FORM

6-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

Report of Foreign Private Issuer

Pursuant to Rule

13a-16

or

15d-16

under

the Securities Exchange Act of 1934

For the month of June 2017

Commission File Number:

1-07952

KYOCERA CORPORATION

6 Takeda

Tobadono-cho,

Fushimi-ku,

Kyoto

612-8501,

Japan

Indicate by check mark whether the registrant files or will file annual reports under cover of Form

20-F

or Form

40-F:

Form

20-F

x

Form

40-F

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as

permitted by

Registration S-T

Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by

Registration S-T

Rule

101(b)(7):

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

|

KYOCERA CORPORATION

|

|

|

|

/s/ Shoichi Aoki

|

|

Shoichi Aoki

Director,

|

|

Managing Executive Officer and

General Manager of

|

|

Corporate Financial and Accounting Group

|

Date: June 6, 2017

Information furnished on this form:

EXHIBITS

|

|

|

|

|

|

Securities Code 6971

|

Notice of the 63

rd

Ordinary General Meeting of Shareholders

June 27, 2017

Kyoto, Japan

6 Takeda

Tobadono-cho,

Fushimi-ku,

Kyoto, Japan

Please note that this is an English

translation of the Japanese original of the Notice of the 63

rd

Ordinary General Meeting of Shareholders of Kyocera Corporation distributed to shareholders in Japan. The translation is prepared solely for the reference and convenience of foreign shareholders. In the

event of any discrepancy between this translation and the Japanese original, the latter shall prevail.

Table of Contents

Kyocera Management Philosophy

Corporate Motto

“Respect the Divine and Love People”

Preserve the spirit to work fairly and honorably,

respecting people, our work, our company and our global community.

Management

Rationale

To provide opportunities for the material and intellectual growth of all our

employees, and through our joint efforts, contribute to the advancement of

society and humankind.

Management Philosophy

To coexist harmoniously with our society, our global

community and nature.

Harmonious coexistence is the underlying foundation of all our business activities

as we work to create a world of prosperity and harmony.

Management Based on the Bonds of Human Minds

Kyocera started as a small,

suburban factory, with no money, credentials or reputation. We had nothing to rely on but a little technology and 28 trustworthy colleagues. Nonetheless, the company experienced rapid growth because everyone exerted their maximum efforts and

managers devoted their lives to earning the trust of employees. We wanted to be an excellent company where all employees could believe in each other, abandon selfish motives, and be truly proud to work. This desire became the foundation of

Kyocera’s management.

Human minds are said to be easily changeable. Yet, there is nothing stronger than the human mind.

Kyocera developed into what it is today because it is based on the bonds of human minds.

Kazuo Inamori

Founder and Chairman Emeritus

Greetings

We are pleased to present to you Notice of the 63

rd

Ordinary General Meeting of Shareholders.

In the year ended March 31, 2017 (hereinafter, “fiscal 2017” refers to the fiscal year ended March 31, 2017, with other fiscal years referred to in a corresponding manner), profit from

operations increased due to the effects of cost reductions, and to the absence of the recording of impairment losses on goodwill and long lived assets in fiscal 2016, despite a decline in sales due primarily to the yen’s appreciation compared

with fiscal 2016. Net income remained at a level exceeding ¥100 billion for the third year in a row despite a decline in income before income taxes due to the absence of a gain on the sale of an asset recorded in fiscal 2016.

Kyocera is planning a

year-end

dividend of 60 yen per share in light of the aforementioned

financial results and our dividend policy. When aggregated with the interim dividend of 50 yen per share already paid, the total annual dividend for fiscal 2017 will be 110 yen per share, an increase of 10 yen per share compared with fiscal 2016.

In fiscal 2018, Kyocera will strive to strengthen price competitiveness by further reducing costs as we expand existing

businesses and to bolster ties with entities inside and outside the Kyocera Group as we create new businesses based on a new management structure. By doing so, we aim to realize a high-growth, highly profitable company.

We would very much appreciate your continued support of the Kyocera Group as we forge ahead with our endeavors.

Goro Yamaguchi

Chairman of the Board and

Representative Director

Hideo Tanimoto

President and Representative Director

1

Securities Code 6971

June 6, 2017

To our shareholders

Notice of the 63

rd

Ordinary General Meeting of Shareholders

This is to inform you that Kyocera Corporation (the “Company”) will hold its 63

rd

Ordinary General Meeting of Shareholders (the “Meeting”), as described below, which you are cordially

invited to attend.

If you are unable to attend the Meeting, please examine the attached reference documents for the General

Meeting of Shareholders and exercise your voting rights in written form (voting card) or electronically (via Internet or other means),

no later than 5:30 p.m. Monday, June 26, 2017, Japan time.

|

|

|

|

|

1. Date and Time

|

|

10:00 a.m. on Tuesday, June 27, 2017, Japan Time

|

|

|

|

|

2. Venue

|

|

20th Floor Event Hall at the Head Office of the Company,

6 Takeda

Tobadono-cho,

Fushimi-ku,

Kyoto, Japan

|

3. Purpose of the Meeting

Matters to Be Reported

|

|

(1)

|

Contents of the business report, consolidated financial statements and the audit results of consolidated financial statements by the Accounting Auditor

and the Audit & Supervisory Board for the 63

rd

fiscal year (April 1, 2016 to March 31, 2017)

|

|

|

(2)

|

Contents of the

non-consolidated

financial statements for the 63

rd

fiscal year (April 1, 2016 to March 31, 2017)

|

Matters to Be Resolved

|

|

|

|

|

Proposal 1

|

|

Appropriation of Surplus

|

|

|

|

|

Proposal 2

|

|

Election of Fifteen (15) Directors

|

2

4. Matters Relating to Exercise of Voting Rights

(1)

Method of Exercising Voting Rights in attending at the Meeting (Voting Card)

Please indicate your vote “for” or “against” the proposal on the voting card enclosed herewith and hand it to the

receptionist.

(2)

Method of Exercising Voting Rights in Written Form (Voting Card)

Please indicate your vote “for” or “against” the proposal on the voting card enclosed herewith and ensure it is

returned to us no later than the deadline mentioned page 2.

(3)

Method of Exercising Voting Rights Electronically

(via Internet or other means)

Please access the website (http://www.evote.jp/) to exercise voting rights through a

personal computer, smartphone or mobile phone. Using the code and password written on the voting card enclosed herewith and follow the instructions on the website. Please enter “for” or “against” the proposal no later than the

deadline mentioned page 2.

[Handling in Event Multiple Exercises Voting Rights]

|

|

(1)

|

In the event that any shareholder exercises voting rights in written form (voting card) and electronically (via Internet or other means), the electronically exercised

voting rights shall prevail.

|

|

|

(2)

|

In the event of multiple electronically exercised of voting rights (via Internet or other means) by a shareholder, the last electronically exercised voting right shall

prevail.

|

|

|

|

Truly yours,

|

|

|

|

Hideo Tanimoto

|

|

President and Representative Director

|

|

KYOCERA Corporation

|

Notes:.

|

1.

|

When a main meeting place becomes full, the Company guides you to the second meeting place. We appreciate your understanding in advance.

|

|

2.

|

This meeting is conducted in Japanese. In addition interpreter is not hired. We appreciate your understanding in advance.

|

|

3.

|

In the accompanying documents for the Notice of the 63

rd

Ordinary General Meeting of Shareholders, the “Notes to Consolidated Financial Statements” and the

“Notes to Financial Statements” are available to shareholders on the Company’s website (http://global.kyocera.com/ir/s_info.html), pursuant to the provisions of laws and regulations as well as the Articles of Incorporation of the

Company. The “Notes to Consolidated Financial Statements” and the “Notes to Financial Statements” are a part of the Consolidated Financial Statements and the Financial Statements that were audited by Audit & Supervisory

Board Members and the Accounting Auditor in preparing the Audit Reports.

|

|

4.

|

In the event of any changes to the reference documents for the General Meeting of Shareholders, the business report, the financial statements or the consolidated

financial statements, the Company shall give notice thereof to shareholders by posting it on the Company’s website (http://global.kyocera.com/ir/s_info.html), which can be accessed via Internet.

|

3

Reference Documents for the General Meeting of Shareholders

Proposals and References are as follows:

Proposal 1 Appropriation of Surplus

The Company believes that the best way to increase corporate value and meet shareholders’ expectations is to improve future

consolidated performance on an ongoing basis.

The Company therefore has adopted the principal guideline that dividend amounts

be within a range based on net income attributable to shareholders of Kyocera Corporation on a consolidated basis, and has set its dividend policy to maintain a payout ratio of around 40% of consolidated net income attributable to shareholders of

Kyocera Corporation. In addition, the Company determines dividend amounts based on an overall assessment, taking into account various factors including the amount of capital expenditures necessary for the medium to long-term corporate growth.

Pursuant to this policy and based on full year performance through the year ended March 31, 2017, the Company proposes a

year-end

dividend for the year ended March 31, 2017 in the amount of 60 yen per share. When aggregated with the interim dividend in the amount of 50 yen per share, the total annual dividend will be 110 yen per

share. This means an increase of 10 yen per share compared with 100 yen per share for the year ended March 31, 2016.

The

Company also proposes that funds shall be set aside as General Reserve, taking into account the necessary reserve amounts for creation of new businesses, exploitation of new markets, development of new technologies and acquisition of outside

management resources that enable us to achieve stable and sustainable growth of the Company.

The proposed appropriation of

surplus is as follows:

|

|

|

|

|

|

|

|

|

|

|

1.

|

|

Matters Relating to

Year-end

Dividend

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Type of Assets Distributed as Dividend:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

|

|

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Matters Relating to the Appropriation to Shareholders of Assets Distributed as Dividend and Aggregate Amount thereof:

|

|

|

|

|

|

|

|

|

|

|

|

60 yen per share of common stock of the Company.

|

|

|

|

|

|

|

|

|

|

The aggregate amount thereof shall be 22,062,742,980 yen.

|

|

|

4

|

|

|

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Effective Date of the Distribution of Surplus as Dividend:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 28, 2017

|

|

|

|

|

|

Note:

|

The Company undertook a stock split at the ratio of two for one of all common shares on October 1, 2013. Dividends per share in FY2013 and FY2014 have been

re-calculated based on the ratio of the stock split.

|

|

|

|

|

|

|

|

|

|

|

|

2.

|

|

Matters Relating to Appropriation of General Reserve

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Category of Surplus to Increase and Amount thereof:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General Reserve:

|

|

40,000,000,000 yen.

|

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Category of Surplus to Decrease and Amount thereof:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unappropriated Retained Earnings:

|

|

40,000,000,000 yen.

|

|

|

5

Proposal 2 Election of Fifteen

(15) Directors

The terms of office of all of sixteen (16) Directors will expire at the conclusion of the

Meeting. Accordingly, the Company proposes fifteen (15) Directors be elected.

The candidates for the Directors are as

follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

No.

|

|

Name

(Date of birth)

|

|

Career Summary, Position and Area of Responsibility,

and Important Concurrent

Post

|

|

Number of the

Company’s

Shares held

|

|

1

|

|

Goro Yamaguchi

(Jan. 21, 1956)

|

|

Mar.

|

|

1978

|

|

Joined the Company

|

|

24,467

|

|

|

|

Jun.

|

|

2003

|

|

Executive Officer of the Company

|

|

|

|

|

Jun.

|

|

2005

|

|

Senior Executive Officer of the Company

|

|

|

|

|

Apr.

|

|

2009

|

|

Managing Executive Officer of the Company

|

|

|

|

|

Jun.

|

|

2009

|

|

Director and Managing Executive Officer of the Company

|

|

|

|

|

Apr.

|

|

2013

|

|

President and Representative Director, President and Executive Officer of the Company

|

|

|

|

|

Apr.

|

|

2017

|

|

Chairman of the Board and Representative Director of the Company [Present]

(Important Concurrent Post outside the Company)

Director of AVX Corporation

|

|

|

|

|

Reason of the candidate for

Director

|

|

Since 2013 when Mr. Goro Yamaguchi took office as a President, he has been working hard for

corporate management. From April 2017, he works as the Chairman of the Board and Representative Director of the Company. The Company nominated him as a Director sequentially because the Company believes that he will be adequately capable of

accomplishing his duties as a Director of the Company, based on such his experience and exceptional insight.

|

|

2

|

|

Hideo Tanimoto (Mar. 18, 1960)

|

|

Mar.

|

|

1982

|

|

Joined the Company

|

|

2,885

|

|

|

|

Apr.

|

|

2014

|

|

General Manager of Corporate Fine Ceramics Group of the Company

|

|

|

|

|

Apr.

|

|

2015

|

|

Executive Officer of the Company

|

|

|

|

|

Apr.

|

|

2016

|

|

Managing Executive Officer of the Company

|

|

|

|

|

Jun.

|

|

2016

|

|

Director and Managing Executive Officer of the Company

|

|

|

|

|

Apr.

|

|

2017

|

|

President and Representative Director, President and Executive Officer of the Company [Present]

|

|

|

|

|

Reason of the candidate for

Director

|

|

From 2014, Mr. Hideo Tanimoto contributed to development of the fine ceramics business as a

General Manager of Corporate Fine Ceramics Group. From April 2017, he works as a President and Representative Director of the Company. The Company nominated him as a Director sequentially because the Company believes that he will be adequately

capable of accomplishing his duties as a Director of the Company, based on such his experience and exceptional insight.

|

6

|

|

|

|

|

|

|

|

|

|

|

|

|

No.

|

|

Name

(Date of birth)

|

|

Career Summary, Position and Area of Responsibility,

and Important Concurrent

Post

|

|

Number of the

Company’s

Shares held

|

|

3

|

|

Ken Ishii

(Oct. 6, 1953)

|

|

Mar.

|

|

1977

|

|

Joined the Company

|

|

9,254

|

|

|

|

Apr.

|

|

2009

|

|

Executive Officer of the Company

General Manager of Corporate Cutting Tool Group of the Company [Present]

|

|

|

|

|

Apr.

|

|

2011

|

|

Senior Executive Officer of the Company

|

|

|

|

|

Apr.

|

|

2012

|

|

Managing Executive Officer of the Company

|

|

|

|

|

Jun.

|

|

2012

|

|

Director and Managing Executive Officer of the Company

|

|

|

|

|

Apr.

|

|

2015

|

|

Director and Senior Managing Executive Officer of the Company [Present]

|

|

|

|

|

Reason of the candidate for

Director

|

|

From 2009, Mr. Ken Ishii has been contributing to development of the cutting tool business as

a General Manager of Corporate Cutting Tool Group of the Company. The Company nominated him as a Director sequentially because the Company believes that he will be adequately capable of accomplishing his duties as a Director of the Company, based on

such his experience and exceptional insight.

|

|

4

|

|

Hiroshi Fure

(Feb. 24, 1960)

|

|

Mar.

|

|

1984

|

|

Joined the Company

|

|

4,694

|

|

|

|

Apr.

|

|

2009

|

|

General Manager of Corporate Automotive Components Group of the Company

|

|

|

|

|

Apr.

|

|

2011

|

|

Executive Officer of the Company

|

|

|

|

|

Apr.

|

|

2013

|

|

Managing Executive Officer of the Company

|

|

|

|

|

Jun.

|

|

2013

|

|

Director and Managing Executive Officer of the Company

|

|

|

|

|

Apr.

|

|

2015

|

|

Director and Senior Managing Executive Officer of the Company [Present]

|

|

|

|

|

Sep.

|

|

2016

|

|

General Manager of Corporate Organic Materials Semiconductor Components Group of the Company [Present]

|

|

|

|

|

Reason of the candidate for

Director

|

|

Mr. Hiroshi Fure contributed to development of the automotive components business from 2009

as a General Manager of Corporate Automotive Components Group, and he has been in charge of the organic material business from 2016 as a General Manager of Corporate Organic Materials Semiconductor Components Group. The Company nominated him as a

Director sequentially because the Company believes that he will be adequately capable of accomplishing his duties as a Director of the Company, based on such his experiences and exceptional

insight.

|

7

|

|

|

|

|

|

|

|

|

|

|

|

|

No.

|

|

Name

(Date of birth)

|

|

Career Summary, Position and Area of Responsibility,

and Important Concurrent

Post

|

|

Number of the

Company’s

Shares held

|

|

5

|

|

Yoji Date

(Sep. 20, 1956)

|

|

Mar.

|

|

1979

|

|

Joined the Company

|

|

8,217

|

|

|

|

Oct.

|

|

2008

|

|

Transferred to Kyocera ELCO Corporation Managing Director of the above company

|

|

|

|

|

Apr.

|

|

2009

|

|

President and Representative Director of Kyocera ELCO Corporation (The above company changed the name to Kyocera Connector

Products Corporation in April 2012)

|

|

|

|

|

Apr.

|

|

2012

|

|

Executive Officer of the Company

|

|

|

|

|

Apr.

|

|

2013

|

|

Managing Executive Officer of the Company

|

|

|

|

|

Jun.

|

|

2013

|

|

Director and Managing Executive Officer of the Company

|

|

|

|

|

Apr.

|

|

2015

|

|

Director and Senior Managing Executive Officer of the Company [Present]

|

|

|

|

|

|

Apr.

|

|

2017

|

|

General Manager of Corporate Electronic Components Group of the Company [Present]

|

|

|

|

|

Reason of the candidate for

Director

|

|

Mr. Yoji Date contributed to development of connector business from 2009 as a President and

Representative Director of the subsidiary of the Company which performs connectors, and he has been in charge of the electronic device business from April 2017 as a General Manager of Corporate Electronic Components Group. The Company nominated him

as a Director sequentially because the Company believes that he will be adequately capable of accomplishing his duties as a Director of the Company, based on such his experiences and exceptional insight.

|

|

6

|

|

Koichi Kano

(Sep. 21, 1961)

|

|

Mar.

|

|

1985

|

|

Joined the Company

|

|

3,208

|

|

|

|

Jun.

|

|

2005

|

|

General Manager of Circuit Device Division of the Company

|

|

|

|

|

Apr.

|

|

2012

|

|

General Manager of Corporate Development Group of the Company [Present]

|

|

|

|

|

Apr.

|

|

2013

|

|

Executive Officer of the Company

|

|

|

|

|

Apr.

|

|

2015

|

|

Senior Executive Officer of the Company

|

|

|

|

|

Apr.

|

|

2016

|

|

Managing Executive Officer of the Company

|

|

|

|

|

Jun.

|

|

2016

|

|

Director and Managing Executive Officer of the Company [Present]

(Important Concurrent Post outside the Company)

Director of AVX Corporation

|

|

|

|

|

Reason of the candidate for

Director

|

|

From 2012, Mr. Koichi Kano has been contributing to development of domestic and foreign

subsidiaries with his appropriate leading as a General Manager of Corporate Development Group of the Company. The Company nominated him as a Director sequentially because the Company believes that he will be adequately capable of accomplishing his

duties as a Director of the Company, based on his such experience and exceptional insight.

|

8

|

|

|

|

|

|

|

|

|

|

|

|

|

No.

|

|

Name

(Date of birth)

|

|

Career Summary, Position and Area of Responsibility,

and Important Concurrent

Post

|

|

Number of the

Company’s

Shares held

|

|

7

|

|

Shoichi Aoki

(Sep. 19, 1959)

|

|

Mar.

|

|

1983

|

|

Joined the Company

|

|

9,178

|

|

|

|

Jun.

|

|

2005

|

|

Executive Officer of the Company

General Manager of Corporate Accounting Group of the Company

|

|

|

|

|

May

|

|

2008

|

|

General Manager of Corporate Financial and Accounting Group of the Company

|

|

|

|

|

Apr.

|

|

2009

|

|

Managing Executive Officer of the Company

|

|

|

|

|

Jun.

|

|

2009

|

|

Director and Managing Executive Officer of the Company [Present]

|

|

|

|

|

Oct.

|

|

2010

|

|

General Manager of Corporate Financial and Business Systems Administration Group of the Company

|

|

|

|

|

Apr.

|

|

2013

|

|

General Manager of Corporate Financial and Accounting Group of the Company [Present]

(Important Concurrent Post outside the Company)

Director of AVX Corporation

|

|

|

|

|

Reason of the candidate for

Director

|

|

Mr. Shoichi Aoki has been in charge of the accounting and financing strategy, and contributing

to development of the Company, from 2005 as a General Manager of Corporate Accounting Group, and from 2008 as a General Manager of Corporate Financial and Accounting Group of the Company. The Company nominated him as a Director sequentially because

the Company believes that he will be adequately capable of accomplishing his duties as a Director of the Company, based on such his experience and exceptional insight.

|

|

8

|

|

John Sarvis

(Mar. 4, 1950)

|

|

Dec.

|

|

1973

|

|

Joined AVX Corporation

|

|

1,822

(ADR)

|

|

|

|

Mar.

|

|

2005

|

|

Officer of the Ceramics Division of AVX Corporation

|

|

|

|

|

Apr.

|

|

2015

|

|

President, Chief Executive Officer and Director of AVX Corporation

|

|

|

|

|

Jun.

|

|

2016

|

|

Director of the Company [Present]

|

|

|

|

|

Jul.

|

|

2016

|

|

Chairman of the Board and President, Chief Executive Officer and Director of AVX Corporation [Present]

|

|

|

|

|

Reason of the candidate for

Director

|

|

Mr. John Sarvis was in charge of Officer of Ceramic Capacitor Division of AVX Corporation,

that is a subsidiary of the Company in United States of America, for many years. As a President and Chief Executive Officer and Director of AVX Corporation from 2015, and as a Chairman of the Board and President, Chief Executive Officer of AVX

Corporation from 2016, he contributes to development of AVX Corporation. The Company nominated him as a Director sequentially because the Company believes that he will be adequately capable of accomplishing his duties as a Director of the Company,

based on his such experience and exceptional insight.

|

9

|

|

|

|

|

|

|

|

|

|

|

|

|

No.

|

|

Name

(Date of birth)

|

|

Career Summary, Position and Area of Responsibility,

and Important Concurrent

Post

|

|

Number of the

Company’s

Shares held

|

|

9

|

|

Robert Whisler

(Feb. 17, 1953)

|

|

Mar.

|

|

1981

|

|

Joined Kyocera America Inc.

|

|

3,752

(ADR)

|

|

|

|

Sep.

|

|

2000

|

|

President and Representative Director of Kyocera America Inc.

|

|

|

|

|

Jun.

|

|

2005

|

|

Executive Officer of the Company

|

|

|

|

|

Apr.

|

|

2016

|

|

President and Director of Kyocera International Inc. [Present]

|

|

|

|

|

Jun.

|

|

2016

|

|

Director of the Company [Present]

|

|

|

|

Reason of the candidate for

Director

|

|

Mr. Robert Whisler contributed to development of semiconductor package business as a President

and Director of Kyocera America Inc., that was a subsidiary of the Company in United States of America, for many years. From 2016, he serves as a President and Director of Kyocera International Inc. The Company nominated him as a Director

sequentially because the Company believes that he will be adequately capable of accomplishing his duties as a Director of the Company, based on such his experience and exceptional insight.

|

|

10

|

|

Tadashi Onodera

(Feb. 3, 1948)

|

|

Jun.

|

|

1989

|

|

Director of DDI Corporation (currently

KDDI Corporation)

|

|

2,006

|

|

|

|

Jun.

|

|

1995

|

|

Managing Director of DDI Corporation

|

|

|

|

|

Jun.

|

|

1997

|

|

Vice President and Representative Director of

DDI Corporation

|

|

|

|

|

Jun.

|

|

2001

|

|

President and Representative Director of

KDDI Corporation

|

|

|

|

|

Jun.

|

|

2005

|

|

President and Representative Director and Chairman of the Board of KDDI Corporation

|

|

|

|

|

Dec.

|

|

2010

|

|

Chairman of the Board and Representative Director of KDDI

Corporation

|

|

|

|

|

Jun.

|

|

2013

|

|

Outside Director of the Company [Present]

|

|

|

|

|

|

Jun.

|

|

2015

|

|

Chairman of the Board and Director of KDDI Corporation [Present]

(Important Concurrent Post outside the Company)

Director of Okinawa Cellular Telephone Company

Outside Director of Daiwa Securities Group Inc.

|

|

|

|

|

Reason of the candidate for

Outside Director

|

|

The Company nominated Mr. Tadashi Onodera as an Outside Director sequentially. The Company

believes that he will be continuously capable of providing advice and undertaking supervision, based on his abundant management experience and exceptional insight as a corporate executive. In addition, he understands profoundly in the management

rationale of the Company, and he gave precise advice and supervision of general corporate activities after the Outside Director assumption of office.

|

10

|

|

|

|

|

|

|

|

|

|

|

|

|

No.

|

|

Name

(Date of birth)

|

|

Career Summary, Position and Area of Responsibility,

and Important Concurrent

Post

|

|

Number of the

Company’s

Shares held

|

|

11

|

|

Hiroto Mizobata

(Jul. 31, 1963)

|

|

Apr.

|

|

1986

|

|

Joined KPMG Asahi Shinwa Accounting, Inc. (now known as KPMG AZSA LLC)

|

|

1,559

|

|

|

|

Mar.

|

|

1988

|

|

Registration as certified public accountant

|

|

|

|

|

Dec.

|

|

1991

|

|

Registration as licensed tax accountant

|

|

|

|

|

Mar.

|

|

1992

|

|

Representative of Mizobata Certified Public Accountant Office [Present]

|

|

|

|

|

|

Jun.

|

|

2015

|

|

Outside Director of the Company [Present]

(Important Concurrent Post outside the Company)

Outside Director (the Audit Committee) of Yamaki Co., LTD.

Outside Director (the Audit Committee) of

ES-CON JAPAN

Ltd.

|

|

|

|

|

Reason of the candidate for

Outside Director

|

|

The Company nominated Mr. Hiroto Mizobata as an Outside Director sequentially. The Company believes that he will be

continuously capable of providing advice and undertaking supervision, based on his abundant experience as a certified public accountant and licensed tax accountant, and exceptional insight. In addition, he gave precise advice and supervision of

general corporate activities after the Outside Director assumption of office.

|

|

12

|

|

Atsushi Aoyama

(Aug. 2, 1960)

|

|

Apr.

|

|

1985

|

|

Joined Mitsubishi Research Institute, Inc.

|

|

122

|

|

|

|

May

|

|

1995

|

|

Researcher of Imperial College London

|

|

|

|

|

Oct.

|

|

1999

|

|

Associate Professor of Resources Science Laboratory, Tokyo Institute of Technology

|

|

|

|

|

Apr.

|

|

2005

|

|

Professor of Graduate School of Technology Management, Ritsumeikan University [Present]

|

|

|

|

|

Jun.

|

|

2016

|

|

Outside Director of the Company [Present]

|

|

|

|

|

Reason of the candidate for

Outside Director

|

|

The Company nominated Mr. Atsushi Aoyama as an Outside Director sequentially. The Company

believes that he will be continuously capable of providing advice and undertaking supervision, based on his abundant experience and exceptional insight about area of technology management that study companies who make much of technology development

and innovation. In addition, he gave precise advice and supervision of general corporate activities after the Outside Director assumption of office.

|

11

|

|

|

|

|

|

|

|

|

|

|

|

|

No.

|

|

Name

(Date of birth)

|

|

Career Summary, Position and Area of Responsibility,

and Important Concurrent

Post

|

|

Number of the

Company’s

Shares held

|

|

13*

|

|

Keiji Itsukushima

(May 3, 1958)

|

|

Mar.

|

|

1982

|

|

Joined the Company

|

|

4,315

|

|

|

|

Jul.

|

|

2004

|

|

Executive Officer of the Kyocera Mita Corporation (currently Kyocera Document Solutions Inc.)

|

|

|

|

|

Apr.

|

|

2007

|

|

Managing Executive Officer of the Kyocera Mita Corporation

Senior General Manager of Corporate R&D Division 1 of the Kyocera Mita Corporation

|

|

|

|

|

Apr.

|

|

2008

|

|

Senior General Manager of Corporate R&D Division of the Kyocera Mita Corporation

|

|

|

|

|

Jun.

|

|

2008

|

|

Director and Managing Executive Officer of the Kyocera Mita Corporation

|

|

|

|

|

Apr.

|

|

2012

|

|

Senior General Manager of Corporate Quality Assurance Division of the Kyocera Document Solutions Inc.

|

|

|

|

|

Apr.

|

|

2015

|

|

Director and Senior Managing Executive Officer of the Kyocera Document Solutions Inc.

|

|

|

|

|

Apr.

|

|

2016

|

|

Senior Executive Officer of the Company

General Manager of Corporate Communication Equipment Group of the Company [Present]

|

|

|

|

|

Apr.

|

|

2017

|

|

Managing Executive Officer of the Company [Present]

|

|

|

|

Reason of the candidate for

Director

|

|

Mr. Keiji Itsukushima was in charge of Corporate R&D Division of the Kyocera Document

Solutions Inc., that is a subsidiary of the Company, and is contributing to development of the Company, from 2016 as a General Manager of Corporate Communication Equipments Group of the Company. The Company nominated him as a Director because the

Company believes that he will be adequately capable of accomplishing his duties as a Director of the Company, based on such his experience and exceptional insight.

|

|

14*

|

|

Norihiko Ina

(Sep. 16, 1963)

|

|

Apr.

|

|

1987

|

|

Joined the Mita Industrial Company Ltd. (currently Kyocera Document Solutions Inc.)

|

|

456

|

|

|

|

Aug.

|

|

2011

|

|

President of the Kyocera Mita America Inc (currently Kyocera Document Solutions America, Inc.).

|

|

|

|

|

Apr.

|

|

2012

|

|

Executive Officer of the Kyocera Document Solutions Inc.

|

|

|

|

|

Apr.

|

|

2014

|

|

Managing Executive Officer of the Kyocera Document Solutions Inc.

|

|

|

|

|

Jun.

|

|

2014

|

|

Director and Managing Executive Officer of the Kyocera Document Solutions Inc.

|

|

|

|

|

Apr.

|

|

2016

|

|

Director of the Kyocera Document Solutions Inc.

Senior General Manager of the Corporate Sales Division

|

|

|

|

|

Apr.

|

|

2017

|

|

Managing Executive Officer of the Company [Present]

President and Representative Director of the Kyocera Document Solutions Inc. [Present]

|

|

|

|

Reason of the candidate for

Director

|

|

Mr. Norihiko Ina has been in charge of domestic and oversea sales in area of the

information equipment business, and contributing to global development of the information equipments business of the Company, from 2017 as a President and Representative Director of the Kyocera Document Solutions Inc. The Company nominated him as a

Director because the Company believes that he will be adequately capable of accomplishing his duties as a Director of the Company, based on such his experience and exceptional

insight.

|

12

|

|

|

|

|

|

|

|

|

|

|

|

|

No.

|

|

Name

(Date of birth)

|

|

Career Summary, Position and Area of Responsibility,

and Important Concurrent

Post

|

|

Number of the

Company’s

Shares held

|

|

15*

|

|

Takashi Sato

(Sep. 22, 1960)

|

|

Mar.

|

|

1983

|

|

Joined the Company

|

|

4,109

|

|

|

|

Jan.

|

|

2005

|

|

General Manager of Human Resource Division of the Company

|

|

|

|

|

Apr.

|

|

2013

|

|

Executive Officer of the Company

General Manager of Corporate Human Resources Group of the Company

|

|

|

|

|

Apr.

|

|

2016

|

|

Senior Executive Officer of the Company

General Manager of Corporate General Affairs Human Resources Group of the Company [Present]

|

|

|

|

|

Apr.

|

|

2017

|

|

Managing Executive Officer of the Company [Present]

|

|

|

|

|

Reason of the candidate for

Director

|

|

Mr. Takashi Sato has been in charge of personnel affairs for long time, and contributing to

development of the Company with his appropriate leading to General Affairs and Personnel Affairs Group as a General Manager of Corporate General Affairs Human Resources Group from 2016. The Company nominated him as a Director because the Company

believes that he will be adequately capable of accomplishing his duties as a Director of the Company, based on such his experience and exceptional insight.

|

Asterisks (*) above denote new candidates.

Notes:

|

1.

|

Mr. Goro Yamaguchi, candidate for Director, is a Representative Director of Kyoto Purple Sanga Co., Ltd., with which the Company engages in transactions relating

to advertising, etc. Also he is a Representative Director of Kyocera Communication Systems Co., Ltd., with which the Company engages in transactions relating to offering such as the distribution of solar power generating system related products and

purchasing such as the information system.

|

|

2.

|

Mr. Hideo Tanimoto, candidate for Director, is Chairman of the Board of Dongguan Shilong Kyocera Co., Ltd., with which the Company engages in transactions relating

to supply and purchase of electronic components and cutting tools, etc. Also, he is the Chairman of the Board of Kyocera (China) Sales & Trading Corporation, with which the Company engages in transactions relating to sale of electronic

components and cutting tools, etc.

|

|

3.

|

Mr. Ken Ishii, candidate for Director, is a Representative Director of Kyocera Precision Tools Korea Co., Ltd., with which the Company engages in transactions

relating to sale and purchase of cutting tools, etc. And also he is the Chairman of the Board of Kyocera Precision Tools (Ganzhou) Co., Ltd., with which the Company engages in transactions relating to purchase of cutting tools, etc and sale of

equipment.

|

|

4.

|

Mr. John Sarvis, candidate for Director, is Chairman of the Board and, President and Chief Executive Officer and Director of AVX Corporation, with which the

Company engages in transactions relating to supply and purchase of electronic components.

|

|

5.

|

There is no special interest between the other candidates and the Company.

|

|

6.

|

The number of shares of the Company owned by the candidates for the Directors above is as of March 31, 2017 and it includes their ownership in the Stock Purchase Plan

for Kyocera Group Executives.

|

|

7.

|

Candidates who substantively own common stock of the Company by way of American Depositary Receipts (ADRs) are as follows:

|

|

|

|

|

|

Mr. John Sarvis

|

|

1,822 shares of common stock of the Company (1,822 ADRs)

|

|

Mr. Robert Whisler

|

|

3,752 shares of common stock of the Company (3,752 ADRs)

|

13

|

8.

|

Mr. Goro Yamaguchi, candidate for Director, is scheduled to be an Outside Director of KDDI Corporation at the Annual General Meeting of stockholders in KDDI

Corporation to be held in June 2017.

|

|

9.

|

Matters with respect to the candidates for Outside Director are as follows:

|

|

|

(1)

|

Messrs. Tadashi Onodera, Hiroto Mizobata and Atsushi Aoyama are candidates for Outside Director.

|

|

|

(2)

|

The time in office of the candidates for Outside Director at the close of this Meeting is as follows.

|

|

|

|

|

|

Mr. Tadashi Onodera

|

|

4 years

|

|

Mr. Hiroto Mizobata

|

|

2 years

|

|

Mr. Atsushi Aoyama

|

|

1 year

|

|

|

(3)

|

The Company enters into an agreement with Messrs. Tadashi Onodera, Hiroto Mizobata and Atsushi Aoyama, regarding the limitation of their liability for damages due to

negligence in the performance of their duties, in accordance with the provisions of the Companies Act and the Articles of Incorporation of the Company. The amount of their liability, as set under such agreement, shall be limited to the smallest

amount specified in the applicable laws and regulations.

|

|

|

(4)

|

The Company will designate Messrs. Hiroto Mizobata and Atsushi Aoyama as Independent Director as provided for the rules Tokyo Stock Exchange upon their election as

Outside Director.

|

- END -

14

(Accompanying Documents for the 63

rd

Ordinary General Meeting of Shareholders)

Business Report

(April 1, 2016 to March 31, 2017)

1. Current Conditions of

Kyocera Corporation and its Consolidated Subsidiaries

(1) Business Progress and Results

For fiscal 2017 sales in the Fine Ceramic Parts Group and the Semiconductor Parts Group increased compared with fiscal 2016 supported by

increases in automobile sales in Asia and investment in communications infrastructure. By contrast, sales in the solar energy business decreased due primarily to market price erosion. Sales in the Telecommunications Equipment Group also decreased

due to a decline in sales volume as a result of a revision in product strategy. In addition, a shift to appreciation of the yen as compared to depreciation in fiscal 2016 adversely affected sales. As a result, consolidated net sales for fiscal 2017

amounted to ¥1,422,754 million, down ¥56,873 million, or 3.8%, compared with fiscal 2016. Profit from operations increased by ¥11,886 million, or 12.8%, to ¥104,542 million as compared with fiscal 2016, due mainly

to cost reduction efforts, and to the absence of impairment losses on goodwill and long lived assets recorded in fiscal 2016. Income before income taxes decreased by ¥7,734 million, or 5.3%, to ¥137,849 million as compared with

fiscal 2016 due to the absence of a gain on the sale of an asset in the amount of approximately ¥20 billion recorded in fiscal 2016. Net income attributable to shareholders of Kyocera Corporation decreased by ¥5,204 million, or

4.8%, to ¥103,843 million.

Average exchange rates for fiscal 2017 were ¥108 to the U.S. dollar, marking

appreciation of ¥12 (10.0%), and ¥119 to the Euro, marking appreciation of ¥14 (10.5%), from fiscal 2016. As a result, net sales and income before income taxes after translation into yen for fiscal 2017 were pushed down by approximately

¥94 billion and approximately ¥26 billion, respectively, compared with fiscal 2016.

15

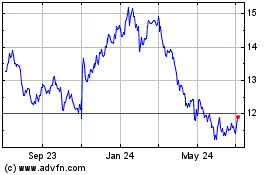

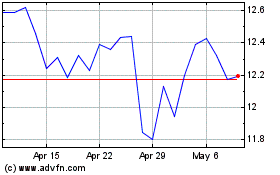

Highlights of Consolidated Results

Notes:

|

1.

|

The amounts, numbers of shares and ratios (%) in this report are rounded to the nearest unit.

|

|

2.

|

Graphs in this report are presented solely for reference.

|

16

Consolidated Results by Reporting Segment

Fine Ceramic Parts Group

|

|

|

|

|

Net Sales:

¥97,445 million, up 2.5% year on year

Operating Profit:

¥14,512 million, down 7.8% year on year

|

|

|

Sales in this reporting segment increased compared with fiscal 2016 due to an increase in sales of

automotive components and components for semiconductor processing equipment, despite the negative impact of the yen’s appreciation. Operating profit decreased compared with fiscal 2016 due mainly to the negative impact of the yen’s

appreciation and higher R&D expenses.

17

Semiconductor Parts Group*

|

|

|

|

|

|

|

|

Net Sales:

¥245,727 million, up 4.0% year on year

Operating Profit:

¥25,662 million, down 39.2% year on year

|

|

|

Sales in this reporting segment increased compared with fiscal 2016 due to an increase in sales of

ceramic packages for optical communications and other applications, which was more than enough to offset sluggish demand for organic multilayer boards for communications infrastructure. Operating profit decreased due to the absence of a gain on the

sale of an asset in the amount of approximately ¥12 billion recorded in fiscal 2016, as well as to the negative impact of the yen’s appreciation and a decline in profit from the organic materials business.

|

*

|

Please refer to page 23.

|

18

Applied Ceramic Products Group

|

|

|

|

|

|

|

Net Sales:

Operating Profit:

|

|

¥225,176 million, down 9.0% year on year

¥15,639 million, down 4.6% year on year

|

|

|

|

|

|

Sales in this reporting segment decreased compared with fiscal 2016 as a result of a decline in sales in

the solar energy business due to a reduction in product prices worldwide and a decline in purchase price under the

feed-in

tariff system in Japan. Operating profit decreased as a result of the impact of lower

sales and a decline in profit from the cutting tool business due to the negative impact of the yen’s appreciation.

19

Electronic Device Group

|

|

|

|

|

|

|

|

|

|

|

Net Sales:

Operating Profit:

|

|

¥288,511 million, down 0.8% year on year

¥30,061 million, up 173.9% year on year

|

|

|

|

|

|

Sales in this reporting segment remained flat compared with fiscal 2016 due to the negative impact of the

yen’s appreciation and to sales price erosion in capacitors and other products, which were enough to offset increased sales of crystal components. Operating profit increased due to the absence of impairment losses on goodwill and long lived

assets in the display business in the amount of approximately ¥18 billion recorded in fiscal 2016.

20

Telecommunications Equipment Group

|

|

|

|

|

|

|

|

|

|

|

Net Sales:

Operating Profit:

|

|

¥145,682 million, down 14.8% year on year

¥1,084 million, improve ¥5,642 million year on year

|

|

|

|

|

|

Sales in this reporting segment decreased compared with fiscal 2016 due to a decline in sales volume as a

result of a reduction in the production ratio of

low-end

mobile phones for the overseas market, which was pursuant to Kyocera’s product strategy to specialize in distinctive mobile phones with unique

features, such as high durability. Operating profit was recorded in fiscal 2017 as a result of product strategy and structural reforms.

21

Information Equipment Group

|

|

|

|

|

|

|

|

|

|

|

Net Sales:

Operating Profit:

|

|

¥324,012 million, down 3.7% year on year

¥28,080 million, up 3.6% year on year

|

|

|

|

|

|

Sales in this reporting segment decreased compared with fiscal 2016 due to the negative impact of the

yen’s appreciation, which was more than enough to offset solid sales volume for equipment supported by aggressive sales activities for new products. Operating profit increased compared with fiscal 2016, however, due to the effect of new product

launches and cost reductions resulting from, among others, an improvement in productivity.

22

Others*

|

|

|

|

|

|

Net Sales:

Operating Profit(Loss):

|

|

¥138,362 million, down 5.8% year on year

¥(544) million, improve ¥1,178 million year on year

|

|

|

|

|

|

Sales in this reporting segment decreased compared with fiscal 2016 due primarily to a decline in sales

of Kyocera Communication Systems Co. Ltd. Operating loss was reduced compared with fiscal 2016 due to a cost reduction by principal subsidiaries while R&D expenses for new products and technologies were recorded in this reporting segment.

|

*

|

Former Kyocera Chemical Group, included in “Others” until fiscal 2016, has been reclassified and included in the “Semiconductor Parts Group”

commencing from fiscal 2017. Due to this change, results for from fiscal 2014 to fiscal 2016 have been reclassified to conform to the current presentation.

|

|

Note :

|

|

The sum total of sales composition ratio shown on pages 17 to 23 shall not be 100% because “Adjustments and Eliminations” accounts for (2.9%) of consolidated

net sales in fiscal 2017.

|

23

(2) Capital Expenditures

During fiscal 2017, Kyocera made capital expenditures to enhance production capacity in order to cope with high levels of demand and productivity in the Electronic Device Group and Semiconductor Parts

Group. However, the capital expenditure in the Equipment Business decreased due to the rationalizing the production system for new models. As a result, capital expenditures for fiscal 2017 decreased by ¥1,152 million, or 1.7%, to

¥67,781 million, compared with fiscal 2016.

Required funds for fiscal 2017 were mainly financed from internal

resources.

24

(3) Management Challenges

Kyocera has a wide range of management resources within the Kyocera Group, from materials technologies such as ceramics to components, devices, equipment, systems and services. Kyocera strives to expand

existing businesses and create new businesses by strengthening ties in each business and maximizing the collective capabilities of the Kyocera Group in order to be a high-growth, highly profitable company. To expand existing businesses, Kyocera

works to lower costs through process reform and enhance productivity through the use of advanced technologies as means to boost market share. To create new businesses, Kyocera works to develop new products by pursuing synergies on a technological

front

in-house,

through M&A, and by collaborating with external entities.

Kyocera

is focused on the following challenges:

i) Expand business in key markets

Kyocera views the information and communications market, the automotive-related market, the environment and energy market and the medical

and healthcare market as key markets and will strive to increase sales and profit by expanding existing businesses and creating new businesses in these markets.

Specifically, in the information and communications market, Kyocera is pushing ahead with development and expansion of high-value-added products that contribute to the advanced performance, multiple

functionality, miniaturization and ever thinner profile of digital consumer equipment, which includes smartphones, as well as components for network systems supporting the increasing volume of data and high-speed transmission. In addition, Kyocera

works to introduce new products and cultivate new markets for telecommunications equipment and information equipment that incorporate unique technologies and are distinct from the competition.

In the automotive-related market, we actively seek to secure orders by way of a framework that straddles the Kyocera Group so that we can

take advantage of various business opportunities associated with increased electrification and environmental responsiveness of automobiles and proliferation of automated driving. We will take steps to increase market share by expanding application

of existing products and cultivating new customers. In addition, we will accelerate new product development for promising fields by strengthening technology development and collaborating with customers.

In the environment and energy market, Kyocera will push ahead with broad business development, from energy creating business through

solar power generating systems and fuel cells to energy storage business through the supply of electricity storage units and energy management systems that utilize generated and stored power without any waste. In response to the rise in

self-generation and self-consumption of power, we will seek to improve the conversion efficiency of solar modules, introduce a high-efficiency fuel cell system to market and expand sales of large storage batteries. We will also strengthen

development of a system that contributes to the stable supply of power and power savings.

In the medical and healthcare

market, Kyocera will expand the medical devices business, which includes prosthetic joints. Additionally, we will take advantage of business opportunities by pursuing synergies in technologies from materials to components and systems, and by linking

up with external organizations. We will also work to reinforce new product development and expand business domain through the construction of a new R&D center that integrates development divisions for this market.

ii) Enhance management foundations

Kyocera will strive to expand production capacity and optimize its production system in Japan and overseas with the aim of further boosting competitiveness. We will actively invest in products with a

forecast of increasing demand and work to introduce high-value-added products by leveraging sophisticated production technology capabilities. We will also pursue expansion of production volume and production items as well as pursue reductions in

production costs in Vietnam. Moreover, we will strive to optimize our bases in an effort to further enhance productivity.

25

Note: Forward-Looking Statements

Certain of the statements made in this Notice are forward-looking statements (within the meaning of Section 21E of the U.S. Securities and Exchange Act of 1934), which are based on our current assumptions

and beliefs in light of the information currently available to us. These forward-looking statements involve known and unknown risks, uncertainties and other factors. Such risks, uncertainties and other factors include, but are not limited to the

following:

|

(1)

|

General conditions in the Japanese or global economy;

|

|

(2)

|

Unexpected changes in economic, political and legal conditions in countries where we operate;

|

|

(3)

|

Various export risks which may affect the significant percentage of our revenues derived from overseas sales;

|

|

(4)

|

The effect of foreign exchange fluctuations on our results of operations;

|

|

(5)

|

Intense competitive pressures to which our products are subject;

|

|

(6)

|

Fluctuations in the price and ability of suppliers to provide the required quantity of raw materials for use in Kyocera’s production activities;

|

|

(7)

|

Manufacturing delays or defects resulting from outsourcing or internal manufacturing processes;

|

|

(8)

|

Shortages and rising costs of electricity affecting our production and sales activities;

|

|

(9)

|

The possibility that future initiatives and

in-process

research and development may not produce the desired results;

|

|

(10)

|

Companies or assets acquired by us not produce the returns or benefits, or bring in business opportunities;

|

|

(11)

|

Inability to secure skilled employees, particularly engineering and technical personnel;

|

|

(12)

|

Insufficient protection of our trade secrets and intellectual property rights including patents;

|

|

(13)

|

Expenses associated with licenses we require to continue to manufacture and sell products;

|

|

(14)

|

Environmental liability and compliance obligations by tightening of environmental laws and regulations;

|

|

(15)

|

Unintentional conflict with laws and regulations or newly enacted laws and regulations;

|

|

(16)

|

Our market or supply chains being affected by terrorism, plague, wars or similar events;

|

|

(17)

|

Earthquakes and other natural disasters affecting our headquarters and major facilities as well as our suppliers and customers;

|

|

(18)

|

Credit risk on trade receivables;

|

|

(19)

|

Fluctuations in the value of, and impairment losses on, securities and other assets held by us;

|

|

(20)

|

Impairment losses on long-lived assets, goodwill and intangible assets;

|

|

(21)

|

Unrealized deferred tax assets and additional liabilities for unrecognized tax benefits; and

|

|

(22)

|

Changes in accounting principles.

|

Such risks, uncertainties and other factors may cause our actual results, performance, achievements or financial condition to be

materially different from any future results, performance, achievements or financial condition expressed or implied by these forward-looking statements. We undertake no obligation to publicly update any forward-looking statements included in this

Notice.

26

(4) Four-Year Financial Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Yen in millions except per share amount)

|

|

|

|

|

Fiscal 2014

|

|

|

Fiscal 2015

|

|

|

Fiscal 2016

|

|

|

Fiscal 2017

|

|

|

Net Sales

|

|

|

1,447,369

|

|

|

|

1,526,536

|

|

|

|

1,479,627

|

|

|

|

1,422,754

|

|

|

|

|

|

|

|

|

Income before Income Taxes

|

|

|

146,268

|

|

|

|

121,862

|

|

|

|

145,583

|

|

|

|

137,849

|

|

|

|

|

|

|

|

|

Net Income Attributable to Shareholders of Kyocera Corporation

|

|

|

88,756

|

|

|

|

115,875

|

|

|

|

109,047

|

|

|

|

103,843

|

|

|

|

|

|

|

|

|

Basic Earnings per Share Attributable to Shareholders of Kyocera Corporation (Yen)

|

|

|

241.93

|

|

|

|

315.85

|

|

|

|

297.24

|

|

|

|

282.62

|

|

|

|

|

|

|

|

|

Total Assets

|

|

|

2,636,704

|

|

|

|

3,021,184

|

|

|

|

3,095,049

|

|

|

|

3,110,470

|

|

|

|

|

|

|

|

|

Kyocera Corporation Shareholders’ Equity

|

|

|

1,910,083

|

|

|

|

2,215,319

|

|

|

|

2,284,264

|

|

|

|

2,334,219

|

|

|

|

|

|

|

|

|

Kyocera Corporation Shareholders’ Equity per Share (Yen)

|

|

|

5,206.48

|

|

|

|

6,038.57

|

|

|

|

6,226.58

|

|

|

|

6,347.95

|

|

Notes:

|

1.

|

The consolidated financial statements are prepared in conformity with accounting principles generally accepted in the United States.

|

|

2.

|

Basic earnings per share attributable to shareholders of Kyocera Corporation is calculated using the average number of shares in issue during each respective fiscal

year and Kyocera Corporation shareholders’ equity per share is calculated using the number of shares in issue excluding treasury stock at the end of each respective fiscal year.

|

|

3.

|

Net sales for fiscal 2014 increased compared with fiscal 2013 due to increases in component demand for digital consumer equipment mainly for smartphones and in demand

for solar energy systems in Japan, in addition to an increase in sales overseas in the Information Equipment Group, and this result marked record high. Net income attributable to shareholders of Kyocera Corporation increased compared with fiscal

2013 due to the effect of higher sales and enhancement of productivity as well as recording of the environmental remediation charge at AVX Corporation in fiscal 2013.

|

|

4.

|

Net sales for fiscal 2015 marked record high as it did for the previous year due to increases in component sales for digital consumer equipment and automotive-related

market. Net income attributable to shareholders of Kyocera Corporation increased compared with fiscal 2014 due mainly to the effect derived from the revaluation of deferred tax assets and liabilities in line with a revision of the tax system in

Japan despite the recording of a loss from a review of asset valuation.

|

|

5.

|

Net sales for fiscal 2016 decreased compared with fiscal 2015 due mainly to a decline in sales of telecommunications equipment and solar energy systems, despite an

increase in sales of components for smartphones and automotive-related market. Net income attributable to shareholders of Kyocera Corporation decreased compared with fiscal 2015 due mainly to the decrease of the effect derived from the

revaluation of deferred tax assets and liabilities in line with a revision of the tax system in Japan.

|

|

6.

|

Performance for fiscal 2017 is as stated in “(1) Business Progress and Results” on previous pages.

|

27

(5) Principal Businesses

(as of March 31, 2017)

Kyocera manufactures and sells a highly diversified range of products, including components involving fine ceramic technologies and

applied ceramic products, telecommunications and information equipment, etc. The principal products and businesses are as follows:

|

|

|

|

|

Reporting Segment

and Content of Business

|

|

Principal Product and Business

|

|

Fine Ceramic Parts Group:

Kyocera widely provides ceramic components for

industrial machinery, information and communications equipment, automotive and various other industrial sectors by taking advantage of unique characteristics of ceramics.

|

|

Components for Semiconductor Processing Equipment and

Flat Panel Display Manufacturing Equipment

Information and Telecommunication Components

General Industrial Machinery Components

LED

Related Products

Automotive Components

|

|

Semiconductor Parts Group:

Kyocera provides packages for protecting electronic

components and semiconductor devices, organic multilayer boards for mounting these components and devices on electronic equipment and organic packaging materials.

|

|

Ceramic Packages

Organic Multilayer Substrates

Organic Multilayer Boards

Organic Packaging

Materials

|

|

Applied Ceramic Products Group:

Kyocera provides solar energy products, cutting

tools, medical devices, jewelry and applied ceramic related products such as ceramic knives through application of technologies accumulated via development and production of fine ceramics.

|

|

Solar Power Generating Systems

Battery Energy Storage

Systems

Cutting Tools

Micro

Drills

Medical devices

Jewelry and

Applied Ceramic Related Products

|

|

Electronic Device Group:

Kyocera provides various electronic components and

devices in a wide range of market such as information and communications equipment, industrial machinery and automotive-related.

|

|

Capacitors

Connectors

Crystal Components

SAW Devices

Power Semiconductor Products

Printing Devices

Liquid Crystal Displays

|

|

Telecommunications Equipment Group:

Kyocera provides high functionality and

ruggedized smartphones and mobile phones stick to facilitate ease of use in Japan and overseas.

|

|

Smartphones

Mobile Phones

Communication Modules

|

|

Information Equipment Group:

Kyocera provides a diverse lineup of printers and

MFPs featuring outstanding environmental and economic performance as well as solutions that resolve customers’ individual management issues.

|

|

Monochrome and Color Printers and Multifunctional Products

Document Solutions

Application Software

Supplies

|

|

Others:

Kyocera provides information and communications service business and engineering business, among

others.

|

|

Information Systems

and Telecommunication Services

Engineering Business

Management Consulting Business

Realty Development Business

|

28

(6) Significant Subsidiaries

(as of March 31, 2017)

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Subsidiary

|

|

Amount of Capital

(Yen in millions

and others

in thousands)

|

|

|

Ownership by

Kyocera Corporation

(%)

|

|

|

Principal Business

|

|

|

|

|

|

|

Kyocera Solar Corporation

|

|

|

¥310

|

|

|

|

100.00

|

|

|

Construction of solar energy products

|

|

|

|

|

|

|

Kyocera Medical Corporation*1

|

|

|

¥2,500

|

|

|

|

100.00

|

|

|

Development, manufacturing and sale of medical devices

|

|

|

|

|

|

|

Kyocera Connector Products Corporation*1

|

|

|

¥400

|

|

|

|

100.00

|

|

|

Development, manufacturing and sale of electronic devices

|

|

|

|

|

|

|

Kyocera Crystal Device Corporation*1

|

|

|

¥16,318

|

|

|

|

100.00

|

|

|

Development, manufacturing and sale of electronic devices

|

|

|

|

|

|

|

Kyocera Display Corporation

|

|

|

¥4,075

|

|

|

|

100.00

|

|

|

Development, manufacturing and sale of electronic devices

|

|

|

|

|

|

|

Kyocera Document Solutions Inc.

|

|

|

¥12,000

|

|

|

|

100.00

|

|

|

Development, manufacturing and sale of information equipment

|

|

|

|

|

|

|

Kyocera Communication Systems Co., Ltd.

|

|

|

¥2,986

|

|

|

|

76.30

|

|

|

Provision of engineering services and IT services

|

|

|

|

|

|

|

Shanghai Kyocera Electronics Co., Ltd.

|

|

|

¥17,321

|

|

|

|

100.00

|

|

|

Manufacturing of fine ceramic-related products

|

|

|

|

|

|

|

Kyocera (Tianjin) Solar Energy Co., Ltd.

|