Report of Foreign Issuer (6-k)

January 09 2017 - 5:29PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

January 9, 2017

Commission File Number

001-37651

Atlassian Corporation Plc

(Translation of registrant’s name into English)

Exchange House

Primrose Street

London EC2A 2EG

c/o Herbert Smith Freehills LLP

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

Form 20-F

x

Form 40-F

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

¨

Other Events.

On January 9, 2017, Atlassian Corporation Plc, a corporation incorporated and registered under the laws of England and Wales (“Atlassian”), Atlassian, Inc., a Delaware corporation and an indirect wholly-owned subsidiary of Atlassian (“Atlassian U.S.”), Gilbert Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Atlassian U.S. (“Merger Sub”), Trello, Inc., a Delaware corporation (“Target”), and Fortis Advisors LLC, as Securityholder Representative, entered into an Agreement and Plan of Merger (the “Merger Agreement”). Pursuant to the Merger Agreement, Merger Sub will merge (the “Merger”) with and into Target, with Target continuing as the surviving corporation and becoming a wholly-owned subsidiary of Atlassian U.S.

The aggregate consideration payable in exchange for all of the outstanding equity interests of Target is approximately $425 million comprised of approximately $360 million in cash and the remainder in restricted Atlassian Class A ordinary shares, restricted share units and options to acquire Atlassian Class A ordinary shares, all subject to continued vesting provisions. The consideration is subject to adjustment based on (i) working capital adjustment provisions, (ii) the amount of Target transaction expenses, indebtedness, and taxes that remain unpaid as of the closing of the acquisition and (iii) indemnification obligations of the holders of vested securities of Target after the closing of the acquisition. A portion of the consideration payable in the transaction will be placed into escrow as partial security to satisfy any potential claims under the indemnification obligations of the holders of vested securities of Target described in the Merger Agreement.

The Merger Agreement contains customary representations, warranties and covenants by Target, Atlassian U.S., Merger Sub and Atlassian. The closing of the Merger is subject to customary closing conditions as described in the Merger Agreement, including the expiration or termination of any waiting periods applicable to the consummation of the Merger under applicable antitrust and competition laws. The description of the Merger Agreement contained herein is qualified in its entirety by the Merger Agreement filed as Exhibit 99.1 hereto.

A copy of the press release announcing the signing of the Merger Agreement is attached hereto as Exhibit 99.2.

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Date:

|

January 9, 2017

|

|

Atlassian Corporation Plc

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

/S/ MURRAY J. DEMO

|

|

|

|

|

Murray J. Demo

Chief Financial Officer

(Principal Financial and Accounting Officer)

|

Exhibit Index

|

|

|

|

|

|

Exhibit Number

|

Exhibit Title

|

|

|

|

|

99.1

|

Merger Agreement

|

|

99.2

|

Press Release

|

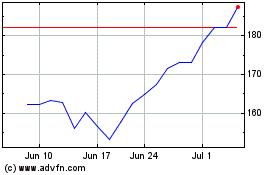

Atlassian (NASDAQ:TEAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

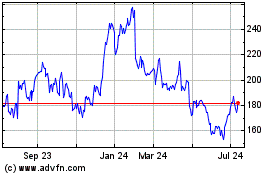

Atlassian (NASDAQ:TEAM)

Historical Stock Chart

From Apr 2023 to Apr 2024