Report of Foreign Issuer (6-k)

June 14 2017 - 6:07AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

F O R M 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of June, 2017

TRINITY

BIOTECH PLC

(Name of Registrant)

IDA Business

Park

Bray, Co. Wicklow

Ireland

(Address of

Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of

Form 20-F

or

Form 40-F.

Form

20-F

☒

Form 40-F

☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1):

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

☐

No

☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

82-

June 9, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact:

|

|

Trinity Biotech plc

Kevin

Tansley

(353)-1-2769

|

|

|

|

Lytham Partners LLC

Joe

Diaz, Joe Dorame & Robert Blum

800 602-889-9700

E-mail: kevin.tansley@trinitybiotech.com

|

Trinity Biotech Announces Results of AGM

DUBLIN, Ireland (June 9, 2017)….

Trinity Biotech plc (Nasdaq: TRIB), a leading developer and manufacturer of diagnostic products for the

point-of-care and clinical laboratory markets, today announced results of the Annual General Meeting (AGM).

AGM Results

On June 9, 2017, Trinity Biotech plc held an AGM of Shareholders at the Company’s headquarters at IDA Business Park, Bray, Co. Wicklow, Ireland. The

ordinary resolutions were passed by a simple majority of the votes cast by the Company’s shareholders. The special resolutions were passed by at least 75% of votes cast by the Company’s shareholders being in favour of the special

resolutions. At the AGM the Company’s shareholders approved the following resolutions:

|

|

1.

|

To receive and consider the financial statements of the Company for the year ended December 31, 2016 together with the reports of the directors and auditors thereon.

|

|

|

2.

|

To re-elect as a director Mr. Clint Severson who retires by rotation and, being eligible, offers himself for re-election.

|

|

|

3.

|

To authorise the board of directors to fix the auditors remuneration.

|

|

|

4.

|

To consider and, if thought fit, pass the following resolution as an ordinary resolution:

|

“That, for the purposes of Section 1021 of the Companies Act 2014, the directors be and are generally and unconditionally authorised

to exercise all the powers of the Company to allot and issue relevant securities (as defined by Section 1021 of that Act (including, without limitation, any treasury shares, as defined by Section 106 of that Act)) up to a maximum amount of

the number of authorised but unissued relevant securities in the capital of the Company from time to time and for the time being. The authority hereby conferred shall expire five years after the date of this resolution unless previously renewed,

varied or revoked by the Company. The Company may make an offer or agreement before the expiry of this authority which would or might require relevant securities to be allotted after this authority has expired and the directors may allot relevant

securities in pursuance of any such offer or agreement as if the authority conferred hereby had not expired.”

|

|

5.

|

To consider and, if thought fit, pass the following resolution as a special resolution:

|

“That the directors be and are empowered pursuant to section 1023 of the Companies Act 2014 to allot equity securities (as defined by

section 1023 of the Companies Act 2014) for cash pursuant to the authority conferred on the Directors of the Company by Resolution 4 above as if section 1022 of the Companies Act 2014 did not apply to any such allotment. The power hereby conferred

shall expire at the close of business on the day five years from the date upon which the resolution is passed unless previously renewed, revoked or varied; provided that the Company may before such expiry make an offer or agreement which would or

might require equity securities to be allotted after such expiry and the directors may allot equity securities in pursuance of such offer or agreement as if the power hereby conferred had not expired.”

|

|

6.

|

To consider and, if thought fit, pass the following resolution as a special resolution:

|

“That the Company and/or any subsidiary (as defined by Section 7 of the Companies Act 2014) of the Company be generally authorised

to make overseas market purchases (as defined by Section 1072 of that Act) on the National Association of Securities Dealers Automated Quotation Market (NASDAQ), of A Ordinary Shares of US$0.0109 each (the “Share(s)”) and/or American

Depositary Receipts, on such terms and conditions and in such manner as the directors may determine from time to time but subject, however, to the provisions of the Companies Act 2014, the Articles of Association of the Company and to the following

provisions:

|

|

a.

|

the maximum number of the Shares (or Shares comprised in American Depositary Receipts) authorised to be acquired shall not exceed 25% of the Shares in issue of the Company as at the close of business on the date of the

passing of the resolution;

|

|

|

b.

|

the minimum price (exclusive of taxes and expenses) which may be paid for a Share (or per Share comprised in American Depositary Receipts) shall be an amount equal to the nominal value of that Share; and

|

|

|

c.

|

the maximum price (exclusive of taxes and expenses) which may be paid for a Share (or per Share comprised in American Depositary Receipts) shall be an amount equal to 110% of the average of the NASDAQ official close

price of the Shares (being appropriately adjusted to reflect the number of Shares comprised in American Depositary Receipts) for the ten business days immediately preceding the day on which the Share is purchased.

|

The authority hereby conferred shall expire at the close of business on the date which is eighteen months after the date of passing this

resolution unless previously revoked, varied or renewed in accordance with the provisions of Section 1074 of the Companies Act 2014. The Company or any subsidiary may, before such expiry, enter into a contract for the purchase of Shares and/or

American Depositary Receipts which would or might be executed wholly or partly after such expiry and may complete any such contract as if the authority conferred hereby had not expired.”

|

|

7.

|

To consider and, if thought fit, pass the following resolution as a special resolution:

|

“That, for the purposes of Section 1078 of the Companies Act 2014, the re-allotment price range at which ‘A’ Ordinary

Shares of US$0.0109 each (the “Share(s)”) and/or American Depositary Receipts held as treasury shares (as defined by Section 106 of that Act) (“Treasury Shares”) may be re- allotted off-market shall be as follows:

|

|

a.

|

the maximum price (exclusive of expenses) at which a Treasury Share may be re-allotted off-market shall be an amount equal to 115% of the Relevant Price; and

|

|

|

b.

|

the minimum price (exclusive of expenses) at which Treasury Shares may be re- allotted off-market shall be an amount equal to 85% of the Relevant Price.

|

For the purposes of this Resolution the expression “the Relevant Price” shall mean the average of the NASDAQ official close price of

the Shares (being appropriately adjusted to reflect the number of Shares comprised in American Depositary Receipts) for the period of ten business days immediately preceding the day on which the Treasury Shares is re- allotted.

The authority hereby conferred shall expire at the close of business on the date of the next Annual General Meeting of the Company after the

passing of this resolution or the date which is eighteen months after the passing of this resolution (whichever is the earlier) unless previously varied, revoked or renewed in accordance with and subject to the provision of the said

Section 1078.”

|

|

8.

|

To consider and, if thought fit, pass the following resolution as an ordinary resolution:

|

“That the Trinity Biotech plc Employee Share Option Plan 2017 (the “Plan”), the main features of which are summarised in the

Chairman’s letter accompanying this Notice and a copy of the rules of which is produced to the meeting and signed by the Chairman for the purposes of identification, be and is hereby approved and adopted.”

Trinity Biotech develops, acquires, manufactures and markets diagnostic systems, including both reagents and instrumentation, for the point-of-care and

clinical laboratory segments of the diagnostic market. The products are used to detect infectious diseases and to quantify the level of Haemoglobin A1c and other chemistry parameters in serum, plasma and whole blood. Trinity Biotech sells direct in

the United States, Germany, France and the U.K. and through a network of international distributors and strategic partners in over 75 countries worldwide. For further information please see the Company’s website:

www.trinitybiotech.com

.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

TRINITY BIOTECH PLC

|

|

|

|

(Registrant)

|

|

|

|

|

By:

|

|

/s/ Kevin Tansley

|

|

|

|

Kevin Tansley

|

|

|

|

Chief Financial Officer

|

Date: 13 June 2017

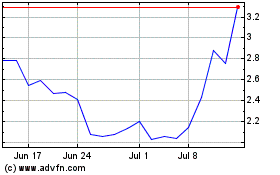

Trinity Biotech (NASDAQ:TRIB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trinity Biotech (NASDAQ:TRIB)

Historical Stock Chart

From Apr 2023 to Apr 2024