FORM 6-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the month of July 2015

Commission File Number: 1-07952

KYOCERA CORPORATION

6, Takeda Tobadono-cho, Fushimi-ku,

Kyoto 612-8501, Japan

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Registration S-T Rule 101(b)(1): __

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Registration S-T Rule 101(b)(7): __

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

KYOCERA CORPORATION |

|

|

|

|

|

/s/ SHOICHI AOKI |

|

|

Shoichi Aoki |

|

|

Director, |

|

|

Managing Executive Officer and |

|

|

General Manager of |

|

|

Corporate Financial and Accounting Group |

Date : July 30, 2015

Information furnished on this form:

EXHIBITS

July 30, 2015

To All Persons Concerned,

|

Name of Company : |

KYOCERA Corporation |

|

Name of Representative : |

Goro Yamaguchi, President and Representative Director |

|

|

(Code Number: 6971, The First Section of the Tokyo Stock Exchange) |

|

Person of Inquiry : |

Shoichi Aoki, |

|

|

Director, Managing Executive Officer and General Manager of |

|

|

Corporate Financial and Accounting Group |

|

|

Tel : +81-75-604- 3500 |

KYOCERA Corporation Announces Commencement of

Tender Offer for Share Certificates, Etc. of Nihon Inter Electronics Corporation

(Code Number: 6974)

KYOCERA Corporation (the “Offeror”) announced that it has resolved, at the meeting of its board of directors held on July 30, 2015, to acquire shares of common stock of Nihon Inter Electronics Corporation (the “Target”) (Code Number: 6974, the Second Section of the Tokyo Stock Exchange), shares of Class A Preferred Stock, issued under the meeting of the board of directors of the Target, held on June 10, 2010, and the resolution of the 59th annual shareholders meeting of the Target, held on June 30, 2010 (the “Preferred Shares”), Stock Acquisition Rights No. 2, issued under the resolution of the 63rd annual shareholders meeting of the Target, held on June 27, 2014, and the meeting of the board of directors of the Target, held on the same date (the “Stock Acquisition Rights No. 2”), and Stock Acquisition Rights No. 3, issued under the resolution of the 64th annual shareholders meeting of the Target, held on June 26, 2015, and the meeting of the board of directors of the Target, held on the same date (the “Stock Acquisition Rights No. 3”; collectively, together with Stock Acquisition Rights No. 2, the “Stock Acquisition Rights”), by way of a tender offer (the “Tender Offer”) under the Financial Instruments and Exchange Act of Japan (Act No. 25 of 1948, as amended) (the “Act”) as set forth below.

1. Purposes of Tender Offer

(1) Outline of the Tender Offer

The Offeror resolved, at the meeting of the board of its directors held today, to make the Tender Offer for the purpose of acquiring out of the common shares of the Target (the “Target Common Shares”) listed on the Second Section of the Tokyo Stock Exchange, Inc. (the “Tokyo Stock Exchange”), all of the Target Common Shares owned by Innovation Network Corporation of Japan (“INCJ”), the largest shareholders of the Target (the number of the Target Common Shares owned as of today: 31,250,000 shares, the Shareholding Ratio (Note 1): 35.19%), and all of the Target Common Shares owned by The Bank of Yokohama, Ltd. (“The Bank of Yokohama”; collectively, together with INCJ, the “Tendering Shareholders”), one of the major shareholders of the Target (the number of the Target Common Shares owned as of today: 1,486,000 shares, the Shareholding Ratio: 1.67%), and out of the Preferred Shares, the Preferred Shares owned by The Bank of Yokohama (the number of the Preferred Shares owned by The Bank of Yokohama as of today is 9,121,148 (the “Tendered Preferred Shares”). The number of shares by converting (Note 2) the Preferred Shares into the Target Common Shares in consideration of put options to claim the delivery of Target Common Shares for Preferred Shares (“Preferred Shares to Common Shares Conversion Options”) is 21,461,524 shares, and the Shareholding Ratio is 24.16%. Together with 1,486,000 Target Common Shares owned by The Bank of Yokohama, the total is 22,947,524 shares, with the Shareholding Ratio of 25.84%). As of today, the Offeror owns no Target Common Shares, Preferred Shares or Stock Acquisition Rights.

1

Note 1: In this press release, “Shareholding Ratio” means any ratio of shareholding in the total number of issued Target Common Shares as of March 31, 2015 as stated in the “Annual Securities Report for the 64th Term,” filed by the Target on June 29, 2015 (the “Target’s 64th Term Annual Securities Report”) (65,500,686 shares), minus the treasury shares of Target Common Shares held by the Target as of the same date (927 shares) (resulting number of shares: 65,499,759 shares), plus the number of shares converted from all of the Preferred Shares into Target Common Shares pursuant to the terms and conditions of the Preferred Shares (22,370,232 shares) in consideration of the Preferred Shares to Common Shares Conversion Options of the number of the Preferred Shares as of the same date (9,507,349 shares) and the number of the Target Common Shares (942,800 shares) subject to the Stock Acquisition Rights as of July 15, 2015 (9,428 options) (the resulting number of shares as converted into Target Common Shares is 88,812,791 shares in total) (such ratio shall be rounded to the second decimal place; the same shall apply hereinafter as to ratio calculations unless otherwise specified). The number of the Stock Acquisition Rights as of July 15, 2015 was confirmed with the commercial register of the Target and then with the Target, not to have changed as of the date of this press release (the same shall apply hereinafter as to descriptions of the number of the Stock Acquisition Rights as of July 15, 2015).

Note 2: The terms and conditions of the Preferred Shares set forth that the number of the Target Common Shares to be delivered in exchange for the Preferred Shares to Common Shares Conversion Options is equivalent to the number of the Preferred Shares subject to the exercise of the Preferred Shares to Common Shares Conversion Options, multiplied by 500 yen and divided by the Acquisition Price thereof (any fractional Target Common Shares less than one share shall be rounded off).

According to the “Announcement of the Modification of the Acquisition Price of its Class A Preferred Shares,” issued by the Target on March 11, 2015, the Acquisition Price from April 1, 2015 to March 31, 2016 is 212.5 yen, and such Acquisition Price is used in this press release.

Upon the Tender Offer, the Offeror entered into a tender agreement with INCJ under which INCJ shall accept the Tender Offer for all of its Target Common Shares, and the Offeror entered into a tender agreement with The Bank of Yokohama under which The Bank of Yokohama shall accept the Tender Offer for all of its Target Common Shares and all of its Tendered Preferred Shares (the Target Common Shares owned by INCJ and the Target Common Shares and Tendered Preferred Shares owned by The Bank of Yokohama shall be hereinafter referred to as the “Tendered Shares”) (together with the tender agreement with INCJ, the “Tender Agreements”) as of today. For the outline of the Tender Agreements, please see “(5) Important agreements or arrangements concerning the Tender Offer” below.

Also, the Offeror and the Target entered into the Capital and Business Alliance Agreement dated July 30, 2015 (the “Alliance Agreement”), and agreed that the Offeror shall make the Target one of its consolidated subsidiaries upon the Tender Offer, and they shall form a business alliance such as in sharing of know-how of production management, sharing of sales channels and sales infrastructures, product development, procurement and logistics in order to maintain and respect the brand and management independence of the Offeror and the Target and pursue any possible synergies in their respective business domains, and the Offeror shall dispatch officers and other employees to the Target. For the outline of the Alliance Agreement, please see “(1) Agreements between the Offeror and the Target or its Officers, and the terms thereof” of “4. Others” below.

The purchase price in the Tender Offer is the price that was determined as the result of mutual consultation and upon agreement between the Offeror and INCJ and between the Offeror and The Bank of Yokohama as stated in “(ii) Background to the determination to make the Tender Offer” of “(2) Background, purpose and decision-making process of the determination to make the Tender Offer” below.

2

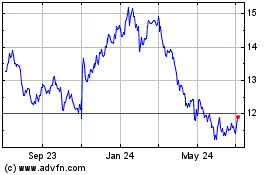

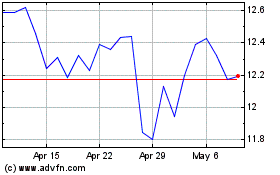

The purchase price for each Target Common Share of 197 yen is the closing price of 182 yen of a Target Common Share on the Second Section of the Tokyo Stock Exchange as of July 29, 2015, which is the business day immediately preceding the announcement of the implementation of the Tender Offer, with a premium of 8.24% (rounded to the second decimal place; the same shall apply hereinafter as to calculations of discounts and premiums), or the simple average of 188 yen of the closing prices of the Target Common Shares for the past one month from July 29, 2015 (rounded to the nearest yen; the same shall apply hereinafter as to calculations of the simple average of the closing prices), with a premium of 4.79%, or the simple average of 198 yen of the closing prices of the Target Common Shares for the past three months from the same date, discounted by 0.51%, or the simple average of 205 yen of the closing prices of the Target Common Shares for the past six months from the same date, discounted by 3.90%.

The purchase price of the Preferred Shares (464 yen) is determined to be the number of the Target Common Shares to be acquired upon conversion of all of the Tendered Preferred Shares pursuant to the method described in Note 2 above (21,461,524 shares, the same method shall be applied in case of conversion of the Preferred Shares) divided by the number of Tendered Preferred Shares (9,121,148 shares), assuming that the Preferred Shares to Common Shares Conversion Options, attached to all of the Tendered Preferred Shares, will be exercised, multiplied by the purchase price per Target Common Share, such that the purchase price of the Preferred Shares will be substantially equivalent to the purchase price per Target Common Share (rounded to the nearest yen).

As for the purchase price of the Stock Acquisition Rights, in order to exercise any Stock Acquisition Right, the holder of such Stock Acquisition Right shall be required to be at the position of director or executive officer of the Target or any of its subsidiaries in principle, and even if the Offeror purchases the Stock Acquisition Rights through the Tender Offer, the Offeror may not be able to exercise such Stock Acquisition Rights, and thus, the purchase price of a Stock Acquisition Right is determined to be 1 yen per Stock Acquisition Right. Furthermore, under the terms and conditions of the Stock Acquisition Right, the board approval is necessary for the transfer of the Stock Acquisition Rights.

In the Tender Offer, the number of share certificates, etc. for the Tendered Shares (54,197,524 shares (Shareholding Ratio: 61.02%), the calculation of the number of such share certificates, etc. is made assuming that all of the Tendered Preferred Shares are converted into the Target Common Shares pursuant to the terms and conditions of the Preferred Shares, considering that the Preferred Shares to Common Shares Conversion Options are attached to the Preferred Shares; the same shall apply hereinafter as to calculations of the number of shares to be purchased) is set as the minimum number of shares to be purchased, and thus, if the total number of share certificates, etc. offered to sell is less than the minimum number of shares to be purchased (54,197,524 shares), the purchase, etc. of all of the share certificates, etc. offered to sell will not be made. Meanwhile, since the Tender Offer will be made without excluding the intentions of any shareholders of the Target other than the Tendering Shareholders, the maximum number of shares to be purchased in the Tender Offer is not set, and thus, if the total number of share certificates, etc. offered to sell is the minimum number of shares to be purchased or higher, the purchase, etc. of all of the share certificates, etc. offered to sell will be made, but the Tender Offer is not intended to delist the Target Common Shares. As a result of the Tender Offer, if the Target Common Shares are likely to conflict with delisting standards within one year, which is specified as a moratorium for delisting, the Offeror will consult with the Target in good faith to consider any measures to avoid delisting, and then, implement those agreed-upon measures such that the listing of the Target Common Shares may be maintained, as stated in “(7) Possibility of delisting” below. For specific actions, details of implementation and various conditions of such measures, no matter has been decided yet.

After acquiring the Preferred Shares of the Target upon the Tender Offer, the Offeror will request the conversion of all of such acquired Preferred Shares into Target Common Shares pursuant to the terms and conditions of the Preferred Shares. Although the Preferred Shares have no voting rights, the total number of voting rights of the Target will increase upon conversion of the Preferred Shares into the Target Common Shares in the Target.

3

Meanwhile, according to the “Announcement Concerning Opinion on Tender Offer from KYOCERA Corporation for Share Certificates, Etc. of the Company and Execution of Capital and Business Alliance Agreement with KYOCERA Corporation” that was issued by the Target today (the “Target Press Release”), and as described in “(ii) Background to the determination to make the Tender Offer” of “(2) Background, purpose and decision-making process of the determination to make the Tender Offer” below, with a certain prospect of reconstructing the Target’s business, the Target, upon receiving the proposal of the Tender Offer and capital and business alliance by the Offeror, and as a result of careful review in terms of improving corporate value, determined that the Offeror’s proposal can enhance the corporate values of the Target. The Tender Offer is a transaction which is in line with the intentions of INCJ and The Bank of Yokohama, and they believe that, because the Tendered Preferred Shares owned by The Bank of Yokohama are planned to be acquired by the Offeror and to be requested for conversion to the Target Common Shares, and thereby the Target will no longer be requested to acquire any Tendered Preferred Shares in exchange for money, the Tender Offer can lead to stabilization of the Target’s financial ground and improvement of the Target’s credibility. Therefore, the Target confirmed with the Offeror the details of the conditions for the Tender Offer, the management policy of the Offeror after the Tender Offer, and the necessity and reasonableness of the Tender Offer, and then conducted deliberate consultation and consideration based on the intention of the Offeror and the advice from Mori Hamada & Matsumoto, a legal advisor independent of the Target, the Tendering Shareholders and the Offeror, and as a result, the Target determined that by becoming a consolidated subsidiary of the Offeror, the Target could further enhance its corporate value, providing a higher value of its shares and Stock Acquisition Rights to all of its shareholders and Stock Acquisition Right holders.

For the foregoing reasons, at the meeting of the board of directors of the Target held on July 30, 2015, the directors who participated in the deliberations and resolutions unanimously resolved to enter into the Alliance Agreement and express an opinion in favor of the Tender Offer. The resolution of the board of directors of the Target was adopted before the presence of all of the three directors other than Mr. Nobuyuki Nakano and Mr. Eiichi Arai out of the five directors of the Target. The Offeror has been informed that in order to ensure fairness and objectivity and avoid suspected conflicts of interest in the decision-making of the board of directors as regards the Tender Offer, Mr. Nobuyuki Nakano and Mr. Eiichi Arai, who are also serving as employees of INCJ, did not participate in the deliberations and resolutions of all agendas concerning the Tender Offer and the Alliance Agreement.

Meanwhile, although the maximum number of shares to be purchased is not set in the Tender Offer, the Offeror does not intend to delist the Target Common Shares, and if the Target Common Shares are likely to conflict with delisting standards, within one year, which is specified as a moratorium for delisting, the Offeror shall faithfully consult and discuss with the Target any specific measures to avoid delisting, and then, implement those agreed-upon measures such that the listing of the Target Common Shares may be maintained, as stated in “(7) Possibility of delisting” below. From this perspective, with respect to the Target Common Shares and the Preferred Shares, it is sufficiently reasonable that the shareholders of the Target will continue to own the Target Common Shares after the Tender Offer. Meanwhile, the Offeror has been informed that the Target resolved to refrain from expressing its own opinion regarding the validity of the purchase price of the Target Common Shares and leave it to the shareholders of the Target whether to accept the Tender Offer or not, comprehensively considering that since the purchase price of the Target Common Shares is the price that is discounted from 198 yen, the simple average of closing prices for three months in the past from July 29, 2015, and 205 yen, the simple average of the closing prices for the past six months from July 29, 2015 as stated above, it is questionable whether the purchase price of the Target Common Shares is a fair price or not, the purchase price of the Target Common Shares was originally determined as a result of the mutual consultations and negotiations between the Offeror and the Tendering Shareholders, and it is deemed that as a result of the Target’s becoming a consolidated subsidiary of the Offeror, the corporate value and stock value of the Target could be enhanced. Also, the Offeror has been informed that the Target resolved to leave it to the holders of the Stock Acquisition Rights whether or not to accept the Tender Offer for the Stock Acquisition Rights because the Stock Acquisition Rights are Stock Acquisition Rights and the purchase price per Stock Acquisition Right is set to be 1 yen.

4

(2) Background, purpose and decision-making process of the determination to make the Tender Offer

(i) Status of the Offeror

Since its establishment as “Kyoto Ceramic Company, Limited,” a fine ceramics manufacturer, in April 1959, the Offeror has been growing into a corporate group that develops diverse business all over the world under the corporate identity of “To provide opportunities for the material and intellectual growth of all our employees, and through our joint efforts, contribute to the advancement of society and humankind.” As of today, the group of the Offeror consists of the Offeror and other related companies (214 consolidated subsidiaries, one equity method subsidiary and 10 equity-method affiliated companies (as of March 31, 2015)) (the Offeror and other affiliated companies shall be hereinafter collectively referred to as the “Offeror Group”), and engages in seven major businesses: (a) fine ceramic parts business (such as semiconductor/flat panel display manufacturing equipment components, information and telecommunication components and general industry machinery components), (b) semiconductor parts business (such as ceramic packages and organic multilayer packages), (c) applied ceramic products business (such as solar power generation systems, cutting tools and micro drills and medical or dental implants), (d) electronic devices business (such as capacitors, SAW devices and crystal components), (e) telecommunications equipment business (such as mobile phones, PHS handsets and PHS base stations), (f) information equipment business (monochrome and color printers and multifunctional products, wide format systems and document solutions) and (g) other business (such as information systems and telecommunication services, engineering business and management consulting business).

(ii) Background to the determination to make the Tender Offer

As of today, the Target, its subsidiaries and affiliated companies consists of the Target and its seven (7) consolidated subsidiaries, has operations mainly in the manufacture and sale of power semiconductors, and engages in three major businesses: (a) discreet business (such as schottky barrier diodes (‘SBD”), (b) fast recovery epitaxial diodes (“FRED”) and (c) general rectifier elements for low electric power), module business (such as general rectifier diodes for mid or high electric power, thyristors, power modules and stacks) and product business (such as active-type liquid crystal display devices, photoelectric conversion elements and developed products).

The Target was established in August 1957 as a joint venture company between Kyosan Electric Manufacturing Co., Ltd. and International Rectifier Corporation, a U.S. corporation, for the purpose of manufacturing and selling silicon rectifier elements, produced the first silicon rectifier element in Japan in the following year, and has been a pioneer in the development of the semiconductor industry in Japan. Also, the Target was listed on the Second Section of the Tokyo Stock Exchange in May 1970 and was transferred to the First Section of the Tokyo Stock Exchange in 2004. Furthermore, the Target focused on overseas production and established an affiliated manufacturing company in Taiwan in February 1974, and subsequently promoted global development such as establishing overseas locations in the Philippines, Singapore, Hong Kong and Shanghai.

The Target also focused its management resources on the three markets of IT and digital home appliances, automobile electronic components and related equipment, and industrial equipment and clean energy, and promoted strategic investments in a large-diameter 8-inch wafer manufacturing line, for the purpose of increasing production capacity and enhancing cost competitiveness of its SBD business (which is one of the main products of the Target; SBD are rectifier diodes used for electric power circuits and other products) from the fiscal year ending March 2005, and the structuring of production and sales systems corresponding to globalization. However, from the middle of the fiscal year for March 2008, the global economic slump, due to the financial crisis that began in the U.S., caused the strong growth in demand to slow down suddenly and the Target’s sales to decrease significantly. In response to these changes in circumstances, the Target made for it an unprecedented decrease of its variable expense ratio and cut fixed costs, and by lowering its break-even point, promoted the structuring of a strong revenue base that could survive economic depressions. However, increases in depreciation cost of the said strategic investments in an 8-inch wafer manufacturing line and lack of progress on the restructuring of its business corresponding to globalization resulted in a net loss of 1,529 million yen in the consolidated results for the fiscal year ended March 31, 2008, a net loss of 5,614 million yen in the consolidated results for the fiscal year ended March 31, 2009, and a net loss of 9,196 million yen in the consolidated results for the fiscal year ended March 31, 2010, which was the third consecutive year in which the Target recorded net losses. This resulted in net profit, which was 12,019 million yen for the fiscal year ended March 31, 2007, dropping to negative 4,740 million yen for the fiscal year ended March 31, 2010, and the Target became insolvent.

5

While the business environment surrounding the Target was becoming more severe, for the purpose of radically revising its business structure and strengthening its profitability and improving its financial position toward its business reconstruction, the Target filed an application for the alternative dispute resolution procedure under the Act on Special Measures Concerning Revitalization of Industry and Innovation in Industrial Activities of Japan (the “Business Reconstruction ADR Procedure”) in April 2010, and the Business Reconstruction ADR Procedure became effective in June 2010. In connection to this, 10,219,622 shares of the Preferred Shares were issued with an issuance price of 500 yen per share by means of a third-party allocation through a debt-equity swap of a sum of 5,109 million yen to The Bank of Yokohama, Ltd., Sumitomo Mitsui Banking Corporation and The Bank of Tokyo-Mitsubishi UFJ, Ltd. In parallel, the Target conducted a third-party allocation of 1,666,700 shares of the Target Common Shares for 150 yen per share, a sum of 250 million yen, to Ningbo Mingxin Microelectronics Co., Ltd., a Chinese manufacturer specializing in semiconductor assembly, to which the Target consigns its production and assembly process of semiconductor devices, on the same date to reduce the Target’s excessive liabilities and strengthen its financial position. During the foregoing process, the listing of the Target on the Tokyo Stock Exchange was transferred from the First Section to the Second Section in August 2010. Furthermore, in December 2010, the Target conducted a third-party allocation of 31,250,000 shares of the Target Common Shares for 112 yen per share, a sum of 3,500 million yen, to INCJ, an investment fund contributed to by both the public and private sectors, with the consideration that the best way for further strengthening its financial position and promptly achieving its growth strategy was to secure a viewpoint concerning corporate value enhancement and entire industry growth and jointly manage its business with a variety of industry networks and partners with management experience.

As a result of obtaining the support described above and striving to restructure its business and improve earnings on a company-wide basis, the Target completed repayment of debt under the plan arising from the Business Reconstruction ADR Procedure in March 2014, and in its consolidated results for the fiscal year ended March 31, 2015 recorded an operating profit of 1,090 million yen, a recurring profit of 1,074 million yen and net income of 466 million yen, with net assets of 6,382 million yen, showing a stable turnaround situation.

Since the support provided for the Target’s growth was successful to some extent, INCJ embarked on searching for a supporter for the Target’s further growth from March 2014 and made proposals to several candidates, including the Offeror which operates a semiconductor parts business.

The Offeror was one of the candidates that showed preliminary interest, and in the course of this search, the Offeror commenced discussions with INCJ in early May 2014 as to how the Target should operate its business in the future. Through discussions, the Offeror determined that the Offeror can provide new value in the power semiconductor area and can enhance the corporate values of the Offeror and the Target through the sharing of knowledge about substrates of the Offeror, which manufactures and sells ceramic packages and other products, and the knowledge about chips of the Target, which operates a business mainly in manufacturing and selling power semiconductors, which could result in an expansion into a new business area with a combination of their respective products, and is expected to contribute to a wider corporate size of the Offeror Group and the Target. From the perspective of the Target, the utilization of management platforms for research and development and production technologies of the Offeror Group enables the Target to strengthen its research, development and production systems and strengthen their respective production development capabilities; and that the Offeror develops a variety of business operations on a global basis, such as materials, components, devices, equipment and services and network business, and the Offeror can accelerate the Target’s overseas expansion by providing the Offeror’s overseas sales channels to the Target. Therefore, in March 2015, the Offeror adopted the policy of promoting serious considerations about making the Target a consolidated subsidiary of the Offeror. On that basis, the Offeror proposed to INCJ, The Bank of Yokohama and the Target that the discussions about making the Target a consolidated subsidiary of the Offeror would be commenced in March to April 2015, and obtained their respective consents and commenced due diligence on the Target in April 2015.

6

Concurrently with such due diligence, the Offeror held discussions and negotiations with INCJ and The Bank of Yokohama regarding the purchase price, and made a comprehensive review of the financial condition of the Target, industry trends, the valuation results from each of the analyses in the valuation report obtained from Daiwa Securities Co., Ltd. (“Daiwa Securities”), results of due diligence of the Target, the trend in the market price of the Target Common Shares in the most recent one-year period, whether or not the Target can express its opinion on the Tender Offer, and the number of shares expected to be tendered in the Tender Offer, and it was agreed in mid-July 2015 that the purchase price per Target Common Share in the Tender Offer will be 197 yen.

In late June 2015, the Offeror proposed to the Target regarding the implementation of the Tender Offer assuming that the Target’s listing will be maintained and the conclusion of the Alliance Agreement, and has been in discussion with the Target until now. The Target confirmed with the Offeror the details of the conditions for the Tender Offer, the management policy of the Offeror after the Tender Offer, and the necessity and reasonableness of the Tender Offer, and then conducted deliberate consultation and consideration based on the intention of the Offeror and the advice from Mori Hamada & Matsumoto, a legal advisor independent of the Target, the Tendering Shareholders and the Offeror, and as a result, the Target determined that by becoming a consolidated subsidiary of the Offeror, the Target could further enhance its corporate value, providing a higher value of its shares and Stock Acquisition Rights to all of its shareholders and stock acquisition right holders. The Tender Offer is a transaction which is in line with the intentions of INCJ and The Bank of Yokohama, and they believe that, because the Tendered Preferred Shares owned by The Bank of Yokohama are planned to be acquired by the Offeror and to be requested for conversion to the Target Common Shares, and thereby the Target will no longer be requested to acquire any Tendered Preferred Shares in exchange for money, the Tender Offer can lead to stabilization of the Target’s financial ground and improvement of the Target’s credibility.

Following the foregoing events, the Offeror resolved to make the Tender Offer at the meeting of the board of directors of the Offeror today, entered into the Tender Agreements with INCJ and The Bank of Yokohama, respectively, and entered into the Alliance Agreement with the Target on the same date.

(3) Management policy after the implementation of the Tender Offer

After the Tender Offer, the Target will become a listed consolidated subsidiary of the Offeror. Under the Alliance Agreement, the Offeror and the Target agreed to implement a business alliance such as in sharing of know-how of production management, sharing of sales channels and sales infrastructures, product development, procurement and logistics in order to maintain and respect the brand and management independence of the Offeror and the Target and pursue any possible synergies in their respective business domains after the Tender Offer is accepted, aim to expand the size of their respective businesses and improve operational efficiency, and aim to maximize the corporate values of the Offeror and the Target in connection with the business alliance.

Also, under the Alliance Agreement, the Offeror and the Target agreed that the Offeror may, in proportion to the voting rights held by it, appoint directors and statutory auditors of the Target on or after the settlement date of the Tender Offer, and if the meeting of the board of directors of the Target is held on or after the settlement date of the Tender Offer, the Offeror may dispatch a few observers to such meeting of the board of directors so as to understand the details of the proceedings of such meetings, and to pursue faster synergies through the business alliance with the Offeror (provided that the observers execute a confidentiality agreement requested by the Target and agreed to by the Offeror). For the outline of the Alliance Agreement, please see “(1) Agreements between the Offeror and the Target or its Officers, and the terms thereof” of “4. Others”.

7

(4) The Target’s measures to ensure the fairness of the Tender Offer

Since the Tendering Shareholders, who are major shareholders of the Target, have entered into the Tender Agreements with the Offeror and some conflicts of interest may arise between the Tendering Shareholders and minority shareholders, the Target has taken the following measures, in discussing the expression of opinions regarding the Tender Offer and the conclusion of the Alliance Agreement, to ensure the fairness and appropriateness of the Tender Offer and to be careful about the deliberations on the Tender Offer:

(i) Receipt of legal advice by the Target from an independent law firm

According to the Target Press Release, to ensure the fairness and appropriateness in the decision-making of the board of directors of the Target, the Target has appointed Mori Hamada & Matsumoto as a legal advisor that is independent of the Target, the Tendering Shareholders and the Offeror, and has obtained legal advice from Mori Hamada & Matsumoto as to the decision-making method and process of the board of directors of the Target, and other important matters regarding the Tender Offer, the Alliance Agreement and a series of subsequent procedures.

(ii) Approval by directors without conflicts of interest and no objection from all statutory auditors

According to the Target Press Release, based on the legal advice from Mori Hamada & Matsumoto, the substance of the valuation report obtained from Nomura Securities Co., Ltd. (“Nomura Securities”), the substance of a series of continuous discussions with the Offeror and other related materials, the Target carefully investigated and reviewed the various conditions for the Tender Offer by the Offeror and the substance of the Alliance Agreement, and as a result, at the meeting of the board of directors of the Target held on July 30, 2015, the Target expressed its opinion in favor of the Tender Offer, and resolved to leave it to the shareholders and holders of the Stock Acquisition Rights of the Target whether to accept the Tender Offer for the Target Common Shares, the Preferred Shares and the Stock Acquisition Rights or not and resolved to enter into the Alliance Agreement.

The foregoing resolution of the meeting of the board of directors of the Target was unanimously adopted by all of the three directors present, other than Mr. Nobuyuki Nakano and Mr. Eiichi Arai, out of the five directors of the Target. The Company has been informed that in order to ensure the fairness and objectivity and avoid conflict of interest in the decision-making of the board of directors of the Target as regards the Tender Offer, of the directors of the Target, Mr. Nobuyuki Nakano and Mr. Eiichi Arai, also serving as employees of INCJ, did not participate in the deliberations and resolutions of all agendas concerning the Tender Offer or attend the above meeting of the board of directors of the Target.

Of the three statutory auditors of the Target, two statutory auditors (out of which one is an outside statutory auditor) other than Mr. Yoshihiko Kobayashi, an outside statutory auditor, were present at the foregoing meeting of the board of directors of the Target, and all of the two statutory auditors present expressed their opinion that they had no objection to the foregoing resolution. In order to ensure the fairness and objectivity and avoid conflict of interest in the decision-making of the board of directors of the Target as regards the Tender Offer, Mr. Yoshihiko Kobayashi, also serving as an employee of INCJ, did not participate in the deliberations of the agendas concerning the Tender Offer at the foregoing meeting of the board of directors of the Target, and refrained from stating any opinion regarding the foregoing resolution of the meeting of the board of directors. Mr. Yoshihiko Kobayashi did not attend the above meeting of the board of directors of the Target.

8

(iii) Receipt of a valuation report by the Target from an independent third-party appraiser

In determining the opinion on the Tender Offer, the Target requested Nomura Securities, a third-party appraiser that is independent of the Target and the Offeror, to perform a valuation of the shares of the Target. Nomura Securities conducted, after consideration based on analysis methods that suit the Tender Offer, a valuation of the shares of the Target based on each of a Market Share Price Analysis (because the Target Common Shares are listed on the Tokyo Stock Exchange), a Comparable Company Analysis (because there are multiple listed companies that can be compared with the Target and it is possible to presume the stock value of the Target Common Shares by comparing comparable companies) and a Discounted Cash Flow Analysis (“DCF Analysis”) (for the purpose of reflecting the future status of business activities in the valuation), and the Target obtained a valuation report on the Target Common Shares from Nomura Securities on July 30, 2015. The Target has not obtained an opinion on the fairness of the Offer Price (a fairness opinion) from Nomura Securities. Nomura Securities is not a related party of the Target or the Offeror and does not have any material interest in the Tender Offer.

According to Nomura Securities, upon valuation of the Target Common Shares, the analysis methods so adopted and the per share value ranges of the Target Common Shares calculated by each of those analyses are as follows:

|

Market Share Price Analysis |

182 yen to 205 yen |

|

Comparable Company Analysis |

81 yen to 138 yen |

|

DCF Analysis |

182 yen to 318 yen |

With respect to the Market Share Price Analysis, the record date was set as July 29, 2015 and the valuation per Target Common Share was made based upon the closing price of the Target Common Share on the Second Section of the Tokyo Stock Exchange on the record date of 182 yen, as well as the simple average closing prices of the last one week, one month, three months and six months immediately prior to the record date of 183 yen, 188 yen, 198 yen and 205 yen, respectively. Under the Market Share Price Analysis, the price range for the Target Common Share was derived to be 182 yen to 205 yen per share.

In the Comparable Company Analysis, the valuation of the Target Common Shares was conducted through comparison with the market share prices and financial measures, indications such as profitability, of listed companies which engage in business relatively similar to that of the Target. Under the Comparable Company Analysis, the price range for the Target Common Share was derived to be 81 yen to 138 yen per share.

In the DCF Analysis, the free cash flow that the Target is expected to create in and after the fiscal year ending March 2016 (based on various factors including the Target’s earnings as set forth in its business plan, as well as its investment projects and publicly disclosed information) was discounted to the present value using a certain discount rate, in order to analyze the Target’s corporate value and share value. Under the DCF Analysis, the price range for the Target Common Shares was derived to be 182 yen to 318 yen per share.

9

With respect to the business plans that are a basis for the DCF Analysis, a significant increase in earnings is expected in the fiscal year ending March 2017, versus the preceding fiscal period (specifically, the estimated amount of operating profit, recurring profit and net income are respectively expected to increase by 30% or more), because the Target forecasts expanding overseas sales due to a larger share of major products and cost reduction toward better profit margins.

Also, Nomura Securities conducted a valuation of the Target Common Shares, assuming that all of the Preferred Shares are converted into common shares pursuant to the terms and conditions of the Preferred Shares, because the Preferred Shares to Common Shares Conversion Options of the Preferred Shares can be exercised today.

(5) Important agreements or arrangements concerning the Tender Offer

Upon making the Tender Offer, the Offeror entered into a tender agreement with INCJ, a major shareholder of the Target, today, under which INCJ shall accept the Tender Offer for all of the Target Common Shares owned by INCJ as of today (31,250,000 shares; its Shareholding Ratio is 35.19%). Also, the Offeror entered into a tender agreement with The Bank of Yokohama, a major shareholder of the Target, today, under which The Bank of Yokohama shall accept the Tender Offer for all of the Target Common Shares owned by The Bank of Yokohama (1,486,000 shares; its Shareholding Ratio is 1.67%) and the Tendered Preferred Shares (9,121,148 shares (the number of shares converted into the Target Common Shares in consideration of the Preferred Shares to Common Shares Conversion Options is 21,461,524 shares); its Shareholding Ratio is 24.16%; together with the Target Common Shares owned by The Bank of Yokohama, 22,947,524 shares, and its Shareholding Ratio is 25.84%).

As conditions precedent for the Tendering Shareholders’ tendering, the Tender Agreements require that (a) the Tender Offer not be withdrawn or there have been no events that may have an adverse material impact on the business, assets, liabilities, financial conditions or business performances of the Target, and (b) the board of directors of the Target resolve to agree to the Tender Offer, and such resolution be announced, and not withdrawn, and (c) there be no material breach in the Offeror’s representations and warranties (Note 1), and (d) the Offeror not commit any material breach of the obligations set forth in the Tender Agreements (Note 2). The Tendering Shareholders are not restrained from accepting the Tender Offer at their own discretion after waiving all or part of those conditions precedent at their own discretion.

Note 1: In the Tender Agreements, the Offeror represents and warrants as of the execution date of the Tender Agreements and as of the commencement date and settlement date of the Tender Offer (or if any other specific time is clearly specified, as of such time) that (a) the Offeror is lawfully and validly established and existing; (b) the Offeror has necessary authority and power to execute and perform the Tender Agreements, and the execution and performance of the Tender Agreements are actions within the scope of the purpose of the Offeror, and any and all necessary internal procedures have been lawfully performed; (c) the Tender Agreements are enforceable against the Offeror; (d) the execution and performance of the Tender Agreements do not conflict with any laws and regulations, any internal regulations of the Offeror, or any decision of any judicial or administrative agencies; (e) the Offeror has obtained any permission or authorization necessary for the execution and performance of the Tender Agreements; and (f) the Offeror has never been antisocial forces or related to antisocial forces.

Note 2: In the Tender Agreements, the obligations to be performed or complied with by the Offeror on or before the commencement date of the Tender Offer include the obligation to keep confidentiality, the obligation regarding announcement and the prohibition from assignment of contractual status.

10

Also, the Offeror and the Target entered into the Alliance Agreement dated July 30, 2015, and for the outline of the Alliance Agreement, please see “(1) Agreements between the Offeror and the Target or its Officers, and the terms thereof” of “4. Others” below.

(6) Expectation to further acquire share certificates, etc. of the Target after the Tender Offer

As stated above, the Offeror will make the Tender Offer for the purpose of acquiring the Tendered Shares, and at this moment, the Offeror does not expect to further acquire share certificates, etc. of the Target if the Tender Offer is accepted.

(7) Possibility of delisting

As of today, the Target Common Shares are listed on the Second Section of the Tokyo Stock Exchange, and the purpose of the Tender Offer is to acquire the Tendered Shares, and as stated in “(1) Outline of the Tender Offer” above, since the purchase price of the Target Common Shares is set to be equivalent to their recent market price, the Offeror assumes that the Tender Offer will be accepted to a limited extent other than for the Tendered Shares, and contemplates maintaining the listing of the Target Common Shares after the implementation of the Tender Offer. However, since the maximum number of shares to be purchased in the Tender Offer is not set, depending on the result of the Tender Offer, the Target Common Shares may be delisted after prescribed procedures are taken if, out of the delisting standards of the Second Section of the Tokyo Stock Exchange as specified by the Tokyo Stock Exchange, (i) the number of shareholders at the last day of any business year is less than 400, and does not increase to 400 or more within one year; (ii) the number of outstanding shares at the last day of any business year (the number of listed shares, minus the number of shares held by officers (directors, accounting advisors, statutory auditors and executive officers), the number of shares held by the shareholders owning 10% or more of the number of issued shares (except for any shares that are obviously deemed not to be non-floating shares) and the number of treasury shares; the same shall apply hereinafter) is less than 2,000 units, and does not increase to 2,000 units or more within one year; (iii) the aggregate market value of outstanding shares at the last day of any business year (the closing price during floor trading at the last day of any business year, multiplied by the number of outstanding shares at the last day of such business year) is less than 500 million yen, and does not increase to 500 million yen or more within one year; or (iv) the number of outstanding shares at the last day of any business year is less than 5% of the number of listed share certificates, etc., and the listed company does not file any statement of public offering, secondary offering or distribution with a quantitative restriction as prescribed by the Tokyo Stock Exchange on or before the earlier of the date on which the listed company files an annual securities report or the last day of such term as set forth in Article 24, Paragraph 1 of the Act.

As a result of the Tender Offer, if the Target Common Shares are likely to conflict with the delisting standards, within one year, which is specified as a moratorium for delisting, the Offeror shall faithfully consult and discuss with the Target any specific measures to avoid delisting, such as off-floor selling or secondary offering, and then, implement the agreed-upon measures such that the listing of the Target Common Shares may be maintained. For specific actions, details of implementation and various conditions of such measures, no matter has been decided yet.

11

2. Information concerning Tender Offer

(1) Profile of the Target

|

(i) |

|

Trade name |

|

Nihon Inter Electronics Corporation |

|

|

|

|

|

|

|

|

|

(ii) |

|

Address of head office |

|

1204 Soya, Hadano City, Kanagawa Prefecture |

|

|

|

|

|

|

|

|

|

(iii) |

|

Name and title of representative |

|

TAE HO KIM, President & CEO |

|

|

|

|

|

|

|

|

|

(iv) |

|

Main business |

|

Development, manufacture and sale of power semiconductors, and purchase and sale of other companies’ electronic components, etc. |

|

|

|

|

|

|

|

|

|

(v) |

|

Amount of share capital |

|

2,234 million yen (as of March 31, 2015) |

|

|

|

|

|

|

|

|

|

(vi) |

|

Date of incorporation |

|

August 21, 1957 |

|

|

|

|

|

|

|

|

|

(vii) |

|

Composition of major shareholders and shareholding ratio (as of March 31, 2015) |

|

Innovation Network Corporation of Japan |

41.66% |

|

|

|

|

The Bank of Yokohama, Ltd. |

14.14% |

|

|

|

|

Kyosan Electric Manufacturing Co., Ltd. |

8.42% |

|

|

|

|

International Rectifier Corporation |

3.79% |

|

|

|

|

|

Ningbo Mingxin Microelectronics Co., Ltd. |

2.22% |

|

|

|

|

|

Nihon Inter Cooperating Companies’ Shareholding Association |

1.17% |

|

|

|

|

|

Japan Securities Finance Co., Ltd. |

1.01% |

|

|

|

|

|

SBI Securities Co., ltd. |

0.72% |

|

|

|

|

|

Sumitomo Mitsui Banking Corporation |

0.51% |

|

|

|

|

|

Mr. Norio Bada |

0.30% |

|

|

|

|

|

|

|

|

(viii) |

|

Relationship between the Offeror and the Target |

|

|

|

|

|

|

|

|

|

|

|

Capital relationship |

|

There is no capital relationship between the Offeror and the Target. Also, there is no capital relationship between the related persons and related companies of the Offeror and the related persons and related companies of the Target. |

|

|

|

|

|

|

|

|

|

Personal relationship |

|

There is no personal relationship between the Offeror and the Target. Also, there is no personal relationship between the related persons and related companies of the Offeror and the related persons and related companies of the Target. |

|

|

|

|

|

|

|

|

|

Transaction relationship |

|

There is a transaction relationship where the Target group purchases products from the Offeror Group. |

|

|

|

|

|

|

|

|

|

Status of relationships with related parties |

|

The Target is not a related party of the Offeror. Also, the related persons and related companies of the Target are not related parties of the Offeror. |

Note: The shareholding ratios to the total outstanding shares are rounded to two decimal places.

(2) Schedule, etc.

(i) Schedule

|

Board of Directors’ resolution |

|

July 30, 2015 (Thursday) |

|

|

|

|

|

Date of public notice |

|

July 31, 2015 (Friday) Public notice will be made electronically via the Internet, and a notice to that effect will be published in the Nihon Keizai Shimbun. (URL of the electronic notice: http://disclosure.edinet-fsa.go.jp/) |

|

|

|

|

|

Date of filing of the Tender Offer Registration Statement |

|

July 31, 2015 (Friday) |

12

(ii) Tender Offer Period as of the date of filing of the Tender Offer Registration Statement

From July 31, 2015 (Friday) through August 28, 2015 (Friday) (21 Business Days)

(iii) Possibility of extension of the Tender Offer Period at the request of the Target

If the Target files a position statement describing the request to extend the period for the Tender Offer (the “Tender Offer Period”) pursuant to Article 27-10, Paragraph 3 of the Act, the Tender Offer Period shall be extended until September 10, 2015 (Thursday) (30 Business Days).

(3) Price of Tender Offer

197 yen per share of common stock

464 yen per Preferred Share

1 yen per Stock Acquisition Right No. 2

1 yen per Stock Acquisition Right No. 3

(4) Basis for calculation of price of Tender Offer

(i) Basis of calculation

(a) Common Shares

In determining the price of the Tender Offer, the Offeror requested Daiwa Securities, the Offeror’s financial advisor as a third-party appraiser that is independent of the Offeror and the Target, to perform a valuation of the Target Common Shares. Daiwa Securities is not a related party of the Offeror or the Target and does not have any material interest in the Tender Offer.

Daiwa Securities conducted a valuation of the shares of the Target based on each of a Market Share Price Analysis and a DCF Analysis, and the Offeror obtained the valuation report from Daiwa Securities today. The Offeror has not obtained an opinion on the fairness of the purchase price of the Target Common Shares (a fairness opinion) from Daiwa Securities.

The valuation per Target Common Share calculated in each of those analyses is as follows:

|

Market Share Price Analysis |

182 yen to 205 yen |

|

DCF Analysis |

137 yen to 268 yen |

With respect to the Market Share Price Analysis, the record date was set as July 29, 2015 and the valuation per Target Common Share was made based upon the closing price of the Target Common Share on the Second Section of the Tokyo Stock Exchange on the record date of 182 yen, as well as the simple average closing prices of the last one month, three months and six months immediately prior to the record date of 188 yen, 198 yen and 205 yen, respectively. Under the Market Share Price Analysis, the price range for the Target Common Share was derived to be 182 yen to 205 yen per share.

In the DCF Analysis, the free cash flow that the Target is expected to create based on the Target’s earnings prospect after the fiscal year ending March 2016 (which is revised to a certain extent), considering various factors including the Target’s business plan provided to the Offeror, recent earnings trends, management interview with the Target, was discounted to the present value using a certain discount rate, in order to analyze the Target’s corporate value and share value. Under the DCF Analysis, the price range for the Target Common Share was derived to be 137 yen to 268 yen per share. With respect to the business plans that are a basis for the DCF Analysis, no significant increase or decrease in earnings is expected in any business year.

13

In addition to the valuation results from each of the analyses in the valuation report obtained from Daiwa Securities, the Offeror made a comprehensive review of, among other factors, the results of the due diligence on the Target, the trend in the market price of the Target Common Shares in the most recent one–year period, whether or not the Target can express its opinion on the Tender Offer, and the number of shares expected to be tendered in the Tender Offer, and took into consideration the process of the discussions and negotiations with the Target and the Tendering Shareholders. As a result, the Offer Price for the Target Common Share was finally determined as of today to be 197 yen.

The purchase price for each Target Common Share of 197 yen is the closing price of 182 yen of a Target Common Share on the Second Section of the Tokyo Stock Exchange as of July 29, 2015, which is the business day immediately preceding the announcement date of the implementation of the Tender Offer, with a premium of 8.24%, or the simple average of 188 yen of the closing prices of the Target Common Share for the past one month from July 29, 2015, with a premium of 4.79%, or the simple average of 198 yen of the closing prices of the Target Common Share for the past three months from the same date, discounted by 0.51%, or the simple average of 205 yen of the closing prices of the Target Common Share for the past six months from the same date, discounted by 3.90%.

(b) Preferred Shares

The purchase price of the Preferred Shares (464 yen) is determined to be the number of the Target Common Shares to be acquired upon conversion of all of the Tendered Preferred Shares (21,461,524 shares) divided by the number of Tendered Preferred Shares (9,121,148 shares), assuming that the Preferred Shares to Common Shares Conversion Options, attached to all of the Tendered Preferred Shares, will be exercised, multiplied by the purchase price per Target Common Share, such that the purchase price of the Preferred Shares will be substantially equivalent to the purchase price per Target Common Share (rounded to the nearest yen).

Upon determining the tender offer price for the Preferred Shares in the Tender Offer, the Offeror did not obtain any validation from any third party appraiser.

For each period from July 1 to July 31 of each year after July 1, 2019 (a “Call Period”), to the extent permitted by laws and regulations, and up to the upper limit (Note 2) of the call value (Note 1), any holder of the Preferred Shares (a “Preferred Shareholder”) may call the Target to acquire all or part of the Preferred Shares owned by such Preferred Shareholder, in exchange for the delivery of money (“Call”; the date on which a Call becomes effective shall be referred to as a “Call Date”), and the Target shall deliver the money of call value to such shareholder in exchange for acquiring the Preferred Shares for which such Preferred Shareholder makes a Call. The Offer Price per Preferred Share in the Tender Offer of 464 yen is lower than such call value (500 yen).

Note 1: Call value:

The call value per Preferred Share is set as 500 yen.

Note 2: Upper limit of call value:

Any Preferred Shareholder may make a Call for any call value up to one half of net income recorded in the profit and loss statement for the last business year of the Call Date, minus the total of the following amounts:

(A) The total amount of dividends (“Preferred Dividends”) (Note 3) from any Preferred Shares for which any dividend of surplus is determined from (but excluding) the last day of the last business year of the Call Date to (but excluding) the commencement date of the Call Period.

(B) The total amount of money delivered in exchange for acquisition of the Preferred Shares acquired or determined subject to call in exchange for money from (but excluding) the last day of the last business year of the Call Date to (but excluding) the commencement date of the Call Period.

14

Note 3: Preferred Dividends:

If distributing any dividend of surplus for any business year on or after April 1, 2014, the Target shall pay 500 yen per Preferred Share, multiplied by the annual rate calculated by the formula stated in (A) below (“Preferred Dividend Annual Rate”) for each business year (calculated to two decimal places and rounded to one decimal place), to any Preferred Shareholder or any registered pledgee of the Preferred Shares (“Preferred Registered Pledgees of Shares”) in priority to any holders of the Target Common Shares and any registered pledgee of the Target Common Shares.

(A) Preferred Dividend Annual Rate

Japanese yen TIBOR (12 months) + 1.00%

In the formula above, “Japanese yen TIBOR (12 months)” means a value that is published by the Japanese Bankers Association as a Japanese yen 12-month Tokyo Interbank Offered Rate at 11:00 a.m. of the first day of each business year (or if such day is a bank holiday, the immediately preceding business day) (“Preferred Dividend Annual Rate Determination Reference Date”), or if no Japanese yen 12-month Tokyo Interbank Offered Rate is published on the Preferred Dividend Annual Rate Determination Reference Date, alternatively means a value that is published by The British Bankers’ Association as a Euro yen 12-month London Interbank Offered Rate at 11:00 a.m., London time, of the same day (or if such day is a bank holiday in London, the immediately preceding business day) or any value deemed to be similar thereto.

(B) Non-accumulation clause

If the amount of any dividends of surplus payable to any Preferred Shareholders or Preferred Registered Pledgees of Shares for any business year falls below the amount of the Preferred Dividends, the amount of such deficiency shall not be accumulated to the following business years.

(C) Non-participation clause

No dividend of surplus in excess of any Preferred Dividends shall be distributed to any Preferred Shareholders or Preferred Registered Pledgees of Shares.

(c) Stock Acquisition Rights

The Stock Acquisition Rights were issued as stock options for all directors (except for any outside directors) and executive officers of the Target. The exercise price of a Stock Acquisition Right is 1 yen per Target Common Share, and is less than the purchase price of a Target Common Share, and the exercise period for part of such Stock Acquisition Rights has already commenced. However, in order to exercise any Stock Acquisition Right, the holder of such Stock Acquisition Right shall be required to be at the position of director or executive officer of the Target or any of its subsidiaries in principle, and even if the Offeror purchases the Stock Acquisition Rights through the Tender Offer, the Offeror may not be able to exercise such Stock Acquisition Rights, and thus, the purchase price of a Stock Acquisition Right is determined to be 1 yen per Stock Acquisition Right.

Upon determining the tender offer price for the Stock Acquisition Rights in the Tender Offer, the Offeror did not obtain any validation from any third party appraiser.

(ii) Background of calculation

The Offeror commenced the due diligence on the Target in April 2015, and then, concurrently with such due diligence, explained to the Target the purposes of the Tender Offer, the advantages of making the Target a consolidated subsidiary of the Offeror and the opinions on the purchase price of the Target Common Shares, and continued discussions with the Target regarding specific synergies and measures to be taken after the Tender Offer, and as a result, the Offeror resolved to make the Tender Offer at the meeting of the board of directors of the Offeror as of today and determined the purchase price per Target Common Share by the following procedures.

For details of the specific measures considered in order to improve the corporate values of the Offeror and the Target, please see “(ii) Background to the determination to make the Tender Offer” of “(2) Background, purpose and decision-making process of the determination to make the Tender Offer” of “1. Purposes of Tender Offer” above.

15

i) Acquisition of valuation report from a third-party appraiser

In determining the purchase price per Target Common Share, the Offeror requested Daiwa Securities, the Offeror’s financial advisor as a third-party appraiser that is independent of the Offeror and the Target, to perform a valuation of the Target Common Shares. Daiwa Securities is not a related party of the Offeror or the Target and does not have any material interest in the Tender Offer. The Offeror has not obtained an opinion on the fairness of the purchase price of the Target Common Shares (a fairness opinion) from Daiwa Securities.

ii) Overview of the said opinion

Daiwa Securities conducted a valuation of the price per Target Common Share based on each of a Market Share Price Analysis and a DCF Analysis, and the results are as follows:

|

Market Share Price Analysis |

182 yen to 205 yen |

|

DCF Analysis |

137 yen to 268 yen |

iii) Background in determining the purchase price based on the said opinion

In addition to the valuation results from each of the analyses in the valuation report obtained from Daiwa Securities, the Offeror made a comprehensive review of, among other factors, the results of the due diligence on the Target, the trend in the market price of the Target Common Shares in the most recent one–year period, whether or not the Target can express its opinion on the Tender Offer, and the number of shares expected to be tendered in the Tender Offer, and took into consideration the process of the discussions and negotiations with the Tendering Shareholders. As a result, the Offeror determined as of today that the Offer Price per Target Common Share shall be 197 yen and the Offer Price per Preferred Share shall be 464 yen.

(iii) Relationship with the appraiser

Daiwa Securities, the Offeror’s financial advisor and appraiser, is not a related party of the Offeror and does not have any material interest in the Tender Offer.

(5) Number of shares to be purchased

|

Number of shares to be

purchased |

|

Minimum number of shares to be

purchased |

|

Maximum number of shares to

be purchased |

|

54,197,524 (shares) |

|

54,197,524 (shares) |

|

- (shares) |

Note 1: Considering that the Preferred Shares to Common Shares Conversion Options are attached to the Preferred Shares, the number of shares to be purchased is calculated by converting all of the Tendered Preferred Shares (9,121,148 shares) into the Target Common Shares (21,461,524 shares) pursuant to the terms and conditions of the Preferred Shares.

Note 2: If the total number of the Tendered Shares is less than the minimum number of shares to be purchased (54,197,524 shares), the Offeror will not purchase all of the Tendered Shares. If the total number of the Tendered Shares is equal to or more than the minimum number of shares to be purchased, the Offeror will purchase all of the Tendered Shares. Considering that the Preferred Shares to Common Shares Conversion Options are attached to the Preferred Shares, the total number of the Tendered Shares is calculated by converting all of the Preferred Shares tendered into the Target Common Shares pursuant to the terms and conditions of the Tendered Preferred Shares upon determining whether the minimum number of shares to be purchased is reached or not.

Note 3: Shares constituting less than one unit are also subject to the Tender Offer. The Target may purchase its own shares in accordance with legal procedures during the Tender Offer Period from any shareholder who exercises the right under the Companies Act (Act No. 86 of 2005, as amended) to require the Target to purchase its shares constituting less than a whole unit.

16

Note 4: The Offeror does not intend to acquire the treasury shares owned by the Target through the Tender Offer.

Note 5: The maximum number of shares in the Target to be acquired by the Offeror through the Tender Offer is the total number of issued Target Common Shares as of March 31, 2015 as stated in the Target’s 64th Term Annual Securities Report, filed by the Target on June 29, 2015 (65,500,686 shares), minus the treasury shares of Target Common Shares held by the Target as of the same date (927 shares) (resulting number of shares: 65,499,759 shares), plus the number of shares converted from all of the Preferred Shares into Target Common Shares pursuant to the terms and conditions of the Preferred Shares (22,370,232 shares) in consideration of the Preferred Shares to Common Shares Conversion Options of the number of the Preferred Shares as of the same date (9,507,349 shares) and the number of the Target Common Shares (942,800 shares) subject to the Stock Acquisition Rights as of July 15, 2015 (9,428 options) (the resulting number of shares as converted into Target Common Shares is 88,812,791 shares in total).

Note 6: The Stock Acquisition Rights may be exercised by any option holder before the last day of the Tender Offer Period. The Common Shares delivered upon such exercise shall also be subject to the Tender Offer.

(6) Changes to proportion of ownership of shares through Tender Offer

|

Number of voting rights represented by shares held by the Offeror before tender offer |

|

0 |

|

(Percentage of ownership of shares before tender offer: 0%) |

|

Number of voting rights represented by the shares held by special related parties before tender offer |

|

0 |

|

(Percentage of ownership of shares before tender offer: 0%) |

|

Number of voting rights represented by shares held by the Offeror after tender offer |

|

541,975 |

|

(Percentage of ownership of shares after tender offer: 61.02%) |

|

Number of voting rights represented by the shares held by special related parties after tender offer |

|

0 |

|

(Percentage of ownership of shares after tender offer: 0%) |

|

Total number of voting rights of the shareholders, etc. of the Target |

|

654,833 |

|

|

Note 1: “Number of voting rights represented by the shares held by special related parties before tender offer” is the total number of voting rights represented by shares held by respective special related parties (except for any special related party that is excluded from the category of special related party pursuant to Article 3, Paragraph 2, Item 1 of the Cabinet Ordinance with respect to Disclosure of a Tender Offer for Share Certificates, etc. by an Offeror other than the Issuing Company (Ministry of Finance Ordinance No. 38 of 1990, as amended; the “Cabinet Ordinance”) for the purpose of calculation of the ownership ratio under each Item of Article 27-2, Paragraph 1 of the Act.

Note 2: “Number of voting rights represented by shares held by the Offeror after tender offer” is the number of voting rights (541,975) represented by the number of shares to be purchased in the Tender Offer (54,197,524 shares).

Note 3: “Total number of voting rights of the shareholders, etc. of the Target” is the total number of voting rights of all shareholders of the Target as of March 31, 2015 indicated in the Target’s 64th Term Annual Securities Report filed on June 29, 2015. However, because the shares constituting less than one unit, the Preferred Shares and the Stock Acquisition Rights are also subject to the Tender Offer, the calculation of “Percentage of ownership of shares before tender offer” and “Percentage of ownership of shares after tender offer” has used as the denominator the number of voting rights (888,127) attached to the total number of issued Target Common Shares as of March 31, 2015 as stated in the Target’s 64th Term Annual Securities Report, filed by the Target on June 29, 2015 (65,500,686 shares), minus the treasury shares of Target Common Shares held by the Target as of the same date (927 shares) (resulting number of shares: 65,499,759 shares), plus the number of shares converted from all of the Preferred Shares into Target Common Shares pursuant to the terms and conditions of the Preferred Shares (22,370,232 shares) in consideration of the Preferred Shares to Common Shares Conversion Options of the number of the Preferred Shares as of the same date (9,507,349 shares) and the number of the Target Common Shares (942,800 shares) subject to the Stock Acquisition Rights as of July 15, 2015 (9,428 options) (the resulting number of shares as converted into Target Common Shares is 88,812,791 shares in total).

17

Note 4: “Percentage of ownership of shares before tender offer” and “Percentage of ownership of shares after tender offer” are rounded to second decimal place.

(7) Purchase price 10,676,912,228 yen

Note: Purchase price is an amount calculated by multiplying the number of shares to be purchased in the Tender Offer (54,197,524 shares) by the Offer Price per Target Common Share (197 yen).

(8) Method of Settlement

(i) Name and address of head office of securities companies, banks etc. in charge of settlement of purchase

Daiwa Securities Co., Ltd. 1-9-1, Marunouchi, Chiyoda-ku, Tokyo

(ii) Commencement date of settlement

September 4, 2015 (Friday)

Note: If the Target files a position statement describing the request to extend the Tender Offer Period pursuant to Article 27-10, Paragraph 3 of the Act, the commencement date of settlement will be September 17, 2015 (Thursday).

(iii) Method of settlement

A notice of purchase under the Tender Offer will be mailed to the address of the Tendering Shareholders (in the case of Foreign Shareholders, to the address of their standing agents) without delay after the expiration of the Tender Offer Period.

The purchase will be conducted in cash. The Tender Offer Agent will remit the sales proceeds for the purchased shares to the place designated by the Tendering Shareholders (in the case of foreign shareholders, to their standing agents) (in which case the Tendering Shareholders may be subject to remittance fees) or pay such sales proceeds to such accounts of the Tendering Shareholders as accepted by the Tender Offer Agent, in accordance with the Tendering Shareholders’ directions, without delay after the commencement date of settlement.

(iv) Method of return of shares

In the event that all of the shares will not be purchased under the terms detailed in “(i) Conditions set forth in Article 27-13, Paragraph 4 of the Act and the details thereof” and “(ii) Conditions for withdrawal of the Tender Offer, details thereof and method of disclosure for withdrawal” in the section titled “(9) Other Conditions and Methods of Tender Offer” below, the Tender Offer Agent will, without delay from the second Business Day following the last day of the Tender Offer Period (or the date of withdrawal of the Tender Offer if the Offeror withdraws the Tender Offer), return the shares that must be returned by reverting the record of shares to the original entry in the Tendering Shareholders Accounts opened with the Tender Offer Agent at the time of the tender.

Also, with respect to the Preferred Shares and the Stock Acquisition Rights, the documents submitted upon the tender will be mailed or delivered to the Tendering Shareholders (or if any shareholder of the Preferred Shares or any Stock Acquisition Right holder is a foreign resident, his/her standing agent).

18

(9) Other Conditions and Methods of Tender Offer

(i) Conditions set forth in Article 27-13, Paragraph 4 of the Act and the details thereof

If the total number of the Tendered Shares is less than the minimum number of shares to be purchased (54,197,524 shares), the Offeror will not purchase all of the Tendered Shares. If the total number of the Tendered Shares is equal to or more than the minimum number of shares to be purchased (54,197,524 shares), the Offeror will purchase all of the Tendered Shares. Since the Preferred Shares to Common Shares Conversion Options are attached to the Preferred Shares, the total number of the Tendered Shares is calculated by converting all of the Preferred Shares tendered into the Target Common Shares pursuant to the terms and conditions of the Preferred Shares upon determining whether the minimum number of shares to be purchased is reached or not.

(ii) Conditions for withdrawal of the Tender Offer, details thereof and method of disclosure for withdrawal

If any event listed in Article 14, Paragraph 1, Items 1 i through ri and Items wo through so, Item 2, Items 3 i through chi and nu as well as Article 14, Paragraph 2, Items 3 through 6 of the Financial Instruments and Exchange Act Enforcement Order (Cabinet Order No. 321 of 1965, as amended) (the “Enforcement Order”) occurs, the Offeror may withdraw the Tender Offer. Also, in the Tender Offer, the “facts equivalent to those listed in Article 14, Paragraph 1, Items 3 i through ri” as referred to in Article 14, Paragraph 1, Item 3 nu of the Enforcement Order means the case where any of the statutory disclosure documents filed by the Target in the past is found to have included any false statement regarding any material matter or lacked a statement about any material matter that should have been included therein.

If the Offeror intends to withdraw the Tender Offer, the Offeror will give an electronic public notice and publish a notice thereof in The Nihon Keizai Shimbun. However, if it is deemed difficult to give the public notice by the last day of the Tender Offer Period, the Offeror will make a public announcement by the method set out in Article 20 of the Cabinet Ordinance and give public notice immediately after the announcement.

(iii) Conditions of reduction of purchase price and method of disclosure of the reduction