UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign

Private Issuer

Pursuant to Rule

13a-16 or 15d-16

of the Securities

Exchange Act of 1934

For the Month of

July 2015

Commission file number

0-30070

AUDIOCODES LTD.

(Translation of registrant’s

name into English)

1 Hayarden Street

• Airport City, Lod 7019900 • ISRAEL

(Address of principal

executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Note: Regulation S-T Rule 101(b)(1)

only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Note: Regulation S-T Rule 101(b)(7)

only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant

foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on

which the registrant's securities are traded, as long as the report or other document is not a press release, is not required

to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been

the subject of a Form 6-K submission or other Commission filing on EDGAR.

On July 28, 2015,

AudioCodes Ltd. (the “Registrant”) issued a press release announcing financial results for the second quarter of 2015

and other matters. A copy of this press release is attached hereto as Exhibit 1.

The following document

is attached hereto and incorporated by reference herein:

Exhibit 1. Press

release, dated July 28, 2015, announcing financial results for the second quarter of 2015 and other matters.

The information set

forth in (a) the first, second and fifth paragraphs following the list captioned “Second Quarter Highlights,” the

first paragraph following the caption “Share Buy Back Program” of, and (b) the condensed consolidated balance sheets,

condensed consolidated statements of operations and condensed consolidated statement of cash flows contained in, the press release

attached as Exhibit 1 to this Report on Form 6-K are hereby incorporated by reference into (i) the Registrant’s Registration

Statement on Form S-8, File No. 333-11894; (ii) the Registrant’s Registration Statement on Form S-8, File No. 333-13268;

(iii) the Registrant’s Registration Statement on Form S-8, File No. 333-105473; (iv) the Registrant’s Registration

Statement on Form S-8, File No. 333-144825; (v) the Registrant’s Registration Statement on Form S-8, File No. 333-160330;

(vi) the Registrant’s Registration Statement on Form S-8, File No. 333-170676; (vii) the Registrant’s Registration

Statement on Form S-8, File No. 333-190437; and (viii) the Registrant’s Registration Statement on Form F-3, File No. 333-193209.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

AUDIOCODES LTD. |

| |

(Registrant) |

| |

By: |

/s/ NIRAN

BARUCH |

| |

|

Niran Baruch |

| |

|

Vice President Finance and |

| |

|

Chief Accounting Officer |

Dated: July 28, 2015

EXHIBIT INDEX

| Exhibit No. |

|

Description |

| 1 |

|

Press release, dated July 28, 2015, announcing financial results for the second quarter of 2015

and other matters. |

Exhibit 1

| Company

Contacts |

|

|

|

IR

Agency Contact |

Niran Baruch,

VP Finance & Chief Accounting Officer

AudioCodes

Tel: +972-3-976-4000

Niran.baruch@audiocodes.com |

|

Shirley Nakar,

Director, Investor Relations

AudioCodes

Tel: +972-3-976-4000

shirley@audiocodes.com |

|

Philip Carlson/Collin Dennis

KCSA Strategic

Communications

Tel: +1-212-896-1233

audc@kcsa.com |

AudioCodes Reports

Second Quarter 2015 Results

Lod, Israel –

July 28, 2015 - AudioCodes (NasdaqGS: AUDC), a leading provider of converged voice solutions, which enables enterprises

and service providers to transition to all-IP voice networks, today announced financial results for the second quarter ended June

30, 2015.

Second Quarter Highlights:

| · | Quarterly

revenues decreased 13.7% year-over-year to $32.4 million; |

| · | Service

revenues increased 13.7% year-over-year to $9.3 million from $8.2 million; |

| · | Quarterly

Non-GAAP gross margin was 59.9%, compared to 60.0% in the prior year period; |

| · | Quarterly

Non-GAAP operating expenses decreased 4.2% year-over-year to $20.2 million; |

| · | Quarterly

cash flow from operating activities remained positive at $3.4 million; |

| · | Quarterly

Non-GAAP net loss was $537,000, or ($0.01) per diluted share, compared to net income

of $1.6 million, or $0.04 per diluted share, in the prior year period; |

| · | AudioCodes

repurchased 1,449,000 of its ordinary shares at an aggregate cost of $6.1 million during

the quarter. |

Revenues for the second quarter of 2015

were $32.4 million, compared to $37.6 million for the second quarter of 2014.

Net loss was $1.9 million, or ($0.05)

per diluted share, for the second quarter of 2015, compared to a net loss of $46,000, or ($0.00) per diluted share, for the second

quarter of 2014.

| AudioCodes Reports Second Quarter 2015 Results | Page 1 of 10 |

On a Non-GAAP basis, the Company reported

a quarterly net loss of $537,000, or ($0.01) per diluted share, compared to net income of $1.6 million, or $0.04 per diluted share,

in the second quarter last year.

Non-GAAP net income (loss) excludes: (i)

stock-based compensation expenses; (ii) amortization expenses related to intangible assets; and (iii) non-cash deferred tax benefit

or expenses. A reconciliation of net income (loss) on a GAAP basis to a non-GAAP basis is provided in the tables that accompany

the condensed consolidated financial statements contained in this press release.

Net cash provided by operating activities

for the second quarter of 2015 totaled $3.4 million. Cash and cash equivalents, bank deposits and marketable securities were $78.6

million as of June 30, 2015 compared to $91.8 million as of June 30, 2014. The decrease in cash and cash equivalents, bank deposits

and marketable securities was the result of the use of cash to repurchase the Company’s ordinary shares pursuant to its

share repurchase program.

"We are disappointed with the financial

results for the second quarter of 2015, more so in view of our growing business activity and the progress made in the second quarter

in the unified communications and the business services market segments. As pre-announced on June 9th, AudioCodes’ second

quarter results reflect weakness in our business in Central and Latin America and certain markets in Europe. In addition, we experienced

larger than expected weakness in the contact center market, and lower gateway revenues in the areas of low and mid capacity and

legacy residential gateways," said Shabtai Adlersberg, President and Chief Executive Officer of AudioCodes. “On a more

positive note, we saw encouraging developments in our Microsoft Lync business and in our service provider activity, reflected

in increased success in sales of CPE products into the hosted PBX market and projects related to the All-IP transformation trend.

In order to compensate for the decline in revenues, we have initiated a cost reduction plan. The plan is expected to generate

an estimated annualized savings of 5% to 10% of the Company’s operating expenses and be implemented over the next six to

twelve months. We expect the initial steps already taken to reduce our operating expenses by approximately 5% below the level

of expenses in the first quarter as early as the fourth quarter of this year. In addition, we have started a full review of our

business line activities in order to support our plan to return to profitability and growth in the second half of 2015 and beyond,”

Mr. Adlersberg added.

| AudioCodes Reports Second Quarter 2015 Results | Page 2 of 10 |

“Our Skype for Business One Voice

Solution, and the One Box 365 solution continue to gain market traction. We see great potential, and saw good progress with our

service provider activity, mainly as a result of targeting our efforts towards the global trend of migrating public telephony

and voice services into All-IP networks. In this space, we made progress towards winning two large multi-year projects with leading

tier-1 service providers. Additionally, we continued to focus our efforts on developing and selling more complete end-to-end solutions

and software products to end customers, which we believe will support further growth in coming years. As we continue to adapt

and align our offering towards industry trends such as NFV and SDN, as well as the migration to hybrid and pure Cloud environments,

we are confident in our ability to weather challenging market conditions and drive growth and success in the future,” concluded

Mr. Adlersberg.

Share Buy Back Program

In August 2014, AudioCodes announced that

its Board of Directors had approved a program to repurchase up to $3.0 million of its Ordinary Shares. In November 2014, AudioCodes

received court approval to repurchase up to an additional $15.0 million of its Ordinary Shares and in May 2015 the court approved

an additional $15.0 million in share repurchases. During the quarter ended June 30, 2015, AudioCodes acquired 1,449,000 shares

under this program for a total consideration of approximately $6.1 million. As of June 30, 2015, AudioCodes had acquired an aggregate

of 3,537,000 shares under this program for an aggregate consideration of approximately $16.6 million.

2015 Full Year Outlook update

AudioCodes is updating its full year guidance.

The Company’s outlook is based on current indications for its business, which are subject to change.

We now expect revenues for 2015 to be

in the range of $137 million to $143 million compared with the prior forecast of a range of $158 million to $162 million. We are

now forecasting non-GAAP net income per diluted share to be in the range of $0.09 to $0.12 compared with the prior forecast of

$0.24 to $0.28.

AudioCodes management believes that Non-GAAP

financial guidance provides the best comparative basis for investors to understand the Company’s on-going operations and

prospects for the future. Non-GAAP net income per diluted share should be evaluated in light of the Company’s financial

results prepared in accordance with U.S. GAAP.

| AudioCodes Reports Second Quarter 2015 Results | Page 3 of 10 |

Conference Call & Web Cast Information

AudioCodes will conduct a conference call

at 8:00 A.M., Eastern Time today to discuss the Company’s second quarter operating performance, financial results and outlook.

Interested parties may participate in the conference call by dialing one the following numbers:

United States Participants: +1 (877) 407-0778

International Participants: +1 (201) 689-8565

The conference call will also be simultaneously

webcast. Investors are invited to listen to the call live via webcast at the AudioCodes investor website at http://www.audiocodes.com/investors-lobby.

About AudioCodes

AudioCodes Ltd. (NasdaqGS, TASE: AUDC)

designs, develops and sells advanced Voice-over-IP (VoIP) and converged VoIP and Data networking products and applications to

Service Providers and Enterprises. AudioCodes is a VoIP technology market leader, focused on converged VoIP and data communications,

and its products are deployed globally in Broadband, Mobile, Enterprise networks and Cable. The Company provides a range of innovative,

cost-effective products including Media Gateways, Multi-Service Business Routers, Session Border Controllers (SBC), Residential

Gateways, IP Phones, Media Servers, Value Added Applications and Professional Services. AudioCodes’ underlying technology,

VoIPerfectHD™, relies on AudioCodes’ leadership in DSP, voice coding and voice processing technologies. AudioCodes’

High Definition (HD) VoIP technologies and products provide enhanced intelligibility and a better end user communication experience

in Voice communications. For more information on AudioCodes, visit http://www.audiocodes.com.

To download the AudioCodes investor relations

app, which offers access to its SEC filings, press releases, videos, audiocasts and more, please visit Apple's App Store

for the iPhone and iPad or Google Play for Android mobile devices.

Statements concerning AudioCodes' business

outlook or future economic performance; product introductions and plans and objectives related thereto; and statements concerning

assumptions made or expectations as to any future events, conditions, performance or other matters, are "forward-looking

statements'' as that term is defined under U.S. Federal securities laws. Forward-looking statements are subject to various risks,

uncertainties and other factors that could cause actual results to differ materially from those stated in such statements. These

risks, uncertainties and factors include, but are not limited to: the effect of global economic conditions in general and conditions

in AudioCodes' industry and target markets in particular; shifts in supply and demand; market acceptance of new products and the

demand for existing products; the impact of competitive products and pricing on AudioCodes' and its customers' products and markets;

timely product and technology development, upgrades and the ability to manage changes in market conditions as needed; possible

need for additional financing; the ability to satisfy covenants in the Company’s loan agreements; possible disruptions from

acquisitions; the ability of AudioCodes to successfully integrate the products and operations of acquired companies into AudioCodes’

business; and other factors detailed in AudioCodes' filings with the U.S. Securities and Exchange Commission. AudioCodes assumes

no obligation to update the information in this release.

©2015 AudioCodes Ltd. All rights

reserved. AudioCodes, AC, HD VoIP, HD VoIP Sounds Better, IPmedia, Mediant, MediaPack, What’s Inside Matters, OSN, SmartTAP,

VMAS, VoIPerfect, VoIPerfectHD, Your Gateway To VoIP, 3GX, VocaNom and One Box 365 are trademarks or registered trademarks of

AudioCodes Limited All other products or trademarks are property of their respective owners. Product specifications are subject

to change without notice.

Summary

financial data follows

| AudioCodes Reports Second Quarter 2015 Results | Page 4 of 10 |

| AUDIOCODES LTD. AND ITS

SUBSIDIARIES |

| CONDENSED

CONSOLIDATED BALANCE SHEETS |

| U.S. dollars in thousands |

| | |

June 30, | | |

December 31, | |

| | |

2015 | | |

2014 | |

| | |

(Unaudited) | | |

(Audited) | |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT ASSETS: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 15,307 | | |

$ | 14,797 | |

| Short-term and restricted bank deposits | |

| 4,361 | | |

| 7,630 | |

| Short-term marketable securities and accrued interest | |

| 4,100 | | |

| 543 | |

| Trade receivables, net | |

| 28,059 | | |

| 31,056 | |

| Other receivables and prepaid expenses | |

| 8,279 | | |

| 9,564 | |

| Inventories | |

| 15,132 | | |

| 14,736 | |

| Total current assets | |

| 75,238 | | |

| 78,326 | |

| | |

| | | |

| | |

| LONG-TERM ASSETS: | |

| | | |

| | |

| Long-term and restricted bank deposits | |

| 2,733 | | |

| 4,066 | |

| Long-term marketable securities | |

| 52,107 | | |

| 58,684 | |

| Deferred tax assets | |

| - | | |

| 872 | |

| Severance pay funds | |

| 18,579 | | |

| 17,835 | |

| Total long-term assets | |

| 73,419 | | |

| 81,457 | |

| | |

| | | |

| | |

| PROPERTY AND EQUIPMENT, NET | |

| 4,226 | | |

| 3,856 | |

| | |

| | | |

| | |

| GOODWILL, INTANGIBLE ASSETS AND OTHER, NET | |

| 36,080 | | |

| 36,745 | |

| | |

| | | |

| | |

| Total assets | |

$ | 188,963 | | |

$ | 200,384 | |

| | |

| | | |

| | |

| LIABILITIES AND

EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Current maturities of long-term bank loans | |

$ | 4,686 | | |

$ | 4,686 | |

| Trade payables | |

| 6,442 | | |

| 10,111 | |

| | |

| | | |

| | |

| Other payables and accrued expenses | |

| 16,401 | | |

| 15,758 | |

| Deferred revenues | |

| 12,166 | | |

| 10,233 | |

| Total current liabilities | |

| 39,695 | | |

| 40,788 | |

| | |

| | | |

| | |

| LONG-TERM LIABILITIES: | |

| | | |

| | |

| Accrued severance pay | |

| 18,731 | | |

| 17,908 | |

| Long-term bank loans | |

| 2,763 | | |

| 5,105 | |

| Deferred revenues and other liabilities | |

| 3,896 | | |

| 2,862 | |

| Total long-term liabilities | |

| 25,390 | | |

| 25,875 | |

| | |

| | | |

| | |

| Total equity | |

| 123,878 | | |

| 133,721 | |

| | |

| | | |

| | |

| Total liabilities and equity | |

$ | 188,963 | | |

$ | 200,384 | |

| AudioCodes Reports Second Quarter 2015 Results | Page 5 of 10 |

| AUDIOCODES LTD. AND ITS

SUBSIDIARIES |

| CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS |

| U.S. dollars in thousands, except per

share data |

| | |

Six months ended | | |

Three months ended | |

| | |

June

30, | | |

June

30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| Revenues: | |

| | | |

| | | |

| | | |

| | |

| Products | |

$ | 51,673 | | |

$ | 57,917 | | |

$ | 23,089 | | |

$ | 29,369 | |

| Services | |

| 18,212 | | |

| 15,600 | | |

| 9,316 | | |

| 8,197 | |

| Total Revenues | |

| 69,885 | | |

| 73,517 | | |

| 32,405 | | |

| 37,566 | |

| Cost of revenues: | |

| | | |

| | | |

| | | |

| | |

| Products | |

| 23,821 | | |

| 26,193 | | |

| 10,678 | | |

| 13,276 | |

| Services | |

| 4,823 | | |

| 3,961 | | |

| 2,577 | | |

| 2,036 | |

| Total Cost of revenues | |

| 28,644 | | |

| 30,154 | | |

| 13,255 | | |

| 15,312 | |

| Gross profit | |

| 41,241 | | |

| 43,363 | | |

| 19,150 | | |

| 22,254 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development, net | |

| 14,676 | | |

| 16,228 | | |

| 7,097 | | |

| 8,416 | |

| Selling and marketing | |

| 22,637 | | |

| 22,895 | | |

| 11,340 | | |

| 11,669 | |

| General and administrative | |

| 4,655 | | |

| 3,716 | | |

| 2,493 | | |

| 1,802 | |

| Total operating expenses | |

| 41,968 | | |

| 42,839 | | |

| 20,930 | | |

| 21,887 | |

| Operating income (loss) | |

| (727 | ) | |

| 524 | | |

| (1,780 | ) | |

| 367 | |

| Financial income, net | |

| 606 | | |

| 102 | | |

| 541 | | |

| 15 | |

| Income (loss) before taxes on income | |

| (121 | ) | |

| 626 | | |

| (1,239 | ) | |

| 382 | |

| Taxes on income, net | |

| (2,179 | ) | |

| (950 | ) | |

| (683 | ) | |

| (428 | ) |

| Net loss | |

$ | (2,300 | ) | |

$ | (324 | ) | |

$ | (1,922 | ) | |

$ | (46 | ) |

| Basic net loss per share | |

$ | (0.06 | ) | |

$ | (0.01 | ) | |

$ | (0.05 | ) | |

$ | (0.00 | ) |

| Diluted net loss per share | |

$ | (0.06 | ) | |

$ | (0.01 | ) | |

$ | (0.05 | ) | |

$ | (0.00 | ) |

| Weighted average number of shares used in computing basic net loss per

share (in thousands) | |

| 41,391 | | |

| 41,600 | | |

| 40,813 | | |

| 43,230 | |

| Weighted average number of shares used in computing diluted net earnings

loss per share (in thousands) | |

| 41,391 | | |

| 41,600 | | |

| 40,813 | | |

| 43,230 | |

| AudioCodes Reports Second Quarter 2015 Results | Page 6 of 10 |

| AUDIOCODES LTD. AND ITS

SUBSIDIARIES |

| NON-GAAP

PROFORMA STATEMENTS OF OPERATIONS |

| U.S. dollars in thousands, except per

share data |

| | |

Six months ended | | |

Three months ended | |

| | |

June

30, | | |

June

30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| Revenues: | |

| | | |

| | | |

| | | |

| | |

| Products | |

$ | 51,673 | | |

$ | 57,917 | | |

$ | 23,089 | | |

$ | 29,369 | |

| Services | |

| 18,212 | | |

| 15,600 | | |

| 9,316 | | |

| 8,197 | |

| Total Revenues | |

| 69,885 | | |

| 73,517 | | |

| 32,405 | | |

| 37,566 | |

| Cost of revenues: | |

| | | |

| | | |

| | | |

| | |

| Products | |

| 23,422 | | |

| 25,762 | | |

| 10,484 | | |

| 13,063 | |

| Services | |

| 4,677 | | |

| 3,845 | | |

| 2,497 | | |

| 1,976 | |

| Total Cost of revenues (1) (2) | |

| 28,099 | | |

| 29,607 | | |

| 12,981 | | |

| 15,039 | |

| Gross profit | |

| 41,786 | | |

| 43,910 | | |

| 19,424 | | |

| 22,527 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development, net (1) | |

| 14,438 | | |

| 15,922 | | |

| 6,980 | | |

| 8,253 | |

| Selling and marketing (1) (2) | |

| 21,906 | | |

| 22,167 | | |

| 10,992 | | |

| 11,278 | |

| General and administrative (1) | |

| 4,203 | | |

| 3,303 | | |

| 2,266 | | |

| 1,595 | |

| Total operating expenses | |

| 40,547 | | |

| 41,392 | | |

| 20,238 | | |

| 21,126 | |

| Operating income (loss) | |

| 1,239 | | |

| 2,518 | | |

| (814 | ) | |

| 1,401 | |

| Financial income, net | |

| 606 | | |

| 102 | | |

| 541 | | |

| 15 | |

| Income (loss) before taxes on income | |

| 1,845 | | |

| 2,620 | | |

| (273 | ) | |

| 1,416 | |

| Taxes on income, net (3) | |

| (432 | ) | |

| 11 | | |

| (264 | ) | |

| 153 | |

| Net income (loss) | |

$ | 1,413 | | |

$ | 2,631 | | |

$ | (537 | ) | |

$ | 1,569 | |

| Diluted net earnings (loss) per share | |

$ | 0.03 | | |

$ | 0.06 | | |

$ | (0.01 | ) | |

$ | 0.04 | |

| Weighted average number of shares used in computing basic net earnings

(loss) per share (in thousands) | |

| 42,172 | | |

| 43,175 | | |

| 41,453 | | |

| 44,616 | |

| (1) | Excluding stock-based compensation expenses

related to options and restricted stock units granted to employees and others. |

| (2) | Excluding amortization of intangible

assets related to the acquisitions of Nuera, Netrake and Mailvision assets. |

| (3) | Excluding non-cash deferred tax expenses. |

Note: Non-GAAP measures should be

considered in addition to, and not as a substitute for, the results prepared in accordance with GAAP. The Company believes that

non-GAAP information is useful because it can enhance the understanding of its ongoing economic performance and therefore uses

internally this non-GAAP information to evaluate and manage its operations. The Company has chosen to provide this information

to investors to enable them to perform comparisons of operating results in a manner similar to how the Company analyzes its operating

results and because many comparable companies report this type of information.

| AudioCodes Reports Second Quarter 2015 Results | Page 7 of 10 |

| AUDIOCODES LTD. AND ITS

SUBSIDIARIES |

| RECONCILIATION

OF GAAP NET LOSS TO NON-GAAP NET INCOME (LOSS) |

| U.S. dollars in thousands, except per

share data |

| | |

Six months ended | | |

Three months ended | |

| | |

June

30, | | |

June

30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| GAAP net loss | |

$ | (2,300 | ) | |

$ | (324 | ) | |

$ | (1,922 | ) | |

$ | (46 | ) |

| GAAP net loss per share | |

$ | (0.06 | ) | |

$ | (0.01 | ) | |

$ | (0.05 | ) | |

$ | (0.00 | ) |

| Cost of revenues: | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation (1) | |

| 49 | | |

| 51 | | |

| 26 | | |

| 25 | |

| Amortization expenses (2) | |

| 496 | | |

| 496 | | |

| 248 | | |

| 248 | |

| | |

| 545 | | |

| 547 | | |

| 274 | | |

| 273 | |

| Research and development, net: | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation (1) | |

| 238 | | |

| 306 | | |

| 117 | | |

| 163 | |

| Selling and marketing: | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation (1) | |

| 568 | | |

| 546 | | |

| 276 | | |

| 300 | |

| Amortization expenses (2) | |

| 163 | | |

| 182 | | |

| 72 | | |

| 91 | |

| | |

| 731 | | |

| 728 | | |

| 348 | | |

| 391 | |

| General and administrative: | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation (1) | |

| 452 | | |

| 413 | | |

| 227 | | |

| 207 | |

| Income taxes: | |

| | | |

| | | |

| | | |

| | |

| Deferred tax (3) | |

| 1,328 | | |

| 961 | | |

| 419 | | |

| 581 | |

| Non-GAAP net income (loss) | |

$ | 994 | | |

$ | 2,631 | | |

$ | (537 | ) | |

$ | 1,569 | |

| Non-GAAP diluted net earnings (loss) per share | |

$ | 0.03 | | |

$ | 0.06 | | |

$ | (0.01 | ) | |

$ | 0.04 | |

| | |

| | | |

| | | |

| | | |

| | |

| (1) | Stock-based compensation expenses related

to options and restricted stock units granted to employees and others. |

| (2) | Amortization of intangible assets related

to the acquisitions of Nuera, Netrake and Mailvision assets. |

| (3) | Non-cash deferred tax expenses. |

Note: Non-GAAP measures should be

considered in addition to, and not as a substitute for, the results prepared in accordance with GAAP. The Company believes that

non-GAAP information is useful because it can enhance the understanding of its ongoing economic performance and therefore uses

internally this non-GAAP information to evaluate and manage its operations. The Company has chosen to provide this information

to investors to enable them to perform comparisons of operating results in a manner similar to how the Company analyzes its operating

results and because many comparable companies report this type of information.

| AudioCodes Reports Second Quarter 2015 Results | Page 8 of 10 |

| AUDIOCODES LTD. AND ITS

SUBSIDIARIES |

| CONDENSED

CONSOLIDATED STATEMENT OF CASH FLOWS |

| U.S. dollars in thousands |

| | |

Six months ended | | |

Three months ended

| |

| | |

June

30, | | |

June

30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| | |

(

Unaudited) | | |

(

Unaudited) | |

| Cash flows from operating

activities: | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (2,300 | ) | |

$ | (324 | ) | |

$ | (1,922 | ) | |

$ | (46 | ) |

| Adjustments required to reconcile net income or loss

to net cash provided by or used in operating activities: | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

| 1,627 | | |

| 1,629 | | |

| 803 | | |

| 773 | |

| Amortization of marketable securities premiums and

accretion of discounts, net | |

| 552 | | |

| 195 | | |

| 239 | | |

| 156 | |

| Increase (decrease) in accrued severance pay, net | |

| 79 | | |

| (186 | ) | |

| (82 | ) | |

| 26 | |

| Stock-based compensation expenses | |

| 1,307 | | |

| 1,316 | | |

| 646 | | |

| 695 | |

| Decrease in long-term deferred tax assets, net | |

| 872 | | |

| 967 | | |

| 253 | | |

| 496 | |

| Amortization of senior convertible notes discount and

deferred charges | |

| - | | |

| (15 | ) | |

| - | | |

| - | |

| Decrease (increase) in accrued interest on marketable

securities, bank deposits and structured notes | |

| 29 | | |

| 174 | | |

| 177 | | |

| (4 | ) |

| Decrease (increase) in trade receivables, net | |

| 2,997 | | |

| (4,363 | ) | |

| 2,853 | | |

| (3,751 | ) |

| Decrease (increase) in other receivables and

prepaid expenses | |

| 2,810 | | |

| (2,370 | ) | |

| 2,519 | | |

| (231 | ) |

| Increase in inventories | |

| (396 | ) | |

| (234 | ) | |

| (528 | ) | |

| (277 | ) |

| Increase (decrease) in trade payables | |

| (3,669 | ) | |

| 546 | | |

| (1,145 | ) | |

| (1,515 | ) |

| Increase (decrease) in deferred revenues | |

| 3,212 | | |

| 3,273 | | |

| (1,010 | ) | |

| 17 | |

| Increase in other payables and

accrued expenses | |

| 950 | | |

| 953 | | |

| 554 | | |

| 3,275 | |

| Net cash provided by (used in)

operating activities | |

| 8,070 | | |

| 1,561 | | |

| 3,357 | | |

| (386 | ) |

| Cash flows from investing

activities: | |

| | | |

| | | |

| | | |

| | |

| Purchase of marketable securities | |

| - | | |

| (60,170 | ) | |

| - | | |

| (60,170 | ) |

| Decrease (increase) in short-term deposits, net | |

| 3,269 | | |

| 1,000 | | |

| (7 | ) | |

| - | |

| Proceeds from redemption of long-term bank deposits | |

| 1,365 | | |

| 1,381 | | |

| 850 | | |

| 851 | |

| Proceeds from redemption of marketable securities upon

maturity | |

| 2,711 | | |

| 15,390 | | |

| 2,711 | | |

| 4,000 | |

| Purchase of property and equipment | |

| (1,332 | ) | |

| (719 | ) | |

| (490 | ) | |

| (308 | ) |

| Net cash provided by (used in)

investing activities | |

| 6,013 | | |

| (43,118 | ) | |

| 3,064 | | |

| (55,627 | ) |

| AudioCodes Reports Second Quarter 2015 Results | Page 9 of 10 |

| AUDIOCODES LTD. AND ITS

SUBSIDIARIES |

| CONDENSED

CONSOLIDATED STATEMENT OF CASH FLOWS |

| U.S. dollars in thousands |

| | |

Six months ended | | |

Three months ended

| |

| | |

June

30, | | |

June

30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| | |

(

Unaudited) | | |

(

Unaudited) | |

| Cash flows from financing

activities: | |

| | | |

| | | |

| | | |

| | |

| Purchase of treasury stock | |

| (11,329 | ) | |

| - | | |

| (6,080 | ) | |

| - | |

| Repayment of senior convertible notes | |

| - | | |

| (285 | ) | |

| - | | |

| - | |

| Repayment of long-term bank loans | |

| (2,342 | ) | |

| (2,343 | ) | |

| (1,366 | ) | |

| (1,367 | ) |

| Consideration related to payment of acquisition of

Mailvision | |

| (233 | ) | |

| (233 | ) | |

| (233 | ) | |

| (233 | ) |

| Proceeds from issuance of shares upon exercise of options

and warrants | |

| 331 | | |

| 2,112 | | |

| 59 | | |

| 388 | |

| Proceeds from issuance of shares, net | |

| - | | |

| 29,744 | | |

| - | | |

| - | |

| Payment of issuance costs | |

| - | | |

| - | | |

| - | | |

| (111 | ) |

| Net cash provided by (used in)

financing activities | |

| (13,573 | ) | |

| 28,995 | | |

| (7,620 | ) | |

| (1,323 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Increase (decrease) in cash and cash equivalents | |

| 510 | | |

| (12,562 | ) | |

| (1,199 | ) | |

| (57,336 | ) |

| Cash and cash equivalents at the

beginning of the period | |

| 14,797 | | |

| 30,763 | | |

| 16,506 | | |

| 75,537 | |

| Cash and cash equivalents at

the end of the period | |

$ | 15,307 | | |

$ | 18,201 | | |

$ | 15,307 | | |

$ | 18,201 | |

| AudioCodes Reports Second Quarter 2015 Results | Page 10 of 10 |

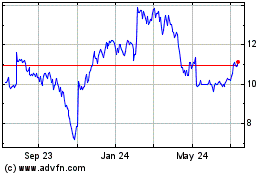

AudioCodes (NASDAQ:AUDC)

Historical Stock Chart

From Mar 2024 to Apr 2024

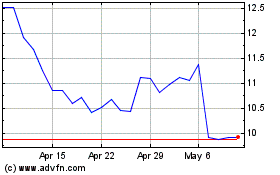

AudioCodes (NASDAQ:AUDC)

Historical Stock Chart

From Apr 2023 to Apr 2024