Rio Tinto Launches New Debt Reduction Plan for Up To $3 Billion

September 26 2016 - 11:22AM

Dow Jones News

By Razak Musah Baba

LONDON--Miner Rio Tinto PLC (RIO.LN) Monday launched a new debt

reduction program for up to $3 billion as part of the company's

ongoing capital management.

Under the plan, Rio Tinto has issued a redemption notice for

$1.5 billion of its 2017 and 2018 U.S. dollar-denominated notes and

commenced cash tender offers to purchase up to $1.5 billion of its

2019, 2020, 2021 and 2022 U.S. dollar-denominated notes.

The Anglo-Australian mining company said it is again taking

advantage of its strong liquidity position to further reduce gross

debt, by launching the bond purchase plan.

Monday's announcement is part of the Rio Tinto Group's ongoing

capital management and follows the successful completion of $4.5

billion cash tender offers earlier this year, the company said.

In April, Rio Tinto launched a program to purchase $1.5 billion

of its 2017 and 2018 notes and in June it announced plans to

purchase $3 billion of its 2018, 2020, 2021 and 2022 notes. Both

offers were successfully completed. In June, $1.5 billion of notes

also matured and were repaid with cash, it said.

Rio Tinto shares in London at 1445 GMT were down 29 pence, or

1.1%, at 2,492 pence, valuing the company at 34.25 billion pounds

($44.39 billion).

Write to Razak Musah Baba at razak.baba@wsj.com; Twitter:

@Raztweet

(END) Dow Jones Newswires

September 26, 2016 11:07 ET (15:07 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

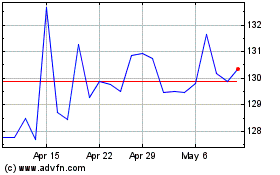

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

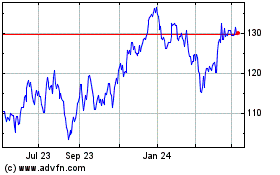

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024