SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the

month of July 2017

RYANAIR HOLDINGS PLC

(Translation

of registrant's name into English)

c/o Ryanair Ltd Corporate Head Office

Dublin

Airport

County Dublin Ireland

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file

annual

reports

under cover Form 20-F or Form 40-F.

Form

20-F..X.. Form 40-F

Indicate

by check mark whether the registrant by furnishing the

information

contained

in this Form is also thereby furnishing the information to

the

Commission

pursuant to Rule 12g3-2(b) under the Securities

Exchange

Act of

1934.

Yes

No ..X..

If

"Yes" is marked, indicate below the file number assigned to the

registrant

in

connection with Rule 12g3-2(b): 82- ________

RYANAIR Q1 PROFITS RISE

55%

TO €

397

M DUE

TO

STRONG EASTER BUT NO CHANGE TO FY GUIDANCE

Ryanair,

Europe's No. 1 airline, today (July 24) reported a 55% rise in Q1

profit to €397m. This result is distorted by the timing of

Easter in Q1 with no holiday period in the prior year

comparative. Traffic grew 12% to 35m as Ryanair's lower fares

and "Always Getting Better" (AGB) programme delivered a record 96%

load factor.

|

Q1 (IFRS)

|

June 30, 2016

|

June 30, 2017

|

% Change

|

|

Customers

(m)

|

31.2

|

35.0

|

+12%

|

|

Revenue

(m)

|

€1,687

|

€1,910

|

+13%

|

|

Profit

after Tax (m)

|

€256

|

€397

|

+55%

|

|

Net

Margin

|

15%

|

21%

|

+6%

|

|

Basic

EPS (euro cent)

|

20.01

|

32.66

|

+63%

|

Ryanair's CEO Michael O'Leary said:

"We are

pleased to report this 55% increase in PAT to €397m but

caution that the outcome is distorted by the absence of Easter in

the prior year Q1. While Q1 ave. fares rose by 1% to just over

€40, this was due to a strong April (boosted by Easter)

offset by adverse sterling, lower bag revenue as more customers

switch to our 2 free carry-on bag policy, and yield stimulation

following a series of security events in Manchester and London. Q1

highlights include:

-

Traffic up 12% to 35m (LF +2% to 96%)

-

Ave. fare up 1% to €40.30

-

Unit costs down 6% (ex-fuel -3%)

-

10 additional B737-MAX-200 "

Game

Changers

" ordered (now 110 firm & 100

options)

-

Over €200m returned to shareholders via share

buybacks

-

397 B737's in fleet at end of Q1

New Routes, Bases & Fleet:

We took

delivery of 14 new B737's in Q1, ahead of the peak summer period.

Our new bases in Frankfurt Main (opened in March) and Naples

(April) are performing well with strong advance bookings at low

fares. The Frankfurt Main base will increase from 2 to 7 aircraft

in Sept. We will launch 2 new bases in Memmingen (Munich) &

Poznan in the autumn and open 170 new routes for winter '17.

We continue to see significant growth opportunities for Ryanair

across Europe as competitors close bases or move capacity and

legacy airlines restructure.

In June

we ordered 10 more B737-MAX-200 "

Game Changer

" aircraft. Five of these

will be delivered in spring 2019 and 5 more in spring 2020. In

addition, we recently agreed extensions of 10 operating leases

which will provide us with 3 more aircraft for S.18 and 10 for

S.19. This addresses a temporary capacity shortage in S.19 (before

our Boeing MAX deliveries accelerate in Sept. '19) and allows us to

maintain consistent growth through FY20.

AGB & Labs:

Year 4 of AGB is under way. In May we launched flight connections

at Rome Fiumicino, and in July extended it to Milan Bergamo. We

have started selling Air Europa long-haul flights from Madrid on

our website and have become the exclusive airline partner of the EU

Erasmus Student Network. This partnership will enable Erasmus

students to benefit from exclusive flight discounts to suit their

budget and will be available from Aug. From June, our

customers who purchase reserved seats now enjoy a 60-day check-in

window. On Ryanair Rooms, we added a 5

th

partner, increasing both choice and value for our

customers. Ryanair Holidays continues to roll out across our

network and went live in Italy and Spain in Q1.

We continue to invest heavily in Travel Labs, and recently opened

our 3

rd

Lab facility in Madrid which will see us hire up

to 250 highly skilled digital professionals in Spain over the next

2 years. This follows on from the doubling in size of the

team in Travel Labs Poland to almost 200 IT professionals earlier

this year.

Our

industry leading on-time performance improved in Q1 to 89%.

We work hard to ensure that our customers enjoy punctual flights

and we continue to campaign with our partners in A4E (Airlines for

Europe) to encourage the EC to take action to ameliorate the impact

of ATC strikes on overflights in Europe.

|

Punctuality

|

Apr.

|

May

|

Jun.

|

Q1

|

|

FY17

|

91%

|

89%

|

81%

|

87%

|

|

FY18

|

91%

|

90%

|

88%

|

89%

|

Costs:

The

cost gap between Ryanair and competitor airlines continues to

widen. We delivered a 6% unit cost reduction in Q1 as our

fuel bill fell despite a 12% increase in traffic. Ex-fuel

unit costs, helped by weaker sterling (which will, we believe, be

reversed in H2 due to more difficult y-o-y comparisons), fell by 3%

as we delivered unit cost reductions across nearly all cost

lines. We remain on-track to deliver our previously guided

ex-fuel unit cost reduction of 1% in FY18.

Our

FY18 fuel is 90% hedged at approx. $49pbl and will deliver

significant savings this year. We took advantage of recent

price dips to increase our H1 FY19 hedging to approx. 45% at

$48pbl. We expect these fuel savings will be passed back to

Ryanair customers through lower fares.

Brexit:

We

remain concerned at the uncertainty which surrounds the terms of

the UK's departure from the EU in March '19. While we continue to

campaign for the UK to remain in the EU Open Skies agreement, we

caution that should the UK leave, there may not be sufficient time,

or goodwill on both sides, to negotiate a timely replacement

bilateral which could result in a disruption of flights between the

UK and Europe for a period of time from April '19 onwards.

We, like all airlines, seek clarity on this issue before we publish

our summer 2019 schedule in the second quarter of 2018. If we

do not have certainty about the legal basis for the operation of

flights between the UK and the EU by autumn 2018, we may be forced

to cancel flights and move some, or all, of our UK based aircraft

to Continental Europe from April '19 onwards. We have

contingency plans in place and will, as always, adapt to changed

circumstances in the best interests of our customers and

shareholders.

Balance Sheet & Shareholder Returns:

Ryanair's

balance sheet remains one of the strongest in our industry.

In May the Board approved a €600m ordinary share buyback

programme. In Q1 we spent €165m under this buyback at

an ave. price of €18.20. We also purchased €39m worth

of ADR's under the €150m "Evergreen" ADR buyback programme

launched last Feb. Despite this cumulative spend of over

€200m on buybacks and capex of almost €400m in Q1, we

reduced net debt by €150m from €244m at Mar. 31 to

€94m at Jun. 30.

Outlook:

As

previously guided, Q1 results were substantially boosted by the

presence of Easter in April but not in the prior year

comparable. While the H1 outcome remains dependent on

close-in Q2 summer bookings, we continue to guide H1 ave. fares

down approx. 5% as we grow H1 traffic by almost 11% and

checked bag revenue continues to steeply decline. Thanks to

the higher Q1 load factors and the completion of our winter '17

schedule, we are raising our FY18 traffic target to 131m (up 1m on

previous guidance). After a difficult winter last year, we

expect the pricing environment to remain very competitive into H2

where we will grow traffic by approx. 7%. Yield visibility

into H2 is zero and we see no reason at this time to alter our H2

ave. fare guidance of an 8% decline.

Ex-fuel

unit costs are on track to deliver a 1% reduction this year, and

our fuel hedging should deliver savings of approx. €70m, when

adjusted for volume growth, which is being passed on to customers

in lower fares. Ancillary revenue continues to grow in line

with traffic as we discount pricing to drive penetration in

products such as Ryanair Rooms, Ryanair Holidays and the PLUS

bundles (which are reported in scheduled

revenue).

Based

on the above, we continue to guide FY18 PAT in a range of

€1.40bn to €1.45bn. This guidance remains heavily

dependent on close-in summer bookings, H2 ave. fares, and the

absence of any further security events, ATC strikes or negative

Brexit developments."

ENDS.

|

For

further information

|

Neil

Sorahan

|

Piaras

Kelly

|

|

please

contact:

|

Ryanair

Holdings plc

|

Edelman

|

|

www.ryanair.com

|

Tel: 353-1-9451212

|

Tel: 353-1-6789333

|

Ryanair is Europe's favourite airline, carrying 131m customers p.a.

on more than 2,200 daily flights from 86 bases, connecting over 210

destinations in 33 countries on a fleet of over 400, new, Boeing

737 aircraft, with a further 270 B737's on order, which will enable

Ryanair to lower fares and grow traffic to 200m p.a. by FY24. These

modern aircraft are among the quietest and most fuel efficient in

operation, making Ryanair one of the greenest, cleanest airline

operations in Europe. Ryanair's team of over 13,000 highly skilled

aviation professionals deliver Europe's No.1 on-time performance,

and an industry leading 32 year safety record.

Certain

of the information included in this release is forward looking and

is subject to important risks and uncertainties that could cause

actual results to differ materially. It is not reasonably

possible to itemise all of the many factors and specific events

that could affect the outlook and results of an airline operating

in the European economy. Among the factors that are subject

to change and could significantly impact Ryanair's expected results

are the airline pricing environment, fuel costs, competition from

new and existing carriers, market prices for the replacement

aircraft, costs associated with environmental, safety and security

measures, actions of the Irish, U.K., European Union ("EU") and

other governments and their respective regulatory agencies,

uncertainties surrounding Brexit, weather related disruptions,

fluctuations in currency exchange rates and interest rates, airport

access and charges, labour relations, the economic environment of

the airline industry, the general economic environment in Ireland,

the UK and Continental Europe, the general willingness of

passengers to travel and other economics, social and political

factors and unforeseen security events.

Ryanair Holdings plc and Subsidiaries

Condensed Consolidated Interim Balance Sheet as at June 30, 2017

(unaudited)

|

|

|

At Jun 30,

|

At Mar 31,

|

|

|

|

2017

|

2017

|

|

|

Note

|

€M

|

€M

|

|

Non-current assets

|

|

|

|

|

Property,

plant and equipment

|

10

|

7,467.5

|

7,213.8

|

|

Intangible

assets

|

|

46.8

|

46.8

|

|

Derivative

financial instruments

|

|

12.1

|

23.0

|

|

Total non-current assets

|

|

7,526.4

|

7,283.6

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

Inventories

|

|

3.3

|

3.1

|

|

Other

assets

|

|

197.2

|

222.1

|

|

Trade

receivables

|

|

61.2

|

54.3

|

|

Derivative

financial instruments

|

|

41.7

|

286.3

|

|

Restricted

cash

|

|

11.8

|

11.8

|

|

Financial

assets: cash > 3 months

|

|

3,140.6

|

2,904.5

|

|

Cash

and cash equivalents

|

|

1,034.3

|

1,224.0

|

|

Total current assets

|

|

4,490.1

|

4,706.1

|

|

|

|

|

|

|

Total assets

|

|

12,016.5

|

11,989.7

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

Trade

payables

|

|

324.0

|

294.1

|

|

Accrued

expenses and other liabilities

|

|

2,351.9

|

2,257.2

|

|

Current

maturities of debt

|

|

450.1

|

455.9

|

|

Derivative

financial instruments

|

|

84.1

|

1.7

|

|

Current

tax

|

|

46.9

|

2.9

|

|

Total current liabilities

|

|

3,257.0

|

3,011.8

|

|

|

|

|

|

|

Non-current liabilities

|

|

|

|

|

Provisions

|

|

142.6

|

138.2

|

|

Derivative

financial

instruments

|

|

84.9

|

2.6

|

|

Deferred

tax

|

|

426.0

|

473.1

|

|

Other

creditors

|

|

7.4

|

12.4

|

|

Non-current

maturities of debt

|

|

3,830.8

|

3,928.6

|

|

Total non-current liabilities

|

|

4,491.7

|

4,554.9

|

|

|

|

|

|

|

Shareholders' equity

|

|

|

|

|

Issued

share capital

|

12

|

7.2

|

7.3

|

|

Share

premium account

|

|

719.4

|

719.4

|

|

Other

undenominated capital

|

12

|

2.7

|

2.7

|

|

Retained

earnings

|

12

|

3,649.8

|

3,456.8

|

|

Other

reserves

|

|

(111.3)

|

236.8

|

|

Shareholders' equity

|

|

4,267.8

|

4,423.0

|

|

|

|

|

|

|

Total liabilities and shareholders' equity

|

|

12,016.5

|

11,989.7

|

Ryanair Holdings plc and Subsidiaries

Condensed Consolidated Interim Income Statement for the quarter

ended June 30, 2017 (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Quarter

Ended

|

Quarter

Ended

|

|

|

|

|

|

Jun 30,

|

Jun 30,

|

|

|

|

|

Change

|

2017

|

2016

|

|

|

|

Note

|

%

|

€M

|

€M

|

|

Operating revenues

|

|

|

|

|

|

|

Scheduled

revenues

|

|

+13%

|

1,409.3

|

1,244.0

|

|

|

Ancillary

revenues

|

|

+13%

|

501.0

|

443.4

|

|

Total operating revenues - continuing operations

|

|

+13%

|

1,910.3

|

1,687.4

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

Fuel and oil

|

|

-1%

|

513.0

|

518.4

|

|

|

Airport and handling charges

|

|

+11%

|

267.0

|

241.4

|

|

|

Route charges

|

|

+7%

|

191.0

|

177.9

|

|

|

Staff costs

|

|

+10%

|

182.4

|

165.8

|

|

|

Depreciation

|

|

+11%

|

139.0

|

125.6

|

|

|

Marketing, distribution and other

|

|

+15%

|

100.6

|

87.6

|

|

|

Maintenance, materials and repairs

|

|

-13%

|

35.9

|

41.3

|

|

|

Aircraft rentals

|

|

-6%

|

21.2

|

22.6

|

|

Total operating expenses

|

|

+5%

|

1,450.1

|

1,380.6

|

|

|

|

|

|

|

|

|

Operating profit - continuing operations

|

|

+50%

|

460.2

|

306.8

|

|

|

|

|

|

|

|

Other (expense)/income

|

|

|

|

|

|

|

Finance expense

|

|

-15%

|

(17.8)

|

(21.0)

|

|

|

Finance income

|

|

-56%

|

0.6

|

1.3

|

|

|

Foreign exchange gain/(loss)

|

|

-232%

|

0.7

|

(0.6)

|

|

Total other (expense)/income

|

|

-19%

|

(16.5)

|

(20.3)

|

|

|

|

|

|

|

|

|

Profit before tax

|

|

+55%

|

443.7

|

286.5

|

|

|

|

|

|

|

|

|

|

Tax expense on profit

|

4

|

+51%

|

(46.6)

|

(31.0)

|

|

|

|

|

|

|

|

|

Profit for the quarter - all attributable to equity holders of

parent

|

|

+55%

|

397.1

|

255.5

|

|

|

|

|

|

|

|

|

|

Earnings per ordinary share (in € cent)

|

|

|

|

|

|

|

Basic

|

9

|

+63%

|

32.66

|

20.01

|

|

|

Diluted

|

9

|

+63%

|

32.38

|

19.90

|

|

|

Weighted

average no. of ordinary shares (in Ms)

|

|

|

|

|

|

|

Basic

|

9

|

|

1,216.0

|

1,276.8

|

|

|

Diluted

|

9

|

|

1,226.4

|

1,284.2

|

Ryanair Holdings plc and Subsidiaries

Condensed Consolidated Interim

Statement of Comprehensive Income for the quarter ended June 30,

2017 (unaudited

)

|

|

Quarter

|

Quarter

|

|

|

Ended

|

Ended

|

|

|

Jun 30,

|

Jun 30,

|

|

|

2017

|

2016

|

|

|

€M

|

€M

|

|

|

|

|

|

Profit for the quarter

|

397.1

|

255.5

|

|

|

|

|

|

Other comprehensive income:

|

|

|

|

|

|

|

|

Items that are or may be reclassified to profit or

loss:

|

|

|

|

Cash flow hedge reserve movements:

|

|

|

|

Net

movement in cash flow hedge reserve

|

(349.6)

|

348.4

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive (loss)/income for the quarter, net of income

tax

|

(349.6)

|

348.4

|

|

|

|

|

|

Total comprehensive income for the quarter - all attributable to

equity holders of parent

|

47.5

|

603.9

|

|

|

|

|

|

Ryanair Holdings plc and Subsidiaries

Condensed Consolidated Interim Statement of Cash Flows for the

quarter ended June 30, 2017 (unaudited)

|

|

|

|

Quarter

|

Quarter

|

|

|

|

|

Ended

|

Ended

|

|

|

|

|

Jun 30,

|

Jun 30,

|

|

|

|

|

2017

|

2016

|

|

|

|

Note

|

€M

|

€M

|

|

Operating activities

|

|

|

|

|

|

Profit after tax

|

|

397.1

|

255.5

|

|

|

|

|

|

|

|

Adjustments to reconcile profit after tax to net cash provided by

operating activities

|

|

|

|

|

|

Depreciation

|

|

139.0

|

125.6

|

|

|

(Increase)/decrease in inventories

|

|

(0.2)

|

0.3

|

|

|

Tax expense on profit on ordinary activities

|

|

46.6

|

31.0

|

|

|

Share based payments

|

|

1.5

|

1.5

|

|

|

(Decrease)/increase in trade receivables

|

|

(6.9)

|

16.4

|

|

|

Decrease in other current assets

|

|

25.1

|

15.6

|

|

|

Increase in trade payables

|

|

29.9

|

49.2

|

|

|

Increase in accrued expenses

|

|

102.2

|

229.6

|

|

|

(Decrease) in other creditors

|

|

(5.0)

|

(5.1)

|

|

|

Increase/(decrease) in provisions

|

|

4.3

|

(4.6)

|

|

|

(Increase)/decrease in finance income

|

|

(0.1)

|

0.3

|

|

|

(Decrease) in finance expense

|

|

(7.4)

|

(8.5)

|

|

|

Income tax paid

|

|

-

|

(0.1)

|

|

Net cash provided by operating activities

|

|

726.1

|

706.7

|

|

|

|

|

|

|

|

Investing activities

|

|

|

|

|

|

Capital expenditure (purchase of property, plant and

equipment)

|

|

(392.6)

|

(381.4)

|

|

|

Decrease/(increase) in restricted cash

|

|

-

|

0.1

|

|

|

Decrease in financial assets: cash > 3 months

|

|

(236.1)

|

4.6

|

|

Net cash provided/(used in) investing activities

|

|

(628.7)

|

(376.7)

|

|

|

|

|

|

|

|

Financing activities

|

|

|

|

|

|

Shareholder returns

|

12

|

(204.1)

|

(467.5)

|

|

|

Repayments of long term borrowings

|

|

(83.0)

|

(88.5)

|

|

Net cash provided/(used in) financing activities

|

|

(287.1)

|

(556.0)

|

|

|

|

|

|

|

|

(Decrease)/increase in cash and cash equivalents

|

|

(189.7)

|

(226.0)

|

|

Cash and cash equivalents at beginning of the period

|

|

1,224.0

|

1,259.2

|

|

Cash and cash equivalents at end of the period

|

|

1,034.3

|

1,033.2

|

Ryanair Holdings plc and Subsidiaries

Condensed Consolidated Interim Statement of Changes in

Shareholders' Equity for the quarter ended June 30, 2017

(unaudited)

|

|

|

|

|

|

|

|

Other Reserves

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary

|

Issued

Share

|

Share

Premium

|

Retained

|

Other

Undenominated

|

|

|

Other

|

|

|

|

Shares

|

Capital

|

Account

|

Earnings

|

Capital

|

Treasury

|

Hedging

|

Reserves

|

Total

|

|

|

M

|

€M

|

€M

|

€M

|

€M

|

€M

|

€M

|

€M

|

€M

|

|

Balance at March 31, 2016

|

1,290.7

|

7.7

|

719.4

|

3,166.1

|

2.3

|

(7.3)

|

(300.6)

|

9.2

|

3,596.8

|

|

Profit for the year

|

-

|

-

|

-

|

1,315.9

|

-

|

-

|

-

|

-

|

1,315.9

|

|

Other comprehensive income

|

|

|

|

|

|

|

|

|

|

|

Net

movements in cash flow reserve

|

-

|

-

|

-

|

-

|

-

|

-

|

522.5

|

-

|

522.5

|

|

Total other comprehensive income

|

-

|

-

|

-

|

-

|

-

|

-

|

522.5

|

-

|

522.5

|

|

Total comprehensive income

|

-

|

-

|

-

|

1,315.9

|

-

|

-

|

522.5

|

-

|

1,838.4

|

|

Transactions with owners of the Company recognised directly in

equity

|

|

|

|

|

|

|

|

|

|

|

Share-based payments

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

5.7

|

5.7

|

|

Repurchase of ordinary equity shares

|

-

|

-

|

|

(1,017.9)

|

-

|

-

|

-

|

-

|

(1,017.9)

|

|

Cancellation of repurchased ordinary shares

|

(72.3)

|

(0.4)

|

-

|

-

|

0.4

|

-

|

-

|

-

|

-

|

|

Treasury shares cancelled

|

(0.5)

|

-

|

-

|

(7.3)

|

-

|

7.3

|

-

|

-

|

-

|

|

Balance at March 31, 2017

|

1,217.9

|

7.3

|

719.4

|

3,456.8

|

2.7

|

-

|

221.9

|

14.9

|

4,423.0

|

|

Profit for the quarter

|

-

|

-

|

-

|

397.1

|

-

|

-

|

-

|

-

|

397.1

|

|

Other comprehensive income

|

|

|

|

|

|

|

|

|

|

|

Net

movements in cash flow reserve

|

-

|

-

|

-

|

|

-

|

-

|

(349.6)

|

-

|

(349.6)

|

|

Total other comprehensive income

|

-

|

-

|

-

|

|

-

|

-

|

(349.6)

|

-

|

522.5

|

|

Total comprehensive income

|

-

|

-

|

-

|

397.1

|

-

|

-

|

(349.6)

|

-

|

47.5

|

|

Transactions with owners of the Company recognised directly in

equity

|

|

|

|

|

|

|

|

|

|

|

Share-based payments

|

-

|

-

|

-

|

|

-

|

-

|

-

|

1.5

|

1.5

|

|

Repurchase of ordinary equity shares

|

-

|

-

|

-

|

(204.1)

|

-

|

-

|

-

|

-

|

(204.1)

|

|

Cancellation of repurchased ordinary shares

|

(10.9)

|

(0.1)

|

-

|

-

|

0.4

|

-

|

-

|

-

|

-

|

|

Balance at June 30, 2017

|

1,207.0

|

7.2

|

719.4

|

3,649.8

|

2.7

|

-

|

(127.7

)

|

16.4

|

4,267.8

|

Ryanair Holdings plc and Subsidiaries

MD&A Quarter Ended June 30, 2017

Income Statement

Scheduled revenues:

Scheduled

revenues are up by

13% to

€1,409.3M

due to 12% traffic growth (to 35M) and a 1%

increase in average fare to over €40.

Ancillary revenues:

Ancillary

revenues increased by

13% to

€501.0M

as reserved seating, priority boarding and car

hire continue to improve offset by lower travel insurance and hotel

penetration.

Operating Expenses:

Fuel and oil:

Fuel

and oil fell by

1% to

€513.0M

due to lower hedged fuel prices offset by a

12% increase in block hours and a higher load factor (up 2 points

to 96%).

Airport and handling charges:

Airport

and handling charges are up by

11%

to €267.0M

due to 12% traffic growth offset by more

competitive airport deals and weaker sterling against the

euro.

Route

charges:

Route

charges rose

7% to

€191.0M

due to a 10% increase in sectors offset by

Eurocontrol price reductions in France, Germany and the UK (aided

by weaker sterling).

Staff

costs:

Staff

costs increased by

10% to

€182.4M,

lower than the 12% increase in traffic, due

to 10% more sectors and the impact of a 2% pay increase in April

2017 offset by weaker sterling against the euro.

Depreciation:

Depreciation

is

11% higher at

€139.0M

due to 50 (+16%) additional owned aircraft in

the fleet at period end (364 at June 30, 2017 compared to 314 at

June 30, 2016).

Marketing, distribution and other:

Marketing,

distribution and other are up by

15% to €100.6M

, due to increased

distribution costs related to stronger on-board sales and higher

EU261 passenger compensation claims.

Maintenance, materials and repairs:

Maintenance,

materials and repairs fell by

13%

to €35.9M

due to 8 lease handbacks over the past year

offset by the stronger US dollar against the euro.

Aircraft rentals:

Aircraft

rentals fell by

6% to

€21.2M

due to the handback of 8 leased aircraft over

the past year.

Ownership and maintenance:

During

the quarter ended June 30, 2017 ownership and maintenance costs

(depreciation, maintenance, aircraft rentals and financing costs)

increased by

2% to

€213.8M

, which is significantly lower than the 12%

increase in passenger numbers.

Unit costs fell by 6%, excluding fuel they were down 3%,

which compares favourably to the 12% increase in traffic in the

quarter

.

Other income/(expense):

Finance

expense:

Finance

expense decreased by

15% to

€17.8M

primarily due to lower interest

rates.

Finance

income:

Finance

income fell by

€0.7M

due to significantly lower deposit interest rates.

Balance sheet:

Gross

cash rose by €46.4M to €4,186.7M at June 30,

2017.

Gross

debt fell by €103.6M to €4,280.9M due to debt

repayments.

€726.1M

net cash was generated by operating activities. Net capital

expenditure was €392.6M, shareholder returns and debt

repayments amounted to €204.1M and €83.0M

respectively.

Net

debt was €94.2M at period end. (March 31, 2017: Net

debt €244.2M).

Shareholders'

equity:

Shareholders'

equity decreased by €155.2M to €4,267.8M in the quarter

due to IFRS hedge accounting treatment for derivatives of

€349.6M and €204.1M of shareholder returns, offset by

net profit after tax of €397.1M in the quarter.

Ryanair

Holdings plc and Subsidiaries

Notes

forming Part of the Condensed Consolidated

Interim Financial Statements

1.

Basis of preparation and significant accounting

policies

Ryanair

Holdings plc (the "Company") is a company domiciled in Ireland. The

unaudited condensed consolidated preliminary financial statements

of the Company for the quarter ended June 30, 2017 comprise the

Company and its subsidiaries (together referred to as the

"Group").

These

unaudited condensed consolidated interim financial statements ("the

interim financial statements"), which should be read in conjunction

with our 2016 Annual Report for the year ended March 31, 2016, have

been prepared in accordance with International Accounting Standard

No. 34 "

Interim Financial

Reporting

" as adopted by the EU ("IAS 34"). They do

not include all of the information required for full annual

financial statements, and should be read in conjunction with the

most recent published consolidated financial statements of the

Group. The consolidated financial statements of the Group as at and

for the year ended March 31, 2017, are available at

http://investor.ryanair.com/

.

The

June 30, 2017 figures and the June 30, 2016 comparative figures do

not constitute statutory financial statements of the Group within

the meaning of the Companies Act, 2014. The consolidated financial

statements of the Group for the year ended March 31, 2016, together

with the independent auditor's report thereon, were filed with the

Irish Registrar of Companies following the Company's Annual General

Meeting and are also available on the Company's Website. The

auditor's report on those financial statements was

unqualified. The consolidated financial statements of the

Group for the year ended March 31, 2017 will be filed with the

Irish Registrar of Companies following the Company's Annual General

Meeting and will be available to shareholders in due

course.

The

Audit Committee, upon delegation of authority by the Board of

Directors, approved the condensed consolidated preliminary

financial statements for the year ended March 31, 2017 on May 26,

2017.

Except

as stated otherwise below, this period's financial information has

been prepared in accordance with the accounting policies set out in

the Group's most recent published consolidated financial

statements, which were prepared in accordance with IFRS as adopted

by the EU and also in compliance with IFRS as issued by the

International Accounting Standards Board (IASB).

The

following new and amended standards, that have been issued by the

IASB, and which were effective for the first time for the current

financial year beginning on or after January 1, 2016, and have also

been endorsed by the EU, have been applied by the Group for the

first time in these condensed consolidated financial

statements;

●

Amendments to IFRS

11: "Accounting for Acquisitions of Interests in Joint Operations"

(effective for fiscal periods beginning on or after January 1,

2016)

●

Amendments to IAS 16 and IAS 38: "Clarification

of Acceptable Methods of Depreciation and Amortisation" (effective

for fiscal periods beginning on or after January 1,

2016)

●

Amendments to IAS

16 Property, Plant and Equipment and IAS 41 Bearer Plants

(effective for fiscal periods beginning on or after January 1,

2016)

●

Amendments to IAS

27 Equity method in Separate Financial Statements (effective for

fiscal periods beginning on or after January 1, 2016)

●

Amendments to IAS

1: "Disclosure Initiative" (effective for fiscal periods beginning

on or after January 1, 2016)

●

"Annual

Improvements to IFRSs" 2012-2014 Cycle (effective for fiscal

periods beginning on or after January 1, 2016)

●

Amendments to IFRS 10, IFRS 12 and IAS 28:

"Investment Entities - Exception to Consolidation" (effective for

fiscal periods beginning on or after January 1,

2016)

The adoption of these amended standards did not have a material

impact on our financial position or results from operations in the

year ended March 31, 2017.

The

following new or revised IFRS standards and IFRIC interpretations

will be adopted for purposes of the preparation of future financial

statements, where applicable. Those that are not as yet EU endorsed

are flagged below. While under review, we do not anticipate that

the adoption of these new or revised standards and interpretations

will have a material impact on our financial position or results

from operations:

●

Amendments to IAS

7: "Disclosure Initiative" (effective for fiscal periods beginning

on or after January 1, 2017)*

●

Amendments to IAS

12: "Recognition of Deferred Tax Assets for Unrealised Losses"

(effective for fiscal periods beginning on or after January 1,

2017)*

●

IFRS 15: "Revenue

from Contracts with Customers including Amendments to IFRS 15"

(effective for fiscal periods beginning on or after January 1,

2018)

●

IFRS 9: "Financial

Instruments" (effective for fiscal periods beginning on or after

January 1, 2018)

●

Clarifications to IFRS 15: "Revenue from

Contracts with Customers (effective for fiscal periods beginning on

or after January 1, 2018)*

●

Amendments to IFRS 2: "Classification and

Measurement of Share Based Payment Transactions" (effective for

fiscal periods beginning on or after January 1,

2018)*

●

Amendments to IFRS 4: Applying IFRS 9 "Financial

Instruments" with IFRS 4: "Insurance Contracts" (effective for

fiscal periods beginning on or after January 1,

2018)*

●

Annual Improvements to IFRS 2014-2016 Cycle

(effective for fiscal periods beginning on or after January 1,

2018)*

●

IFRIC Interpretation 22: "Foreign Currency

Transactions and Advance Consideration" (effective for fiscal

periods beginning on or after January 1, 2018)*

●

IFRS 16: "Leases"

(effective for fiscal periods beginning on or after January 1,

2019)

* These

standards or amendments to standards are not as yet EU

endorsed.

2.

Estimates

The

preparation of financial statements requires management to make

judgements, estimates and assumptions that affect the application

of accounting policies and the reported amounts of assets and

liabilities, income and expense. Actual results may differ

from these estimates.

In

preparing these condensed consolidated interim financial

statements, the significant judgements made by management in

applying the Group's accounting policies and the key sources of

estimation uncertainty were the same as those that applied in the

most recent published consolidated financial

statements.

3.

Seasonality of operations

The

Group's results of operations have varied significantly from

quarter to quarter, and management expects these variations to

continue. Among the factors causing these variations are the

airline industry's sensitivity to general economic conditions and

the seasonal nature of air travel. Accordingly the first

half-year typically results in higher revenues and

results.

4.

Income tax expense

The

Group's consolidated effective tax rate in respect of operations

for the quarter ended June 30, 2017 was 10.5% (June 30, 2016:

10.8%). The tax charge for the quarter ended June 30, 2017 of

€46.6M (June 30, 2016: €31.0M) comprises a current tax

charge of €43.7M and a deferred tax charge of €2.9M

relating to the temporary differences for property, plant and

equipment recognised in the income statement.

5.

Share based payments

The

terms and conditions of the share option programme are disclosed in

the most recent, published, consolidated financial statements. The

charge of €1.5M is the fair value of various share options

granted in prior periods, which are being recognised within the

income statement in accordance with employee services

rendered.

6.

Contingencies

The

Group is engaged in litigation arising in the ordinary course of

its business. The Group does not believe that any such

litigation will individually, or in aggregate, have a material

adverse effect on the financial condition of the Group.

Should the Group be unsuccessful in these litigation actions,

management believes the possible liabilities then arising cannot be

determined but are not expected to materially adversely affect the

Group's results of operations or financial position.

7.

Capital commitments

At June

30, 2017 Ryanair had an operating fleet of 397 (2016: 353) Boeing

737 aircraft. The Group agreed to purchase 183 new Boeing

737-800NG aircraft from the Boeing Corporation during the periods

FY15 to FY19 of which 11 aircraft were delivered in the year ended

March 31, 2015, 41 were delivered in the year ended March 31, 2016,

a further 52 were delivered in the year ended March 31, 2017 and 14

in the quarter ended June 30, 2017.

The

Group also agreed to purchase up to 210 (110 firm and 100 options)

Boeing 737 Max 200 aircraft from the Boeing Corporation during the

periods FY20 to FY24; these include 10 additional firm orders

announced in June 2017 which will see aircraft deliveries increase

by 5 in spring 2019 and 5 in spring 2020.

8.

Analysis of operating segment

The

Group is managed as a single business unit that provides low fares

airline-related activities, including scheduled services, car-hire,

internet income and related sales to third parties. The Group

operates a single fleet of aircraft that is deployed through a

single route scheduling system.

The

Group determines and presents operating segments based on the

information that internally is provided to the CEO, who is the

Group's Chief Operating Decision Maker (CODM). When making

resource allocation decisions the CODM evaluates route revenue and

yield data. However, resource allocation decisions are made based

on the entire route network and the deployment of the entire

aircraft fleet, which are uniform in type. The objective in

making resource allocation decisions is to maximise consolidated

financial results, rather than individual routes within the

network.

The

CODM assesses the performance of the business based on the adjusted

profit/(loss) after tax of the Group for the period. All

segment revenue is derived wholly from external customers and as

the Group has a single reportable segment, intersegment revenue is

zero.

The

Group's major revenue-generating asset comprises its aircraft

fleet, which is flexibly employed across the Group's integrated

route network and is directly attributable to its reportable

segment operations. In addition, as the Group is managed as a

single business unit, all other assets and liabilities have been

allocated to the Group's single reportable segment.

|

|

|

|

|

Reportable

segment information is presented as follows:

|

|

|

|

|

Quarter

|

Quarter

|

|

|

|

Ended

|

Ended

|

|

|

|

Jun 30,

|

Jun 30,

|

|

|

|

2017

|

2016

|

|

|

|

€M

|

€'M

|

|

|

External revenues

|

1,910.3

|

1,687.4

|

|

|

|

|

|

|

|

Reportable segment profit after income tax

|

397.1

|

255.5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At Jun 30,

2017

€M

|

At Mar 31,

2017

€M

|

|

|

Reportable segment assets

|

12,016.5

|

11,989.7

|

|

|

|

|

|

|

|

Reportable segment liabilities

|

7,748.7

|

7,566.7

|

|

|

|

|

|

|

|

|

|

|

|

|

9.

Earnings per share

|

|

|

|

Quarter

|

Quarter

|

|

|

|

|

Ended

|

Ended

|

|

|

|

|

Jun 30,

|

Jun

30,

|

|

|

|

|

2017

|

2016

|

|

|

|

|

|

|

|

Basic earnings per ordinary share euro cent

|

|

|

32.66

|

20.01

|

|

Diluted earnings per ordinary share euro cent

|

|

|

32.38

|

19.90

|

|

Weighted average number of ordinary shares (in M's) -

basic

|

|

|

1,216.0

|

1,276.8

|

|

Weighted average number of ordinary shares (in M's) -

diluted

|

|

|

1,226.4

|

1,284.2

|

Diluted

earnings per share takes account of the potential future exercises

of share options granted under the Company's share option schemes

and the weighted average number of shares includes weighted average

share options assumed to be converted of 10.4M (2016:

7.4M).

10. Property,

plant and equipment

Acquisitions and disposals

Capital

expenditure in the quarter to June 30, 2017 amounted to

€392.6M and primarily relates to aircraft pre delivery

payments and 14 aircraft deliveries.

11.

Financial instruments and financial

risk management

The

Group is exposed to various financial risks arising in the normal

course of business. The Group's financial risk exposures are

predominantly related to commodity price, foreign exchange and

interest rate risks. The Group uses financial instruments to manage

exposures arising from these risks.

These

preliminary financial statements do not include all financial risk

management information and disclosures required in the annual

financial statements, and should be read in conjunction with the

2016 Annual Report. There have been no changes in our risk

management policies in the period.

Fair value hierarchy

Financial

instruments measured at fair value in the balance sheet are

categorised by the type of valuation method used. The different

valuation levels are defined as follows:

●

Level 1: quoted

prices (unadjusted) in active markets for identical assets or

liabilities that the Group can access at the measurement

date.

●

Level 2: inputs

other than quoted prices included within Level 1 that are

observable for that asset or liability, either directly or

indirectly.

●

Level 3:

significant unobservable inputs for the asset or

liability.

Fair value estimation

Fair

value is the price that would be received to sell an asset, or paid

to transfer a liability, in an orderly transaction between market

participants at the measurement date. The following methods and

assumptions were used to estimate the fair value of each material

class of the Group's financial instruments:

Financial instruments measured at fair value

●

Derivatives - interest rate swaps:

Discounted cash flow analyses have been used to determine the fair

value, taking into account current market inputs and rates. (Level

2)

●

Derivatives - currency forwards, aircraft fuel

contracts and carbon swaps:

A comparison of the contracted

rate to the market rate for contracts providing a similar risk

profile at March 31, 2017 has been used to establish fair value.

(Level 2)

The

Group policy is to recognise any transfers between levels of the

fair value hierarchy as of the end of the reporting period during

which the transfer occurred. During the quarter to June 30, 2017,

there were no reclassifications of financial instruments and no

transfers between levels of the fair value hierarchy used in

measuring the fair value of financial instruments.

Financial instruments disclosed at fair value

●

Fixed-rate long-term debt:

The

repayments which Ryanair is committed to make have been discounted

at the relevant market rates of interest applicable (including

credit spreads) at June 30, 2017 to arrive at a fair value

representing the amount payable to a third party to assume the

obligations.

There

were no significant changes in the business or economic

circumstances during the quarter to June 30, 2017 that affect the

fair value of our financial assets and financial

liabilities.

11.

Financial instruments and financial

risk management (continued)

The

fair value of financial assets and financial liabilities, together

with the carrying amounts in the condensed consolidated financial

balance sheet, are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At Jun 30,

|

At Jun 30,

|

At Mar 31,

|

At Mar 31,

|

|

|

2017

|

2017

|

2017

|

2017

|

|

|

Carrying

|

Fair

|

Carrying

|

Fair

|

|

|

Amount

|

Value

|

Amount

|

Value

|

|

Non-current financial assets

|

€M

|

€M

|

€M

|

€M

|

|

Derivative

financial instruments:-

|

|

|

|

|

|

- U.S.

dollar currency forward contracts

|

4.9

|

4.9

|

14.5

|

14.5

|

|

- Jet

fuel derivative contracts

|

4.7

|

4.7

|

-

|

-

|

|

-

Interest rate swaps

|

2.5

|

2.5

|

8.5

|

8.5

|

|

|

12.1

|

12.1

|

23.0

|

23.0

|

|

Current financial assets

|

|

|

|

|

|

Derivative

financial instruments:-

|

|

|

|

|

|

- U.S.

dollar currency forward contracts

|

40.8

|

40.8

|

224.9

|

224.9

|

|

- Jet

fuel derivative contracts

|

-

|

-

|

58.2

|

58.2

|

|

-

Interest rate swaps

|

0.9

|

0.9

|

3.2

|

3.2

|

|

|

41.7

|

41.7

|

286.3

|

286.3

|

|

Trade

receivables*

|

61.2

|

|

54.3

|

|

|

Cash

and cash equivalents*

|

1,034.3

|

|

1,224.0

|

|

|

Financial

asset: cash > 3 months*

|

3,140.6

|

|

2,904.5

|

|

|

Restricted

cash*

|

11.8

|

|

11.8

|

|

|

Other

assets*

|

1.0

|

|

1.0

|

|

|

|

4,290.6

|

41.7

|

4,481.9

|

286.3

|

|

Total

financial assets

|

4,302.7

|

53.8

|

4,504.9

|

309.3

|

11. Financial

instruments and financial risk management (continued)

|

|

At Jun 30,

|

At Jun 30,

|

At Mar 31,

|

At Mar 31,

|

|

|

2017

|

2017

|

2017

|

2017

|

|

|

Carrying

|

Fair

|

Carrying

|

Fair

|

|

|

Amount

|

Value

|

Amount

|

Value

|

|

Non-current

financial liabilities

|

€M

|

€M

|

€M

|

€M

|

|

Derivative

financial instruments:-

|

|

|

|

|

|

- U.S.

dollar currency forward contracts

|

83.2

|

83.2

|

0.4

|

0.4

|

|

-

Interest rate swaps

|

1.7

|

1.7

|

2.2

|

2.2

|

|

- Jet

fuel derivative contracts

|

-

|

-

|

-

|

-

|

|

|

84.9

|

84.9

|

2.6

|

2.6

|

|

Long-term

debt

|

1,392.1

|

1,426.9

|

1,489.9

|

1,519.4

|

|

Bonds

|

2,438.7

|

2,504.9

|

2,438.7

|

2,499.9

|

|

|

3,915.7

|

4,016.7

|

3,931.2

|

4,021.9

|

|

Current financial liabilities

|

|

|

|

|

|

Derivative

financial instruments:-

|

|

|

|

|

|

- U.S.

dollar currency forward contracts

|

57.2

|

57.2

|

0.1

|

0.1

|

|

-

Interest rate swaps

|

1.2

|

1.2

|

1.6

|

1.6

|

|

- Jet

fuel derivative contracts

|

25.7

|

25.7

|

-

|

-

|

|

|

84.1

|

84.1

|

1.7

|

1.7

|

|

Long-term

debt

|

450.1

|

450.1

|

455.9

|

455.9

|

|

Trade

payables*

|

324.0

|

|

294.1

|

|

|

Accrued

expenses*

|

362.5

|

|

348.0

|

|

|

|

1,220.7

|

534.6

|

1,099.7

|

457.6

|

|

Total

financial liabilities

|

5,136.4

|

4,550.9

|

5,030.9

|

4,479.5

|

*The fair value of these financial instruments approximate their

carrying values due to the short-term nature of the

instruments.

12.

Shareholder returns

In the

quarter ended June 30, 2017 the Company bought back 10.9M shares at

a total cost of €204.1M. This buy-back was equivalent

to approximately 0.9% of the Company's issued share capital at

March 31, 2017. All of these ordinary shares repurchased were

cancelled at June 30, 2017.

In FY17

the Company bought back 72.3M shares at a total cost of

approximately €1,018M, all of which were cancelled at March

31, 2017. The ordinary shares bought back equated to approximately

5.6% of the Company's issued share capital at March 31,

2016.

As a

result of the share buybacks in the quarter ended June 30, 2017,

share capital decreased by 10.9M ordinary shares (72.8M ordinary

shares in the year ended March 31, 2017) with a nominal value of

€0.1M (€0.4M in the year ended March 31, 2017) and the

other undenominated capital reserve increased by a corresponding

€0.1M (€0.4M in the year ended March 31, 2017). The

other undenominated capital reserve is required to be created under

Irish law to preserve permanent capital in the Parent

Company.

13.

Related party transactions

The

Company has related party relationships with its subsidiaries,

directors and senior key management personnel. All transactions

with subsidiaries eliminate on consolidation and are not

disclosed.

There

were no related party transactions in the quarter ended June 30,

2017 that materially affected the financial position or the

performance of the Company during that period and there were no

changes in the related party transactions described in the 2016

Annual Report that could have a material effect on the financial

position or performance of the Company in the same

period.

14.

Post balance sheet events

Between

July 1, 2017 and July 20, 2017 the Company bought back 5.2M

ordinary shares at a total cost of €95.2M under its

€600M share buyback programme which commenced in May 2017.

This was equivalent to 0.4% of the Company's issued share capital

at June 30, 2017.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf

by the undersigned, hereunto duly authorized.

Date: 24

July, 2017

|

|

By:___/s/

Juliusz Komorek____

|

|

|

|

|

|

Juliusz

Komorek

|

|

|

Company

Secretary

|

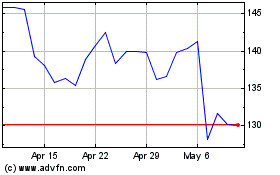

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

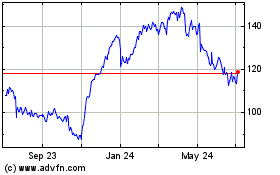

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Apr 2023 to Apr 2024