SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

VASCULAR BIOGENICS LTD.

|

|

Date: August 14, 2017

|

By:

|

/s/ Dror Harats

|

|

|

|

Name:

|

Dror Harats

|

|

|

|

Title:

|

Chief Executive Officer

|

VBL Therapeutics Announces Second Quarter 2017 Financial Results

Conference Call and Webcast at 8:30am Eastern Time Today

TEL AVIV, ISRAEL, August 14, 2017

-- VBL Therapeutics (NASDAQ: VBLT), announced financial results for the three and six months ended June 30, 2017 and provided a corporate update.

“VBL made significant advances on clinical and operational fronts during the second quarter of 2017,” said Prof. Dror Harats, Chief Executive Officer of VBL Therapeutics. “We continue to progress in our Phase 3 GLOBE study investigating our lead asset VB-111 in patients with recurrent glioblastoma (rGBM). The trial is proceeding according to plan, following a second positive review by the independent Data Safety Monitoring Committee (DSMC) that took place in April. We expect a final DSMC review in late September, and top-line data in Q1 2018. Based on our interactions with the FDA and the SPA for the trial, the GLOBE study should support a Biologics License Application (BLA)."

“VB-111 continues to generate positive clinical results and we recently provided follow-up data demonstrating that more than 50% of patients achieved long-term survival following treatment with VB-111 in our three completed Phase 2 trials, in rGBM, platinum-resistant ovarian cancer and radioiodine refractory differentiated thyroid cancer. VBL is also following up on patients who remain alive for up to 7 years after enrolling into VB-111 Phase 1 study,” continued Prof Harats. "We are on track to initiate a Phase 3 study of VB-111 in ovarian cancer by year-end 2017 and an exploratory clinical study in combination with a checkpoint inhibitor in lung cancer in Q1 2018.”

As we are planning for commercialization of VB-111 in rGBM and preparing to launch our new manufacturing facility, we also made an important senior management addition during the quarter, with the appointment of Dr. Corinne Epperly as our US Chief Operating Officer. Dr. Epperly’s impressive skills and industry track record will be valuable assets to VBL as we continue to advance VB-111 in multiple oncology indications. We welcome her to the team and look forward to the contributions she will make.

Second Quarter and Recent Corporate Highlights:

|

|

·

|

|

Long-term survival update on VB-111: In addition to long-term survival for some Phase 1 patients being followed up to 7 years, the Company provided an update on long-term survival from VB-111 Phase 2 trials of patients with multiple tumor types, at the BIO International Convention.

|

|

|

o

|

|

rGBM: In the Phase 2 rGBM study, 12-month survival was 54% in patients who were treated with VB-111 through progression, including a rGBM patient who remains alive with complete response after 38 months, compared to 23% of patients who had limited exposure of a therapeutic dose of VB-111. According to a meta-analysis, the 12-month survival on Avastin

®

(bevacizumab) is only 24%.

|

|

|

o

|

|

Ovarian cancer: In the Phase 2 recurrent platinum-resistant and refractory ovarian cancer study, 53% of patients treated with a therapeutic dose of VB-111 in combination with paclitaxel were alive at 15 months. No patients in the sub-therapeutic dose were alive at the 15-month time point.

|

|

|

o

|

|

Thyroid cancer: In the Phase 2 radioiodine refractory differentiated thyroid cancer study, 53% of those who received multiple therapeutic doses of VB-111 were alive at 24 months, compared to 33% of those who received a single, sub-therapeutic dose of VB-111. 35% of patients on the therapeutic dose cohort remain alive at 39 to 46 months.

|

|

|

·

|

|

Presented new data at the American Society of Clinical Oncology (ASCO) annual meeting that strengthen the evidence for the anti-tumor activity of VB-111 in rGBM.

|

|

|

o

|

|

The data, from patients in the completed Phase 2 study of VB-111 in rGBM, demonstrate that longer exposure of VB-111 significantly attenuated tumor growth kinetics and was associated with more frequent tumor regression, compared with limited exposure.

|

|

|

o

|

|

Full data analysis of our Phase 2 study in rGBM shows statistically-significant benefit of VB-111 not just on Overall Survival (OS) (p=0.043), but also on Progression-Free Survival (PFS) (p=0.01).

|

|

|

·

|

|

Published research on MOSPD2, a novel immune-oncology target at the annual American Association of Cancer Research (AACR) meeting.

|

|

|

o

|

|

Targeting of MOSPD2 may have several therapeutic applications, including inhibition of monocyte migration in chronic inflammatory conditions, inhibition of tumor cell metastases and targeting of MOSPD2 tumor cells.

|

|

|

o

|

|

VBL’s “VB-600 series” of pipeline candidates is being developed toward these applications.

|

|

|

·

|

|

Appointed Corinne Epperly, MD, MPH, as US Chief Operating Officer.

|

|

|

o

|

|

Dr. Epperly is an oncology expert with industry background in drug development, strategy, commercialization and operations. Her experience includes seven years at Bristol-Myers Squibb, where most recently she was involved in leading the preparation for the commercial launches of OPDIVO

®

(nivolumab) in hepatocellular carcinoma, glioblastoma and metastatic melanoma.

|

|

|

o

|

|

Dr. Epperly will have key responsibilities in forming VBL's marketing strategy and commercialization plans for VB-111.

|

|

|

·

|

|

Awarded a grant of 8.75 million New Israeli Shekels (approximately $2.5 million) by the Israel Innovation Authority. The grant will support clinical trials and development activities for calendar year 2017 and beyond.

|

Second Quarter Ended June 30, 2017 Financial Results:

|

|

·

|

|

Cash Position

: At June 30, 2017, we had cash, cash equivalents and short-term bank deposits totaling $33.8 million and working capital of $31.8 million. We expect that our cash, cash equivalents and short-term bank deposits will enable us to fund our operating expenses and capital expenditure requirements into 2019 and is expected to be sufficient to enable us to complete our on-going Phase 3 clinical trial of VB-111 in

rGBM, to support our planned potential registrational trial in ovarian cancer and an exploratory clinical study of VB-111 in combination with a checkpoint inhibitor in lung cancer, as well as to support the launch of our new Modiin facility

.

|

|

|

·

|

|

R&D Expenses:

Research and development expenses for the quarter ended June 30, 2017 were approximately $3.2 million, compared to approximately $2.2 million in the same period of 2016.

|

|

|

·

|

|

G&A Expenses:

General and administrative expenses for the quarter ended June 30, 2017 were approximately $1.9 million, compared to approximately $1.1 million in the same period of 2016. The bulk of this increase is attributed to a one-time non-cash cost for management share-based compensation expense.

|

|

|

·

|

|

Net Loss:

The Company reported a net loss for the quarter ended June 30, 2017 of $4.9 million, or ($0.18) per share, compared to a net loss of $3.3 million, or ($0.14) per share in the quarter ended June 30, 2016.

|

Six Months Ended June 30, 2017 Financial Results:

|

|

·

|

|

R&D Expenses

: Research and development expenses (net) were $7.4 million for the six month period of 2017, compared to $6.2 million for the six month period of 2016.

|

|

|

·

|

|

G&A Expenses

: General and administrative expenses for the six month period of 2017 were $3.0 million, compared to $1.9 million in the same period of 2016. See related comment for second quarter above.

|

|

|

·

|

|

Net Loss

: Net loss for the six months of 2017 was $9.9 million, or ($0.37) per share, compared to a net loss of $8.0 million, or ($0.35) per share in the first six months of 2016.

|

Conference Call

Monday, August 14

th

@ 8:30am Eastern Time

Replays, Available through August 27, 2017

|

|

|

|

Domestic:

|

866-932-5017

|

|

International:

|

347-366-9565

|

|

Conference ID:

|

1065636

|

About VBL

Vascular Biogenics Ltd., operating as VBL Therapeutics, is a clinical stage biopharmaceutical company focused on the discovery, development and commercialization of first-in-class treatments for cancer. The Company’s lead oncology product candidate, ofranergene obadenovec (VB-111), is a first-in-class biologic agent that uses a dual mechanism to target solid tumors. It utilizes an angiogenesis-specific sensor (VBL's PPE-1-3x proprietary promoter) to specifically target the tumor vasculature, by induction of cell death in angiogenic endothelial cells in the tumor milieu. Moreover, it is an immune-stimulant that triggers a local anti-tumor immune response, which is accompanied by recruitment of CD8 T-cells and apoptosis of tumor cells. Ofranergene obadenovec is positioned to treat a wide range of solid tumors and is conveniently administered as an IV infusion once every two months. It has been observed to be well-tolerated in >300 cancer patients and we have observed its efficacy signals in an “all comers” Phase 1 trial as well as in three tumor-specific Phase 2 studies. Ofranergene obadenovec is currently being studied in a Phase 3 pivotal trial for recurrent Glioblastoma, conducted under an FDA Special Protocol Assessment (SPA).

Forward Looking Statements

This press release contains forward-looking statements. All statements other than statements of historical fact are forward-looking statements, which are often indicated by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “goal,” “intend,” “look forward to”, “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” and similar expressions. These forward-looking statements include, but are not limited to, statements regarding the clinical development of ofranergene obadenovec (VB-111) and its therapeutic potential, ongoing and planned clinical trials and clinical results, including the timing thereof, our other pipeline candidates, including the clinical development and therapeutic potential of our VB-600 series of pipeline candidates and Lecinoxoids in NASH, our new Modiin facility and our cash position and financial outlook. These forward-looking statements are not promises or guarantees and involve substantial

risks and uncertainties. Among the factors that could cause actual results to differ materially from those described or projected herein include uncertainties associated generally with research and development, clinical trials and related regulatory reviews and approvals, and the risk that historical clinical trial results may not be predictive of future trial results. In particular, results from our pivotal Phase 3 clinical trial of ofranergene obadenovec (VB-111) in rGBM may not support approval of ofranergene obadenovec for marketing in the United States, notwithstanding the positive results seen in prior clinical experience. A further list and description of these risks, uncertainties and other risks can be found in the Company’s regulatory filings with the U.S. Securities and Exchange Commission. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. VBL Therapeutics undertakes no obligation to update or revise the information contained in this press release, whether as a result of new information, future events or circumstances or otherwise.

INVESTOR CONTACT:

Michael Rice

LifeSci Advisors, LLC

(646) 597-6979

MEDIA CONTACT:

Matt Middleman

LifeSci Public Relations

(646) 627-8384

VASCULAR BIOGENICS LTD.

CONDENSED INTERIM STATEMENTS OF FINANCIAL POSITION

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

June 30,

|

|

December 31,

|

|

|

|

|

2017

|

|

2016

|

|

|

|

|

U.S. dollars in thousands

|

|

|

Assets

|

|

|

|

|

|

|

|

|

CURRENT ASSETS:

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

11,064

|

|

$

|

11,585

|

|

|

Short-term bank deposits

|

|

|

22,724

|

|

|

33,669

|

|

|

Other current assets

|

|

|

3,875

|

|

|

1,320

|

|

|

TOTAL CURRENT ASSETS

|

|

|

37,663

|

|

|

46,574

|

|

|

NON-CURRENT ASSETS:

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

3,171

|

|

|

687

|

|

|

Long-term prepaid expenses

|

|

|

176

|

|

|

13

|

|

|

TOTAL NON-CURRENT ASSETS

|

|

|

3,347

|

|

|

700

|

|

|

TOTAL ASSETS

|

|

$

|

41,010

|

|

$

|

47,274

|

|

|

Liabilities and equity

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES—

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses:

|

|

|

|

|

|

|

|

|

Trade

|

|

$

|

4,087

|

|

$

|

2,522

|

|

|

Other

|

|

|

1,730

|

|

|

2,266

|

|

|

TOTAL CURRENT LIABILITIES

|

|

|

5,817

|

|

|

4,788

|

|

|

NON-CURRENT LIABILITIES—

|

|

|

|

|

|

|

|

|

Severance pay obligations, net

|

|

|

94

|

|

|

86

|

|

|

TOTAL LIABILITIES

|

|

|

5,911

|

|

|

4,874

|

|

|

EQUITY:

|

|

|

|

|

|

|

|

|

Ordinary shares

|

|

|

50

|

|

|

50

|

|

|

Accumulated other comprehensive income

|

|

|

40

|

|

|

40

|

|

|

Additional paid in capital

|

|

|

200,005

|

|

|

197,400

|

|

|

Warrants

|

|

|

2,960

|

|

|

2,960

|

|

|

Accumulated deficit

|

|

|

(167,956)

|

|

|

(158,050)

|

|

|

TOTAL EQUITY

|

|

|

35,099

|

|

|

42,400

|

|

|

TOTAL LIABILITIES AND EQUITY

|

|

$

|

41,010

|

|

$

|

47,274

|

|

The accompanying notes are an integral part of the condensed financial statements.

VASCULAR BIOGENICS LTD.

CONDENSED INTERIM STATEMENTS OF COMPREHENSIVE LOSS

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30,

|

|

Six Months Ended June 30,

|

|

|

|

|

2017

|

|

2016

|

|

2017

|

|

2016

|

|

|

|

|

U.S. dollars in thousands

|

|

|

RESEARCH AND DEVELOPMENT EXPENSES,

net

|

|

$

|

3,209

|

|

$

|

2,230

|

|

$

|

7,353

|

|

$

|

6,233

|

|

|

GENERAL AND ADMINISTRATIVE EXPENSES

|

|

|

1,898

|

|

|

1,060

|

|

|

3,003

|

|

|

1,923

|

|

|

OPERATING LOSS

|

|

|

5,107

|

|

|

3,290

|

|

|

10,356

|

|

|

8,156

|

|

|

FINANCIAL INCOME

|

|

|

(239)

|

|

|

(22)

|

|

|

(458)

|

|

|

(159)

|

|

|

FINANCIAL EXPENSES

|

|

|

4

|

|

|

6

|

|

|

8

|

|

|

6

|

|

|

FINANCIAL INCOME,

net

|

|

|

(235)

|

|

|

(16)

|

|

|

(450)

|

|

|

(153)

|

|

|

COMPREHENSIVE LOSS

|

|

$

|

4,872

|

|

$

|

3,274

|

|

$

|

9,906

|

|

$

|

8,003

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOSS PER ORDINARY SHARE

|

|

U.S. dollars

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

$

|

0.18

|

|

$

|

0.14

|

|

$

|

0.37

|

|

$

|

0.35

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of shares

|

|

|

WEIGHTED AVERAGE ORDINARY SHARES OUTSTANDING—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

|

27,009,719

|

|

|

23,602,333

|

|

|

26,957,719

|

|

|

23,033,339

|

|

The accompanying notes are an integral part of the condensed financial statements.

VASCULAR BIOGENICS LTD.

CONDENSED INTERIM CASH FLOW STATEMENTS

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30,

|

|

|

|

|

2017

|

|

2016

|

|

|

|

|

U.S. dollars in thousands

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

|

|

|

|

|

Loss for the period

|

|

$

|

(9,906)

|

|

$

|

(8,003)

|

|

|

Adjustments required to reflect net cash used in operating activities (see Appendix A)

|

|

|

(1,183)

|

|

|

745

|

|

|

Interest received

|

|

|

159

|

|

|

62

|

|

|

Net cash used in operating activities

|

|

|

(10,930)

|

|

|

(7,196)

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

|

|

|

|

|

|

|

|

Purchase of property and equipment

|

|

|

(1,118)

|

|

|

(360)

|

|

|

Maturity of short-term deposits

|

|

|

10,966

|

|

|

11,400

|

|

|

Net cash generated from investing activities

|

|

|

9,848

|

|

|

11,040

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

Exercise of employees stock options

|

|

|

361

|

|

|

47

|

|

|

Issuance of ordinary shares, net

|

|

|

—

|

|

|

21,860

|

|

|

Net cash generated from financing activities

|

|

|

361

|

|

|

21,907

|

|

|

NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS

|

|

|

(721)

|

|

|

25,751

|

|

|

CASH AND CASH EQUIVALENTS AT BEGINNING OF THE YEAR

|

|

|

11,585

|

|

|

7,090

|

|

|

EXCHANGE GAINS ON CASH AND CASH EQUIVALENTS

|

|

|

200

|

|

|

14

|

|

|

CASH AND CASH EQUIVALENTS AT END OF THE PERIOD

|

|

$

|

11,064

|

|

$

|

32,855

|

|

|

APPENDIX A:

|

|

|

|

|

|

|

|

|

Adjustments required to reflect net cash used in operating activities:

|

|

|

|

|

|

|

|

|

Depreciation

|

|

$

|

83

|

|

$

|

60

|

|

|

Interest income

|

|

|

(181)

|

|

|

(129)

|

|

|

Exchange gains on cash and cash equivalents

|

|

|

(200)

|

|

|

(14)

|

|

|

Net changes in severance pay

|

|

|

9

|

|

|

—

|

|

|

Share based payments

|

|

|

2,244

|

|

|

583

|

|

|

|

|

|

1,955

|

|

|

500

|

|

|

Changes in working capital:

|

|

|

|

|

|

|

|

|

Decrease (increase) in other current assets

|

|

|

(2,308)

|

|

|

99

|

|

|

Decrease (increase) in long-term prepaid expenses

|

|

|

(163)

|

|

|

148

|

|

|

Increase (decrease) accounts payable and accrued expenses:

|

|

|

|

|

|

|

|

|

Trade

|

|

|

(131)

|

|

|

(735)

|

|

|

Other

|

|

|

(536)

|

|

|

733

|

|

|

|

|

|

(3,138)

|

|

|

245

|

|

|

|

|

$

|

(1,183)

|

|

$

|

745

|

|

|

|

|

|

|

|

|

|

|

|

APPENDIX B:

|

|

|

|

|

|

|

|

|

Non cash activity-

|

|

|

|

|

|

|

|

|

Purchase of property and equipment

|

|

|

(1,450)

|

|

|

|

|

The accompanying notes are an integral part of the condensed financial statements.

VASCULAR BIOGENICS LTD.

NOTES TO CONDENSED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

NOTE 1 – GENERAL

Vascular Biogenics Ltd. (the “Company” or "VBL") was incorporated on January 27, 2000. The Company is a clinical-stage biopharmaceutical company focused on the discovery, development and commercialization of first-in-class treatments for cancer. VBL has also developed a proprietary platform of small molecules, Lecinoxoids, for the treatment of chronic immune-related indications, and is also conducting a research program exploring the potential of targeting of MOSPD2 for immuno-oncology and anti-inflammatory applications.

VB-111 (ofranergene obadenovec), a Phase 3 drug candidate, is the Company’s lead product candidate in the Company’s cancer program. VB-201, a Phase 2-ready drug candidate, is the Company’s lead Lecinoxoid-based product candidate. The Company's “VB-600 series” for targeting of MOSPD2 is at pre-clinical stage.

In 2015, the Company launched its Phase 3 clinical trial of VB-111 in rGBM, whereby the first patient was randomized in August 2015 and the trial enrollment was completed by December 2016. The Company is conducting its Phase 3 clinical trial of VB-111 in rGBM under a special protocol assessment concurred by the FDA.

Since its inception, the Company has incurred significant losses, and it expects to continue to incur significant expenses and losses for at least the next several years. As of June 30, 2017, the Company had an accumulated deficit of $168.0 million. The Company’s losses may fluctuate significantly from quarter to quarter and year to year, depending on the timing of its clinical trials, the receipt of payments under any future collaboration agreements it may enter into, and its expenditures on other research and development activities.

As of June 30, 2017, the Company had cash, cash equivalents and short-term bank deposits of $33.8 million. The Company may seek to raise more capital to pursue additional activities. The Company may seek these funds through a combination of private and public equity offerings, government grants, strategic collaborations and licensing arrangements. Additional financing may not be available when the Company needs it or may not be available on terms that are favorable to the Company.

NOTE 2 - BASIS OF PREPARATION

The Company’s condensed interim financial statements as of June 30, 2017 and for the six and three months then ended (the “interim financial statements”) have been prepared in accordance with International Accounting Standard No. 34, “Interim Financial Reporting” (“IAS 34”). These interim financial statements, which are unaudited, do not include all disclosures necessary for a complete presentation of the Company’s financial position, results of operations, and cash flows, in conformity with generally accepted accounting principles. The condensed interim financial statements should be read in conjunction with the Company’s annual financial statements as of December 31, 2016 and for the year then ended, along with the accompanying notes, which have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB).” The results of operations for the six and three months ended June 30, 2017 are not necessarily indicative of the results that may be expected for the entire fiscal year or for any other interim period.

NOTE 3 - SIGNIFICANT ACCOUNTING POLICIES

The accounting policies and calculation methods applied in the preparation of the interim financial statements are consistent with those applied in the preparation of the annual financial statements as of December 31, 2016 and for the year then ended.

NOTE 4 - FINANCIAL RISK MANAGEMENT AND FINANCIAL INSTRUMENTS

The Company’s activities expose it to a variety of financial risks: market risk (including currency risk, fair value interest rate risk, cash flow interest rate risk and price risk), credit risk and liquidity risk. The interim financial statements do not include all financial risk management information and disclosures required in the annual financial statements; therefore, they should be read in conjunction with the Company’s annual financial statements as of

December 31, 2016. There have been no significant changes in the risk management policies since the year end.

NOTE 5 - CASH AND CASH EQUIVALENTS AND SHORT-TERM BANK DEPOSITS

Cash and cash equivalents and short-term bank deposits as of June 30, 2017 comprised of $11.1 million and $22.7 million, respectively. The short-term bank deposits as of June 30, 2017 were for terms of six months to twelve months and carried interest at annual rates of 1.24%-1.56%.

NOTE 6 – SHAREHOLDERS' EQUITY

a.

In June 2017, the Company’s Board of Directors modified the term of all outstanding options granted in March 2008, June 2008 and January 2009 by extending the life of the options from 10 years expiry to 20 years. At the date of modification, all of the options were fully vested. The extension involves 533,075 options and the incremental increase in the value amounted to approximately $832 thousand.

b.

In June 2017, the Company’s Board of Directors approved the grant of options to purchase 100,000 shares of Common Stock with an exercise price equal to $5.39 per share vesting over 4 years and 36,000 restricted stock units (RSUs) to a new executive officer of the Company. The fair value of options and RSUs were $612 thousand. The fair value of the options on the date of grant was computed using the Black-Scholes model. The underlying data used for computing the fair value of the options are mainly as follows: an exercise price equal to $5.39, expected volatility: 97%; risk-free interest rate: 2.15%; expected dividend: zero; and the contractual term.

c.

During the period, the Company issued a total of 146,250 shares of Common Stock in connection with the exercise of options by certain employees of the Company. The Company received aggregate cash proceeds equal to approximately $361 thousand. These options were due for expiry during 2017 should they have not been exercised.

d.

In March 2017, the Board of Directors approved the increase of 1,027,911 Ordinary Shares to the number of shares available for issuance under the 2014 Plan.

NOTE 7 – SUBSEQUENT EVENT

On July 2017, the Company executed a contract with Biopharmax Group Ltd. for approximately $5.5 million to design and build the new facility in Modiin, Israel.

OPERATING AND FINANCIAL REVIEW

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the Company’s annual financial statements as of and for the year ended December 31, 2016 (included in our Annual Report of Foreign Private Issuer on Form 20-F for the year ended December 31, 2016) and their accompanying notes and the related notes and the other financial information included elsewhere in this Form 6-K. This discussion contains forward-looking statements that involve risks, uncertainties and assumptions. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of various factors. Our audited financial statements as of and for the year ended December 31, 2016 and our unaudited financial statements for the six months ended on June 30, 2017 (the “Period”) have been prepared in accordance with IFRS, as issued by the IASB. Unless stated otherwise, comparisons included herein are made to the six months period ended on June 30, 2016 (the “Parallel Period”).

Overview

We are a clinical-stage biopharmaceutical company focused on the discovery, development and commercialization of first-in-class treatments for cancer. Our main program is based on our proprietary Vascular Targeting System, or VTS, platform technology, which utilizes genetically targeted therapy to destroy newly formed, or angiogenic, blood vessels, and which we believe will allow us to develop product candidates for multiple oncology indications.

Our lead product candidate, VB-111 (ofranergene obadenovec), is a gene-based biologic that we are developing for solid tumor indications, with an advanced program for recurrent glioblastoma, or rGBM, an aggressive form of brain cancer. We have obtained fast track designation for VB-111 in the United States for prolongation of survival in patients with glioblastoma that has recurred following treatment with standard chemotherapy and radiation. We have also received orphan drug designation in both the United States and Europe. Our pivotal Phase 3 GLOBE study in rGBM began in August 2015. The study is being conducted under a special protocol assessment, or SPA, agreement with the U.S. Food and Drug Administration, or FDA, with full endorsement by the Canadian Brain Tumor Consortium (“CBTC”). We completed enrollment for the trial in December 2016, five months ahead of our initial plan, with a total of 256 patients in the US, Canada and Israel.

We also have been conducting a program targeting anti-inflammatory diseases based on the use of our Lecinoxoid platform technology. Lecinoxoids are a novel class of small molecules we developed that are structurally and functionally similar to naturally occurring molecules known to modulate inflammation. As we reported in February 2015, the lead product candidate from this program, VB-201, failed to meet the primary endpoint in Phase 2 clinical trials for psoriasis and for ulcerative colitis. As a result, we have terminated our development of VB-201 in those indications. Nevertheless, based on recent pre-clinical studies, we believe that VB-201 and some second generation molecules such as VB-703 may be applicable for NASH and renal fibrosis. Since the Company intends to focus substantially all of our efforts and resources on advancing our oncology program, we will seek to monetize our Lecinoxoid assets via strategic deals.

We are also conducting a research program exploring the potential of targeting of MOSPD2 for immuno-oncology and anti-inflammatory applications. We believe that targeting of MOSPD2 may have several therapeutic applications, including targeting of MOSPD2-expressing tumor cells, inhibition of tumor cell metastases and inhibition of monocyte migration in chronic inflammatory conditions. We are developing our “VB-600 series” of pipeline candidates towards these applications.

We are developing our lead oncology product candidate, VB-111, for solid tumor indications, with current clinical programs in rGBM and ovarian cancer. Data from our open-label Phase 2 clinical trial of VB-111 in rGBM demonstrated dose-dependent reduction of tumor growth and an increase in median overall survival, which is the time interval from initiation of treatment to the patient’s death. The U.S. FDA has granted VB-111 fast track designation for prolongation of survival in patients with glioblastoma that has recurred following treatment with temozolomide, a chemotherapeutic agent commonly used to treat newly diagnosed glioblastoma, and radiation. On July 1, 2014, the FDA approved the design and planned analyses of our Phase 3 pivotal trial of VB-111 in rGBM pursuant to an SPA. We began our Phase 3 pivotal trial of VB-111 in rGBM in August 2015 and completed patient enrollment for the study in December 2016, five months ahead of our initial plan. Following positive safety reviews announced in December 2016 and in April 2017, the GLOBE trial continues as planned. The final DSMC review will take place after 105 mortality

events and after 50% of the patients have more than 12 months follow up, with a recommendation expected in late September 2017. Given the fast recruitment rate of the GLOBE study and the current proximity to the end of the trial, it was agreed with the FDA under the SPA, that this interim review will not require futility analysis. Top-line data after the occurrence of 189 events are expected in early 2018. Based on interactions with the FDA

and the SPA for the trial

, we believe the current trial should support a Biologics License Application (BLA).

VB-111 was also being studied in a Phase 2 trial for recurrent platinum-resistant ovarian cancer and in a Phase 2 study in recurrent, iodine-resistant differentiated thyroid cancer. In a Phase 2 trial for recurrent platinum-resistant ovarian cancer, VB-111 demonstrated a statistically significant increase in overall survival and 60% durable response rate (as measured by reduction in CA-125), approximately twice the historical response with bevacizumab plus chemotherapy in ovarian cancer. In December 2016, we had an end-of-Phase-2 meeting with the FDA, following which we advanced VB-111 to a Phase 3 study in platinum-resistant ovarian cancer that we intend to launch in Q4 2017.

In February 2017, we reported full data from our exploratory Phase 2 study of VB-111 in recurrent, iodine-resistant differentiated thyroid cancer. The primary endpoint of the trial, defined as 6-month progression-free-survival (PFS-6) of 25%, was met with a dose response. Forty-seven percent of patients in the therapeutic-dose cohort reached PFS-6, versus 25% in the sub-therapeutic cohort, both groups meeting the primary endpoint. An overall survival benefit was seen, with a tail of more than 40% at 3.7 years for the therapeutic-dose cohort, similar to historical data for pazopanib (Votrient), a tyrosine kinase inhibitor; however, most patients in the VB-111 study had tumors that previously had progressed on pazopanib or other kinase inhibitors.

In

June 2017, at the BIO international conference we provided an update on the long-term status and survival of patients from three completed Phase 2 trials with VB-111. In the Phase 2 study in rGBM patients, 12-month survival was 54% in patients who were treated with VB-111 through progression, including a rGBM patient who remains alive with complete response after 38 months (as of June 2017), compared to 23% of patients who had limited exposure of a therapeutic dose of VB-111. According to a meta-analysis, the 12-month survival on Avastin™ (bevacizumab) is only 24%. In the Phase 2 study in recurrent platinum-resistant and refractory ovarian cancer, 53% of patients treated with a therapeutic dose of VB-111 in combination with paclitaxel were alive at 15 months. No patients in the sub-therapeutic dose were alive at the 15-month time point. In the Phase 2 study in radioiodine refractory differentiated thyroid cancer, 53% of those who received multiple therapeutic doses of VB-111 were alive at 24 months, compared to 33% of those who received a single, sub-therapeutic dose of VB-111. 35% of patients on the therapeutic dose cohort remain alive at 39 to 46 months.

Based on support from pre-clinical data, which we recently presented at the American Society of Gene & Cell Therapy (ASGCT) conference, we also plan to conduct an exploratory study for VB-111 in combination with a checkpoint inhibitor in non-small cell lung cancer

. Launch of this trial is expected in the first quarter of 2018.

As of June 30, 2017, we had studied VB-111 in over 300 patients and have observed it to be well-tolerated. In December 2015, we were granted a US composition of matter patents that provides intellectual property protection for VB-111 in the US until October 2033 before any patent term extension.

We commenced operations in 2000, and our operations to date have been limited to organizing and staffing our company, business planning, raising capital, developing our VTS, Lecinoxoids and MOSPD2-based platform technologies and developing our product candidates, including conducting pre-clinical studies and clinical trials of VB-111 and VB-201. To date, we have funded our operations through private sales of preferred shares, a convertible loan, public offerings and grants from the Israeli Office of Chief Scientist, or OCS, which has later transformed to the National Authority for Technology and Innovation, or NATI, under the Israel Encouragement of Research and Development in Industry, or the Research Law. We have no products that have received regulatory approval and accordingly have never generated revenue. Since our inception and through June 30, 2017, we had raised an aggregate of $212.8 million to fund our operations, of which $113.4 million was from sales of our equity securities, $40.5 from our initial public offering, or IPO, $15.0 million from a November 3, 2015 underwritten offering, approximately $24.0 million from a June 7, 2016 registered direct offering and $19.9 million from NATI grants.

Since inception, we have incurred significant losses. Our loss for the Period was $9.9 million. For the years ended December 31, 2016 and 2015, our loss was $16.0 million and $14.9 million, respectively. We expect to continue to incur significant expenses and losses for at least the next several years. As of June 30, 2017, we had an accumulated deficit of $168.0 million. Our losses may fluctuate significantly from quarter to quarter and year to year, depending on the timing of our clinical trials, the receipt of payments under any future collaborations we may enter into, and our expenditures on

other research and development activities.

As of June 30, 2017, we had cash, cash equivalents and short-term bank deposits of $33.8 million. To fund further operations, we will need to raise additional capital. We may seek to raise more capital to pursue additional activities, which may be through a combination of private and public equity offerings, government grants, strategic collaborations and licensing arrangements. Additional financing may not be available when we specifically need it or may not be available on terms that are favorable to us. As of June 30, 2017, we had 35 employees. Our operations are currently located in a single facility in Or Yehuda, Israel, but we intend to relocate to a new facility in Modiin, Israel in the second half of 2017.

Various statements in this release concerning our future expectations constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include words such as “may,” “expects,” “anticipates,” “believes,” and “intends,” and describe opinions about future events. These forward-looking statements involve known and unknown risks and uncertainties that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Some of these risks are incurred losses; dependence on the success of our lead product candidate, VB-111, its clinical development, regulatory approval and commercialization; the novelty of our technologies, which makes it difficult to predict the time and cost of product candidate development and potential regulatory approval; as well as potential delays in our clinical trials.

These and other factors are more fully discussed in the “Risk Factors” section of the Annual Report on Form 20-F for the year ended December 31, 2016. In addition, any forward-looking statements represent our views only as of the date of this release and should not be relied upon as representing our views as of any subsequent date. We do not assume any obligation to update any forward-looking statements unless required by law.

Financial Overview

Revenue

To date, we have not generated any revenue. We do not expect to receive any revenue from any product candidates that we develop unless and until we obtain regulatory approval and commercialize our products or enter into collaborative agreements with third parties.

Research and Development Expenses

Research and development expenses consist of costs incurred for the development of both of our platform technologies and our product candidates. Those expenses include:

|

|

·

|

|

employee-related expenses, including salaries and share-based compensation expenses for employees in research and development functions;

|

|

|

·

|

|

expenses incurred in operating our laboratories and small-scale manufacturing facility;

|

|

|

·

|

|

expenses incurred under agreements with CROs and investigative sites that conduct our clinical trials;

|

|

|

·

|

|

expenses relating to outsourced and contracted services, such as external laboratories, consulting and advisory services;

|

|

|

·

|

|

supply, development and manufacturing costs relating to clinical trial materials;

|

|

|

·

|

|

maintenance of facilities, depreciation and other expenses, which include direct and allocated expenses for rent and insurance; and

|

|

|

·

|

|

costs associated with pre-clinical and clinical activities.

|

Research expenses are recognized as incurred. An intangible asset arising from the development of our product candidates is recognized if certain capitalization conditions are met. As of June 30, 2017, we did not have any

capitalized development costs.

Costs for certain development activities are recognized based on an evaluation of the progress to completion of specific tasks using information and data provided to us by our vendors and clinical sites. Nonrefundable advance payments for goods or services to be received in future periods for use in research and development activities are deferred and capitalized. The capitalized amounts are then expensed as the related goods are delivered and the services are performed.

We have received grants from the NATI as part of the research and development programs for our VTS and Lecinoxoid platform technologies. The requirements and restrictions for such grants are found in the Research Law. These grants are subject to repayment through future royalty payments on any products resulting from these research and development programs, including VB-111 and VB-201. The total gross amount of grants actually received by us from the NATI, including accrued LIBOR interest as of June 30, 2017 totaled $24.5 million. As of June 30, 2017, we had not paid any royalties to the NATI.

Information on our liabilities and the restrictions that we are subject to under the Research Law in connection with the NATI grants that we have received is detailed in the Annual Report on Form 20-F as of and for the year ended December 31, 2016.

Under applicable accounting rules, the grants from the NATI have been accounted for as an off-set against the related research and development expenses in our financial statements. As a result, our research and development expenses are shown on our financial statements net of the NATI grants.

General and Administrative Expenses

General and administrative expenses consist principally of salaries and related costs for personnel in executive and finance functions such as salaries, benefits and share-based compensation. Other general and administrative expenses include facility costs not otherwise included in research and development expenses, communication expenses, and professional fees for legal services, patent counseling and portfolio maintenance, consulting, auditing and accounting services.

Financial Expenses (Income), Net

Financial income is comprised of interest income generated from interest earned on our cash, cash equivalents and short-term bank deposits and gains and losses due to fluctuations in foreign currency exchange rates, mainly in the appreciation and depreciation of the NIS exchange rate against the U.S. dollar.

Financial expenses primarily consist of gains and losses due to fluctuations in foreign currency exchange rates.

Taxes on Income

We have not generated taxable income since our inception, and had carry forward tax losses as of December 31, 2016 of $139.5 million. We anticipate that we will be able to carry forward these tax losses indefinitely to future tax years. Accordingly, we do not expect to pay taxes in Israel until we have taxable income after the full utilization of our carry forward tax losses.

We recognize deferred tax assets on losses for tax purposes carried forward to subsequent years if utilization of the related tax benefit against a future taxable income is expected. We have not created deferred taxes on our tax loss carry forward since their utilization is not expected in the foreseeable future.

Critical Accounting Policies and Significant Judgments and Estimates

This management’s discussion and analysis of our financial condition and results of operations is based on our financial statements, which have been prepared in accordance with IFRS. The preparation of these financial statements requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported expenses incurred during the reporting periods. Estimates and judgments are continually evaluated and are based on historical experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances.

We make estimates and assumptions concerning the future. The resulting accounting estimates will, by definition, seldom equal the related actual results. The estimates and assumptions that have a significant risk of causing a material adjustment to the carrying amounts of assets and liabilities within the next financial year are discussed below.

Share-Based Compensation

We operate a number of equity-settled, share-based compensation plans for employees (as defined in IFRS 2 “Share-Based Payments”), directors and service providers. As part of the plans, we grant employees, directors and service providers, from time to time and at our discretion, options and RSUs to purchase our ordinary shares. The fair value of the employee and service provider services received in exchange for the grant of the options and RSUs is recognized as an expense in our statements of comprehensive loss and is carried to additional paid in capital in our statements of financial position. The total amount is recognized as an expense ratably over the vesting period of the options, which is the period during which all vesting conditions are expected to be met.

We estimate the fair value of our share-based awards to employees and directors using the Black-Scholes option pricing model, which requires the input of highly subjective assumptions, including (a) the expected volatility of our shares, (b) the expected term of the award, (c) the risk-free interest rate, and (d) expected dividends. Due to the lack of a public market for the trading of our shares until October 2014 and a lack of company-specific historical and implied volatility data, we have based our estimate of expected volatility on the historic volatility of a group of similar companies that are publicly traded. We will continue to apply this process until a sufficient amount of historical information regarding the volatility of our own share price becomes available. For options granted since 2015, the expected volatility was calculated using weighted average and was based on the stock price volatility of the Company since October 1st, 2014 (IPO date) and the remaining years on the stock price volatility of similar companies. We estimate the fair value of our share-based awards to service providers based on the value of services received, which is based on the additional cash compensation that we would need to pay if such options were not granted.

Service conditions and performance vesting conditions are included in assumptions about the number of options and RSUs that are expected to vest. The total expense is recognized over the vesting period, which is the period over which all of the specified vesting conditions are to be satisfied.

We are also required to estimate forfeitures at the time of grant, and revise those estimates in subsequent periods if actual forfeitures differ from the estimates. Vesting conditions are included in assumptions about the number of options and RSUs that are expected to vest. At the end of each reporting period, we revise our estimates of the number of options and RSUs that are expected to vest based on the nonmarket vesting conditions. We recognize the impact of the revision to original estimates, if any, in profit or loss, with a corresponding adjustment to additional paid in capital.

Results of Operations

Comparison of six month periods ended June 30, 2017 and 2016:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended

|

|

|

|

|

|

|

|

|

|

June 30,

|

|

Increase (decrease)

|

|

|

|

|

2017

|

|

2016

|

|

$

|

|

%

|

|

|

|

|

(in thousands)

|

|

|

|

|

(unaudited)

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development, gross

|

|

$

|

9,145

|

|

$

|

6,904

|

|

$

|

2,241

|

|

32

|

%

|

|

Government grants

|

|

|

(1,792)

|

|

|

(671)

|

|

|

(1,121)

|

|

167

|

%

|

|

Research and development, net

|

|

$

|

7,353

|

|

$

|

6,233

|

|

$

|

1,120

|

|

18

|

%

|

|

General and administrative

|

|

|

3,003

|

|

|

1,923

|

|

|

1,080

|

|

56

|

%

|

|

Operating loss

|

|

|

10,356

|

|

|

8,156

|

|

|

2,200

|

|

27

|

%

|

|

Financial expense (income), net

|

|

|

(450)

|

|

|

(153)

|

|

|

(297)

|

|

194

|

%

|

|

Loss

|

|

$

|

9,906

|

|

$

|

8,003

|

|

$

|

1,903

|

|

24

|

%

|

Research and development expenses, net

. Research and development expenses are shown net of NATI grants. Research and development expenses, net were approximately $7.4 million for the Period, compared to approximately $6.2 million

in the Parallel Period, an increase of approximately $1.1 million or 18%. The increase in gross research and development expenses is $2.2 million or 32%. It is mainly related to the increased GBM Phase 3 subcontractor costs that is operating at full capacity compared to the Parallel Period where patient recruitment was underway, in addition to an increase in share based compensation expense and other payroll related costs. This is offset by an increase in NATI grants due in the Period compared to the Parallel Period of $1.1 million or 167%, reflecting an increase in the NATI grant for the year 2017 in comparison to the previous period.

General and administrative expenses

. General and administrative expenses for the Period were $3.0 million, compared to $1.9 million for the Parallel Period, an increase of $1.1 million or 56%. This increase is mainly attributed to payroll related costs for management share-based compensation expense.

Financial expenses (income), net

. Financial expenses (income), net for the Period were approximately ($450) thousand, compared to approximately ($153) thousand for the Parallel Period

.

The higher financial income of $297 thousand is primarily attributable to foreign exchange gains.

Liquidity and Capital Resources

Since our inception and through June 30, 2017, we have raised a total of $113.4 million from sales of our equity securities before the initial public offering, $40.5 million gross in the initial public offering itself ($34.9 million net), $15 million from a November 3, 2015 underwritten offering, $24.0 million from a June 7, 2016 registered direct offering and $19.9 million from NATI grants. Our primary uses of cash have been to fund working capital requirements and research and development, and we expect these will continue to represent our primary uses of cash. We expect our cash, cash equivalents and short-term bank deposits as of June 30, 2017 to be sufficient to fund our operations into 2019.

Funding Requirements

At June 30, 2017, we had cash, cash equivalents and short-term bank deposits totaling $33.8 million and working capital of $31.8 million. We expect that our cash, cash equivalents and short-term bank deposits will enable us to fund our operating expenses and capital expenditure requirements into 2019 and is expected to be sufficient to enable us to complete our on-going Phase 3 clinical trial of VB-111 in

rGBM, to support our planned potential registration trial in ovarian cancer and an exploratory clinical study of VB-111 in combination with a checkpoint inhibitor in lung cancer, as well as to support the investment in the new Modiin facility.

We are unable to estimate the amounts of increased capital outlays and operating expenses associated with completing the development of VB-111 and our other product candidates. Our future capital requirements will depend on many factors, including:

|

|

·

|

|

the costs, timing and outcome of regulatory review of VB-111 and any other product candidates we may pursue;

|

|

|

·

|

|

the costs of future development activities, including clinical trials, for VB-111 and any other product candidates we may pursue;

|

|

|

·

|

|

the costs of preparing, filing and prosecuting patent applications, maintaining and enforcing our intellectual property rights and defending intellectual property-related claims;

|

|

|

·

|

|

the extent to which we acquire or in-license other products and technologies; and

|

|

|

·

|

|

our ability to establish any future collaboration arrangements on favorable terms, if at all.

|

Until such time, if ever, as we can generate substantial product revenue, we expect to finance our cash needs through a combination of equity offerings, debt financings, collaborations, strategic alliances and licensing arrangements. We do not have any committed external source of funds.

Cash Flows

The following table sets forth the primary sources and uses of cash for each of the periods set forth below:

|

|

|

|

|

|

|

|

|

|

|

|

Period ended June 30,

|

|

|

|

|

2017

|

|

2016

|

|

|

|

|

(in thousands)

|

|

|

|

|

(unaudited)

|

|

|

Cash used in operating activities

|

|

$

|

(10,930)

|

|

$

|

(7,196)

|

|

|

Cash provided by investing activities

|

|

|

9,848

|

|

|

11,040

|

|

|

Cash provided by financing activities

|

|

|

361

|

|

|

21,907

|

|

|

Net increase (decrease) in cash and cash equivalents

|

|

$

|

(721)

|

|

$

|

25,751

|

|

Operating Activities

Cash used in operating activities for the Period was $10.9 million and consisted primarily of net loss of $9.9 million arising primarily from research and development activities in addition to a net increase in working capital of $3.1 million, and partially offset by net aggregate non-cash charges of $2.0 million.

Cash used in operating activities for the Parallel Period was $7.2 million and consisted primarily of net loss of $8.0 million arising primarily from research and development activities, partially offset by a net decrease in working capital of $0.2 million, and net aggregate non-cash charges of $0.5 million.

Investing Activities

Net cash provided by investing activities was $9.8 million for the Period and $11.0 million for the Parallel Period. This was primarily due to the maturation of short-term bank deposits, respectively.

Financing Activities

Net cash provided by financing activities was $361 thousand for the Period resulted from exercise of employees' stock options.

Net cash provided by financing activities of $21.9 million for the Parallel Period was the result of the net receipt of $21.9 million, after deducting placement agent and other offering expenses, from the issuance of ordinary shares per the closing of the June 7, 2016 securities offering.

Contractual Obligations and Commitments

The following tables summarize our contractual obligations and commitments as of June 30, 2017 that will affect our future liquidity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less than

|

|

1-3

|

|

4-5

|

|

More than

|

|

|

|

|

Total

|

|

1 Year

|

|

Years

|

|

Years

|

|

5 Years

|

|

|

|

|

(in thousands)

|

|

|

Licenses

|

|

$

|

344

|

|

$

|

115

|

|

$

|

229

|

|

$

|

—

|

|

$

|

—

|

|

|

Operating Leases

|

|

|

2,684

|

|

|

386

|

|

|

782

|

|

|

686

|

|

|

830

|

|

|

Total

|

|

$

|

3,028

|

|

$

|

501

|

|

$

|

1,011

|

|

$

|

686

|

|

$

|

830

|

|

In October 2016, we entered into a long-term lease contract for approximately $2.0 million in lease payments over seven years for a new facility in Modiin, Israel. The site will house our local biological drugs manufacturing facility, headquarters, discovery research and clinical development. We intend to operate and relocate to the new site in the second half of 2017.

Off-Balance Sheet Arrangements

Since our inception, we have not engaged in any off-balance sheet arrangements, as defined in the rules and regulations of the SEC, such as relationships with unconsolidated entities or financial partnerships, which are often referred to as

structured finance or special purpose entities, established for the purpose of facilitating financing transactions that are not required to be reflected on our statement of financial positions.

Quantitative and Qualitative Disclosures about Market Risk

We are exposed to market risks in the ordinary course of our business. Market risk represents the risk of loss that may impact our financial position due to adverse changes in financial market prices and rates. Our market risk exposure is primarily a result of foreign currency exchange rates. Approximately 17% of our expenses in the first six months of 2017 were denominated in New Israeli Shekels. Changes of 5% in the US$/NIS exchange rate will increase or decrease the operation expenses by up to 1%.

Foreign Currency Exchange Risk

Fluctuations in exchange rates, especially the NIS against the U.S. dollar, may affect our results, as some of our assets are linked to NIS, as are some of our liabilities. In addition, the fluctuation in the NIS exchange rate against the U.S. dollar may impact our results, as a portion of our operating cost is NIS denominated.

Inflation Risk

We do not believe that inflation had a material effect on our business, financial condition or results of operations in the last two fiscal years. If our costs were to become subject to significant inflationary pressures, we may not be able to fully offset such higher costs through hedging transactions. Our inability or failure to do so could harm our business, financial condition and results of operations.

Recently Issued and Adopted Accounting Pronouncements

IFRS 9, Financial Instruments, addresses the classification, measurement and recognition of financial assets and financial liabilities. The complete version of IFRS 9 was issued in July 2014. It replaces the guidance in IAS 39 that relates to the classification and measurement of financial instruments. IFRS 9 retains but simplifies the mixed measurement model and establishes three primary measurement categories for financial assets: amortized cost, fair value through other comprehensive income I and fair value through the statement of comprehensive loss. There is now a new expected credit losses model that replaces the incurred loss impairment model used in IAS 39. For financial liabilities, there were no changes to classification and measurement except for the recognition of changes in own credit risk in other comprehensive income for liabilities designated at fair value through profit or loss. The standard is effective for accounting periods beginning on or after January 1, 2018. Early adoption is permitted. We have yet to assess IFRS 9’s full impact.

In January 2016, the IASB issued IFRS 16—Leases which sets out the principles for the recognition, measurement, presentation and disclosure of leases for both parties to a contract and replaces the previous leases standard, IAS 17—Leases. IFRS 16 eliminates the classification of leases for the lessee as either operating leases or finance leases as required by IAS 17 and instead introduces a single lessee accounting model whereby a lessee is required to recognize assets and liabilities for all leases with a term that is greater than 12 months, unless the underlying asset is of low value, and to recognize depreciation of leases assets separately from interest on lease liabilities in the income statement. As IFRS 16 substantially carries forward the lessor accounting requirements in IAS 17, a lessor will continue to classify its leases as operating leases or finance leases and to account for those two types of leases differently. IFRS 16 is effective from January 1, 2019 with early adoption allowed only if IFRS 15—Revenue from Contracts with Customers is also applied. The Company is currently evaluating the impact of adoption on its Financial Statements.

JOBS Act

On April 5, 2012, the JOBS Act was signed into law. The JOBS Act contains provisions that, among other things, reduce certain reporting requirements for an “emerging growth company.” As an “emerging growth company,” we are electing to not take advantage of the extended transition period afforded by the JOBS Act for the implementation of new or revised accounting standards, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to not take advantage of the extended transition period for complying with new or revised accounting standards is irrevocable. In addition, we are in the process of evaluating the benefits of relying on the other exemptions and reduced reporting requirements provided by the JOBS Act.

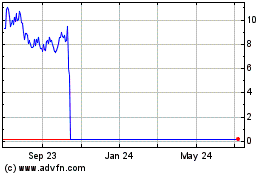

Vascular Biogenics (NASDAQ:VBLT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vascular Biogenics (NASDAQ:VBLT)

Historical Stock Chart

From Apr 2023 to Apr 2024