Riverview Bancorp Announces Lifting of Riverview Community Bank's Agreement with the Office of the Comptroller of the Currenc...

April 08 2014 - 5:00PM

Riverview Bancorp, Inc. (Nasdaq:RVSB) ("Riverview" or the

"Company") today reported that the Office of the Comptroller of the

Currency ("OCC") has lifted the formal agreement ("Agreement") with

Riverview Community Bank ("Bank"). This action immediately ends the

regulatory restrictions that were contained in the Agreement and no

further reporting under the Agreement is necessary.

"We are pleased that the OCC has acknowledged the significant

improvement in the financial condition and operating results of the

Bank," stated Pat Sheaffer, Chairman and CEO of the Company and the

Bank. "The lifting of the Agreement is a testament to the diligent

efforts of our employees and we're proud that we were able to

accomplish this without any government financial assistance. We

made a commitment to lending $200 million in new loans this year

and our teams will continue to focus on meeting the financial needs

of our retail and small business clients throughout the communities

we serve."

Riverview continues to maintain capital levels in excess of the

regulatory requirements to be categorized as "well capitalized"

with a total risk-based capital ratio of 16.76%, Tier 1 leverage

ratio of 10.42% and tangible common equity to tangible assets of

7.10% at December 31, 2013.

About Riverview

Riverview Bancorp, Inc. (www.riverviewbank.com) is

headquartered in Vancouver, Washington – just north of Portland,

Oregon on the I-5 corridor. With assets of $805 million, it is the

parent company of the 90 year-old Riverview Community Bank, as well

as Riverview Asset Management Corp. The Bank offers true community

banking services, focusing on providing the highest quality service

and financial products to commercial and retail customers. There

are 18 branches, including thirteen in the Portland-Vancouver area

and three lending centers.

Forward-Looking Statements:

Statements in this news release regarding future events,

performance or results are "forward-looking statements" within the

meaning of the Private Securities Litigation Reform Act of 1995

("PSLRA") and are made pursuant to the safe harbors of the PSLRA.

These forward-looking statements relate to, among other things,

expectations of the business environment in which the Company

operates, projections of future performance, perceived

opportunities in the market, potential future credit experience,

the Company's compliance with regulatory enforcement actions we

have entered into with the Federal Reserve and the possibility that

our noncompliance could result in the imposition of additional

enforcement actions and additional requirements or restriction on

our operations; legislative or regulatory changes that adversely

affect the Company's business including changes in regulatory

policies and principles, or the interpretation of regulatory

capital or other rules; and statements regarding the Company's

mission and vision. These forward-looking statements are based upon

current management expectations and may, therefore, involve risks

and uncertainties. Actual results could be materially different

from those expressed or implied by the forward-looking statements.

Factors that could cause results to differ include but are not

limited to: general economic and banking business conditions,

competitive conditions between banks and non-bank financial service

providers, interest rate fluctuations, the credit risk of lending

activities, including changes in the level and trend of loan

delinquencies and write-offs; results of examinations by our

banking regulators, regulatory and accounting changes, risks

related to construction and development lending, commercial and

small business banking, our ability to successfully integrate any

assets, liabilities, customers, systems, and management personnel

we have acquired or may in the future acquire into our operations

and our ability to realize related revenue synergies and cost

savings within expected time frames, and other risks. Additional

factors that could cause actual results to differ materially are

disclosed in Riverview Bancorp, Inc.'s recent filings with the

Securities and Exchange Commission, including but not limited to

its Annual Report on Form 10-K for the year ended March 31, 2013,

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

Forward-looking statements are accurate only as of the date

released, and we do not undertake any responsibility to update or

revise any forward-looking statements to reflect subsequent events

or circumstances.

CONTACT: Pat Sheaffer or Ron Wysaske,

Riverview Bancorp, Inc. 360-693-6650

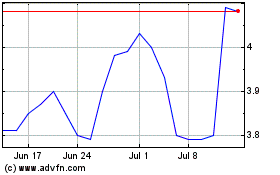

Riverview Bancorp (NASDAQ:RVSB)

Historical Stock Chart

From Mar 2024 to Apr 2024

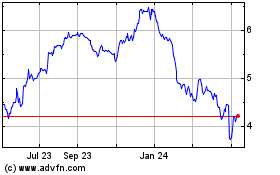

Riverview Bancorp (NASDAQ:RVSB)

Historical Stock Chart

From Apr 2023 to Apr 2024