SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2017

TRINITY

BIOTECH PLC

(Name of Registrant)

IDA Business

Park

Bray, Co. Wicklow

Ireland

(Address of

Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

☒

Form

40-F

☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(1):

☐

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

☐

Indicate by check mark whether by

furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

☐

No

☒

If “Yes” is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): 82-

|

|

|

|

|

|

|

Press Release dated March 14, 2017

|

|

|

|

|

|

Contact:

|

|

Trinity Biotech plc

|

|

Lytham Partners LLC

|

|

|

|

Kevin Tansley

|

|

Joe Diaz, Joe Dorame & Robert Blum

|

|

|

|

(353)-1-2769800

|

|

602-889-9700

|

|

|

|

E-mail:

kevin.tansley@trinitybiotech.com

|

|

|

Trinity Biotech announces Quarter 4 and Fiscal Year 2016 Financial Results

DUBLIN, Ireland (March 14, 2017)….

Trinity Biotech plc (Nasdaq: TRIB), a leading developer and manufacturer of diagnostic products for the

point-of-care and clinical laboratory markets, today announced results for the quarter ended December 31, 2016 and fiscal year 2016.

Fiscal

Year 2016 Results

Total revenues for fiscal year 2016 were $99.6m versus $100.2m in 2015, a decrease of 0.6% year on year.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Full Year

2015

|

|

|

Full Year

2016

|

|

|

Full Year

2016 vs 2015

|

|

|

|

|

US$’000

|

|

|

US$’000

|

|

|

%

|

|

|

Point-of-Care

|

|

|

18,810

|

|

|

|

16,908

|

|

|

|

(10.1

|

%)

|

|

Clinical Laboratory

|

|

|

81,385

|

|

|

|

82,703

|

|

|

|

1.6

|

%

|

|

Total

|

|

|

100,195

|

|

|

|

99,611

|

|

|

|

(0.6

|

%)

|

Point-of-Care revenues decreased from $18.8m in 2015 to $16.9m in 2016, which represents a decrease of 10.1%. This was due to

lower HIV sales in Africa where, due to the nature of the market, sales tend to fluctuate significantly quarter on quarter. Critically, during 2016, the Company maintained its position as the designated supplier of confirmatory tests in all of the

markets in which it operates.

Meanwhile, Clinical Laboratory revenues were $82.7m, an increase of 1.6% versus 2015. This level of increase would have

been higher but for the impact of foreign exchange movements. The impact of the strengthening of the US Dollar against the Brazilian Real, Canadian Dollar and Sterling, all of which represent the non-dollar currencies in which the Company invoices

sales, resulted in a reduction in our US Dollar denominated revenues. In addition, in markets where we invoice in dollars but where the local currency has weakened, we have been required to reduce our pricing in order to preserve our competiveness.

The primary drivers of Clinical Laboratory growth during 2016 continued to be sales of Diabetes and Autoimmune products, though this growth was partly offset by lower infectious diseases revenues.

Gross margin for the year was 43.3% compared to 46.2% in 2015. This decrease was due to adverse sales mix (lower sales of higher margin point-of-care

products) and foreign exchange factors, including the impact of exchange rates on distributor pricing.

Operating profit for the year decreased from $13.5m to $7.5m in 2016. This decrease was attributable to a

reduction in gross margin combined with higher Selling General and Administrative (SG&A) expenses. The increase in SG&A expenses was due to higher amortisation charges and the impact of favourable non-cash foreign exchange rate movements

last year, principally in Q4, 2015.

Profit after tax (before the impact of once-off items) was $5.2m which compares to $21.8m in 2015. However, these

amounts include non-cash financial income recognised in relation to the Company’s Exchangeable Loan Notes. Excluding such movements, profit after tax would have been $3.6m compared with $9.3m in 2015. This reduction is due to the lower

operating profit but is also impacted by the full year effect of financing expenses associated with the Exchangeable Notes which were issued in early Q2, 2015.

Basic EPS (excluding once-off charges) for the year was 22.4 cents. However, excluding the impact of non-cash financial income this would have been 15.7 cents

versus 40.2 cents in 2015. Meanwhile, unconstrained diluted EPS was 29.0 cents compared to 46.2 cents in 2015.

Earnings before interest, tax,

depreciation, amortisation and share option expense for the year was $15.0m compared with $20.7m in 2015.

The above measures exclude the impact of

once-off charges amounting to $105.8m, more details of which are provided below.

Quarter 4 Results

Total revenues for Q4, 2016 were $23.7m which compares to $24.9m in Q4, 2015, a decrease of $1.2m.

Point-of-Care revenues for Q4, 2016 decreased from $5.4m to $4.0m when compared to Q4, 2015, a decline of 27.3%. This is due to the normal fluctuation

patterns which impact HIV sales in Africa.

Clinical Laboratory revenues increased to $19.7m, which represents an increase of 1.2% compared to Q4, 2015.

As in the case of the annual revenues, this increase would have been higher but for the impact of exchange rate movements.

Revenues for Q4, 2016 were as

follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2015

Quarter 4

|

|

|

2016

Quarter 4

|

|

|

Increase/

(decrease)

|

|

|

|

|

US$’000

|

|

|

US$’000

|

|

|

%

|

|

|

Point-of-Care

|

|

|

5,436

|

|

|

|

3,950

|

|

|

|

(27.3

|

%)

|

|

Clinical Laboratory

|

|

|

19,501

|

|

|

|

19,731

|

|

|

|

1.2

|

%

|

|

Total

|

|

|

24,937

|

|

|

|

23,681

|

|

|

|

(5.0

|

%)

|

Gross profit for Q4, 2016 amounted to $9.5m representing a gross margin of 40%, which is lower than the 43.2% achieved in Q4,

2015. This decrease is largely due to lower sales of higher margin point-of-care products and the impact of currency movements on distributor pricing. It has also been impacted by lower production levels during the quarter in line with the lower

revenues experienced.

Research and Development expenses of $1.3m are slightly lower than the equivalent quarter last year. However, Selling, General and

Administrative (SG&A) expenses at $7.2m are $1.2m higher than Q4, 2015. Last year’s SG&A expenses of $6.0m were unusually low due to the benefit from some once-off foreign exchange gains. This quarter’s expense was actually

slightly lower than the average for the preceding three quarters of $7.4m.

Operating profit for the quarter was $0.6m, which is lower than the $3.1m achieved in Q4, 2015. This is due to

the combination of the lower revenues and gross margin, and higher indirect costs.

The profit after tax, but before once-off charges, for the quarter was

$4.9m, though this was largely impacted by non-cash income related to the Exchangeable Notes. Excluding these non-cash items, the profit after tax, before once-off charges, for the quarter was $0.1m.

The basic EPS (excluding once-off charges) for the quarter was 21.6 cents. However, excluding non-cash financial income, principally a gain of $5.0m on the

fair value of the embedded derivatives of the Exchangeable Notes, the EPS would have been 0.2 cents versus 8.0 cents in Q4, 2015. Diluted EPS for the quarter amounted to 4.3 cents, which compares to 10.5 cents in the equivalent quarter in 2015.

Cash generated from operations during the quarter was $4.6m, though this was largely offset by capital expenditure of $4.2m and resulted in free cash inflows

for the quarter of $0.4m. This was offset by shares bought back of $3.3m, Exchangeable Note interest of $2.3m and payments of $2.4m incurred in relation to the closure of our facility in Sweden. Overall, this resulted in a cash balance at the end of

the quarter of $77.1m.

Earnings before interest, tax, depreciation, amortisation and share option expense for the quarter was $2.6m compared to $4.8m in

Q4, 2015.

Once-off Charges

During the period

the Company recognised once-off charges amounting to $105.8m net of tax which is broken down in the table below.

|

|

|

|

|

|

|

|

|

$m

|

|

|

Meritas

|

|

|

|

|

|

- Impairment of Assets

|

|

|

56.7

|

|

|

- Closure costs

|

|

|

5.8

|

|

|

- Foreign currency translation reserve

|

|

|

3.8

|

|

|

Total Meritas

|

|

|

66.3

|

|

|

Impairment Charges

|

|

|

43.4

|

|

|

Product Cull Provision

|

|

|

4.8

|

|

|

Tax Impact

|

|

|

(8.7

|

)

|

|

Total

|

|

|

105.8

|

|

The Meritas impairment of $56.7m followed the Company’s decision to withdraw its Meritas Troponin submission from the FDA

in October, 2016. The impairment charge represents the write-off of all capitalised development costs, tangible fixed assets, inventories and other assets associated with the Meritas project. In addition, a further $5.8m was recognised in relation

to closure costs of the Swedish facility. This principally consisted of employee redundancy costs and other contractual obligations associated with terminating premises and supplier contracts. A further charge of $3.8m was recognised in relation to

foreign translation reserves which had been recognised in previous periods as a reserve movement, but which under accounting rules is now required to be recognised through the income statement.

The Company is also recognising an impairment charge of $43.4m in relation to non-Meritas assets. This was largely driven by the provisions of accounting

standards, whereby companies are required to carry out annual impairment reviews of asset valuations contained on their balance sheet. In

determining whether a potential asset impairment exists, companies are required to consider a range of internal and external factors. One such factor is the relationship between a company’s

market valuation and the book value of its net assets. The fall in the Company’s share price after our Meritas announcement resulted in the Company trading at a significant discount to the book value of its net assets. In such circumstances,

given the accounting standard requirements, the Company felt it was prudent to recognise an impairment provision. By its nature this adjustment has no cash implications for the Company.

Finally, the company has recognised a product cull charge of $4.8m. This is in relation to a number of products which have been discontinued. This mainly

represents our Bartels and Microtrak product lines which we acquired over 15 years ago. Sales of these products have been declining significantly over the last number of years and have now reached the end of their economic life, especially given the

level of technical support required to keep older products of this nature on the market. The revenue impact of this decision will be a reduction of approximately $3.0m per annum.

The tax impact of the above mentioned items was a tax credit of $8.7m, which is mainly the reversal of deferred tax liabilities recognised in previous

quarters.

Share Buyback

During the quarter the

company bought back 572,000 shares at an average price of $6.84 and a total value of $3.9m, of which $3.3m was paid out during the quarter. This brings the total buyback for the year to over 1.1 million shares at an average price of $8.95 and a

total value of $9.9m. A further 143,000 shares at a price of $6.92 were bought back during the period to date in Q1, 2017.

Comments

Commenting on the results Kevin Tansley, Chief Financial Officer said “Profitability for the quarter was adversely impacted by a number of factors. Lower

revenues due to HIV fluctuations and compressed margins attributable to exchange rate and sales mix factors have resulted in an operating profit for the quarter of $0.6m and a reduction in diluted EPS to 4 cents per ADR. During the quarter we

recognised once-off charges totalling $105.8m. Of this, $66.3m was due to our withdrawal of our Meritas Troponin submission to the FDA and had previously been flagged, whilst a further non-cash impairment charge of $43.4m was recognised on

non-Meritas assets, though this was largely driven by the recent fall in the Company’s share price.

Meanwhile, for the year as a whole the Company

made an operating profit of $7.5m and a profit after tax of $3.6m (excluding non-cash financing items and once-off charges) which equates to an unconstrained diluted EPS of 29 cents for the year. This is lower than earned in 2015 due to the impact

of exchange rate movements and higher SG&A expenses.”

Commenting, Ronan O’Caoimh, Chief Executive Officer stated “The latter part of

2016 was particularly challenging for Trinity Biotech. We withdrew our Troponin submission to the FDA and this was followed shortly thereafter by our decision to close our plant in Sweden and move the Meritas technology to another group facility.

Since then we have also reviewed our product portfolio and have decided to cull a number of older products which have been declining for a number of

years. These products which would have continued to decrease were becoming economically inefficient and no longer merited the level of investment and resources required.

On a more positive note, the remainder of the business remains strong, particularly with regard to Premier and Autoimmunity, but also in the case of HIV

notwithstanding the fluctuating nature of its sales. By carrying out a targeted cull we have removed a number of declining products from our

portfolio which have been depressing revenue growth in the Company. Furthermore, with the closure of our Swedish facility, we have meaningfully changed the cash generative ability of the Company,

such that going forward we will operate at close to a free cash flow break even position. This provides us with the financial flexibility to continue our share buyback program, which in our opinion represents the best deployment of capital at

current share price levels.”

Conference Call Dial-in Details

The conference call to discuss the results released today will be held at 11:00am ET (3:00pm GMT – not 4:00pm GMT as previously released).

Interested parties can access the call by dialing:

|

|

|

|

|

|

|

|

|

USA:

|

|

1-844-861-5499

|

|

|

|

International:

|

|

1-412-317-6581

|

|

|

|

Conference ID #:

|

|

10102284

|

A simultaneous webcast of the call can be accessed at:

https://www.webcaster4.com/Webcast/Page/1135/19990

Forward-looking statements in this release are made pursuant to the “safe harbor” provision of the Private Securities

Litigation Reform Act of 1995. Investors are cautioned that such forward-looking statements involve risks and uncertainties including, but not limited to,

the results of research and development efforts, the effect of regulation by the United States Food and Drug Administration and other agencies, the impact of competitive products, product development commercialisation and technological difficulties,

and other risks detailed in the Company’s periodic reports filed with the Securities and Exchange Commission.

Trinity Biotech develops,

acquires, manufactures and markets diagnostic systems, including both reagents and instrumentation, for the point-of-care and clinical laboratory segments of the diagnostic market. The products are used to detect infectious diseases and to quantify

the level of Haemoglobin A1c and other chemistry parameters in serum, plasma and whole blood. Trinity Biotech sells direct in the United States, Germany, France and the U.K. and through a network of international distributors and strategic partners

in over 75 countries worldwide. For further information please see the Company’s website:

www.trinitybiotech.com

.

Trinity Biotech plc

Consolidated Income Statements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(US$000’s except share data)

|

|

Three Months

Ended

Dec 31,

2016

(unaudited)

|

|

|

Three Months

Ended

Dec 31,

2015

(unaudited)

|

|

|

Year

Ended

Dec 31,

2016

(unaudited)

|

|

|

Year

Ended

Dec 31,

2015

(unaudited)

|

|

|

Revenues

|

|

|

23,681

|

|

|

|

24,937

|

|

|

|

99,611

|

|

|

|

100,195

|

|

|

Cost of sales

|

|

|

(14,202

|

)

|

|

|

(14,170

|

)

|

|

|

(56,518

|

)

|

|

|

(53,950

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

9,479

|

|

|

|

10,767

|

|

|

|

43,093

|

|

|

|

46,245

|

|

|

Gross profit %

|

|

|

40.0

|

%

|

|

|

43.2

|

%

|

|

|

43.3

|

%

|

|

|

46.2

|

%

|

|

Other operating income

|

|

|

28

|

|

|

|

65

|

|

|

|

239

|

|

|

|

288

|

|

|

Research & development expenses

|

|

|

(1,330

|

)

|

|

|

(1,508

|

)

|

|

|

(5,041

|

)

|

|

|

(5,068

|

)

|

|

Selling, general and administrative expenses

|

|

|

(7,206

|

)

|

|

|

(6,009

|

)

|

|

|

(29,451

|

)

|

|

|

(26,475

|

)

|

|

Indirect share based payments

|

|

|

(378

|

)

|

|

|

(184

|

)

|

|

|

(1,349

|

)

|

|

|

(1,541

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating profit

|

|

|

593

|

|

|

|

3,131

|

|

|

|

7,491

|

|

|

|

13,449

|

|

|

Financial income

|

|

|

221

|

|

|

|

132

|

|

|

|

877

|

|

|

|

431

|

|

|

Financial expenses

|

|

|

(1,182

|

)

|

|

|

(1,189

|

)

|

|

|

(4,726

|

)

|

|

|

(3,483

|

)

|

|

Non-cash financial income

|

|

|

4,860

|

|

|

|

975

|

|

|

|

1,552

|

|

|

|

12,480

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net financing income / (expense)

|

|

|

3,899

|

|

|

|

(82

|

)

|

|

|

(2,297

|

)

|

|

|

9,428

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit before tax & once-off items

|

|

|

4,492

|

|

|

|

3,049

|

|

|

|

5,194

|

|

|

|

22,877

|

|

|

Income tax credit / (expense)

|

|

|

421

|

|

|

|

(223

|

)

|

|

|

(41

|

)

|

|

|

(1,081

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit before once-off items

Once-off charges (net of tax)

|

|

|

4,913

(105,779

|

)

|

|

|

2,826

—

|

|

|

|

5,153

(105,779

|

)

|

|

|

21,796

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) / profit after tax and once-off items

|

|

|

(100,866

|

)

|

|

|

2,826

|

|

|

|

(100,626

|

)

|

|

|

21,796

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) / earnings per ADR (US cents)

|

|

|

(443.1

|

)

|

|

|

12.1

|

|

|

|

(438.2

|

)

|

|

|

94.1

|

|

|

Earnings per ADR (US cents)**

|

|

|

21.6

|

|

|

|

12.1

|

|

|

|

22.4

|

|

|

|

94.1

|

|

|

Earnings per ADR excluding non-cash financial income (US cents)**

|

|

|

0.2

|

|

|

|

8.0

|

|

|

|

15.7

|

|

|

|

40.2

|

|

|

Diluted (loss) / earnings per ADR (US cents)

|

|

|

(373.1

|

)

|

|

|

10.5

|

|

|

|

(344.8

|

)*

|

|

|

46.2

|

|

|

Diluted earnings per ADR (US cents)**

|

|

|

4.3

|

|

|

|

10.5

|

|

|

|

29.0

|

*

|

|

|

46.2

|

|

|

Weighted average no. of ADRs used in computing basic earnings per ADR

|

|

|

22,761,641

|

|

|

|

23,259,669

|

|

|

|

22,964,703

|

|

|

|

23,161,773

|

|

|

Weighted average no. of ADRs used in computing diluted earnings per ADR

|

|

|

28,031,122

|

|

|

|

28,690,599

|

|

|

|

28,299,399

|

|

|

|

27,407,793

|

|

|

*

|

Under IAS 33 Earnings per Share, diluted earnings per share cannot be anti-dilutive. Therefore, diluted earnings per ADR in accordance with IFRS would be 22.4 cents for the year (i.e. equal to basic earnings per ADR).

|

|

**

|

Excluding once-off charges

|

The above financial statements have been prepared in accordance with the

principles of International Financial Reporting Standards and the Company’s accounting policies but do not constitute an interim financial report as defined in IAS 34 (Interim Financial Reporting). Once-off charges is a non-GAAP accounting

presentation.

Trinity Biotech plc

Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec 31,

2016

US$ ‘000

(unaudited)

|

|

|

Sept 30,

2016

US$ ‘000

(unaudited)

|

|

|

June 30,

2016

US$ ‘000

(unaudited)

|

|

|

Dec 31,

2015

US$ ‘000

(unaudited)

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment

|

|

|

13,403

|

|

|

|

21,495

|

|

|

|

21,760

|

|

|

|

20,659

|

|

|

Goodwill and intangible assets

|

|

|

87,275

|

|

|

|

173,240

|

|

|

|

169,049

|

|

|

|

161,324

|

|

|

Deferred tax assets

|

|

|

14,556

|

|

|

|

13,531

|

|

|

|

13,312

|

|

|

|

12,792

|

|

|

Other assets

|

|

|

870

|

|

|

|

849

|

|

|

|

932

|

|

|

|

954

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-current assets

|

|

|

116,104

|

|

|

|

209,115

|

|

|

|

205,053

|

|

|

|

195,729

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inventories

|

|

|

32,589

|

|

|

|

39,989

|

|

|

|

39,253

|

|

|

|

35,125

|

|

|

Trade and other receivables

|

|

|

22,586

|

|

|

|

25,802

|

|

|

|

27,832

|

|

|

|

25,602

|

|

|

Income tax receivable

|

|

|

1,205

|

|

|

|

811

|

|

|

|

712

|

|

|

|

550

|

|

|

Cash and cash equivalents

|

|

|

77,108

|

|

|

|

84,751

|

|

|

|

84,920

|

|

|

|

101,953

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

133,488

|

|

|

|

151,353

|

|

|

|

152,717

|

|

|

|

163,230

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

|

249,592

|

|

|

|

360,468

|

|

|

|

357,770

|

|

|

|

358,959

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY AND LIABILITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity attributable to the equity holders of the parent

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share capital

|

|

|

1,224

|

|

|

|

1,222

|

|

|

|

1,221

|

|

|

|

1,220

|

|

|

Share premium

|

|

|

16,187

|

|

|

|

15,801

|

|

|

|

15,575

|

|

|

|

15,526

|

|

|

Accumulated surplus

|

|

|

93,004

|

|

|

|

197,379

|

|

|

|

197,588

|

|

|

|

201,951

|

|

|

Other reserves

|

|

|

(1,688

|

)

|

|

|

(4,002

|

)

|

|

|

(3,721

|

)

|

|

|

(4,809

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total equity

|

|

|

108,727

|

|

|

|

210,400

|

|

|

|

210,663

|

|

|

|

213,888

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax payable

|

|

|

175

|

|

|

|

772

|

|

|

|

657

|

|

|

|

1,163

|

|

|

Trade and other payables

|

|

|

25,028

|

|

|

|

19,976

|

|

|

|

19,384

|

|

|

|

18,874

|

|

|

Provisions

|

|

|

75

|

|

|

|

75

|

|

|

|

75

|

|

|

|

75

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

25,278

|

|

|

|

20,823

|

|

|

|

20,116

|

|

|

|

20,112

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exchangeable senior note payable

|

|

|

96,491

|

|

|

|

101,351

|

|

|

|

99,232

|

|

|

|

98,044

|

|

|

Other payables

|

|

|

735

|

|

|

|

1,939

|

|

|

|

1,986

|

|

|

|

2,096

|

|

|

Deferred tax liabilities

|

|

|

18,361

|

|

|

|

25,955

|

|

|

|

25,773

|

|

|

|

24,819

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-current liabilities

|

|

|

115,587

|

|

|

|

129,245

|

|

|

|

126,991

|

|

|

|

124,959

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES

|

|

|

140,865

|

|

|

|

150,068

|

|

|

|

147,107

|

|

|

|

145,071

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL EQUITY AND LIABILITIES

|

|

|

249,592

|

|

|

|

360,468

|

|

|

|

357,770

|

|

|

|

358,959

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The above financial statements have been prepared in accordance with the principles of International Financial Reporting

Standards and the Company’s accounting policies but do not constitute an interim financial report as defined in IAS 34 (Interim Financial Reporting).

Trinity Biotech plc

Consolidated Statement of Cash Flows

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(US$000’s)

|

|

Three Months

Ended

Dec 31,

2016

(unaudited)

|

|

|

Three Months

Ended

Dec 31,

2015

(unaudited)

|

|

|

Year

Ended

Dec 31,

2016

(unaudited)

|

|

|

Year

Ended

Dec 31,

2015

(unaudited)

|

|

|

Cash and cash equivalents at beginning of period

|

|

|

84,751

|

|

|

|

104,289

|

|

|

|

101,953

|

|

|

|

9,102

|

|

|

Operating cash flows before changes in working capital

|

|

|

3,294

|

|

|

|

5,574

|

|

|

|

16,245

|

|

|

|

19,853

|

|

|

Changes in working capital

|

|

|

1,325

|

|

|

|

234

|

|

|

|

(2,147

|

)

|

|

|

(7,157

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash generated from operations

|

|

|

4,619

|

|

|

|

5,808

|

|

|

|

14,098

|

|

|

|

12,696

|

|

|

Net Interest and Income taxes received/(paid)

|

|

|

(64

|

)

|

|

|

79

|

|

|

|

(327

|

)

|

|

|

(361

|

)

|

|

Capital Expenditure & Financing (net)

|

|

|

(4,185

|

)

|

|

|

(5,980

|

)

|

|

|

(21,165

|

)

|

|

|

(21,604

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Free cash flow

|

|

|

370

|

|

|

|

(93

|

)

|

|

|

(7,394

|

)

|

|

|

(9,269

|

)

|

|

Payment of HIV-2 licence fee

|

|

|

—

|

|

|

|

—

|

|

|

|

(1,112

|

)

|

|

|

(1,112

|

)

|

|

Share buyback

|

|

|

(3,296

|

)

|

|

|

—

|

|

|

|

(9,322

|

)

|

|

|

—

|

|

|

Once-off items

|

|

|

(2,417

|

)

|

|

|

—

|

|

|

|

(2,417

|

)

|

|

|

—

|

|

|

30 year Exchangeable Note proceeds, net of fees

|

|

|

—

|

|

|

|

(45

|

)

|

|

|

—

|

|

|

|

110,529

|

|

|

30 year Exchangeable Note interest payment

|

|

|

(2,300

|

)

|

|

|

(2,198

|

)

|

|

|

(4,600

|

)

|

|

|

(2,198

|

)

|

|

Dividend payment

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(5,099

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at end of period

|

|

|

77,108

|

|

|

|

101,953

|

|

|

|

77,108

|

|

|

|

101,953

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The above financial statements have been prepared in accordance with the principles of International Financial Reporting

Standards and the Company’s accounting policies but do not constitute an interim financial report as defined in IAS 34 (Interim Financial Reporting).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

TRINITY BIOTECH PLC

|

|

|

|

(Registrant)

|

|

|

|

|

By:

|

|

/s/ Kevin Tansley

|

|

|

|

Kevin Tansley

|

|

|

|

Chief Financial Officer

|

Date: 14 March 2017

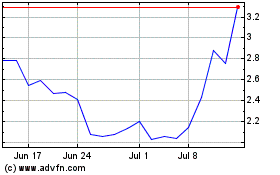

Trinity Biotech (NASDAQ:TRIB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trinity Biotech (NASDAQ:TRIB)

Historical Stock Chart

From Apr 2023 to Apr 2024