SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2016

(Commission File No. 001-32221) ,

GOL LINHAS AÉREAS INTELIGENTES S.A.

(Exact name of registrant as specified in its charter)

GOL INTELLIGENT AIRLINES INC.

(Translation of Registrant's name into English)

Praça Comandante Linneu Gomes, Portaria 3, Prédio 24

Jd. Aeroporto

04630-000 São Paulo, São Paulo

Federative Republic of Brazil

(Address of Regristrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

São Paulo, May 3, 2016 - GOL Linhas Aéreas Inteligentes S.A. “GOL” or “Company” (BM&FBOVESPA: GOLL4 and NYSE: GOL), (S&P: CCC-, Fitch: CCC and Moody’s: Caa1)

,

the largest low-cost and best-fare airline in Latin

America, today announced that its subsidiary GOL LuxCo S.A. (“LuxCo” or the “Issuer”) has commenced private Exchange Offers (the "Exchange Offers") for any and all of the outstanding 7.50% Senior Notes due 2017 (the “2017 Notes”) issued by GOL Finance (“Finance”) for cash and LuxCo’s newly issued 8.50% Secured Amortizing Notes due 2018 (the “New 2018 Notes”); 9.250% Senior Notes due 2020 (the “2020 Notes”) issued by Finance, 8.875% Senior Notes Due 2022 (the “2022 Notes”) issued by LuxCo and 10.750% Senior Notes due 2023 (the “2023 Notes”) issued by LuxCo for cash and LuxCo’s newly issued 8.50% Secured Notes due 2022 (the “New 2022 Notes”); and 8.75% Perpetual Notes (the “Perpetual Notes” and, together with the 2017 Notes, 2020 Notes, 2022 Notes and 2023 Notes, the “Old Notes”) issued by Finance for newly issued 8.50% Secured Notes due 2028 (the “New 2028 Notes” and, together with the New 2018 Notes and New 2022 Notes, the “New Notes”).

The New Notes will be guaranteed by the Company and VRG Linhas Aéreas S.A.

The New Notes will be secured by a first priority security interest in all spare parts owned by GOL and, as a result, structurally senior to all of GOL’s existing and future unsecured indebtedness, including the Old Notes, to the extent of the value of collateral securing the New Notes and, in the case of the New 2028 Notes, until January 21, 2022, and senior to any future subordinated indebtedness that GOL may incur. Old Notes will not get the benefit of the collateral securing the New Notes and holders of Old Notes who do not participate in the Exchange Offers will be effectively subordinated to the New Notes, to the extent of the value of the collateral securing the New Notes.

GOL has in recent years faced a challenging economic scenario, including: (1) political instability; (2) contraction of the Brazilian economy; (3) sharp devaluation of the Brazilian

real

; and (4) inflationary pressures and high interest rates. In addition, GOL and the Brazilian aviation sector were affected by: (1) decreased demand; (2) industry overcapacity; (3) increased labor costs; (4) scarce and expensive credit; (5) ratings decline; (6) operating cost increase; (7) high financial expenses; and (8) reduced payment capacity.

GOL embarked in the past year on a series of initiatives to comprehensively address its liquidity and capital structure concerns. The initiatives in the second half of 2015 and first months of 2016 include: (1) an equity infusion; (2) financing support from Delta Air Lines; (3) fleet reduction; (4) operating cost reductions; (5) advanced ticket sales to Smiles; (6) route network changes; (7) supplier negotiations; (8) leasing contract negotiations; and (9) capital structure improvements. Together with

|

1

|

|

GOL Linhas Aéreas Inteligentes S.A

.

|

these efforts, the Exchange Offers are intended to ensure that GOL emerges from the current political and economic crisis in the best competitive position.

In exchange for each US$1,000 principal amount of the Old Notes that are validly tendered (and not validly withdrawn) at or before the Early Participation Time, 5:00 p.m., New York City time, on May 17, 2016, and accepted for exchange, Eligible Holders will receive the Following Total Exchange Consideration:

·

2017 Notes: US$210 in cash and US$490 in principal amount of the New 2018 Notes, including the Early Participation Premium of US$15 in cash and US$35 in principal amount of the New 2018 Notes;

·

2020 Notes: US$70 in cash and US$280 in principal amount of the New 2022 Notes, including the Early Participation Premium of US$10 in cash and US$40 in principal amount of the New 2022 Notes;

·

2022 Notes: US$70 in cash and US$280 in principal amount of the New 2022 Notes, including the Early Participation Premium of US$10 in cash and US$40 in principal amount of the New 2022 Notes;

·

2023 Notes: US$70 in cash and US$280 in principal amount of the New 2022 Notes, including the Early Participation Premium of US$10 in cash and US$40 in principal amount of the New 2022 Notes; and

·

Perpetual Notes: US$300 in principal amount of the New 2028 Notes, including the Early Participation Premium of US$50 in principal amount of the New 2028 Notes.

For each US$1,000 principal amount of the Old Notes that are validly tendered (and not validly withdrawn) after the Early Participation Time but at or before the Expiration Time, 11:59 p.m., New York City time, on June 1, 2016, that are accepted for exchange, Eligible Holders will receive only the applicable Exchange Consideration which is equal to the applicable Total Exchange Consideration less the applicable Early Participation Premium. GOL will pay, upon closing of the Exchange Offers, all accrued and unpaid interest on the Old Notes exchanged for New Notes.

Tendered Old Notes may not be withdrawn subsequent to the Withdrawal Deadline, subject to limited exceptions. If, after the Withdrawal Deadline, at 5:00 p.m., New York City time, on May 17, 2016, the Issuer (i) reduces the principal amount of Old Notes subject to the Exchange Offers, (ii) reduces the Exchange Consideration or (iii) is otherwise required by law to permit withdrawals, then previously tendered Old Notes may be validly withdrawn within a reasonable period under the circumstances after the date that notice of such reduction or permitted withdrawal is first

|

2

|

|

GOL Linhas Aéreas Inteligentes S.A

.

|

to holders of the Old Notes by the Issuer. The Issuer may extend the Early Participation Time or the Expiration Time without extending the Withdrawal Deadline, unless otherwise required by law.

In the event of a termination of an Exchange Offer, no Exchange Consideration will be paid, and the Old Notes tendered pursuant to that Exchange Offer will be promptly returned to the tendering holders.

The obligation of the Issuer to consummate the Exchange Offers is conditioned upon, among other items identified in an exchange offer memorandum available to Eligible Holders (as defined below), for each Exchange Offer individually, the valid tender, without subsequent withdrawal, of at least 95% in aggregate principal amount of outstanding Old Notes that are the target of that Exchange Offer, unless lowered by the Company. None of the Exchange Offers is conditioned upon any of the other Exchange Offers. In addition, the Company has the right to amend, terminate or withdraw, in its sole discretion, any of the Exchange Offers at any time and for any reason, including failure to satisfy any condition to the Exchange Offers.

The New Notes (including the guarantees) have not been registered under the Securities Act and may not be offered or sold within the United States or to, or for the account or benefit of, U.S. persons except to qualified institutional buyers in compliance with applicable exemptions.

Documents relating to the Exchange Offers will only be distributed to “Eligible Holders” of Old Notes who complete and return an eligibility form confirming that they are (1) a “Qualified Institutional Buyer” (as defined in Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”)) or (2) a person outside the United States that is not a “U.S. Person,” (as that term is defined in Rule 902 of Regulation S under the Securities Act).

More Information

D.F. King & Co., Inc. has been appointed as the information agent and the exchange agent for the Exchange Offer. Holders may contact the information agent to request the eligibility letter at (212) 269-5550 or toll free at (866) 796-6898.

This press release is neither an offer to sell nor the solicitation of an offer to buy any security. Neither GOL, its officers, our board of directors, the Exchange Agent nor the Information Agent is making any recommendation as to whether noteholders should tender Old Notes for exchange pursuant to the

|

3

|

|

GOL Linhas Aéreas Inteligentes S.A

.

|

Exchange Offers. Further, none of the aforementioned parties have authorized anyone to make any such recommendation.

PJT Partners is serving as financial advisor to GOL. Milbank, Tweed, Hadley & McCloy LLP and Mattos Filho, Veiga Filho, Marrey Jr. e Quiroga Advogados are serving as legal advisors to GOL.

|

4

|

|

GOL Linhas Aéreas Inteligentes S.A

.

|

Reasons for the Exchange Offers

Economic and Sector Background

After years of healthy growth, Brazil’s economy began to weaken in 2012, when GDP growth was only 1.8%. The deterioration has accelerated since 2015, when the recession began, fueled by significant uncertainty caused by the Petrobras-related scandals, growing lack of confidence in the economic and political outlook and the recent House of Representatives vote to impeach the President of Brazil. Credit default swaps on Brazilian bonds increased by 115.2% in 2015, reflecting the weak and contracting economy.

This same period saw the Brazilian aviation sector as a whole being adversely affected, principally by a shrinking economy, climbing inflation and a steep decline of the real versus the U.S. dollar.

The negative economic scenario included:

•

Political instability.

The ongoing Lava Jato investigations (Operation Car Wash), revolving around Petrobras, has implicated numerous government officials, members of Congress, senior officers of large state-owned companies and executives of major private sector companies. The investigation centers on bribes and kickbacks related to government contracts which allegedly financed the campaigns of the governing coalition political parties and enriched a number of politicians and others. Senior political figures and officers of important companies in Brazil have been arrested and several have been convicted or entered into plea bargain agreements.

The frequent change at the ministerial and appointive positions in government, the distractions of these investigations and the possibility of a change of top leadership have contributed to hesitant decision-making and execution at all levels of government.

On April 17, 2016, the Brazilian House of Representatives voted to impeach Dilma Rousseff, the Brazilian President. The impeachment process is now before the Senate, and an impeachment trial by the Senate is widely viewed as likely, which will cause further instability and uncertainty.

•

Contraction of the Brazilian economy.

Brazil’s GDP contracted 3.8% in 2015, after averaging only 1.3% growth in 2012-2014. The market analyst consensus compiled by the Brazilian Central Bank in April 2016 shows an expected GDP decline in 2016 of 3.9%. According to estimates published

|

5

|

|

GOL Linhas Aéreas Inteligentes S.A

.

|

by the IMF, the Brazilian economy is expected to shrink more, or grow only marginally, until 2018. Unemployment rose from 6.8% in January 2015 to 10.9% in March 2016.

•

Sharp devaluation of the real.

A significant part of our operating and capital expense, as well as a significant part of our debt, is U.S. dollar-based. The real devalued 47% versus the U.S. dollar in 2015, ending the year at R$3.90 per U.S. dollar. On April 29, 2016 the exchange rate was R$3.44 per U.S. dollar. Thus, for example, while oil prices in 2015 decreased 47.5% (per WTI barrel), our fuel expense dropped only 14.1% because of the real devaluation.

•

Inflationary pressures and high interest rates.

Inflation (as measured by the IPCA index) increased from an average of 5% between 2012 and 2014 to 10.7% in 2015. Market analyst consensus compiled by the Brazilian Central Bank in April 2016 shows an expected inflation rate for 2016 of 7%; inflation in the first quarter of 2016 was 2.6%. In part to combat inflation, the Brazilian Central Bank has reacted by successively raising the base interest rate for Brazilian government reference rate (SELIC). At year-end 2014 the SELIC rate was 11.75%, rose to 14.25% by the end of 2015 and has remained unchanged since, which has depressed air travel and substantially increased borrowing costs.

In addition, we and the aviation sector were affected by:

•

Decrease in demand.

We and the Brazilian industry in general saw a marked decrease in certain segments, and especially in corporate air travel, which fell to 58% of our total passenger revenue in 2015 from a historical average of approximately 70%. As the business travel segment has a significantly higher yield than other segments, our revenue were negatively affected as a consequence. Rio de Janeiro is the capital of the Brazilian oil and gas industry. As the market leader in Rio de Janeiro, as measured by departures, we were particularly affected by the crisis the oil and gas industry suffered because of the government investigations and the collapse of international oil prices.

•

Industry overcapacity.

The largest airlines in Brazil, including Gol, have taken steps to rationalize capacity, but these were offset by increased competition in major airports and rapid growth of smaller competitors. As a result, as of September 2015 (the latest data for which public data exists) the industry had suffered a 2% yield decline.

•

Labor costs.

The labor unions representing our employees won new industry-wide contracts that raised monthly salaries by 11% in 2016 and 7% in 2015. At the same time, costly changes in labor

|

6

|

|

GOL Linhas Aéreas Inteligentes S.A

.

|

rules took effect, especially the requirement to give hazard pay to ground employees and increased paid time-off for crew members. As a result, and also as a consequence of inflation, our personnel cost increased by 15% in 2015, despite an overall reduction in employee headcount.

•

Scarce and expensive credit.

The economic crisis has resulted in a constricted and expensive credit environment in Brazil. For example, the interest rate on our debentures increased from 120% of the Brazilian interbank lending rate (CDI) in June 2014 to 132% of the CDI in September 2015. Lenders, lessors and fuel providers have also increased their cash collateral requirements or reduced payment flexibility, negatively affecting our available cash on hand, as shown by our restricted cash, which more than doubled from the end of 2014 to the end of 2015.

•

Ratings decline.

Our credit ratings of B-/B3/B (Fitch, Moody’s and S&P) in July 2015 declined to CCC/Caa1/CCC-, which has reduced our access to and increased our cost of capital.

•

Operating cost increase.

At the same time as yield and high margin revenue decreased, operating costs increased, principally as a function of exchange rate variation, inflationary pressures, increase in sales incentives and service improvements. Our ex-fuel cost per available seat kilometer increased by 15.9% in 2015, thus compressing our operating margin.

•

High financial expense.

Factors cited above have caused our financial expense to climb significantly. Our interest expense increased by 49.5%, from R$592.4 million in 2014 to R$885.9 million in 2015.

•

Reduced payment capacity.

Since 2012, we have been strategically reducing capacity. This reduction, the shrinking Brazilian economy, the real devaluation, pricing pressure and increased competition, have reduced significantly our cash flow and payment capacity.

We have since 2012 successfully worked to rationalize our route network and fleet size, but the confluence of adverse effects in 2015 offset much of the actual and expected operational improvements. Most observers and we believe that a turnaround in the Brazilian economy is two or more years away. As a consequence, we embarked in the past year on a series of initiatives to comprehensively address our liquidity and capital structure concerns.

Initiatives

The initiatives in the second half of 2015 and first months of 2016 include:

|

7

|

|

GOL Linhas Aéreas Inteligentes S.A

.

|

•

Equity infusion.

In September, 2015, Volluto, our controlling shareholder, made an equity investment in us of R$283.9 million. Concurrently, Delta purchased additional capital stock for R$177.3 million.

•

Delta financing support.

Working closely with Delta, we obtained a new unsecured term loan of US$300 million, fully guaranteed by Delta. Being able to offer this guarantee allowed us to secure this financing on amounts and on terms that most likely would not have been available to us otherwise. Our obligation to reimburse Delta if its guarantee is called upon is secured by a pledge to Delta of our shares in Smiles.

•

Fleet reduction.

In early 2016, we returned five aircraft under finance leases, two of them outright and the other three under sale and leaseback agreements, and sold our rights to three aircraft deliveries from Boeing in 2016, which originally would have replaced outgoing fleet aircraft.

•

Operating cost reductions.

We implemented various operating cost-saving initiatives, including overhead reductions, introduction of part-time employees to offset reduced demand during low seasons, and renegotiations with suppliers.

In the last several months we embarked on additional initiatives:

•

Advance ticket sales.

In February 2016 VRG entered into a ticket purchase agreement with Smiles, totaling up to R$1.0 billion, providing for advance ticket sales to Smiles in various tranches through June 30, 2017. The first tranche, of R$376.0 million, was disbursed by Smiles in February 2016 and the remaining tranches are conditioned upon certain other additional cost-savings and liquidity initiatives.

•

Route network changes.

On May 1, 2016 we implemented a change to our route network to focus on more profitable routes, suspended flights to eight destinations and expect to reduce our fleet by approximately 15% by year-end. We estimate that these changes will reduce year-over-year the number of take-offs and seats by 15% to 18% and the number of ASKs by 5% to 8%.

•

Supplier negotiations.

We began discussions with key suppliers to reduce our costs and adjust to the new network and fleet profiles. For example, in the first quarter of 2016 we revised our delivery schedule with Boeing so that we will not receive any new aircraft until mid-2018.

|

8

|

|

GOL Linhas Aéreas Inteligentes S.A

.

|

•

Leasing contract negotiations.

We began discussions with all our lessors to renegotiate certain commercial terms of lease agreements, including returning aircraft, deferring and reducing aircraft return cost obligations and reducing and deferring payments.

•

Capital structure improvements.

We engaged PJT Partners to advise us in connection with measures to strengthen our capital structure and liquidity and to improve the profile of our debt. Additionally, PJT is advising us in connection with our U.S. dollar denominated unsecured bonds.

Renegotiation of Commitments

The concluding phase of our initiatives includes the renegotiation of the vast majority of our debt and lease obligations, specifically the consummation of the Exchange Offers, renegotiation of the leases and amendments to the terms of the debentures.

Debentures

We have outstanding R$1,050 million of debentures. We have begun discussions with our debentureholders to seek concessions, including:

•

a deferral of 90% of principal due in 2016 and 2017 to 2018, 2019 and 2020;

•

a new two-year credit facility of R$380 million; and

•

waiver for one year of compliance with the debt service and leverage covenants.

We expect that the concessions we have asked from our debentureholders would reduce our principal payments until 2018 by R$225 million.

Lessors

We engaged SkyWorks Capital to assist us in renegotiating our aircraft lease agreements and have approached our aircraft lessors to seek concessions including:

•

reducing the leased fleet by 20 aircraft, which we expect should have expected annual savings of approximately R$220 million;

|

9

|

|

GOL Linhas Aéreas Inteligentes S.A

.

|

•

deferring and reducing aircraft return cost obligations; and

•

reducing monthly lease rates on a substantial number of remaining aircraft.

Delta

Delta has agreed, on an interim basis, to reduce the overcollateralization ratio we are required to maintain under our reimbursement agreement related to Delta’s guarantee of our US$300 million term-loan. Delta has agreed to make this reduction permanent, subject to the successful completion of the Exchange Offers.

Boeing

At December 31, 2015 we had R$555.5 million in future commitments with Boeing. Boeing supported the rationalization of our network and fleet plan. We have agreed with Boeing additional flexibility on the future deliveries of aircraft. This agreement will give us a material relief in terms of cash flow. Part of this cash flow relief is intended to fund the Exchange Offers.

Smiles

Our agreement with Smiles provides that, if we achieve the expected cash savings from a series of initiatives, including the Exchange Offers and lease renegotiations, we will receive from Smiles advance payments for future ticket sales of up to R$1.0 billion (including the R$376.0 million disbursed by Smiles in February 2016).

New Business Plan

There is a great deal of uncertainty, political and economic, in Brazil and also globally, and significant challenges in the airline sector, but we believe our plan, including the Exchange Offers, renegotiation of other commitments and achievement of the listed initiatives, should permit us to address our current situation.

|

10

|

|

GOL Linhas Aéreas Inteligentes S.A

.

|

Investor Relations

ri@voegol.com.br

www.voegol.com.br/ir

+55(11)2128-4700

Media Relations

Marcelo Mota

In Press Porter Novelli

+55 11 94547 7447

Michael Freitag, Meaghan Repko and Dan Moore

Joele Frank, Wilkinson Brimmer Katcher

(212) 355-4449

About GOL Linhas Aéreas Inteligentes S.A.

GOL Linhas Aéreas Inteligentes S.A. (BM&FBOVESPA: GOLL4 and NYSE: GOL), the largest low-cost and best-fare airline in Latin America, offers around 900 daily flights to 68 destinations, 13 international, in South America and the Caribbean, using a young, modern fleet of Boeing 737-700 and 737-800 Next Generation aircraft, the safest, most efficient and most economical of their type. The SMILES loyalty program allows members to accumulate miles and redeem tickets to more than 700 locations around the world via flights with foreign partner airlines. The Company also operates Gollog, a logistics service which retrieves and delivers cargo and packages to and from more than 3,192 cities in Brazil and more than 47 countries and 90 foreign destinations through international partnerships. With its portfolio of innovative products and services, GOL Linhas Aéreas Inteligentes offers the best cost-benefit ratio in the market.

Disclaimer

This release contains forward-looking statements relating to the prospects of the business, estimates for operating and financial results, and those related to growth prospects of GOL. These are merely projections and, as such, are based exclusively on the expectations of GOL’s management Such forward-looking statements depend, substantially, on external factors, in addition to the risks disclosed in GOL’s filed disclosure documents and are, therefore, subject to change without prior notice. The Company's non-financial information was not reviewed by the independent auditors.

|

1

1

|

|

GOL Linhas Aéreas Inteligentes S.A

.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date:

May

5, 2016

|

GOL LINHAS AÉREAS INTELIGENTES S.A.

|

|

|

|

|

|

|

|

By:

|

/S/ Edmar Prado Lopes Neto

|

|

|

Name: Edmar Prado Lopes Neto

Title: Investor Relations Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

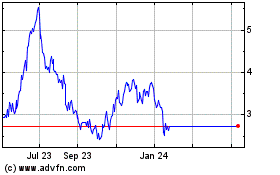

Gol Linhas Aereas Inteli... (NYSE:GOL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gol Linhas Aereas Inteli... (NYSE:GOL)

Historical Stock Chart

From Apr 2023 to Apr 2024