SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2016

Commission File Number: 000-22320

TRINITY

BIOTECH PLC

(Name of Registrant)

IDA Business

Park

Bray, Co. Wicklow

Ireland

(Address of

Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of

Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

Press Release dated March 3, 2016

|

|

|

|

|

| Contact: |

|

Trinity Biotech plc |

|

Lytham Partners LLC |

|

|

Kevin Tansley |

|

Joe Diaz, Joe Dorame & Robert Blum |

|

|

(353)-1-2769800 |

|

602-889-9700 |

|

|

E-mail: kevin.tansley@trinitybiotech.com |

|

|

Trinity Biotech Announces Results for Q4 and Fiscal Year 2015

Annual Dividend Suspended, Share Buyback Program Announced

DUBLIN, Ireland (March 3, 2016)…. Trinity Biotech plc (Nasdaq: TRIB), a leading developer and manufacturer of diagnostic products for the

point-of-care and clinical laboratory markets, today announced results for fiscal year 2015 and the quarter ended December 31, 2015. The Company also announced that it is suspending its annual dividend and initiating a share buyback program.

Fiscal Year 2015 Results

Total revenues for

fiscal year 2015 were $100.2m versus $104.9m in 2014, a decrease of 4.5% year on year. This was due to the impact of the strengthening US dollar on the Company’s foreign currency denominated revenues. Other factors included lower Lyme sales due

to weather related factors and unusually low HIV sales in Q2. These were partly offset by underlying growth in Premier and Immco revenues for the year.

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Full Year

2014 |

|

|

Full Year

2015 |

|

|

Full Year

2015 vs 2014 |

|

| |

|

US$’000 |

|

|

US$’000 |

|

|

% |

|

| Point-of-Care |

|

|

20,036 |

|

|

|

18,810 |

|

|

|

(6.1 |

%) |

| Clinical Laboratory |

|

|

84,835 |

|

|

|

81,385 |

|

|

|

(4.1 |

%) |

| Total |

|

|

104,871 |

|

|

|

100,195 |

|

|

|

(4.5 |

%) |

Point-of-care revenues decreased from $20.0m in 2014 to $18.8m in 2015, which represents a decrease of 6.1%. This was due to

lower HIV sales in Africa in Q2, due to unusual ordering patterns. These revenues immediately rebounded in Q3 and Q4 to normal levels.

Meanwhile,

Clinical Laboratory revenues were $81.4m, a decrease of 4.1% versus 2014. The impact of the abovementioned strengthening of the dollar was largely confined to Clinical Laboratory revenues. In particular, the weakness of the Euro, Brazilian Real,

Canadian dollar and Sterling, all of which represent significant currencies in which the Company invoices sales, resulted in a reduction in our US dollar denominated revenues. This was accentuated by weakness in the currencies of other countries

such as Turkey, Russia and a number of South American countries where the Company invoices in US dollars. In such countries the dollar’s strength served to erode our competitiveness, which had a detrimental effect on our revenues.

The other key financial results for 2015 were as follows:

| |

• |

|

Operating profit for the year was $13.4m which represents an operating margin of 13.4%. |

| |

• |

|

Profit after tax for the year was $21.8m though this includes non-cash financial income of $12.5m recognised in relation to the Company’s convertible loan notes. Excluding this, profit after tax would have been

$9.3m compared with $17.2m in 2014. |

| |

• |

|

Basic EPS for the year was 94.1 cents (40.2 cents excluding the impact of non-cash financial income) versus 75.7 cents in 2014. |

| |

• |

|

Diluted EPS was 46.2 cents compared to 72.6 cents in 2014. |

The effective tax charge for the year (which

excludes the impact of non-cash financial income) was 10.4%. This low effective rate of tax is due to the competitive corporation tax rate in Ireland and the availability of research and development tax credits in a number of jurisdictions.

EBITDA before share option expense for the year was $20.7m.

Quarter 4 Results

Total revenues for Q4, 2015 were

$24.9m which compares to $26.7m in Q4, 2014, a decrease of 6.5%.

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2014

Quarter 4 |

|

|

2015

Quarter 4 |

|

|

Increase/

(decrease) |

|

| |

|

US$’000 |

|

|

US$’000 |

|

|

% |

|

| Point-of-Care |

|

|

5,451 |

|

|

|

5,436 |

|

|

|

(0.3 |

%) |

| Clinical Laboratory |

|

|

21,229 |

|

|

|

19,501 |

|

|

|

(8.1 |

%) |

| Total |

|

|

26,680 |

|

|

|

24,937 |

|

|

|

(6.5 |

%) |

Point-of-Care revenues for Q4, 2015 were broadly flat compared to Q4, 2014.

Clinical Laboratory revenues decreased from $21.2m to $19.5m, a decrease of 8.1% compared to Q4, 2014, a decrease which is largely due to the impact of

exchange rate movements.

Gross margins for the quarter were 43.2%, and this is consistent with Q4 having the lowest gross margin in the year, due to

seasonality of certain products. This is lower than the gross margin noted in Q4, 2014 of 47.5%, largely reflecting the impact of foreign currency movements.

Research and Development expenses were $1.5m. Selling, General and Administrative (SG&A) expenses decreased from $7.2m to $6.0m also partly due to foreign

currency movements.

The combination of lower revenues and gross margins resulted in a reduction in operating profit from $4.3m to $3.1m. Meanwhile,

profit after tax for the quarter was $2.8m, which represents an EPS for the quarter of 12.1 cents or 10.5 cents on a fully diluted basis. EBITDA before share option expense for the quarter was $4.8m.

Cardiac Update

In December, 2015 we submitted our 510(k) application for our high sensitivity cardiac Troponin-I assay and Meritas Point-of-Care Analyzer to the FDA. The

application was supported by three clinical studies:

| |

• |

|

determination of the 99th percentile Upper Reference Limit; |

| |

• |

|

point-of-care precision performance; and |

| |

• |

|

the validation of clinical performance of the Meritas system with subjects presenting to Emergency Departments with symptoms suggestive of Acute Coronary Syndrome (ACS). |

In the ACS clinical study, we enrolled subjects at 14 different sites in the USA. Results were adjudicated by a panel of cardiologists according to the Third

Universal Definition of Myocardial Infarction (MI), which includes both Type-I and Type-II MI subjects. We were pleased to report sensitivity at admission of 78% for plasma and 66% for whole blood. These results are better than we obtained with the

clinical studies supporting the test’s CE Mark. The 510(k) application is currently under FDA review.

Clinical trials are currently in progress for

our second cardiac marker assay, B-type Natriuretic Protein (BNP). We have 10 clinical sites that are actively enrolling and to date we have obtained approximately 50% of the patient samples we require. Enrollment is expected to be completed in Q2,

2016, and we are anticipating submission of our BNP 510(k) application to the FDA in Q3, 2016.

Share Buyback and Suspension of Dividend

The Company’s Board of Directors has authorized the commencement of a share repurchase program. Based on a resolution passed at its most

recent AGM, the Company is currently authorized to repurchase up to 10% of its own shares (approximately 2.3m ADRs). The Company’s ability to buy back shares will be determined by available liquidity and general market conditions and will be

carried out in accordance with applicable securities laws and regulations.

In conjunction with its initiation of a share repurchase program, the Company

has decided to suspend the payment of annual dividends. It is felt that given the Company’s current share price, share repurchases represent a better deployment of capital.

Comments

Commenting on the results, Kevin Tansley, Chief

Financial Officer, said “Revenues for Q4, 2015 were $24.9m, which resulted in an operating profit of $3.1m and profit after tax of $2.8m. This equates to a basic EPS of 12.1 cents or 10.5 cents on a fully diluted basis.

Total revenues in 2015 decreased from $104.9m to $100.2m and this decrease was effectively driven by exchange rate movements. These exchange rate movements

also contributed to a 2% reduction in gross margins. As a direct result, operating profits for the year were $13.4m, $4.6m lower than in 2014. In addition, we incurred interest charges of $3.5m on our convertible loan notes which were issued during

the year. Overall profit for the year was $21.8m, though if we were to exclude the non-cash income recognized on the convertible loan notes the profit for the year would have been $9.3m.”

Ronan O’Caoimh, CEO of Trinity said “During 2015 we operated in a very challenging economic environment. The strength of the US dollar against a

range of currencies had a very significant adverse impact on our foreign currency denominated revenues. Meanwhile, in many of the countries where we actually sell in US dollars, the strength of the dollar negatively impacted on our competitiveness

resulting in a knock-on effect on both revenues and margins.

We announced the submission of our high sensitivity cardiac Troponin-I assay and Meritas Point-of-Care Analyzer

to the FDA in December, 2015. This is the culmination of over three years work completing the development of both the test and associated analyzer as well as running extensive clinical trials in the USA. We were very pleased with the data that was

submitted and the FDA is currently reviewing the submission. We expect to be liaising with them closely in the months ahead as the review process continues. Meanwhile, the trials for the second test on the Meritas platform, BNP, are progressing well

and we expect to submit this to the FDA in Q3, 2016.

Today, we are also announcing that we are initiating a share buyback program. At our current share

price and in the absence of suitable acquisition targets at present, we believe that buying Trinity’s shares constitutes a sensible use of capital. At the same time, we have decided to suspend our annual dividend payment. We feel that given our

size, level of R&D expenditure and the stage of the Company’s development it is not appropriate to be paying dividends.”

Litigation

Reform Act of 1995. Investors are cautioned that such forward-looking statements involve risks and uncertainties including, but not limited to, the results of research and development efforts, the effect of regulation by the United States Food and

Drug Administration and other agencies, the impact of competitive products, product development commercialisation and technological difficulties, and other risks detailed in the Company’s periodic reports filed with the Securities and Exchange

Commission.

Trinity Biotech develops, acquires, manufactures and markets diagnostic systems, including both reagents and instrumentation, for the

point-of-care and clinical laboratory segments of the diagnostic market. The products are used to detect infectious diseases and to quantify the level of Haemoglobin A1c and other chemistry parameters in serum, plasma and whole blood. Trinity

Biotech sells direct in the United States, Germany, France and the U.K. and through a network of international distributors and strategic partners in over 75 countries worldwide. For further information please see the Company’s website:

www.trinitybiotech.com.

Trinity Biotech plc

Consolidated Income Statements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (US$000’s except share data) |

|

Three Months

Ended Dec 31,

2015

(unaudited) |

|

|

Three Months

Ended Dec 31,

2014

(unaudited) |

|

|

Year

Ended Dec 31,

2015

(unaudited) |

|

|

Year

Ended Dec 31,

2014

(unaudited) |

|

| Revenues |

|

|

24,937 |

|

|

|

26,680 |

|

|

|

100,195 |

|

|

|

104,871 |

|

|

|

|

|

|

| Cost of sales |

|

|

(14,170 |

) |

|

|

(14,014 |

) |

|

|

(53,950 |

) |

|

|

(54,524 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

10,767 |

|

|

|

12,666 |

|

|

|

46,245 |

|

|

|

50,347 |

|

| Gross profit % |

|

|

43.2 |

% |

|

|

47.5 |

% |

|

|

46.2 |

% |

|

|

48.0 |

% |

|

|

|

|

|

| Other operating income |

|

|

65 |

|

|

|

85 |

|

|

|

288 |

|

|

|

424 |

|

|

|

|

|

|

| Research & development expenses |

|

|

(1,508 |

) |

|

|

(961 |

) |

|

|

(5,068 |

) |

|

|

(4,290 |

) |

| Selling, general and administrative expenses |

|

|

(6,009 |

) |

|

|

(7,238 |

) |

|

|

(26,475 |

) |

|

|

(26,964 |

) |

| Indirect share based payments |

|

|

(184 |

) |

|

|

(255 |

) |

|

|

(1,541 |

) |

|

|

(1,478 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating profit |

|

|

3,131 |

|

|

|

4,297 |

|

|

|

13,449 |

|

|

|

18,039 |

|

|

|

|

|

|

| Financial income |

|

|

132 |

|

|

|

48 |

|

|

|

431 |

|

|

|

96 |

|

| Financial expenses |

|

|

(1,189 |

) |

|

|

(34 |

) |

|

|

(3,483 |

) |

|

|

(69 |

) |

| Non-cash financial income |

|

|

975 |

|

|

|

— |

|

|

|

12,480 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net financing (expense) / income |

|

|

(82 |

) |

|

|

14 |

|

|

|

9,428 |

|

|

|

27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit before tax |

|

|

3,049 |

|

|

|

4,311 |

|

|

|

22,877 |

|

|

|

18,066 |

|

|

|

|

|

|

| Income tax expense |

|

|

(223 |

) |

|

|

(187 |

) |

|

|

(1,081 |

) |

|

|

(853 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit for the period |

|

|

2,826 |

|

|

|

4,124 |

|

|

|

21,796 |

|

|

|

17,213 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per ADR (US cents) |

|

|

12.1 |

|

|

|

18.0 |

|

|

|

94.1 |

|

|

|

75.7 |

|

|

|

|

|

|

| Earnings per ADR excluding non-cash financial income (US cents) |

|

|

8.0 |

|

|

|

18.0 |

|

|

|

40.2 |

|

|

|

75.7 |

|

|

|

|

|

|

| Diluted earnings per ADR (US cents) |

|

|

10.5 |

|

|

|

17.6 |

|

|

|

46.2 |

|

|

|

72.6 |

|

|

|

|

|

|

| Weighted average no. of ADRs used in computing basic earnings per ADR |

|

|

23,259,669 |

|

|

|

22,916,417 |

|

|

|

23,161,773 |

|

|

|

22,749,726 |

|

| Weighted average no. of ADRs used in computing diluted earnings per ADR |

|

|

28,690,599 |

|

|

|

23,482,268 |

|

|

|

27,407,793 |

|

|

|

23,717,747 |

|

Trinity Biotech plc

Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Dec 31,

2015 US$ ‘000

(unaudited) |

|

|

Sept 30,

2015 US$ ‘000

(unaudited) |

|

|

Dec 31,

2014 US$ ‘000

(unaudited) |

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-current assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Property, plant and equipment |

|

|

20,659 |

|

|

|

19,198 |

|

|

|

17,877 |

|

| Goodwill and intangible assets |

|

|

161,324 |

|

|

|

156,326 |

|

|

|

145,024 |

|

| Deferred tax assets |

|

|

12,792 |

|

|

|

10,370 |

|

|

|

9,798 |

|

| Other assets |

|

|

954 |

|

|

|

1,040 |

|

|

|

1,091 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total non-current assets |

|

|

195,729 |

|

|

|

186,934 |

|

|

|

173,790 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Inventories |

|

|

35,125 |

|

|

|

36,882 |

|

|

|

33,517 |

|

| Trade and other receivables |

|

|

25,602 |

|

|

|

27,153 |

|

|

|

26,080 |

|

| Income tax receivable |

|

|

550 |

|

|

|

119 |

|

|

|

351 |

|

| Cash and cash equivalents |

|

|

101,953 |

|

|

|

104,289 |

|

|

|

9,102 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

163,230 |

|

|

|

168,443 |

|

|

|

69,050 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL ASSETS |

|

|

358,959 |

|

|

|

355,377 |

|

|

|

242,840 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EQUITY AND LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

| Equity attributable to the equity holders of the parent |

|

|

|

|

|

|

|

|

|

|

|

|

| Share capital |

|

|

1,220 |

|

|

|

1,216 |

|

|

|

1,204 |

|

| Share premium |

|

|

15,526 |

|

|

|

14,560 |

|

|

|

12,422 |

|

| Accumulated surplus |

|

|

201,951 |

|

|

|

198,882 |

|

|

|

183,375 |

|

| Other reserves |

|

|

(4,809 |

) |

|

|

(3,661 |

) |

|

|

(26 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total equity |

|

|

213,888 |

|

|

|

210,997 |

|

|

|

196,975 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax payable |

|

|

1,163 |

|

|

|

951 |

|

|

|

785 |

|

| Trade and other payables |

|

|

18,874 |

|

|

|

18,694 |

|

|

|

21,196 |

|

| Provisions |

|

|

75 |

|

|

|

75 |

|

|

|

75 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

20,112 |

|

|

|

19,720 |

|

|

|

22,056 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

| Exchangeable senior note payable |

|

|

98,044 |

|

|

|

99,069 |

|

|

|

— |

|

| Other payables |

|

|

2,096 |

|

|

|

3,569 |

|

|

|

2,370 |

|

| Deferred tax liabilities |

|

|

24,819 |

|

|

|

22,022 |

|

|

|

21,439 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total non-current liabilities |

|

|

124,959 |

|

|

|

124,660 |

|

|

|

23,809 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES |

|

|

145,071 |

|

|

|

144,380 |

|

|

|

45,865 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL EQUITY AND LIABILITIES |

|

|

358,959 |

|

|

|

355,377 |

|

|

|

242,840 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trinity Biotech plc

Consolidated Statement of Cash Flows

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (US$000’s) |

|

Three Months

Ended Dec 31,

2015

(unaudited) |

|

|

Three Months

Ended Dec 31,

2014

(unaudited) |

|

|

Year

Ended Dec 31,

2015

(unaudited) |

|

|

Year

Ended Dec 31,

2014

(unaudited) |

|

| Cash and cash equivalents at beginning of period |

|

|

104,289 |

|

|

|

8,949 |

|

|

|

9,102 |

|

|

|

22,317 |

|

| Operating cash flows before changes in working capital |

|

|

5,574 |

|

|

|

5,048 |

|

|

|

19,853 |

|

|

|

22,027 |

|

| Changes in working capital |

|

|

234 |

|

|

|

3,596 |

|

|

|

(7,157 |

) |

|

|

(6,512 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash generated from operations |

|

|

5,808 |

|

|

|

8,644 |

|

|

|

12,696 |

|

|

|

15,515 |

|

| Net Interest and Income taxes received/(paid) |

|

|

79 |

|

|

|

(53 |

) |

|

|

(361 |

) |

|

|

237 |

|

| Capital Expenditure & Financing (net) |

|

|

(5,980 |

) |

|

|

(8,438 |

) |

|

|

(21,604 |

) |

|

|

(23,937 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Free cash flow |

|

|

(93 |

) |

|

|

153 |

|

|

|

(9,269 |

) |

|

|

(8,185 |

) |

| Payment of HIV-2 licence fee |

|

|

— |

|

|

|

— |

|

|

|

(1,112 |

) |

|

|

— |

|

| 30 year Convertible Note proceeds, net of fees |

|

|

(45 |

) |

|

|

— |

|

|

|

110,529 |

|

|

|

— |

|

| 30 year Convertible Note interest payment |

|

|

(2,198 |

) |

|

|

— |

|

|

|

(2,198 |

) |

|

|

— |

|

| Dividend payment |

|

|

— |

|

|

|

— |

|

|

|

(5,099 |

) |

|

|

(5,030 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of period |

|

|

101,953 |

|

|

|

9,102 |

|

|

|

101,953 |

|

|

|

9,102 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

| TRINITY BIOTECH PLC |

| (Registrant) |

|

|

| By: |

|

/s/ Kevin Tansley |

|

|

Kevin Tansley Chief Financial

Officer |

Date: March 7, 2016.

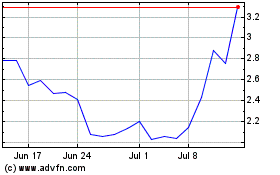

Trinity Biotech (NASDAQ:TRIB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trinity Biotech (NASDAQ:TRIB)

Historical Stock Chart

From Apr 2023 to Apr 2024