Report of Foreign Issuer (6-k)

October 29 2015 - 7:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2015

Commission File Number: 001-33129

Allot Communications Ltd.

(Translation of registrant's name into English)

22 Hanagar Street

Neve Ne’eman Industrial Zone B

Hod-Hasharon 4501317

Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No x

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ________

EXPLANATORY NOTE

On October 29, 2015, Allot Communications Ltd. issued a press release announcing the quarterly results for the third quarter of 2015.

A copy of the press release entitled “Allot Communications Announces Third Quarter 2015 Financial Results” is attached to this Form 6-K as Exhibit 99.1.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Allot Communications Ltd.

|

|

| |

|

|

|

| |

By:

|

/s/ Shmuel Arvatz |

|

| |

|

Shmuel Arvatz |

|

| |

|

Chief Financial Officer

|

|

| |

|

|

|

Date: October 29, 2015

EXHIBIT INDEX

The following exhibits have been filed as part of this Form 6-K:

|

99.1

|

Allot Communications Announces Third Quarter 2015 Financial Results

|

3

Exhibit 99.1

Allot Communications Announces Third Quarter 2015

Financial Results

Hod Hasharon, Israel - October 29, 2015 - Allot Communications Ltd. (NASDAQ, TASE: ALLT), a leading global provider of intelligent broadband solutions that empowers communication service providers to optimize and monetize their networks, enterprises to enhance productivity and consumers to improve their digital lifestyle, today announced its third quarter 2015 results.

Q3 2015 – Financial Highlights:

|

|

·

|

Non-GAAP revenues were $23.5 million, down 22% year over year

|

|

|

·

|

Non-GAAP gross margin reached 77%

|

|

|

·

|

Non-GAAP operating profit was 1%

|

|

|

·

|

Book-to-bill was above one

|

|

|

·

|

The Company recorded positive operating cash flow of $2.9 million

|

|

|

·

|

Net cash and cash equivalents as of September 30, 2015 totaled $122.8 million

|

Financial results:

On a GAAP basis, total revenues for the third quarter of 2015 were $23.5 million compared to $21.6 million of revenue reported for the second quarter of 2015 and $30.1 million of revenue reported for the third quarter of 2014. Net loss for the third quarter of 2015 was $3.4 million, or $0.10 per basic and diluted share. This compares with a net loss of $6.0 million, or $0.18 per basic and diluted share, in the second quarter of 2015 and a net profit of $0.8 million, or $0.02 per basic and diluted share, in the third quarter of 2014.

On a non-GAAP basis, total revenues for the third quarter of 2015 were $23.5 million, compared with $21.6 million of revenue reported for the second quarter of 2015 and $30.1 million of revenue reported for the third quarter of 2014. On a non-GAAP basis, net loss for the third quarter of 2015 was $0.7 million, or $0.02 per basic and diluted share. This compares with non-GAAP net loss of $3.0 million, or $0.09 per basic and diluted share, in the second quarter of 2015 and non-GAAP net income of $3.1 million, or $0.09 per basic and diluted share, in the third quarter of 2014.

Q3 2015 - Key Achievements:

|

|

·

|

During Q3 2015, 18 large orders were received, 4 of which were from new customers

|

|

|

·

|

7 of the large orders came from mobile-service providers and 7 were from fixed-line service providers

|

| |

·

|

In addition, 4 large orders were received for private and public cloud deployments

|

|

|

·

|

During Q3, 2015, Allot received three, over $1 million deals, compared to 6 in the previous quarter and 4 during Q3, 2014.

|

|

|

·

|

Allot is collaborating with HP by offering its virtualized security services on the HP OpenNFV cloud platform.

|

|

|

·

|

Allot received an $8 million expansion order from a tier-1 fixed line operator in APAC.

|

|

|

·

|

Allot received, after the end of the third quarter a follow on order of over $10 million, from an existing Tier 1 service provider. This order is included in the fourth quarter's booking.

|

|

|

·

|

Published the latest MobileTrends report revealing that 6% of mobile subscribers visit risky websites every day.

|

“During the third quarter of 2015, our revenues and booking grew sequentially and we expect further sequential increase in the fourth quarter. We are also pleased with the strong momentum of our security segment." said Mr. Andrei Elefant, President & CEO of Allot Communications. "We continue to control our OPEX and align it with the revenue level without compromising our future growth." Added Mr. Elefant. “We are encouraged with the new win of over $10 million that we booked in the beginning of the fourth quarter from an existing customer and we expect to recognize the majority of this order during 2016. This win together with the current backlog and prospects make us believe that we will return to growth in 2016.” Concluded Mr. Elefant.

2015 Outlook

The Company reiterates its previously provided guidance and expects total non-GAAP revenues to be in the range of $100 million to $105 million for full year 2015.

# # #

Conference Call & Webcast:

The Allot management team will host a conference call to discuss third quarter 2015 earnings results today at 8:30 AM ET, 2:30 p.m. Israel time. To access the conference call, please dial one of the following numbers: US: +1212 444 0412, UK: +44(0)2031408286, Israel: +97237219510, participant code 4389708.

A replay of the conference call will be available from 12:00 AM ET on October 30 2015 for 30 days. To access the replay, please dial: US: +1 347 366 9565; UK: +44(0) 2034270598, access code: 4389708. A live webcast of the conference call can be accessed on the Allot Communications website at www.allot.com. The webcast also will be archived on the website following the conference call.

About Allot Communications

Allot Communications Ltd. (NASDAQ, TASE: ALLT) empowers service providers to monetize and optimize their networks, enterprises to enhance productivity and consumers to enjoy an always-on digital lifestyle. Allot’s advanced DPI-based broadband solutions identify and leverage network intelligence to analyze, protect, improve and enrich mobile, fixed and cloud service delivery and user experience. Allot’s unique blend of innovative technology, proven know-how and collaborative approach to industry standards and partnerships enables network operators worldwide to elevate their role in the digital lifestyle ecosystem and to open the door to a wealth of new business opportunities. For more information, please visit www.allot.com.

GAAP to Non-GAAP Reconciliation:

The difference between GAAP and non-GAAP revenues is related to the acquisitions made by the Company and represents revenues adjusted for the impact of the fair value adjustment to acquired deferred revenue related to purchase accounting. Non-GAAP net income is defined as GAAP net income after including deferred revenues related to the fair value adjustment resulting from purchase accounting and excluding stock-based compensation expenses, amortization of acquisition-related intangible assets, inventory write-off expenses, regulatory matter expenses, acquisition-related expenses, restructuring costs and compensation expenses related to the acquisitions.

These non-GAAP measures should be considered in addition to, and not as a substitute for, comparable GAAP measures. The non-GAAP results and a full reconciliation between GAAP and non-GAAP results are provided in the accompanying Table 2. The Company provides these non-GAAP financial measures because it believes they present a better measure of the Company’s core business and management uses the non-GAAP measures internally to evaluate the Company’s ongoing performance. Accordingly, the Company believes they are useful to investors in enhancing an understanding of the Company’s operating performance.

Safe Harbor Statement

This release contains forward-looking statements, which express the current beliefs and expectations of Company management. Such statements involve a number of known and unknown risks and uncertainties that could cause our future results, performance or achievements to differ significantly from the results, performance or achievements set forth in such forward-looking statements. Important factors that could cause or contribute to such differences include risks relating to: our ability to compete successfully with other companies offering competing technologies; the loss of one or more significant customers; consolidation of, and strategic alliances by, our competitors, government regulation; the timing of completion of key project milestones which impact the timing of our revenue recognition; lower demand for key value-added services; our ability to keep pace with advances in technology and to add new features and value-added services; managing lengthy sales cycles; operational risks associated with large projects; our dependence on third party channel partners for a material portion of our revenues; court approval of the Company’s proposed share buy-back program; and other factors discussed under the heading "Risk Factors" in the Company's annual report on Form 20-F filed with the Securities and Exchange Commission. Forward-looking statements in this release are made pursuant to the safe harbor provisions contained in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are made only as of the date hereof, and the company undertakes no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise

|

Investor Relations Contact:

Rami Rozen

AVP Corporate Development

|

Public Relations Contact:

Sigalit Orr

Director Corporate Communications

International access code +972-54-268-1500

sorr@allot.com

|

| TABLE - 1 |

| ALLOT COMMUNICATIONS LTD. |

| AND ITS SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF OPERATIONS |

| (U.S. dollars in thousands, except share and per share data) |

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

September 30,

|

|

|

September 30,

|

|

| |

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

| |

|

(Unaudited)

|

|

|

(Unaudited)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

$ |

23,461 |

|

|

$ |

30,101 |

|

|

$ |

74,585 |

|

|

$ |

86,551 |

|

|

Cost of revenues

|

|

|

6,042 |

|

|

|

8,059 |

|

|

|

20,242 |

|

|

|

24,311 |

|

|

Gross profit

|

|

|

17,419 |

|

|

|

22,042 |

|

|

|

54,343 |

|

|

|

62,240 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development costs, net

|

|

|

6,446 |

|

|

|

7,240 |

|

|

|

19,946 |

|

|

|

21,649 |

|

|

Sales and marketing

|

|

|

10,532 |

|

|

|

11,411 |

|

|

|

33,176 |

|

|

|

32,544 |

|

|

General and administrative

|

|

|

2,867 |

|

|

|

2,798 |

|

|

|

9,492 |

|

|

|

8,616 |

|

|

Total operating expenses

|

|

|

19,845 |

|

|

|

21,449 |

|

|

|

62,614 |

|

|

|

62,809 |

|

|

Operating profit (loss)

|

|

|

(2,426 |

) |

|

|

593 |

|

|

|

(8,271 |

) |

|

|

(569 |

) |

|

Financial and other income (loss), net

|

|

|

(910 |

) |

|

|

224 |

|

|

|

(816 |

) |

|

|

460 |

|

|

Profit (loss) before income tax benefit

|

|

|

(3,336 |

) |

|

|

817 |

|

|

|

(9,087 |

) |

|

|

(109 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax expenses

|

|

|

67 |

|

|

|

52 |

|

|

|

374 |

|

|

|

134 |

|

|

Net profit (loss)

|

|

$ |

(3,403 |

) |

|

$ |

765 |

|

|

$ |

(9,461 |

) |

|

$ |

(243 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net profit (loss) per share

|

|

$ |

(0.10 |

) |

|

$ |

0.02 |

|

|

$ |

(0.28 |

) |

|

$ |

(0.01 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted net profit (loss) per share

|

|

$ |

(0.10 |

) |

|

$ |

0.02 |

|

|

$ |

(0.28 |

) |

|

$ |

(0.01 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

used in computing basic net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

earnings per share

|

|

|

33,512,755 |

|

|

|

33,234,558 |

|

|

|

33,443,418 |

|

|

|

33,096,065 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

used in computing diluted net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

earnings per share

|

|

|

33,512,755 |

|

|

|

33,631,356 |

|

|

|

33,443,418 |

|

|

|

33,096,065 |

|

| TABLE - 2 |

| ALLOT COMMUNICATIONS LTD. |

| AND ITS SUBSIDIARIES |

| RECONCILATION OF GAAP TO NON-GAAP CONSOLIDATED STATEMENTS OF OPERATIONS |

| (U.S. dollars in thousands, except per share data) |

| |

|

Three Months Ended

|

|

|

Three Months Ended

|

|

| |

|

September 30, 2015

|

|

|

September 30, 2014

|

|

| |

|

(Unaudited)

|

|

|

(Unaudited)

|

|

| |

|

$ |

|

|

% of Revenues

|

|

|

$ |

|

|

% of Revenues

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP operating profit (loss)

|

|

$ |

(2,426 |

) |

|

|

(10 |

)% |

|

$ |

593 |

|

|

|

2 |

% |

|

Share-based compensation (1)

|

|

|

1,754 |

|

|

|

|

|

|

|

1,894 |

|

|

|

|

|

|

Amortization of intangible assets (2)

|

|

|

778 |

|

|

|

|

|

|

|

457 |

|

|

|

|

|

|

Expenses related to M&A activities (3)

|

|

|

101 |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Fair value adjustment for acquired deferred revenues write down

|

|

|

11 |

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

Non-GAAP Operating income

|

|

$ |

218 |

|

|

|

1 |

% |

|

$ |

2,955 |

|

|

|

10 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net profit (loss)

|

|

$ |

(3,403 |

) |

|

|

(15 |

)% |

|

$ |

765 |

|

|

|

3 |

% |

|

Share-based compensation (1)

|

|

|

1,754 |

|

|

|

|

|

|

|

1,894 |

|

|

|

|

|

|

Amortization of intangible assets (2)

|

|

|

778 |

|

|

|

|

|

|

|

457 |

|

|

|

|

|

|

Expenses related to M&A activities (3)

|

|

|

119 |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Fair value adjustment for acquired deferred revenues write down

|

|

|

11 |

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

Non-GAAP net income (Loss)

|

|

$ |

(741 |

) |

|

|

(3 |

)% |

|

$ |

3,127 |

|

|

|

10 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP profit (loss) per share (diluted)

|

|

$ |

(0.10 |

) |

|

|

|

|

|

$ |

0.02 |

|

|

|

|

|

|

Share-based compensation

|

|

|

0.05 |

|

|

|

|

|

|

|

0.05 |

|

|

|

|

|

|

Amortization of intangible assets

|

|

|

0.03 |

|

|

|

|

|

|

|

0.02 |

|

|

|

|

|

|

Expenses related to M&A activities

|

|

|

0.00 |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Fair value adjustment for acquired deferred revenues write down

|

|

|

0.00 |

|

|

|

|

|

|

|

0.00 |

|

|

|

|

|

|

Non-GAAP Net income (loss) per share (diluted)

|

|

$ |

(0.02 |

) |

|

|

|

|

|

$ |

0.09 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Share-based compensation:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues

|

|

$ |

80 |

|

|

|

|

|

|

$ |

90 |

|

|

|

|

|

|

Research and development costs, net

|

|

|

426 |

|

|

|

|

|

|

|

476 |

|

|

|

|

|

|

Sales and marketing

|

|

|

680 |

|

|

|

|

|

|

|

830 |

|

|

|

|

|

|

General and administrative

|

|

|

568 |

|

|

|

|

|

|

|

498 |

|

|

|

|

|

| |

|

$ |

1,754 |

|

|

|

|

|

|

$ |

1,894 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) Amortization of intangible assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues

|

|

$ |

620 |

|

|

|

|

|

|

$ |

400 |

|

|

|

|

|

|

Sales and marketing

|

|

|

158 |

|

|

|

|

|

|

|

57 |

|

|

|

|

|

| |

|

$ |

778 |

|

|

|

|

|

|

$ |

457 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3) Expenses related to M&A activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

$ |

101 |

|

|

|

|

|

|

$ |

- |

|

|

|

|

|

|

Research and development costs, net

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Sales and marketing

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Finanacial expensees

|

|

|

18 |

|

|

|

|

|

|

|

- |

|

|

|

|

|

| |

|

$ |

119 |

|

|

|

|

|

|

$ |

- |

|

|

|

|

|

| TABLE - 2 cont. |

| ALLOT COMMUNICATIONS LTD. |

| AND ITS SUBSIDIARIES |

| RECONCILATION OF GAAP TO NON-GAAP CONSOLIDATED STATEMENTS OF OPERATIONS |

| (U.S. dollars in thousands, except per share data) |

| |

|

Nine Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

September 30, 2015

|

|

|

September 30, 2014

|

|

| |

|

(Unaudited)

|

|

|

(Unaudited)

|

|

| |

|

$ |

|

|

% of Revenues

|

|

|

$ |

|

|

% of Revenues

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP operating loss

|

|

$ |

(8,271 |

) |

|

|

(11 |

)% |

|

$ |

(569 |

) |

|

|

(1 |

)% |

|

Share-based compensation (1)

|

|

|

5,547 |

|

|

|

|

|

|

|

5,872 |

|

|

|

|

|

|

Amortization of intangible assets (2)

|

|

|

2,075 |

|

|

|

|

|

|

|

1,387 |

|

|

|

|

|

|

Expenses related to M&A activities (3)

|

|

|

678 |

|

|

|

|

|

|

|

33 |

|

|

|

|

|

|

Fair value adjustment for acquired deferred revenues write down

|

|

|

33 |

|

|

|

|

|

|

|

34 |

|

|

|

|

|

|

Non-GAAP Operating income

|

|

$ |

62 |

|

|

|

0 |

% |

|

$ |

6,757 |

|

|

|

8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Net Loss

|

|

$ |

(9,461 |

) |

|

|

(13 |

)% |

|

$ |

(243 |

) |

|

|

0 |

% |

|

Share-based compensation (1)

|

|

|

5,547 |

|

|

|

|

|

|

|

5,872 |

|

|

|

|

|

|

Amortization of intangible assets (2)

|

|

|

2,075 |

|

|

|

|

|

|

|

1,387 |

|

|

|

|

|

|

Expenses related to M&A activities (3)

|

|

|

960 |

|

|

|

|

|

|

|

33 |

|

|

|

|

|

|

Fair value adjustment for acquired deferred revenues write down

|

|

|

33 |

|

|

|

|

|

|

|

34 |

|

|

|

|

|

|

Non-GAAP net income (loss)

|

|

$ |

(846 |

) |

|

|

(1 |

)% |

|

$ |

7,083 |

|

|

|

8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP loss per share (diluted)

|

|

$ |

(0.28 |

) |

|

|

|

|

|

$ |

(0.01 |

) |

|

|

|

|

|

Share-based compensation

|

|

|

0.16 |

|

|

|

|

|

|

|

0.17 |

|

|

|

|

|

|

Amortization of intangible assets

|

|

|

0.06 |

|

|

|

|

|

|

|

0.04 |

|

|

|

|

|

|

Expenses related to M&A activities

|

|

|

0.03 |

|

|

|

|

|

|

|

0.00 |

|

|

|

|

|

|

Fair value adjustment for acquired deferred revenues write down

|

|

|

0.00 |

|

|

|

|

|

|

|

0.00 |

|

|

|

|

|

|

Non-GAAP Net income (loss) per share (diluted)

|

|

$ |

(0.03 |

) |

|

|

|

|

|

$ |

0.21 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Share-based compensation:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues

|

|

$ |

245 |

|

|

|

|

|

|

$ |

268 |

|

|

|

|

|

|

Research and development costs, net

|

|

|

1,271 |

|

|

|

|

|

|

|

1,432 |

|

|

|

|

|

|

Sales and marketing

|

|

|

2,172 |

|

|

|

|

|

|

|

2,462 |

|

|

|

|

|

|

General and administrative

|

|

|

1,859 |

|

|

|

|

|

|

|

1,710 |

|

|

|

|

|

| |

|

$ |

5,547 |

|

|

|

|

|

|

$ |

5,872 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) Amortization of intangible assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues

|

|

$ |

1,701 |

|

|

|

|

|

|

$ |

1,199 |

|

|

|

|

|

|

Sales and marketing

|

|

|

374 |

|

|

|

|

|

|

|

188 |

|

|

|

|

|

| |

|

$ |

2,075 |

|

|

|

|

|

|

$ |

1,387 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3) Expenses related to M&A activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

$ |

452 |

|

|

|

|

|

|

$ |

33 |

|

|

|

|

|

|

Research and development costs, net

|

|

|

45 |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Sales and marketing

|

|

|

181 |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Finanacial expensees

|

|

|

282 |

|

|

|

|

|

|

|

- |

|

|

|

|

|

| |

|

$ |

960 |

|

|

|

|

|

|

$ |

33 |

|

|

|

|

|

| TABLE - 3 |

| ALLOT COMMUNICATIONS LTD. |

| AND ITS SUBSIDIARIES |

| RECONCILATION OF GAAP TO NON-GAAP CONSOLIDATED REVENUES |

| (U.S. dollars in thousands, except share and per share data) |

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

September 30,

|

|

|

September 30,

|

|

| |

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

| |

|

(Unaudited)

|

|

|

(Unaudited)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Revenues

|

|

$ |

23,461 |

|

|

$ |

30,101 |

|

|

$ |

74,585 |

|

|

$ |

86,551 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair value adjustment for acquired deferred revenues write down

|

|

|

11 |

|

|

|

11 |

|

|

$ |

33 |

|

|

$ |

34 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Revenues

|

|

$ |

23,472 |

|

|

$ |

30,112 |

|

|

$ |

74,618 |

|

|

$ |

86,585 |

|

| TABLE - 4 |

| ALLOT COMMUNICATIONS LTD. |

| AND ITS SUBSIDIARIES |

| CONSOLIDATED BALANCE SHEETS |

| (U.S. dollars in thousands) |

| |

|

September 30,

|

|

|

December 31,

|

|

| |

|

2015

|

|

|

2014

|

|

| |

|

(Unaudited)

|

|

|

(Audited)

|

|

| |

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

CURRENT ASSETS:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

28,112 |

|

|

$ |

19,180 |

|

|

Short term deposits

|

|

|

36,750 |

|

|

|

59,000 |

|

|

Marketable securities and restricted cash

|

|

|

57,975 |

|

|

|

54,271 |

|

|

Trade receivables, net

|

|

|

22,491 |

|

|

|

23,759 |

|

|

Other receivables and prepaid expenses

|

|

|

4,723 |

|

|

|

5,383 |

|

|

Inventories

|

|

|

9,159 |

|

|

|

10,109 |

|

|

Total current assets

|

|

|

159,210 |

|

|

|

171,702 |

|

| |

|

|

|

|

|

|

|

|

|

LONG-TERM ASSETS:

|

|

|

|

|

|

|

|

|

|

Severance pay fund

|

|

|

277 |

|

|

|

262 |

|

|

Deferred taxes

|

|

|

1,856 |

|

|

|

1,716 |

|

|

Other assets

|

|

|

3,208 |

|

|

|

4,948 |

|

|

Total long-term assets

|

|

|

5,341 |

|

|

|

6,926 |

|

| |

|

|

|

|

|

|

|

|

|

PROPERTY AND EQUIPMENT, NET

|

|

|

5,287 |

|

|

|

5,957 |

|

|

GOODWILL AND INTANGIBLE ASSETS, NET

|

|

|

44,431 |

|

|

|

28,363 |

|

| |

|

|

|

|

|

|

|

|

|

Total assets

|

|

$ |

214,269 |

|

|

$ |

212,948 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES:

|

|

|

|

|

|

|

|

|

|

Trade payables

|

|

$ |

5,112 |

|

|

$ |

6,300 |

|

|

Deferred revenues

|

|

|

13,727 |

|

|

|

12,704 |

|

|

Other payables and accrued expenses

|

|

|

13,600 |

|

|

|

14,524 |

|

|

Total current liabilities

|

|

|

32,439 |

|

|

|

33,528 |

|

| |

|

|

|

|

|

|

|

|

|

LONG-TERM LIABILITIES:

|

|

|

|

|

|

|

|

|

|

Deferred revenues

|

|

|

4,938 |

|

|

|

4,158 |

|

|

Accrued severance pay

|

|

|

449 |

|

|

|

282 |

|

|

Other long term liabilities

|

|

|

4,091 |

|

|

|

0 |

|

|

Total long-term liabilities

|

|

|

9,478 |

|

|

|

4,440 |

|

| |

|

|

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY

|

|

|

172,352 |

|

|

|

174,980 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders' equity

|

|

$ |

214,269 |

|

|

$ |

212,948 |

|

| TABLE - 5 |

| ALLOT COMMUNICATIONS LTD. |

| AND ITS SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (U.S. dollars in thousands) |

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

September 30,

|

|

|

September 30,

|

|

| |

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

| |

|

(Unaudited)

|

|

|

(Unaudited)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (Loss)

|

|

$ |

(3,403 |

) |

|

$ |

765 |

|

|

$ |

(9,461 |

) |

|

$ |

(243 |

) |

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation

|

|

|

725 |

|

|

|

764 |

|

|

|

2,121 |

|

|

|

2,326 |

|

|

Stock-based compensation related to options granted to employees

|

|

|

1,770 |

|

|

|

1,894 |

|

|

|

5,542 |

|

|

|

5,873 |

|

|

Amortization of intangible assets

|

|

|

779 |

|

|

|

457 |

|

|

|

2,013 |

|

|

|

1,387 |

|

|

Capital loss

|

|

|

123 |

|

|

|

- |

|

|

|

138 |

|

|

|

- |

|

|

Decrease (Increase) in accrued severance pay, net

|

|

|

99 |

|

|

|

(4 |

) |

|

|

152 |

|

|

|

(7 |

) |

|

Decrease (Increase) in other assets

|

|

|

334 |

|

|

|

131 |

|

|

|

(32 |

) |

|

|

60 |

|

|

Decrease in accrued interest and amortization of premium on marketable securities

|

|

|

240 |

|

|

|

275 |

|

|

|

713 |

|

|

|

520 |

|

|

Increase (Decrease) in trade receivables

|

|

|

2,150 |

|

|

|

(1,539 |

) |

|

|

25 |

|

|

|

(8,417 |

) |

|

Decrease (Increase) in other receivables and prepaid expenses

|

|

|

844 |

|

|

|

(1,468 |

) |

|

|

(469 |

) |

|

|

(1,269 |

) |

|

Decrease (Increase) in inventories

|

|

|

(1,705 |

) |

|

|

835 |

|

|

|

60 |

|

|

|

756 |

|

|

Increase (Decrease) in long-term deferred taxes, net

|

|

|

- |

|

|

|

- |

|

|

|

(140 |

) |

|

|

56 |

|

|

Increase (Decrease) in trade payables

|

|

|

(551 |

) |

|

|

(2,121 |

) |

|

|

686 |

|

|

|

2,181 |

|

|

Increase (Decrease) in employees and payroll accruals

|

|

|

(769 |

) |

|

|

(598 |

) |

|

|

(918 |

) |

|

|

407 |

|

|

Increase in deferred revenues

|

|

|

1,265 |

|

|

|

1,313 |

|

|

|

1,648 |

|

|

|

1,677 |

|

|

Increase in other payables and accrued expenses

|

|

|

1,006 |

|

|

|

2,212 |

|

|

|

571 |

|

|

|

2,459 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities

|

|

|

2,907 |

|

|

|

2,916 |

|

|

|

2,649 |

|

|

|

7,766 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Redemption of short-term deposits

|

|

|

- |

|

|

|

- |

|

|

|

38,000 |

|

|

|

29,500 |

|

|

Investment in short-term deposit

|

|

|

(15,750 |

) |

|

|

(30,000 |

) |

|

|

(15,750 |

) |

|

|

(30,000 |

) |

|

Purchase of property and equipment

|

|

|

(522 |

) |

|

|

(900 |

) |

|

|

(1,606 |

) |

|

|

(2,513 |

) |

|

Investment in marketable securities

|

|

|

(2,537 |

) |

|

|

(885 |

) |

|

|

(20,812 |

) |

|

|

(19,866 |

) |

|

Proceeds from redemption or sale of marketable securities

|

|

|

4,792 |

|

|

|

500 |

|

|

|

16,399 |

|

|

|

4,764 |

|

|

Acquisitions

|

|

|

- |

|

|

|

- |

|

|

|

(10,052 |

) |

|

|

- |

|

|

Loan provided to third party, net

|

|

|

- |

|

|

|

157 |

|

|

|

- |

|

|

|

(2,235 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) investing activities

|

|

|

(14,017 |

) |

|

|

(31,128 |

) |

|

|

6,179 |

|

|

|

(20,350 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exercise of employee stock options

|

|

|

4 |

|

|

|

14 |

|

|

|

104 |

|

|

|

1,402 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by financing activities

|

|

|

4 |

|

|

|

14 |

|

|

|

104 |

|

|

|

1,402 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase (Decrease) in cash and cash equivalents

|

|

|

(11,106 |

) |

|

|

(28,198 |

) |

|

|

8,932 |

|

|

|

(11,182 |

) |

|

Cash and cash equivalents at the beginning of the period

|

|

|

39,218 |

|

|

|

59,829 |

|

|

|

19,180 |

|

|

|

42,813 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at the end of the period

|

|

$ |

28,112 |

|

|

$ |

31,631 |

|

|

$ |

28,112 |

|

|

$ |

31,631 |

|

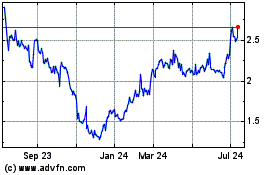

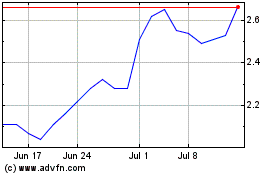

Allot (NASDAQ:ALLT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Allot (NASDAQ:ALLT)

Historical Stock Chart

From Apr 2023 to Apr 2024