Rio Tinto Likely To Pay Dividend in 2017 But Board to Decide--CFO

February 11 2016 - 6:00AM

Dow Jones News

By Alex MacDonald

LONDON-- Rio Tinto PLC (RIO) is likely to pay a dividend next

year despite volatile commodity prices but it's up to the board to

make a final decision, the company's Chief Financial Officer said

Thursday.

"I think it's highly unlikely" that Rio Tinto wouldn't pay a

dividend in 2017, Chris Lynch told an investor conference in

response to specific analyst question on the matter.

Rio Tinto, the world's second largest diversified miner by

market value after BHP Billiton Ltd (BHP, on Thursday said it would

payout at least $2 billion in dividends after scrapping a

progressive dividend policy that led the company to pay $4 billion

in dividends for 2015, up from $3.7 billion the year before and

$3.3 billion in 2013.

"A number of people have criticised a progressive dividend

policy in a cyclical industry," Chief Executive Sam Walsh said. "It

works to some extent in an up cycle, but in a down cycle it becomes

very difficult."

As a result the board took the decision to focus on ensuring

that Rio Tinto is able to maintain a strong enough balance sheet to

move solidly through the downturn cycle rather than focusing more

on the company's long term outlook, he said.

Mr. Walsh said the company feels comfortable that the dividend

payout guidance of at least $2 billion for this year is manageable

despite the commodity price uncertainty.

Rio Tinto's London shares fell more than 6% earlier in the day

before paring back losses to 1,696 pence a share, down 3% from

Wednesday.

-Write to Alex MacDonald at alex.macdonald@wsj.com

(END) Dow Jones Newswires

February 11, 2016 05:45 ET (10:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

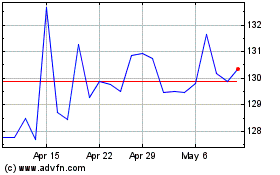

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024