FORM 6-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the month of October 2015

Commission File Number: 1-07952

KYOCERA CORPORATION

6, Takeda Tobadono-cho, Fushimi-ku,

Kyoto 612-8501, Japan

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Registration S-T Rule 101(b)(1): _____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Registration S-T Rule 101(b)(7): _____

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

KYOCERA CORPORATION |

|

|

|

|

|

/s/ SHOICHI AOKI |

|

|

Shoichi Aoki |

|

|

Director, |

|

|

Managing Executive Officer and |

|

|

General Manager of |

|

|

Corporate Financial and Accounting Group |

Date: October 29, 2015

Information furnished on this form:

EXHIBITS

Consolidated Financial Results of Kyocera Corporation and its Subsidiaries

for the Six Months Ended September 30, 2015

The consolidated financial information is prepared in accordance with accounting principles generally accepted in the United States of America.

1. Consolidated Financial Results for the Six Months Ended September 30, 2015

(1) Consolidated results of operations

(% of change from previous period)

|

|

|

Net sales |

|

Profit

from operations |

|

Income before

income taxes |

|

Net income attributable to

shareholders of

Kyocera Corporation |

|

|

|

|

Million yen |

|

% |

|

Million yen |

|

% |

|

Million yen |

|

% |

|

Million yen |

|

% |

|

|

Six Months ended September 30, 2015 |

|

722,577 |

|

1.2 |

|

61,949 |

|

13.1 |

|

78,000 |

|

14.5 |

|

50,792 |

|

16.4 |

|

|

Six Months ended September 30, 2014 |

|

714,329 |

|

2.1 |

|

54,751 |

|

(5.9 |

) |

68,118 |

|

(1.4 |

) |

43,649 |

|

1.7 |

|

(Note) Comprehensive income:

34,304 million yen for the six months ended September 30, 2015, (71.6)% of change from previous period

120,677 million yen for the six months ended September 30, 2014, (24.2)% of change from previous period

|

|

|

Net income attributable

to shareholders of

Kyocera Corporation

per share - Basic |

|

Net income attributable

to shareholders of

Kyocera Corporation

per share - Diluted |

|

|

|

|

Yen |

|

Yen |

|

|

Six Months ended September 30, 2015 |

|

138.45 |

|

138.45 |

|

|

Six Months ended September 30, 2014 |

|

118.98 |

|

118.98 |

|

(2) Consolidated financial condition

|

|

|

Total assets |

|

Total equity |

|

Kyocera Corporation

shareholders’ equity |

|

Kyocera Corporation

shareholders’ equity

to total assets |

|

|

|

|

Million yen |

|

Million yen |

|

Million yen |

|

% |

|

|

September 30, 2015 |

|

3,018,740 |

|

2,318,796 |

|

2,224,795 |

|

73.7 |

|

|

March 31, 2015 |

|

3,021,184 |

|

2,303,623 |

|

2,215,319 |

|

73.3 |

|

2. Dividends

|

|

|

Dividends per share |

|

|

|

|

End of

first quarter |

|

End of

second quarter |

|

End of

third quarter |

|

Year-end |

|

Annual |

|

|

|

|

Yen |

|

Yen |

|

Yen |

|

Yen |

|

Yen |

|

|

Year ended March 31, 2015 |

|

–– |

|

40.00 |

|

–– |

|

60.00 |

|

100.00 |

|

|

Year ending March 31, 2016 |

|

–– |

|

50.00 |

|

–– |

|

50.00 |

|

100.00 |

|

(Note) Kyocera Corporation has adopted a resolution at the meeting of its Board of Directors held on October 29, 2015 to pay “End of second quarter” dividends (or interim dividends) per share of 50.00 yen for the year ending March 31, 2016.

1

3. Consolidated Financial Forecasts for the Year Ending March 31, 2016

(% of change from previous year)

|

|

|

Net sales |

|

Profit from

operations |

|

Income before

income taxes |

|

Net income attributable

to shareholders of

Kyocera Corporation |

|

Net income attributable

to shareholders of

Kyocera Corporation

per share |

|

|

|

|

Million yen |

|

% |

|

Million yen |

|

% |

|

Million yen |

|

% |

|

Million yen |

|

% |

|

Yen |

|

|

Year ending March 31, 2016 |

|

1,530,000 |

|

0.2 |

|

110,000 |

|

17.7 |

|

140,000 |

|

14.9 |

|

85,000 |

|

(26.6 |

) |

231.70 |

|

(Note) Forecast of earnings per share attributable to shareholders of Kyocera Corporation is calculated based on the diluted average number of shares outstanding during the six months ended September 30, 2015.

(Notes)

(1) Increase or decrease in significant subsidiaries during the six months ended September 30, 2015: None

(2) Adoption of concise quarterly accounting method or procedure: None

(3) Changes in accounting policies:

(i) Changes due to adoption of new accounting standards: Please refer to the accompanying “3. OTHER INFORMATION” on page 15.

(ii) Changes due to other than adoption of new accounting standards: None

(4) Number of shares (common stock):

|

(i) |

Number of shares issued: |

|

|

|

|

|

|

377,618,580 shares at September 30, 2015 |

377,618,580 shares at March 31, 2015 |

|

|

|

|

|

(ii) |

Number of treasury stock: |

|

|

|

|

|

|

10,759,185 shares at September 30, 2015 |

10,757,224 shares at March 31, 2015 |

|

|

|

|

|

(iii) |

Average number of shares outstanding: |

|

|

|

|

|

|

366,860,136 shares for the six months ended September 30, 2015 |

366,865,668 shares for the six months ended September 30, 2014 |

Presentation of Situation of Review Procedure

The consolidated financial information included in this report is out of scope of the review procedure under the Financial Instruments and Exchange Law of Japan. The review procedure under the Financial Instruments and Exchange Law of Japan has not been completed at the date of disclosure of this report.

Instruction for Forecasts and Other Notes

Cautionary Statement for Forecasts:

With regard to forecasts set forth above, please refer to the accompanying “Forward-Looking Statements” on page 10.

2

Accompanying Information

1. BUSINESS RESULTS, FINANCIAL CONDITION AND PROSPECTS

(1) Business Results for the Six Months Ended September 30, 2015

Economic Situation and Business Environment

During the six months ended September 30, 2015 (“the first half”), the Japanese economy showed a moderate recovery trend due to an improvement in corporate earnings and an increase in capital investment. Overseas, the U.S. economy expanded primarily on the back of an increase in personal consumption, while in contrast growth in the Chinese economy weakened and the European economy, despite signs of a recovery trend, posted only a low growth rate.

With regard to the principal markets for Kyocera Corporation and its subsidiaries (“Kyocera Group” or “Kyocera”), demand for smartphones grew in the digital consumer equipment market, and demand expanded in the automotive market mainly in the United States and Europe.

Consolidated Financial Results

Despite a decline in sales in the Telecommunications Equipment Group and the Applied Ceramic Products Group including the solar energy business, sales increased due mainly to growth in sales in the Semiconductor Parts Group, the Electronic Device Group and the Fine Ceramic Parts Group for communications and automotive-related markets as well as to an increase in sales in the Information Equipment Group in the United States. As a result, consolidated net sales for the first half increased by ¥8,248 million, or 1.2%, to ¥722,577 million compared with ¥714,329 million for the six months ended September 30, 2014 (“the previous first half”).

Profits for the first half increased compared with the previous first half, reflecting increased profits in all reporting segments in the Components Business, together with recording of profit from a sale of assets in the Others reporting segment, which more than offset a decline in profits in the Equipment Business. Profit from operations increased by ¥7,198 million, or 13.1%, to ¥61,949 million, compared with ¥54,751 million for the previous first half. Income before income taxes increased by ¥9,882 million, or 14.5%, to ¥78,000 million, compared with ¥68,118 million for the previous first half. Net income attributable to shareholders of Kyocera Corporation for the first half increased by ¥7,143 million, or 16.4%, to ¥50,792 million, compared with ¥43,649 million for the previous first half.

Average exchange rates for the first half were ¥122 to the U.S. dollar, marking depreciation of ¥19 (approximately 18%) from ¥103 for the previous first half, and ¥135 to the Euro, marking appreciation of ¥4 (approximately 3%) from ¥139 for the previous first half.

|

|

|

Six months ended September 30, |

|

Increase |

|

|

|

|

2014 |

|

2015 |

|

(Decrease) |

|

|

|

|

Amount |

|

% |

|

Amount |

|

% |

|

Amount |

|

% |

|

|

|

|

(Yen in millions, except exchange rates) |

|

|

Net sales |

|

¥ |

714,329 |

|

100.0 |

|

¥ |

722,577 |

|

100.0 |

|

¥ |

8,248 |

|

1.2 |

|

|

Profit from operations |

|

54,751 |

|

7.7 |

|

61,949 |

|

8.6 |

|

7,198 |

|

13.1 |

|

|

Income before income taxes |

|

68,118 |

|

9.5 |

|

78,000 |

|

10.8 |

|

9,882 |

|

14.5 |

|

|

Net income attributable to shareholders of Kyocera Corporation |

|

43,649 |

|

6.1 |

|

50,792 |

|

7.0 |

|

7,143 |

|

16.4 |

|

|

Average US$ exchange rate |

|

103 |

|

–– |

|

122 |

|

–– |

|

–– |

|

–– |

|

|

Average Euro exchange rate |

|

139 |

|

–– |

|

135 |

|

–– |

|

–– |

|

–– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3

Consolidated Results by Reporting Segment

1) Fine Ceramic Parts Group

Sales and operating profit in this reporting segment increased compared with the previous first half due primarily to growth in sales of components for industrial machinery such as semiconductor processing equipment as well as in sales of automotive components such as camera modules.

2) Semiconductor Parts Group

Sales of packages and substrates for the communications market increased, particularly for communications infrastructure and smartphones, and sales of packages for LEDs also increased in automotive-related markets. As a result, sales and operating profit in this reporting segment increased compared with the previous first half.

3) Applied Ceramic Products Group

Sales in this reporting segment decreased compared with the previous first half due to a decline in sales in the solar energy business, which more than offset growth in sales in the cutting tool business, primarily for automotive-related markets. Operating profit, however, increased significantly compared with the previous first half due to efforts to reduce costs.

4) Electronic Device Group

Sales and operating profit in this reporting segment increased compared with the previous first half as a result of growth in sales of electronic components such as capacitors for smartphones and printing devices for industrial equipment.

5) Telecommunications Equipment Group

Sales of handsets featuring exceptional damage and water resistance grew steadily due to new customer cultivation and new product introductions, while sales of PHS-related products and low-end handsets decreased. As a result, sales and operating profit in this reporting segment decreased compared with the previous first half.

6) Information Equipment Group

Sales in this reporting segment increased compared with the previous first half due to growth in sales volume of equipment as result of active efforts to increase sales. On the other hand, operating profit decreased compared with the previous first half due to increased raw material costs reflecting the impact of foreign currency rate fluctuations.

7) Others

Sales in this reporting segment increased compared with the previous first half due primarily to a sales increase at Kyocera Communication Systems Co., Ltd. Operating profit increased substantially compared with the previous first half due mainly to recording of profit from a sale of assets.

4

Net Sales by Reporting Segment

|

|

|

Six months ended September 30, |

|

Increase |

|

|

|

|

2014 |

|

2015 |

|

(Decrease) |

|

|

|

|

Amount |

|

% |

|

Amount |

|

% |

|

Amount |

|

% |

|

|

|

|

(Yen in millions) |

|

|

Fine Ceramic Parts Group |

|

¥ |

43,224 |

|

6.0 |

|

¥ |

46,945 |

|

6.5 |

|

¥ |

3,721 |

|

8.6 |

|

|

Semiconductor Parts Group |

|

102,173 |

|

14.3 |

|

111,226 |

|

15.4 |

|

9,053 |

|

8.9 |

|

|

Applied Ceramic Products Group |

|

124,714 |

|

17.5 |

|

113,636 |

|

15.7 |

|

(11,078 |

) |

(8.9 |

) |

|

Electronic Device Group |

|

138,843 |

|

19.4 |

|

146,211 |

|

20.3 |

|

7,368 |

|

5.3 |

|

|

Total Components Business |

|

408,954 |

|

57.2 |

|

418,018 |

|

57.9 |

|

9,064 |

|

2.2 |

|

|

Telecommunications Equipment Group |

|

91,555 |

|

12.8 |

|

78,697 |

|

10.9 |

|

(12,858 |

) |

(14.0 |

) |

|

Information Equipment Group |

|

157,648 |

|

22.1 |

|

162,511 |

|

22.5 |

|

4,863 |

|

3.1 |

|

|

Total Equipment Business |

|

249,203 |

|

34.9 |

|

241,208 |

|

33.4 |

|

(7,995 |

) |

(3.2 |

) |

|

Others |

|

83,457 |

|

11.7 |

|

84,700 |

|

11.7 |

|

1,243 |

|

1.5 |

|

|

Adjustments and eliminations |

|

(27,285 |

) |

(3.8 |

) |

(21,349 |

) |

(3.0 |

) |

5,936 |

|

— |

|

|

Net sales |

|

¥ |

714,329 |

|

100.0 |

|

¥ |

722,577 |

|

100.0 |

|

¥ |

8,248 |

|

1.2 |

|

Operating Profit (Loss) by Reporting Segment

|

|

|

Six months ended September 30, |

|

Increase |

|

|

|

|

2014 |

|

2015 |

|

(Decrease) |

|

|

|

|

Amount |

|

%* |

|

Amount |

|

%* |

|

Amount |

|

% |

|

|

|

|

(Yen in millions) |

|

|

Fine Ceramic Parts Group |

|

¥ |

7,009 |

|

16.2 |

|

¥ |

8,267 |

|

17.6 |

|

¥ |

1,258 |

|

17.9 |

|

|

Semiconductor Parts Group |

|

14,655 |

|

14.3 |

|

16,626 |

|

14.9 |

|

1,971 |

|

13.4 |

|

|

Applied Ceramic Products Group |

|

5,776 |

|

4.6 |

|

8,023 |

|

7.1 |

|

2,247 |

|

38.9 |

|

|

Electronic Device Group |

|

16,684 |

|

12.0 |

|

18,411 |

|

12.6 |

|

1,727 |

|

10.4 |

|

|

Total Components Business |

|

44,124 |

|

10.8 |

|

51,327 |

|

12.3 |

|

7,203 |

|

16.3 |

|

|

Telecommunications Equipment Group |

|

(1,258 |

) |

— |

|

(5,621 |

) |

— |

|

(4,363 |

) |

— |

|

|

Information Equipment Group |

|

17,207 |

|

10.9 |

|

12,039 |

|

7.4 |

|

(5,168 |

) |

(30.0 |

) |

|

Total Equipment Business |

|

15,949 |

|

6.4 |

|

6,418 |

|

2.7 |

|

(9,531 |

) |

(59.8 |

) |

|

Others |

|

2,494 |

|

3.0 |

|

11,262 |

|

13.3 |

|

8,768 |

|

351.6 |

|

|

Operating profit |

|

62,567 |

|

8.8 |

|

69,007 |

|

9.6 |

|

6,440 |

|

10.3 |

|

|

Corporate gains and equity in earnings of affiliates and an unconsolidated subsidiary |

|

6,109 |

|

— |

|

8,902 |

|

— |

|

2,793 |

|

45.7 |

|

|

Adjustments and eliminations |

|

(558 |

) |

— |

|

91 |

|

— |

|

649 |

|

— |

|

|

Income before income taxes |

|

¥ |

68,118 |

|

9.5 |

|

¥ |

78,000 |

|

10.8 |

|

¥ |

9,882 |

|

14.5 |

|

* % to net sales of each corresponding segment

5

Net Sales by Geographic Area

1) Japan

Sales in Japan decreased compared with the previous first half due mainly to a decline in sales in the solar energy business.

2) Asia

Sales in Asia increased compared with the previous first half due mainly to an increase in sales of the Components Business such as the Semiconductor Parts Group and the Electronic Device Group used for smartphones.

3) United States of America

Sales in the United States of America increased compared with the previous first half due to increased sales in the solar energy business and the Information Equipment Group as well as to the effect of the yen’s depreciation against the U.S. dollar.

4) Europe

Sales in Europe decreased compared with the previous first half due to a decline in sales in the Information Equipment Group as well as to the effect of the yen’s appreciation against the Euro.

5) Others

Sales in Others decreased compared with the previous first half due mainly to a decrease in sales in the solar energy business and the Information Equipment Group.

|

|

|

Six months ended September 30, |

|

Increase |

|

|

|

|

2014 |

|

2015 |

|

(Decrease) |

|

|

|

|

Amount |

|

% |

|

Amount |

|

% |

|

Amount |

|

% |

|

|

|

|

(Yen in millions) |

|

|

Japan |

|

¥ |

295,404 |

|

41.4 |

|

¥ |

280,703 |

|

38.9 |

|

¥ |

(14,701 |

) |

(5.0 |

) |

|

Asia |

|

142,288 |

|

19.9 |

|

160,411 |

|

22.2 |

|

18,123 |

|

12.7 |

|

|

United States of America |

|

115,056 |

|

16.1 |

|

127,482 |

|

17.6 |

|

12,426 |

|

10.8 |

|

|

Europe |

|

129,071 |

|

18.1 |

|

122,861 |

|

17.0 |

|

(6,210 |

) |

(4.8 |

) |

|

Others |

|

32,510 |

|

4.5 |

|

31,120 |

|

4.3 |

|

(1,390 |

) |

(4.3 |

) |

|

Net sales |

|

¥ |

714,329 |

|

100.0 |

|

¥ |

722,577 |

|

100.0 |

|

¥ |

8,248 |

|

1.2 |

|

6

(2) Financial Condition

Consolidated Cash Flows

Cash and cash equivalents at September 30, 2015 decreased by ¥20,254 million to ¥331,109 million from ¥351,363 million at March 31, 2015.

1) Cash flows from operating activities

Net cash provided by operating activities for the first half increased by ¥23,393 million to ¥87,308 million from ¥63,915 million for the previous first half. This mainly reflected that cash flow adjustments related to receivables and inventories exceeded cash flow adjustment related to other current liabilities including accrued expenses.

2) Cash flows from investing activities

Net cash used in investing activities for the first half decreased by ¥9,844 million to ¥77,206 million from ¥87,050 million for the previous first half. This mainly reflected that a decrease in purchase of securities and an increase in proceeds from withdrawal of time deposits exceeded a decrease in maturities of securities and an increase in acquisition of time deposits.

3) Cash flows from financing activities

Net cash used in financing activities for the first half increased by ¥6,478 million to ¥28,515 million from ¥22,037 million for the previous first half. This was due mainly to an increase in dividends paid.

|

|

|

Six months ended September 30, |

|

|

|

|

2014 |

|

2015 |

|

|

|

|

(Yen in millions) |

|

|

Cash flows from operating activities |

|

¥ |

63,915 |

|

¥ |

87,308 |

|

|

Cash flows from investing activities |

|

(87,050 |

) |

(77,206 |

) |

|

Cash flows from financing activities |

|

(22,037 |

) |

(28,515 |

) |

|

Effect of exchange rate changes on cash and cash equivalents |

|

7,798 |

|

(1,841 |

) |

|

Net decrease in cash and cash equivalents |

|

(37,374 |

) |

(20,254 |

) |

|

Cash and cash equivalents at beginning of period |

|

335,174 |

|

351,363 |

|

|

Cash and cash equivalents at end of period |

|

¥ |

297,800 |

|

¥ |

331,109 |

|

(3) Acquisition of Shares of Common Stock, etc. of Nihon Inter Electronics Corporation

Kyocera Corporation completed a tender offer to acquire shares of common stock, etc. of Nihon Inter Electronics Corporation (herein “NIEC”), a company engaged in the development, manufacture and sale of power semiconductors, and NIEC became a consolidated subsidiary of Kyocera in September 2015.

Kyocera Corporation aims to achieve further corporate growth by pursuing synergies with NIEC in each business domain through sharing of their respective management resources, such as technologies and sales channels, and expanding into new business fields through combination of their respective products.

7

(4) Consolidated Financial Forecasts for the Year Ending March 31, 2016

From the three months ending December 31, 2015 onward, the economic environment will encompass concern regarding the slowing of the Chinese economy. At the same time, uncertainty is growing with respect to the economies of Europe and emerging countries. Consequently manufacturing volume of digital consumer equipment is expected to be below the projection made at the beginning of the year ending March 31, 2016 (“fiscal 2016”), and expansion of manufacturing activities in the automotive-related market and the industrial equipment market is also expected to slow.

Under these business circumstances, Kyocera will strive to continue securing orders from principal markets. However, it expects that demand in the Components and the Equipment Businesses will be below the projections made at the beginning of fiscal 2016. Therefore, Kyocera has revised its consolidated forecasts as announced in April 2015 as set forth below.

Kyocera has revised its forecasts of average exchange rates for the second half from the projections made in April 2015, from ¥115 to ¥117 against the U.S. dollar and from ¥125 to ¥130 against the Euro. As a result, full-year forecasts of average exchange rates for the fiscal 2016 have been revised to ¥120 to the U.S. dollar and ¥133 to the Euro.

|

|

|

Results for |

|

Forecasts for the year ending

March 31, 2016 announced on |

|

Increase

(Decrease) |

|

|

|

|

the year ended

March 31, 2015 |

|

April 27, 2015

(Previous) |

|

October 29, 2015

(Revised) |

|

to

Results |

|

|

|

|

Amount |

|

% |

|

Amount |

|

% |

|

Amount |

|

% |

|

% |

|

|

|

|

(Yen in millions, except exchange rates) |

|

|

Net sales |

|

¥ |

1,526,536 |

|

100.0 |

|

¥ |

1,600,000 |

|

100.0 |

|

¥ |

1,530,000 |

|

100.0 |

|

0.2 |

|

|

Profit from operations |

|

93,428 |

|

6.1 |

|

160,000 |

|

10.0 |

|

110,000 |

|

7.2 |

|

17.7 |

|

|

Income before income taxes |

|

121,862 |

|

8.0 |

|

184,000 |

|

11.5 |

|

140,000 |

|

9.2 |

|

14.9 |

|

|

Net income attributable to shareholders of Kyocera Corporation |

|

115,875 |

|

7.6 |

|

120,000 |

|

7.5 |

|

85,000 |

|

5.6 |

|

(26.6 |

) |

|

Average US$ exchange rate |

|

110 |

|

— |

|

115 |

|

— |

|

120 |

|

— |

|

— |

|

|

Average Euro exchange rate |

|

139 |

|

— |

|

125 |

|

— |

|

133 |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8

Net Sales by Reporting Segment

|

|

|

Results for |

|

Forecasts for the year ending

March 31, 2016 announced on |

|

Increase |

|

|

|

|

the year ended

March 31, 2015 |

|

April 27, 2015

(Previous) |

|

October 29, 2015

(Revised) |

|

(Decrease)

to Results |

|

|

|

|

Amount |

|

% |

|

Amount |

|

% |

|

Amount |

|

% |

|

% |

|

|

|

|

(Yen in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fine Ceramic Parts Group |

|

¥ |

90,694 |

|

5.9 |

|

¥ |

100,000 |

|

6.3 |

|

¥ |

95,000 |

|

6.2 |

|

4.7 |

|

|

Semiconductor Parts Group |

|

217,879 |

|

14.3 |

|

248,000 |

|

15.5 |

|

222,500 |

|

14.6 |

|

2.1 |

|

|

Applied Ceramic Products Group |

|

277,629 |

|

18.2 |

|

247,000 |

|

15.4 |

|

252,500 |

|

16.5 |

|

(9.1 |

) |

|

Electronic Device Group |

|

284,145 |

|

18.6 |

|

295,000 |

|

18.4 |

|

297,000 |

|

19.4 |

|

4.5 |

|

|

Total Components Business |

|

870,347 |

|

57.0 |

|

890,000 |

|

55.6 |

|

867,000 |

|

56.7 |

|

(0.4 |

) |

|

Telecommunications Equipment Group |

|

204,290 |

|

13.4 |

|

205,000 |

|

12.8 |

|

188,000 |

|

12.3 |

|

(8.0 |

) |

|

Information Equipment Group |

|

332,596 |

|

21.8 |

|

360,000 |

|

22.5 |

|

345,000 |

|

22.5 |

|

3.7 |

|

|

Total Equipment Business |

|

536,886 |

|

35.2 |

|

565,000 |

|

35.3 |

|

533,000 |

|

34.8 |

|

(0.7 |

) |

|

Others |

|

172,925 |

|

11.3 |

|

184,000 |

|

11.5 |

|

175,000 |

|

11.4 |

|

1.2 |

|

|

Adjustments and eliminations |

|

(53,622 |

) |

(3.5 |

) |

(39,000 |

) |

(2.4 |

) |

(45,000 |

) |

(2.9 |

) |

— |

|

|

Net sales |

|

¥ |

1,526,536 |

|

100.0 |

|

¥ |

1,600,000 |

|

100.0 |

|

¥ |

1,530,000 |

|

100.0 |

|

0.2 |

|

Operating Profit (Loss) by Reporting Segment

|

|

|

Results for |

|

Forecasts for the year ending

March 31, 2016 announced on |

|

Increase |

|

|

|

|

the year ended

March 31, 2015 |

|

April 27, 2015

(Previous) |

|

October 29, 2015

(Revised) |

|

(Decrease)

to Results |

|

|

|

|

Amount |

|

%* |

|

Amount |

|

%* |

|

Amount |

|

%* |

|

% |

|

|

|

|

(Yen in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fine Ceramic Parts Group |

|

¥ |

16,134 |

|

17.8 |

|

¥ |

18,000 |

|

18.0 |

|

¥ |

16,200 |

|

17.1 |

|

0.4 |

|

|

Semiconductor Parts Group |

|

33,971 |

|

15.6 |

|

39,000 |

|

15.7 |

|

32,000 |

|

14.4 |

|

(5.8 |

) |

|

Applied Ceramic Products Group |

|

3,159 |

|

1.1 |

|

19,000 |

|

7.7 |

|

20,000 |

|

7.9 |

|

533.1 |

|

|

Electronic Device Group |

|

34,372 |

|

12.1 |

|

43,000 |

|

14.6 |

|

15,000 |

|

5.1 |

|

(56.4 |

) |

|

Total Components Business |

|

87,636 |

|

10.1 |

|

119,000 |

|

13.4 |

|

83,200 |

|

9.6 |

|

(5.1 |

) |

|

Telecommunications Equipment Group |

|

(20,212 |

) |

— |

|

3,000 |

|

1.5 |

|

(2,000 |

) |

— |

|

— |

|

|

Information Equipment Group |

|

34,569 |

|

10.4 |

|

36,000 |

|

10.0 |

|

29,000 |

|

8.4 |

|

(16.1 |

) |

|

Total Equipment Business |

|

14,357 |

|

2.7 |

|

39,000 |

|

6.9 |

|

27,000 |

|

5.1 |

|

88.1 |

|

|

Others |

|

6,848 |

|

4.0 |

|

15,000 |

|

8.2 |

|

13,000 |

|

7.4 |

|

89.8 |

|

|

Operating profit |

|

108,841 |

|

7.1 |

|

173,000 |

|

10.8 |

|

123,200 |

|

8.1 |

|

13.2 |

|

|

Corporate and others |

|

13,021 |

|

— |

|

11,000 |

|

— |

|

16,800 |

|

— |

|

29.0 |

|

|

Income before income taxes |

|

¥ |

121,862 |

|

8.0 |

|

¥ |

184,000 |

|

11.5 |

|

¥ |

140,000 |

|

9.2 |

|

14.9 |

|

* % to net sales of each corresponding segment

9

Note: Forward-Looking Statements

Certain of the statements made in this document are forward-looking statements (within the meaning of Section 21E of the U.S. Securities and Exchange Act of 1934), which are based on our current assumptions and beliefs in light of the information currently available to us. These forward-looking statements involve known and unknown risks, uncertainties and other factors. Such risks, uncertainties and other factors include, but are not limited to the following:

(1) General conditions in the Japanese or global economy;

(2) Unexpected changes in economic, political and legal conditions in countries where we operate;

(3) Various export risks which may affect the significant percentage of our revenues derived from overseas sales;

(4) The effect of foreign exchange fluctuations on our results of operations;

(5) Intense competitive pressures to which our products are subject;

(6) Fluctuations in the price and ability of suppliers to provide the required quantity of raw materials for use in Kyocera’s production activities;

(7) Manufacturing delays or defects resulting from outsourcing or internal manufacturing processes;

(8) Shortages and rising costs of electricity affecting our production and sales activities;

(9) The possibility that future initiatives and in-process research and development may not produce the desired results;

(10) Companies or assets acquired by us not produce the returns or benefits, or bring in business opportunities;

(11) Inability to secure skilled employees, particularly engineering and technical personnel;

(12) Insufficient protection of our trade secrets and intellectual property rights including patents;

(13) Expenses associated with licenses we require to continue to manufacture and sell products;

(14) Environmental liability and compliance obligations by tightening of environmental laws and regulations;

(15) Unintentional conflict with laws and regulations or newly enacted laws and regulations;

(16) Our market or supply chains being affected by terrorism, plague, wars or similar events;

(17) Earthquakes and other natural disasters affecting our headquarters and major facilities as well as our suppliers and customers;

(18) Credit risk on trade receivables;

(19) Fluctuations in the value of, and impairment losses on, securities and other assets held by us;

(20) Impairment losses on long-lived assets, goodwill and intangible assets;

(21) Unrealized deferred tax assets and additional liabilities for unrecognized tax benefits; and

(22) Changes in accounting principles.

Such risks, uncertainties and other factors may cause our actual results, performance, achievements or financial condition to be materially different from any future results, performance, achievements or financial condition expressed or implied by these forward-looking statements. We undertake no obligation to publicly update any forward-looking statements included in this document.

10

2. CONSOLIDATED FINANCIAL STATEMENTS

(1) Consolidated Balance Sheets (Unaudited)

|

|

|

March 31, 2015 |

|

September 30, 2015 |

|

Increase |

|

|

|

|

Amount |

|

% |

|

Amount |

|

% |

|

(Decrease) |

|

|

|

|

(Yen in millions) |

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

¥ |

351,363 |

|

|

|

¥ |

331,109 |

|

|

|

¥ |

(20,254 |

) |

|

Short-term investments in debt and equity securities |

|

95,237 |

|

|

|

110,248 |

|

|

|

15,011 |

|

|

Other short-term investments |

|

184,358 |

|

|

|

214,337 |

|

|

|

29,979 |

|

|

Trade notes receivables |

|

19,130 |

|

|

|

19,115 |

|

|

|

(15 |

) |

|

Trade accounts receivables |

|

299,412 |

|

|

|

274,142 |

|

|

|

(25,270 |

) |

|

Less allowances for doubtful accounts and sales returns |

|

(5,378 |

) |

|

|

(5,550 |

) |

|

|

(172 |

) |

|

Inventories |

|

354,499 |

|

|

|

357,953 |

|

|

|

3,454 |

|

|

Deferred income taxes |

|

42,314 |

|

|

|

37,978 |

|

|

|

(4,336 |

) |

|

Other current assets |

|

116,612 |

|

|

|

111,753 |

|

|

|

(4,859 |

) |

|

Total current assets |

|

1,457,547 |

|

48.2 |

|

1,451,085 |

|

48.1 |

|

(6,462 |

) |

|

Non-current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Investments and advances: |

|

|

|

|

|

|

|

|

|

|

|

|

Long-term investments in debt and equity securities |

|

1,051,638 |

|

|

|

1,034,885 |

|

|

|

(16,753 |

) |

|

Other long-term investments |

|

20,402 |

|

|

|

20,280 |

|

|

|

(122 |

) |

|

Total investments and advances |

|

1,072,040 |

|

35.5 |

|

1,055,165 |

|

35.0 |

|

(16,875 |

) |

|

Property, plant and equipment: |

|

|

|

|

|

|

|

|

|

|

|

|

Land |

|

59,590 |

|

|

|

60,465 |

|

|

|

875 |

|

|

Buildings |

|

350,354 |

|

|

|

351,613 |

|

|

|

1,259 |

|

|

Machinery and equipment |

|

846,391 |

|

|

|

854,515 |

|

|

|

8,124 |

|

|

Construction in progress |

|

11,015 |

|

|

|

11,428 |

|

|

|

413 |

|

|

Less accumulated depreciation |

|

(1,005,859 |

) |

|

|

(1,009,487 |

) |

|

|

(3,628 |

) |

|

Total property, plant and equipment |

|

261,491 |

|

8.6 |

|

268,534 |

|

8.9 |

|

7,043 |

|

|

Goodwill |

|

102,167 |

|

3.4 |

|

114,121 |

|

3.8 |

|

11,954 |

|

|

Intangible assets |

|

56,615 |

|

1.9 |

|

55,986 |

|

1.8 |

|

(629 |

) |

|

Other assets |

|

71,324 |

|

2.4 |

|

73,849 |

|

2.4 |

|

2,525 |

|

|

Total non-current assets |

|

1,563,637 |

|

51.8 |

|

1,567,655 |

|

51.9 |

|

4,018 |

|

|

Total assets |

|

¥ |

3,021,184 |

|

100.0 |

|

¥ |

3,018,740 |

|

100.0 |

|

¥ |

(2,444 |

) |

11

|

|

|

March 31, 2015 |

|

September 30, 2015 |

|

Increase |

|

|

|

|

Amount |

|

% |

|

Amount |

|

% |

|

(Decrease) |

|

|

|

|

(Yen in millions) |

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Short-term borrowings |

|

¥ |

4,129 |

|

|

|

¥ |

5,108 |

|

|

|

¥ |

979 |

|

|

Current portion of long-term debt |

|

9,441 |

|

|

|

10,206 |

|

|

|

765 |

|

|

Trade notes and accounts payable |

|

119,654 |

|

|

|

118,391 |

|

|

|

(1,263 |

) |

|

Other notes and accounts payable |

|

59,613 |

|

|

|

59,389 |

|

|

|

(224 |

) |

|

Accrued payroll and bonus |

|

59,454 |

|

|

|

61,431 |

|

|

|

1,977 |

|

|

Accrued income taxes |

|

17,316 |

|

|

|

17,971 |

|

|

|

655 |

|

|

Other accrued liabilities |

|

53,305 |

|

|

|

40,065 |

|

|

|

(13,240 |

) |

|

Other current liabilities |

|

33,339 |

|

|

|

31,354 |

|

|

|

(1,985 |

) |

|

Total current liabilities |

|

356,251 |

|

11.8 |

|

343,915 |

|

11.4 |

|

(12,336 |

) |

|

Non-current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Long-term debt |

|

17,881 |

|

|

|

19,436 |

|

|

|

1,555 |

|

|

Accrued pension and severance liabilities |

|

34,764 |

|

|

|

34,881 |

|

|

|

117 |

|

|

Deferred income taxes |

|

292,454 |

|

|

|

284,590 |

|

|

|

(7,864 |

) |

|

Other non-current liabilities |

|

16,211 |

|

|

|

17,122 |

|

|

|

911 |

|

|

Total non-current liabilities |

|

361,310 |

|

12.0 |

|

356,029 |

|

11.8 |

|

(5,281 |

) |

|

Total liabilities |

|

717,561 |

|

23.8 |

|

699,944 |

|

23.2 |

|

(17,617 |

) |

|

Kyocera Corporation shareholders’ equity: |

|

|

|

|

|

|

|

|

|

|

|

|

Common stock |

|

115,703 |

|

|

|

115,703 |

|

|

|

— |

|

|

Additional paid-in capital |

|

162,695 |

|

|

|

162,775 |

|

|

|

80 |

|

|

Retained earnings |

|

1,502,310 |

|

|

|

1,531,090 |

|

|

|

28,780 |

|

|

Accumulated other comprehensive income |

|

469,673 |

|

|

|

450,302 |

|

|

|

(19,371 |

) |

|

Common stock in treasury, at cost |

|

(35,062 |

) |

|

|

(35,075 |

) |

|

|

(13 |

) |

|

Total Kyocera Corporation shareholders’ equity |

|

2,215,319 |

|

73.3 |

|

2,224,795 |

|

73.7 |

|

9,476 |

|

|

Noncontrolling interests |

|

88,304 |

|

2.9 |

|

94,001 |

|

3.1 |

|

5,697 |

|

|

Total equity |

|

2,303,623 |

|

76.2 |

|

2,318,796 |

|

76.8 |

|

15,173 |

|

|

Total liabilities and equity |

|

¥ |

3,021,184 |

|

100.0 |

|

¥ |

3,018,740 |

|

100.0 |

|

¥ |

(2,444 |

) |

Note: Accumulated other comprehensive income is as follows:

|

|

|

March 31, 2015 |

|

September 30, 2015 |

|

Increase

(Decrease) |

|

|

|

|

|

|

(Yen in millions) |

|

|

|

|

Net unrealized gains on securities |

|

¥ |

467,841 |

|

¥ |

453,832 |

|

¥ |

(14,009 |

) |

|

Net unrealized losses on derivative financial instruments |

|

(372 |

) |

(397 |

) |

(25 |

) |

|

Pension adjustments |

|

(28,452 |

) |

(29,266 |

) |

(814 |

) |

|

Foreign currency translation adjustments |

|

30,656 |

|

26,133 |

|

(4,523 |

) |

|

Total |

|

¥ |

469,673 |

|

¥ |

450,302 |

|

¥ |

(19,371 |

) |

12

(2) Consolidated Statements of Income and Comprehensive Income (Unaudited)

Consolidated Statements of Income

|

|

|

Six months ended September 30, |

|

Increase |

|

|

|

|

2014 |

|

2015 |

|

(Decrease) |

|

|

|

|

Amount |

|

% |

|

Amount |

|

% |

|

Amount |

|

% |

|

|

|

|

(Yen in millions and shares in thousands, except per share amounts) |

|

|

Net sales |

|

¥ |

714,329 |

|

100.0 |

|

¥ |

722,577 |

|

100.0 |

|

¥ |

8,248 |

|

1.2 |

|

|

Cost of sales |

|

525,286 |

|

73.5 |

|

531,517 |

|

73.6 |

|

6,231 |

|

1.2 |

|

|

Gross profit |

|

189,043 |

|

26.5 |

|

191,060 |

|

26.4 |

|

2,017 |

|

1.1 |

|

|

Selling, general and administrative expenses |

|

134,292 |

|

18.8 |

|

129,111 |

|

17.8 |

|

(5,181 |

) |

(3.9 |

) |

|

Profit from operations |

|

54,751 |

|

7.7 |

|

61,949 |

|

8.6 |

|

7,198 |

|

13.1 |

|

|

Other income (expenses) : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and dividend income |

|

11,104 |

|

1.5 |

|

13,765 |

|

1.9 |

|

2,661 |

|

24.0 |

|

|

Interest expense |

|

(880 |

) |

(0.1 |

) |

(769 |

) |

(0.1 |

) |

111 |

|

— |

|

|

Foreign currency transaction gains, net |

|

1,923 |

|

0.2 |

|

2,034 |

|

0.3 |

|

111 |

|

5.8 |

|

|

Other, net |

|

1,220 |

|

0.2 |

|

1,021 |

|

0.1 |

|

(199 |

) |

(16.3 |

) |

|

Total other income (expenses) |

|

13,367 |

|

1.8 |

|

16,051 |

|

2.2 |

|

2,684 |

|

20.1 |

|

|

Income before income taxes |

|

68,118 |

|

9.5 |

|

78,000 |

|

10.8 |

|

9,882 |

|

14.5 |

|

|

Income taxes |

|

21,055 |

|

2.9 |

|

24,296 |

|

3.4 |

|

3,241 |

|

15.4 |

|

|

Net income |

|

47,063 |

|

6.6 |

|

53,704 |

|

7.4 |

|

6,641 |

|

14.1 |

|

|

Net income attributable to noncontrolling interests |

|

(3,414 |

) |

(0.5 |

) |

(2,912 |

) |

(0.4 |

) |

502 |

|

— |

|

|

Net income attributable to shareholders of Kyocera Corporation |

|

¥ |

43,649 |

|

6.1 |

|

¥ |

50,792 |

|

7.0 |

|

¥ |

7,143 |

|

16.4 |

|

|

Per share information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to shareholders of Kyocera Corporation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

¥ |

118.98 |

|

|

|

¥ |

138.45 |

|

|

|

|

|

|

|

|

Diluted |

|

118.98 |

|

|

|

138.45 |

|

|

|

|

|

|

|

|

Average number of shares of common stock outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

366,866 |

|

|

|

366,860 |

|

|

|

|

|

|

|

|

Diluted |

|

366,866 |

|

|

|

366,860 |

|

|

|

|

|

|

|

Note:

Basic earnings per share attributable to shareholders of Kyocera Corporation is calculated based on the average number of shares of common stock outstanding during each period, and diluted earnings per share attributable to shareholders of Kyocera Corporation is calculated based on the diluted average number of shares of stock outstanding during each period.

13

Consolidated Statements of Comprehensive Income

|

|

|

Six months ended September 30, |

|

Increase |

|

|

|

|

2014 |

|

2015 |

|

(Decrease) |

|

|

|

|

Amount |

|

Amount |

|

Amount |

|

|

|

|

(Yen in millions) |

|

|

Net income |

|

¥ |

47,063 |

|

¥ |

53,704 |

|

¥ |

6,641 |

|

|

Other comprehensive income (loss) — net of taxes |

|

|

|

|

|

|

|

|

Net unrealized gains (losses) on securities |

|

50,531 |

|

(14,083 |

) |

(64,614 |

) |

|

Net unrealized losses on derivative financial instruments |

|

(164 |

) |

(31 |

) |

133 |

|

|

Pension adjustments |

|

(355 |

) |

(814 |

) |

(459 |

) |

|

Foreign currency translation adjustments |

|

23,602 |

|

(4,472 |

) |

(28,074 |

) |

|

Total other comprehensive income (loss) |

|

73,614 |

|

(19,400 |

) |

(93,014 |

) |

|

Comprehensive income |

|

120,677 |

|

34,304 |

|

(86,373 |

) |

|

Comprehensive income attributable to noncontrolling interests |

|

(6,447 |

) |

(2,883 |

) |

3,564 |

|

|

Comprehensive income attributable to shareholders of Kyocera Corporation |

|

¥ |

114,230 |

|

¥ |

31,421 |

|

¥ |

(82,809 |

) |

(3) Notes to the consolidated financial statements

Cautionary Statement for Premise of a Going Concern

None.

Cautionary Statement for Significant Changes in Equity

None.

14

3. OTHER INFORMATION

Changes in accounting policies

Recently Adopted Accounting Standards

On April 1, 2015, Kyocera adopted Accounting Standards Update (ASU) No. 2014-08, “Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity.” This accounting standard changes the requirements for reporting discontinued operations in ASC 205-20, “Presentation of Financial Statements—Discontinued Operations.” A disposal of a component of an entity or a group of components of an entity is required to be reported in discontinued operations if the disposal represents a strategic shift that has (or will have) a major effect on an entity’s operations and financial results. This accounting standard also requires an entity to provide disclosures about a disposal of an individually significant component of an entity that does not qualify for discontinued operations presentation in the financial statements. The adoption of this accounting standard did not have a material impact on Kyocera’s consolidated results of operations, financial condition and cash flows.

15

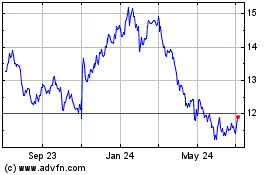

Kyocera (PK) (USOTC:KYOCY)

Historical Stock Chart

From Mar 2024 to Apr 2024

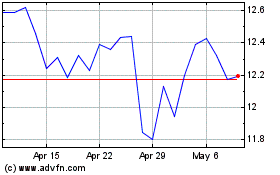

Kyocera (PK) (USOTC:KYOCY)

Historical Stock Chart

From Apr 2023 to Apr 2024