SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of July, 2015

Commission File Number 1-15106

PETRÓLEO BRASILEIRO S.A. - PETROBRAS

(Exact name of registrant as specified in its charter)

Brazilian Petroleum Corporation - PETROBRAS

(Translation of Registrant's name into English)

Avenida República do Chile, 65

20031-912 - Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

MINUTES OF THE ANNUAL AND EXTRAORDINARY GENERAL MEETINGS OF THE PETRÓLEO BRASILEIRO S.A.-PETROBRAS,

HELD ON APRIL, 29th 2015

(Drawn up in summary form, pursuant to the first paragraph of Article 130 of Law 6,404 of December 15th 1976)

OPEN COMPANY CNPJ no 33.000.167/0001-01 NIRE no 33300032061

I. DATE, TIME AND LOCAL:

Assemblies held on April, 29th 2015 at 3 pm, at the Company’s headquarters located at Avenida República do Chile no 65, Centro, Rio de Janeiro, RJ.

II. ATTENDANCE, QUORUM AND CALL:

Present were shareholders representing a percentage corresponding to 77.97% of the common shares comprising the share capital, as evidenced by the records and signatures in the Shareholders Attendance, communicated and summoned through a notice published in the editions of 27, 30 and 31 of March 2015 and advertisements published in the editions of 30 and 31 of March and 1 of April 2015, in the Official Gazette of the State of Rio de Janeiro and Valor Econômico. The Meetings were chaired by the shareholder Francisco Augusto da Costa e Silva, designated by the Act of the Company's Chairman, Aldemir Bendine, based on Article 42 of Petrobras' Bylaws. Present was Ms Maria Teresa Pereira Lima, Attorney of the National Treasury, accredited through Ordinance / PGFN No. 755 of September 19th of 2013, and published in the DOU (Official Journal) of September 20th, 2013. Also present, pursuant to the provisions of paragraph 1 of Article 134 of Law 6,404 of December 15th 1976, Law of Corporations, Messrs Alexandre Vinicius Ribeiro de Figueiredo, Carlos Alberto de Souza and Marcos Donizete Panassol, representatives of PricewaterhouseCoopers Auditores Independentes, the Directors Ivan de Souza Monteiro and João Adalberto Elek Junior and Mr. Antonio Sergio Oliveira Santana, the latter responding by affections endeavors the Director José Eduardo de Barros Dutra. Also attending, Messrs Paulo José dos Reis Souza, Reginaldo Ferreira Alexandre, Walter Luis Bernardes Albertoni and César Acosta Rech, members of the Audit Committee of the Company, pursuant to the provisions of Article 164 of the Act.

III. BOARD:

● President: Francisco Augusto da Costa e Silva

● Union Representative: Maria Teresa Pereira Lima

● Secretary: João Gonçalves Gabriel

PG. 1/8

AGO/AGE of PETROBRAS – 29/4/2015.

IV. AGENDA:

Annual General Meeting

I. Election of ten (10) members of the Board of Directors, among which one (1) is indicated by the Company's employees, one (1) by minority shareholders, in separate election process (if a larger number does not sanction by the cumulative voting process) and one (1) by the holders of preferred shares, also at separate election process;

II. Election of the Chairman of the Board of Directors; and

III. Election of five (5) members of the Audit Committee, among which one (1) is indicated by the minority shareholders and one (1) by the holders of preferred shares, both through separate election process, and their alternates.

Extraordinary General Meeting

I. Establishment of the remuneration of the directors and the members of the Audit Committee.

II. Ratification of resource utilization related to the balance of the total amount of directors approved at the Extraordinary General Meeting of 04.02.2014 for payment of holiday balance, housing assistance and airfare to members of the Executive Board.

V. RESOLUTIONS ADOPTED:

On a Procedural Question

It was approved by the majority of the shareholders present, the drawing up of the minute in summary format, pursuant to article 130 of Law 6,404 of December 15th 1976.

At the Annual General Meeting:

Item I: Were elected by the majority of shareholders present, in accordance with the vote of the representative of the Union, as members of the Board of Directors, with term of office until the next Annual General Meeting, Messrs Murilo Pinto de Oliveira Ferreira, Brazilian , born in the city of Uberaba (MG), married, business administrator, domiciled at Avenida Graça Aranha, 26, 18th floor, Castelo - Rio de Janeiro (RJ), Postal Code 20030-000, bearer of the identity Card nº 004922272-2, issued by Felix Pacheco Institute - IFP / RJ and CPF nº 212466706-82; Aldemir Bendine, Brazilian, born in the city of Paraguaçu Paulista (SP), married, business administrator, domiciled at Avenida República do Chile 65, 23º floor, Centro. - Rio de Janeiro (RJ), Postal Code 20031-912, bearer of the identity card nº 10126451, issued by the Ministry of Public Security - SSP / SP, and CPF nº 043980408-62; Luciano Galvao Coutinho, Brazilian, born in the city of Recife (PE), divorced, economist, domiciled at Avenida República do Chile No. 100, 22º floor, Centro. - Rio de Janeiro (RJ), CEP 20031-917, bearer of the identity card nº 8925795, issued by the Ministry of Public Security - SSP / PE, and CPF nº 636831808-20; Luiz Nelson Guedes de Carvalho, Brazilian, born in the city of São Paulo (SP), married, economist and accountant, domiciled at Avenida Professor Luciano Gualberto, 908, FEA3, Cidade Universitária, São Paulo(SP), Postal Code 05508-010, bearer of the identity card nº 3561055-4, issued by the Ministry of Public Security - SSP / SP and CPF nº 027.891.838-72;

PG. 2/8

AGO/AGE of PETROBRAS – 29/4/2015.

Luiz Augusto Fraga Navarro de Britto Filho, Brazilian, born in the city of Salvador (BA), stable union, lawyer, domiciled at Avenida República do Chile 65, 24º floor, Centro, Rio de Janeiro. - RJ, Postal Code 20031-912 , bearer of identity card nº 13693, issued by the Brazilian Bar Association - OAB / DF, and CPF nº 347230215-15; Roberto da Cunha Castello Branco, Brazilian, born in the city of São Luís (MA), married, economist, domiciled at Praia de Botafogo, 190, 11º floor, Botafogo, Rio de Janeiro (RJ), Postal Code 22250-900, bearer of the identity card nº 13170, issued by the Regional Economic Council, 1º Region and CPF nº 031.389.097-87; and Segen Farid Estefen, Brazilian, born in the city of Juiz de For a (MG), married, civil engineer, domiciled at Avenida República do Chile, 65, 24º floor, Centro, Rio de Janeiro (RJ), Postal Code 20031-912, bearer of identity card nº 1066660, issued by the Ministry of Public Security - SSP /MG, and CPF nº 135.786.856-15.

Was elected as the Union vote, with term of office until the next Annual General Meeting, Sir. Deyvid Souza Bacelar da Silva, Brazilian, born in the city of Feira de Santana (BA), married, business administrator, domiciled at Rua Boulevard America, 55, Jardim Baiano, Salvador (BA), Postal Code 40050-320, bearer of identity card nº 968719627, issued by the Ministry of Public Security - SSP / BA, and CPF nº 988300155-04,as a member of the Board of Directors as representative of the employees of Petrobras, chosen through elections prepared in accordance with Law nº 12,353, of December 28th , 2010, Ordinance nº. 26 of March, 11th, 2011, the Ministry of Planning, Budget and Management, and the Company's Bylaws.

The following, in the manner provided for in Article 239 of the Corporation Law, was elected by a majority vote, with the abstention of the Union, by separate vote of the minority shareholders, Mr. Walter Mendes de Oliveira Filho, Brazilian, natural of Sao Paulo (SP), married, economist, with domicile at Avenida República do Chile, 65, 24th floor, Centro, Rio de Janeiro (RJ), Postal Code 20031- -912, bearer of identity card nº 6692636-1, issued by the Secretary of Public Security - SSP/SP, and CPF nº 686,596,52801-00 as a member of the Board of Directors of the Company, with a term of office until the next Ordinary General Assembly.

Was also elected by a majority vote, under item II of article 19 of the Bylaws of the Company, with the abstention of the Union, by separate vote of holders of preferred shares, Mr. William Affonso Ferreira, Brazilian, born in Rio de Janeiro (RJ), divorced, economist, with domicile at Avenida República do Chile, 65, 24th floor, Centro, Rio de Janeiro (RJ), Postal Code 20031- -912, bearer of identity card nº. 4405163-3, issued by the State Secretariat of Public Security - SSP/SP, and CPF nº 762,604,298 -00, as a member of the Board of Directors of the Company, with term of office until the next Ordinary General Assembly.

Were also fulfilled the provisions of Article 3, heading and paragraph 2nd of Instruction nº 367, of May 29, 2002, the Securities and Exchange Commission - CVM, as regards the provision of information to the Ordinary General Meeting.

PG. 3/8

AGO/AGE of PETROBRAS – 29/4/2015.

The elected to integrate the Company's board of Directors presented declaration, in compliance with paragraph II of article 35 of the Law 8,934 /1994, stating that they have not been convicted of any crime whose punishment denies access to mercantile activity.

Item II: Was elected by a majority of the shareholders present, to the post of President of the Board of Directors, among the Members elected herein, in accordance with the vote of the representative of the Union, the Director Murilo Pinto de Oliveira Ferreira.

Item III: Was elected by the majority of shareholders present, in accordance with the vote of the representative of the Union, as a member of the Audit Committee, to hold office until the next Annual General Meeting, Mr. César Acosta Rech, Brazilian, born in the city of Porto Alegre (RS), single, economist, bearer of identity card nº 5259-0, issued by the Regional Economic Council of the 4th Region, and CPF nº 579471710-68, residing at Avenida República Chile 65, 901- Sala 901-A, Centro, Rio de Janeiro (RJ), Postal Code 20031-912, having as alternate Ms. Symone Christine de Santana Araújo, Brazilian, born in the city of Aracaju (SE), married, federal employee, bearer of identity card nº 468345, issued by the Ministry of Public Security - SSP / SE, and CPF nº 358921965-34, residing at Avenida República Chile 65, Sala 901-A, Centro, Rio de Janeiro (RJ), Postal Code 20031-912; Ms. Marisete Fátima Dadald Pereira, Brazilian, born in the city of Crissiumal (RS), married, accountant, bearer of identity card nº. 15132, issued by the Regional Accounting Board of the State of Santa Catarina - CRC / SC, and CPF nº 409905160-91, domiciled at Avenida República Chile 65, Sala 901-A, Centro, Rio de Janeiro (RJ), Postal Code 20031-912, having as alternate Ms. Agnes Maria de Aragon da Costa, Brazilian, born in the city of São Paulo (SP), married, economist, bearer of identity card nº 11869726-7, issued by Félix Pacheco Institute-IFP/RJ and CPF nº 080.909.187-94, residing at Avenida República Chile 65, Sala 901-A, Centro, Rio de Janeiro (RJ), Postal Code 20031-912. Was also elected by a majority of the shareholders present, in accordance with the vote of the representative of the Union, as a member of the Audit Committee of the Company, as representative of the National Treasury, Mr. Paul Joseph Reis de Souza, Brazilian, born in Belo Horizonte (MG), married, business administrator, domiciled at Avenida República Chile 65, Sala 901-A, Centro, Rio de Janeiro (RJ), Postal Code 20031-912, bearer of identity card nº 2,536,569 , issued by the State Secretariat of Public Security - SSP/MG, and the CPF nº 494,424,306 -53, having as an alternate member Ms. Paula Bicudo de Castro Magalhães, Brazilian, born in the city of Brasília (DF), stable union, federal employee, residing at Avenida República Chile 65, Sala 901-A, Centro, Rio de Janeiro (RJ), Postal Code 20031-912, bearer of identity card nº 1275949, issued by the State Secretariat of Public Security – SSP/DF and CPF nº 787.873.861-00.

The following, in the manner provided in Article 240 of the Law of Corporations, with the abstention of the Union, was elected by a majority, as a member of the Fiscal Board of the Company, for a term until the next Ordinary General Assembly, by separate vote of the minority shareholders, Mr. Reginaldo Ferreira Alexandre, Brazilian, born in the city of São Paulo (SP), married, economist, bearer of the identity card nº 8.781.281, issued by the State Secretariat of Public Security – SSP/SP, and CPF nº 003.662.408-03, domiciled at Avenida República Chile 65, Sala 901-A, Centro, Rio de Janeiro (RJ), Postal Code 20031-912, having as an alternate, Mr. Mário Cordeiro Filho, Brazilian, born in the city of São Paulo (SP), single, economist, bearer of the identity card nº 10234310-X, issued by the State Secretariat of Public Security – SSP/SP,and CPF nº 033.547.388-12, domiciled at Avenida República Chile 65, Sala 901-A, Centro, Rio de Janeiro (RJ), Postal Code 20031-912

PG. 4/8

AGO/AGE of PETROBRAS – 29/4/2015.

Was also elected by a majority, with the abstention of the Union, as a member of the Fiscal Committee of the Company, as well as offers the Article 240 of the Corporation Law, with mandate until the next Ordinary General Assembly, by separate vote of holders of preferred shares, Mr. Walter Luis Bernardes Albertoni, Brazilian born in the city of São Paulo (SP), married, attorney, bearer of identity card nº 123.283, issued by the Brazilian Bar Association-OAB/SP and CPF nº 147.427.468-48, domiciled at Avenida República Chile, 65, Sala 901-A, Centro, Rio de Janeiro (RJ), Postal Code 20031-912, having as an alternate Mr. Roberto Lamb, Brazilian, born in the city of Caxias do Sul (RS), married, physicist, bearer of identity card nº 300.421.290-2, issued by the State Secretariat of Public Security – SSP/RS and CPF nº 009.352.630-04, residing at Avenida República Chile , 65, Sala 901-A, Centro, Rio de Janeiro (RJ), Postal Code 20031-912.

Before proceeding to each of the separate votes by the minority and preferred shareholders, both for elections to the Board of Directors and to the Audit Committee, the President of the Assembly read and requested that were stated in the minutes the direction of the Circular Letter / CVM / SEP / nº 02/2015, which prescribes a matter for each supplementary private pension entity to assess whether their vote, to some extent, is influenced by the controlling shareholder of Petrobras and, should it decide to vote in the separate election, should be able to present, if questioned after the Assembly, evidence to demonstrate that there was no the aforementioned influence.

Closed the Annual General Meeting, upon confirmation of the existence of legal quorum, the Extraordinary General Assembly was initiated.

At the Extraordinary General Meeting

Item I: Approved by a majority vote of the shareholders present, in accordance with the vote of the representative of the Union, delivered in accordance with guidance from the Department of Coordination and Governance of State Companies (DEST) in the Official Letter No. 433 / DEST-MP of April 24th, 2015 (Technical Note No. 220 / CGCOR / DEST / SE-MP of April 24th), and in compliance with the provisions of section IV of art. 8 of Annex I of Decree No. 8189 of January 21th , 2014, with the abstention of directors: a) the fixing of up to R $ 19,430,778.39 of the overall compensation payable to Petrobras management, in the period from April of this year and March the following year; b) the recommendation that the individual limits defined by the DEST are observed, highlighted its power to set such limits for the period of twelve-months, by heading and position, manifested as table provided by it, sticking to the global limit set in item "a"; c) the delegation to the Board of Directors competence to authorize the effective monthly payment of remuneration, subject to the overall and individual limit provided for in items "a" and "b", respectively; d) the fixing of the monthly fees for members of the Board of Directors and the Audit Committee holders at one tenth of the maximum average monthly remuneration of the members of the Executive Board, excluding amounts related to additional holidays and benefits;

PG. 5/8

AGO/AGE of PETROBRAS – 29/4/2015.

e) the express nullification of transfer of any benefits that eventually come to be granted to company employees, during the formalization of the Collective Labor Agreement - ACT in their respective data base; f) The guidance to the company to update all of the information from the Information System of State-owned Enterprises - SIEST, under the terms of Circular Letter DEST/IF-MP no. 8, 03.06.2015 , within 180 days, being able to reduce by 10% the amount of the RVA 2015 and also cancel any increase in fees in 2016 if this deadline is not met; g) due to the occurrence of damage, the cancellation of the payment in full of the Annual Variable Remuneration - RVA 2014 and all deferred installments not yet paid of the 2013 RVA of Directors, pursuant to the respective program of corporate goals and Law 6,404 / 76, art . 152, Paragraph 2nd; h) the nullification of payment of any compensation item not acted in this House for administrators, including benefits of any nature and representation fees, pursuant to Law 6,404 / 76, art. 152.

Item II: Was approved by the majority vote of the shareholders present, in accordance with the vote of the representative of the Union, the ratification of the use of resources related to the balance of the overall amount of directors, approved at the Extraordinary General Meeting of April 2, 2014 for payment of holiday balance, housing assistance and airfare to members of the Executive Board.

Nothing further to be dealt with, were closed the Ordinary and Extraordinary General Meetings and, subsequently, these Minutes were drawn up, which, read and found in compliance, were signed by the President of these Ordinary and Extraordinary General Meetings, Francisco Augusto da Costa e Silva, the Representative of the Union, Maria Teresa Pereira Lima, by the Representative of The Bank of New York Mellon - Depositary Receipts, Ralph Figueiredo de Azevedo, and the Secretary, John Goncalves Gabriel. Was what contained the pages 67-74 of the Book # 6, used to register the Minutes of the General Meetings of Shareholders of the Petróleo Brasileiro SA – Petrobras, from where was extracted this authentic copy, typed by me, Clarissa Magela de Oliveira and goes checked and closed by me, João Gonçalves Gabriel, Secretary. Rio de Janeiro, April 29th, 2015.

VI. REGISTRY OF THE SHAREHOLDERS MANIFESTATIONS:

There were verbal manifestations of the following shareholders:

- The shareholder, Luis Eduardo Potsch de Carvalho e Silva, voting contrary to the drafting of the proposed minutes in summary format and indicating Mr. Fernando Leite Siqueira as a candidate for member of the Board of Directors of Petrobras in the vacant job intended for minority shareholders and Messrs Silvio Sinedino Pinheiro (holder) and Ricardo Maranhão (alternate) as candidates for members of the Supervisory Board in the vacant job intended for minority shareholders;

- Shareholder and employee representative on the Board of Directors of Petrobras Silvio Sinedino Pinheiro, speaking out on general aspects of the Company and governance, as well as his role as a Board member;

PG. 6/8

AGO/AGE of PETROBRAS – 29/4/2015.

- Shareholder Gilberto Esmeraldo, on the sharing scheme of the pre-salt, difference in the percentage of payment of dividends to common and preferred shareholders as well as praising the Petrobras' Investor Relations Unit.

- Association of Engineers of Petrobras - AEPET, represented in these Meetings by Mr. Fernando Leite Siqueira, with manifestation of vote contrary to the election of Mr. Murilo Pinto de Oliveira Ferreira as a member of the Board of Directors of Petrobras due to possible conflict of interest, and some considerations on various aspects of the Company. Concerning the conflict of interest, clarifications were provided by the Chairman of the House attesting that Mr. Murilo Pinto de Oliveira Ferreira Assembly had submitted the declaration mentioned in CVM Instruction No. 367 of May, 29th 2002. The issue was also examined by Company's legal department, which did not present objection to the said election;

- Tempo Capital Main Equity Funds, represented in these Meetings by Sra. Domenica Eisenstein Noronha, presenting protest against aspects of the Company's governance;

- Shareholder José Martins Ribeiro, on political and operational aspects involving Petrobras and applying for the vacancy of a member of the Board of Directors by the preferred shareholders;

- Pension Fund for Employees of the Bank of Brazil - Previ, represented in these Meetings by Mr. Vinicius Nascimento Neves, reaffirming its voting right exercise in the election of the members representing the preferred shareholders and minority shareholders, to the Board of Directors and Audit Committee of the Company, and manifesting support to the candidate, Eduardo Bunker Kind, as a member of the Board of Directors in vacancy intended for minority shareholders; Otavio Yazbec as a member of the Board of Directors in vacancy intended to preferred, as well as support to the candidate Reginaldo Ferreira Alexandre, as a full member and Mario Cordeiro Filho as an alternate member on the vacancy intended for minority common; Walter Luis Bernardes Albertoni, as a full member and Roberto Lamb as alternate member on the post intended for preferred shareholders;

- Deyvid Bacelar de Souza da Silva, employee of Petrobras elected as representative of the employees in the Company's Board of Directors, addressing the current situation of Petrobras, the future prospects of the Company and thanking for the support of voters.

VII. DOCUMENTS FILED AT THE COMPANY HEAD OFFICE:

Filed at the Company's headquarters, in attention and in the manner provided in Article 130, paragraph 1, item "a", of Law 6,404 / 76, the following documents:

PG. 7/8

AGO/AGE of PETROBRAS – 29/4/2015.

- Completed ballots by the shareholders or their proxies and delivered to the Bureau containing the resolutions in items I to III of the Agenda of the Annual General Meeting, and items I and II of the Agenda of the Extraordinary General Meeting;

- Voting proxy of shareholders registered in the Online Meeting, represented by their attorneys, Ana Paula Couri de Carvalho Oliveira, Carlos Henrique Dumortout Castro and Fabio Luis Soares Xavier ;

- / 343.775.231 (Walter Power of Attorney and voting manifestation of The Bank of New York Mellon - Depositary Receipts, Depositary Institution abroad, issuer of ADRs representing the Company’s shares, represented in these Meetings by Mr. Ralph Figueiredo de Azevedo, reporting the manifestations of ADR holders favorable (AGO: item I - 64,277,377 (indicated by the Controller)Mendes de Oliveira Filho – member of the CA (BD) by Minority) / 882.489.454 (Guilherme Affonso Ferreira - member of the CA (BD) by Preferred) / item II – 248.130.705 / item III – 138.852.443 (indicated by the Controller) / 344.369.719 (Reginaldo Ferreira Alexandre- full member and Mário Cordeiro Filho – alternate – member of CF (FC) by Minority) / 891.304.420 (Walter Luis Bernardes Albertoni – full member - and Roberto Lamb - alternate – member of CF by Preferred)/ (AGE: item I – 247.391.865; item II – 347.866.105) / against(AGO: item I – 292.270.699 (indicated by the Controller) / 8.643.129 (Walter Mendes de Oliveira Filho, by Minority) / 10.375.127 (Guilherme Affonso Ferreira – member of CA (BD) by Preferred)/ item II – 109.610.646; item III – 208.833.628 (indicated by the Controller) / 7.988.097 (Reginaldo Ferreira Alexandre- full member and Mário Cordeiro Filho – alternate – member of CF (FC) by Minority) / 2.895.643 (Walter Luis Bernardes Albertoni – full member and Roberto Lamb - alternate - member of CF (FC) by Preferred) / (AGE: item I – 120.060.225; item II – 9.339.002; and abstaining from vote (AGO: item I – 12.905.259 (indicated by the Controller) / 17.034.975 (Walter Mendes de Oliveira Filho, by Minority) / 7.721.976 (Guilherme Affonso Ferreira - member of CA (BD) by Preferred) / item II – 11.711.984, item III – 21.767.264 (indicated by the Controller) / 17.095.519 (Reginaldo Ferreira Alexandre- full member and Mário Cordeiro Filho – alternate – member of CF (FC) by Minority) / 6.386.494 (Walter Luis Bernardes Albertoni – full member and Roberto Lamb - alternate - member of CF (FC) by Preferred) / (AGE: item I – 2.001.245; item II – 12.248.228), in the Agenda of the Ordinary and Extraordinary General Meetings;

- Manifestation and vote of the Association of Engineers of Petrobras – AEPET;

- Manifestation of the Welfare Fund of Banco do Brasil’s Employees- Previ;

- Manifestation and vote of the Shares Funds “Tempo Capital”;

- Manifestation and vote of the shareholder Luis Eduardo Potsch de Carvalho e Silva;

- Manifestation and vote of the shareholder Paulo Cesar Chamadoiro Martin.

PG. 8/8

AGO/AGE of PETROBRAS – 29/4/2015.

PETROBRAS

ANNUAL AND SPECIAL MEETINGS OF SHAREHOLDERS

April 29th, 2015

Name of the Shareholder or Grantee:

Paulo Cesar C. Martin – CPF no. 267.888.025-72

Statement of Shareholder or Grantee:

I am against the majority decision, due to majority´s shareholder vote, explaining that the Minutes of the Meeting is short, which restricts the record of votes, statements and registers of the shareholder in the Minutes presented in such Meeting.

AGO/AGE of PETROBRAS – 29/4/2015.

VOTE OF TEMPO CAPITAL SHARE INVESTMENT FUND ("Tempo Capital") presented to the Board of the Annual and Special Meetings of Shareholders of Petróleo Brasileiro S.A. - Petrobras ("Petrobras" or "Company "), held on April 29th, 2015, at 03:00 PM.

1. In relation to item (I) of the Agenda, in the Annual Meeting of Shareholders, Tempo Capital votes for Mr. Guilherme Affonso Ferreira, separately in the elections, for the position of member of the Board of Directors, in the position intended to Company´s preferred shareholders.

2. In relation to item (II) of the Agenda, in the Annual Meeting of Shareholders, Tempo Capital registers its ABSTENTION.

3. In relation to item (III) of the Agenda, in the Annual Meeting of Shareholders, Tempo Capital votes for Mr. Walter Luis Bernardes Albertoni, separately in the elections, as the holder, and Mr. Roberto Lamb, as substitute, for the position of member of the Executive Committee, in the position intended to Company´s preferred shareholders.

4. In relation to items (I) and (II) of the Agenda, in the Special Meeting of Shareholders,

Time Capital registers its vote AGAINST the Proposal of the Administration. Actually, it is important to mention that the Company is going through a period of institutional and management crisis, due to mismanagement and aggravated scenario of financial leverage. Therefore, the proposal to increase the administrators´ compensation is an inappropriate, inconvenient and inadequate measure. It seems impracticable to us the approval of any readjustment or increased values of fixed component not coupled to operational and financial targets aligned to Company´s shareholders. Besides, it is important that the goals of the Administration´s variable compensation take into consideration, among other relevant aspects, the Administrator´s commitment to law enforcement and anti-corruption practices, including the support to discovery and treatment of improper behavior by subordinates or other administrators.

5. Finally, Tempo Capital registers its PROTEST, since the Company does not disclose its information according to CVM Instruction no. 480/09 (Article 30), through IPE, the disagreeing votes of the members of the Board of Directors and the Executive Committee, as determined by the Company´s act. It is important to note that the recent disclosure of votes casted by the independent board of directors present an obstacle to access of directors´ information by the administration, which we understand that violates the principle presented in article 142 of Act 6.404, 1976. In addition, regarding “Lava-Jato” investigations, in which Petrobras presents itself as victim of corruption and mismanagement so far disclosed, the impossibility to grant access to information or clarifications to its independent directors is not consistent to governance good practices and transparency; not to mention its illegality.

AGO/AGE of PETROBRAS – 29/4/2015.

Given that Petrobras is being investigated and analyzed by market regulatory agencies (CVM and SEC), including Brazilian criminal investigation agencies, (Accounting Court, Prosecutors Office and Federal Police), it is necessary to encourage and facilitate the work of independent representatives. We understand that such activity should be the Company´s modus operante, and its new Director of Governance may be responsible for such supervision and implementation.

Finally, register that, in compliance with the terms presented in the OFFICIAL LETTER/CVM/SEP/No.002/2015, in its item 2.4.4, the Company must include “possible statements of vote, dissent or protest” in the digital file containing the Minutes, in the IPE system of the Brazilian Securities Commission.

Rio de Janeiro, April 29th, 2015

Tempo Principal Share Investment Fund

AGO/AGE of PETROBRAS – 29/4/2015.

AEPET

Association of Engineers of Petrobras

Mrs. Shareholders,

AEPET, in the capacity of Petrobras´ controlling shareholder, declares its vote through its representative in the Annual Meeting of Shareholders, held on April 29th, 2015, as well as request its transcription in the Minutes of the meeting.

This election becomes imperative in the moment that Petrobras is going through a deep crisis due to: political interference in its management; weaknesses of internal controls and favoring to suppliers, in addition to other events that require a public, evident, firm and transparent position of its shareholders in view of Company´s preservation.

Thus, AEPET, whereas the occurred events, is strongly against the election of members to the Board of Directors who act on market in activities that involve business with Petrobras, which can lead to a conflict of interests.

Therefore, AEPET respectfully registers its vote against the election of Dr. Murilo, chairman of Vale, to preside Petrobras´ Board of Directors, for the following reasons.

AEPET presents the opportunity to alert the new members of the Board of Directors and the Audit Committee for the following events that request the involvement of the same considering its legal responsibility.

The legal milestone for management of State-owned companies is not being obeyed, which guarantees an independent and competitive performance, according to private corporations, maintaining the Social Function for which exists. Thus, new criteria must be established so that the choice of members of the Executive Committee, Board of Directors and Ombudsman, which favors competence, independence, ethics and honesty, ensuring compliance with its Social Function.

We were against the nomination of directors such as Fabio Colleti Barbosa (chairman of Santander, owner of Repsol, Petrobras´ competitor) and Jorge Gerdau (chief of lobby, which overthrew the Federal Government´s monopoly on oil). The Board of Directors has not been able to actually perform, but its members have access to privileged information. Thus, the current model has created serious problems for the Company, namely:

1. The state corruption, which is a historical problem, is systemic and goes far beyond Petrobras and present govern.

Corruption also appears in international private corporations, which are the largest

Corrupting parties. However, the Company´s institutional fragility is undeniable, in relation to its suppliers of goods and services.

AGO/AGE of PETROBRAS – 29/4/2015.

2. AEPET is filling information against deviations in the relationship between private business owners and Petrobras, through letters to the executive board and in votes in Annual Meetings of Shareholders. We have pointed out, for example, agreements such as EPC - packages - as harmful for systematizing the cartel, increasing costs, reducing quality and making the Company hostage of contractor. The performance of enterprises of COMPERJ, RNEST, PREMIUM 1 and PREMIUM 2 was carried out using this model, a real setback in relation to the successful historical practice of Petrobras, and it presented extremely abusive results.

On March 17th, 2015, in order to cure these fragilities, we sent a letter to Chairman Aldemir Bendine, in which we presented 14 initiatives of corporate nature to the Company´s defense. These proposals were the result of volunteer work from many experienced and competent professionals. The letter is available at www.aepet.org.br, Here are some proposals:

3.1. That P&D´s resources management prioritize the direct performance of its own technical staff and the development of specialized cooperatives of Brazilian professionals;

3.2. That Petrobras use its Tecnologias Proprietárias in its projects, whenever available;

3.3. That Petrobras hire detailing projects (executive) only after the conclusion of basic projects;

3.4. That the executive project and the construction/assembly are not executed by the same company.

PETROBRAS´ INTERNAL STRENGTHENING - TRANSPARENCY, DEMOCRACY IN THE WORKPLACE AND SOCIAL CONTROL

To ensure that the wealth generated by Petrobras is intended for the benefit of all Brazilians, the principles of Company´s Governance must be revised. It is not necessary a new board for this matter, but officials to respect the Company´s regulations.

The current management is too hierarchical and autocratic, and does not fit to a strategic Company whose objective is to promote the country´s development - which means acting to prevent corruption, to create Jobs, to relate with the environment and the management of strategic resource as in oil. It is necessary to subject Petrobras to the interests of the Brazilians, as opposed to private interests of contractors, political parties and oil cartel.

Petrobras must have the highest transparency in management in relation to society and oil workers. Democracy in the workplace, including the end of workplace harassment bullying and enhancement of competence to which workers engage themselves in Company´s defense and influence decisions that will improve the future of Brazilians.

AGO/AGE of PETROBRAS – 29/4/2015.

DIRECTORS AND OFFICERS MUST CORRECT DIRECTIONS SUCH AS:

OUTSOURCING

Outsourcing has reached such high and dangerous level that could ruin Petrobras. It is an unacceptable situation, which depends on more than 300.000 workers who are precarious, under proper training and without social charges. Some of these workers work at strategic and main activities, including CENPES researching field. The outsourcing puts the Company´s future at risk through loss of its independence and capacity to control its own destiny.

PETROBRAS´ FINANCIAL RECOVERY

Petrobras is the world´s most viable oil company, which went on a financial fragility, resulting from corruption and overcharging, but mainly due to Government imposition of a policy of derivative imports for consecutive years, supplying the internal market at a lower price to the import cost. AEPET sustains in Annual Meeting of Shareholders that the Government must supported its program. According to independent directors´ calculation, such loss exceeded R$ 60 billion. The Government must replace such amount, but officials do not charge it.

The harmful consequence is an attempt to financially cure the Company through measures such as sale of assets in an improper time, at a bargain price.

AEPET shareholder is against the sale of assets, especially those of high oil strategic value, which have lower price, although temporary. The assets of all companies are undervalued. It is not the time to sell. It is even more disturbing watching E&P Director recommend the sale of assets in the pre-salt in order to share risks, i.e. selling awarded tickets to divide risks.

PETROS´ CASE

1- Petrobras, as the main sponsor of supplementary retirement plans, does not exercise its responsibility imposed by Law, and that would eliminate the rigging political-party in Petros management, and would guarantee the implementation of a joint management, with participation of members elected by participants and beneficiaries in Foundation´s Executive Board, according to Brazilian Constitution; it is necessary to immediately implement the investor´s Management Committee, with joint formation and elected by the participants, according to Foundation´s Articles of Association.

According to its own experience at Banco do Brasil, Petrobras´ Chairman Bendine knows that Previ is an efficient foundation with its officers elected and derived from the Bank, who are familiar with the obligation to well manage its own assets.

PERFORMANCE OF PWC IN PETROBRAS

The performance of PWC, Petrobras´ external auditing and its predecessors, was strongly

questioned during the course of Lava Jato (“Car Wash”) Operation by the approval of balances since 2014, without indicating deviations occurred, reaching its crucial moment with the controversy of non-approval of 2014 Financial Statements.

AGO/AGE of PETROBRAS – 29/4/2015.

In the disclosure of the trial balance for the 3rd quarter/2014, PWC made several demands to sign those financial statements, including that no person involved in the Lava Jato (“Car Wash”) Operation was connected to accounts presented by the Company, which resulted in the troubled, but assertive, withdrawal of Transpetro´s former chairman.

While Petrobras and PWC discussed new ways of calculating the accounts´ reduction, the PWC contract celebrated with Petrobras terminated at the end of 2014. This contract, as usual, in this kind of document, foresees its automatic renewal for two years, with a readjustment clause already defined in original contract.

PWC did not accept this automatic renewal by judging that the Company´s new reality required a major work and participation of a more experienced auditors, which would be reflected in higher readjustment to contractor.

Petrobras would have to enter into a new competitive bidding, where free competition would define new prices for the work. Instead, the Company made an invitation to tender to PWC, which presented a US$47 million/year proposal, when the previous contract was US$19 million, resulting in an adjustment of 147% (!?).

PWC´s position is uncomfortable: how to explain that there is nothing strange in balances signed in 2012, 2013 and in the first two quarters of 2014, while Lava Jato (“Car Wash”) Operation indicates that, since 2004, there were assets involved in corruption and overpricing?

Did PWC not notice that an asset such as RNEST was counted for US$18 billion, when, by international metrics, should be US$8 billion? Did PWC visualize the errors in presented costs only after information of Lava Jato (“Car Wash”) Operation? So, what is the purpose of an external audit?

It is advisable to mention the planning episode to Petrobras´ Human Resources, performed by it, in which recommended the reduction of the Social Security Plan and AMS, also considering social security and medical assistance as costing, instead of a high return investment by the security and tranquility which would provide to workers, who will respond with their competent high level work and fidelity to Petrobras.

PLANNING AND MANAGEMENT OF THE COMPANY

Petrobras´ chairman Bendine mentioned in a press interview that Company´s planning was inappropriate. It is the truth. PWC has many failures in strategic, Boston Group and tactic-operational due to foreign companies from countries desiring Petrobras´ failure so that they would have “pre-salt”.

Another fact considering revision is the testimony of Graça Foster, former chairwoman of Petrobras, in the Senate: the Company´s Center for data Integrated Processing have 35 companies under operating, among which 16 Brazilian, 14 American and 5 in other countries; data encryption is carried out by three American companies; the software that runs geophysical data is from Halliburton, which results in total lack of confidentiality of strategic data on country´s wealth. Former NSA technician (ANS), Edward Snowden

informed through WikiLeaks that, at every 72 hours, a volume of data from Petrobras is send to the so-called "Five Eyes" - USA, Great Britain, Australia, New Zealand and Canada.

AGO/AGE of PETROBRAS – 29/4/2015.

WORK SHUTDOWN

Another mismanagement fact: we understand as an error to shutdown Comperj´s works for several reasons presented below:

The Country needs to expand the refining park in order to terminate such import that significantly damaged Petrobras. The shutdown causes abrupt and non-gradual unemployment, without giving proper time to reallocate the employees, resulting in serious social damages.

1. To interrupt any work gives rise to a damage of 2-5% of global value monthly invested, with conditioning and preservation of large equipment already purchased, maintenance what was already built, in addition to the repossession of work also contribute to irreparable damages. There are refining units with 86% accomplishment, therefore, considered its shutdown a serious mistake.

WE WOULD LIKE TO REMIND THAT:

“Pre-salt” has a reserve potential of 300 billion barrels, which Petrobras discovered 60 billion (Tupi-9 billion barrels; Franco – 10 billion barrels; Libra - 15 billion barrels; Iara - 4 billion barrels; Sapinhoá - 2 billion 184,000 barrels; Área das Baleias – 6 billion barrels; Carioca and others – 14 billion barrels); we are self-sufficiency to over 50 years.

Petrobras has the highest field portfolio to go into production, adding Campos Basin and others, with 14 billion barrels. It does not make sense to reduce investments in refining, where we have a deficit, and sell assets to increase oil production to export.

Such Government´s imposition is deleterious to Petrobras and country´s strategic interest; all serving exclusively to dependent-oil countries, presenting them with our present and our future. A management with independency would restrain it.

Petrobras won the OTC award – Offshore Technology Conference – for the third time, due to its technology ability in ultra-deep waters, besides the excellence award in engineering by SPE – World Society of Oil Engineers;

The low price on oil is temporary by a geopolitical issue: the United States of America wishes to destabilize Russia, similar with the URSS in 1990, and the BRICS, who threaten its hegemony. Such barrel price does not sustain itself in this level because we are at the world´s production peak, with perspectives to rising again in less than two years.

Petrobras was stablished to supply the fuel domestic market to lower prices and to promote the country´s social and technological development, which has been done admirably, becoming one of the world´s greatest oil company in 60 years, which favors its credits.

Until 1960´s, Norway was Europe´s second poorest country. The discovery of its oil in the North Sea, along with its wealth´s management in the country´s own good, made Norway the most developed country in the world, wherein the last five years it has the best Human Development index (HDI) on the planet. And we have more oil and wealth

than Norway.

AGO/AGE of PETROBRAS – 29/4/2015.

Here is a message to the representative of majority shareholder – the Government: all countries that gave its oil to multinational companies are poor: Nigeria, Angola, Gabon, Libya, Syria, Afghanistan, Iraq and others.

CONCLUSIONS

The problem with corruption in Petrobras is not only settled with punishment to those involved in Lava Jato (“Car Wash”) Operation. This process has been developed for decades and has had a harmful effect over Petrobras and the Country. The companies´ controllers indulged themselves at its expenses and the country´s as well. They caused a deep loss in the Company´s image. Controllers and those involved must reimburse the Company.

The fragility of the Company´s planning and control system has allowed that an interference of spurious interests - whether by consulting firms, political parties and government or multinational companies - would lead us to this finance, image and governance fragility situation, despite the technological successes. In order to improve itself, we have to adopt new proceedings of nomination of members in the Board of Directors, members of the Executive Board, and the Ombudsman's Office, which could favor its competence, ethics, honesty, independence and strong commitment to Petrobras´ social and strategic mission.

We profoundly regret that our several alerts and warnings expressed in this distinguished Meeting, due to experience and knowledge of members committed to Petrobras, have not been taken into due consideration by its Managements. A significant part of such problems would probably have been avoided if such event had occurred.

Rio de Janeiro, April 29th, 2015.

Fernando Siqueira

Vice-President and Representative of AEPET

AGO/AGE of PETROBRAS – 29/4/2015.

CAIXA DE PREVIDÊNCIA DOS FUNCIONÁRIOS DA BANCO DO BRASIL

ANNUAL MEETING OF SHAREHOLDERS

PETROBRAS

04.29.2015

Auditorium of the Headquarters, at Avenida República do Chile,

65, 1st floor, in Rio de Janeiro (RJ),

Statement of Caixa de Previdência dos Funcionários do Banco do Brasil – Previ

Mr. Chairman,

CAIXA DE PREVIDÊNCIA DOS FUNCIONÁRIOS DO BANCO DO BRASIL S. A - PREVI, in the capacity of minority shareholder of Petróleo Brasileiro S.A. ("Company" or “Petrobras”), holding 2.81% of the Company´s capital, hereby informs to this Annual Meeting of Shareholders as follows:

1. PREVI is a closed entity of complementary social security organized according to Supplementary Law 108/2001, accounting with parity governance in all administration authorities.

2. The Executive Board and the Deliberative Council have three members elected by the participants and three indicated by the sponsor, while the Audit Committee has two members elected by participants and two members indicated by the sponsors.

2.1. According to articles 11 and 15 of Supplementary Law 108/0111: (i) quality vote within the scope of the Deliberative Council, by its counselor-chairman indicated by the

1 Art. 11. The formation of the Deliberative Council, with maximum of six members, will be parity between representatives of the participants and beneficiaries and the sponsors, who will be responsible for the nomination of the counselor-chairman, who will have the quality vote, besides its own vote.

§ 1o. The choice of the representatives of the participants and beneficiaries will occurred by means of a direct election among their pairs.

§ 2o. If the Article of Association of the closed entity, respecting the maximum number of counselors presented at the head provision of article 11 and the parity participation between the representatives of the participants and beneficiaries and sponsors, provides another formation, which have been approved according to its Article of Association, such last formation may be applied by permission of the regulatory and supervisory authority.

Art. 15. The formation of the audit committee, with maximum of four members, will be parity between the representatives of sponsors and participants and beneficiaries, who will be responsible for the nomination of the counselor-chairman, who will have the quality vote, besides its own vote.

Sole Paragraph. If the Article of Association of the closed entity, respecting the maximum number of counselors presented at the head provision of article 11 and the parity participation between the representatives of the participants and beneficiaries and sponsors, provides another formation, which have been approved according to its Article of Association, such last formation may be applied by permission of the regulatory and supervisory authority.

AGO/AGE of PETROBRAS – 29/4/2015.

representatives of the sponsors; (ii) quality vote within the scope of the Audit Committee, by its counselor-chairman designated by the representatives of the participants and beneficiaries.

2.2 The formation of the Executive Board of PREVI also follows the rule of parity, without casting vote.

2.3. It is noticed that PREVI´s governance structure is based on the rule of parity, in view of complying with the exact terms of the supplementary legislation and the principles presented in article 202 of the Brazilian Constitution.

3. Clarified these points, with regard to the present Meeting, PREVI will support the candidates nominated by BRAM – Bradesco Asset Management S.A., Distributor of Titles and Securities to the positions of members of the Board of Directors, namely: (a) Eduardo Bunker Kind, to member of the Board of Directors, in the position intended to minority common shareholders, and, b) Otavio Yazbek, a member of the Board of Directors, in the position intended to minority preferred shareholders.

4. Furthermore, the PREVI will support the candidates nominated by Mr. Reginaldo Ferreira Alexandre to the positions of members of the Audit Committee, namely: a) Reginaldo Ferreira Alexandre, as main member and Mario Cordeiro Filho, as a substitute member, to the position intended to minority common shareholders, and, b) Walter Luis Bernardes Albertoni, as main member and Roberto Lamb as substitute, to the position intended to minority preferred shareholders.

5. It is worth mentioning that similar situation occurred in 2013, at the Annual Meeting of Shareholders of Petrobras, where PREVI supported candidates indicated by other minority shareholders for filling the positions in the Board of Directors and the Audit Committee, in elections intended to minority shareholders.

6. PREVI prepared consultation to the Securities Commission, informing the names of the candidates indicated by shareholders Aberdeen Asset Management PLC and BlackRock, which would be supported by PREVI, with clarifications on the governance structure adopted by the entity in case of support to the indicated candidates by other shareholders.

7. In response, the Securities Commission expressed the following understanding:

"Notwithstanding, according to OFICIAL LETTER/CVM/SEP/No.01/2013, of 28.02.2013, the governance structure of the entity is the main element to be considered in the analysis of the controller´s influence, but it is not the only aspect to be taken into account in this review. The characteristics presented in each case cannot be neglected and may, eventually, have to demonstrate that, in a particular situation, it does not have the determining influence of the controlling shareholder in the decision. ( ... )

Thus, in this particular case, considering its specific characteristics, and based only on the elements available until now, in our view, there are not sufficient characteristics that would lead to the conclusion of vote impediment of the vote of Previ on the Annual Meeting of Shareholders, held on 29.04.2013, as to separated

election of members of the Board of Directors and the Audit Committee."

AGO/AGE of PETROBRAS – 29/4/2015.

8. According with such statement of the Securities Commission, supported the candidates presented by the minorities Aberdeen Asset Management PLC and BlackRock in the Annual Meeting of shareholders of Petrobras.

9. Therefore, in relation to the Annual Meeting of Shareholders of Petrobras on 2015, whereas the names of candidates indicated by BRAM - Bradesco Asset Management S.A., Distributor of Titles and Securities, and by Mr. Reginaldo Ferreira Alexandre, minorities shareholders of Petrobras, were evaluated by PREVI´s technical department, it is understood that there is no impediment to the exercise of the right to vote of such Entity in the election intended to minority shareholders to the positions in the Company´s Board of Directors and the Audit Committee.

10. Therefore, PREVI, in the capacity of Company´s minority shareholder as controlling reaffirms its right, granted by law, to exercise the vote in the election of members of the Company´s Board of Directors and Audit Committee, in the positions intended to minority shareholders, since it is not considered as any situation of determining influence of the Company´s controlling shareholder.

11. Finally, REQUEST that such statement is attached and registered in the Minutes of this Annual Meeting of Shareholder.

Arthur Prado Silva

Director of Participation e.e.

CAIXA DE PREVIDÊNCIA DOS FUNCIONÁRIOS DO BANCO DO BRASIL

AGO/AGE of PETROBRAS – 29/4/2015.

PETROBRAS

ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

April 29th, 2015

Identification of Shareholder and Grantee:

LUIS EDUARDO POTSCH DE CARVALHO E SILVA

Statement of Shareholder and Grantee:

VOTE AGAINST THE MINUTES OF THE ANNUAL MEETING OF SHAREHOLDERS OF PETROBRAS HELD ON 04.29.2015.

STATEMENT OF VOTE:

I PROTEST AGAINST THE POSITION DEFENDED BY THE OFFICE OF THE ATTORNEY GENERL OF GOVERNMENT´S COMPANIES IN RESTRICTING THE RIGHT OF SHAREHOLDING EXPRESSION, ELIMINATING CRITICISM/DIVERGENT POSITIONINGS THE MINUTES, AS REPRESENTATIVE OF PRESIDENT DILMA ROUSSEFF.

AGO/AGE of PETROBRAS – 29/4/2015.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

PETRÓLEO BRASILEIRO S.A--PETROBRAS |

|

|

|

|

By: |

/S/ Ivan de Souza Monteiro

|

|

| |

Ivan de Souza Monteiro

Chief Financial Officer and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended (Exchange Act) that are not based on historical facts and are not assurances of future results. These forward-looking statements are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

All forward-looking statements are expressly qualified in their entirety by this cautionary statement, and you should not place reliance on any forward-looking statement contained in this press release. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

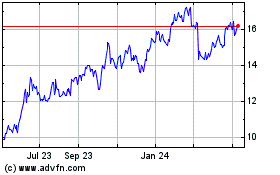

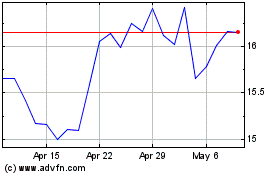

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Apr 2023 to Apr 2024