SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of September, 2016

Commission File Number 1-15106

PETRÓLEO BRASILEIRO S.A. - PETROBRAS

(Exact name of registrant as specified in its charter)

Brazilian Petroleum Corporation - PETROBRAS

(Translation of Registrant's name into English)

Avenida República do Chile, 65

20031-912 - Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Strategic Plan and Business and Management Plan 2017-2021

Rio de Janeiro, September 20, 2016 – Petróleo Brasileiro S.A. – Petrobras announces that its Board of Directors approved, at a meeting held yesterday, the new Strategic Plan and the Business and Management Plan 2017-2021.

The Strategic Plan and Business and Management Plan were drawn up in an integrated manner and had the direct involvement of the Senior Management and other company officers at all of the stages of its development.

Two main metrics were set, one concerning the safety aspect and other concerning the financial aspect, which guide the company's strategy

:

·

Reduce by 36% the Total Recordable Injury Frequency Rate (TRIFR*)1 from 2.2 in 2015 to 1.4 in 2018

·

Reduce the leverage (net debt/EBITDA) of 5.3 in 2015 to 2.5 in 2018

Strategic Plan

The new Strategic Plan includes five crucial principles that establish what Petrobras wants to be:

"An integrated energy company focusing on oil and gas that evolves with society, generating high value and with a unique technical ability"; with the following values: respect for life, people and the environment; ethics and transparency; market driven; overcoming and confidence; and results

.

1

TRIFR = number of reportable injuries per million man-hours

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

|

Investor Relations Department

I

e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies.

A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2015, and the Company’s other filings with the U.S. Securities and Exchange Commission.

These principles unfold into 21 strategies, as follows

:

Integrated energy company

·

Reduce the risk of Petrobras' operation in Exploration and Production, Refining, Transportation, Logistics, Distribution and Sales through partnerships and divestments

·

Restructure the Energy Businesses, consolidating the thermoelectric assets and other businesses in this segment, seeking the alternative that maximizes value for the company.

·

Review the positioning of the Lubricant business, in order to maximize the creation of value for Petrobras.

Focus on oil and gas

·

Manage the exploratory portfolio in order to maximize cost effectiveness and ensure the sustainability of oil and gas production.

·

Manage the portfolio of Exploration and Production portfolio in an integrated manner

·

Optimize the business portfolio, withdrawing entirely from biofuel production, LPG distribution, fertilizer production and petrochemical interests, preserving technological competencies in areas with development potential.

·

Maximize value creation in the gas chain, aligned with regulatory developments, ensuring the monetization of proprietary production and optimizing participation in the chain of natural gas as a fuel of transition to the long term

Evolution with the society

·

Strengthen internal controls and governance, ensuring transparency and an effective system for preventing and combating irregularities, without prejudice the agility in the decision- making process.

·

Recover Petrobras’ credibility and strengthen its relation and reputation with all its stakeholders, including control and supervisory bodies of the company.

·

Maintain transparent, respectful and proactive dialogue with all stakeholders, through the use of the best and most up-to-date internal and external communication practices.

·

Align social responsibility actions with the company`s projects.

Value generation

·

Strengthen the reservoir management to maximize the value of E&P contracts in all the regulatory regimes, seeking opportunities to continuously incorporate reserves.

·

Ensure disciplined use of capital and return to shareholders in all Petrobras projects, with high reliability and predictability in the delivery

·

Continuously maximize the productivity and the reduction of costs in accordance with the best international practices

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

|

Investor Relations Department

I

e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies.

A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2015, and the Company’s other filings with the U.S. Securities and Exchange Commission.

·

Promote a market price policy and maximize margins in the value chain

·

Operate with an emphasis on partnerships and divestments as key value generation elements.

·

Promote the management of our workforce in an environment of participatory culture and mutual trust, focused on results that add value, with safety, ethical conduct, responsibility, encouragement of argument, meritocracy, simplicity and conformity.

·

Manage the process of contracting goods and services with a focus on value, aligned with international standards and metrics, meeting conformity requirements, maintaining flexibility in adverse and volatile demand scenarios and contributing to the development of the chain as a whole.

Technical capacity

·

Ensure the constant development of technological competencies in areas with development potential, strengthening the performance of the current business and opening options for competitive operations with low-carbon and renewable energy technologies and refinery-petrochemical integration.

·

Prioritize the development of deep-water production, with a focus on strategic partnerships, combining technical competencies and technologies.

·

Enable the conception and implementation of projects with a low oil equilibrium price, with safety and compliance with environmental requirements

Based on the Company's new management system, each one of these strategies has particular associated initiatives, totaling 72. In turn, each initiative has goals, unfolded up to the level of supervision and with systematic monitoring, in order to ensure the discipline in its execution.

Business and Management Plan 2017-2021

Integrated with the Strategic Plan, the Business and Management Plan detailed the operational plan, focusing on safety, as well as the Company's financial plan for the next five years

.

The Program Commitment to Life will have as its main goal the reduction of the Total Recordable Injury

Frequency Rate (TRIFR*) to 1.4 in 2018, based on the operational discipline and safety of processes. The program aims at improving the awareness to safety in the company, with the commitment of the leadership, continuous training focused on the knowledge on risks and processes, evaluation of the management and system of consequences

.

Among the assumptions used for plan, we can point out:

·

Competitive prices for oil products in Brazil;

·

Brent’s average price and average exchange rate, as follows;

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

|

Investor Relations Department

I

e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies.

A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2015, and the Company’s other filings with the U.S. Securities and Exchange Commission.

·

Growth of the Brazilian oil products market by 5.2% in the period.

The investment portfolio of the Plan prioritizes exploration and production projects of oil in Brazil, with emphasis on deep water. In other business areas, investments are intended primarily to maintain operations and projects related to the flow of oil and natural

gas. Total investments were reduced by 25% when compared to the last review of the Business and Management Plan 2015-2019, disclosed in January 2016, and are distributed according to the chart below

:

Of the investments in the Exploration and Production area (US$60.6 billion), 76% will be allocated to production development, 11% to exploration and 13% to operating support.

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

|

Investor Relations Department

I

e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies.

A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2015, and the Company’s other filings with the U.S. Securities and Exchange Commission.

A total of US$12.4 billion will be invested in the Refining and Natural Gas area, 50% of which allocated to the assets’ operational continuity and the remainder to projects related to the outflow of oil and gas production

.

In addition to greater efficiency of the funds invested, which will allow reducing the volume of investments without much impact on operational goals, the Plan also provides for the adoption of new measures to reduce costs (manageable operating expenses). Among these initiatives, we can highlight the implementation of new management tools, such as the Zero-Based Budgeting and differentiated management of contracts and personnel. The aim is to reduce by 18% the manageable operating expenses, when compared to the value estimated if no initiative had been implemented.

Another important strategy is the expansion of partnerships and divestments, disseminating the successful experience in the exploration and production area to the other areas of the Company. A total of US$19.5 billion in partnerships and divestments is estimated for 2017 and 2018.

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

|

Investor Relations Department

I

e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies.

A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2015, and the Company’s other filings with the U.S. Securities and Exchange Commission.

These initiatives, coupled with the operating cash flow estimated in US$158 billion, net of dividends, will allow Petrobras to carry out its investments and reduce its debt, without the need of new net capital rising within the period of the Plan

.

Oil, NGL and Natural Gas Production Curve

The Company expects to reach a total production of oil and gas, in Brazil and abroad, of 3.41 million boed in 2021, of which 2.77 million bpd of oil and NGL in Brazil, already taking into account the new level of investments, the partnerships and the divestments

.

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

|

Investor Relations Department

I

e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies.

A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2015, and the Company’s other filings with the U.S. Securities and Exchange Commission.

Risk Management

Petrobras is adopting specific initiatives to enhance its risk management, including the identification and planning of mitigation initiatives, in order to allow for a timely and adequate response under any circumstances.

Within the identified risks, the highlights are

:

·

Material changes in market conditions

·

Partnerships and divestments, subject to the market conditions prevailing at the time of the transactions;

·

Legal disputes;

·

Renegotiation of the Transfer of Rights;

·

Impact of Local Content on costs and deadlines of projects;

·

Delays in the construction of platforms;

·

Higher than expected capex costs

.

Execution Discipline and Management System

A meritocratic-based management system will be adopted, with goals being measured up to the supervisory level, systematic monitoring and correction of nonconformities, so as to ensure discipline in the execution of initiatives and in reaching the goals set forth in the Business and Management Plan.

Petrobras's employees will work towards a company that is operationally safe, financially solid, carries out its business in an ethical way, delivers, generates value, and learns and evolves with society as a whole

.

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

|

Investor Relations Department

I

e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies.

A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2015, and the Company’s other filings with the U.S. Securities and Exchange Commission.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

PETRÓLEO BRASILEIRO S.A--PETROBRAS

|

|

|

|

|

|

By:

|

/

S

/ Ivan de Souza Monteiro

|

|

|

|

Ivan de Souza Monteiro

Chief Financial Officer and Investor Relations Officer

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended (Exchange Act) that are not based on historical facts and are not assurances of future results. These forward-looking statements are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

All forward-looking statements are expressly qualified in their entirety by this cautionary statement, and you should not place reliance on any forward-looking statement contained in this press release. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

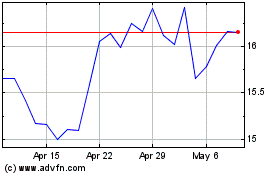

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

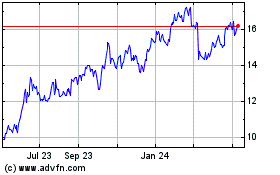

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Apr 2023 to Apr 2024