Report of Foreign Issuer (6-k)

April 07 2017 - 8:43AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE

13a-16

OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2017

Commission File Number:

001-34238

THE9 LIMITED

Building

No. 3, 690 Bibo Road

Zhangjiang

Hi-tech

Park, Pudong New Area

Shanghai 201203, People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form

20-F

or Form

40-F.

Form

20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(7): ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

THE9 LIMITED

|

|

|

|

|

By:

|

|

/s/ Jun Zhu

|

|

Name:

|

|

Jun Zhu

|

|

Title:

|

|

Chairman and Chief Executive Officer

|

Date: April 7, 2017

Exhibit Index

Exhibit 99.1 – Press Release

Exhibit 99.1

The9 Limited Announces Unaudited Financial Information

As of and For the Six Months Ended December 31, 2016

The9 Limited (the “Company”) hereby announces its unaudited consolidated statement of income for the six months ended December 31, 2016 and its

unaudited consolidated balance sheet as of December 31, 2016.

THE9 LIMITED

UNAUDITED CONSOLIDATED STATEMENTS OF INCOME INFORMATION

(Expressed in Renminbi - RMB and US Dollars - US$, except share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six month

ended Jun 30

|

|

|

Six month

ended December 31

|

|

|

|

|

2016

|

|

|

2015

|

|

|

2016

|

|

|

2016

|

|

|

|

|

RMB

(unaudited)

|

|

|

RMB

(unaudited)

|

|

|

RMB

(unaudited)

|

|

|

US$

(Note)

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Online game services

|

|

|

20,655,337

|

|

|

|

18,901,326

|

|

|

|

27,910,283

|

|

|

|

4,019,917

|

|

|

Other revenues

|

|

|

2,392,933

|

|

|

|

3,365,669

|

|

|

|

5,326,969

|

|

|

|

767,243

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23,048,270

|

|

|

|

22,266,995

|

|

|

|

33,237,252

|

|

|

|

4,787,160

|

|

|

Sales taxes

|

|

|

(61,508

|

)

|

|

|

(163,042

|

)

|

|

|

(24,728

|

)

|

|

|

(3,562

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total net revenues

|

|

|

22,986,762

|

|

|

|

22,103,953

|

|

|

|

33,212,524

|

|

|

|

4,783,598

|

|

|

Cost of revenues

|

|

|

(28,335,686

|

)

|

|

|

(33,056,539

|

)

|

|

|

(20,183,093

|

)

|

|

|

(2,906,970

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross (loss) profit

|

|

|

(5,348,924

|

)

|

|

|

(10,952,586

|

)

|

|

|

13,029,431

|

|

|

|

1,876,628

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating (expenses) income :

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product development

|

|

|

(43,825,469

|

)

|

|

|

(72,600,152

|

)

|

|

|

(34,165,939

|

)

|

|

|

(4,920,918

|

)

|

|

Sales and marketing

|

|

|

(11,383,633

|

)

|

|

|

(16,251,921

|

)

|

|

|

(9,903,014

|

)

|

|

|

(1,426,331

|

)

|

|

General and administrative

|

|

|

(42,786,711

|

)

|

|

|

(84,550,138

|

)

|

|

|

(86,261,135

|

)

|

|

|

(12,424,188

|

)

|

|

Impairment loss on goodwill

|

|

|

(10,561,857

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

(Provision)/reversal of provision for allowance for long-term receivables and prepayments

|

|

|

—

|

|

|

|

(8,439,580

|

)

|

|

|

—

|

|

|

|

—

|

|

|

Impairment on intangible assets

|

|

|

(68,003,805

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Gain on disposal of subsidiaries

|

|

|

—

|

|

|

|

3,339,394

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

(176,561,475

|

)

|

|

|

(178,502,397

|

)

|

|

|

(130,330,088

|

)

|

|

|

(18,771,437

|

)

|

|

Other operating income (expenses)

|

|

|

163,642

|

|

|

|

(1,797,518

|

)

|

|

|

3,441,107

|

|

|

|

495,622

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

|

|

(181,746,757

|

)

|

|

|

(191,252,501

|

)

|

|

|

(113,859,550

|

)

|

|

|

(16,399,187

|

)

|

|

Impairment on

available-for-sale

investment

|

|

|

(244,798,058

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Impairment on other investment

|

|

|

—

|

|

|

|

—

|

|

|

|

(2,806,439

|

)

|

|

|

(404,211

|

)

|

|

Interest income (expenses), net

|

|

|

(33,073,698

|

)

|

|

|

(6,615,217

|

)

|

|

|

(23,236,767

|

)

|

|

|

(3,346,791

|

)

|

|

Fair value change on warrants liability

|

|

|

37,249,592

|

|

|

|

(7,129,161

|

)

|

|

|

10,807,612

|

|

|

|

1,556,620

|

|

|

Loss on disposal of equity investee and

available-for-sale

investment

|

|

|

—

|

|

|

|

—

|

|

|

|

(1,217,405

|

)

|

|

|

(175,343

|

)

|

|

Other income (expenses), net

|

|

|

(2,217,574

|

)

|

|

|

(651,562

|

)

|

|

|

(7,734,697

|

)

|

|

|

(1,114,028

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income tax expense and share of loss in equity method investments

|

|

|

(424,586,495

|

)

|

|

|

(205,648,441

|

)

|

|

|

(138,047,246

|

)

|

|

|

(19,882,940

|

)

|

|

Income tax benefit (expense)

|

|

|

—

|

|

|

|

—

|

|

|

|

6,079,282

|

|

|

|

875,599

|

|

|

Share of loss in equity method investments

|

|

|

(29,955,544

|

)

|

|

|

(11,973,707

|

)

|

|

|

(80,579,942

|

)

|

|

|

(11,605,926

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss for the year

|

|

|

(454,542,039

|

)

|

|

|

(217,622,148

|

)

|

|

|

(212,547,906

|

)

|

|

|

(30,613,267

|

)

|

|

Net loss attributable to noncontrolling interest

|

|

|

(45,277,123

|

)

|

|

|

(9,682,188

|

)

|

|

|

(13,307,081

|

)

|

|

|

(1,916,618

|

)

|

|

Net loss attributable to redeemable noncontrolling interest

|

|

|

(7,072,359

|

)

|

|

|

(17,123,902

|

)

|

|

|

(7,651,793

|

)

|

|

|

(1,102,087

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attributable net loss to The9 Limited

|

|

|

(402,192,557

|

)

|

|

|

(190,816,058

|

)

|

|

|

(191,589,032

|

)

|

|

|

(27,594,562

|

)

|

|

Change in redemption value of redeemable noncontrollling interest

|

|

|

37,863,439

|

|

|

|

43,042,743

|

|

|

|

45,026,749

|

|

|

|

6,485,201

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to holders of ordinary shares

|

|

|

(440,055,996

|

)

|

|

|

(233,858,801

|

)

|

|

|

(236,615,781

|

)

|

|

|

(34,079,763

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Currency translation adjustments

|

|

|

(1,314,419

|

)

|

|

|

(320,719

|

)

|

|

|

(440,220

|

)

|

|

|

(63,405

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive loss

|

|

|

(455,856,458

|

)

|

|

|

(217,942,867

|

)

|

|

|

(212,988,126

|

)

|

|

|

(30,676,672

|

)

|

|

Comprehensive loss attributable to:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

noncontrolling interest

|

|

|

(53,853,568

|

)

|

|

|

(10,800,210

|

)

|

|

|

(12,439,886

|

)

|

|

|

(1,791,716

|

)

|

|

redeemable noncontrolling interest

|

|

|

(7,072,359

|

)

|

|

|

(17,123,902

|

)

|

|

|

(7,651,793

|

)

|

|

|

(1,102,087

|

)

|

|

The9 Limited

|

|

|

(394,930,531

|

)

|

|

|

(190,018,755

|

)

|

|

|

(192,896,447

|

)

|

|

|

(27,782,869

|

)

|

|

Net loss attributable to holders of ordinary shares per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Basic

|

|

|

(18.46

|

)

|

|

|

(10.05

|

)

|

|

|

(9.89

|

)

|

|

|

(1.42

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Diluted

|

|

|

(18.46

|

)

|

|

|

(10.05

|

)

|

|

|

(9.89

|

)

|

|

|

(1.42

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares outstanding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Basic

|

|

|

23,836,873

|

|

|

|

23,269,536

|

|

|

|

23,915,501

|

|

|

|

23,915,501

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Diluted

|

|

|

23,836,873

|

|

|

|

23,269,536

|

|

|

|

23,915,501

|

|

|

|

23,915,501

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: The United States dollar (“US dollar” or “US$”) amounts disclosed in the accompanying financial

statements are presented solely for the convenience of the readers at the rate of US$1.00 = RMB6.9430, representing the noon buying rate in the City of New York for cable transfers of RMB, as certified for customs purposes by the Federal Reserve

Bank of New York, on December 31, 2016.

THE9 LIMITED

UNAUDITED CONSOLIDATED BALANCE SHEETS INFORMATION

(Expressed in Renminbi - RMB and US Dollars - US$)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December

31, 2015

|

|

|

As of December

31, 2016

|

|

|

|

|

RMB

(audited)

|

|

|

RMB

(unaudited)

|

|

|

US$

(unaudited)

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

49,010,541

|

|

|

|

38,878,076

|

|

|

|

5,599,608

|

|

|

Accounts receivable, net of allowance for doubtful accounts of RMB991,743 and RMB992,010 as of

December 31, 2015 and 2016, respectively

|

|

|

7,153,663

|

|

|

|

8,607,120

|

|

|

|

1,239,683

|

|

|

Advances to suppliers

|

|

|

898,126

|

|

|

|

9,085,165

|

|

|

|

1,308,536

|

|

|

Prepayments and other current assets

|

|

|

9,463,149

|

|

|

|

11,625,716

|

|

|

|

1,674,452

|

|

|

Amounts due from a related party

|

|

|

10,732,643

|

|

|

|

19,842,139

|

|

|

|

2,857,862

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

77,258,122

|

|

|

|

88,038,216

|

|

|

|

12,680,141

|

|

|

Investments in equity investees

|

|

|

267,539,694

|

|

|

|

163,037,501

|

|

|

|

23,482,284

|

|

|

Property, equipment and software, net

|

|

|

33,846,518

|

|

|

|

26,765,824

|

|

|

|

3,855,081

|

|

|

Goodwill

|

|

|

10,342,694

|

|

|

|

—

|

|

|

|

—

|

|

|

Intangible assets, net

|

|

|

78,876,486

|

|

|

|

—

|

|

|

|

—

|

|

|

Land use right, net

|

|

|

68,352,386

|

|

|

|

66,431,476

|

|

|

|

9,568,123

|

|

|

Other long-lived assets, net

|

|

|

1,879,021

|

|

|

|

6,618,977

|

|

|

|

953,331

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets

|

|

|

538,094,921

|

|

|

|

350,891,994

|

|

|

|

50,538,960

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities, Redeemable Noncontrolling Interest and Shareholders’ Equity

(Deficit)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-term bank borrowing

|

|

|

—

|

|

|

|

107,517,367

|

|

|

|

15,485,722

|

|

|

Accounts payable

|

|

|

41,248,455

|

|

|

|

37,038,856

|

|

|

|

5,334,704

|

|

|

Other taxes payable

|

|

|

551,445

|

|

|

|

283,994

|

|

|

|

40,904

|

|

|

Advances from customers

|

|

|

19,605,593

|

|

|

|

26,711,967

|

|

|

|

3,847,323

|

|

|

Amounts due to related parties

|

|

|

77,730,267

|

|

|

|

107,203,023

|

|

|

|

15,440,447

|

|

|

Deferred revenue

|

|

|

18,552,217

|

|

|

|

15,921,873

|

|

|

|

2,293,227

|

|

|

Refund of game points

|

|

|

169,998,682

|

|

|

|

169,998,682

|

|

|

|

24,484,903

|

|

|

Warrants

|

|

|

64,414,941

|

|

|

|

16,357,737

|

|

|

|

2,356,004

|

|

|

Interest payables

|

|

|

—

|

|

|

|

412,626

|

|

|

|

59,431

|

|

|

Accrued expense and other current liabilities

|

|

|

35,864,424

|

|

|

|

92,302,898

|

|

|

|

13,294,383

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

427,966,024

|

|

|

|

573,749,023

|

|

|

|

82,637,048

|

|

|

Long-term borrowing

|

|

|

31,726,575

|

|

|

|

35,141,459

|

|

|

|

5,061,423

|

|

|

Convertible notes

|

|

|

135,182,536

|

|

|

|

197,284,836

|

|

|

|

28,414,927

|

|

|

Deferred tax liabilities,

non-current

|

|

|

5,690,705

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities

|

|

|

600,565,840

|

|

|

|

806,175,318

|

|

|

|

116,113,398

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Redeemable noncontrolling interest

|

|

|

178,605,097

|

|

|

|

246,771,133

|

|

|

|

35,542,436

|

|

|

Shareholders’ Equity (Deficits):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary shares (US$0.01 par value; 23,701,601 and 23,915,501 shares issued and outstanding as of

December 31, 2015 and December 31, 2016, respectively)

|

|

|

1,917,620

|

|

|

|

1,931,642

|

|

|

|

278,214

|

|

|

Additional

paid-in

capital

|

|

|

2,080,041,288

|

|

|

|

2,525,599,832

|

|

|

|

363,762,038

|

|

|

Statutory reserves

|

|

|

28,071,982

|

|

|

|

28,071,982

|

|

|

|

4,043,206

|

|

|

Accumulated other comprehensive (loss) income

|

|

|

(3,372,588

|

)

|

|

|

2,582,023

|

|

|

|

371,889

|

|

|

Accumulated deficit

|

|

|

(2,304,020,698

|

)

|

|

|

(2,897,802,287

|

)

|

|

|

(417,370,342

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The9 Limited shareholders’ equity (deficit)

|

|

|

(197,362,396

|

)

|

|

|

(339,616,808

|

)

|

|

|

(48,914,995

|

)

|

|

Noncontrolling interest

|

|

|

(43,713,620

|

)

|

|

|

(362,437,649

|

)

|

|

|

(52,201,879

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total shareholder’s equity (deficit)

|

|

|

(241,076,016

|

)

|

|

|

(702,054,457

|

)

|

|

|

(101,116,874

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities, redeemable noncontrolling interest and shareholder’s equity

(deficits)

|

|

|

538,094,921

|

|

|

|

350,891,994

|

|

|

|

50,538,960

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: The United States dollar (“US dollar” or “US$”) amounts disclosed in the accompanying financial

statements are presented solely for the convenience of the readers at the rate of US$1.00 =RMB6.9430, representing the noon buying rate in the City of New York for cable transfers of RMB, as certified for customs purposes by the Federal Reserve Bank

of New York, on December 31, 2016.

About The9 Limited

The9 Limited is an online game developer and operator in China. The9 Limited develops and/or operates, directly or through its affiliates, its proprietary MMO

and mobile games, including CrossFire new mobile game and Song of Knights. The9 Limited’s joint venture has also obtained an exclusive license for publishing and operating CrossFire 2, which is under development by a third-party game developer,

in China. The9 Limited also engages in mobile advertising and mobile app education businesses. The9 Limited has formed a joint venture with Shanghai ZTE to develop and operate home entertainment set top box business.

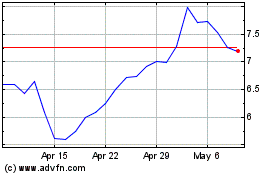

The9 (NASDAQ:NCTY)

Historical Stock Chart

From Mar 2024 to Apr 2024

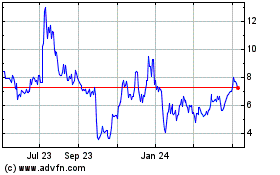

The9 (NASDAQ:NCTY)

Historical Stock Chart

From Apr 2023 to Apr 2024