Report of Foreign Issuer (6-k)

March 21 2017 - 5:02PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

Dated: March 21, 2017

Commission File No. 001-33811

NAVIOS

MARITIME PARTNERS L.P.

7 Avenue de Grande Bretagne, Office 11B2

Monte Carlo, MC 98000 Monaco

(Address of Principal Executive Offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate the file number assigned to the registrant in connection with Rule 12g3-2(b):

N/A

On March 14, 2017, Navios Maritime Partners L.P., a Marshall Islands limited partnership (the

“

Partnership

”) entered into a Placement Agency Agreement (the “

Placement Agency Agreement

”) between Navios GP, L.L.C., a Marshall Islands limited liability company and the general partner of the Partnership, Navios

Maritime Operating L.L.C., a Marshall Islands limited liability company and subsidiary of the Partnership, and Fearnley Securities, Inc., on behalf of itself, S Goldman Advisors LLC, and Fearnley Securities AS (collectively, the

“

Agents

”), pursuant to which the Agents agreed to serve as placement agents in connection with a registered direct offering (the “

Offering

”) of 47,795,000 of the Partnership’s common units representing

limited partnership interests (the “

Common Units

”) for $2.10 per Common Unit. Net proceeds to the Partnership after deducting the Agents’ fees were approximately $96 million. In connection with the Offering, the Company entered

into subscription agreements (“

Subscription Agreements

”) with each of the investors purchasing Common Units in the Offering.

The

Offering was made pursuant to the Partnership’s shelf registration statement, filed on Form F-3 (File No. 333-192176) with the U.S. Securities and Exchange Commission (the “

SEC

”) and declared effective on January 15,

2014, and a Prospectus Supplement, dated March 14, 2017, filed with the U.S. Securities and Exchange Commission on March 16, 2017.

The

foregoing description of the Placement Agency Agreement and the Subscription Agreements do not purport to be complete and are qualified in their entirety by reference to the full text of such agreements. A copy of the Placement Agency Agreement and

a form of Subscription Agreement are filed herewith as Exhibit 1.1 and Exhibit 99.1, respectively, and are incorporated herein by reference.

The Company

issued press releases announcing the pricing and the closing of the Offering on March 14, 2017 and March 20, 2017, respectively. Copies of the pricing and closing press releases are attached as Exhibit 99.2 and 99.3, respectively, and are

incorporated herein by reference.

Also attached to this report as Exhibit 5.1 is the opinion of Reeder & Simpson P.C., Marshall Islands counsel

to the Partnership, relating to the issuance of the Common Units.

|

Item 9.01

|

Financial Statements and Exhibits

|

|

|

|

|

|

Exhibit No.

|

|

Exhibit

|

|

|

|

|

1.1

|

|

Placement Agency Agreement, dated March 14, 2017

|

|

|

|

|

5.1

|

|

Opinion of Reeder & Simpson P.C., dated March 20, 2017

|

|

|

|

|

23.1

|

|

Consent of Reeder & Simpson P.C. (included in Exhibit 5.1 above)

|

|

|

|

|

99.1

|

|

Form of Subscription Agreement

|

|

|

|

|

99.2

|

|

Press Release, dated March 14, 2017

|

|

|

|

|

99.3

|

|

Press Release, dated March 20, 2017

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

NAVIOS MARITIME PARTNERS L.P.

|

|

|

|

|

By:

|

|

/

S

/ A

NGELIKI

F

RANGOU

|

|

|

|

Angeliki Frangou

Chief Executive Officer

Date: March 21, 2017

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit No.

|

|

Exhibit

|

|

|

|

|

1.1

|

|

Placement Agency Agreement, dated March 14, 2017

|

|

|

|

|

5.1

|

|

Opinion of Reeder & Simpson P.C., dated March 20, 2017

|

|

|

|

|

23.1

|

|

Consent of Reeder & Simpson P.C. (included in Exhibit 5.1 above)

|

|

|

|

|

99.1

|

|

Form of Subscription Agreement

|

|

|

|

|

99.2

|

|

Press Release, dated March 14, 2017

|

|

|

|

|

99.3

|

|

Press Release, dated March 20, 2017

|

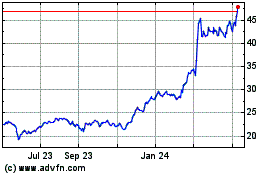

Navios Maritime Partners (NYSE:NMM)

Historical Stock Chart

From Mar 2024 to Apr 2024

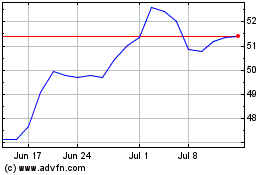

Navios Maritime Partners (NYSE:NMM)

Historical Stock Chart

From Apr 2023 to Apr 2024