SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2016

(Commission File No. 001-32221) ,

GOL LINHAS AÉREAS INTELIGENTES S.A.

(Exact name of registrant as specified in its charter)

GOL INTELLIGENT AIRLINES INC.

(Translation of Registrant's name into English)

Praça Comandante Linneu Gomes, Portaria 3, Prédio 24

Jd. Aeroporto

04630-000 São Paulo, São Paulo

Federative Republic of Brazil

(Address of Regristrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

ANNEX I

POLICY FOR TRADING WITH RELATED PARTIES

OF GOL LINHAS AÉREAS INTELIGENTES S.A.

1

CHAPTER I

PURPOSE AND APPLICATION

ARTICLE 1 - This Policy for Trading with Related Parties (“Policy”) of Gol Linhas Aéreas Inteligentes S.A. (“Gol” or “Company”) is designed to provide for rules and consolidate guidelines that ensure that all the decisions, especially those involving Related Parties (as defined below) of the Company, as well as other situations giving rise to potential conflict of interest, may be made by taking into consideration the Company’s and its shareholders’ interests, assuring transparency and adoption of the best corporate governance practices in trading and carrying out such transactions.

ARTICLE 2 – In addition, with due regard to the procedures provided for herein, the Policy’s purpose is to ensure equity in transactions involving Related Parties (as defined below), allowing said transactions to be timely disclosed, in detail, to the Company’s shareholders.

ARTICLE 3 – All Gol’s employees and officers should note this Policy when acting or taking part in Company’s transactions involving Related Parties of the Company.

Sole paragraph – The Board of Directors of the Company shall act to the effect of ensuring the compliance with this Policy, in conformity with the provisions in article 21, “m” of the Company’s Bylaws.

CHAPTER II

DEFINITIONS

ARTICLE 4 – For all purposes and effects of this Policy, the following terms and expressions capitalized and defined shall have the meanings indicated below, without prejudice to other capitalized and defined expressions and terms, whose meanings are provided in this Policy:

I. Relatives: The family members expected to have influence on or be influenced by the person in their business with the company and include:

a) ascendants or descendants of the person straight and first degree, spouse or common-law companion; or

b) ascendants or descendants in first degree, spouse or common-law companion; or

c) The person’s, his/her spouse’s or companion’s dependents.

II. Related Party: The person or entity with which the Company may enter into agreements under other than the conditions usually prevailing in transactions with third parties not related to the Company, by reason that, under the terms of

CVM Resolution no. 642, dated October 07, 2010, which approved Technical Pronouncement CPC 05 (R1) (“Resolution 642/10”):

2

a) the related party and the Company are members of the same economic group; or

b) the related party and the Company are under common control of a third entity; or

c) the related party is affiliated to, or jointly controlled by, an entity belonging to the same economic group as the Company; or

d) the related party is under joint control of a third entity and the Company is affiliated to such third entity; or

e) the related party is controlled, either fully or under joint control, by an individual, or by a Relative of such individual, who

(i) has the full or shared control of the Company; or

(ii) has material influence over the Company; or

(iii) is a member of the Key Management Staff (as defined below) of the Company or of its controlling company; or

f) the related party is an individual, or a Relative of such individual, who has full or shared control of the Company and exercises a material influence over the related party, or is a member of the Key Management Staff (as defined below) of the related party or of its controlling company.

III. Key Management Staff: Individuals who have direct or indirect authority and responsibility for the planning, direction and control of the activities of the Company.

IV. Transaction with Related Party: Transfer of resources, services or obligations between Related Parties, regardless of payment of any price whatsoever.

CHAPTER III

ENTRY INTO TRANSACTIONS WITH RELATED PARTIES

ARTICLE 5 – The Board of Directors, the Executive Committee and the Audit Committee of the Company shall act in such manner as to ensure that the Transactions with Related Parties:

a) are preferably negotiated by employees of the Company not having any personal interest in the entry of the transaction with the Related Party;

3

b) are entered into in writing, providing for the main terms and conditions in the respective instrument, especially the form of contract, prices, terms, guaranties, quality standards, taxes and charges, subcontractor conditions, rights, and responsibilities;

c) are carried out at market conditions or, in the absence of a market parameter, performed in similar conditions of previous transactions;

d) are clearly recorded in the financial statements, terms and pursuant to the applicable regulations; and

e) are filed with the Company’s head-office, together with documents evidencing the transactions and, if any, the proposals received from third parties.

ARTICLE 6 – In addition to the provisions in Article 5, in case of the Transaction with Related Parties, either in one sole transaction or in a series of related transactions, exceeds the lesser of the amounts described in (a) and (b) below (“Relevant Transaction”), such Relevant Transaction shall be negotiated by an independent special committee, which shall submit its recommendations to the members of the Audit Committee of the Company for majority approval.

a) R$50,000,000.00 (fifty million reais); or

b) 1% (one percent) of the Company’s total assets, to be ascertained based on the most recent financial statements or, if any, in the most recent consolidated financial statements disclosed by the Company.

Sole paragraph – The independent special committee referred to in the head paragraph of this article shall be made up of:

(a) an executive officer selected by the majority of the Board of Directors of the Company;

(b) one member of the Board of Directors of the Company elected by the non-controlling shareholders; and

(c) a third member, either an executive officer or not, jointly selected by the other two members.

CHAPTER IV

DISCLOSURE OBLIGATION

ARTICLE 8 – The disclosure of Transactions with Related Parties shall be made under the terms of the applicable laws, in special Resolution 642/10 and Article 247 of Law no. 6.404, dated December 15, 1976 (“Corporations Act”), in explanatory notes to the

financial statements.

4

Sole paragraph – Without prejudice to the provisions in Article 8 above, the Board of Directors shall fully disclose all the Transactions with Related Parties to the market, either if the transaction represents a relevant fact or at the time of the disclosure of the financial statements.

ARTICLE 9 – The disclosure of Transactions with Related Parties of the Company shall, among other things:

(a) describe the transaction;

(b) inform if, when, how and to what extent the transaction counterparty, its partners or managers took part in the Company’s decision making process regarding the transaction; and

(c) detailed justification of the reasons why the Company’s management considered that the transaction was carried out under commutative conditions or adequate compensatory payment is provided; detailed description of the actions taken and procedures adopted for ensuring the commutative of the transaction; and comparative analysis of prices, terms and conditions available in the market and of similar transactions already carried out by the Company, a Related Party, or in the market.

Sole paragraph: In case the relevant transaction is a loan granted by the Company to the Related Party, the information provided for in the head paragraph hereof shall necessarily include:

(a) explanation of the reasons why the Company elected to grant the same instead of investing the funds in its activities;

(b) summary analysis on the borrower’s credit risk, including independent risk rating, if any;

(c) description of how the interest rate was determined, considering the rate free of market risk and the borrower’s credit risk;

(d) comparison between the interest rate for the loan and other similar investments available on the market, explaining reasons for possible discrepancies; and

(e) comparison between the interest rate for the loan and the rates for other loans granted to the borrower, explaining the reasons for possible discrepancies.

CHAPTER V

PENALTIES

5

ARTICLE 10 – Violations to the terms of this Policy shall be examined by the Company’s Audit Committee, and subsequently submitted to the Board of Directors for the latter to adopt the applicable actions, subjecting the violators to the penalties set forth in the applicable laws.

CHAPTER VI

MISCELLANEOUS

ARTICLE 11 – In case of a conflict of interest between any Company’s manager and the Company itself in the negotiation of a Transaction with Related Party, such manager shall be required to communicate such conflict, refraining him/herself from intervening in the transaction with Related Party and causing the nature and extent of his/her interest to be recorded in the minutes of the Board of Directors, as set forth in articles 155 and 156 of the Corporations Act.

ARTICLE 12 – The Board of Directors shall update this Policy as a result of changes in the law, especially as far as they refer to the definition of related parties, Corporate Governance Practices of the BMF&Bovespa and the Company’s Bylaws.

[Policy approved at the Meeting of the Board of Directors of Gol Linhas Aéreas Inteligentes S.A. held on February 03RD , 2016.]

6

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: February 03, 2016

|

GOL LINHAS AÉREAS INTELIGENTES S.A. |

|

|

|

|

|

By: |

/S/ Edmar Prado Lopes Neto

|

| |

Name: Edmar Prado Lopes Neto

Title: Investor Relations Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

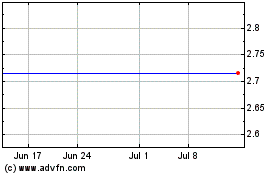

Gol Linhas Aereas Inteli... (NYSE:GOL)

Historical Stock Chart

From Mar 2024 to Apr 2024

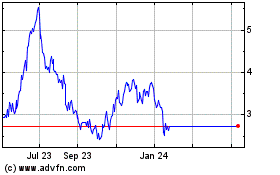

Gol Linhas Aereas Inteli... (NYSE:GOL)

Historical Stock Chart

From Apr 2023 to Apr 2024