SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of July, 2016

Commission File Number 1-15106

PETRÓLEO BRASILEIRO S.A. - PETROBRAS

(Exact name of registrant as specified in its charter)

Brazilian Petroleum Corporation - PETROBRAS

(Translation of Registrant's name into English)

Avenida República do Chile, 65

20031-912 - Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Leniency Agreement signed between Brazilian Authorities, Petrobras

and SBM Offshore

Rio de Janeiro, July 15, 2016 – Petróleo Brasileiro S.A. – Petrobras announces that today, together with the Ministry of Transparency, Oversight and Control (Ministério da Transparência, Fiscalização e Controle – “MTFC”), the Public Prosecutor’s Office (Ministério Público Federal – “MPF”), the General Counsel for the Republic (Advocacia Geral da União – “AGU”) and SBM Offshore, it signed a leniency agreement through which the Dutch company will pay compensation of US$341.8 million (approximately R$1.12 billion), as follows: US$328.2 million to Petrobras and US$13.6 million to the Brazilian government. The agreement is the outcome of a negotiation process that began in March 2015.

Petrobras will receive US$149.2 million, in three installments. The first, US$129.2 million, will be paid as soon as the agreement comes into effect. The second and third, US$10 million each, will be paid 12 and 24 months after the agreement was signed.

The other US$179 million represents the nominal value to be deducted from future payments owed by Petrobras to SBM based on prevailing contracts.

Following this agreement, SBM will be able to participate in public tenders under way and future procurement processes. The company will have to pass through all the compliance filters and controls to which Petrobras suppliers are subject.

This is an important milestone in the set of measures being taken to ensure that Petrobras is compensated for losses it has suffered.

The total sum covered by the new agreement includes the amount already received by Petrobras, to compensate for damages, worth around R$310 million, arranged through plea bargain agreements.

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

|

Investor Relations Department

I

e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – B – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies.

A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2015, and the Company’s other filings with the U.S. Securities and Exchange Commission.

See below the official joint statement giving details of the leniency agreement:

“The Ministry of Transparency, Oversight and Control (Ministério da Transparência, Fiscalização e Controle – “MTFC”), the Public Prosecutor’s Office (Ministério Público Federal – “MPF”), the General Counsel for the Republic (Advocacia Geral da União – “AGU”), Petróleo Brasileiro S.A. – Petrobras (“Petrobras”) and SBM Offshore, signed a settlement agreement (“Settlement Agreement”) today that closes out the inquiries of the MPF, the MTFC and Petrobras into the payment of undue advantages to employees of Petrobras. The MTFC investigation was suspended as a result of the execution of a Memorandum of Understanding between the MTFC and the SBM Offshore in March 2015. Following the execution of the Memorandum of Understanding, SBM Offshore, the MTFC, the MPF, the AGU and Petrobras engaged in negotiations which resulted in the signature today of the Settlement Agreement.

Under the terms of the Settlement Agreement, SBM Offshore is granted, by the MTFC, the MPF, the AGU and Petrobras, full discharge and exemption from legal actions for all matters related to or arising from any acts relating to its then main Brazilian agent and his companies over the period 1996 – 2012 and all related investigations conducted by Petrobras, the MPF and the MTFC.

The Settlement Agreement provides for Petrobras and SBM Offshore to resume normal business relationships.

The terms for final settlement negotiated between the Parties are made up as follows:

·

cash payment by SBM Offshore totalling US$ 162.8 million, of which US$ 149.2 million will go to Petrobras, US$ 6.8 million to the MPF and US$ 6.8 million to the Council of Control of Financial Activities (Conselho de Controle de Atividades Financeiras – “COAF”), for the implementation of units for massive electronic process of information and other instruments to be used in the prevention and combat against corruption by the MPF and the COAF. This amount will be paid in three instalments. The first instalment of US$142.8 million will be payable as of the effective date of the Settlement Agreement. The two further instalments of US$10 million each will be due respectively one and two years following the effective date of the Settlement Agreement; and

·

a reduction of 95% in future performance bonus payments related to FPSOs Cidade de Anchieta and Capixaba lease and operate contracts, representing a nominal value of approximately US$ 179 million over the period 2016 to 2030, or a present value for SBM Offshore of approximately US$ 112 million.

·

SBM further remains under the obligation to cooperate with the procedures that may be conducted by the MTFC and the MPF against third parties, as developments of the case.

·

The implementation by SBM of improvements of its internal compliance program in relation to Brazil, in consultation with the MTFC, to whom SBM for three years following the effective date of the Settlement Agreement, will periodically report on matters addressed in the agreement. These arrangements do not affect the regular activities of the compliance departments of Petrobras and of SBM Offshore.

The Public Prosecutor’s Office shall submit the Settlement Agreement for approval of the Fifth Chamber for Coordination and Review and Anti-Corruption of the Federal Prosecutor Service, to the extent it is concerned.

The MTFC will additionally send the Settlement Agreement to the Federal Court of Accounts (Tribunal de Contas da União – “TCU”).

The Settlement Agreement constitutes the results of the institutional collaboration efforts between the MTFC, the AGU and the Federal Prosecutor Service of the State of Rio de Janeiro, which jointly conducted the negotiations, with a view to reaching the best solution for the case.”

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

|

Investor Relations Department

I

e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – B – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies.

A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2015, and the Company’s other filings with the U.S. Securities and Exchange Commission.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

PETRÓLEO BRASILEIRO S.A--PETROBRAS

|

|

|

|

|

|

By:

|

/

S

/ Ivan de Souza Monteiro

|

|

|

|

Ivan de Souza Monteiro

Chief Financial Officer and Investor Relations Officer

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended (Exchange Act) that are not based on historical facts and are not assurances of future results. These forward-looking statements are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

All forward-looking statements are expressly qualified in their entirety by this cautionary statement, and you should not place reliance on any forward-looking statement contained in this press release. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

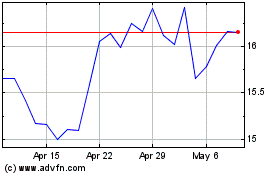

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

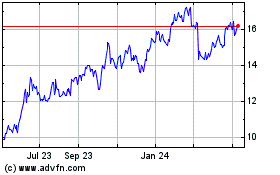

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Apr 2023 to Apr 2024