UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the Month of September 2015

Commission file number 0-30070

AUDIOCODES LTD.

(Translation of registrant’s name

into English)

1 Hayarden Street • Airport City,

Lod 7019900 • ISRAEL

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ý Form 40-F

¨

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Note: Regulation S-T Rule 101(b)(1)

only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Note: Regulation S-T Rule 101(b)(7)

only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant

foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on

which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to

be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the

subject of a Form 6-K submission or other Commission filing on EDGAR.

The following documents are attached hereto

and incorporated by reference herein:

| Exhibit 99.1. | Interim Condensed Consolidated Financial Statements as

of June 30, 2015. |

| Exhibit 99.2. | Operating Results and Financial Review in connection

the Interim Condensed Consolidated Financial Statements for the six months ended June 30, 2015. |

The Interim Condensed Consolidated Financial

Statements of AudioCodes Ltd. as of June 30, 2015 attached as Exhibit 99.1 and the Operating Results and Financial Review in connection

with the Interim Condensed Consolidated Financial Statements of AudioCodes Ltd. for the six months ended June 30, 2015 attached

as Exhibit 99.2 to this Report on Form 6-K are hereby incorporated by reference into (i) the Registrant’s Registration Statement

on Form S-8, File No. 333-11894; (ii) the Registrant’s Registration Statement on Form S-8, File No. 333-13268; (iii) the

Registrant’s Registration Statement on Form S-8, File No. 333-105473; (iv) the Registrant’s Registration Statement

on Form S-8, File No. 333-144825; (v) the Registrant’s Registration Statement on Form S-8, File No. 333-160330; (vi) the

Registrant’s Registration Statement on Form S-8, File No. 333-170676; (vii) the Registrant’s Registration Statement

on Form S-8, File No. 333-190437; and (viii) the Registrant’s Registration Statement on Form F-3, File No. 333-193209.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

AUDIOCODES LTD. |

| |

(Registrant) |

| |

|

|

| |

|

|

| |

By: |

/s/ Niran Baruch |

| |

|

Niran Baruch |

| |

|

Vice President Finance and |

| |

|

Chief Accounting Officer |

Dated: September 25, 2015

EXHIBIT INDEX

|

Exhibit

No. |

|

Description |

| 99.1 |

|

Interim Unaudited Condensed Consolidated Financial Statements of AudioCodes Ltd. as of June 30, 2015 |

| 99.2 |

|

Operating Results and Financial Review in connection with the Interim Condensed Consolidated Financial Statements of AudioCodes Ltd. for the six months ended June 30, 2015 |

Exhibit 99.1

AUDIOCODES LTD.

INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

AS OF JUNE 30, 2015

IN U.S. DOLLARS

UNAUDITED

INDEX

- - - - - - - - -

- -

AUDIOCODES LTD.

| INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS |

| U.S. dollars in thousands |

| | |

June 30, | | |

December 31, | |

| | |

2015 | | |

2014 | |

| | |

Unaudited | | |

Audited | |

| | |

| | |

| |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT ASSETS: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 15,307 | | |

$ | 14,797 | |

| Short-term and restricted bank deposits | |

| 4,361 | | |

| 7,630 | |

| Short-term marketable securities and accrued interest | |

| 4,100 | | |

| 543 | |

| Trade receivables (net of allowance for doubtful accounts of $ 2,737 (unaudited) and $ 2,437 at June 30, 2015 and December 31, 2014, respectively) | |

| 28,059 | | |

| 31,056 | |

| Other receivables and prepaid expenses | |

| 5,833 | | |

| 6,244 | |

| Deferred tax assets, net | |

| 2,446 | | |

| 3,320 | |

| Inventories | |

| 15,132 | | |

| 14,736 | |

| | |

| | | |

| | |

| Total current

assets | |

| 75,238 | | |

| 78,326 | |

| | |

| | | |

| | |

| LONG-TERM ASSETS: | |

| | | |

| | |

| Long-term and restricted bank deposits and accrued interest | |

| 2,733 | | |

| 4,066 | |

| Long-term marketable securities | |

| 52,107 | | |

| 58,684 | |

| Deferred tax assets, net | |

| - | | |

| 872 | |

| Severance pay funds | |

| 18,579 | | |

| 17,835 | |

| | |

| | | |

| | |

| Total long-term assets | |

| 73,419 | | |

| 81,457 | |

| | |

| | | |

| | |

| PROPERTY AND EQUIPMENT, NET | |

| 4,226 | | |

| 3,856 | |

| | |

| | | |

| | |

| INTANGIBLE ASSETS, NET | |

| 2,331 | | |

| 2,996 | |

| | |

| | | |

| | |

| GOODWILL | |

| 33,749 | | |

| 33,749 | |

| | |

| | | |

| | |

| Total assets | |

$ | 188,963 | | |

$ | 200,384 | |

The accompanying notes are an integral

part of the interim condensed consolidated financial statements.

AUDIOCODES LTD.

| INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS |

| U.S. dollars in thousands, except share and per share data |

| | |

June 30, | | |

December 31, | |

| | |

2015 | | |

2014 | |

| | |

Unaudited | | |

Audited | |

| LIABILITIES AND EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Current maturities of long-term bank loans | |

$ | 4,686 | | |

$ | 4,686 | |

| Trade payables | |

| 6,442 | | |

| 10,111 | |

| Other payables and accrued expenses | |

| 16,401 | | |

| 15,758 | |

| Deferred revenues | |

| 12,166 | | |

| 10,233 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 39,695 | | |

| 40,788 | |

| | |

| | | |

| | |

| LONG-TERM LIABILITIES: | |

| | | |

| | |

| Accrued severance pay | |

| 18,731 | | |

| 17,908 | |

| Long-term banks loans | |

| 2,763 | | |

| 5,105 | |

| Deferred revenues and other liabilities | |

| 3,896 | | |

| 2,862 | |

| | |

| | | |

| | |

| Total long-term liabilities | |

| 25,390 | | |

| 25,875 | |

| | |

| | | |

| | |

| COMMITMENTS AND CONTINGENT LIABILITIES | |

| | | |

| | |

| | |

| | | |

| | |

| EQUITY: | |

| | | |

| | |

| Share capital - | |

| | | |

| | |

| Ordinary shares of NIS 0.01 par value - | |

| | | |

| | |

| Authorized: 100,000,000 (unaudited) shares at June 30, 2015 and 100,000,000 shares at December 31, 2014; Issued: 54,929,810 (unaudited) shares at June 30, 2015 and 54,785,756 shares at December 31, 2014; Outstanding: 40,036,128 (unaudited) shares at June 30, 2015 and 42,380,158 shares at December 31, 2014 | |

| 118 | | |

| 125 | |

| Additional paid-in capital | |

| 237,398 | | |

| 235,760 | |

| Treasury stock at cost- 14,893,682 (unaudited) shares as of June 30, 2015 and 12,405,598 shares as of December 31, 2014 | |

| (52,354 | ) | |

| (41,032 | ) |

| Accumulated other comprehensive income (loss) | |

| 1,887 | | |

| (261 | ) |

| Accumulated deficit | |

| (63,171 | ) | |

| (60,871 | ) |

| | |

| | | |

| | |

| Total equity | |

| 123,878 | | |

| 133,721 | |

| | |

| | | |

| | |

| Total liabilities and equity | |

$ | 188,963 | | |

$ | 200,384 | |

The accompanying notes are an integral

part of the interim condensed consolidated financial statements.

AUDIOCODES LTD.

| INTERIM CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

| U.S. dollars in thousands, except per share data |

| | |

Six months ended

June 30, | |

| | |

2015 | | |

2014 | |

| | |

Unaudited | |

| Revenues: | |

| | | |

| | |

| Products | |

$ | 51,673 | | |

$ | 57,917 | |

| Services | |

| 18,212 | | |

| 15,600 | |

| | |

| | | |

| | |

| Total revenues | |

| 69,885 | | |

| 73,517 | |

| | |

| | | |

| | |

| Cost of revenues: | |

| | | |

| | |

| Products | |

| 23,821 | | |

| 26,193 | |

| Services | |

| 4,823 | | |

| 3,961 | |

| | |

| | | |

| | |

| Total cost of revenues | |

| 28,644 | | |

| 30,154 | |

| | |

| | | |

| | |

| Gross profit | |

| 41,241 | | |

| 43,363 | |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| Research and development, net | |

| 14,676 | | |

| 16,228 | |

| Selling and marketing | |

| 22,637 | | |

| 22,895 | |

| General and administrative | |

| 4,655 | | |

| 3,716 | |

| | |

| | | |

| | |

| Total operating expenses | |

| 41,968 | | |

| 42,839 | |

| | |

| | | |

| | |

| Operating income (loss) | |

| (727 | ) | |

| 524 | |

| Financial income, net | |

| 606 | | |

| 102 | |

| | |

| | | |

| | |

| Income (loss) before taxes on income | |

| (121 | ) | |

| 626 | |

| Income tax expenses, net | |

| (2,179 | ) | |

| (950 | ) |

| | |

| | | |

| | |

| Net loss | |

$ | (2,300 | ) | |

$ | (324 | ) |

| | |

| | | |

| | |

| Net loss per share – basic and diluted | |

$ | (0.06 | ) | |

$ | (0.01 | ) |

The accompanying notes are an integral

part of the interim condensed consolidated financial statements.

| AUDIOCODES LTD. |

| |

| INTERIM CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS |

| U.S. dollars in thousands |

| | |

Six months ended

June 30, | |

| | |

2015 | | |

2014 | |

| | |

Unaudited | |

| | |

| | |

| |

| Net loss | |

$ | (2,300 | ) | |

$ | (324 | ) |

| | |

| | | |

| | |

| Other comprehensive income ("OCI") related to: | |

| | | |

| | |

| Unrealized gain on marketable securities recognized in OCI | |

| 272 | | |

| - | |

| | |

| | | |

| | |

| Other comprehensive income (“OCI”), related to: | |

| | | |

| | |

| Gain on derivatives recognized in OCI | |

| 1,613 | | |

| - | |

| Loss on derivatives (effective portion) recognized in income | |

| 263 | | |

| - | |

| Other comprehensive income, related to unrealized gains on cash flow hedges | |

| 1,876 | | |

| - | |

| | |

| | | |

| | |

| Other comprehensive income | |

| 2,148 | | |

| - | |

| | |

| | | |

| | |

| Total comprehensive loss | |

$ | (152 | ) | |

$ | (324 | ) |

The accompanying notes are an integral

part of the interim condensed consolidated financial statements.

| AUDIOCODES LTD. |

| |

| INTERIM CONDENSED STATEMENTS OF CHANGES IN EQUITY |

| U.S. dollars in thousands |

| | |

| | |

| | |

| | |

Accumulated | | |

| | |

| |

| | |

| | |

Additional | | |

| | |

other | | |

| | |

| |

| | |

Share | | |

paid-in | | |

Treasury | | |

comprehensive | | |

Accumulated | | |

Total | |

| | |

capital | | |

capital | | |

stock | | |

income

(loss) | | |

deficit | | |

equity | |

| Balance

as of December 31, 2013 (audited) | |

$ | 114 | | |

$ | 201,248 | | |

$ | (35,768 | ) | |

$ | - | | |

$ | (60,785 | ) | |

$ | 104,809 | |

| Purchase of treasury

stock (audited) | |

| (3 | ) | |

| - | | |

| (5,264 | ) | |

| - | | |

| - | | |

| (5,267 | ) |

| Issuance of ordinary

shares (audited) | |

| 12 | | |

| 29,732 | | |

| - | | |

| - | | |

| - | | |

| 29,744 | |

| Issuance of shares upon

exercise of options (audited) | |

| 2 | | |

| 2,234 | | |

| - | | |

| - | | |

| - | | |

| 2,236 | |

| Stock compensation related

to options granted to employees (audited) | |

| - | | |

| 2,546 | | |

| - | | |

| - | | |

| - | | |

| 2,546 | |

| Other comprehensive

loss (audited) | |

| - | | |

| - | | |

| - | | |

| (261 | ) | |

| - | | |

| (261 | ) |

| Net

loss (audited) | |

| - | | |

| - | | |

| - | | |

| - | | |

| (86 | ) | |

| (86 | ) |

| Balance as of December

31, 2014 (audited) | |

| 125 | | |

| 235,760 | | |

| (41,032 | ) | |

| (261 | ) | |

| (60,871 | ) | |

| 133,721 | |

| Purchase of treasury

stock (unaudited) | |

| (7 | ) | |

| - | | |

| (11,322 | ) | |

| - | | |

| - | | |

| (11,329 | ) |

| Issuance of shares upon

exercise of options (unaudited) | |

| - | | |

| 331 | | |

| - | | |

| - | | |

| - | | |

| 331 | |

| Stock compensation related

to options granted to employees (unaudited) | |

| - | | |

| 1,307 | | |

| - | | |

| - | | |

| - | | |

| 1,307 | |

| Other comprehensive

income (unaudited) | |

| - | | |

| - | | |

| - | | |

| 2,148 | | |

| - | | |

| 2,148 | |

| Net

loss (unaudited) | |

| - | | |

| - | | |

| - | | |

| - | | |

| (2,300 | ) | |

| (2,300 | ) |

| Balance

as of June 30, 2015 (unaudited) | |

$ | 118 | | |

$ | 237,398 | | |

$ | (52,354 | ) | |

$ | 1,887 | | |

$ | (63,171 | ) | |

$ | 123,878 | |

The accompanying notes are an integral

part of the interim condensed consolidated financial statements.

| AUDIOCODES LTD. |

| |

| INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| U.S. dollars in thousands |

| | |

Six months ended

June 30, | |

| | |

2015 | | |

2014 | |

| | |

Unaudited | |

| Cash flows from operating activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Net loss | |

$ | (2,300 | ) | |

$ | (324 | ) |

| Adjustments required to reconcile net loss to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 1,627 | | |

| 1,629 | |

| Amortization of marketable securities premiums and accretion of discounts, net | |

| 552 | | |

| 195 | |

| Stock-based compensation expenses | |

| 1,307 | | |

| 1,316 | |

| Decrease in accrued interest on loans, convertible notes, marketable securities, bank deposits and structured notes | |

| 29 | | |

| 159 | |

| Decrease in deferred tax assets, net | |

| 1,746 | | |

| 961 | |

| Decrease (increase) in trade receivables, net | |

| 2,997 | | |

| (4,363 | ) |

| Decrease (increase) in other accounts receivable and prepaid expenses | |

| 1,936 | | |

| (2,364 | ) |

| Increase in inventories | |

| (396 | ) | |

| (234 | ) |

| Increase (decrease) in trade payables | |

| (3,669 | ) | |

| 546 | |

| Increase in other accounts payable and accrued expenses | |

| 950 | | |

| 953 | |

| Increase in deferred revenues | |

| 3,212 | | |

| 3,273 | |

| Increase (decrease) in accrued severance pay, net | |

| 79 | | |

| (186 | ) |

| | |

| | | |

| | |

| Net cash provided by operating activities | |

| 8,070 | | |

| 1,561 | |

The accompanying notes are an integral

part of the interim condensed consolidated financial statements.

| AUDIOCODES LTD. |

| |

| INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| U.S. dollars in thousands |

| | |

Six months ended

June 30, | |

| | |

2015 | | |

2014 | |

| | |

Unaudited | |

| Cash flows from investing activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Purchase of marketable securities | |

| - | | |

| (60,170 | ) |

| Proceeds from redemption and sale of marketable securities | |

| 2,711 | | |

| 15,390 | |

| Decrease in short-term deposits | |

| 3,269 | | |

| 1,000 | |

| Proceeds from redemption of long-term bank deposits | |

| 1,365 | | |

| 1,381 | |

| Purchase of property and equipment | |

| (1,332 | ) | |

| (719 | ) |

| | |

| | | |

| | |

| Net cash provided by (used in) investing activities | |

| 6,013 | | |

| (43,118 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Purchase of treasury stock | |

| (11,329 | ) | |

| - | |

| Repayment of senior convertible notes | |

| - | | |

| (285 | ) |

| Repayment of long-term bank loans | |

| (2,342 | ) | |

| (2,343 | ) |

| Proceeds from issuance of shares upon exercise of stock options and warrants | |

| 331 | | |

| 2,112 | |

| Proceeds from issuance of shares, net of issuance

cost in the amount of $ 2,456 | |

| - | | |

| 29,744 | |

| Consideration related to payment of acquisition of Mailvision | |

| (233 | ) | |

| (233 | ) |

| | |

| | | |

| | |

| Net cash provided by (used in) financing activities | |

| (13,573 | ) | |

| 28,995 | |

| | |

| | | |

| | |

| Increase (decrease) in cash and cash equivalents | |

| 510 | | |

| (12,562 | ) |

| Cash and cash equivalents at the beginning of the period | |

| 14,797 | | |

| 30,763 | |

| | |

| | | |

| | |

| Cash and cash equivalents at the end of the period | |

$ | 15,307 | | |

$ | 18,201 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Cash paid during the period for income taxes | |

$ | 148 | | |

$ | 185 | |

| | |

| | | |

| | |

| Cash paid during the period for interest | |

$ | 175 | | |

$ | 229 | |

The accompanying notes are an integral

part of the interim condensed consolidated financial statements.

| AUDIOCODES LTD. |

| |

| NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| U.S. dollars in thousands, except share and per share data |

AudioCodes Ltd. (the "Company")

and its subsidiaries (together the "Group") design, develop and market products and services for voice, data and video

over IP networks to service providers and channels (such as distributors), OEMs, network equipment providers and systems integrators.

The Company operates through

its wholly-owned subsidiaries in the United States, Europe, Asia, Latin America and Israel.

| b. | The Group's major customer in the six months ended June 30, 2015, and 2014, accounted for 11.8%

(unaudited) and 14.3% (unaudited) of the Group's revenues in those periods, respectively. No other customer accounted for more

than 10% of the Group's revenues in those periods. |

| c. | Asset Purchase Agreement with Mailvision Ltd ("Mailvision"): |

In April 2013, the Company entered

into an asset purchase agreement with Mailvision, an Israeli company which develops, markets and licenses VoIP solutions for mobile,

PC and tablet devices for telecom operators and service providers, in which the Company held 29.2% of the outstanding share capital.

Pursuant to the agreement, in May 2013, the Company acquired certain assets and assumed certain liabilities of Mailvision.

In May 2015, the Company paid

an earn-out consideration of $ 233 and shall pay an additional amount of $ 233 in May 2016, due to meeting certain milestones of

revenues. (See also Note 5 for changes in the fair value of contingent consideration liabilities related to Mailvision's acquisition).

| d. | The Group is dependent upon sole source suppliers for

certain key components used in its products, including certain digital signal processing chips. Although there are a limited number

of manufacturers of these particular components, management believes that other suppliers could provide similar components at

comparable terms. A change in suppliers, however, could cause a delay in manufacturing and a possible loss of sales, which could

adversely affect the operating results of the Group and its financial position. |

| AUDIOCODES LTD. |

| |

| NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| U.S. dollars in thousands, except share and per share data |

| NOTE 2:- | SIGNIFICANT ACCOUNTING POLICIES |

The significant

accounting policies applied in the annual financial statements of the Company as of December 31, 2014, are applied consistently

in these financial statements. For further information refer to the consolidated financial statements as of December 31, 2014.

| a. | Interim financial statements: |

The interim

condensed consolidated balance sheet as of June 30, 2015 and the related interim condensed consolidated statements of operations,

comprehensive loss and cash flows for the six months ended June 30, 2015 and 2014, and the statement of changes in equity for the

six months ended June 30, 2015, are unaudited. This unaudited information has been prepared by the Company in accordance with accounting

principles generally accepted in the United States of America ("U.S. GAAP") for interim financial statements, and on

the same basis as the audited annual consolidated financial statements. In management's opinion, this unaudited information reflects

all adjustments (consisting only of normal recurring accruals) necessary for a fair presentation of the financial information,

in accordance with generally accepted accounting principles, for interim financial reporting for the periods presented and accordingly,

they do not include all of the information and footnotes required by generally accepted accounting principles for audited financial

statements. However, the Company believes that the disclosures are adequate to make the information presented not misleading. These

interim condensed consolidated financial statements should be read in conjunction with the 2014 Annual consolidated financial statements

and the notes thereto. The interim condensed consolidated balance sheet data as of December 31, 2014 was derived from the 2014

Annual Consolidated Financial Statements, but does not include all disclosures required by U.S. GAAP.

The preparation

of financial statements in conformity with U.S. GAAP requires management to make estimates, judgments and assumptions that affect

the amounts reported in the financial statements and accompanying notes. The Company's management believes that the estimates,

judgments and assumptions used are reasonable based upon information available at the time they are made. As applicable to these

interim condensed consolidated financial statements, the most significant estimates and assumptions relate to revenue recognition

and allowance for sales returns, allowance for doubtful accounts, inventories, intangible assets, goodwill, income taxes and valuation

allowance, stock-based compensation and contingent liabilities. Actual results could differ from those estimates.

| c. | Impact of recently issued accounting standard not yet adopted: |

In May

2014, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU")

2014-09, "Revenue from Contracts with Customers". ASU 2014-09 requires an entity to recognize revenue to depict the

transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects

to be entitled in exchange for those goods and services. Insurance contracts do not fall within the scope of this ASU. The

effective date of ASU 2014-09 is for annual reporting periods beginning after December 15, 2017. In July 2015, the FASB

decided to defer by one year the effective date of this ASU. The Company is currently in the process of evaluating the impact

of the adoption of ASU 2014-09 on its consolidated financial statements.

| AUDIOCODES LTD. |

| |

| NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| U.S. dollars in thousands, except share and per share data |

| NOTE 3:- | MARKETABLE SECURITIES AND ACCRUED INTEREST |

The following is a summary of

available for sale marketable securities:

| | |

June 30, 2015 | |

| | |

Amortized | | |

Unrealized | | |

Unrealized | | |

Fair | |

| | |

cost | | |

gains | | |

losses | | |

Value | |

| | |

Unaudited | |

| Corporate debentures: | |

| | | |

| | | |

| | | |

| | |

| Maturing within one year | |

$ | 3,584 | | |

$ | 14 | | |

$ | (12 | ) | |

$ | 3,586 | |

| Maturing between one to five years | |

| 52,225 | | |

| 49 | | |

| (167 | ) | |

| 52,107 | |

| Accrued interest | |

| 514 | | |

| - | | |

| - | | |

| 514 | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

$ | 56,323 | | |

$ | 63 | | |

$ | (179 | ) | |

$ | 56,207 | |

| | |

December 31, 2014 | |

| | |

Amortized | | |

Unrealized | | |

Unrealized | | |

Fair | |

| | |

cost | | |

gains | | |

losses | | |

Value | |

| | |

Audited | |

| Corporate debentures: | |

| | | |

| | | |

| | | |

| | |

| Maturing between one to five years | |

$ | 59,072 | | |

$ | 12 | | |

$ | (400 | ) | |

$ | 58,684 | |

| Accrued interest | |

| 543 | | |

| - | | |

| - | | |

| 543 | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

$ | 59,615 | | |

$ | 12 | | |

$ | (400 | ) | |

$ | 59,227 | |

These investments were issued

by highly rated corporations. Accordingly, it is expected that the securities would not be settled at a price less than the amortized

cost of the Company's investment. As of June 30, 2015 and December 31, 2014, the Group did not have any investment in marketable

securities that was in an unrealized loss position for a period of twelve months or greater. Since the Company had the ability

and intent to hold these investments until an anticipated recovery of fair value, which may be until maturity, the Company did

not consider these investments to be other-than-temporarily impaired as of June 30, 2015. Unrealized gains (losses) are valued

using alternative pricing sources and models utilizing market observable inputs.

| AUDIOCODES LTD. |

| |

| NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| U.S. dollars in thousands, except share and per share data |

| | |

June 30, | | |

December 31, | |

| | |

2015 | | |

2014 | |

| | |

Unaudited | | |

Audited | |

| | |

| | |

| |

| Raw materials | |

$ | 6,158 | | |

$ | 6,794 | |

| Finished products | |

| 8,974 | | |

| 7,942 | |

| | |

| | | |

| | |

| | |

$ | 15,132 | | |

$ | 14,736 | |

In the six months ended June

30, 2015 and 2014, the Group wrote-off inventories in a total amount of $ 67 (unaudited) and $ 60 (unaudited), respectively.

| NOTE 5:- | FAIR VALUE MEASUREMENTS |

In accordance

with Accounting Statdards Codification ("ASC") No. 820, "Fair Value Measurements and Disclosures", the Group

measures its foreign currency derivative instruments and its contingent consideration relating to the Mailvision acquisition, at

fair value. Investments in foreign currency derivative instruments and debt securities are classified within Level 2 value hierarchy.

This is because these assets are valued using alternative pricing sources and models utilizing market observable inputs.

The Group's

financial assets and liabilities measured at fair value on a recurring basis, consisted of the following types of instruments as

of the following dates:

| | |

June 30, 2015 | |

| | |

Fair value measurements using input type | |

| | |

Level 2 | | |

Level 3 | | |

Total | |

| | |

Unaudited | |

| Financial assets related to foreign currency derivative hedging contracts | |

$ | 2,002 | | |

$ | - | | |

$ | 2,002 | |

| Marketable securities | |

| 56,207 | | |

| - | | |

| 56,207 | |

| Contingent consideration related to Mailvision | |

| - | | |

| (221 | ) | |

| (221 | ) |

| | |

| | | |

| | | |

| | |

| Total Financial assets (liability) | |

$ | 58,209 | | |

$ | (221 | ) | |

$ | 57,988 | |

| | |

December 31, 2014 | |

| | |

Fair value measurements using input type | |

| | |

Level 2 | | |

Level 3 | | |

Total | |

| | |

Audited | |

| Financial assets related to foreign currency derivative hedging contracts | |

$ | 127 | | |

$ | - | | |

$ | 127 | |

| Marketable securities | |

| 59,227 | | |

| - | | |

| 59,227 | |

| Contingent consideration related to Mailvision | |

| - | | |

| (443 | ) | |

| (443 | ) |

| | |

| | | |

| | | |

| | |

| Total Financial assets (liability) | |

$ | 59,354 | | |

$ | (443 | ) | |

$ | 58,911 | |

| AUDIOCODES LTD. |

| |

| NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| U.S. dollars in thousands, except share and per share data |

| NOTE 5:- | FAIR VALUE MEASUREMENTS (Cont.) |

Fair value

measurements using significant unobservable inputs (Level 3):

| Balance at January 1, 2015 (audited) | |

$ | (443 | ) |

| Payment of earn out liability (unaudited) | |

| 233 | |

| Adjustment due to time change value (unaudited) | |

| (11 | ) |

| | |

| | |

| Balance at June 30, 2015 (unaudited) | |

$ | (221 | ) |

| NOTE 6:- | COMMITMENTS AND CONTINGENT LIABILITIES |

The Company's

facilities are rented under several lease agreements in Israel, Europe and the U.S. for periods ending in 2024.

As of June

30, 2015, future minimum rental commitments under non-cancelable operating leases are as follows:

| Year ending June 30, | |

| |

| | |

Unaudited | |

| 2016 | |

$ | 6,791 | |

| 2017 | |

| 6,783 | |

| 2018 | |

| 6,375 | |

| 2019 | |

| 5,557 | |

| 2020 and on | |

| 25,294 | |

| | |

| | |

| Total minimum lease payments *) | |

$ | 50,800 | |

| *) | Minimum payments have been reduced by minimum sublease rental of $ 462 (unaudited) due in

the future under non-cancelable subleases. |

In connection

with the Company's offices lease agreement in Israel, the lessor has a lien of approximately $ 1,500 (unaudited) which is

included in short-term and restricted bank deposits.

Rent expenses

for the six months ended June 30, 2015 and 2014, were approximately $ 3,052 (unaudited) and $ 3,150 (unaudited), respectively.

The Company

is obligated under certain agreements with its suppliers to purchase specified items of excess inventory. Non-cancelable obligations

as of June 30, 2015, were $ 14,550 (unaudited).

| AUDIOCODES LTD. |

| |

| NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| U.S. dollars in thousands, except share and per share data |

| NOTE 6:- | COMMITMENTS AND CONTINGENT LIABILITIES (Cont.) |

| c. | Royalty commitment to the Office of the Chief Scientist of the Israeli Ministry of Economy ("OCS"): |

As of June

30, 2015 and December 31, 2014 , the Company and its Israeli subsidiaries have a contingent obligation to pay royalties in the

amount of $ 42,473 (unaudited) and $ 39,559 (audited), respectively.

As of June

30, 2015 and December 31, 2014, the Company and its Israeli subsidiaries have paid or accrued royalties to the OCS in the amount

of $ 4,110 (unaudited) and $ 3,423 (audited), respectively, which was recorded as cost of revenues.

| NOTE 7:- | BASIC AND DILUTED NET LOSS PER SHARE |

| | |

Six months ended

June 30, | |

| | |

2015 | | |

2014 | |

| | |

Unaudited | |

| Numerator: | |

| | | |

| | |

| | |

| | | |

| | |

| Net loss available to ordinary shareholders | |

$ | (2,300 | ) | |

$ | (324 | ) |

| | |

| | | |

| | |

| Denominator: | |

| | | |

| | |

| | |

| | | |

| | |

| Denominator for basic loss per share - weighted average number of ordinary shares, net of treasury stock | |

| 41,390,523 | | |

| 41,599,731 | |

| Effect of dilutive securities: | |

| | | |

| | |

| Employee stock options | |

| - | *) | |

| - | *) |

| Senior convertible notes | |

| - | | |

| - | **) |

| | |

| | | |

| | |

| Denominator for diluted net loss per share - adjusted weighted average number of shares | |

| 41,390,523 | | |

| 41,599,731 | |

| NOTE 8:- | DERIVATIVE INSTRUMENTS |

The Group

enters into hedge transactions with a major financial institution, using derivative instruments, primarily forward contracts and

options to purchase and sell foreign currencies, in order to reduce the net currency exposure associated with anticipated expenses

(primarily salaries and rent expenses) in currencies other than the dollar. The Group currently hedges such future exposures for

a maximum period of one year. However, the Group may choose not to hedge certain foreign currency exchange exposures for a variety

of reasons, including but not limited to immateriality, accounting considerations and the prohibitive economic cost of hedging

particular exposures. There can be no assurance the hedges will offset more than a portion of the financial impact resulting from

movements in foreign currency exchange rates.

The Group

records all derivatives in the consolidated balance sheet at fair value. The effective portions of cash flow hedges are recorded

in other comprehensive income until the hedged item is recognized in earnings. The ineffective portions of cash flow hedges are

adjusted to fair value through earnings in financial income or expense.

| AUDIOCODES LTD. |

| |

| NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| U.S. dollars in thousands, except share and per share data |

| NOTE 8:- | DERIVATIVE INSTRUMENTS (Cont.) |

As of June 30,

2015 and December 31, 2014, the Group had a net deferred gain associated with cash flow hedges of $ 2,002 (unaudited), and $ 127

recorded in other comprehensive income, respectively.

The Group

entered into forward and options contracts that did not meet the requirement for hedge accounting. The Group measured the fair

value of the contracts in accordance with ASC 820, at Level 2. The net gains recognized in "financial income, net" during

the six month ended June 30, 2014 were $ 165. During the six month ended June 30, 2015 there were no net gains (losses) recognized

in "financial income, net".

As of June

30, 2015 and December 31, 2014, the Group had outstanding forward and options collar (cylinder) contracts in the amount of $ 41,070

and $ 43,500 which were designated as payroll and rent hedging contracts.

The fair value

of the Group's outstanding derivative instruments and the effect of derivative instruments in cash flow hedging relationship on

other comprehensive income for the periods ended June 30, 2015 and December 31, 2014 are summarized below:

| Foreign exchange forward | |

| |

June 30, | | |

December 31, | |

| and options contracts | |

Balance sheet | |

2015 | | |

2014 | |

| | |

| |

| | |

| |

| Fair value of foreign exchange forward and options collar (cylinder) contracts | |

"Other receivables and prepaid expenses" | |

$ | 2,002 | | |

$ | 446 | |

| | |

"Other payables and accrued expenses" | |

$ | - | | |

$ | (319 | ) |

| | |

| |

| | | |

| | |

| Gains (losses) recognized in other comprehensive income (loss) (effective portion) | |

"Other comprehensive income (loss)" | |

$ | 2,002 | | |

$ | 127 | |

| NOTE 9:- | GEOGRAPHIC INFORMATION |

| a. | Summary information about geographic areas: |

The Group

manages its business on a basis of one reportable segment (see Note 1 for a brief description of the Group's business). The data

is presented in accordance with ASC 280, "Segment Reporting". Revenues in the table below are attributed to geographical

areas based on the location of the end customers.

| AUDIOCODES LTD. |

| |

| NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| U.S. dollars in thousands, except share and per share data |

| NOTE 9:- | GEOGRAPHIC INFORMATION (Cont.) |

The following

presents total revenues for the six months ended June 30, 2015 and 2014.

| | |

Six months ended

June 30, | |

| | |

2015 | | |

2014 | |

| | |

Unaudited | |

| | |

| | |

| |

| Americas | |

$ | 37,076 | | |

$ | 37,170 | |

| Europe | |

| 18,204 | | |

| 21,093 | |

| Far East | |

| 10,977 | | |

| 10,771 | |

| Israel | |

| 3,628 | | |

| 4,483 | |

| | |

| | | |

| | |

| | |

$ | 69,885 | | |

$ | 73,517 | |

The following

presents long-lived assets as of June 30, 2015 and December 31, 2014.

| | |

June 30,

2015 | | |

December 31,

2014 | |

| | |

Unaudited | | |

Audited | |

| | |

| | |

| |

| Israel | |

$ | 3,954 | | |

$ | 3,576 | |

| Americas | |

| 123 | | |

| 141 | |

| Europe | |

| 58 | | |

| 56 | |

| Far East | |

| 91 | | |

| 83 | |

| | |

| | | |

| | |

| | |

$ | 4,226 | | |

$ | 3,856 | |

Total revenues

from external customers divided on the basis of the Company's product lines are as follows:

| | |

Six months ended

June 30, | |

| | |

2015 | | |

2014 | |

| | |

Unaudited | |

| | |

| | |

| |

| Networking | |

$ | 61,111 | | |

$ | 64,103 | |

| Technology | |

| 8,774 | | |

| 9,414 | |

| | |

| | | |

| | |

| | |

$ | 69,885 | | |

$ | 73,517 | |

- - - - - - - - - - - - - - - - - - -

- -

Exhibit 99.2

OPERATING RESULTS AND FINANCIAL REVIEW

IN CONNECTION WITH THE INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS FOR THE SIX MONTHS ENDED JUNE 30, 2015.

The following discussion and analysis

should be read in conjunction with our interim condensed consolidated financial statements as of and for the six months ended June

30, 2015, appearing elsewhere in this Form 6-K, our audited consolidated financial statements and other financial information for

the year ended December 31, 2014 appearing in our Annual Report on Form 20-F for the year ended December 31, 2014 and Item 5—"Operating

and Financial Review and Prospects" of that Annual Report.

Statements in this Report on Form 6-K concerning

our business outlook or future economic performance; anticipated revenues, expenses or other financial items; product introductions

and plans and objectives related thereto; and statements concerning assumptions made or expectations as to any future events, conditions,

performance or other matters, are “forward-looking statements” as that term is defined under the United States Federal

securities laws. Forward-looking statements are subject to various risks, uncertainties and other factors that could cause actual

results to differ materially from those stated in such statements. Factors that could cause or contribute to such differences include,

but are not limited to, those set forth under “Risk Factors” in our Annual Report on Form 20-F for the year ended December

31, 2014, as well as those discussed elsewhere in that Annual Report and in our other filings with the Securities and Exchange

Commission.

Overview

We design, develop

and sell advanced voice over IP, or VoIP, and converged VoIP and data networking products and applications to service providers

and enterprises. We are a VoIP technology leader focused on VoIP communications, applications and networking elements. Our products

are deployed globally in broadband, mobile, cable, and enterprise networks. We provide a range of innovative, cost-effective products

including media gateways, multi-service business gateways, residential gateways, IP phones, media servers, session border controllers,

and value-added applications. Our underlying technology, VoIPerfectHD, relies primarily on our leadership in digital signal processing,

or DSP, voice coding and voice processing technologies. Our high definition (“HD”) VoIP technologies and products provide

enhanced intelligibility and a better end user communication experience in emerging voice networks.

Our headquarters and

research and development facilities are located in Israel with research and development extensions in the U.S. and U.K. We have

other offices located in Europe, the Far East, and Latin America.

The identities of

our principal customers have changed and we expect that they will continue to change, from year to year. Historically, a substantial

portion of our revenue has been derived from large purchases by a limited number of original equipment manufacturers, or OEMs,

and network equipment providers, or NEPs, systems integrators and distributors. ScanSource Communications, our largest customer,

accounted for 11.8% of our revenues in the six months ended June 30, 2015 and 14.3% of our revenues in the same period in 2014.

Our top five customers accounted for 32.2% of our revenues in the six months ended June 30, 2015 and 32.5% of our revenues in the

same period in 2014. If we lose a large customer and fail to add new customers to replace lost revenue, our operating results may

be materially adversely affected.

Revenues based on

the location of our customers for the six months ended June 30, 2015 and 2014 are as follows:

| | |

Six Months Ended June 30, | |

| | |

2015 | | |

2014 | |

| Americas | |

| 53.1 | % | |

| 50.5 | % |

| Far East | |

| 15.7 | | |

| 14.7 | |

| Europe | |

| 26.0 | | |

| 28.7 | |

| Israel | |

| 5.2 | | |

| 6.1 | |

| Total | |

| 100.0 | % | |

| 100.0 | % |

In April 2014, the Israeli Office of the Chief Scientist (OCS)

approved a three-year program (2014-2016) for approximately NIS100 million (equal to approximately $26.5 million based on the exchange

rate in effect as of June 30, 2015) to enable us to establish an advanced innovative research and development center for cloud

computing technologies and Unified Communications. In May 2014, the research and development center was established. The new research

and development center had a staff of approximately 60 engineers as of June 30, 2015 and is expected to increase its staff to 100

engineers by 2016. We expect that a significant portion of the cost of this project will be reimbursed to us through grants from

the OCS pursuant to this program. To date, the OCS has been reimbursing costs of this project on a periodic basis after expenses

are incurred by us. The grants are subject to conditions relating to grants by the OCS. Funding for the whole term of the program

is subject to the continued review and approval of the progress of the project by the OCS.

Results of Operations

The following table

sets forth the percentage relationships of certain items from our consolidated statements of operations, as a percentage of total

revenues for the periods indicated:

| | |

Six Months Ended June 30, | |

| Statement of Operations Data: | |

2015 | | |

2014 | |

| | |

| | |

| |

| Revenues | |

| 100.0 | % | |

| 100.0 | % |

| Cost of revenues | |

| 41.0 | | |

| 41.0 | |

| Gross profit | |

| 59.0 | | |

| 59.0 | |

| Operating expenses: | |

| | | |

| | |

| Research and development, net | |

| 21.0 | | |

| 22.1 | |

| Selling and marketing | |

| 32.4 | | |

| 31.1 | |

| General and administrative | |

| 6.7 | | |

| 5.1 | |

| Total operating expenses | |

| 60.1 | | |

| 58.3 | |

| | |

| | | |

| | |

| Operating income (loss) | |

| (1.1 | ) | |

| 0.7 | |

| Financial income, net | |

| 0.9 | | |

| 0.2 | |

| Income (loss) before taxes on income | |

| (0.2 | ) | |

| 0.9 | |

| Income tax expense | |

| (3.1 | ) | |

| (1.3 | ) |

| | |

| | | |

| | |

| Net loss | |

| (3.3 | )% | |

| (0.4 | )% |

Revenues. Revenues

decreased 4.9% to $69.9 million in the six months ended June 30, 2015 from $73.5 million in the same period in 2014. The decrease

in revenues reflects weakness in our business in Central and Latin America and certain markets in Europe.

Our revenues from

products in the six months ended June 30, 2015 decreased by 10.8% to $51.7 million, or approximately 74% of total revenues, from

$57.9 million, or approximately 79% of total revenues, in the same period in 2014. The decrease in revenues from products was primarily

attributable to the weakness in our business in Central and Latin America and certain markets in Europe.

Our revenues from

services in the six months ended June 30, 2015 increased by 16.7% to $18.2 million, or approximately 26% of total revenues,

from $15.6 million, or approximately 21% of total revenues, in the same period in 2014. The increase in revenues from

services was predominantly driven by the growth in support services related to the increase in revenues from products in

previous periods and by the growth in professional services.

Cost of Revenues

and Gross Profit. Cost of revenues includes the manufacturing cost of hardware, quality assurance, overhead related

to manufacturing activity, technology licensing and royalty fees payable to third parties and royalties payable to the OCS. Gross

profit decreased to $41.2 million in the six months ended June 30, 2015 from $43.4 million in the same period in 2014. Gross profit

as a percentage of revenues was 59.0% in each of the six month periods ended June 30, 2015 and 2014.

Cost of revenues from

products decreased by 9.1% to $23.8 million in the six months ended June 30, 2015 from $26.2 million in the same period in 2014.

This decrease is primarily attributable to a decrease in the procurement of materials, in line with the decrease in revenues from

products. Gross margin percentage from products was 54% in the six months ended June 30, 2015 and 55% in the same period in 2014.

Cost of revenues from

services increased by 21.8% to $4.8 million in the six months ended June 30, 2015 from $4.0 million in the same period in 2014.

This increase is primarily attributable to higher support personnel expenses associated with providing services and implementation

of our products with service providers as well as enterprise customers. Gross margin percentage from services was 74% in the six

months ended June 30, 2015 and 75% in the same period in 2014.

Research and Development

Expenses, net. Research and development expenses, net consist primarily of compensation and related costs of employees

engaged in ongoing research and development activities, development-related raw materials and the cost of subcontractors less grants

from the OCS. Research and development expenses, net decreased by 9.6% to $14.7 million in the six months ended June 30, 2015 from

$16.2 million in the same period in 2015 and decreased as a percentage of revenues to 21.0% in the six months ended June 30, 2015

from 22.1% in the same period in 2014. Research and development expenses decreased primarily as a result of higher grants received

from the OCS related to the new program to establish a research and development center that is described above.

Selling and Marketing

Expenses. Selling and marketing expenses consist primarily of compensation for selling and marketing personnel,

as well as exhibition, travel and related expenses. Selling and marketing expenses decreased by 1.1% in the six months ended June

30, 2015 to $22.6 million from $22.9 million in the same period in 2015 and increased as a percentage of revenues to 32.4% in the

six months ended June 30, 2015 from 31.1% in the same period in 2014.

General and Administrative

Expenses. General and administrative expenses consist primarily of compensation for finance, human resources and

general management personnel, rent, network expenses and bad debt reserve, as well as insurance and consulting services expenses.

General and administrative expenses increased by 25.3% to $4.7 million in in the six months ended June 30, 2015 from $3.7 million

in the same period in 2014. As a percentage of revenues, general and administrative expenses increased to 6.7% in the six months

ended June 30, 2015 from 5.1% in the same period in 2014. The increase in general and administrative expenses was primarily due

to an increase in the allowance for doubtful accounts and changes in other provisions.

Financial Income,

net. Financial income, net consists primarily of interest derived on cash and cash equivalents, marketable securities

and bank deposits, net of interest accrued in connection with our bank loans and bank charges. Financial income, net, in the six

months ended June 30, 2015 was $606,000 compared to $102,000 in the same period in 2014. The increase in financial income, net

in the six months ended June 30, 2015 was primarily due to higher income recorded with respect to interest on our marketable securities

and higher income related to exchange rate fluctuations.

Taxes on Income. We

had net income tax expenses of $2.2 million in the six months ended June 30, 2015 compared to $950,000 in the same period in 2014.

The increase in net income tax expenses in the six months ended June 30, 2015 is primarily a result of utilization of deferred

tax assets.

LIQUIDITY AND CAPITAL

RESOURCES

We finance our operations

primarily from our cash and cash equivalents, bank deposits, bank borrowings and cash from operations. In addition, in March 2014

we realized net proceeds of approximately $29.7 million as a result of the sale by us of 4,025,000 of our ordinary shares in a

public offering.

As of June 30, 2015,

we had $78.6 million in cash and cash equivalents, marketable securities and bank deposits compared to $91.8 million at December

31, 2014. As of June 30, 2015, we were restricted with respect to using approximately $6.2 million of our cash as a result of provisions

in our loan agreements, a lease agreement and foreign exchange derivatives transactions.

Share Repurchase Program

In August 2014, our

Board of Directors approved a program to repurchase up to $3.0 million of our ordinary shares. In November 2014, we received court

approval in Israel to repurchase up to an additional $15.0 million of our ordinary shares and in May 2015 the court approved an

additional $15.0 million in share repurchases. Share repurchases take place in open market transactions or in privately negotiated

transactions and may be made from time to time depending on market conditions, share price, trading volume or other factors. The

repurchase program does not require us to purchase a specific number of shares and may be suspended from time to time or discontinued.

During the six months ended June 30, 2015, we acquired an aggregate of 2,488,084 of our ordinary shares for an aggregate consideration

of approximately $11.3 million. As of June 30, 2015, we had acquired an aggregate of 3,537,000 shares under this program for an

aggregate consideration of approximately $16.6 million.

Cash Flows from Operating Activities

Our operating activities

provided cash in the amount of $8.1 million in the six months ended June 30, 2015, primarily due to an increase in deferred revenues

of $3.2 million, decreases in trade receivables in the amount of $3.0 million, other receivables in the amount of $1.9 million

and deferred tax assets in the amount of $1.7 million, as well as non-cash charges of $1.6 million for depreciation and amortization

and $1.3 million for stock-based compensation expenses, offset, in part, by our net loss of $2.3 million and a decrease in trade

payables in the amount of $3.7 million. Our deferred revenues increased due to the increase in the revenues from services and the

deferred tax assets decreased as a result of utilization of these assets. Our trade receivables and trade payables decreases are

in line with our lower sales volume in the six months ended June 30, 2015, compared to the same period in 2014.

Cash Flows from Investing Activities

Our investing activities

provided cash in the amount of $6.0 million in the six months ended June 30, 2015, primarily due to a decrease in bank deposits

of $4.6 million and proceeds from redemption of marketable securities of $2.7 million offset, in part, by purchase of property

and equipment of $1.3 million, mainly related to the new research and development center establishment.

Cash Flows from Financing Activities

In the six months

ended June 30, 2015, we used cash in financing activities in the amount of $13.6 million, primarily due to $11.3 million used to

repurchase our shares and $2.3 million used for repayment of loans.

Financing Needs

We anticipate that our operating expenses

will be a material use of our cash resources for the foreseeable future. We believe that our current working capital

is sufficient to meet our operating cash requirements for at least the next twelve months, including payments required under our

existing bank loans. Part of our strategy is to pursue acquisition opportunities. If we do not have available sufficient

cash to finance our operations and the completion of additional acquisitions, we may be required to obtain additional debt or equity

financing. We cannot be certain that we will be able to obtain, if required, additional financing on acceptable terms or at all.

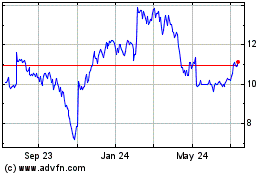

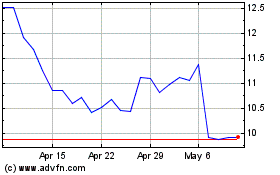

AudioCodes (NASDAQ:AUDC)

Historical Stock Chart

From Mar 2024 to Apr 2024

AudioCodes (NASDAQ:AUDC)

Historical Stock Chart

From Apr 2023 to Apr 2024