SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of April, 2016

Commission File Number 1-15106

PETRÓLEO BRASILEIRO S.A. - PETROBRAS

(Exact name of registrant as specified in its charter)

Brazilian Petroleum Corporation - PETROBRAS

(Translation of Registrant's name into English)

Avenida República do Chile, 65

20031-912 - Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

RESOLUTIONS OF THE EXTRAORDINARY AND ORDINARY GENERAL MEETINGS

Rio de Janeiro, April 28th, 2016, Petróleo Brasileiro S.A. - Petrobras hereby informs that the Ordinary and Extraordinary General Meetings, held this day, at 03:00 pm, in the main auditorium of the Company’s Head office building, at Avenida República do Chile 65 – 1st floor, in the city of Rio de Janeiro (RJ), ruled, by majority of the votes, and approved as follows:

EXTRAORDINARY GENERAL MEETING

|

I.

|

Amendment proposal of Petrobras’s By-Law in order to:

|

|

|

(i)

|

Amend Article 1 with the inclusion of defined terms: "Petrobras" and "Company";

|

|

|

(ii)

|

Amend the wording of Article 6, suppressing the provision of rules established by the Board of Directors on stock payment in case of authorized capital increase, since there is no provision of "authorized capital" in Petrobras’ s By-Law;

|

|

|

(iii)

|

Amend the use of the word "subsidiary" to "wholly owned", "controlled" and "associates" throughout the By- Law in accordance with Law 6404 / 76 and the Civil Code of 2002. Such adjustments are reflected in articles 14, 15, 16, 20, 30, 36, 40 and 50 of the proposed By-Law;

|

|

|

(iv)

|

Amend the wording of Article 16 to improve the text with regard to the independence of the governing bodies and patrimonial autonomy of the companies in the Petrobras System;

|

|

|

(v)

|

Amend the lead paragraph of Article 18 to include the new term of office of members of Board of Directors, from one (1) year to two (2) years, and exclude the words "members and their respective alternates" of writing, taking off the provision of an alternate member of Board;

|

|

|

(vi)

|

Exclude paragraph 2 of article 18 to remove the provision of alternate members to the Board of Directors;

|

|

|

(vii)

|

Amend Article 18 to include paragraphs, which set limits for the reappointment of members of Board of Directors, as a good corporate governance practice and prohibit the holding of the Chairman of the Board of Directors and President of the Company positions by the same person;

|

|

|

(viii)

|

Amend article 19 to exclude provision of alternate members of Board of Directors;

|

|

|

(ix)

|

Amend article 19 to exclude mention of transition rule included in art. 8, paragraph 4 of Law 10303 / 2001;

|

|

|

(x)

|

Amend Article 20, lead paragraph, to improve the wording which deals about the choice of CEO and change the number of Executive Directors from 7 (seven) to six (6), according to the new management and governance model of Petrobras;

|

|

|

(xi)

|

Amend the wording of paragraph 1 of Article 20 to replace the word "Officers " by "members of the Executive Board";

|

|

|

(xii)

|

Amend the wording of paragraph 2 of article 20 to provide that the holding of management positions by Petrobras' Executive Board members in wholly-owned subsidiaries, subsidiaries and affiliated companies shall depend on justification and approval by the Board of Directors, as well as to provide the possibility of such members to take office exceptionally in the Board of Directors in other companies;

|

|

|

(xiii)

|

Exclude paragraph 3 of Article 20 to relocate the provisions to paragraph 1 of Article 27 of Petrobras By- Law;

|

|

|

(xiv)

|

Amend Article 21, transferring the final part of its content to the new paragraph 1 of the same instrument and amend the wording of paragraph 2;

|

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

|

Investor Relations Department

I

e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – B – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies.

A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2013, and the Company’s other filings with the U.S. Securities and Exchange Commission.

|

|

(xv)

|

Amend the wording of Article 22, lead paragraph, to replace the term "Officers" by "members of the Executive Board";

|

|

|

(xvi)

|

Amend Paragraph 1 of Article 22 to provide for other types of representations required by legal regulations to be made at the time of the investiture of the managers, especially the rules of the Comissão de Valores Mobiliários (CVM) and the Company; and also to amend the reference to the Article included in the wording;

|

|

|

(xvii)

|

Exclude lead paragraph of Article 24, to amend the removal of provision of an alternate Board of Directors member of the Petrobras by-Law, moving the wording of the sole paragraph to the lead paragraph of Article 24;

|

|

|

(xviii)

|

Exclude from the wording of the lead paragraph of Article 25, the word "effective or alternate" to adapt it to the removal of the provision of alternate Board of Directors member from the Petrobras by-Law;

|

|

|

(xix)

|

Amend the wording of paragraph 3 and exclude paragraph 4 of Article 25 so that the rule of replacement from the Board of Directors member elected by the employees may comply with the provisions of paragraph 3 of Article 25, thus maintaining the term uniformity of all members;

|

|

|

(xx)

|

Amend Article 26 to include that the Company may also be represented in court or out of court individually by its President;

|

|

|

(xxi)

|

Amend the wording of the lead paragraph of Article 27 regarding the period limit of absence from the tenure as CEO and Executive Officers;

|

|

|

(xxii)

|

Amend Paragraph 1 of Article 27 to adopt the terminology "paid leave", of CEO and Executive Officers, previously subject to paragraph 3 of Article 20 and renumbering the paragraphs and replacing the words "Officer" by "Executive Officer " and "Officers" by "Executive Officers";

|

|

|

(xxiii)

|

Amend Article 28, to provide the period and assumptions of further impediments to the exercise of the position of Executive Officer, Board of Director member and Fiscal Council member at Petrobras, regulating issues related to compensation;

|

|

|

(xxiv)

|

Change numbering of current Article 28 to 29 and amend its wording and its items, and add the word "risks" to item VII and including item X to include the powers of the Board of Directors to approve the plans providing for admission, career, succession, benefits and disciplinary regime of Petrobras employees;

|

|

|

(xxv)

|

Change numbering of current Article 29 to 30; amend wording; renumber and include items to address the responsibility of the Board of Directors for approval of the appointment and dismissal of Executive Managers; to amend the wording of the instrument to CVM Instruction 567/2015; to approve integrity and compliance criteria applicable to the election of members of the Executive Board and the appointment of the Executive Managers as well as to regulate, expressly, the residual powers of the Board of Directors;

|

|

|

(xxvi)

|

Change numbering of current Article 30 to 31;

|

|

|

(xxvii)

|

Change numbering of current Article 31 to 32 and amend the wording of Paragraph 1 to replace "video conference" for "videoconference" and paragraph 3 to replace the word "Officers" by "members of the

Executive Board";

|

|

|

(xxviii)

|

Change numbering of current Article 32 to 33 and amend the wording to include the members of the

Executive Board, according to the new management and governance model;

|

|

|

(xxix)

|

Change numbering of current Article 33 to 34 and amend the wording; Include items "e" and "f" to item I to

determine the competence of the Executive Board for review and submission to the Board of Directors of

appointment of Executive Managers and admission plans, career, succession, benefits and disciplinary

regime of Petrobras employees; exclude and include competence rules to consider the new management

and governance model of Petrobras;

|

|

|

(xxx)

|

Change numbering of current Article 34 to 35 and amend the wording of the lead paragraph; amend the

wording of sole Paragraph to provide the creation of Statutory Technical Committees to advise members of

|

|

|

|

|

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

|

Investor Relations Department

I

e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – B – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies.

A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2013, and the Company’s other filings with the U.S. Securities and Exchange Commission.

|

|

|

the Executive Board, consisting of Executive Managers, pursuant to the rule of Article 160 of the Law of Corporations - Law 6404 / 76;

|

|

|

(xxxi)

|

Exclude current article 35, due to the change of the competence rules of the Executive Board and its members, including the new model of management and governance of Petrobras;

|

|

|

(xxxii)

|

Amend Article 36 to provide individual competences of the members of the Executive Board as proposed by the management, except for section VIII, which wording was approved as follows: "VIII - guide and promote the implementation of policies , guidelines and rules of the Company's Social Responsibility" ;

|

|

|

(xxxiii)

|

Change numbering of current Article 36 to 37;

|

|

|

(xxxiv)

|

Change numbering of current Article 37 to 38 and include Sole Paragraph to provide submission of management acts report of the Executive Board to the Board of Directors, in compliance to new model of management and governance of Petrobras;

|

|

|

(xxxv)

|

Exclude the current article 38, due to competence issues of Petrobras President have been transferred to the new Article 36, paragraph 1;

|

|

|

(xxxvi)

|

Amend the wording of item II and exclude items III and V of Article 40 to simplify the wording regarding the change in the capital ownership; in addition to the exclusion of the current item XII, so that the remuneration of management may be determined at the general meeting, according to the wording of Article 41, thus changing the numbering of paragraphs;

|

|

|

(xxxvii)

|

Exclude sole paragraph of Article 41 to adapt it to the removal of provision of alternate member of Board of Directors from the Petrobras by-Law;

|

|

|

(xxxviii)

|

Amend the wording of item VI of Article 46 to replace the word "Board" by "Executive Board";

|

|

|

(xxxix)

|

Amend the wording of paragraph 1 of Article 49 to provide for the competence of the Board of Directors to assign to technicians or experts, who are not part of the Company's permanent staff, the functions of Senior Management, related to them; include Paragraph 2 of Article 49 to provide for the competence of the Board of Directors, upon proposal and justification of the Executive Board, to assign to technicians or experts who are not part of the Company's permanent staff, functions of Senior Management, linked to the Executive Board; change numbering of former paragraph 2 to paragraph 3;

|

|

|

(xl)

|

Amend the wording of Article 54 to replace the word "sociedade" for "Company";

|

|

|

(xli)

|

Amend the wording of Article 56 to replace the words "on account of profit sharing" by "per variable compensation";

|

|

|

(xlii)

|

Exclude Article 61, which deals with restrictions on trading of securities, since its wording complied with the repealed CVM Instruction No. 31/84, replaced by CVM Instruction No. 358/02.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

II.

Consolidation of Petrobras´s By-Law to reflect the approved changes;

III.

Adjustment of Petrobras waiver to subscription of new shares issued by Logum Logística S.A. on March 09,2016

ORDINARY GENERAL MEETING

I.

To analise management accounts, discuss and vote Report, Financial Statements and Fiscal Board's Report of Fiscal Year of 2015;

II.

Election of the following members of the Board of Directors, with mandate of two years:

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

|

Investor Relations Department

I

e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – B – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies.

A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2013, and the Company’s other filings with the U.S. Securities and Exchange Commission.

Representing the Majority Shareholders

Mr. Luiz Nelson Guedes de Carvalho

Mr. Aldemir Bendine

Mr. Luciano Galvão Coutinho

Mr. Jerônimo Antunes

Mr. Segen Farid Estefen

Mr. Francisco Petros Oliveira Lima Papathanasiadis

Mr. Durval José Soledade Santos

Representing the Minority Ordinary Shareholders

Mr. Walter Mendes De Oliveira Filho

Representing the Preferred Shareholders

Mr. Guilherme Affonso Ferreira

Representing the Employees of Petrobras

Mrs. Betânia Rodrigues Coutinho

III.

Election of the Mr. Luiz Nelson Guedes de Carvalho as

Chairman of the Board of Directors

.

IV.

Election of the following as Members of the Fiscal Council and their respective substitutes:

Representing the Majority Shareholders

Mr. William Baghdassarian – as Member and Mr. Paulo José dos Reis Souza as deputy;

Mrs. Marisete Fátima Dadald Pereira – as Member and Mrs. Agnes Maria de Aragão da Costa as deputy;

Mr. Luiz Augusto Fraga Navarro de Britto Filho – as Member and Mr. César Acosta Rech as deputy.

Representing the Minority Ordinary Shareholders

Mr.

Reginaldo Ferreira Alexandre

– as Member and Mr.

Mário Cordeiro Filho

as deputy;

Representing the Preferred Shareholders

Mr.

Walter Luis Bernardes Albertoni

– as Member and Mr.

Roberto Lamb

as deputy;

V.

Determination of the overall compensation of Management and the members of the Fiscal Council, observing the following items:

a. To establish the overall compensation of Petrobras’ Management for the period between April of this year and March of next year at up to twenty-eight million, seven hundred and seventy-five thousand, nine hundred and fifty-seven reais and seventy-five centavos (R$28,775,957.75);

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

|

Investor Relations Department

I

e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – B – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies.

A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2013, and the Company’s other filings with the U.S. Securities and Exchange Commission.

b. To recommend compliance with the individual limits defined by the DEST, recognizing its responsibility for determining these limits for the 12-month period, by category and position, respecting the overall limit defined in item “a”;

c. To delegate the power to authorize the effective monthly payment of the compensation to the Board of Directors, respecting the overall and individual limits envisaged in items "a" and "b", respectively;

d. To establish the monthly compensation of the Board of Directors and the sitting members of the Fiscal Council at one tenth of the average maximum monthly compensation of the members of the Board of Executive Officers, excluding vacation pay and benefits;

e. To expressly forbid the transfer of any benefits eventually granted to the Company’s employees through the formalization of the Collective Bargaining Agreement (ACT) on their respective base date;

f. To forbid the payment of any item of compensation to Management not resolved by this meeting, including benefits of any nature and representation allowances, pursuant to Law 6404/76, art. 152; and

g. To condition the payment of the 40- day period after leaving strategic public positions during which the former holders of such posts are prevented from accepting a position in the private sector on approval by the Public Ethics Commission of the President’s Office - CEP/PR, pursuant to the prevailing legislation.

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

|

Investor Relations Department

I

e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – B – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies.

A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2013, and the Company’s other filings with the U.S. Securities and Exchange Commission.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

PETRÓLEO BRASILEIRO S.A--PETROBRAS

|

|

|

|

|

|

By:

|

/

S

/ Ivan de Souza Monteiro

|

|

|

|

Ivan de Souza Monteiro

Chief Financial Officer and Investor Relations Officer

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended (Exchange Act) that are not based on historical facts and are not assurances of future results. These forward-looking statements are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results o f operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

All forward-looking statements are expressly qualified in their entirety by this cautionary statement, and you should not place reliance on any forward-looking statement contained in this press release. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

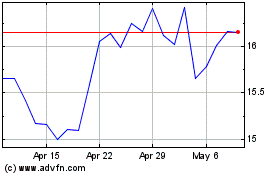

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

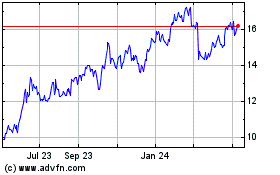

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Apr 2023 to Apr 2024