UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October

1, 2015

Commission File Number 001-34984

FIRST

MAJESTIC SILVER CORP.

(Translation of registrant's name into English)

925 West Georgia Street,

Suite 1805, Vancouver BC V6C 3L2

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

SUBMITTED HEREWITH

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| FIRST MAJESTIC SILVER CORP. |

|

| |

|

| By: |

|

| |

|

| /s/ Connie Lillico |

|

| Connie Lillico |

|

| Corporate Secretary |

|

| |

|

| October 1, 2015 |

|

Exhibit 99.1

NYSE – AG

TSX – FR

Frankfurt – FMV

Mexico – AG

|

October 1, 2015

FIRST MAJESTIC COMPLETES ACQUISITION

OF SILVERCREST

VANCOUVER, BC, CANADA – First Majestic

Silver Corp. (“First Majestic”) and SilverCrest Mines Inc. (“SilverCrest”) are pleased to announce

the completion of the plan of arrangement (the "Arrangement") previously announced in the joint news release of First

Majestic and SilverCrest dated July 27, 2015.

Under the arrangement, which took

effect as of 12:01 a.m. (Vancouver time) this morning, First Majestic has acquired all of the issued and outstanding common

shares of SilverCrest. Shareholders of SilverCrest will receive 0.2769 First Majestic shares and CDN$0.0001 for each share

of SilverCrest held. In addition, shareholders of SilverCrest will receive 0.1667 shares in a newly formed company which

will hold certain exploration assets currently held by SilverCrest and First Majestic.

Keith Neumeyer, President and CEO of First

Majestic said, "With this closing, First Majestic is integrating a well-built, low-cost, profitable silver mine into its large

portfolio of operating mines. The Santa Elena Silver Mine, becoming our sixth mine in Mexico, is projected to increase the Company’s

total production by approximately 5 million silver equivalent ounces per year. We are very excited to have this free cash flowing

mine added to our portfolio.”

“Over the coming quarters, we will be

communicating our plan for Santa Elena which will include ways to further reduce operating costs,” continued Mr. Neumeyer.

“Finally, I would like to take this opportunity to personally welcome the SilverCrest shareholders into the First Majestic

family.”

With the Arrangement now complete, it is expected

that SilverCrest’s shares will cease trading and will be delisted from the Toronto Stock Exchange ("TSX") in approximately

2-3 business days in accordance with the rules of the TSX and will cease trading and be delisted from the New York Stock Exchange

MKT before the opening on October 2, 2015.

ABOUT FIRST MAJESTIC

First Majestic is a mining company focused

on silver production in Mexico and is aggressively pursuing the development of its existing mineral property assets and the pursuit

through acquisition of additional mineral assets which contribute to First Majestic achieving its corporate growth objectives.

For further information, contact info@firstmajestic.com,

visit its website at www.firstmajestic.com or contact Todd Anthony, Investor Relations at 1-866-529-2807.

|

ON BEHALF OF THE BOARD OF

FIRST MAJESTIC SILVER CORP.

“Keith Neumeyer”

Keith Neumeyer

President & CEO |

|

SPECIAL NOTE REGARDING FORWARD LOOKING

STATEMENTS

This news release includes certain "Forward-Looking

Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking

information” under applicable Canadian securities laws. When used in this news release, the words "anticipate",

"believe", "estimate", "expect", "target", "plan", "forecast", "may",

"schedule" and similar words or expressions, identify forward-looking statements or information. These forward-looking

statements or information relate to, among other things: the date of de-listing of SilverCrest’s shares; anticipated benefits

of the Arrangement to First Majestic; the future plans for and the development of the Santa Elena Mine; future silver production;

future growth potential for First Majestic; and plans to reduce operating costs.

These statements reflect the parties’

respective current views with respect to future events and are necessarily based upon a number of assumptions and estimates that,

while considered reasonable by the respective parties, are inherently subject to significant business, economic, competitive, political

and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements

to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking

statements or information and the parties have made assumptions and estimates based on or related to many of these factors. Such

factors include, without limitation: decisions by the Toronto Stock Exchange and the NYSE MKT with respect to de-listing of SilverCrest’s

shares; the synergies expected from the Arrangement not being realized; business integration risks; fluctuations in general macro-economic

conditions; fluctuations in securities markets and the market price of First Majestic’s shares; fluctuations in the spot

and forward price of silver, gold, base metals or certain other commodities (such as natural gas, fuel oil and electricity); fluctuations

in the currency markets (such as the Canadian dollar and Mexican peso versus the U.S. dollar); changes in national and local government,

legislation, taxation, controls, regulations and political or economic developments in Canada or Mexico; operating or technical

difficulties in connection with mining or development activities; risks and hazards associated with the business of mineral exploration,

development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins

and flooding); risks relating to the credit worthiness or financial condition of suppliers, refiners and other parties with whom

the parties do business; inability to obtain adequate insurance to cover risks and hazards; and the presence of laws and regulations

that may impose restrictions on mining, including those currently enacted in Mexico; employee relations; relationships with and

claims by local communities and indigenous populations; availability and increasing costs associated with mining inputs and labour;

the speculative nature of mineral exploration and development, including the risks of obtaining necessary licenses, permits and

approvals from government authorities; diminishing quantities or grades of mineral reserves as properties are mined; title to properties;

and the factors identified under the caption "Risk Factors" in First Majestic’s Annual Information Form, and under

the caption "Factors" in SilverCrest’s Annual Information Form..

Readers are cautioned against attributing undue

certainty to forward-looking statements or information. Although the parties have attempted to identify important factors that

could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated

or intended. The parties do not intend, and do not assume any obligation, to update these forward-looking statements or information

to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other

than as required by applicable law.

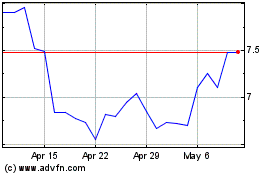

First Majestic Silver (NYSE:AG)

Historical Stock Chart

From Mar 2024 to Apr 2024

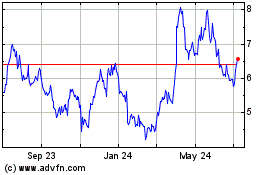

First Majestic Silver (NYSE:AG)

Historical Stock Chart

From Apr 2023 to Apr 2024