SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of January, 2016

Commission File Number 1-15106

PETRÓLEO BRASILEIRO S.A. - PETROBRAS

(Exact name of registrant as specified in its charter)

Brazilian Petroleum Corporation - PETROBRAS

(Translation of Registrant's name into English)

Avenida República do Chile, 65

20031-912 - Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Oil and natural gas production in 2015

Rio de Janeiro, January 15, 2016 – Petróleo Brasileiro S.A. – Petrobras hereby announces that its average Brazilian oil production in 2015 exceeded the annual target established in the Company’s Business and Management Plan for the first time in 13 years.

The period average of 2.128 million barrels per day (bpd) was 4.6% higher than the previous year and 0.15% up on the 2.125 million bpd envisaged in the business plan.

Pre-salt production averaged 767,000 bpd, 56% more than in 2014 and the Company’s highest ever figure.

Factoring in natural gas output, which grew by 9.8% over the year before, total production reached 2.6 million barrels of oil equivalent (boed) per day, 5.5% more than the 2.46 million boed recorded in 2014.

According to Petrobras’ CEO, Aldemir Bendine, “this result is important as it demonstrates the company’s enormous operating capacity, even in an adverse global scenario for the oil and gas industry, and because it exemplifies the predictability and transparency of its activities before the market.”

Bendine emphasized that “the result reinforces our conviction in the decision to prioritize investments that are effectively capable of generating results, with absolute priority for exploration and production projects.”

The rapid growth of production from the P-58 platform, which operates in the Parque das Baleias complex in the Espírito Santo portion of the Campos Basin, and the FPSO Cidade de Mangaratiba, in the pre-salt area of the Santos Basin, were among the factors chiefly responsible for last year’s output expansion. Further impetus came from the anticipation (from November to July) of the start-up of the FPSO Cidade de Itaguaí, in the Santos Basin.

“We have consolidated our deepwater and ultra deepwater exploration expertise. In 2015, we managed to reconcile technological progress with reduced operating costs, leading to a lifting cost of eight dollars per barrel in the pre-salt fields in the third quarter,” explained Solange Guedes, the company’s Exploration and Production Officer.

The satisfactory performance on other production fronts also played a decisive role in achieving the 2015 target, exemplified by annual output from the Marlim field in the Campos Basin, which exceeded 200,000 bpd, and the Campo de Roncador field, which reached its highest ever volume of more than 400,000 bpd.

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS | Investor Relations Department I e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – B – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies. A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2014, and the Company’s other filings with the U.S. Securities and Exchange Commission.

Oil and gas production abroad in 2015

Oil production abroad averaged 99,000 bpd in 2015, 14.4% down on the 116,000 bpd posted in 2014, primarily due to the conclusion of the asset sales in Colombia and Peru in 2014 and in Argentina in March 2015. The impact of these operations was partially offset by the start-up of production in the Saint Malo and Lucius fields in the United States in December 2014 and January 2015, respectively.

Gas production abroad averaged 15.4 million m³/d, 3.1% less than the 15.9 million m³/d recorded in the previous year. In 2015, the transfer of the units in Peru and Argentina was concluded, production from the Hadrian South field in the United States began in March, and two new wells started up in Rio Neuquén in Argentina, giving 190,000 boed, 9.4% down on the previous year’s 209,000 boed.

Consolidating domestic and foreign output, the company also achieved two new records: total oil production came to 2.23 million bpd, 3.6% up on 2014 (2.15 million bpd), while total oil and gas output reached 2.79 million boed, 4.3 more than the year before (2.67 million boed).

Oil and gas production in December

The company’s oil production in Brazil averaged 2.18 million bpd in December 2015, 5.2% more than in the previous month. Gas output grew by 6.9% in the same period, reaching 76.7 million m³/day. Combined oil and gas production stood at 2.66 million boed, a 5.5% improvement over the 2.52 million boed recorded in November.

Petrobras’ pre-salt oil output reached a new monthly record of 874,000 bpd, 6.6% up on the 820,000 bpd in the previous month.

Pre-salt oil and gas production remained above 1 million boed and was also a new monthly record, reaching 1.090 million boed, 6.6% more than in November (1.023 million boed).

Oil production abroad came to 96,000 bpd in December, in line with the previous month’s figure.

Gas output abroad averaged 16.2 million m³/d, 1.4% more than the 16.0 million m³/d recorded in November, mainly due to increased production in Punta Rosada, in the Rio Neuquén field in Argentina.

As a result, total oil and gas output amounted to 192,000 boed in December, 1.0% more than the previous month’s total of 190,000 boed.

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS | Investor Relations Department I e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – B – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies. A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2014, and the Company’s other filings with the U.S. Securities and Exchange Commission.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

PETRÓLEO BRASILEIRO S.A--PETROBRAS |

|

|

|

|

By: |

/S/ Ivan de Souza Monteiro

|

|

| |

Ivan de Souza Monteiro

Chief Financial Officer and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended (Exchange Act) that are not based on historical facts and are not assurances of future results. These forward-looking statements are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

All forward-looking statements are expressly qualified in their entirety by this cautionary statement, and you should not place reliance on any forward-looking statement contained in this press release. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

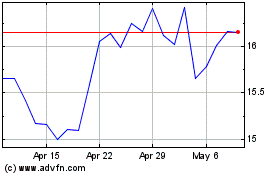

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

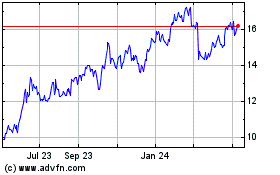

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Apr 2023 to Apr 2024