UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the Month of September 2015

Commission file number 0-30070

AUDIOCODES LTD.

(Translation of registrant’s name

into English)

1 Hayarden Street • Airport City,

Lod 7019900 • ISRAEL

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ý Form 40-F

¨

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Note: Regulation S-T Rule 101(b)(1)

only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Note: Regulation S-T Rule 101(b)(7)

only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant

foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on

which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to

be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the

subject of a Form 6-K submission or other Commission filing on EDGAR.

EXPLANATORY NOTE

On or about September

3, 2015, AudioCodes Ltd. (the “Company”) first distributed copies of its proxy statement to its shareholders and will

mail to its shareholders of record a proxy statement for an Annual General Meeting of Shareholders to be held on October 7, 2015,

in Israel. A copy of the proxy statement is also available on the Company’s website at www.audiocodes.com.

The following documents

are attached hereto and incorporated by reference herein:

Exhibit 99.1. Notice

of and Proxy Statement for the Annual General Meeting of Shareholders, dated September 1, 2015.

Exhibit 99.2. Form

of Proxy Card for use at the Annual General Meeting of Shareholders, to be held on October 7, 2015.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

AUDIOCODES LTD. |

| |

(Registrant) |

| |

|

| |

|

| |

By: |

/s/ ITAMAR ROSEN |

| |

Itamar Rosen, Advocate |

| |

Chief Legal Officer and Company Secretary |

| |

|

| Dated: September 3, 2015 |

|

EXHIBIT INDEX

|

Exhibit

No. |

Description |

| 99.1 |

Notice of and Proxy Statement for the Annual

General Meeting of Shareholders, dated September 1, 2015.

|

| 99.2 |

Form of Proxy Card for use at the Annual General Meeting of Shareholders, to be held on October 7, 2015. |

Exhibit 99.1

September

1, 2015

Dear Shareholder,

You are cordially invited

to attend the 2015 Annual General Meeting of Shareholders of AudioCodes Ltd., to be held on October 7th, 2015, at 2:00

p.m., local time, or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice.

The Meeting will be held at the offices of the Company located at 1 Hayarden Street, Airport City, Lod 7019900, Israel. The telephone

number at that address is +972-3-976-4000.

At the Meeting, shareholders

will be asked to consider and vote on the matters listed in the enclosed Notice of Annual General Meeting of Shareholders. AudioCodes’

board of directors recommends that you vote FOR all of the proposals listed in the Notice. Management will also report on

the affairs of AudioCodes, and a discussion period will be provided for questions and comments of general interest to shareholders.

Whether or not you

plan to attend the Meeting, it is important that your ordinary shares be represented and voted at the Meeting. Accordingly, after

reading the enclosed Notice of Annual General Meeting of Shareholders and the accompanying Proxy Statement, please sign, date and

mail the enclosed proxy card in the envelope provided.

We urge all of our

shareholders to review our annual report on Form 20-F and our quarterly results of operations submitted to the SEC subsequently

as reports on Form 6-K, all of which are available on our website at www.audiocodes.com.

We look forward to

greeting as many of you as can attend the Meeting.

| |

Sincerely, |

| |

|

| |

/s/ Stanley Stern |

| |

Stanley Stern |

| |

Chairman of the Board of Directors |

AUDIOCODES LTD.

_______________

NOTICE OF 2015 ANNUAL GENERAL MEETING

OF SHAREHOLDERS

TO BE HELD ON OCTOBER 7,

2015

TO THE SHAREHOLDERS OF AUDIOCODES LTD.:

NOTICE IS HEREBY GIVEN

that the Annual General Meeting of Shareholders (the “Meeting”) of AudioCodes Ltd., a company formed under the

laws of the State of Israel (the “Company”), will be held on October 7th, 2015 at 2:00 p.m., local

time, at the principal executive offices of the Company located at 1 Hayarden Street, Airport City, Lod 7019900, Israel (the telephone

number at that address is +972-3-976-4000), for the following purposes:

| |

(1) |

To reelect Mr. Doron Nevo as an outside director for an additional term of three years; |

| |

(2) |

Subject to approval of Proposal One, to approve the grant of options to purchase Ordinary Shares of the Company to Mr. Doron Nevo for his services as an outside director of the Company; |

| |

(3) |

To reelect Mr. Shabtai Adlersberg as a Class III director for an additional term of three years; |

| |

(4) |

To reelect Mr. Stanley Stern as a Class III director for an additional term of three years; |

| |

(5) |

Subject to approval of Proposal Four, to approve the grant of options to purchase Ordinary Shares of the Company to Mr. Stanley Stern for his services as a director of the Company; |

| |

(6) |

To approve an amendment to compensation package of Ms. Zehava Simon for her services as a director of the Company; |

| |

(7) |

To ratify the appointment of Kost, Forer, Gabbay & Kasierer, a member of Ernst & Young Global, as the independent auditors of the Company for the year ending December 31, 2015, and to authorize the Board of Directors (or the Audit Committee of the Board of Directors, if authorized by the Board) to determine the compensation of the auditors; and |

| |

(8) |

To review and discuss the audited Consolidated Financial Statements of the Company for the year ended December 31, 2014. |

The foregoing items

of business are more fully described in the Proxy Statement that is attached to this Notice and that is being mailed to the Company’s

shareholders of record. A copy of the Proxy Statement is also available at the following websites: http://www.tase.co.il/tase/

or http://www.magna.isa.gov.il (the “Distribution Sites”). Furthermore, shareholders may obtain the Proxy Statement

by contacting the Company directly, at the following telephone number: +972-3-976-4000. Shareholders may send statements of position

in accordance with Israeli law to the Company no later than September 27th, 2015. As more fully described in the Proxy

Statement, shareholders may present proposals for consideration at the Meeting by submitting their proposals to the Company no

later than September 10th, 2015. If we determine that a shareholder proposal has been duly and timely received and is

appropriate under applicable Israeli law, we will publish a revised agenda in the manner set forth in the Proxy Statement.

Each member of The

Tel-Aviv Stock Exchange Ltd. (a “Member”) shall e-mail, upon request and without charge, a link to the Distribution

Sites, to each shareholder who is not listed in the Company’s shareholder register and whose shares are held through the

Member; provided that each shareholder’s request shall have been submitted (a) with respect to a specific securities

account, and (b) prior to the Record Date (as defined below).

A shareholder whose

shares are held through a Member may obtain, upon request from the Member, a certification of ownership regarding his/her/its shares.

Such certification may be obtained in the Member’s offices or may be sent to the shareholder by mail (subject to payment

of the cost of mailing), at the election of the shareholder; provided that the shareholder’s request shall have been

submitted with respect to a specific securities account.

Shareholders may review

the detailed versions of the proposed resolutions at the offices of the Company located at 1 Hayarden Street, Airport City, Lod

7019900, Israel, during regular working hours. Only shareholders who hold Ordinary Shares, nominal value NIS 0.01, of the Company

(“Ordinary Shares”) at the close of business on August 31st , 2015 (the “Record Date”)

will be entitled to notice of, and to vote at, the Meeting and any adjournments thereof.

Each Ordinary Share

is entitled to one vote upon each of the matters to be presented at the Meeting. The affirmative vote of the holders of a majority

of the voting power represented and voting on each of the proposals in person or by proxy is required to approve each of the proposals.

In addition, in order to approve the reelection of Mr. Doron Nevo as an outside director in accordance with Proposal No. 1, either

the affirmative vote of the Ordinary Shares must include at least a majority of the Ordinary Shares voted by shareholders who are

not controlling shareholders and do not have a personal interest in the election of the outside director (excluding a personal

interest that is not related to a relationship with the controlling shareholders), or the total number of shares of non-controlling

shareholders and non-interested shareholders voted against this proposal must not represent more than two percent of the outstanding

Ordinary Shares. For this purpose, you are asked to indicate on the enclosed proxy card whether you are a controlling shareholder

or whether you have a personal interest in the adoption of Proposal No. 1. For this purpose, a “controlling shareholder”

is any shareholder who has the ability to direct the Company’s actions, including any shareholder holding 25% or more of

the voting rights if no other shareholder owns more than 50% of the voting rights in the Company.

All shareholders of

record on the Record Date are cordially invited to attend the Meeting in person. Any shareholder attending the Meeting may vote

in person even if such shareholder previously signed and returned a proxy.

Shareholders may sign

and return proxy cards to the Company no later than October 6, 2015, at 02:00 p.m. Israel time.

| |

FOR THE BOARD OF DIRECTORS |

| |

|

| |

|

| |

Stanley Stern |

| |

Chairman of the Board |

| |

|

| Lod, Israel |

|

| September 1, 2015 |

|

AUDIOCODES LTD.

PROXY STATEMENT

FOR 2015 ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON october 7, 2015

The enclosed proxy

is solicited on behalf of the Board of Directors of AudioCodes Ltd. (the “Company”) for use at the Company’s

Annual General Meeting of Shareholders (the “Meeting”) to be held on October 7th, 2015, at 14:00

p.m., local time, or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice.

The Meeting will be held at the offices of the Company located at 1 Hayarden Street, Airport City, Lod 7019900, Israel. The telephone

number at that address is +972-3-976-4000.

These proxy solicitation

materials are first being distributed on September 2nd, 2015, and will be mailed to all shareholders entitled to vote

at the Meeting.

INFORMATION

CONCERNING SOLICITATION AND VOTING

Record Date and Shares Outstanding

You are entitled to

receive notice of the Meeting and to vote at the Meeting if you were a shareholder of record of Ordinary Shares, nominal value

NIS 0.01, of the Company (“Ordinary Shares”) at the close of business on August 31, 2015 (the “Record

Date”). You are also entitled to receive notice of the Meeting and to vote at the Meeting if you held Ordinary Shares

through a bank, broker or other nominee that was a shareholder of record of the Company at the close of business on the Record

Date or that appeared in the participant listing of a securities depository on that date.

On the Record Date

54,955,234 Ordinary Shares were issued, of which 39,277,706 Ordinary Shares were outstanding and 15,677,528 Ordinary Shares

were held in treasury.

Revocability of Proxies

A form of proxy card

for use at the Meeting is attached. Please follow the instructions on the proxy card. If you return a duly executed proxy card

to us, you may change your mind and cancel your proxy card by filing a written notice of revocation with the Company, by completing

and returning a duly executed proxy card bearing a later date, or by voting in person at the Meeting. Attendance at the Meeting

will not in and of itself constitute revocation of a proxy. Ordinary Shares represented by a valid proxy card in the attached form

will be voted in favor of all of the proposed resolutions to be presented to the Meeting, unless you clearly vote against a specific

resolution.

Quorum, Voting and Solicitation

At least two shareholders

who attend the Meeting in person or by proxy will constitute a quorum at the Meeting, provided that they hold shares conferring

in the aggregate more than 50% of the voting power of the Company. If a quorum is not present within half an hour from the time

scheduled for the Meeting, the Meeting will be adjourned to the same day in the next week, at the same time and place. The Chairman

of the Meeting may, however, adjourn the Meeting to a different day, time or place, with the consent of the holders of a majority

of the voting power represented at the Meeting in person or by proxy and voting on the question of adjournment. At an adjourned

Meeting, any two shareholders who attend the Meeting in person or by proxy will constitute a quorum. The vote necessary to approve

the resolutions relating to the matters upon which you will be asked to vote is specified below immediately following each proposed

resolution. Each outstanding Ordinary Share is entitled to one vote upon each of the matters to be presented at the Meeting.

The Board of Directors

of the Company is soliciting the attached proxy cards for the Meeting, primarily by mail and email. The original solicitation of

proxies by mail and email may be further supplemented by solicitation by telephone and other means by certain officers, directors,

employees and agents of the Company, but they will not receive additional compensation for these services. The Company will bear

the cost of the solicitation of the proxy cards, including postage, printing and handling, and will reimburse the reasonable expenses

of brokerage firms and others for forwarding material to beneficial owners of shares.

Under Israeli law,

if a quorum is present in person or by proxy, broker non-votes and abstentions will be disregarded and will have no effect on whether

the requisite vote is obtained. “Broker non-votes” are shares held by brokers or other nominees that are present in

person or by proxy, but which are not voted on a particular matter because instructions have not been received from the beneficial

owner. Brokers and other nominees have discretionary authority under the applicable rules to vote on “routine” matters.

This means that if a brokerage firm holds your shares on your behalf, those shares will not be voted in the election and compensation

of directors (Proposals No. 1 through 7), which are not considered to be routine matters, unless you provide voting instructions

by way of your proxy card. Thus, it is critical for a shareholder that holds Ordinary Shares through a bank or broker to instruct

its bank or broker how to vote those shares, if the shareholder wants those shares to count.

COMPENSATION

OF EXECUTIVE OFFICERS AND DIRECTORS

Summary Compensation Table

The table and summary

below outline the compensation granted to our five most highly compensated office holders during or with respect to the year ended

December 31, 2014. We refer to the five individuals for whom disclosure is provided herein as our “Covered Executives.”

For purposes of the

table and the summary below, “compensation” includes base salary, discretionary and non-equity incentive bonuses, equity-based

compensation, payments accrued or paid in connection with retirement or termination of employment, and personal benefits and perquisites

such as car, phone and social benefits paid to or earned by each Covered Executive during the year ended December 31, 2014.

| Name and Principal Position | |

Salary ($) | | |

Bonus

($) (1) | | |

Equity-Based

Compensation ($) (2) | | |

All Other

Compensation ($) (3) | | |

Total ($) | |

| Shabtai Adlersberg – CEO | |

$ | 333,998 | | |

$ | 208,749 | | |

$ | 491,291 | | |

$ | 204,374 | | |

$ | 1,238,412 | |

| Lior Aldema – COO and Head of Global Sales | |

$ | 267,199 | | |

$ | 139,875 | | |

$ | 347,400 | | |

$ | 81,563 | | |

$ | 836,037 | |

| Nimrode Borovsky – VP Marketing | |

$ | 135,919 | | |

$ | 55,110 | | |

$ | 165,550 | | |

$ | 56,257 | | |

$ | 412,836 | |

| Yair Hevdeli – VP R&D | |

$ | 175,349 | | |

$ | 14,752 | | |

$ | 129,450 | | |

$ | 75,513 | | |

$ | 395,063 | |

Jeffrey Khan

Chief Strategy Officer | |

$ | 185,787 | | |

$ | 90,734 | | |

| - | | |

$ | 75,235 | | |

$ | 351,756 | |

| (1) | Amounts reported in this column represent annual incentive bonuses granted to the Covered Executives

based on performance-metric formulas set forth in their respective employment agreements. |

| (2) | Amounts reported in this column represent the grant date fair value computed in accordance with

accounting guidance for stock-based compensation. For a discussion of the assumptions used in reaching this valuation, see Note

2(u) to our consolidated financial statements included in our Annual Report on Form 20-F for the year ended December 31, 2014. |

| (3) | Amounts reported in this column include personal benefits and perquisites, including those mandated

by applicable law. Such benefits and perquisites may include, to the extent applicable to the respective Covered Executive, payments,

contributions and/or allocations for savings funds (e.g., Managers Life Insurance Policy), education funds (referred to

in Hebrew as “keren hishtalmut”), pension, severance, vacation, car or car allowance, medical insurance and

benefits, risk insurance (e.g., life insurance or work disability insurance), telephone expense reimbursement, convalescence

or recreation pay, relocation reimbursement, payments for social security, and other personal benefits and perquisites consistent

with the Company’s guidelines. All amounts reported in the table represent incremental cost to the Company. |

As of June 30, 2015,

the total number of options and unvested restricted share grants outstanding under the Company’s equity incentive plans was

3,663,255 and the total number of shares available for grant under its current equity incentive plan was 653,867. The total potential

dilution to shareholders, consisting of shares granted and shares reserved for future grant, is 9.73% of the total outstanding

shares, based upon 40,036,128 Ordinary Shares outstanding as of June 30, 2015.

BOARD OF

DIRECTORS

The Company’s

Board of Directors currently has six directors, including two outside directors within the meaning of the Israeli Companies Law

(the “Companies Law”). The Company’s Articles of Association provide for a classified Board of Directors,

with the Company’s directors (other than its outside directors) being divided into Class I, Class II and Class III directors.

Following the Meeting, assuming the reelection of Mr. Doron Nevo as an outside director under Proposal 1, of Mr. Shabtai Adlersberg

as a Class III director under Proposal 3, and of Mr. Stanley Stern as a Class III director under Proposal 4, the Company’s

Board of Directors shall consist of six directors, including two outside directors within the meaning of the Companies Law.

The Company’s

outside directors are Mr. Doron Nevo and Dr. Eyal Kishon. Dr. Eyal Kishon’s term expires in 2017. The term of Mr. Doron Nevo

is scheduled to expire at the Meeting, and he has been nominated for reelection at this Meeting (see Proposal 1). These two outside

directors have each been determined by our Board to meet the independence requirements of the NASDAQ Global Select Market.

The term of Mr. Shabtai

Adlersberg as a Class III director expires at the Meeting and he has been nominated for reelection at this Meeting (see Proposal

3). The term of Mr. Stanley Stern as a Class III director expires at the Meeting and he has been nominated for reelection at this

Meeting (see Proposal 4). The Company’s Class I director, Ms. Zehava Simon, will hold office until the 2016 Annual General

Meeting of Shareholders. The Company’s Class II director, Mr. Joseph Tenne, will hold office until the 2017 Annual General

Meeting of Shareholders.

In accordance with

the Companies Law, each of the Company’s directors who is standing for reelection or election at the Meeting has certified

to the Company that he or she meets all the requirements of the Companies Law for the election as director of a public company,

and possesses the necessary qualifications, and has sufficient time to devote, in order to fulfill his or her duties as a director

of the Company, taking into account the Company’s size and special needs.

Ms. Zehava Simon, Mr.

Joseph Tenne and Dr. Eyal Kishon are not standing for reelection at the Meeting. Biographical information concerning Ms. Zehava

Simon, Mr. Joseph Tenne and Dr. Eyal Kishon follows for informational purposes only.

Stanley Stern

became a director and our Chairman of the Board in December 2012. From 1981-1999 and from 2004 until 2013 Mr. Stern served in various

positions at Oppenheimer & Co., including as a Managing Director and Head of Investment Banking as well as Head of Technology,

Israeli Banking and FIG. Since 2013, Mr. Stern has served as the president of Alnitak Capital, a private merchant bank and strategic

advisory firm. From January 2000 until January 2002, Mr. Stern was the President of STI Ventures Advisory USA Inc., a venture capital

firm focusing on technology investments. Mr. Stern currently serves as a member of the Board of directors of Sodastream, Foamix

Pharmaceuticals and Ekso Bionics, and has previously served as the Chairman of the Board of Directors of Tucows, Inc., an internet

service provider that is public traded company on AMEX, as a director of Given Imaging Ltd., a NASDAQ-listed manufacturer of GI

medical devices until its sale in July 2013, and as a director of as a director and Chairman of the Audit Committee of Fundtech

Ltd until its sale in Dec 2011. From 2000 until its sale in 2007, he was a founder and a Director of Odimo, Inc DBA Diamond.com.

Mr. Stern received his MBA from Harvard University Graduate School of Business and a BS from Queens College.

Shabtai Adlersberg

co-founded AudioCodes in 1993, and has served as our President, Chief Executive Officer and a director since inception. Until December

2012, Mr. Adlersberg also served as the Chairman of our Board of Directors. Mr. Adlersberg co-founded DSP Group, a semiconductor

company, in 1987. From 1987 to 1990, Mr. Adlersberg served as the Vice President of Engineering of DSP Group, and from 1990 to

1992, he served as Vice President of Advanced Technology. As Vice President of Engineering, Mr. Adlersberg established a research

and development team for digital cellular communication which was spun-off in 1992 as DSP Communications. Mr. Adlersberg also serves

as Chairman of the Board of Directors of Natural Speech Communication Ltd. and as a director of CTI Squared Ltd. Mr. Adlersberg

holds an M.Sc. in Electronics and Computer Engineering from Tel Aviv University and a B.Sc. in Electrical Engineering from the

Technion-Israel Institute of Technology.

Dr. Eyal Kishon

has served as one of our directors since 1997. Since 1996, Dr. Kishon has been Managing Partner of Genesis Partners, an Israel-based

venture capital fund. From 1993 to 1996, Dr. Kishon served as Associate Director of Dovrat-Shrem/Yozma-Polaris Fund Limited Partnership.

Prior to that, Dr. Kishon served as Chief Technology Officer at Yozma Venture Capital from 1992 to 1993. From 1998 to 2011, Dr.

Kishon served as a director of Allot Communications Ltd. a company listed on NASDAQ and TASE. From 1991 to 1992, Dr. Kishon was

a Research Fellow in the Multimedia Department of IBM Science & Technology. From 1989 to 1991, Dr. Kishon worked in the Robotics

Research Department of AT&T Bell Laboratories. Dr. Kishon holds a B.A. in Computer Science from the Technion - Israel Institute

of Technology and an M.Sc. and a Ph.D. in Computer Science from New York University.

Doron Nevo has

served as one of our directors since 2000. Mr. Nevo is President and CEO of KiloLambda Technologies Ltd., an optical nanotechnology

company, which he co-founded in 2001. From 1999 to 2001, Mr. Nevo was involved in fund raising activities for Israeli-based startup

companies. From 1996 to 1999, Mr. Nevo served as President and CEO of NKO, Inc. Mr. Nevo established NKO in early 1995 as a startup

subsidiary of Clalcom, Ltd. NKO designed and developed a full scale, carrier grade, IP telephony system platform and established

its own IP network. From 1992 to 1996, Mr. Nevo was President and CEO of Clalcom Ltd. Mr. Nevo established Clalcom in 1992 as a

telecom service provider in Israel. He also serves as a director of Etgar – Portfolio Management Trust Co. and of a number

of private companies. Mr. Nevo holds a B.Sc. in Electrical Engineering from the Technion - Israel Institute of Technology and an

M.Sc. in Telecommunications Management from Brooklyn Polytechnic.

Zehava Simon

was appointed a director in February 2014. Ms. Simon served as a Vice President of BMC Software Inc. from 2000 until 2013,

most recently as Vice President, Corporate Development. From 2002 to 2011, Ms. Simon served as Vice President and General Manager

of BMC Software in Israel. Prior to joining BMC Software, Ms. Simon held a number of executive positions at Intel Corporation which

she joined in 1982. In her last position at Intel, she led Finance and Operations and Business Development for Intel in Israel.

Ms. Simon is serving as a board member of Nova Measuring Instruments a publicly-listed company traded on NASDAQ and TASE, since

July 2014 and of Amiad Filtration Systems, a public company traded on the London Stock Exchange, since March 2014. Ms. Simon has

served as a board member of various companies, including Tower Semiconductor from 1999-2004, M-Systems from 2005-2006 and InSightec

from 2005-2012. Ms. Simon holds a bachelor’s degree in social sciences from the Hebrew University, a law degree (LL.B.) from

the Interdisciplinary Center in Herzlia and a master’s degree in business and management from Boston University.

Joseph

Tenne has served as one of our directors since June 2003. Mr. Tenne is the Vice president of Finance of Itamar Medical

Ltd., a company listed on the Tel AvivStock Exchange, which is engaged in the medical devices business. From March 2005 until April

2013, Mr. Tenne served as the Chief Financial Officer of Ormat Technologies, Inc., a company listed on the New York Stock Exchange,

which is engaged in the geothermal and recovered energy business. From 2003 to 2005, Mr. Tenne was the Chief Financial Officer

of Treofan Germany GmbH & Co. KG, a German company, which is engaged in the development, production and marketing of oriented

polypropylene films, which are mainly used in the food packaging industry. From 1997 until 2003, Mr. Tenne was a partner in Kesselman

& Kesselman, Certified Public Accountants in Israel and a member of PricewaterhouseCoopers International Limited (PwC

Israel). Mr. Tenne serves as a member of the boards of directors of Enzymotrec Ltd., Orbotech Ltd. and MIND C.T.I. Ltd., all of

which are Israeli Nasdaq-listed companies, and Ratio Oil Exploration (finance) Ltd., which is listed listed on the Tel Aviv Stock

Exchange. Mr. Tenne holds a B.A. in Accounting and Economics and an M.B.A, both. from Tel Aviv University. Mr. Tenne is also a

Certified Public Accountant in Israel.

The Independence of Our Board of Directors

A majority of the Company’s

directors must meet the independence standards specified in the NASDAQ Global Select Market’s Corporate Governance Requirements.

Following the Annual Meeting, assuming the election of all nominees, our Board will consist of six members, 5 of whom will be independent

under the NASDAQ Corporate Governance Requirements. Specifically, our Board has determined that Mr. Stanley Stern, Mr. Joseph Tenne,

Ms. Zehava Simon, Mr. Doron Nevo and Dr. Eyal Kishon, meet the independence standards of the NASDAQ Corporate Governance Requirements.

In reaching this conclusion, the Board determined that none of these directors has a relationship that would preclude a finding

of independence and that the other relationships that these directors have with us do not impair their independence. None of our

directors, other than Shabtai Adlersberg, is a member of our executive team.

PROPOSAL ONE

REELECTION

OF Mr. Doron Nevo AS AN OUTSIDE DIRECTOR

FOR AN ADDITIONAL TERM OF THREE YEARS

Background

The Companies Law requires

that the Company have at least two outside directors, who must meet certain statutory requirements of independence prescribed by

the Companies Law. An outside director serves for a term of three years, which may be extended for additional three-year terms.

Pursuant to a regulation adopted under the Companies Law, a company listed on the NASDAQ Stock Market may elect as an outside director,

for additional terms of up to three years each, a person who has completed three terms of service as an outside director if the

company’s audit committee and board of directors have resolved that, in light of the person’s expertise and special

contribution to the function of the board of directors and its committees, his or her service as an outside director is in the

best interests of the company. An outside director can be removed from office only under very limited circumstances. All of the

outside directors must serve on the Company’s Audit Committee, and at least one outside director must serve on each committee

of the Company’s Board of Directors. The Chair of the Audit Committee must also be an outside director.

As noted above, the

Company’s outside directors are Mr. Nevo and Dr. Kishon. Dr. Kishon’s term expires in 2017. The term of Mr. Nevo is

scheduled to expire at the Meeting, and he has been nominated for reelection at this Meeting.

Biographical information

concerning Mr. Nevo, the nominee for reelection as an outside director, is set forth above.

The Company’s

Nominating Committee has recommended that Mr. Doron Nevo be reelected as an outside director at the Meeting for an additional three

year term, and found that Mr. Doron Nevo has all necessary qualifications required to serve as an outside director under the Companies

Law and as an independent director under the Corporate Governance Requirements of the NASDAQ Global Select Market. The Company’s

Audit Committee and Board of Directors have approved the Nominating Committee’s recommendation and determined that, in light

of the expertise and special contribution of Mr. Doron Nevo to the Company’s Board of Directors and board committees the

reelection of Mr. Doron Nevo as an outside director for an additional three years would be in the Company’s best interests.

Proposal

The shareholders are

being asked to reelect Mr. Nevo as an outside director for an additional term of three years, expiring at the 2018 Annual General

Meeting of Shareholders. Management knows of no current circumstances that would render Mr. Nevo unable to accept nomination or

reelection.

It is proposed that

the following resolution be adopted at the Meeting:

“RESOLVED,

that the shareholders of the Company hereby reelect Mr. Doron Nevo to the Board of Directors of the Company to serve as outside

director for an additional term of three years.”

Vote Required

The reelection of Mr.

Nevo as an outside director requires the vote of the holders of a majority of the voting power represented at the Meeting in person

or by proxy and voting on his reelection. In addition, either the affirmative vote of the Ordinary Shares must include at

least a majority of the Ordinary Shares voted by shareholders who are not controlling shareholders and do not have a personal interest

in the election of the outside director (excluding a personal interest that is not related to a relationship with the controlling

shareholders), or the total number of shares of non-controlling shareholders and non-interested shareholders voted against

this proposal must not represent more than two percent of the outstanding Ordinary Shares.

Board Recommendation

The Board of Directors

recommends a vote “FOR” the reelection of Mr. Doron Nevo as an outside director for an additional term of three years.

PROPOSAL

TWO

APPROVAL OF GRANT OF OPTIONS TO PURCHASE ORDINARY SHARES OF THE COMPANY TO Mr. Doron nevo FOR HIS SERVICES AS AN OUTSIDE DIRECTOR

OF THE COMPANY

Background

At the 2013 Annual

General Meeting of Shareholders, the Company’s Executive Compensation Policy for its Directors and Officers (the “Compensation

Policy”) was approved as required by the Israeli Companies Law.

In accordance with

the Compensation Policy, the Compensation Committee, the Audit Committee and the Board of Directors of the Company have approved,

subject to shareholder approval and the reelection of Mr. Nevo as an outside director, the grant of options to Mr. Nevo to purchase

22,500 Ordinary Shares of the Company, with 7,500 options to vest upon each of the first, second and third anniversaries of the

date of the Meeting, subject to the continuing service of Mr. Nevo as an outside director of the Company, with all the options

becoming fully vested and exercisable upon a change of control of the Company. These options will have an exercise price equal

to 100% of the closing price of the Ordinary Shares on the NASDAQ Global Select Market on the date of the Meeting.

Proposal

The shareholders are

being asked to approve the grant of options to purchase Ordinary Shares to Mr. Nevo for his services as an outside director of

the Company, as set forth above.

It is proposed that

the following resolution be adopted at the Meeting:

“RESOLVED,

that subject to approval of Proposal One, Mr. Doron Nevo be awarded compensation for services as an outside director in options

to purchase Ordinary Shares as follows: an aggregate of 22,500 options to purchase Ordinary Shares, of which 7,500 shall vest upon

each of the first, second and third anniversaries of the date of the Meeting, subject to the continuing service of Mr. Doron Nevo

as an outside director of the Company, with all the options becoming fully vested and exercisable upon a change of control of the

Company. These options shall be granted at an exercise price equal to 100% of the closing price of the Ordinary Shares on the NASDAQ

Global Select Market on the date of the Meeting and upon the terms approved by the Company’s Audit Committee and Board of

Directors.”

Vote Required

The affirmative vote

of the holders of a majority of the voting power represented at the Meeting in person or by proxy and voting thereon is necessary

for approval of this proposal.

Board Recommendation

The Board

of Directors recommends a vote “FOR” the approval of the grant of options to purchase Ordinary Shares to Mr. Doron

Nevo for his services as an outside director of the Company.

PROPOSAL

THREE

REELECTION OF Mr. Shabtai Adlersberg AS A CLASS III DIRECTOR

FOR AN ADDITIONAL TERM OF THREE YEARS

Background

The Company’s

Nominating Committee has recommended that Mr. Shabtai Adlersberg be reelected to serve as a Class III director for an additional

term of three years, expiring at the 2018 Annual General Meeting of Shareholders, or until his successor is elected.

Biographical information

concerning Mr. Adlersberg, the nominee for re-election as a Class III director, is set forth above.

Proposal

The shareholders are

being asked to reelect Mr. Adlersberg as a Class III director for a term of three years to expire at the 2018 Annual General Meeting

of Shareholders, or until his successor is elected. Management knows of no current circumstances that would render Mr. Adlersberg

unable to accept nomination or reelection.

It is proposed that the

following resolution be adopted at the Meeting:

“RESOLVED,

that the shareholders of the Company hereby reelect Mr. Shabtai Adlersberg to the Board of Directors of the Company to serve as

a Class III director for a term to expire at the 2018 Annual General Meeting of Shareholders.”

Vote Required

The affirmative vote of

the holders of a majority of the voting power represented at the Meeting in person or by proxy and voting thereon is necessary

for approval of this proposal.

Board Recommendation

The Board

of Directors recommends a vote “FOR” the reelection of Mr. Shabtai Adlersberg as a Class III director for a term to

expire at the 2018 Annual General Meeting of Shareholders.

PROPOSAL

four

REELECTION OF Mr. Stanley Stern AS A CLASS III DIRECTOR

FOR AN ADDITIONAL TERM OF THREE YEARS

Background

The Company’s

Nominating Committee has recommended that Mr. Stanley Stern be reelected to serve as a Class III director for an additional term

of three years, expiring at the 2018 Annual General Meeting of Shareholders, or until his successor is elected.

Biographical information

concerning Mr. Stanley Stern, the nominee for re-election as a Class III director, is set forth above.

Proposal

The shareholders are

being asked to elect Mr. Stanley Stern as a Class III director for a term until the 2018 Annual General Meeting of Shareholders,

or until his successor is elected. Management knows of no current circumstances that would render Mr. Stanley Stern unable to accept

nomination or reelection.

It is proposed that

the following resolution be adopted at the Meeting:

“RESOLVED,

that the shareholders of the Company hereby reelect Mr. Stanley Stern to the Board of Directors of the Company to serve as a Class

III director for a term to expire at the 2018 Annual General Meeting of Shareholders.”

Vote Required

The affirmative vote

of the holders of a majority of the voting power represented at the Meeting in person or by proxy and voting thereon is necessary

for approval of this proposal.

Board Recommendation

The Board

of Directors recommends a vote “FOR” the reelection of Mr. Stanley Stern as a Class III director for a term

to expire at the 2018 Annual General Meeting of Shareholders.

PROPOSAL

five

APPROVAL OF GRANT OF OPTIONS TO PURCHASE ORDINARY SHARES OF THE COMPANY TO Mr. Stanley Stern FOR his SERVICES AS A DIRECTOR OF

THE COMPANY

Background

At the 2013 Annual

General Meeting of Shareholders, the Compensation Policy was approved as required by the Israeli Companies Law.

In accordance with

the Compensation Policy, the Compensation Committee, the Audit Committee and the Board of Directors of the Company have approved,

subject to shareholder approval and the election of Mr. Stanley Stern as a director, the grant of options to Mr. Stanley Stern

to purchase 22,500 Ordinary Shares of the Company, with 7,500 options to vest upon each of the first, second and third anniversaries

of the date of the Meeting, subject to the continuing service of Mr. Stanley Stern as a director of the Company, with all the options

becoming fully vested and exercisable upon a change of control of the Company. These options will have an exercise price equal

to 100% of the closing price of the Ordinary Shares on the NASDAQ Global Select Market on the date of the Meeting.

Proposal

The shareholders are

being asked to approve the grant of options to purchase Ordinary Shares to Mr. Stanley Stern for his services as a director of

the Company, as set forth above.

It is proposed that

the following resolution be adopted at the Meeting:

“RESOLVED,

that subject to approval of Proposal Four, Mr. Stanley Stern be awarded compensation for services as a director in options to purchase

Ordinary Shares as follows: an aggregate of 22,500 options to purchase Ordinary Shares, of which 7,500 shall vest upon each of

the first, second and third anniversaries of the date of the Meeting, subject to the continuing service of Mr. Stanley Stern as

a director of the Company, with all the options becoming fully vested and exercisable upon a change of control of the Company.

These options shall be granted at an exercise price equal to 100% of the closing price of the Ordinary Shares on the NASDAQ Global

Select Market on the date of the Meeting and upon the terms approved by the Company’s Audit Committee and Board of Directors.”

Vote Required

The affirmative vote

of the holders of a majority of the voting power represented at the Meeting in person or by proxy and voting thereon is necessary

for approval of this proposal.

Board Recommendation

The Board

of Directors recommends a vote “FOR” the approval of the grant of options to purchase Ordinary Shares to Mr. Stanley

Stern for his services as a director of the Company.

PROPOSAL

six

APPROVAL

OF AN AMENDMENT TO THE COMPENSATION PACKAGE

OF MS. ZEHAVA SIMON

FOR HER SERVICES AS A DIRECTOR OF THE COMPANY

Background

At the 2014 Annual

General Meeting of Shareholders, Ms. Simon was elected as a Class I director to serve for a term of two years. In accordance with

the Compensation Policy, the Compensation Committee, the Audit Committee and the Board of Directors of the Company approved the

grant of options to Ms. Zehava Simon to purchase 22,500 Ordinary Shares of the Company, with 11,250 options to vest upon each of

the first and second anniversaries of the 2014 Annual General Meeting of Shareholders, which was held on November 25, 2014, subject

to the continuing service of Ms. Zehava Simon as a director of the Company. Due to a typographical error, the shareholders of the

Company were asked to approve vesting over three years rather than over a two-year term.

Proposal

The shareholders are

being asked to approve an amendment to the vesting schedule of the options to purchase Ordinary Shares granted to Ms. Zehava Simon

for her services as a director of the Company, as set forth above.

It is proposed that

the following resolution be adopted at the Meeting:

“RESOLVED,

to ratify and approve the amendment to the vesting schedule of the options to purchase Ordinary Shares granted to Ms. Zehava Simon

on November 25, 2014 for her services as a director of the Company, so that the vesting schedule shall be as follows: of the 22,500

options to purchase Ordinary Shares that were granted to Zehava Simon on November 25, 2014, 11,250 shall vest upon each of the

first and second anniversaries of the 2014 Annual General Meeting of Shareholders, which was held on November 25, 2014, subject

to the continuing service of Ms. Zehava Simon as a director of the Company. All other terms of the options shall not be affected

by the amendment hereunder.”

Vote Required

The affirmative vote

of the holders of a majority of the voting power represented at the Meeting in person or by proxy and voting thereon is necessary

for approval of this proposal.

Board Recommendation

The Board of Directors

recommends a vote “FOR” the approval of the amendment to compensation package of Ms. Zehava Simon for her services

as a director of the Company

proposal

seven

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

AND AUTHORIZATION OF AUDITORS’ COMPENSATION

Background

The Audit Committee

and the Board of Directors have selected the accounting firm Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global,

as the independent auditors to audit the consolidated financial statements of the Company for the year ending December 31, 2015.

Kost Forer Gabbay & Kasierer have audited the Company’s books and accounts since the year ended December 31, 1997.

Representatives of

Kost Forer Gabbay & Kasierer will attend the Meeting and will be available to respond to appropriate questions raised during

the Meeting.

Proposal

Shareholders are being

asked to ratify the selection of Kost Forer Gabbay & Kasierer as the Company’s independent auditors for 2015, and to

authorize the Company’s Board of Directors to set the compensation of these auditors. Subject to the shareholders approving

such authorization, the Board of Directors intends to further delegate the authority to set the compensation of the auditors to

the Audit Committee of the Board of Directors. The Audit Committee will pre-approve all services to be performed by, and compensation

to be paid to, the Company’s auditors as provided for in the U.S. Sarbanes-Oxley Act of 2002 and the rules thereunder.

It is proposed that

the following resolution be adopted at the Meeting:

“RESOLVED,

that the appointment of Kost Forer Gabbay & Kasierer as the Company’s independent public accountants for the fiscal year

ending December 31, 2015 be, and it hereby is, ratified, and that the Board of Directors (or the Audit Committee, if authorized

by the Board of Directors) be, and it hereby is, authorized to fix the remuneration of such independent public accountants in accordance

with the volume and nature of their services.”

Vote Required

The affirmative vote

of the holders of a majority of the voting power represented at the Meeting in person or by proxy and voting thereon is necessary

for approval of this proposal.

Board Recommendation

The Board of Directors

recommends that the shareholders vote “FOR” the ratification of the appointment of the Company’s independent

auditors and the authorization of the compensation of the auditors.

REVIEW AND

DISCUSSION OF THE AUDITED CONSOLIDATED FINANCIAL STATEMENTS

OF THE COMPANY FOR THE YEAR ENDED DECEMBER 31, 2014

In accordance with

Section 60(b) of the Companies Law, shareholders are invited to discuss the audited Consolidated Financial Statements of the Company

for the year ended December 31, 2014. The Annual Report on Form 20-F of the Company filed with the U.S. Securities and Exchange

Commission (“SEC”) for the year ended December 31, 2014, including the audited Consolidated Financial Statements of

the Company, is available on the Company’s website at www.audiocodes.com and on the SEC’s website at www.sec.gov.

PROPOSALS OF SHAREHOLDERS

Shareholder Proposals for this Annual

Meeting

Any shareholder of

the Company who intends to present a proposal at the Annual Meeting must satisfy the requirements of the Companies Law. Under the

Companies Law, only shareholders who severally or jointly hold at least 1% of the Company’s outstanding voting rights are

entitled to request that the Board include a proposal in a future shareholders meeting, provided that such proposal is appropriate

for consideration by shareholders at such meeting. Such shareholders may present proposals for consideration at the Annual Meeting

by submitting their proposals in writing to our Chief Legal Officer at the following address: 1 Hayarden Street, Airport City,

Lod 7019900, Israel, Attention: Chief Legal Officer. For a shareholder proposal to be considered for inclusion in the Annual Meeting,

our Chief Legal Officer must receive the written proposal no later than September 10th, 2015. If the Board of Directors

determines that a shareholder proposal is duly and timely received and is appropriate under applicable Israeli law for inclusion

in the agenda of the Annual Meeting, we will publish a revised agenda for the Annual Meeting no later than September 11th,

2015 by way of issuing a press release or submitting a Report on Form 6-K to the SEC.

Shareholder Proposals for Annual General

Meeting in 2016

To be considered for

inclusion in the Company’s proxy statement for the 2016 Annual General Meeting of Shareholders (the “2016 AGM”)

pursuant to the Companies Law, shareholder proposals must be in writing and must be properly submitted to the Chief Legal Officer

of the Company, 1 Hayarden Street, Airport City, Lod 7019900, Israel, and must otherwise comply with the requirements of the Companies

Law.

We currently expect

that the agenda for the 2016 AGM will include (1) the election (or reelection) of a Class I director, and the approval of compensation

for such director; (2) the approval of the appointment (or reappointment) of the Company’s independent auditors and authorization

of the compensation of the independent auditors; and (3) presentation and discussion of the financial statements of the Company

for the year ended December 31, 2015 and the auditors’ report for this period, as well as such other matters as the Board

shall decide to include in the agenda.

Pursuant to Section

66(b) of the Companies Law, shareholders who hold at least 1% of our outstanding ordinary shares are generally allowed to submit

a proper proposal for inclusion on the agenda of a general meeting of the Company’s shareholders. Such eligible shareholders

may present proper proposals for inclusion in, and for consideration at, the 2016 AGM by submitting their proposals in writing

to AudioCodes Ltd., 1 Hayarden Street, Airport City, Lod 7019900, Israel, Attention: Chief Legal Officer. For a shareholder proposal

to be considered for inclusion in the agenda for the 2016 AGM, our Chief Legal Officer must receive the written proposal not less

than 90 calendar days prior to the first anniversary of the 2015 AGM, i.e., no later than July 7, 2016; provided that if

the date of the 2016 AGM is advanced by more than 30 calendar days prior to, or delayed (other than as a result of adjournment)

by more than 30 calendar days after, the anniversary of the 2015 AGM, for a proposal by a shareholder to be timely it must be so

delivered not later than the earlier of (i) the 7th calendar day following the day on which we call and provide notice of the 2016

AGM and (ii) the 14th calendar day following the day on which public disclosure of the date of the 2016 AGM is first made.

In general, a shareholder

proposal must be in English and must set forth (i) the name, business address, telephone number, fax number and email address of

the proposing shareholder (and each member of the group constituting the proposing shareholder, if applicable) and, if not a natural

person, the same information with respect to the person(s) that controls or manages such person, (ii) the number of Ordinary Shares

held by the proposing shareholder, directly or indirectly, including if beneficially owned by the proposing shareholder (within

the meaning of Rule 13d-3 promulgated under the United States Securities Exchange Act of 1934, as amended) (the “US Exchange

Act”); if any of such Ordinary Shares are held indirectly, an explanation of how they are held and by whom, and, if such

proposing shareholder is not the holder of record of any such ordinary shares, a written statement from an authorized bank, broker,

depository or other nominee, as the case may be, indicating the number of ordinary shares the proposing shareholder is entitled

to vote as of a date that is no more than ten (10) days prior to the date of delivery of the shareholder proposal, (iii) any agreements,

arrangements, understandings or relationships between the proposing shareholder and any other person with respect to any securities

of the Company or the subject matter of the shareholder proposal, including any derivative, swap or other transaction or series

of transactions engaged in, directly or indirectly, by such proposing shareholder, the purpose or effect of which is to give such

proposing shareholder economic risk similar to ownership of shares of any class or series of the Company, (iv) the proposing shareholder’s

purpose in making the proposal, (v) the complete text of the resolution that the proposing shareholder proposes to be voted upon

at the 2016 AGM, (vi) a statement of whether the proposing shareholder has a personal interest in the proposal and, if so, a description

in reasonable detail of such personal interest, (vii) a declaration that all the information that is required under the Companies

Law and any other applicable law to be provided to the Company in connection with such subject, if any, has been provided, (viii)

if the proposal is to nominate a candidate for election to the Board, a questionnaire and declaration, in form and substance reasonably

requested by the Company, signed by the nominee with respect to matters relating to his or her identity, address, background, credentials,

expertise, etc., and his or her consent to be named as a candidate and, if elected, to serve on the Board, and (ix) any other information

reasonably requested by the Company. The Company shall be entitled to publish information provided by a proposing shareholder,

and the proposing shareholder shall be responsible for the accuracy thereof. In addition, shareholder proposals must otherwise

comply with applicable law and our Articles of Association. AudioCodes may disregard shareholder proposals that are not timely

and validly submitted.

The information set

forth in this section is, and should be construed, as a “pre-announcement notice” of the 2016 AGM in accordance with

Rule 5C of the Israeli Companies Regulations (Notice of General and Class Meetings in a Public Company), 2000, as amended.

OTHER BUSINESS

The Board is not aware

of any other matters that may be presented at the Meeting other than those mentioned in the attached Company’s Notice of

2015 Annual General Meeting of Shareholders.

MAILING

OF PROXY STATEMENT; EXPENSES; SOLICITATION

The Company is first

distributing this proxy statement and the enclosed form of proxy on September 2, 2015, and will mail the same to shareholders.

All expenses of this solicitation will be borne by the Company. In addition to the solicitation of proxies by mail, directors,

officers, and employees of the Company, may solicit proxies by telephone, in person, or by other means. Such directors, officers

and employees will not receive additional compensation for such solicitation, but may be reimbursed for reasonable out-of-pocket

expenses in connection with such solicitation. Brokerage firms, nominees, fiduciaries, and other custodians have been requested

to forward proxy solicitation materials to the beneficial owners of ordinary shares of the Company held of record by such persons,

and the Company will reimburse such brokerage, nominees, fiduciaries, and other custodians for reasonable out-of-pocket expenses

incurred by them in connection therewith.

ADDITIONAL

INFORMATION

The Company’s

annual report for the fiscal year ended December 31, 2014 filed on Form 20-F with the SEC on March 24, 2015, is available for viewing

and download on the SEC’s website at www.sec.gov, on the Tel-Aviv Stock Exchange filings at www.tase.co.il, as well as under

the Investors section of AudioCodes’ website at www.audiocodes.com. In addition, the Company has filed a number of press

releases with the SEC on Forms 6-K, which are also available for viewing and download on the SEC’s website at www.sec.gov.

In addition, shareholders may download a copy of these documents without charge at www.audiocodes.com.

The Company is subject

to the information reporting requirements of the U.S. Exchange Act, applicable to foreign private issuers. We fulfill these requirements

by filing reports with the SEC. The Company’s filings with the SEC may be inspected without charge at the SEC’s Public

Reference Room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Information on the operation of the Public Reference Room

can be obtained by calling the SEC at 1-800-SEC-0330. The Company’s SEC filings are also available to the public on the SEC’s

website at www.sec.gov. As a foreign private issuer, the Company is exempt from the rules under the U.S. Exchange Act related to

the furnishing and content of proxy statements. The circulation of this proxy statement should not be taken as an admission that

the Company is subject to these proxy rules.

| |

By Order of the Board of Directors |

| |

|

| |

|

| |

Stanley Stern |

| |

Chairman of the Board |

| |

|

| Dated: September 1, 2015 |

|

Exhibit 99.2

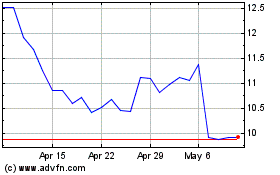

AudioCodes (NASDAQ:AUDC)

Historical Stock Chart

From Mar 2024 to Apr 2024

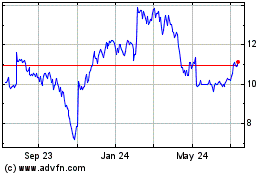

AudioCodes (NASDAQ:AUDC)

Historical Stock Chart

From Apr 2023 to Apr 2024