FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For November 24, 2015

Nymox Pharmaceutical Corporation

9900 Cavendish Blvd., St. Laurent, QC, Canada, H4M 2V2

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F [ X ] Form 40-F [ ]

Indicate by check mark if the registrant is submitting Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(l): [ ]

Indicate by check mark if the registrant is submitting Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes [ ] No [ X ]

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-______________

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

NYMOX PHARMACEUTICAL CORPORATION |

|

(Registrant) |

|

|

|

|

|

By: /s/ Paul Averback |

|

Paul Averback |

|

President and Chief Executive Officer |

Date: November 24, 2015

Exhibit 99.1

NYMOX PHARMACEUTICAL CORPORATION

NOTICE OF THE ANNUAL GENERAL MEETING OF THE SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the Annual General Meeting of the shareholders (the “Meeting”) of Nymox Pharmaceutical Corporation (the “Corporation”) will be held at the British Colonial Hilton, Nassau Bahamas, Number One Bay St., Nassau Bahamas, on Wednesday, December 16, 2015, at 4:30 p.m. (EDT), for the following purposes:

|

|

| 1. |

to receive the annual report of the directors, the financial statements of the Corporation for the fiscal year ended December 31, 2014 and the auditors' report thereon; |

| |

|

| 2. |

to elect the directors of the Corporation; |

| |

|

| 3. |

to appoint the auditors of the Corporation and to authorize the Board of Directors to fix their remuneration; |

| |

|

| 4. |

to ratify the acts of the members of the Board of Directors for the fiscal year ending 2014; |

| |

|

| 5. |

to transact such other matters as may properly be brought before the Meeting, or any adjournment thereof. |

All shareholders are invited to attend the Meeting.

By order of the Board of Directors,

Paul Averback MD CEO & President

/s/ Paul Averback

November 24, 2015 Nassau, The Bahamas

Note: As it is preferable that the greatest possible number of shares be represented and votes be cast at the Meeting, kindly complete, date and sign the enclosed form of proxy and return it in the postage-paid envelope provided for that purpose before 5:00 p.m. (EDT), December 14, 2015, unless it is your intention to attend the Meeting in person. The record date for the determination of those shareholders entitled to receive this notice and to vote at the Meeting is November 24, 2015. A management proxy circular is attached to the present notice.

Exhibit 99.2

NYMOX PHARMACEUTICAL CORPORATION

NOTICE OF THE ANNUAL GENERAL MEETING OF THE SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the Annual General Meeting of the shareholders (the “Meeting”) of Nymox Pharmaceutical Corporation (the “Corporation”) will be held at the British Colonial Hilton, Nassau Bahamas, Number One Bay St., Nassau Bahamas, on Wednesday, December 16, 2015, at 4:30 p.m. (EDT), for the following purposes:

|

|

| 1. |

to receive the annual report of the directors, the financial statements of the Corporation for the fiscal year ended December 31, 2014 and the auditors' report thereon; |

| |

|

| 2. |

to elect the directors of the Corporation; |

| |

|

| 3. |

to appoint the auditors of the Corporation and to authorize the Board of Directors to fix their remuneration; |

| |

|

| 4. |

to ratify the acts of the members of the Board of Directors for the fiscal year ending 2014; |

| |

|

| 5. |

to transact such other matters as may properly be brought before the Meeting, or any adjournment thereof. |

All shareholders are invited to attend the Meeting.

By order of the Board of Directors,

Paul Averback MD CEO & President

/s/ Paul Averback

November 24, 2015 Nassau, The Bahamas

Note: As it is preferable that the greatest possible number of shares be represented and votes be cast at the Meeting, kindly complete, date and sign the enclosed form of proxy and return it in the postage-paid envelope provided for that purpose before 5:00 p.m. (EDT), December 14, 2015, unless it is your intention to attend the Meeting in person. The record date for the determination of those shareholders entitled to receive this notice and to vote at the Meeting is November 24, 2015. A management proxy circular is attached to the present notice.

NYMOX PHARMACEUTICAL CORPORATION

MANAGEMENT PROXY CIRCULAR

November 24, 2015

This proxy circular (the “Circular”) is furnished in connection with the solicitation of proxies by the management of Nymox Pharmaceutical Corporation (the “Corporation”) for use at the Annual General Meeting of the shareholders of the Corporation (the "Meeting") to be held in Nassau Bahamas on December 16, 2015 at 4:30 p.m. (Eastern Daylight Time), at the place and for the purposes set forth in the accompanying notice of meeting (the “Notice”). Unless otherwise provided, the information contained herein is given as of November 24, 2015.

1) SOLICITATION OF PROXIES

The enclosed proxy is solicited by the management of the Corporation, and the cost of solicitation will be borne by the Corporation. This solicitation of proxies is being undertaken by mail.

2) APPOINTMENT AND REVOCATION OF PROXIES

The proxies must be received by the Corporation before 5:00 p.m. (Eastern Daylight Time), December 14, 2015. A shareholder executing the enclosed proxy has the power to revoke it any time prior to its use, in any manner permitted by law, including by instrument in writing executed by the shareholder or by his or her attorney authorized in writing, or in the case of a corporation, by an officer or attorney authorized in writing. This instrument must be deposited either at the office of the transfer agent of the Corporation at any time up to the second to last business day preceding the day of the Meeting or any adjournment thereof at which the proxy is to be used, or with the Chairman on the day of the Meeting or any adjournment thereof. The address of the office of the transfer agent of the Corporation is:

Computershare Investor Services, Inc.

Proxy Department

100 University Avenue, 8th Floor

Toronto, Ontario M5J 2Y1

A shareholder has the right to appoint some other person (who need not be a shareholder of the Corporation) to represent him or her in attendance and to act on his or her behalf at the Meeting other than the individuals designated by the management of the Corporation and named in the enclosed form of the proxy. In such event, the names of such individuals should be deleted and the name of the nominee inserted in the blank space provided for on the form of proxy.

3) VOTING AND EXERCISE OF DISCRETION BY PROXIES

The persons named in the enclosed form of proxy will vote the shares in respect of which they

have been appointed in accordance with the instructions of the shareholder appointing them. Unless otherwise specifically instructed, the persons named in the enclosed form of proxy intend to vote all shares represented by such proxy FOR the election of the proposed directors and FOR the appointment of the proposed auditors and FOR ratifying the acts of the members of the Board of Directors for the fiscal year ending 2014.

The enclosed form of proxy confers discretionary authority upon the persons named therein with respect to amendments or variations of all matters identified in the Notice or other matters which may properly come before the Meeting. Should any amendment, variation, or other matter properly come before the Meeting, the persons named in the enclosed form of proxy will vote on such matter in accordance with their best judgment. As of the date hereof, the management of the Corporation does not anticipate that any such amendment or variation will be presented or that any other matter will come before the Meeting.

All matters properly brought before the Meeting shall be decided by a majority of shares voted thereupon except as specifically provided in this Circular.

Revocation of Proxies: A shareholder giving a proxy may revoke the proxy by depositing an instrument in writing executed by the shareholder or by his/her attorney authorized in writing or, if the shareholder is a corporation, by an instrument in writing executed by an officer or attorney thereof duly authorized, at the Secretary's office of the Corporation, Bay & Deveaux Sts., 2nd Floor Nassau, The Bahamas, at any time up to and including the last business day preceding the day of the Meeting, or any adjournment thereof, at which the proxy is to be used, or with the Chairman of such Meeting, on the day of the Meeting or any adjournment thereof; or in any other manner permitted by law.

Notice and Access: The Corporation has elected not to send proxy-related materials to registered holders or beneficial holders using the new notice-and-access procedures.

Proxy Related Materials – Non-Objecting Beneficial Owners: The Corporation is sending proxy-related materials directly to non-objecting beneficial owners under Canadian Regulation 54-101 respecting Communication with Beneficial Owners of Securities of a Reporting Issuer.

Payment to Deliver Materials to Objecting Beneficial Owners: The Corporation has agreed to pay for intermediaries to deliver to objecting beneficial owners under Canadian Regulation 54-101 respecting Communication with Beneficial Owners of Securities of a Reporting Issuer, the proxy-related materials and Canadian Form 54-101F7 – Request for Voting Instructions Made by Intermediary.

4) VOTING SHARES

As at November 24, 2015, 42,626,369 common shares without par value of the Corporation were outstanding. The holders of common shares will be entitled to one vote per share. The right to vote is determined by the registration of a holder of common shares on the shareholders' list of

the Corporation as at the close of business on November 24, 2015 (the “Record Date”) except where a person has transferred any of his or her shares after the Record Date, in which case the transferee is entitled to vote his or her shares at the Meeting provided he or she produces properly endorsed share certificates or otherwise establishes that he or she owns the shares, and demands, not later than ten days before the Meeting, that his or her name be included in the shareholders' list of the Corporation before the Meeting. The right to receive the Notice is determined by the registration of a holder of common shares on the shareholders' list of the Corporation on the Record Date.

Any individual authorized by a resolution of the directors or governing body of a body corporate or association being a shareholder of the Corporation is entitled to represent it at the Meeting.

If two or more persons hold common shares of the Corporation jointly, one of those holders present at the Meeting may in the absence of the others vote the shares. If two or more of those persons are present, in person or by proxy, they shall vote as one on the shares jointly held by them.

5) PRINCIPAL HOLDERS OF SECURITIES

To the knowledge of the directors and officers of the Corporation, as at November 10, 2015, only the following persons were beneficial owners, directly or indirectly, or exercised control or direction over more than 10% of the outstanding common shares of the Corporation:

|

|

|

| Name of Shareholders |

Number of Common Shares |

Percentage of the Class |

| |

|

|

| Dr. Paul Averback |

15,151,448 |

35.6% |

| As joint trustee of a family trust |

607,031 |

1.4% |

6) ELECTION OF DIRECTORS

The Articles of the Corporation provide that the Board of Directors is to be composed of not more than fifteen (15) and of at least five (5) directors, as may be determined by the Board of Directors, from time to time. The Corporation presently has a board comprised of four (4) directors and it is proposed to elect the four (4) directors mentioned below, with the board appointing one more shortly. Each director holds office until the next annual meeting of shareholders, or until the election of his successor, unless he resigns or his office becomes vacant by death, removal, or other cause.

Unless otherwise specifically instructed, the persons named in the enclosed form of proxy intend to vote at the Meeting FOR the election of the nominees whose names are set forth below. The Management of the Corporation does not contemplate that any of the nominees will be unable or unfit to serve as a director but should there be any change for any reason prior to the Meeting, the

persons named in the enclosed form of proxy intend to vote at the Meeting for another nominee at their discretion, unless instructions have been received to refrain from voting with respect to the election of directors.

The following table states the names of all the persons proposed by management of the Corporation to be nominated for election as directors, their municipality, state or province and country of residence, their age, their principal occupation, their position in the Corporation (if any), the period during which each proposed nominee served as a director and the number of Common Shares beneficially owned, directly or indirectly, by each of them or over which they exercise control or direction.

Unless otherwise specifically instructed, the persons named in the enclosed form of proxy intend to vote at the Meeting FOR the election of the nominees whose names are set forth below.

|

|

|

|

|

| Name and Municipality of Residence of Nominee |

Position with the Corp |

Director of Corp since |

Principal Occupation |

Voting Securities of the Corporation

Owned or Controlled |

Paul Averback, M.D.,

D.A.B.P. Nassau, Bahamas (4) |

CEO,

President, and

Chairman |

Sept. 20, 1995 |

President of the Corporation |

15,151,448 (35.6%)

As trustee 607,031* (1.4%) |

Randall Lanham,

Esq. Rancho Santa Margarita,

USA (1)(2)(3) |

Director |

June 8, 2006 |

Attorney–

Corporate mergers and acquisitions |

0 |

James G. Robinson, Baltimore,

MD, USA (1)(2)(3) |

Director |

July 1, 2015 |

Business Executive |

2,167,550 (5.08%) |

David Morse, Ph.D. Montreal,

Canada (2) (3)(4) |

Director |

June 8, 2006 |

Professor –

University of Montreal |

396 (0.001%) |

(1) Member of Audit Committee (2) Member of the Human Resources and Compensation Committee (3) Member of the Corporate Governance Committee (4) Member of the Communications Committee *As joint trustee of a family trust.

The information as to shares beneficially owned, directly or indirectly, by each nominee, or over

which they control or have direction, has been furnished by the respective nominees. Except as otherwise noted, each of the directors has held the principal occupation shown opposite his name or other executive offices with the same firm or its affiliates, for the last five years.

7) REMUNERATION OF DIRECTORS AND SENIOR OFFICERS Named Executive Officers

The Summary Compensation Table and Outstanding Incentive Plan Awards tables below for Named Executive Officers summarize the total compensation paid during the Corporation's financial year ending on December 31, 2014 to the Named Executive Officers of the Corporation and all incentive plan awards outstanding at December 31, 2014 for the Named Executive Officers: The Named Executive Officers are the Corporation’s Chief Executive Officer, Chief Financial Officer, and three most highly compensated executive officers.

Directors

The Summary Compensation Table and Outstanding Incentive Plan Awards tables below for the directors of the Corporation summarize the total compensation paid during the Corporation's financial year ending on December 31, 2014 to the directors of the Corporation and all incentive plan awards outstanding at December 31, 2014 for the directors.

Two current directors, Dr. Paul Averback, the President and CEO of the Corporation, and Randall Lanham, General Counsel, are members of the senior management of the Corporation and do not receive any compensation for acting as a director. Their compensation as Named Executive Officers are summarized in the summary tables for compensation and incentive plans for Named Executive Officers below.

Compensation Discussion and Analysis

The Human Resources and Compensation Committee of the Board of Directors oversees the compensation of executive officers of the Corporation. The members of the Human Resources and Compensation Committee for the financial year ending December 31, 2014 were Dr. Roger Guy, Paul McDonald, David Morse and Randall Lanham, Esq..

The Corporation’s current compensation policy for its executive officers, including the Chief Executive Officer and the Named Executive Officers, emphasizes the granting of options over base salary as a means of attracting, motivating and retaining talented individuals. Such a policy is believed to better further the Corporation’s business goals by allocating more financial resources to the Corporation’s ongoing product development programs. Given the current stage of the Corporation’s development, the Corporation has not established and does not use formal benchmarks, performance goals, review processes or other qualitative or quantitative criteria or targets relating to the performance of the Corporation or the individual in order to determine

compensation. The Corporation does not have a non-equity incentive plan or a policy of annually granting performance bonuses or salary increases to its executive officers.

The Corporation grants option-based awards to executive officers in accordance with a stock option plan approved by the shareholders. Further details of the stock option plan are provided below in section 8, Stock Option Plan. The stock option plan provides long-term incentives to the Corporation’s officers and employees to advance the Corporation’s drug development programs towards commercialization and to enhance shareholder value. The Corporation endeavors to provide salaries and option grants that are internally equitable and that are consistent with both job performance and ongoing progress towards corporate goals. The amount of option grants is determined in part by the amount and terms of outstanding and expiring options, the experience and expertise of each executive officer and the needs of the Corporation, among other factors. The Human Resources and Compensation Committee of the Board of Directors reviews all proposals for awards of stock options to executive officers and decides on the appropriateness of the awards. In doing so, the Committee relies solely on discussion among the independent board members on the Committee without any formal pre-determined objectives, criteria or analytic processes but with a view to attracting and retaining executive officers who can help further the Corporation’s business plan. By relying on option grants as a primary means of compensating its executive officers, the Corporation’s intention is to provide a direct link between corporate performance and executive compensation while maximizing shareholder value and controlling cash expenditures.

Summary Compensation Table: Named Executive Officers

|

|

|

|

|

|

|

|

|

|

Name and

principal position |

Year |

Salary |

Share-based

awards |

Option-based

awards

(#) |

Non-equity

incentive

plan compensation |

Pension

value |

All Other

Compensation |

Total

Compensation

($) |

Annual

incentive

plans |

Long-term

incentive

plans |

Dr. Paul Averback

CEO and President |

2014 |

$290,000*6 |

|

500,000 |

|

|

|

|

$290,000 |

André Monette

CFO |

2014 |

$128,071*7 |

|

100,000 |

|

|

|

|

$128,071 |

Roy Wolvin

CFO1 |

2014 |

$10,564* |

|

|

|

|

|

$185,0685 |

$195,632 |

Brian Doyle

Global Sales Manager2 |

2014 |

$128,333* |

|

|

|

|

|

$65,6964 |

$194,029 |

Jack Gemmell

General Counsel, CIO3 |

2014 |

$162,122* |

|

|

|

|

|

|

$162,122 |

*Salaries are payable in Canadian dollars, but expressed above in US$.

1 Mr. Wolvin ceased being an Executive Officer on January 22, 2014.

2 Brian Doyle ceased being an Executive Officer on November 21, 2014.

3 Jack Gemmell ceased being an Executive Officer on November 20, 2014.

4 Includes commissions and severance payment paid in Canadian dollars, but expressed above in US$.

5 Amounts paid under option settlement agreement in Canadian dollars, but expressed above in US$.

6 $48,333 expected to be paid in 2015

7 $10,775 paid in 2015

Outstanding Incentive Plan Awards as of December 31, 2014: Named Executive Officers

|

|

|

|

|

|

|

| Name |

Option-based Awards |

Number of securities

underlying

unexercised options |

|

Option

expiration date

(mm/dd/yy) |

Value of unexercised

in-the-money options |

| Total |

Unvested |

Vested |

Option exercise price |

Dr. Paul

Averback |

3,000,000 |

|

3,000,000 |

$3.00 |

08/24/16 |

$0 |

| 500,000 |

|

500,000 |

$7.08 |

01/24/21 |

$0 |

| 500,000 |

|

500,000 |

$6.51 |

10/15/22 |

$0 |

| 500,000 |

|

500,000 |

$5.88 |

01/09/24 |

$0 |

| André Monette |

100,000 |

|

62,500 |

$6.47 |

01/23/24 |

$0 |

Jack

Gemmell2,3 |

210,000 |

|

210,000 |

$3.00 |

08/24/16 |

$0 |

| 50,000 |

|

50,000 |

$3.30 |

01/23/19 |

$0 |

| 25,000 |

|

25,000 |

$3.40 |

05/03/20 |

$0 |

| 170,000 |

|

170,000 |

$7.08 |

01/24/21 |

$0 |

| Brian Doyle1,3 |

30,000 |

|

30,000 |

$3.00 |

08/24/16 |

$0 |

| 100,000 |

|

100,000 |

$7.08 |

01/24/21 |

$0 |

| 50,000 |

|

50,000 |

$4.76 |

04/29/23 |

$0 |

1Brian Doyle ceased being an Executive Officer on November 21, 2014.

2Jack Gemmell ceased being an Executive Officer on November 20 2014.

3The options may be exercised until the expiration of the option or the date that is 90 days following the termination date, whichever occurs first.

Option exercise prices and the values of unexercised in-the-money options are expressed in US$. The Corporation does not have a share-based award plan.

Summary Compensation Table: Directors

|

|

|

|

|

|

|

|

|

| Name |

Year |

Fees Earned |

Share-

based

awards |

Option-

based

awards (#) |

Non-equity

incentive plan

compensation |

Pension

value |

All other

compensation |

Total

($) |

| Paul McDonald |

2014 |

$29,000 |

|

10,000 |

|

|

|

$29,000 |

| Randall Lanham, Esq. |

2014 |

$15,500 |

|

10,000 |

|

|

|

$15,500 |

| Roger Guy, MD1 |

2014 |

$15,500 |

|

10,000 |

|

|

|

$15,500 |

| David Morse, Ph.D. |

2014 |

$13,500 |

|

10,000 |

|

|

|

$13,500 |

1Dr. Roger Guy resigned on December 15, 2014.

Outstanding Incentive Plan Awards as of December 31, 2014: Directors

|

|

|

|

|

| Name |

Option-based Awards |

Number of securities

underlying

unexercised options |

Option exercise

price |

Option expiration

date

(mm/dd/yy) |

Value of

unexercised

in-the-money

options |

| Paul McDonald |

10,000 |

$5.95 |

08/23/17 |

$0 |

| 10,000 |

$3.61 |

07/16/18 |

$0 |

| 10,000 |

$4.83 |

07/09/19 |

$0 |

| 10,000 |

$9.10 |

07/16/21 |

$0 |

| 10,000 |

$6.88 |

07/16/22 |

$0 |

| 10,000 |

$5.83 |

07/16/23 |

$0 |

| 10,000 |

$5.15 |

08/14/24 |

$0 |

Randall Lanham,

Esq. |

10,000 |

$2.74 |

07/17/16 |

$0 |

| 10,000 |

$5.95 |

08/23/17 |

$0 |

| 10,000 |

$3.61 |

07/16/18 |

$0 |

| 10,000 |

$4.83 |

07/09/19 |

$0 |

| 10,000 |

$2.90 |

07/16/20 |

$0 |

| 10,000 |

$9.10 |

07/16/21 |

$0 |

| 10,000 |

$6.88 |

07/16/22 |

$0 |

| 10,000 |

$5.83 |

07/16/23 |

$0 |

| 10,000 |

$5.15 |

08/14/24 |

$0 |

| Roger Guy, MD1 |

10,000 |

$2.74 |

07/17/16 |

$0 |

| 10,000 |

$5.95 |

08/23/17 |

$0 |

| 10,000 |

$3.61 |

07/16/18 |

$0 |

| 10,000 |

$4.83 |

07/09/19 |

$0 |

| 10,000 |

$2.90 |

07/16/20 |

$0 |

| 10,000 |

$9.10 |

07/16/21 |

$0 |

| 10,000 |

$6.88 |

07/16/22 |

$0 |

| 10,000 |

$5.83 |

07/16/23 |

$0 |

| 10,000 |

$5.15 |

08/14/24 |

$0 |

David Morse,

Ph.D. |

10,000 |

$2.74 |

07/17/16 |

$0 |

| 10,000 |

$5.95 |

08/23/17 |

$0 |

| 10,000 |

$3.61 |

07/16/18 |

$0 |

| 10,000 |

$4.83 |

07/09/19 |

$0 |

| 10,000 |

$2.90 |

07/16/20 |

$0 |

| 10,000 |

$9.10 |

07/16/21 |

$0 |

| 10,000 |

$6.88 |

07/16/22 |

$0 |

| 10,000 |

$5.83 |

07/16/23 |

$0 |

1Dr. Roger Guy resigned on December 15, 2014. The options may be exercised until the expiration of the option or the date that is 90 days following the termination date, whichever occurs first.

7) STOCK OPTION PLAN

The Corporation has created a stock option plan (the “Plan”) for key employees, officers and directors and certain consultants of the Corporation and its subsidiaries. The Plan was adopted by the Board of Directors of the Corporation on November 27, 1995. On May 15, 1998, the Board of Directors amended the Plan in order to increase the maximum number of common shares which may be issued under the Plan from 2,000,000 to 2,500,000 shares. On March 16, 2007, the Board of Directors amended the Plan in order to increase the maximum number of common shares, which may be issued under the Plan from 2,500,000 to 5,500,000 shares; to increase the maximum number of common shares that may be optioned to any one individual from 5% to 15%; and to clarify that the number of common shares represented by expired, lapsed or terminated options or by exercised options will be available for subsequent option grants under the Plan. On February 11, 2011, the Board of Directors amended the Plan in order to increase the maximum number of common shares, which may be issued under the Plan from 5,500,000 to 7,500,000 shares

The Plan is administered by the Board of Directors of the Corporation. The Board of Directors may from time to time designate individuals to whom options to purchase common shares of the capital stock of the Corporation may be granted and the number of shares to be optioned to each. The option price per share for common shares which are the subject of any option is fixed by the Board of Directors when such option is granted. The option price cannot involve a discount to the market price of the common shares at the time the option is granted. The period during which an option is exercisable cannot exceed 10 years from the date the option is granted. The options may not be assigned, transferred or pledged and expire after the termination of the optionee’s employment or office with the Corporation or any of its subsidiaries or upon the death of the optionee.

As of December 31, 2014, 5,104,500 share options are outstanding, of which 5,042,000 are currently vested. Expiry dates for Nymox options range from 1.5 years to 10.7 years. These options have been granted to employees, officers, directors and consultants of the Corporation. In 2014, no option were exercised.

|

|

|

|

| Plan Category |

Number of

securities to be |

Weighted-average exercise

price of outstanding |

Number of securities remaining available

for future issuance under equity |

|

|

|

|

| |

issued upon exercise of

outstanding options, warrants and rights

(a) |

options, warrants and rights

(b) |

compensation plans

(excluding securities reflected in column (a))

(c) |

Equity compensation

plans approved by

security holders |

5,789,500 |

$4.38 |

1,710,500 |

Equity compensation

plans not approved by

securityholders |

None |

None |

None |

| Total |

5,789,500 |

$4.38 |

1,710,500 |

During the financial year ended December 31, 2014, the Chief Executive Officer received an option grant totaling 500,000 options and the Chief Financial Officer received an option grant totaling 100,000 options. No executive officer received any other share-based awards, or any bonuses or other non-equity incentive compensation. The Corporation does not have a share-based incentive plan, non-equity incentive plan or pension plan for its executive officers. The Corporation has not made any agreements or arrangements with any of its executive officers in connection with any termination or change of employment or change of control of the Corporation.

8) INDEBTEDNESS OF DIRECTORS AND OFFICERS

No director or officer currently with the Corporation as of the date of this Circular, nor any nominee for election as a director of the Corporation, nor any person associated with such director, officer or nominee is indebted to the Corporation.

9) DIRECTORS' AND OFFICERS' INSURANCE

Directors' and Officers' liability insurance has been obtained by the Corporation for its directors and officers. In 2014-2015, the Corporation paid an annual premium of US$156,220 in respect of such insurance as a group. No portion of the premium was paid directly or indirectly by any of the directors or officers of the Corporation. The aggregate insurance coverage under the current policy is limited to US$15,000,000, subject to a corporate deductible of US$250,000.

11) INTEREST OF INSIDERS AND OTHER PERSONS IN MATERIAL TRANSACTIONS

Neither the Corporation nor its subsidiaries are currently or have been party to, or are currently contemplating, any material transaction or any proposed transaction, which has materially affected or would materially affect the Corporation, with any insider of the Corporation, nor with any associate or affiliate of such insider.

12) DISCLOSURE RESPECTING CORPORATE GOVERNANCE

The Corporation and its operations and corporate governance are subject to a wide range of laws, rules and regulations, including applicable rules and regulations of the NASDAQ Stock Market, the Securities Exchange Commission, as well as federal, state and provincial corporate and securities legislation in Canada and the United States, including the Sarbanes-Oxley Act. In addition, given the nature of its operation, the Corporation is subject to specific regulatory regimes governing its products and services such as the U.S. Food and Drug Act.

The Board of Directors of the Corporation has adopted corporate governance practices, including formal written mandates for the Board of Directors and its committees, a Code of Ethics for Senior Financial Officers and a Code of Business Conduct for its directors, officers and employees. These documents are available at www.nymox.com and have been filed on the EDGAR and SEDAR systems. The Corporation considers good corporate governance to be important to ensure that its operations are managed with a view to enhancing long-term shareholder value, and continues to review its corporate governance practices with a view to ensuring and enhancing compliance with applicable regulations.

The Board of Directors is currently composed of six directors, a majority of whom are independent directors. The Board of Directors has determined that four of its current directors (Dr. Roger Guy, Paul McDonald, Randall Lanham, Esq. and Dr. David Morse) meet the requisite standard of independence as set out in applicable securities laws, rules and regulations, such as the Sarbanes-Oxley Act, the NASDAQ rules, and National Instrument 58-101 – Disclosure of Corporate Governance Practices. The other two current directors are not independent: Dr. Paul Averback is the President and CEO of the Corporation and Mr. Jack Gemmell is a member of the senior management of the Corporation.

The Board of Directors is responsible for supervising the management of the business and affairs of the Corporation with a view to the best interests of the Corporation and its shareholders generally. The Board of Directors reviews and approves matters relating to the strategic direction, business and operations and the organizational structure of the Corporation. The Board appoints the Chairman of the Board and establishes its committees and appoints their members. The Board does not have an executive committee. The Board’s specific responsibilities include recommending candidates for election or appointment to the Board, approving the issuance of any

securities and any related transactions, reviewing financings, investments, acquisitions, dispositions and other transactions not in the ordinary course of business, reviewing the compensation and performance of the Corporation’s officers, approving the issuance of any stock options pursuant to the Corporation’s stock option plan, reviewing, approving and supervising the Corporation’s accounting principles and practices, financial statements and security filings, approving the annual budget, ensuring the proper and timely disclosure of material matters and appropriate communications with the shareholders, reviewing the corporate governance practices of the Corporation and the Board, and reviewing management practices and processes with respect to risk assessment and management and internal controls and audit functions.

The Corporate Governance Committee consists of four independent directors of the Board. This Committee has the general mandate of providing an independent and regular review of the management, business and affairs of the Corporation and has regularly scheduled meetings in executive session. This Committee also reviews the corporate governance of the Corporation to ensure compliance, relevance and effectiveness. This Committee also reviews and approves director nominations to ensure each nominee meets the requisite requirements under applicable corporate and securities laws, rules and regulations and otherwise possesses the skills, judgment and independence appropriate for a director of a public corporation.

The Audit Committee currently consists of three independent directors of the Corporation, each of whom are knowledgeable in financial and auditing matters. The Board has determined that each of the current members of the Audit Committee meet the criteria for independence as set out in applicable securities laws, rules and regulations, such as the Sarbanes-Oxley Act, the NASDAQ rules, and National Instrument 58-101 – Disclosure of Corporate Governance Practices, and are otherwise free of any relationship that would interfere with his individual exercise of independent judgment. The Board has also determined that the Chairman of the Audit Committee, Paul McDonald, possesses the requisite financial management expertise and sophistication to meet the criteria for an audit committee financial expert in accordance with applicable securities laws, rules and regulations.

The Audit Committee provides independent oversight of the quality and integrity of the accounting, auditing, and reporting practices of the Corporation with a particular focus on financial statements and financial reporting to shareholders. Subject to shareholder approval, the Committee is responsible for the appointment, compensation, and oversight of the public accounting firm engaged to prepare or issue an audit report on the financial statements of the Corporation. The independent auditors report directly to the Committee. The Committee’s responsibilities include pre-approving all audit services and permissible non-audit services, reviewing on an ongoing basis all relationships between the auditors and the Corporation, including any that may impact the objectivity or independence of the auditors and taking such appropriate action to oversee and ensure the auditors' independence, reviewing the scope and results of the audit with the independent auditors, meeting at least four times a year to review

with management and the independent auditors the Corporation's financial condition and results, assessing the adequacy of the internal accounting, bookkeeping and control procedures of the Corporation; reviewing with management and the independent auditors any significant risks or exposures to the Corporation and assess the steps management has taken to minimize such risk to the Corporation, reviewing and approving on an ongoing basis the terms of all transactions and arrangements between the Corporation and related parties, reviewing all financial statements and reports prior to filing with the Securities and Exchange Commission or other regulatory authorities, and reviewing and assessing on an annual basis the adequacy of its charter and recommending any changes needed to enable the Committee to properly discharge its duties to the shareholders.

The Audit Committee has the additional responsibilities for establishing procedures for the handling of complaints regarding accounting, internal accounting controls, or auditing matters, including procedures for the receipt, retention and treatment of such complaints and for the confidential and anonymous submission by employees of the Corporation or its affiliates of concerns regarding questionable accounting or auditing matters.

The Audit Committee has the power to conduct or authorize investigations into any matters within its scope of responsibilities. The Committee may ask members of management or other employees of the Corporation to attend at a meeting of the Audit Committee and provide pertinent information as necessary. The Committee may meet with the independent auditors in executive session to discuss any matters that, in the opinion of the Committee or the independent auditors, should be discussed in private. The Committee has the power and authority to retain and determine funding for independent counsel, accountants, or other advisors as it determines necessary to carry out its duties.

The Human Resources and Compensation Committee consists of four independent directors of the Board. When considering the compensation arrangements for the CEO, the Committee meets in executive session without the presence of the CEO. This Committee establishes and reviews overall policy and structure with respect to compensation and employment matters, including the determination of compensation arrangements for directors, executive officers and key employees of the Corporation. The Committee is also responsible for the administration and award of options to purchase common shares of the Corporation pursuant to the Corporation’s stock option plan. The Committee has the power and authority to retain and determine funding for independent counsel, accountants, or other advisors as it determines necessary to carry out its duties.

The Communications Committee establishes and reviews overall policy, practices and controls as they relate to the Corporation’s communications to the public and its shareholders about its business and affairs other than financial statements and related security filings within the mandate of the Audit Committee.

The following table sets out the attendance record of each director for all Board and Audit Committee meetings since the last Annual Meeting of the Shareholders on June 19, 2014 up to the date of this Circular:

Further information about the Corporation’s corporate governance is set out in Schedule A to this Circular.

12) RESPONSIBILITIES OF THE CHAIRMAN OF THE BOARD OF DIRECTORS AND THE LEAD INDEPENDENT DIRECTOR

The Corporation’s CEO is the Chairman of the Board; however, Mr. Randall Lanham has been designated the Lead Independent Director on the Board of Directors.

The Corporation’s Chairman of the Board of Directors oversees the Board’s operations, direction, administration and proceedings, ensuring that the Board works as a cohesive team in accordance with its charter, furthering the goals, values and interests of the Corporation and building a healthy governance culture. The Chairman ensures that the Board and the Corporation act in compliance with the Corporation’s Code of Conduct and corporate governance policies and with applicable laws, rules and regulations and fosters ethical and responsible decision making by the Board, the Board Committees and individual Directors.

The Chairman provides leadership, advice and counsel to the Board, the Committee Chairs, fellow Directors and members of senior management to assist them to effectively carry out their duties and responsibilities and ensures that the responsibilities of the Board, Board Committees, individual Directors and other members of senior management, as set out in the charters or position descriptions, are well understood by the Board and individual Directors and are executed as effectively as possible.

The Chairman ensures that the Board meets at least four times annually and as many additional times as necessary to carry out its duties effectively and in consultation with Committee Chairs, other Directors, members of Management and outside advisors, as appropriate, establish the agenda for each Board meeting. The Chairman ensures that the Independent Directors are kept informed of the business and progress of the Corporation and encourages Directors to ask questions and express viewpoints during meetings. The Chairman ensures that the shareholders meet at least once annually and as many additional times as required by law and ensures that all business set out in the agenda of each shareholder meeting is discussed and brought to resolution, as required.

The Chairman, with the Audit Committee and the Board, monitors, prevents and responds to potential, apparent, or real conflict of interest situations and provides assistance, if requested, to the Corporate Governance Committee to facilitate the recruitment and retention of Directors.

The role of the Lead Director is to coordinate and facilitate the performance of the duties and responsibilities of the independent directors and to perform such other duties and responsibilities as the Board may determine. To that end, the Lead Director has the responsibility to call meetings of the independent directors, set the agenda for and chair such meetings and advise the Chairman of the Board about the substance of any discussions at such meetings or matters arising out of such meetings; advise the Chairman of the Board about the appropriate scheduling of board meetings; assist the Chairman in developing agendas for the Board meetings and advise the Chairman about the nature, quality, completeness or timeliness of the information that is necessary or appropriate to enable the independent directors to perform their duties.

14) APPOINTMENT OF AUDITORS

The Audit Committee of the Board of Directors of the Corporation proposes that Cutler & Co, Chartered Accountants, be appointed as auditors of the Corporation. Cutler & Co have been the auditors of the Corporation since July of 2015.

Unless otherwise specifically instructed, the persons named in the enclosed form of proxy intend to vote all shares represented by such proxy FOR the appointment of Cutler & Co, Chartered Accountants, as auditors of the Corporation to hold office until the next annual general meeting of shareholders at such remuneration as may be fixed by the Board of Directors based on the recommendation of the Audit Committee.

14) OTHER BUSINESS

The Management of the Corporation is not aware of any amendment regarding the items on the agenda set forth in the Notice and of any other item which could be submitted to the Meeting other than those mentioned in the Notice. However, should any amendment or other business be duly submitted to the Meeting, the attached form of proxy confers discretionary authority upon the persons designated therein to vote on the amendments concerning the matters mentioned in the Notice or any other business in accordance with their best judgment.

15) ADDITIONAL INFORMATION

Additional financial information is provided in the Corporation’s Consolidated Financial Statements and MD&A for the fiscal year ended December 31, 2014. All of this information, as well as additional information relating to the Corporation is available on the Electronic Data Gathering, Analysis, and Retrieval system (EDGAR) at www.sec.gov and the System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com. Shareholders may also request copies of the Corporation’s Consolidated Financial Statements and MD&A by contacting the Corporation at:

Nymox Pharmaceutical Corporation

Bay & Deveaux Sts.

2nd Floor, Nassau, The Bahamas

Phone: 800-936-9669

Email: info@nymox.com

Shareholder proposals intended to be presented at the Corporation’s 2016 annual meeting of shareholders must be submitted for inclusion in the Corporation’s proxy materials prior to March 8, 2016.

17) APPROVAL BY DIRECTORS

The contents of this Circular (including Schedule A, hereto) and the sending of such Circular to the shareholders have been approved by the Board of Directors of the Corporation.

November 24, 2015

Hasbrouck Heights, New Jersey

BY ORDER OF THE BOARD OF

DIRECTORS

/s/ Paul Averback

Paul Averback MD CEO & President

Exhibit 99.3

|

|

|

8th Floor, 100 University Avenue

Toronto, Ontario M5J 2Y1

www.computershare.com |

Security Class

Holder Account Number

|

|

|

Form of Proxy - Annual General Meeting to be held on December 16, 2015

This Form of Proxy is solicited by and on behalf of Management. |

| Notes to proxy |

| 1. |

Every holder has the right to appoint some other person or company of their choice, who need not be a holder, to attend and act on their behalf at the meeting or any adjournment or postponement thereof. If you wish to appoint a person or company other than the persons whose names are printed herein, please insert the name of your chosen proxyholder in the space provided (see reverse). |

| |

|

| 2. |

If the securities are registered in the name of more than one owner (for example, joint ownership, trustees, executors, etc.), then all those registered should sign this proxy. If you are voting on behalf of a corporation or another individual you must sign this proxy with signing capacity stated, and you may be required to provide documentation evidencing your power to sign this proxy. |

| |

|

| 3. |

This proxy should be signed in the exact manner as the name(s) appear(s) on the proxy. |

| |

|

| 4. |

If this proxy is not dated, it will be deemed to bear the date on which it is mailed by Management to the holder. |

| |

|

| 5. |

The securities represented by this proxy will be voted as directed by the holder, however, if such a direction is not made in respect of any matter, this proxy will be voted as recommended by Management. |

| |

|

| 6. |

The securities represented by this proxy will be voted in favour or withheld from voting or voted against each of the matters described herein, as applicable, in accordance with the instructions of the holder, on any ballot that may be called for and, if the holder has specified a choice with respect to any matter to be acted on, the securities will be voted accordingly. |

| |

|

| 7. |

This proxy confers discretionary authority in respect of amendments or variations to matters identified in the Notice of Meeting or other matters that may properly come before the meeting or any adjournment or postponement thereof. |

| |

|

| 8. |

This proxy should be read in conjunction with the accompanying documentation provided by Management. |

Proxies submitted must be received by 5:00 pm, Eastern Time, on December 14, 2015.

VOTE USING THE TELEPHONE OR INTERNET 24 HOURS A DAY 7 DAYS A WEEK!

|

|

|

|

|

|

|

|

|

| To Vote Using the Telephone |

|

To Vote Using the Internet |

|

To Receive Documents Electronically |

| • |

Call the number listed BELOW from a touch tone telephone. |

|

• |

Go to the following web site:

www.investorvote.com |

|

|

• |

You can enroll to receive future securityholder communications electronically, by visiting www.investorcentre.com. When you register for electronic documents, a tree will be planted on your behalf. |

|

1-866-732-VOTE (8683) Toll Free |

|

• |

Smartphone?

Scan the QR code to vote now. |

|

|

If you vote by telephone or the Internet, DO NOT mail back this proxy.

Voting by mail may be the only method for securities held in the name of a corporation or securities being voted on behalf of another individual.

Voting by mail or by Internet are the only methods by which a holder may appoint a person as proxyholder other than the Management nominees named on the reverse of this proxy. Instead of mailing this proxy, you may choose one of the two voting methods outlined above to vote this proxy.

To vote by telephone or the Internet, you will need to provide your CONTROL NUMBER listed below.

CONTROL NUMBER

|

|

|

|

|

| Appointment of Proxyholder |

|

|

|

|

| I/We, being holder(s) of Nymox hereby

appoint: Dr. Paul Averback or in his place Randall Lanham |

OR |

Print the name of the person you are appointing if this person is someone other than the Management Nominees listed herein. |

|

|

As my/our proxyholder with full power of substitution and to attend, act and to vote for and on behalf of the shareholder in accordance with the following direction (or if no directions have been given, as the proxyholder sees fit) and all other matters that may properly come before the Annual General Meeting of shareholders of Nymox that will be held at the British Colonial Hilton, Nassau Bahamas, Number One Bay St., Nassau Bahamas, on December 16, 2015, at 4:30 p.m., and at any adjournment or postponement thereof.

VOTING RECOMMENDATIONS ARE INDICATED BY HIGHLIGHTED TEXT OVER THE BOXES.

|

|

|

| |

For |

Withold |

| |

|

|

| 1. Election of Directors |

¨ |

¨ |

| |

To elect the directors of the Corporation.

Vote FOR or WITHHOLD for all nominees proposed by Management. |

| |

|

|

| |

For |

Withhold |

| |

|

|

| 2. Appointment of Auditors |

¨ |

¨ |

| |

| To appoint the auditors of the Corporation and to authorize the Board of Directors to fix their remuneration. |

| |

|

|

| |

For |

Against |

| |

|

|

| 3. Resolution |

¨ |

¨ |

| |

| To ratify the acts of the members of the Board of Directors for the fiscal year ending 2014. |

| |

|

|

|

|

|

|

|

|

| |

|

Signature(s) |

|

Date |

|

| Authorized Signature(s) – This section must be completed for your instructions to be executed. |

|

|

|

|

|

| I/We authorize you to act in accordance with my/our instructions set out above. I/We hereby revoke any proxy previously given with respect to the Meeting. If no voting instructions are indicated above, this Proxy will be voted as recommended by Management. |

|

|

|

DD / MM / YY |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Interim Financial Statements - Mark this box if you would like to receive Interim Financial Statements and accompanying Management's Discussion and Analysis by mail. |

¨ |

Annual Financial Statements - Mark this box if you would like to receive the Annual Financial Statements and accompanying Management's Discussion and Analysis by mail. |

¨ |

Information Circular - Mark this box if you would like to

receive the Information Circular by mail for the next securityholders' meeting. |

¨ |

If you are not mailing back your proxy, you may register online to receive the above financial report(s) by mail at www.computershare.com/mailinglist.

|

|

|

| N Y M Q |

2 1 8 3 6 2 |

A R 1 |

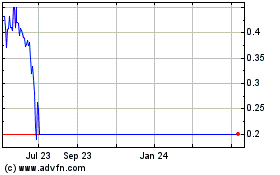

Nymox Pharmaceutical (NASDAQ:NYMX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nymox Pharmaceutical (NASDAQ:NYMX)

Historical Stock Chart

From Apr 2023 to Apr 2024