SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

April 26, 2017

KONINKLIJKE

PHILIPS N.V.

(Exact name of registrant as specified in its charter)

Royal Philips

(Translation of registrant’s name into English)

The Netherlands

(Jurisdiction of incorporation or organization)

Breitner

Center, Amstelplein 2, 1096 BC Amsterdam, The Netherlands

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

Name and address of person authorized to receive notices

and communications from the Securities and Exchange Commission:

M.J. van Ginneken

Koninklijke

Philips N.V.

Amstelplein 2

1096 BC Amsterdam – The Netherlands

This report comprises an extract of certain portions of the following press release:

“Royal Philips announces intended sale of part of its stake in Philips Lighting”, dated April 25, 2017.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf, by the

undersigned, thereunto duly authorized at Amsterdam, on the 26th day of April, 2017.

KONINKLIJKE PHILIPS N.V.

/s/

M.J. van Ginneken

(General Secretary)

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN THE UNITED STATES, CANADA, JAPAN, AUSTRALIA OR ANY OTHER STATE OR

JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL. PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THIS PRESS RELEASE.

Press Information

April 25, 2017

Royal Philips announces intended sale of part of its stake in Philips Lighting

Amsterdam, the Netherlands

- Today, Koninklijke Philips N.V. (“Royal Philips”) announces the launch of an accelerated bookbuild offering to

institutional investors of approximately 22.25 million shares in Philips Lighting N.V. (“Philips Lighting”) currently owned by Royal Philips (the “Offering”), representing approximately 14.8% of Philips Lighting’s

issued share capital.

As part of this transaction, Philips Lighting has irrevocably committed to place an order in the Offering to repurchase

3.5 million shares. Royal Philips will allocate Philips Lighting’s order in whole. Philips Lighting intends to cancel these shares.

Royal

Philips holds in total approximately 80.8 million shares in Philips Lighting’s issued share capital, representing 53.892%. If all offered shares are sold, this stake will be reduced to approximately 39.058%. After cancellation of the

3.5 million shares that Philips Lighting intends to acquire in the Offering and the shares repurchased on February 8, 2017, Royal Philips’ shareholding in Philips Lighting is expected to represent 40.970% of Philips Lighting’s

issued share capital. Philips Lighting will not receive any proceeds from the Offering.

The offer price and final number of shares sold will be

determined by Royal Philips at the conclusion of the bookbuilding process and will be announced in a separate press release. The book is open with immediate effect. The transaction is expected to settle on Friday April 28, 2017.

Royal Philips has agreed to a

lock-up

in respect of its remaining stake in Philips Lighting until 21 July 2017

(subject to limited exemptions and the Joint Bookrunners’ customary right to waive the lock up restrictions).

ABN AMRO, J.P. Morgan,

Société Générale Corporate & Investment Banking and UBS are acting as Joint Bookrunners for the transaction. Rothschild is acting as financial adviser to Royal Philips in connection with the transaction.

The intended transaction is in line with Royal Philips’ stated objective to fully sell down its stake in Philips Lighting over the next years.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN THE UNITED STATES, CANADA, JAPAN, AUSTRALIA OR ANY OTHER STATE OR

JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL. PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THIS PRESS RELEASE.

For further information, please contact:

Steve Klink

Philips Group Communications

Tel: +31 6 10888824

Email: steve.klink@philips.com

Ksenija Gonciarenko

Philips Investor Relations

Tel: +31 6 31914905

Email: ksenija.gonciarenko@philips.com

About Royal Philips

Royal Philips (NYSE: PHG, AEX: PHIA)

is a leading health technology company focused on improving people’s health and enabling better outcomes across the health continuum from healthy living and prevention, to diagnosis, treatment and home care. Philips leverages advanced

technology and deep clinical and consumer insights to deliver integrated solutions. Headquartered in the Netherlands, the company is a leader in diagnostic imaging, image-guided therapy, patient monitoring and health informatics, as well as in

consumer health and home care. Philips’ health technology portfolio generated 2016 sales of EUR 17.4 billion and employs approximately 70,000 employees with sales and services in more than 100 countries. News about Philips can be found at

www.philips.com/newscenter

.

Important Notice

This press release is for information purposes only and does not constitute an offer or invitation to underwrite, subscribe for or otherwise acquire or dispose

of any securities or investment advice in any jurisdiction in which such an offer or solicitation is unlawful, including without limitation, the United States of America (including its territories and possessions, any state of the United States of

America and the District of Columbia) (the “United States”), Australia, Canada or Japan. Any failure to comply with these restrictions may constitute a violation of the securities laws of such jurisdictions.

This press release does not constitute (i) a public offer of securities in the Netherlands, (ii) a prospectus within the meaning of the Dutch

Financial Markets Supervision Act (Wet op het financieel toezicht) or (iii) an offer to acquire securities. No prospectus in accordance with the Prospectus Directive (as defined below), is required in respect of the Offering and no prospectus,

offering circular or similar document will be prepared. Any investment decision in connection with the Offering must be made on the basis of all publicly available information relating to Philips Lighting and the offered shares. Such information has

not been independently verified by the Joint Bookrunners.

The securities being offered have not been and will not be registered under the US Securities

Act of 1933, as amended (the “Securities Act”), or under any applicable securities laws of any state or other jurisdiction of the United States and may not be offered, sold, resold, transferred or delivered, directly or indirectly, in the

United States unless registered under the Securities Act or pursuant to an exemption from, or in a transaction not subject to, such registration requirements and in accordance with any applicable securities laws of any state or other jurisdiction of

the United States. No public offering of the securities discussed herein is being made in the United States.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN THE UNITED STATES, CANADA, JAPAN, AUSTRALIA OR ANY OTHER STATE OR

JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL. PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THIS PRESS RELEASE.

This press release is directed only at the following persons (all such persons together being “Relevant

Persons”):

|

|

(A)

|

in member states of the European Economic Area (the “EEA”) to persons who are “qualified investors” within the meaning of Article 2(1)(e) of the EU Prospectus Directive (Directive 2003/71/EC (and

amendments thereto, including Directive 2010/73/EU, to the extent implemented in the relevant member state of the EEA (the “Prospectus Directive)) and includes any relevant implementing measure in each relevant member state of the EEA) (the

“Qualified Investors”);

|

|

|

(B)

|

in the United Kingdom, to Qualified Investors who are persons who (i) have professional experience in matters relating to investments and who fall within the definition of “investment professionals” in

Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended); or (ii) who are high net worth entities falling within Article 49 of the Order 2005 (as amended); and

|

|

|

(C)

|

outside the EEA to other persons to whom it may otherwise lawfully be communicated.

|

If you are not a Relevant

Person, you will not be eligible to participate in the offering, and you should not act upon, or rely on, this press release.

Statements included in this

press release that are not historical facts (including any statements concerning investment objectives, other plans and objectives of management for future operations or economic performance, or assumptions or forecasts related thereto) are forward

looking statements. These statements are only predictions and are not guarantees. Actual events or the results of Royal Philips’ operations could differ materially from those expressed or implied in the forward looking statements. Forward

looking statements are typically identified by the use of terms such as “may”, “will”, “should”, “expect”, “could”, “intend”, “plan”, “anticipate”, “estimate”,

“believe”, “continue”, “predict”, “potential” or the negative of such terms and other comparable terminology. The forward looking statements are based upon Royal Philips’ current expectations, plans,

estimates, assumptions and beliefs that involve numerous risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business

decisions, all of which are difficult or impossible to predict accurately and many of which are beyond Royal Philips’ control. Although Royal Philips believes that the expectations reflected in such forward looking statements are based on

reasonable assumptions, Royal Philips’ actual results and performance could differ materially from those set forth in the forward looking statements.

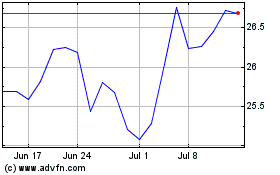

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Mar 2024 to Apr 2024

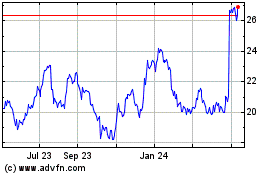

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Apr 2023 to Apr 2024