

|

401 |

|

|

|

401 |

|

| Tangible

shareholders' equity |

|

$ |

80,035 |

|

|

$ |

80,398 |

|

|

$ |

75,939 |

|

|

$ |

77,828 |

|

| |

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

886,152 |

|

|

$ |

896,302 |

|

|

$ |

828,435 |

|

|

$ |

858,750 |

|

| Goodwill |

|

|

25,572 |

|

|

|

25,572 |

|

|

|

25,572 |

|

|

|

25,572 |

|

| Other intangible assets,

net |

|

|

386 |

|

|

|

392 |

|

|

|

401 |

|

|

|

401 |

|

| Tangible

assets |

|

$ |

860,194 |

|

|

$ |

870,338 |

|

|

$ |

802,462 |

|

|

$ |

832,777 |

|

About Riverview

Riverview Bancorp, Inc. (www.riverviewbank.com) is headquartered

in Vancouver, Washington – just north of Portland, Oregon on the

I-5 corridor. With assets of $886 million, it is the parent company

of the 92 year-old Riverview Community Bank, as well as Riverview

Asset Management Corp. The Bank offers true community banking

services, focusing on providing the highest quality service and

financial products to commercial and retail customers. There are 17

branches, including twelve in the Portland-Vancouver area and three

lending centers.

“Safe Harbor” statement under the Private

Securities Litigation Reform Act of 1995: This press release

contains forward-looking statements that are subject to risks and

uncertainties, including, but not limited to: the Company’s ability

to raise common capital; the credit risks of lending activities,

including changes in the level and trend of loan delinquencies and

write-offs and changes in the Company’s allowance for loan losses

and provision for loan losses that may be impacted by deterioration

in the housing and commercial real estate markets; changes in

general economic conditions, either nationally or in the Company’s

market areas; changes in the levels of general interest rates, and

the relative differences between short and long term interest

rates, deposit interest rates, the Company’s net interest margin

and funding sources; fluctuations in the demand for loans, the

number of unsold homes, land and other properties and fluctuations

in real estate values in the Company’s market areas; secondary

market conditions for loans and the Company’s ability to sell loans

in the secondary market; results of examinations of us by the

Office of Comptroller of the Currency or other regulatory

authorities, including the possibility that any such regulatory

authority may, among other things, require us to increase the

Company’s reserve for loan losses, write-down assets, change

Riverview Community Bank’s regulatory capital position or affect

the Company’s ability to borrow funds or maintain or increase

deposits, which could adversely affect its liquidity and earnings;

legislative or regulatory changes that adversely affect the

Company’s business including changes in regulatory policies and

principles, or the interpretation of regulatory capital or other

rules; the Company’s ability to attract and retain deposits;

further increases in premiums for deposit insurance; the Company’s

ability to control operating costs and expenses; the use of

estimates in determining fair value of certain of the Company’s

assets, which estimates may prove to be incorrect and result in

significant declines in valuation; difficulties in reducing risks

associated with the loans on the Company’s balance sheet; staffing

fluctuations in response to product demand or the implementation of

corporate strategies that affect the Company’s workforce and

potential associated charges; computer systems on which the Company

depends could fail or experience a security breach; the Company’s

ability to retain key members of its senior management team; costs

and effects of litigation, including settlements and judgments; the

Company’s ability to successfully integrate any assets,

liabilities, customers, systems, and management personnel it may in

the future acquire into its operations and the Company’s ability to

realize related revenue synergies and cost savings within expected

time frames and any goodwill charges related thereto; increased

competitive pressures among financial services companies; changes

in consumer spending, borrowing and savings habits; the

availability of resources to address changes in laws, rules, or

regulations or to respond to regulatory actions; the Company’s

ability to pay dividends on its common stock; and interest or

principal payments on its junior subordinated debentures; adverse

changes in the securities markets; inability of key third-party

providers to perform their obligations to us; changes in accounting

policies and practices, as may be adopted by the financial

institution regulatory agencies or the Financial Accounting

Standards Board, including additional guidance and interpretation

on accounting issues and details of the implementation of new

accounting methods; other economic, competitive, governmental,

regulatory, and technological factors affecting the Company’s

operations, pricing, products and services and the other risks

described from time to time in our filings with the SEC.

Such forward-looking statements may include

projections. Any such projections were not prepared in accordance

with published guidelines of the American Institute of Certified

Public Accountants or the Securities Exchange Commission regarding

projections and forecasts nor have such projections been audited,

examined or otherwise reviewed by independent auditors of the

Company. In addition, such projections are based upon many

estimates and inherently subject to significant economic and

competitive uncertainties and contingencies, many of which are

beyond the control of management of the Company. Accordingly,

actual results may be materially higher or lower than those

projected. The inclusion of such projections herein should not be

regarded as a representation by the Company that the projections

will prove to be correct.

The Company cautions readers not to place undue

reliance on any forward-looking statements. Moreover, you should

treat these statements as speaking only as of the date they are

made and based only on information then actually known to the

Company. The Company does not undertake and specifically disclaims

any obligation to revise any forward-looking statements to reflect

the occurrence of anticipated or unanticipated events or

circumstances after the date of such statements. These risks could

cause our actual results for fiscal 2016 and beyond to differ

materially from those expressed in any forward-looking statements

by, or on behalf of, us, and could negatively affect the Company’s

operating and stock price performance.

|

|

|

RIVERVIEW BANCORP, INC. AND SUBSIDIARY |

|

|

|

|

|

|

| Consolidated

Balance Sheets |

|

|

|

|

|

|

|

|

(In thousands, except share

data)

(Unaudited) |

December 31, 2015 |

|

September 30, 2015 |

|

December 31, 2014 |

|

March 31, 2015 |

|

ASSETS |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Cash

(including interest-earning accounts of $16,461, $55,094,

$5,872 |

$ |

28,967 |

|

|

$ |

68,865 |

|

|

$ |

21,981 |

|

|

$ |

58,659 |

|

| and $45,490) |

|

|

|

|

|

|

|

|

Certificate of deposits held for investment |

|

17,761 |

|

|

|

21,247 |

|

|

|

27,214 |

|

|

|

25,969 |

|

| Loans

held for sale |

|

400 |

|

|

|

950 |

|

|

|

724 |

|

|

|

778 |

|

|

Investment securities: |

|

|

|

|

|

|

|

| Available for sale, at estimated

fair value |

|

154,292 |

|

|

|

134,571 |

|

|

|

118,366 |

|

|

|

112,463 |

|

| Held to maturity, at amortized |

|

77 |

|

|

|

80 |

|

|

|

88 |

|

|

|

86 |

|

| Loans receivable (net of allowance for loan losses of $10,173,

$10,113 |

|

|

|

|

| $11,701, and $10,762) |

|

600,540 |

|

|

|

585,784 |

|

|

|

567,398 |

|

|

|

569,010 |

|

| Real

estate owned |

|

388 |

|

|

|

909 |

|

|

|

1,604 |

|

|

|

1,603 |

|

| Prepaid

expenses and other assets |

|

3,236 |

|

|

|

3,256 |

|

|

|

3,049 |

|

|

|

3,238 |

|

| Accrued

interest receivable |

|

2,429 |

|

|

|

2,181 |

|

|

|

2,024 |

|

|

|

2,139 |

|

| Federal

Home Loan Bank stock, at cost |

|

988 |

|

|

|

988 |

|

|

|

6,120 |

|

|

|

5,924 |

|

| Premises

and equipment, net |

|

14,814 |

|

|

|

15,059 |

|

|

|

15,683 |

|

|

|

15,434 |

|

| Deferred

income taxes, net |

|

10,814 |

|

|

|

11,153 |

|

|

|

13,500 |

|

|

|

12,568 |

|

| Mortgage

servicing rights, net |

|

386 |

|

|

|

392 |

|

|

|

393 |

|

|

|

399 |

|

|

Goodwill |

|

25,572 |

|

|

|

25,572 |

|

|

|

25,572 |

|

|

|

25,572 |

|

| Bank

owned life insurance |

|

25,488 |

|

|

|

25,295 |

|

|

|

24,719 |

|

|

|

24,908 |

|

| |

|

|

|

|

|

|

|

| TOTAL ASSETS |

$ |

886,152 |

|

|

$ |

896,302 |

|

|

$ |

828,435 |

|

|

$ |

858,750 |

|

| |

|

|

|

|

|

|

|

| LIABILITIES AND

EQUITY |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| LIABILITIES: |

|

|

|

|

|

|

|

| Deposits |

$ |

747,565 |

|

|

$ |

756,996 |

|

|

$ |

689,330 |

|

|

$ |

720,850 |

|

| Accrued expenses and other

liabilities |

|

7,178 |

|

|

|

6,497 |

|

|

|

9,397 |

|

|

|

8,111 |

|

| Advance payments by borrowers for

taxes and insurance |

|

256 |

|

|

|

712 |

|

|

|

199 |

|

|

|

495 |

|

| Federal Home Loan Bank

advances |

|

- |

|

|

|

- |

|

|

|

2,100 |

|

|

|

- |

|

| Junior subordinated debentures |

|

22,681 |

|

|

|

22,681 |

|

|

|

22,681 |

|

|

|

22,681 |

|

| Capital lease obligations |

|

2,479 |

|

|

|

2,484 |

|

|

|

2,298 |

|

|

|

2,276 |

|

| Total

liabilities |

|

780,159 |

|

|

|

789,370 |

|

|

|

726,005 |

|

|

|

754,413 |

|

| |

|

|

|

|

|

|

|

| EQUITY: |

|

|

|

|

|

|

|

|

Shareholders' equity |

|

|

|

|

|

|

|

| Serial preferred stock,

$.01 par value; 250,000 authorized, |

|

|

|

|

|

| issued and outstanding, none |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Common stock, $.01 par

value; 50,000,000 authorized, |

|

|

|

|

|

| December 31, 2015 -

22,507,890 issued and outstanding; |

|

|

|

|

|

| September 30, 2015 - 22,507,890

issued and outstanding; |

|

225 |

|

|

|

225 |

|

|

|

225 |

|

|

|

225 |

|

| December 31, 2014 -

22,471,890 issued and outstanding; |

|

|

|

|

|

| March 31, 2015 –

22,489,890 issued and outstanding; |

|

|

|

|

|

| Additional paid-in capital |

|

64,417 |

|

|

|

65,333 |

|

|

|

65,217 |

|

|

|

65,268 |

|

| Retained earnings |

|

41,773 |

|

|

|

40,460 |

|

|

|

36,565 |

|

|

|

37,830 |

|

| Unearned shares issued to employee

stock ownership plan |

|

(206 |

) |

|

|

(232 |

) |

|

|

(310 |

) |

|

|

(284 |

) |

| Accumulated other comprehensive

income (loss) |

|

(216 |

) |

|

|

576 |

|

|

|

215 |

|

|

|

762 |

|

| Total

shareholders’ equity |

|

105,993 |

|

|

|

106,362 |

|

|

|

101,912 |

|

|

|

103,801 |

|

|

|

|

|

|

|

|

|

|

|

Noncontrolling interest |

|

- |

|

|

|

570 |

|

|

|

518 |

|

|

|

536 |

|

| Total

equity |

|

105,993 |

|

|

|

106,932 |

|

|

|

102,430 |

|

|

|

104,337 |

|

| |

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND

EQUITY |

$ |

886,152 |

|

|

$ |

896,302 |

|

|

$ |

828,435 |

|

|

$ |

858,750 |

|

| |

|

|

|

|

|

|

|

|

RIVERVIEW BANCORP, INC. AND SUBSIDIARY |

|

|

|

Consolidated Statements of Income |

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

(In thousands, except share

data)

(Unaudited) |

Dec. 31, 2015 |

Sept. 30, 2015 |

Dec. 31, 2014 |

|

Dec. 31, 2015 |

Dec. 31, 2014 |

| INTEREST

INCOME: |

|

|

|

|

|

| Interest and fees on loans

receivable |

$ |

7,109 |

|

$ |

6,789 |

|

$ |

6,498 |

|

|

$ |

20,758 |

|

$ |

19,155 |

|

| Interest on investment

securities |

|

702 |

|

|

702 |

|

|

595 |

|

|

|

1,986 |

|

|

1,765 |

|

| Other interest and dividends |

|

110 |

|

|

111 |

|

|

110 |

|

|

|

340 |

|

|

359 |

|

| Total interest and dividend

income |

|

7,921 |

|

|

7,602 |

|

|

7,203 |

|

|

|

23,084 |

|

|

21,279 |

|

| |

|

|

|

|

|

|

| INTEREST

EXPENSE: |

|

|

|

|

|

| Interest on deposits |

|

290 |

|

|

300 |

|

|

322 |

|

|

|

893 |

|

|

1,024 |

|

| Interest on borrowings |

|

144 |

|

|

139 |

|

|

163 |

|

|

|

417 |

|

|

458 |

|

| Total interest expense |

|

434 |

|

|

439 |

|

|

485 |

|

|

|

1,310 |

|

|

1,482 |

|

| Net interest

income |

|

7,487 |

|

|

7,163 |

|

|

6,718 |

|

|

|

21,774 |

|

|

19,797 |

|

| Recapture of loan

losses |

|

- |

|

|

(300 |

) |

|

(400 |

) |

|

|

(800 |

) |

|

(1,050 |

) |

| |

|

|

|

|

|

|

| Net interest income

after recapture of loan losses |

|

7,487 |

|

|

7,463 |

|

|

7,118 |

|

|

|

22,574 |

|

|

20,847 |

|

| |

|

|

|

|

|

|

|

NON-INTEREST INCOME: |

|

|

|

|

| Fees and service charges |

|

1,312 |

|

|

1,132 |

|

|

1,032 |

|

|

|

3,740 |

|

|

3,260 |

|

| Asset management fees |

|

830 |

|

|

801 |

|

|

718 |

|

|

|

2,455 |

|

|

2,248 |

|

| Net gain on sale of loans held for

sale |

|

125 |

|

|

79 |

|

|

154 |

|

|

|

425 |

|

|

435 |

|

| Bank owned life insurance |

|

193 |

|

|

190 |

|

|

196 |

|

|

|

580 |

|

|

528 |

|

| Other, net |

|

(43 |

) |

|

14 |

|

|

164 |

|

|

|

(18 |

) |

|

226 |

|

| Total non-interest income |

|

2,417 |

|

|

2,216 |

|

|

2,264 |

|

|

|

7,182 |

|

|

6,697 |

|

| |

|

|

|

|

|

|

|

NON-INTEREST EXPENSE: |

|

|

|

|

| Salaries and employee benefits |

|

4,452 |

|

|

4,236 |

|

|

4,472 |

|

|

|

13,102 |

|

|

12,987 |

|

| Occupancy and depreciation |

|

1,200 |

|

|

1,154 |

|

|

1,223 |

|

|

|

3,523 |

|

|

3,632 |

|

| Data processing |

|

424 |

|

|

431 |

|

|

495 |

|

|

|

1,345 |

|

|

1,399 |

|

| Advertising and marketing

expense |

|

149 |

|

|

208 |

|

|

169 |

|

|

|

533 |

|

|

522 |

|

| FDIC insurance premium |

|

127 |

|

|

122 |

|

|

143 |

|

|

|

375 |

|

|

498 |

|

| State and local taxes |

|

102 |

|

|

123 |

|

|

162 |

|

|

|

362 |

|

|

416 |

|

| Telecommunications |

|

71 |

|

|

74 |

|

|

73 |

|

|

|

218 |

|

|

223 |

|

| Professional fees |

|

222 |

|

|

218 |

|

|

302 |

|

|

|

673 |

|

|

848 |

|

| Real estate owned expenses |

|

65 |

|

|

167 |

|

|

99 |

|

|

|

511 |

|

|

901 |

|

| Other |

|

537 |

|

|

551 |

|

|

508 |

|

|

|

1,736 |

|

|

1,629 |

|

| Total non-interest expense |

|

7,349 |

|

|

7,284 |

|

|

7,646 |

|

|

|

22,378 |

|

|

23,055 |

|

|

|

|

|

|

|

|

|

| INCOME BEFORE INCOME

TAXES |

|

2,555 |

|

|

2,395 |

|

|

1,736 |

|

|

|

7,378 |

|

|

4,489 |

|

| PROVISION FOR INCOME

TAXES |

|

849 |

|

|

743 |

|

|

587 |

|

|

|

2,425 |

|

|

1,516 |

|

| NET INCOME |

$ |

1,706 |

|

$ |

1,652 |

|

$ |

1,149 |

|

|

$ |

4,953 |

|

$ |

2,973 |

|

| |

|

|

|

|

|

|

| Earnings

per common share: |

|

|

|

|

| Basic |

$ |

0.08 |

|

$ |

0.07 |

|

$ |

0.05 |

|

|

$ |

0.22 |

|

$ |

0.13 |

|

| Diluted |

$ |

0.08 |

|

$ |

0.07 |

|

$ |

0.05 |

|

|

$ |

0.22 |

|

$ |

0.13 |

|

| Weighted

average number of common shares outstanding: |

|

|

| Basic |

|

22,455,543 |

|

|

22,449,386 |

|

|

22,394,910 |

|

|

|

22,446,463 |

|

|

22,388,775 |

|

| Diluted |

|

22,506,341 |

|

|

22,490,351 |

|

|

22,439,195 |

|

|

|

22,491,546 |

|

|

22,421,330 |

|

| |

|

|

|

|

|

|

|

|

|

|

| (Dollars in

thousands) |

|

At or for the three months ended |

|

At or for the nine months ended |

|

|

|

Dec. 31, 2015 |

|

Sept. 30, 2015 |

|

Dec. 31, 2014 |

|

Dec. 31, 2015 |

|

Dec. 31, 2014 |

| AVERAGE

BALANCES |

|

|

|

|

|

|

|

|

|

|

| Average interest–earning

assets |

|

$ |

806,760 |

|

|

$ |

783,371 |

|

|

$ |

744,351 |

|

|

$ |

789,403 |

|

|

$ |

739,951 |

|

| Average interest-bearing

liabilities |

|

|

597,989 |

|

|

|

594,667 |

|

|

|

573,417 |

|

|

|

593,851 |

|

|

|

576,670 |

|

| Net average earning

assets |

|

|

208,771 |

|

|

|

188,704 |

|

|

|

170,934 |

|

|

|

195,552 |

|

|

|

163,281 |

|

| Average loans |

|

|

606,760 |

|

|

|

576,218 |

|

|

|

554,376 |

|

|

|

585,936 |

|

|

|

548,041 |

|

| Average deposits |

|

|

753,405 |

|

|

|

737,851 |

|

|

|

693,695 |

|

|

|

738,172 |

|

|

|

689,964 |

|

| Average equity |

|

|

108,115 |

|

|

|

106,771 |

|

|

|

102,327 |

|

|

|

106,838 |

|

|

|

101,021 |

|

| Average tangible

equity |

|

|

82,151 |

|

|

|

80,794 |

|

|

|

76,358 |

|

|

|

80,865 |

|

|

|

75,053 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| ASSET

QUALITY |

|

Dec. 31, 2015 |

|

Sept. 30, 2015 |

|

Dec. 31, 2014 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Non-performing loans |

|

$ |

3,941 |

|

|

$ |

3,771 |

|

|

$ |

7,729 |

|

|

|

|

|

| Non-performing loans to

total loans |

|

|

0.65 |

% |

|

|

0.63 |

% |

|

|

1.33 |

% |

|

|

|

|

| Real estate/repossessed

assets owned |

|

$ |

388 |

|

|

$ |

909 |

|

|

$ |

1,604 |

|

|

|

|

|

| Non-performing assets |

|

$ |

4,329 |

|

|

$ |

4,680 |

|

|

$ |

9,333 |

|

|

|

|

|

| Non-performing assets to

total assets |

|

|

0.49 |

% |

|

|

0.52 |

% |

|

|

1.13 |

% |

|

|

|

|

| Net recoveries in the

quarter |

|

$ |

(60 |

) |

|

$ |

(76 |

) |

|

$ |

(100 |

) |

|

|

|

|

| Net recoveries in the

quarter/average net loans |

|

|

(0.04 |

)% |

|

|

(0.05 |

)% |

|

|

(0.07 |

)% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Allowance for loan

losses |

|

$ |

10,173 |

|

|

$ |

10,113 |

|

|

$ |

11,701 |

|

|

|

|

|

| Average interest-earning

assets to average |

|

|

|

|

|

|

|

|

|

|

| interest-bearing liabilities |

|

|

134.91 |

% |

|

|

131.73 |

% |

|

|

129.81 |

% |

|

|

|

|

| Allowance for loan losses

to |

|

|

|

|

|

|

|

|

|

|

| non-performing loans |

|

|

258.13 |

% |

|

|

268.18 |

% |

|

|

151.39 |

% |

|

|

|

|

| Allowance for loan losses

to total loans |

|

|

1.67 |

% |

|

|

1.70 |

% |

|

|

2.02 |

% |

|

|

|

|

| Shareholders’ equity to

assets |

|

|

11.96 |

% |

|

|

11.87 |

% |

|

|

12.30 |

% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| CAPITAL

RATIOS |

|

|

|

|

|

|

|

|

|

|

| Total capital (to risk

weighted assets) |

|

|

16.08 |

% |

|

|

16.45 |

% |

|

|

15.59 |

% |

|

|

|

|

| Tier 1 capital (to risk

weighted assets) |

|

|

14.83 |

% |

|

|

15.19 |

% |

|

|

14.33 |

% |

|

|

|

|

| Common equity tier 1 (to

risk weighted assets) |

|

|

14.83 |

% |

|

|

15.19 |

% |

|

|

N/A |

|

|

|

|

|

| Tier 1 capital (to

leverage assets) |

|

|

11.11 |

% |

|

|

11.22 |

% |

|

|

10.72 |

% |

|

|

|

|

| Tangible common equity (to

tangible assets) |

|

|

9.30 |

% |

|

|

9.24 |

% |

|

|

9.46 |

% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| DEPOSIT

MIX |

|

Dec. 31, 2015 |

|

Sept. 30, 2015 |

|

Dec. 31, 2014 |

|

March 31, 2015 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Interest checking |

|

$ |

130,635 |

|

|

$ |

132,727 |

|

|

$ |

107,701 |

|

|

$ |

115,461 |

|

|

|

| Regular savings |

|

|

88,603 |

|

|

|

83,094 |

|

|

|

74,111 |

|

|

|

77,132 |

|

|

|

| Money market deposit

accounts |

|

|

226,746 |

|

|

|

234,194 |

|

|

|

222,300 |

|

|

|

237,465 |

|

|

|

| Non-interest checking |

|

|

177,624 |

|

|

|

176,131 |

|

|

|

144,189 |

|

|

|

151,953 |

|

|

|

| Certificates of

deposit |

|

|

123,957 |

|

|

|

130,850 |

|

|

|

141,029 |

|

|

|

138,839 |

|

|

|

| Total deposits |

|

$ |

747,565 |

|

|

$ |

756,996 |

|

|

$ |

689,330 |

|

|

$ |

720,850 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| COMPOSITION OF COMMERCIAL AND

CONSTRUCTION

LOANS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

Commercial |

|

|

|

|

|

Real Estate |

|

Real Estate |

|

& Construction |

|

|

|

Commercial |

|

Mortgage |

|

Construction |

|

Total |

|

December 31, 2015 |

|

(Dollars in thousands) |

| Commercial |

|

$ |

72,113 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

72,113 |

|

| Commercial

construction |

|

|

- |

|

|

|

- |

|

|

|

15,403 |

|

|

|

15,403 |

|

| Office buildings |

|

|

- |

|

|

|

104,285 |

|

|

|

- |

|

|

|

104,285 |

|

| Warehouse/industrial |

|

|

- |

|

|

|

51,384 |

|

|

|

- |

|

|

|

51,384 |

|

| Retail/shopping

centers/strip malls |

|

|

- |

|

|

|

56,008 |

|

|

|

- |

|

|

|

56,008 |

|

| Assisted living

facilities |

|

|

- |

|

|

|

1,819 |

|

|

|

- |

|

|

|

1,819 |

|

| Single purpose

facilities |

|

|

- |

|

|

|

122,029 |

|

|

|

- |

|

|

|

122,029 |

|

| Land |

|

|

- |

|

|

|

13,061 |

|

|

|

- |

|

|

|

13,061 |

|

| Multi-family |

|

|

- |

|

|

|

34,601 |

|

|

|

- |

|

|

|

34,601 |

|

| One-to-four family

construction |

|

|

- |

|

|

|

- |

|

|

|

8,346 |

|

|

|

8,346 |

|

| Total |

|

$ |

72,113 |

|

|

$ |

383,187 |

|

|

$ |

23,749 |

|

|

$ |

479,049 |

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2015 |

|

|

|

|

|

|

|

|

| Commercial |

|

$ |

77,186 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

77,186 |

|

| Commercial

construction |

|

|

- |

|

|

|

- |

|

|

|

27,967 |

|

|

|

27,967 |

|

| Office buildings |

|

|

- |

|

|

|

86,813 |

|

|

|

- |

|

|

|

86,813 |

|

| Warehouse/industrial |

|

|

- |

|

|

|

42,173 |

|

|

|

- |

|

|

|

42,173 |

|

| Retail/shopping

centers/strip malls |

|

|

- |

|

|

|

60,736 |

|

|

|

- |

|

|

|

60,736 |

|

| Assisted living

facilities |

|

|

- |

|

|

|

1,846 |

|

|

|

- |

|

|

|

1,846 |

|

| Single purpose

facilities |

|

|

- |

|

|

|

108,123 |

|

|

|

- |

|

|

|

108,123 |

|

| Land |

|

|

- |

|

|

|

15,358 |

|

|

|

- |

|

|

|

15,358 |

|

| Multi-family |

|

|

- |

|

|

|

30,457 |

|

|

|

- |

|

|

|

30,457 |

|

| One-to-four family

construction |

|

|

- |

|

|

|

- |

|

|

|

2,531 |

|

|

|

2,531 |

|

| Total |

|

$ |

77,186 |

|

|

$ |

345,506 |

|

|

$ |

30,498 |

|

|

$ |

453,190 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| LOAN

MIX |

|

Dec. 31, 2015 |

|

Sept. 30, 2015 |

|

Dec. 31, 2014 |

|

March 31, 2015 |

| |

|

(Dollars in thousands) |

| Commercial and

construction |

|

|

|

|

|

|

|

|

| Commercial business |

|

$ |

72,113 |

|

|

$ |

78,138 |

|

|

$ |

82,284 |

|

|

$ |

77,186 |

|

| Other real estate mortgage |

|

|

383,187 |

|

|

|

380,529 |

|

|

|

337,030 |

|

|

|

345,506 |

|

| Real estate construction |

|

|

23,749 |

|

|

|

17,304 |

|

|

|

29,199 |

|

|

|

30,498 |

|

| Total commercial and

construction |

|

|

479,049 |

|

|

|

475,971 |

|

|

|

448,513 |

|

|

|

453,190 |

|

| Consumer |

|

|

|

|

|

|

|

|

| Real estate one-to-four family |

|

|

88,839 |

|

|

|

89,520 |

|

|

|

90,865 |

|

|

|

89,801 |

|

| Other installment |

|

|

42,825 |

|

|

|

30,406 |

|

|

|

39,721 |

|

|

|

36,781 |

|

| Total consumer |

|

|

131,664 |

|

|

|

119,926 |

|

|

|

130,586 |

|

|

|

126,582 |

|

| |

|

|

|

|

|

|

|

|

| Total loans |

|

|

610,713 |

|

|

|

595,897 |

|

|

|

579,099 |

|

|

|

579,772 |

|

| |

|

|

|

|

|

|

|

|

| Less: |

|

|

|

|

|

|

|

|

| Allowance for loan losses |

|

|

10,173 |

|

|

|

10,113 |

|

|

|

11,701 |

|

|

|

10,762 |

|

| Loans receivable, net |

|

$ |

600,540 |

|

|

$ |

585,784 |

|

|

$ |

567,398 |

|

|

$ |

569,010 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DETAIL OF NON-PERFORMING ASSETS |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Northwest |

|

Other |

|

Southwest |

|

Other |

|

|

|

|

| |

|

|

Oregon |

|

Oregon |

|

Washington |

|

Washington |

|

Other |

|

Total |

| December 31, 2015 |

|

(dollars in thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial

real estate |

|

$ |

273 |

|

|

$ |

1,289 |

|

|

$ |

913 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

2,475 |

|

| Land |

|

|

|

- |

|

|

|

801 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

801 |

|

| Consumer |

|

|

|

114 |

|

|

|

- |

|

|

|

141 |

|

|

|

233 |

|

|

|

177 |

|

|

|

665 |

|

| Total

non-performing loans |

|

387 |

|

|

|

2,090 |

|

|

|

1,054 |

|

|

|

233 |

|

|

|

177 |

|

|

|

3,941 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| REO |

|

|

|

313 |

|

|

|

- |

|

|

|

30 |

|

|

|

45 |

|

|

|

- |

|

|

|

388 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total

non-performing assets |

$ |

700 |

|

|

$ |

2,090 |

|

|

$ |

1,084 |

|

|

$ |

278 |

|

|

$ |

177 |

|

|

$ |

4,329 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DETAIL OF LAND DEVELOPMENT AND SPECULATIVE CONSTRUCTION

LOANS |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

Northwest |

|

Other |

|

Southwest |

|

|

| |

|

|

|

|

|

|

Oregon |

|

Oregon |

|

Washington |

|

Total |

| December 31, 2015 |

|

|

|

|

|

(dollars in thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Land

development |

|

|

|

|

|

$ |

100 |

|

|

$ |

2,801 |

|

|

$ |

10,160 |

|

|

$ |

13,061 |

|

| Speculative

construction |

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

6,941 |

|

|

|

6,941 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total land

development and speculative construction |

|

|

$ |

100 |

|

|

$ |

2,801 |

|

|

$ |

17,101 |

|

|

$ |

20,002 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

At or for the three

months ended |

|

At or for the nine months ended |

| SELECTED OPERATING

DATA |

Dec. 31, 2015 |

Sept. 30, 2015 |

Dec. 31, 2014 |

|

Dec. 31, 2015 |

Dec. 31, 2014 |

|

|

|

|

|

|

|

|

| Efficiency ratio

(4) |

|

74.20 |

% |

|

77.66 |

% |

|

85.13 |

% |

|

|

77.28 |

% |

|

87.02 |

% |

| Coverage ratio (6) |

|

101.88 |

% |

|

98.34 |

% |

|

87.86 |

% |

|

|

97.30 |

% |

|

85.87 |

% |

| Return on average

assets (1) |

|

0.76 |

% |

|

0.75 |

% |

|

0.55 |

% |

|

|

0.75 |

% |

|

0.48 |

% |

| Return on average

equity (1) |

|

6.28 |

% |

|

6.16 |

% |

|

4.45 |

% |

|

|

6.17 |

% |

|

3.91 |

% |

| |

|

|

|

|

|

|

| NET

INTEREST SPREAD |

|

|

|

|

| Yield on loans |

|

4.66 |

% |

|

4.69 |

% |

|

4.65 |

% |

|

|

4.72 |

% |

|

4.64 |

% |

| Yield on investment

securities |

|

2.09 |

% |

|

2.03 |

% |

|

1.73 |

% |

|

|

2.06 |

% |

|

1.87 |

% |

| Total yield on interest earning

assets |

|

3.91 |

% |

|

3.86 |

% |

|

3.84 |

% |

|

|

3.89 |

% |

|

3.82 |

% |

| |

|

|

|

|

|

|

| Cost of interest

bearing deposits |

|

0.20 |

% |

|

0.21 |

% |

|

0.23 |

% |

|

|

0.21 |

% |

|

0.25 |

% |

| Cost of FHLB advances

and other borrowings |

|

2.28 |

% |

|

2.22 |

% |

|

2.48 |

% |

|

|

2.22 |

% |

|

2.39 |

% |

| Total cost of interest bearing

liabilities |

|

0.29 |

% |

|

0.29 |

% |

|

0.34 |

% |

|

|

0.29 |

% |

|

0.34 |

% |

| |

|

|

|

|

|

|

| Spread (7) |

|

3.62 |

% |

|

3.57 |

% |

|

3.50 |

% |

|

|

3.60 |

% |

|

3.48 |

% |

| Net interest

margin |

|

3.69 |

% |

|

3.64 |

% |

|

3.58 |

% |

|

|

3.67 |

% |

|

3.55 |

% |

| |

|

|

|

|

|

|

| PER SHARE

DATA |

|

|

|

|

|

| Basic earnings per

share (2) |

$ |

0.08 |

|

$ |

0.07 |

|

$ |

0.05 |

|

|

$ |

0.22 |

|

$ |

0.13 |

|

| Diluted earnings per

share (3) |

|

0.08 |

|

|

0.07 |

|

|

0.05 |

|

|

|

0.22 |

|

|

0.13 |

|

| Book value per share

(5) |

|

4.71 |

|

|

4.73 |

|

|

4.54 |

|

|

|

4.71 |

|

|

4.54 |

|

| Tangible book value per

share (5) |

|

3.56 |

|

|

3.57 |

|

|

3.38 |

|

|

|

3.56 |

|

|

3.38 |

|

| Market

price per share: |

|

|

|

|

|

| High for the period |

$ |

5.11 |

|

$ |

4.75 |

|

$ |

4.49 |

|

|

$ |

5.11 |

|

$ |

4.49 |

|

| Low for the period |

|

4.35 |

|

|

4.15 |

|

|

3.84 |

|

|

|

4.08 |

|

|

3.38 |

|

| Close for period end |

|

4.69 |

|

|

4.75 |

|

|

4.48 |

|

|

|

4.69 |

|

|

4.48 |

|

| Cash dividends declared

per share |

|

0.0175 |

|

|

0.0150 |

|

|

- |

|

|

|

0.0450 |

|

|

- |

|

| |

|

|

|

|

|

|

| Average

number of shares outstanding: |

|

|

|

|

| Basic (2) |

|

22,455,543 |

|

|

22,449,386 |

|

|

22,394,910 |

|

|

|

22,446,463 |

|

|

22,388,775 |

|

| Diluted (3) |

|

22,506,341 |

|

|

22,490,351 |

|

|

22,439,195 |

|

|

|

22,491,546 |

|

|

22,421,330 |

|

| |

|

|

|

|

|

|

- Amounts for the quarterly periods are annualized.

- Amounts exclude ESOP shares not committed to be released.

- Amounts exclude ESOP shares not committed to be released and

include common stock equivalents.

- Non-interest expense divided by net interest income and

non-interest income.

- Amounts calculated based on shareholders’ equity and include

ESOP shares not committed to be released.

- Net interest income divided by non-interest expense.

- Yield on interest-earning assets less cost of funds on

interest-bearing liabilities.

Contacts:

Pat Sheaffer, Ron Wysaske or Kevin Lycklama,

Riverview Bancorp, Inc. 360-693-6650

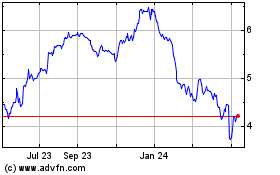

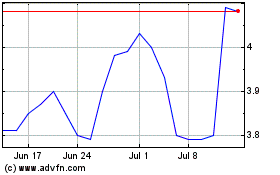

Riverview Bancorp (NASDAQ:RVSB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Riverview Bancorp (NASDAQ:RVSB)

Historical Stock Chart

From Apr 2023 to Apr 2024