SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

May 3, 2016

KONINKLIJKE

PHILIPS N.V.

(Exact name of registrant as specified in its charter)

Royal Philips

(Translation

of registrant’s name into English)

The Netherlands

(Jurisdiction of incorporation or organization)

Breitner Center, Amstelplein 2, 1096 BC Amsterdam, The Netherlands

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule101(b)(7):

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Name and address of person authorized to receive notices

and communications from the Securities and Exchange Commission:

M.J. van Ginneken

Koninklijke

Philips N.V.

Amstelplein 2

1096 BC Amsterdam – The Netherlands

This report comprises an extract of certain portions of the following press release:

“Royal Philips and Philips Lighting announce intention to launch an Initial Public Offering of Philips Lighting and listing on Euronext Amsterdam”,

dated May 3, 2016.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its

behalf, by the undersigned, thereunto duly authorized at Amsterdam, on the 3rd day of May, 2016.

|

|

|

KONINKLIJKE PHILIPS N.V.

|

|

|

|

/s/

M.J. van Ginneken

|

|

(General Secretary)

|

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES,

CANADA, AUSTRALIA OR JAPAN OR ANY OTHER JURISDICTION IN VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION. PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THE PRESS RELEASE.

May 3, 2016

Royal

Philips and Philips Lighting announce intention to launch an Initial Public Offering of

Philips Lighting and listing on Euronext Amsterdam

Amsterdam, the Netherlands – Koninklijke Philips N.V. (“Royal Philips”) and Philips Lighting NewCo B.V. (“Philips

Lighting” or the “Company”), announce their intention to launch an Initial Public Offering (the “IPO” or the “Offering”) and listing on Euronext Amsterdam of Philips Lighting (“the Listing”). Philips

Lighting is a global market leader in the general lighting market measured by sales with recognized expertise in the development, manufacturing and application of innovative lighting products, systems and services. The Offering would consist of a

sale of existing shares only held by Royal Philips, the current sole shareholder of Philips Lighting. The Offering and Listing, and their timing, are subject to, among other factors, market conditions.

Philips Lighting highlights

|

|

●

|

|

Philips Lighting is a global market leader in the general lighting market with a unique competitive position and

recognized expertise in the development, manufacturing and application of innovative lighting products, systems and services.

|

|

|

●

|

|

The Company has been innovating and leading the lighting industry through many technological changes and has established

a track record in conventional and LED lighting products, systems and services.

|

|

|

●

|

|

The Company will use the ‘Philips’ brand on its products, systems and services, which enjoys a long history

and has developed significant brand value over time driven by Philips Lighting’s reputation for innovation, understanding of customer needs, quality and range of propositions

1

.

|

|

|

●

|

|

Philips Lighting, with its registered headquarters in Eindhoven, the Netherlands, has a highly skilled international

senior management team with a broad range of relevant industry and functional knowledge and geographic backgrounds.

|

|

|

●

|

|

The Company has a track record of earnings improvement through proactive cost control, and strong free cash flow

generation.

|

|

|

●

|

|

For the year ended 31 December 2015, Philips Lighting generated

€

7,465 million of sales and Adjusted EBITA

2

of

€

547

million, representing an Adjusted EBITA ratio

3

of 7.3% of sales. Income from Operations (EBIT) amounted to

€

331 million for the year ended 31 December 2015.

|

|

|

●

|

|

At the time of the IPO, the Company is expected to have a net financial indebtedness of approximately

€

950 million representing approximately 1.5x 2015 EBITDA

4

.

|

|

|

●

|

|

Philips Lighting is targeting an annual dividend pay-out ratio of 40% to 50% of continuing net income

5

to be paid out in cash. The Company expects to make its first dividend payment in 2017, which will be based on the results over the full year 2016.

|

1 Under the trademark license agreement, Royal Philips has licensed certain trademarks to Philips Lighting, including the Philips trademark, the

Philips shield emblem and the brand line “innovation and you”. The license was granted for a period of ten years. The term may be extended with two periods of five years if certain financial targets in terms of net turnover are met and

provided that Philips Lighting as licensee has acted in compliance with the conditions of the trademark license agreement. The Company has also secured the right to use the Philips company name for a period of 18 months after the date that it is no

longer controlled by Royal Philips.

2 The Company defines adjusted EBITA as Income from Operations (EBIT) excluding amortization and

impairments of acquired intangible assets and goodwill, restructuring costs, acquisition-related charges and other significant incidental charges attributable to cost of sales, selling expenses, R&D expenses and general and administrative

expenses.

3 The Company defines adjusted EBITA ratio as adjusted EBITA divided by sales (or sales including intersegment sales in case of

adjusted EBITA ratio of Business Groups).

4 Philips Lighting realised Earnings Before Interest, Tax, Depreciation and Amortization

(EBITDA) of

€

646 million for the year ended 31 December 2015. The ratio assumes approximately

€

300 million of cash on balance sheet post completion of the

Offering.

5 Continuing net income is defined as recurring net income from continuing operations, or net income excluding discontinued

operations and excluding material non-recurring items.

1

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED

STATES, CANADA, AUSTRALIA OR JAPAN OR ANY OTHER JURISDICTION IN VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION. PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THE PRESS RELEASE.

Offering highlights

|

|

●

|

|

The intended IPO will consist of an offering of existing shares held by Royal Philips to institutional and retail

investors in the Netherlands and to certain qualified institutional investors in various other jurisdictions.

|

|

|

●

|

|

Royal Philips intends to sell at least 25% of the Philips Lighting shares in the IPO. After the IPO Royal Philips will

retain a majority holding with the aim to fully sell down over the next several years as Royal Philips will focus on its HealthTech businesses.

|

|

|

●

|

|

Royal Philips will enter into customary lock-up arrangements with the underwriters in respect of the sale of its

remaining Philips Lighting shares.

|

Frans van Houten, CEO of Royal Philips “Today’s announcement is an historic one for

Philips as we aim to separate our company into two market-leading companies focused on capturing opportunities in the health technology and connected LED lighting solutions markets, respectively. We believe that the recent performance of both

companies demonstrates that the fundamentals are in place for long-term profitable growth and that Philips Lighting is well positioned for success as a stand-alone company. Philips Lighting’s operational performance in the last six quarters has

benefitted directly from operational excellence programs, strong growth in the connected LED lighting portfolio, and the successful management of the anticipated decline in conventional lighting. We believe Philips Lighting’s future status as a

listed entity will strengthen its position as a global market leader in connected LED lighting solutions. At the same time, Royal Philips will focus on the exciting and fast growing health technology market.”

Eric Rondolat, CEO of Philips Lighting: “We are excited to enter a new chapter in the proud history of Philips Lighting. We are leading the

attractive and growing lighting industry through the shift from conventional to LED lighting, as well as the expansion from individual products to connected lighting systems and services. Our focus on offering customers attractive and innovative

lighting is demonstrated by the progress we have made in extending the Internet of Things into lighting. This innovation-driven strategy provides quality energy efficient lighting and enables our customers to enjoy new lighting experiences and

benefits through apps and cloud-based services across our growth platforms for smart cities, smart retailing, smart offices and smart homes.”

Philips

Lighting business description

|

|

●

|

|

Philips Lighting’s portfolio includes incandescent lamps, halogen lamps, fluorescent lamps, LFLs, CFLs, HID lamps

and LED lamps

6

; electronic components (electronic ballasts and drivers); luminaires for consumers and professional users; and innovative, integrated and customized lighting systems and services,

including light management systems and value-added services such as energy audits, light design and engineering as well as remote monitoring and managed services.

|

|

|

●

|

|

The Company has a global reach with commercial activities that cover approximately 180 countries. Philips Lighting has

operational manufacturing plants in 22 countries in all major regions of the world, and more than 70 sales offices worldwide.

|

|

|

●

|

|

Philips Lighting has a strong track record in innovation and invests in R&D (for the year ended 31 December

2015, 4.9% of sales) to stay at the forefront of technological developments. It has a strong patent portfolio with over 14,000 patent rights, which it believes is more than any of its competitors, and a licensing program with over 600 licensees as

of 31 March 2016.

|

6

Linear fluorescent lamps (“LFL”), compact fluorescent lamps (“CFL”),

high-intensity discharge lamps (“HID”).

2

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED

STATES, CANADA, AUSTRALIA OR JAPAN OR ANY OTHER JURISDICTION IN VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION. PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THE PRESS RELEASE.

|

|

●

|

|

The Company’s business is organized and managed on a functional basis by technology and end-markets through four

Business Groups (“BG”): BG Lamps, BG LED, BG Professional and BG Home.

|

|

|

¡

|

|

BG Lamps comprises Philips Lighting’s conventional lamps and lamp electronics businesses.

|

|

|

¡

|

|

BG LED comprises Philips Lighting’s LED lamps and LED electronics businesses.

|

|

|

¡

|

|

BG Professional comprises Philips Lighting’s conventional and LED luminaires, lighting systems and lighting

services businesses for professional customers.

|

|

|

¡

|

|

BG Home comprises Philips Lighting’s consumer luminaires and home systems businesses.

|

Market

Philips Lighting is active in the general lighting

market

7

. The estimated sales of the general lighting market were

€

65.6 billion in 2014, and annual

sales are forecasted to grow at a Compound Annual Growth Rate (“CAGR”) of approximately 3% up to 2020 reaching approximately

€

79.8 billion by 2020

8

. The general lighting market is currently undergoing a rapid transformation, mainly driven by three underlying trends:

(i)

Increasing need for light

: the growth in the overall demand for light is driven by key macro trends: (1) the expected

increase in the world’s population, (2) the expected increase in urbanization of the world’s population and (3) the expected increase in wealth, especially in emerging markets.

(ii)

Increasing demand for more energy efficient light

: the increasing global demand for light in the context of resource

constraints and climate change has created a need for increased energy efficiency of lighting products. Lighting currently represents approximately 20% of global electricity consumption and the lighting industry will need to adapt to changing

environmental regulations and CO2 emission reduction requirements globally. The key benefits of LED over conventional lighting technologies are lower energy consumption and a longer lifespan.

(iii)

Increasing demand for digital lighting

: the integration of LED technology, lighting controls and software allows for new

functionalities and services which enable customers to benefit from new applications. The cloud and networks are creating a new market that can be defined as digital light, connected lighting systems or smart systems. The lighting systems market is

expected to grow from

€

3.2 billion in 2014 to

€

7.0 billion in

2020, representing a 14% CAGR over the same period

8

.

Strengths

Philips Lighting has global leading positions across the lighting value chain

The Company firmly believes that its global leadership provides it with a competitive advantage that will allow it to benefit from future growth

opportunities. The Company’s size and positioning across the value chain provide significant economies of scale, including procurement advantages, and allow the ongoing development of innovative technologies, products and services across the

value chain.

7 The general lighting market comprises the following four categories: (i) lamps (which include both point and linear lamps), (ii) electronics, (iii) professional

(which includes professional luminaires, systems and services for professional end-customers including offices, retail, industry, governments), and (iv) consumer (which includes consumer luminaires and lighting systems for consumer use in the home).

8 Source: BCG.perspectives (2015), How to Win in a Transforming Lighting Industry, 2015 (converted into euros using 1.3269 EUR/USD FX rate as

per BCG).

3

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED

STATES, CANADA, AUSTRALIA OR JAPAN OR ANY OTHER JURISDICTION IN VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION. PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THE PRESS RELEASE.

Strong global brand and well established global sales channels

The Company believes that the strength of its brand drives sales as lighting customers spend up to 60-70% share of wallet

9

with their preferred brand. In addition to its strong brand, Philips Lighting has a global sales and distribution channel across approximately 180 countries with more than 70 sales offices, which it

believes would be difficult for a competitor to replicate. The size of the Company’s operations and its geographic reach ensure global coverage while maintaining local proximity to its customers.

Leading innovation capabilities drive fundamental change in the lighting industry and fuel Philips Lighting’s growth

Philips Lighting has pioneered many of the key breakthroughs in lighting over the past 125 years, including incandescent lighting, HID lamps,

fluorescent lighting and CFL, and has been a driving force behind several technological transitions, laying the foundation for its current strengths and its leading position in the transition of the lighting industry from conventional lighting

technologies to LED lighting technologies as well as lighting systems (including connected lighting systems) and services.

Strong track record of cost savings

drives profitability and cash generation

Historic cost savings have focused on footprint rationalization, bill-of-material costs, and

productivity and efficiency improvements:

|

|

●

|

|

The Company has reduced the number of its conventional lamps operational manufacturing plants from 45 in 2008 to 21 as

of year-end 2015 and has a clear plan to further build this number down.

|

|

|

●

|

|

The Company believes that its track record of realizing bill-of material cost savings from both product engineering and

price negotiations in addition to its scale provide a sustainable competitive advantage versus its peers.

|

|

|

●

|

|

The Company has successfully realized cost savings programs with regard to overhead and other operating expenses, and

believes more is still achievable.

|

Experienced and diverse management team is driving operational improvements and financial performance

The strength of Philips Lighting’s senior management team is demonstrated by the track record in terms of operational excellence and

financial performance with gross margin improvements and significant operating expense savings having resulted in an adjusted EBITA ratio improvement from 6.4% in 2013 to 7.3% in 2015.

9

The percentage of a specific customer’s spending on products and services that is captured by a

specific company.

4

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED

STATES, CANADA, AUSTRALIA OR JAPAN OR ANY OTHER JURISDICTION IN VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION. PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THE PRESS RELEASE.

Strategy

Philips Lighting’s strategy is to leverage its strengths to capture the market opportunities presented in the transitioning lighting market.

Philips Lighting’s market leading positions in both conventional and LED lamps and electronics provide a strong starting position to expand the LED products, systems and services business whilst further leveraging the conventional lighting

business. Philips Lighting has identified six key strategic priorities to achieve its objectives:

Optimize cash from conventional products to fund its growth

Philips Lighting’s conventional business has historically been and currently remains the greatest contributor to cash flow generation. The

Company aims to leverage its conventional business and to continue managing this business for cash optimisation. In order to achieve this, Philips Lighting has identified two key focus areas: (i) continue consolidating the industry in a declining

market by capturing volumes from smaller players exiting the market, and (ii) continue to exert cost leadership by downscaling the manufacturing footprint and leveraging our procurement scale.

Innovate in LED products commercially and technologically to outgrow the market

BG LED, BG Professional and BG Home strive for continued innovation in LED lighting products and tailored marketing approaches in order to outgrow the

market.

Lead the shift to lighting systems, building the largest connected installed base

Philips Lighting believes that connected lighting will be increasingly important in the general lighting market. Accordingly, the Company plans to play

a leading role in the industry shift to lighting systems in both the professional (BG Professional) and consumer (BG Home) markets. Philips Lighting strives to create the largest installed base of connected light points.

Capture adjacent value through new services business models

In BG Professional, Philips Lighting seeks to realize additional revenues from its installed base through value added service offerings. In order to

capture this value opportunity, Philips Lighting focuses on developing capabilities around data analytics and software, and developing new data-enabled life cycle, professional and managed services.

Be its customers’ best business partner locally, leveraging its global scale

Philips Lighting aims to utilize its long-standing local customer relations and global distribution network in conventional lamps and lamp electronics

to lead the transition to LED lighting, systems and services. The Company’s global reach and client proximity allow it to deliver product portfolios that address local market needs with both high volume products and differentiating

propositions.

Accelerate! on its operational excellence improvement journey

Philips Lighting has a strong track record of improving margins through footprint rationalization, bill-of-material cost savings, and productivity and

efficiency improvements, despite declining volumes in conventional products and price pressure in primarily LED lamps. Philips Lighting will continue to focus on operational excellence and has initiated various cost saving and improvement programs

to continue optimizing costs, including selling expense savings, IT rationalization and other internal overhead savings.

5

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED

STATES, CANADA, AUSTRALIA OR JAPAN OR ANY OTHER JURISDICTION IN VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION. PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THE PRESS RELEASE.

Outlook

Philips Lighting has established the medium and long term objectives

10

set forth below to serve as

measures of its operational and managerial performance on a Company-wide and at the level of each Business Group

11

.

Philips Lighting is targeting the following for the purpose of measuring operational and managerial performance on a Company-wide level:

|

|

●

|

|

Return to positive comparable sales growth

12

in the course of 2016

with comparable sales growth converging to the growth of the general lighting market in the medium term, driven by an increasing contribution of LED lamps, luminaires and systems and services, versus a diminishing proportion of conventional

lighting.

|

|

|

●

|

|

Maintain broadly constant adjusted gross margin

13

in line with

historical performance over the medium term, in which the transition to higher margin LED luminaires and systems is expected to offset the transition to lower margin LED lamps.

|

|

|

●

|

|

Gradually improve the adjusted EBITA ratio

14

to the low teens in

the medium term, driven by significant non-manufacturing cost savings.

|

|

|

●

|

|

Incur annual total restructuring costs of between approximately 1.5% and 2.0% of Philips Lighting’s annual total

sales in each financial year over the medium term, with the majority of these restructuring costs expected to relate to BG Lamps and BG Professional.

|

|

|

●

|

|

Incur annual total restructuring costs of between approximately 0.5% and 1.0% of Philips Lighting’s annual total

sales in each financial year over the long term.

|

|

|

●

|

|

Make net capital expenditures

15

as a percentage of sales of 1.0% to

1.5% in each financial year over the medium term, driven by the transition to a more asset-light outsourcing model; and

|

|

|

●

|

|

Achieve strong cash flow, with free cash flow excluding interest and taxes divided by EBITDA increasing to >75% in

the medium term.

|

For the purpose of measuring operational and managerial performance at the level of each Business Group, Philips

Lighting is targeting the following:

|

|

¡

|

|

Achieve comparable sales development in line with the conventional lamps market development in the medium term;

|

|

|

¡

|

|

Maintain adjusted EBITA ratio over the medium term, driven by pro-active restructuring and cost savings;

|

10

Philips Lighting has not defined by reference to specific periods the terms “medium term” or “long term”, and the financial objectives above are not to be read as indicating

that the Company is targeting or expecting such metrics in respect of any particular financial year.

11

The Company’s ability to achieve these financial objectives is subject to significant business,

economic and competitive uncertainties and contingencies, many of which are beyond the Company’s control, and have been developed based upon assumptions with respect to future business decisions and conditions that are subject to change. As a

result, the Company’s actual results may vary from the financial objectives set forth, and those variations may be material. The Company does not undertake to publish revised financial objectives to reflect events or circumstances existing or

arising after the date of the IPO or to reflect the occurrence of unanticipated events or circumstances.

12

Philips Lighting defines comparable sales growth as the period on comparable prior year period growth in sales excluding the effects of currency movements and changes in consolidation.

13

Philips Lighting defines adjusted gross margin as gross margin excluding restructuring

costs, acquisition-related charges and other significant incidental charges attributable to cost of sales.

14

Philips Lighting defines adjusted EBITA ratio as adjusted EBITA divided by sales (including intersegment sales for BGs). Adjusted EBITA ratio outlook reflects the annual royalty payment to

Royal Philips under the contractual separation arrangements between Philips Lighting and Royal Philips.

15

Philips Lighting defines net capital expenditures as additions of intangible assets, capital expenditures on property, plant and equipment and proceeds from disposal of property, plant and

equipment.

6

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED

STATES, CANADA, AUSTRALIA OR JAPAN OR ANY OTHER JURISDICTION IN VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION. PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THE PRESS RELEASE.

|

|

¡

|

|

Incur total restructuring costs in relation to BG Lamps of approximately

€

0.3 billion over the medium term, primarily in relation to manufacturing footprint rationalization and restructuring of R&D and sales activities;

|

|

|

¡

|

|

Philips Lighting currently does not expect to have to restructure the remaining BG Lamps production facilities over the

long term. However, if Philips Lighting were to decide to restructure all remaining BG Lamps production facilities, it estimates that additional restructuring costs would amount to approximately

€

0.2 billion; and

|

|

|

¡

|

|

Maintain constant free cash flow (including restructuring costs) as a percentage of sales over the medium term.

|

|

|

¡

|

|

Achieve comparable sales growth slightly above the market growth in the medium term; and

|

|

|

¡

|

|

Achieve gradual increase of adjusted EBITA ratio to the low teens in the medium term, driven by operating leverage as a

result of rapidly growing volumes and capitalizing Philips Lighting’s brand strength.

|

|

|

¡

|

|

Achieve comparable sales growth slightly above the growth of the market for professional lighting in the medium term,

driven by the fast growth of systems and services sales; and

|

|

|

¡

|

|

Achieve gradual increase of adjusted EBITA ratio to the low to mid-teens in the medium term, driven by further

performance improvements in North America and an improved product mix through increased sales of LED luminaires, systems and services which have a higher average gross margin.

|

|

|

¡

|

|

Achieve comparable sales growth above the growth of the consumer luminaires market in the medium term, driven by a

turnaround of consumer luminaires business and double-digit home systems growth; and

|

|

|

¡

|

|

Return to positive adjusted EBITA in the course of 2017.

|

|

|

¡

|

|

Incur annual unallocated Company costs in line with 2015 for the medium term.

|

Capital structure and dividend policy

Philips Lighting expects to have approximately

€

1,250

million of gross financial indebtedness upon completion of the Offering, and will also have an undrawn revolving credit facility for a maximum amount of

€

500 million. The Company is expected to have approximately

€

300 million of cash at the time of IPO and a net financial indebtedness to 2015 EBITDA ratio at the time of IPO of approximately 1.5x

17

, with the ability to reduce leverage over time.

Philips Lighting is targeting an annual dividend

pay-out ratio of 40% to 50% of continuing net income

18

to be paid out in cash. The Company expects to make its first dividend payment in 2017, which will be based on the results over the full year

2016.

16

Other includes certain costs, not reflected in the financial results of the Business Groups, relating to

centralized shared services with respect to, among other functions, legal, finance, human resources, business transformation, strategy and marketing, innovation and operations.

17

Philips Lighting realised EBITDA of

€

646 million

for the year ended 31 December 2015. The ratio assumes approximately

€

300 million of cash on balance sheet post completion of the Offering.

18

Continuing net income is defined as recurring net income from continuing operations, or net

income excluding discontinued operations and excluding material non-recurring items.

7

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED

STATES, CANADA, AUSTRALIA OR JAPAN OR ANY OTHER JURISDICTION IN VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION. PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THE PRESS RELEASE.

Leadership and governance

Philips Lighting has a highly skilled international senior management team with a broad range of relevant industry and functional knowledge and

geographic backgrounds. The Company, which will be converted into a public company (Philips Lighting N.V.) prior to Listing, will have a two-tier board structure consisting of the Board of Management and the Supervisory Board.

The Board of Management consists of Eric Rondolat (Chief Executive Officer) and Rene van Schooten (Chief Financial Officer and Leader of BG Lamps). Mr.

Rondolat has more than 25 years of international general management experience in the industrial sector, both in low voltage and lighting. Mr. van Schooten has extensive experience in both financial and general management, and a deep and thorough

knowledge of the lighting industry. The intention is to expand the Board of Management overtime with another member post completion of the IPO, such member to take the CFO role.

The Supervisory Board will consist of Arthur van der Poel (Chairman), Frans van Houten (Vice-Chairman), Rita Lane, Kees van Lede and Abhijit

Bhattacharya. All Supervisory Board members, with the exception of Messrs. Van Houten and Bhattacharya (the CEO and CFO of Royal Philips respectively), will be independent according to the Dutch corporate governance code.

Mr. van Lede is currently a member of the Supervisory Board of Royal Philips, from which he will resign on or before the day of settlement of the IPO.

His extensive experience as a Supervisory Director at Royal Philips and various other listed companies will benefit the Company during its transition into an independent, publicly listed company. The term of his appointment will expire at the end of

the Company’s annual general meeting to be held in 2018.

8

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED

STATES, CANADA, AUSTRALIA OR JAPAN OR ANY OTHER JURISDICTION IN VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION. PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THE PRESS RELEASE.

Financial highlights

The following table sets forth the key financial performance measures of Philips Lighting for the three months ended 31 March 2016 and 2015 and for

the years ended 31 December 2015, 2014 and 2013.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In

€

millions, except percentages

|

|

For the

three months ended

31 March

|

|

|

For the

year ended

31 December

|

|

|

|

|

2016

|

|

|

2015

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

|

|

|

|

|

|

|

Sales

|

|

|

1,702

|

|

|

|

1,727

|

|

|

|

7,465

|

|

|

|

6,981

|

|

|

|

7,129

|

|

|

|

|

|

|

|

|

|

Comparable sales growth (%)

(1)

|

|

|

(1.3)%

|

|

|

|

-

|

|

|

|

(3.5)%

|

|

|

|

(0.8)%

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

Adjusted gross margin ratio (%)

(2)

|

|

|

37.6%

|

|

|

|

36.8%

|

|

|

|

36.6%

|

|

|

|

36.9%

|

|

|

|

36.4%

|

|

|

|

|

|

|

|

|

|

Income from operations

|

|

|

71

|

|

|

|

55

|

|

|

|

331

|

|

|

|

41

|

|

|

|

213

|

|

|

|

|

|

|

|

|

|

EBITA

(3)

|

|

|

100

|

|

|

|

81

|

|

|

|

438

|

|

|

|

149

|

|

|

|

380

|

|

|

|

|

|

|

|

|

|

Adjusted EBITA

(4)

|

|

|

121

|

|

|

|

110

|

|

|

|

547

|

|

|

|

476

|

|

|

|

453

|

|

|

|

|

|

|

|

|

|

Adjusted EBITA ratio (%)

(5)

|

|

|

7.1%

|

|

|

|

6.4%

|

|

|

|

7.3%

|

|

|

|

6.8%

|

|

|

|

6.4%

|

|

|

|

|

|

|

|

|

|

EBITDA

(6)

|

|

|

149

|

|

|

|

128

|

|

|

|

646

|

|

|

|

422

|

|

|

|

603

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA

(7)

|

|

|

161

|

|

|

|

155

|

|

|

|

739

|

|

|

|

665

|

|

|

|

659

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA ratio (%)

(8)

|

|

|

9.5%

|

|

|

|

9.0%

|

|

|

|

9.9%

|

|

|

|

9.5%

|

|

|

|

9.2%

|

|

|

(1)

|

Philips Lighting defines comparable sales growth as the period-on-period growth in sales excluding the effects of

currency movements and changes in consolidation.

|

|

(2)

|

Philips Lighting defines adjusted gross margin ratio as gross margin, excluding restructuring costs, acquisition-related

charges and other significant incidental charges attributable to cost of sales, divided by sales.

|

|

(3)

|

Philips Lighting defines EBITA as income from operations excluding amortization related to acquired intangible assets.

|

|

(4)

|

Philips Lighting defines adjusted EBITA as Income from Operations (EBIT) excluding amortization and impairments of

acquired intangible assets and goodwill, restructuring costs, acquisition-related charges and other significant incidental charges attributable to cost of sales, selling expenses, R&D expenses and general and administrative expenses.

|

|

(5)

|

Philips Lighting defines adjusted EBITA ratio as adjusted EBITA divided by sales (or sales including intersegment sales

in case of adjusted EBITA ratio of Business Groups).

|

|

(6)

|

Philips Lighting defines EBITDA as income from operations excluding depreciation, amortization and impairments of

non-financial assets.

|

|

(7)

|

Philips Lighting defines adjusted EBITDA as EBITDA excluding restructuring costs, acquisition-related charges and other

significant incidental charges attributable to cost of sales, selling expenses, R&D expenses and general and administrative expenses.

|

|

(8)

|

Philips Lighting defines adjusted EBITDA ratio as adjusted EBITDA divided by sales.

|

The following table sets forth the key financial performance measures of Philips Lighting by Business Group for the three months ended 31 March

2016 and 2015 and for the years ended 31 December 2015, 2014 and 2013.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In

€

millions, except percentages

|

|

For the

three months ended

31 March

|

|

|

For the year ended

31 December

|

|

|

|

|

2016

|

|

|

2015

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

|

|

|

|

|

|

|

BG Lamps

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales

|

|

|

615

|

|

|

|

727

|

|

|

|

2,850

|

|

|

|

3,119

|

|

|

|

3,557

|

|

|

|

|

|

|

|

|

|

Comparable Sales Growth (%)

|

|

|

(14.5)%

|

|

|

|

-

|

|

|

|

(15.9)%

|

|

|

|

(9.5)%

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

Adjusted EBITA

|

|

|

125

|

|

|

|

123

|

|

|

|

463

|

|

|

|

506

|

|

|

|

601

|

|

|

|

|

|

|

|

|

|

% of sales incl. intersegment sales

|

|

|

20.1%

|

|

|

|

16.6%

|

|

|

|

16.0%

|

|

|

|

15.9%

|

|

|

|

16.4%

|

|

9

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED

STATES, CANADA, AUSTRALIA OR JAPAN OR ANY OTHER JURISDICTION IN VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION. PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THE PRESS RELEASE.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In

€

millions, except percentages

|

|

For the

three months ended

31 March

|

|

|

For the year ended

31 December

|

|

|

|

|

2016

|

|

|

2015

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

|

|

|

|

|

|

|

BG LED

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales

|

|

|

355

|

|

|

|

275

|

|

|

|

1,334

|

|

|

|

958

|

|

|

|

772

|

|

|

|

|

|

|

|

|

|

Comparable Sales Growth (%)

|

|

|

28.8%

|

|

|

|

-

|

|

|

|

27.0%

|

|

|

|

26.3%

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

Adjusted EBITA

|

|

|

20

|

|

|

|

5

|

|

|

|

74

|

|

|

|

14

|

|

|

|

(17)

|

|

|

|

|

|

|

|

|

|

% of sales incl. intersegment sales

|

|

|

5.2%

|

|

|

|

1.7%

|

|

|

|

5.2%

|

|

|

|

1.4%

|

|

|

|

(2.1)%

|

|

|

|

|

|

|

|

|

|

BG Professional

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales

|

|

|

601

|

|

|

|

610

|

|

|

|

2,757

|

|

|

|

2,420

|

|

|

|

2,308

|

|

|

|

|

|

|

|

|

|

Comparable Sales Growth (%)

|

|

|

(2.1)%

|

|

|

|

-

|

|

|

|

(0.7)%

|

|

|

|

3.3%

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

Adjusted EBITA

|

|

|

6

|

|

|

|

12

|

|

|

|

150

|

|

|

|

102

|

|

|

|

51

|

|

|

|

|

|

|

|

|

|

% of sales incl. intersegment sales

|

|

|

1.0%

|

|

|

|

2.0%

|

|

|

|

5.4%

|

|

|

|

4.2%

|

|

|

|

2.2%

|

|

|

|

|

|

|

|

|

|

BG Home

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales

|

|

|

124

|

|

|

|

112

|

|

|

|

515

|

|

|

|

482

|

|

|

|

490

|

|

|

|

|

|

|

|

|

|

Comparable Sales Growth (%)

|

|

|

10.7%

|

|

|

|

-

|

|

|

|

(0.4)%

|

|

|

|

(0.4)%

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

Adjusted EBITA

|

|

|

(12)

|

|

|

|

(14)

|

|

|

|

(57)

|

|

|

|

(46)

|

|

|

|

(57)

|

|

|

|

|

|

|

|

|

|

% of sales incl. intersegment sales

|

|

|

(9.7)%

|

|

|

|

(12.4)%

|

|

|

|

(11.0)%

|

|

|

|

(9.5)%

|

|

|

|

(11.6%)

|

|

|

|

|

|

|

|

|

|

Other

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales

|

|

|

7

|

|

|

|

3

|

|

|

|

9

|

|

|

|

2

|

|

|

|

2

|

|

|

|

|

|

|

|

|

|

Adjusted EBITA

|

|

|

(18)

|

|

|

|

(16)

|

|

|

|

(83)

|

|

|

|

(100)

|

|

|

|

(125)

|

|

Offering details

The Offering will be available to institutional and retail investors in the Netherlands and to certain qualified institutional investors in various

other jurisdictions. The Offering consists of a secondary sale of existing shares held by its current shareholder only. Royal Philips intends to sell at least 25% of the Philips Lighting shares in the IPO. After the IPO Royal Philips will retain a

majority holding with the aim to fully sell down over the next several years as Royal Philips will focus on its HealthTech businesses.

Upon IPO,

Royal Philips will receive the net proceeds from the Offering and if an over-allotment option is exercised, the net proceeds from the sale of the over-allotment shares. The Company will not receive any proceeds from the Offering.

Royal Philips will enter into customary lock-up arrangements with the underwriters in respect of the sale of its remaining Philips Lighting shares,

subject to certain customary exceptions.

/ / / /

10

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED

STATES, CANADA, AUSTRALIA OR JAPAN OR ANY OTHER JURISDICTION IN VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION. PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THE PRESS RELEASE.

About Royal Philips

Royal Philips (NYSE: PHG, AEX: PHIA) is a leading health technology company focused on improving people’s health and enabling better outcomes across

the health continuum from healthy living and prevention, to diagnosis, treatment and home care. Philips leverages advanced technology and deep clinical and consumer insights to deliver integrated solutions. The company is a leader in diagnostic

imaging, image-guided therapy, patient monitoring and health informatics, as well as in consumer health and home care. Philips’ wholly owned subsidiary Philips Lighting is the global leader in lighting products, systems and services.

Headquartered in the Netherlands, Philips posted 2015 sales of

€

24.2 billion and employs approximately 105,000 employees with sales and services in more

than 100 countries. News about Philips can be found at www.philips.com/newscenter.

Important Information

This document and the information contained herein are not for distribution in or into Canada, Australia or Japan. This document does not constitute, or

form part of, an offer to sell, or a solicitation of an offer to purchase, any securities (the “Shares”) of Philips Lighting Newco B.V. and, after its conversion, Philips Lighting N.V. (the “Company”) in the United States of

America (including its territories and possessions, any state of the United States of America and the District of Columbia) (the “United States”). The Shares of the Company have not been and will not be registered under the U.S. Securities

Act of 1933 (the “Securities Act”) and may not be offered or sold within the United States absent registration or an applicable exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. Any

sale in the United States of the securities mentioned in this communication will be made solely to “qualified institutional buyers” as defined in, and in reliance on, Rule 144A under the Securities Act.

This document does not constitute a prospectus within the meaning of the Dutch Financial Markets Supervision Act (Wet op het financieel toezicht) and

does not constitute an offer to acquire securities.

Forward-looking Information

This document contains forward looking statements that reflect Royal Philips’ and the Company’s intentions, beliefs, or current expectations

about and targets for the Company’s future results of operations, financial condition, liquidity, performance, prospects, anticipated growth, strategies and opportunities and the markets in which the Company operates, including with respect to

the completion and timing of the potential IPO and Listing and the subsequent sell down of the majority holding of Royal Philips. Forward-looking statements involve all matters that are not historical facts. Philips Lighting has tried to identify

forward-looking statements by using words as “may”, “will”, “would”, “should”, “expects”, “intends”, “estimates”, “anticipates”, “projects”,

“believes”, “could”, “hopes”, “seeks”, “plans”, “aims”, “objective”, “potential”, “goal” “strategy”, “target”, “continue”,

“annualized” and similar expressions or negatives thereof or other variations thereof or comparable terminology, or by discussions of strategy that involve risks and uncertainties. The forward-looking statements are based on the

Company’s beliefs, assumptions and expectations regarding future events and trends that affect the Company’s future performance, taking into account all information currently available to the Company, and are not necessarily indicative or

guarantees of future performance and results. These beliefs, assumptions and expectations can change as a result of possible events or factors, not all of which are known to the Company or are within the Company’s

11

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED

STATES, CANADA, AUSTRALIA OR JAPAN OR ANY OTHER JURISDICTION IN VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION. PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THE PRESS RELEASE.

control. If a change occurs, the Company’s business, financial condition, liquidity, results of operations, anticipated growth, strategies or opportunities may vary materially from those

expressed in, or suggested by, these forward-looking statements. In addition, the forward-looking estimates and forecasts reproduced in this document from third-party reports could prove to be inaccurate. A number of important factors could cause

actual results or outcomes to differ materially from those expressed in any forward-looking statement as a result of risks and uncertainties facing the Company, and its subsidiaries. Investors or potential investors should not place undue reliance

on the forward-looking statements in this document. In light of the possible changes to the Company’s beliefs, assumptions and expectations, the forward-looking events described in this document may not occur. Additional risks currently not

known to the Company or that the Company has not considered material as of the date of this document could also cause the forward-looking events discussed in this document not to occur. Forward-looking statements involve inherent risks and

uncertainties and speak only as of the date they are made. The Company undertakes no duty to and will not necessarily update any of the forward-looking statements in light of new information or future events, except to the extent required by

applicable law. The prospectus will also contain a detailed description of risks related to investing in Philips Lighting shares.

12

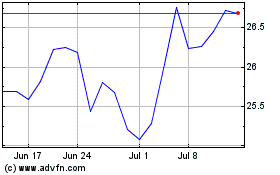

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Mar 2024 to Apr 2024

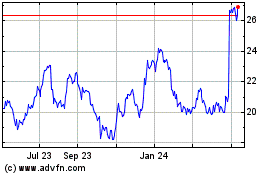

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Apr 2023 to Apr 2024