SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of April 2015

FRESENIUS MEDICAL CARE AG & Co. KGaA

(Translation of registrant’s name into English)

Else-Kröner Strasse 1

61346 Bad Homburg

Germany

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82

On April 29, 2015 Fresenius Medical Care AG & Co. KGaA (the “Company”) issued an Investor News announcing its first quarter results for the period ending March 31, 2015. A copy of the Investor News is furnished as Exhibit 99.1.

The attached Investor News contains non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of a company’s performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with generally accepted accounting principles. To supplement our first quarter 2015 consolidated financial results presented in accordance with Generally Accepted Accounting Principles in the United States, or GAAP, we have used non-GAAP financial measure of (a) EBITDA, or operating income excluding interest, taxes, depreciation and amortization, and (b) free cash flow. These non-GAAP measures are provided to enhance the user’s overall understanding of our current financial performance and our prospects for the future. In addition, because we have historically reported certain non-GAAP financial measures in our financial results, we believe the inclusion of these non-GAAP financial measures provides consistency and comparability in our financial reporting to prior periods for which these non-GAAP financial measures were previously reported. These non-GAAP financial measures should not be used as a substitute for or be considered superior to GAAP financial measures. Reconciliation of the non-GAAP financial measures to the most comparable GAAP financial measures are included in the attached Investor News in a separate statement setting forth the reconciliation and in the Cash Flow Statement.

The Exhibit attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, regardless of any general incorporation language in such filing.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

DATE: April 30, 2015

|

|

FRESENIUS MEDICAL CARE AG & Co. KGaA, |

|

|

a partnership limited by shares, represented by: |

|

|

|

|

|

FRESENIUS MEDICAL CARE MANAGEMENT AG, its |

|

|

General Partner |

|

|

|

|

|

|

|

|

By: |

/s/ RICE POWELL |

|

|

|

|

|

|

|

Name: |

Rice Powell |

|

|

|

|

|

|

|

|

Title: |

Chief Executive Officer and |

|

|

|

Chairman of the Management Board |

|

|

|

of the General Partner |

|

|

|

|

|

|

|

|

|

By: |

/s/ MICHAEL BROSNAN |

|

|

|

|

|

|

|

Name: |

Michael Brosnan |

|

|

|

|

|

|

|

|

Title: |

Chief Financial Officer and |

|

|

|

|

Member of the Management Board |

|

|

|

|

of the General Partner |

|

|

|

|

|

3

Exhibit 99.1

April 29, 2015

INVESTOR

NEWS

Fresenius Medical Care reports

first quarter 2015 results and confirms guidance for full year 2015

· First quarter performance fully on track to achieve full year guidance

· Strong revenue and earnings growth

· Strong cash flow generation

· Segment structure changed and additional disclosures for Care Coordination

First quarter 2015 key figures:

|

Net revenue |

|

$ |

3,960 million |

|

+11 |

% |

|

Operating income (EBIT) |

|

$ |

504 million |

|

+13 |

% |

|

Net income1 |

|

$ |

210 million |

|

+2 |

% |

|

Basic earnings per share |

|

$ |

0.69 |

|

+1 |

% |

Rice Powell, chief executive officer of Fresenius Medical Care stated: “Our first quarter 2015 results show a positive start into the year. We are pleased with our revenue and earnings growth. We have made good progress on our Care Coordination business and will make operating cost investments in this area in 2015 for future growth. Our performance is in line with our full year guidance for 2015 and we are on track to achieve our long-term targets”.

First quarter 2015

Revenue

Net revenue for the first quarter of 2015 increased by 11% to $3,960 million (+17% at constant currency) as compared to the first quarter of 2014. Organic revenue growth worldwide was 7%. Net Health Care revenue grew by 14% to $3,182 million (+18% at constant currency). The dialysis product revenue of $778 million remained on a similar level as compared to the first quarter of 2014 solely due to negative currency developments. On a constant currency basis the dialysis product revenue increased by +11%.

North America revenue for the first quarter of 2015 increased by 16% to $2,771 million. Organic revenue growth was 6%. Net Health Care revenue grew by 17% to $2,571 million with

1 attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

2

a same market treatment growth of 4%. Net Dialysis Care revenue increased by 4% to $2,137 million while the Care Coordination revenue increased by 191% to $434 million (organic growth of 39%). Dialysis product revenue increased by 4% to $200 million as compared to the first quarter of 2014.

International revenue increased by 2% to $1,180 million. On a constant currency basis revenue increased 18%. Organic revenue growth was 10%. Net Health Care revenue increased by 5% to $611 million (+24% at constant currency). Dialysis product revenue decreased by 2% to $569 million (+13% at constant currency).

Earnings

Operating income (EBIT) increased by 13% from $445 million in the first quarter of 2014 to $504 million in the first quarter of 2015. Delivered EBIT (operating income less noncontrolling interests)2 increased 12% to $450 million.

Operating income for North America for the first quarter of 2015 was $340 million, an increase of 1% as compared to the first quarter of 2014. Delivered EBIT decreased 3% to $288 million.

In the International segment, operating income for the first quarter of 2015 increased by 35% to $244 million as compared to $180 million in the first quarter of 2014.

Net interest expense for the first quarter of 2015 was $102 million as compared to $96 million in the first quarter of 2014 which mainly reflects the financing costs of the acquisitions made in the second half of 2014.

Income tax expense was $138 million for the first quarter of 2015, which translates into an effective tax rate of 34.3%. This compares to income tax expense of $102 million and a tax rate of 29.1% for the first quarter of 2014. Adjusted for the positive impact of a German tax audit the tax rate would have been 33.6% in the first quarter 2014.

Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA for the first quarter of 2015 was $210 million, an increase of 2% compared to $205 million for the first quarter of 2014.

2 Approximates the operating income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA.

3

Basic earnings per share (EPS) for the first quarter of 2015 was $0.69, an increase of 1% compared to the corresponding number for the first quarter of 2014. The weighted average number of shares outstanding for the first quarter of 2015 was approximately 303.7 million shares, compared to approximately 301.5 million shares for the first quarter of 2014. The increase in shares outstanding resulted from stock option exercises during the first quarter of 2015.

Cash flow

In the first quarter of 2015, the company generated $447 million in net cash provided by operating activities, representing 11% of revenue, compared to the corresponding figure of last year ($112 million).

A total of $197 million was spent for capital expenditures, net of disposals. Free cash flow was $250 million compared to a negative $85 million in the first quarter of 2014.

A total of $11 million in cash was spent for acquisitions, net of divestitures. Free cash flow after investing activities was $239 million as compared to a negative $220 million in the first quarter of 2014.

Employees

As of March 31, 2015, Fresenius Medical Care had 101,543 employees (full-time equivalents) worldwide, compared to 91,542 employees at the end of March 2014. This increase of ~10,000 employees was mainly attributable to acquisitions as well as our continued organic growth.

4

Balance sheet structure

The company´s total assets were $25,107 million (Dec. 31, 2014: $25,447 million), a decrease of 1%. Current assets decreased by 2% to $6,599 million (Dec. 31, 2014: $6,725 million). Non-current assets were $18,508 million (Dec. 31, 2014: $18,722 million), a decrease of 1%. Total equity increased by 1% to $10,139 million (Dec. 31, 2014: $10,028 million). The equity ratio was 40% as compared to 39% at the end of 2014. Total debt was $9,052 million (Dec. 31, 2014: $9,532 million). As of March 31, 2015, the debt/EBITDA ratio was 2.9 (Dec. 31, 2014: 3.1).

Please refer to the attachments for a complete overview of the results for the first quarter 2015 and the reconciliation of non-GAAP financial measures included in this release to the most comparable GAAP financial measures.

Outlook 3 confirmed

For the 2015 outlook the company expects revenue to grow at 5-7%, which at constant currency is a growth rate of 10-12%. Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA is expected to increase by 0—5% in 2015.

The company expects to spend around $1.0 billion on capital expenditures and around $400 million on acquisitions in 2015. The debt/EBITDA ratio is expected to be around 3.0 by the end of 2015.

For the 2016 projections we expect revenue to increase 9—12% and net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA to grow by 15—20%.

As disclosed in the company’s long-term target for 2020, the company expects revenue to grow at an average annual growth rate of approx. 10% and net income attributable to shareholders in the high single digits.

3 The original outlook/projection provided for 2015/2016 is based on exchange rates prevailing at the beginning of 2015. Savings from the global efficiency program are included, while potential acquisitions are not. In addition the outlook reflects further operating cost investments within the Care Coordination business for future growth in line with our 2020 strategy.

5

Conference call

Fresenius Medical Care will hold a conference call to discuss the results of the first quarter 2015 on Thursday, April 30, 2015 at 3.30 p.m. CEDT/ 9.30 a.m. EDT. The company invites investors to follow the live webcast of the call at the company’s website www.freseniusmedicalcare.com in the “Investors/Events” section. A replay will be available shortly after the call.

Fresenius Medical Care is the world’s largest integrated provider of products and services for individuals undergoing dialysis because of chronic kidney failure, a condition that affects more than 2.6 million individuals worldwide. Through its network of 3,396 dialysis clinics in North America, Europe, Latin America, Asia-Pacific and Africa, Fresenius Medical Care provides dialysis treatments for 286,768 patients around the globe. Fresenius Medical Care is also the world’s leading provider of dialysis products such as hemodialysis machines, dialyzers and related disposable products.

For more information about Fresenius Medical Care, visit the company’s website at www.freseniusmedicalcare.com.

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA’s reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

6

Please note: In 2015, we aligned the disclosure of segments to reflect changes in the way we manage our business. The former International segment is now sub-divided in EMEA (Europe, Middle East, Africa) segment, Asia-Pacific segment and Latin America segment.

Statement of earnings

|

|

|

Three months ended

March 31 |

|

|

in US$ million, except share data, unaudited |

|

2015 |

|

2014 |

|

Change |

|

|

|

|

|

|

|

|

|

|

|

Health Care revenue |

|

3,289 |

|

2,845 |

|

15.6 |

% |

|

Less: patient service bad debt provision |

|

107 |

|

63 |

|

68.6 |

% |

|

Net Health Care revenue |

|

3,182 |

|

2,782 |

|

14.4 |

% |

|

Dialysis products revenue |

|

778 |

|

782 |

|

-0.5 |

% |

|

Total net revenue |

|

3,960 |

|

3,564 |

|

11.1 |

% |

|

|

|

|

|

|

|

|

|

|

Costs of revenue |

|

2,776 |

|

2,482 |

|

11.9 |

% |

|

Gross profit |

|

1,184 |

|

1,082 |

|

9.4 |

% |

|

Selling, general and administrative |

|

655 |

|

620 |

|

5.7 |

% |

|

Research and development |

|

31 |

|

30 |

|

3.0 |

% |

|

Income from equity method investees |

|

(6 |

) |

(13 |

) |

-50.5 |

% |

|

Operating income (EBIT) |

|

504 |

|

445 |

|

13.4 |

% |

|

|

|

|

|

|

|

|

|

|

Interest income |

|

(60 |

) |

(16 |

) |

288.8 |

% |

|

Interest expense |

|

162 |

|

112 |

|

45.1 |

% |

|

Interest expense, net |

|

102 |

|

96 |

|

6.1 |

% |

|

Income before taxes |

|

402 |

|

349 |

|

15.4 |

% |

|

Income tax expense |

|

138 |

|

102 |

|

36.1 |

% |

|

Net income |

|

264 |

|

247 |

|

6.9 |

% |

|

Less: Net income attributable to noncontrolling interests |

|

54 |

|

42 |

|

31.0 |

% |

|

Net income attributable to shareholders of FMC AG & Co. KGaA |

|

210 |

|

205 |

|

2.0 |

% |

|

|

|

|

|

|

|

|

|

|

Operating income (EBIT) |

|

504 |

|

445 |

|

13.4 |

% |

|

Depreciation and amortization |

|

176 |

|

167 |

|

5.2 |

% |

|

EBITDA |

|

680 |

|

612 |

|

11.1 |

% |

|

EBITDA margin |

|

17.2 |

% |

17.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares |

|

|

|

|

|

|

|

|

Ordinary shares |

|

303,683,075 |

|

301,491,046 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share |

|

$ |

0.69 |

|

$ |

0.68 |

|

1.3 |

% |

|

Basic earnings per ADS |

|

$ |

0.35 |

|

$ |

0.34 |

|

1.3 |

% |

|

|

|

|

|

|

|

|

|

|

In percent of revenue |

|

|

|

|

|

|

|

|

Cost of revenue |

|

70.1 |

% |

69.6 |

% |

|

|

|

Gross profit |

|

29.9 |

% |

30.4 |

% |

|

|

|

Operating income (EBIT) |

|

12.7 |

% |

12.5 |

% |

|

|

|

Net income attributable to shareholders of FMC AG & Co. KGaA |

|

5.3 |

% |

5.8 |

% |

|

|

7

Segment and other information

|

|

|

Three months ended

March 31 |

|

|

unaudited |

|

2015 |

|

2014 |

|

Change |

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

Revenue in US$ million |

|

3,960 |

|

3,564 |

|

11.1 |

% |

|

Operating income (EBIT) in US$ million |

|

504 |

|

445 |

|

13.4 |

% |

|

Operating income margin in % |

|

12.7 |

% |

12.5 |

% |

|

|

|

Delivered EBIT in US$ million |

|

450 |

|

403 |

|

11.5 |

% |

|

Days sales outstanding (DSO) |

|

71 |

|

74 |

|

|

|

|

Employees (full-time equivalents) |

|

101,543 |

|

91,542 |

|

|

|

|

|

|

|

|

|

|

|

|

|

North America |

|

|

|

|

|

|

|

|

Revenue in US$ million |

|

2,771 |

|

2,393 |

|

15.8 |

% |

|

Operating income (EBIT) in US$ million |

|

340 |

|

336 |

|

1.3 |

% |

|

Operating income margin in % |

|

12.3 |

% |

14.0 |

% |

|

|

|

Delivered EBIT in US$ million |

|

288 |

|

295 |

|

-2.6 |

% |

|

Days sales outstanding (DSO) |

|

52 |

|

56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. |

|

|

|

|

|

|

|

|

Revenue per dialysis treatment in US$ |

|

341 |

|

339 |

|

0.7 |

% |

|

Cost per dialysis treatment in US$ |

|

288 |

|

285 |

|

1.3 |

% |

|

|

|

|

|

|

|

|

|

|

International |

|

|

|

|

|

|

|

|

Revenue in US$ million |

|

1,180 |

|

1,161 |

|

1.6 |

% |

|

Operating income (EBIT) in US$ million |

|

244 |

|

180 |

|

35.0 |

% |

|

Operating income margin in % |

|

20.6 |

% |

15.5 |

% |

|

|

|

Delivered EBIT in US$ million |

|

242 |

|

179 |

|

35.0 |

% |

|

Days sales outstanding (DSO) |

|

114 |

|

107 |

|

|

|

|

|

|

|

|

|

|

|

|

|

EMEA |

|

|

|

|

|

|

|

|

Revenue in US$ million |

|

629 |

|

732 |

|

-14.1 |

% |

|

Operating income (EBIT) in US$ million |

|

141 |

|

128 |

|

10.5 |

% |

|

Operating income margin in % |

|

22.5 |

% |

17.5 |

% |

|

|

|

Delivered EBIT in US$ million |

|

141 |

|

127 |

|

10.6 |

% |

|

Days sales outstanding (DSO) |

|

110 |

|

97 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Asia-Pacific |

|

|

|

|

|

|

|

|

Revenue in US$ million |

|

353 |

|

243 |

|

45.4 |

% |

|

Operating income (EBIT) in US$ million |

|

85 |

|

33 |

|

147.9 |

% |

|

Operating income margin in % |

|

23.9 |

% |

14.0 |

% |

|

|

|

Delivered EBIT in US$ million |

|

83 |

|

33 |

|

150.5 |

% |

|

Days sales outstanding (DSO) |

|

112 |

|

123 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Latin America |

|

|

|

|

|

|

|

|

Revenue in US$ million |

|

198 |

|

186 |

|

6.5 |

% |

|

Operating income (EBIT) in US$ million |

|

18 |

|

19 |

|

-3.8 |

% |

|

Operating income margin in % |

|

9.0 |

% |

10.0 |

% |

|

|

|

Delivered EBIT in US$ million |

|

18 |

|

19 |

|

-3.6 |

% |

|

Days sales outstanding (DSO) |

|

133 |

|

123 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate |

|

|

|

|

|

|

|

|

Revenue in US$ million |

|

9 |

|

10 |

|

-12.9 |

% |

|

Operating income (EBIT) in US$ million |

|

(80 |

) |

(71 |

) |

11.5 |

% |

|

Delivered EBIT in US$ million |

|

(80 |

) |

(71 |

) |

11.7 |

% |

8

Balance sheet

|

|

|

March 31 |

|

December 31 |

|

|

in US$ million, except debt/EBITDA ratio |

|

2015 |

|

2014 |

|

|

|

|

(unaudited) |

|

(audited) |

|

|

Assets |

|

|

|

|

|

|

Current assets |

|

6,599 |

|

6,725 |

|

|

Goodwill and Intangible assets |

|

13,879 |

|

13,951 |

|

|

Other non-current assets |

|

4,629 |

|

4,771 |

|

|

Total assets |

|

25,107 |

|

25,447 |

|

|

|

|

|

|

|

|

|

Liabilities and equity |

|

|

|

|

|

|

Current liabilities |

|

3,546 |

|

3,477 |

|

|

Long-term liabilities |

|

10,595 |

|

11,117 |

|

|

Noncontrolling interests subject to put provisions |

|

827 |

|

825 |

|

|

Total equity |

|

10,139 |

|

10,028 |

|

|

Total liabilities and equity |

|

25,107 |

|

25,447 |

|

|

|

|

|

|

|

|

|

Equity/assets ratio |

|

40 |

% |

39 |

% |

|

|

|

|

|

|

|

|

Debt |

|

|

|

|

|

|

Short-term borrowings |

|

118 |

|

133 |

|

|

Short-term borrowings from related parties |

|

25 |

|

5 |

|

|

Current portion of long-term debt and capital lease obligations |

|

307 |

|

314 |

|

|

Long-term debt and capital lease obligations, less current portion |

|

8,602 |

|

9,080 |

|

|

Total debt |

|

9,052 |

|

9,532 |

|

|

|

|

|

|

|

|

|

Debt/EBITDA ratio |

|

2.9 |

|

3.1 |

|

Cash flow statement

|

|

|

Three months ended

March 31 |

|

|

in US$ million, unaudited |

|

2015 |

|

2014 |

|

|

Operating activities |

|

|

|

|

|

|

Net income |

|

264 |

|

247 |

|

|

Depreciation / amortization |

|

176 |

|

167 |

|

|

Change in working capital and other non-cash items |

|

7 |

|

(302 |

) |

|

Net cash provided by operating activities |

|

447 |

|

112 |

|

|

In percent of revenue |

|

11.3 |

% |

3.2 |

% |

|

|

|

|

|

|

|

|

Investing activities |

|

|

|

|

|

|

Purchases of property, plant and equipment |

|

(201 |

) |

(200 |

) |

|

Proceeds from sale of property, plant and equipment |

|

4 |

|

3 |

|

|

Capital expenditures, net |

|

(197 |

) |

(197 |

) |

|

|

|

|

|

|

|

|

Free cash flow |

|

250 |

|

(85 |

) |

|

In percent of revenue |

|

6.3 |

% |

-2.4 |

% |

|

|

|

|

|

|

|

|

Acquisitions, net of cash acquired, and purchases of intangible assets |

|

(22 |

) |

(137 |

) |

|

Proceeds from divestitures |

|

11 |

|

2 |

|

|

Acquisitions, net of divestitures |

|

(11 |

) |

(135 |

) |

|

Free cash flow after investing activities |

|

239 |

|

(220 |

) |

9

Revenue development

|

in US$ million, unaudited |

|

2015 |

|

2014 |

|

Change |

|

Change

at cc |

|

Organic

growth |

|

Same

market

treatment

growth1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended March 31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

|

3,960 |

|

3,564 |

|

11.1 |

% |

16.6 |

% |

7.4 |

% |

|

|

|

Net Health Care |

|

3,182 |

|

2,782 |

|

14.4 |

% |

18.3 |

% |

6.7 |

% |

3.9 |

% |

|

Dialysis products |

|

778 |

|

782 |

|

0 |

% |

10.5 |

% |

10.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North America |

|

2,771 |

|

2,393 |

|

15.8 |

% |

15.8 |

% |

6.4 |

% |

|

|

|

Net Health Care |

|

2,571 |

|

2,201 |

|

16.8 |

% |

16.8 |

% |

6.6 |

% |

3.6 |

% |

|

Thereof Net Care Coordination revenue |

|

434 |

|

149 |

|

190.8 |

% |

190.8 |

% |

39.1 |

% |

|

|

|

Thereof Net Dialysis Care revenue |

|

2,137 |

|

2,052 |

|

4.2 |

% |

4.2 |

% |

4.2 |

% |

3.6 |

% |

|

Dialysis products |

|

200 |

|

192 |

|

4.1 |

% |

4.1 |

% |

4.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

International |

|

1,180 |

|

1,161 |

|

1.6 |

% |

18.2 |

% |

9.7 |

% |

|

|

|

Net Health Care |

|

611 |

|

581 |

|

5.1 |

% |

23.7 |

% |

7.3 |

% |

4.3 |

% |

|

Dialysis products |

|

569 |

|

580 |

|

-1.8 |

% |

12.7 |

% |

12.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMEA |

|

629 |

|

732 |

|

-14.1 |

% |

4.5 |

% |

4.6 |

% |

|

|

|

Net Health Care |

|

301 |

|

357 |

|

-15.7 |

% |

3.5 |

% |

3.8 |

% |

4.2 |

% |

|

Dialysis products |

|

328 |

|

375 |

|

-12.6 |

% |

5 |

% |

5.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asia-Pacific |

|

353 |

|

243 |

|

45.4 |

% |

55.6 |

% |

17.7 |

% |

|

|

|

Net Health Care |

|

164 |

|

88 |

|

86.4 |

% |

106.2 |

% |

5.7 |

% |

2.7 |

% |

|

Dialysis products |

|

189 |

|

155 |

|

22.1 |

% |

26.9 |

% |

24.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Latin America |

|

198 |

|

186 |

|

6.5 |

% |

23.4 |

% |

19.0 |

% |

|

|

|

Net Health Care |

|

146 |

|

136 |

|

7.1 |

% |

23.4 |

% |

17.1 |

% |

5.4 |

% |

|

Dialysis products |

|

52 |

|

50 |

|

4.9 |

% |

23.2 |

% |

24.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate |

|

9 |

|

10 |

|

-12.9 |

% |

5.8 |

% |

|

|

|

|

1 same market treatment growth = organic growth less price effects

cc = constant currency. Changes in revenue include the impact of changes in foreign currency exchange rates. We use the non-GAAP financial measure at Constant Exchange Rates or Constant Currency to show changes in our revenue without giving effect to period-to-period currency fluctuations. Under U.S. GAAP, revenues received in local (non-U.S. dollar) currency are translated into U.S. dollars at the average exchange rate for the period presented. Once we translate the current period local currency revenues for the Constant Currency, we then calculate the change, as a percentage, of the current period revenues using the prior period exchange rates versus the prior period revenues. This resulting percentage is a non-GAAP measure referring to a percentage change at Constant Currency.

We believe that revenue growth is a key indication of how a company is progressing from period to period and that the non-GAAP financial measure Constant Currency is useful to investors, lenders, and other creditors because such information enables them to gauge the impact of currency fluctuations on a company’s revenue from period to period. However, we also believe that the usefulness of data on Constant Currency period-over-period changes is subject to limitations, particularly if the currency effects that are eliminated constitute a significant element of our revenue and significantly impact our performance. We therefore limit our use of Constant Currency period-over-period changes to a measure for the impact of currency fluctuations on the translation of local currency revenue into U.S. dollars. We do not evaluate our results and performance without considering both Constant Currency period-over-period changes in non-U.S. GAAP revenue on the one hand and changes in revenue prepared in accordance with U.S. GAAP on the other. We caution the readers of this report to follow a similar approach by considering data on Constant Currency period-over-period changes only in addition to, and not as a substitute for or superior to, changes in revenue prepared in accordance with U.S. GAAP. We present the fluctuation derived from U.S. GAAP revenue next to the fluctuation derived from non-GAAP revenue. Because the reconciliation of non-GAAP to U.S. GAAP measures is inherent in the disclosure, we believe that a separate reconciliation would not provide any additional benefit.

10

Additional information Segment North America

|

|

|

Three months ended

March 31 |

|

|

unaudited |

|

2015 |

|

2014 |

|

Change |

|

|

|

|

|

|

|

|

|

|

|

Care Coordination |

|

|

|

|

|

|

|

|

Net revenue in US$ million |

|

434 |

|

149 |

|

190.8 |

% |

|

Operating income (EBIT) in US$ million |

|

15 |

|

13 |

|

20.5 |

% |

|

Operating income margin in % |

|

3.5 |

% |

8.6 |

% |

|

|

|

Delivered EBIT |

|

6 |

|

10 |

|

-44.6 |

% |

|

|

|

|

|

|

|

|

|

|

Dialysis |

|

|

|

|

|

|

|

|

Net revenue in US$ million |

|

2,337 |

|

2,244 |

|

4.2 |

% |

|

Operating income (EBIT) in US$ million |

|

325 |

|

323 |

|

0.6 |

% |

|

Operating income margin in % |

|

13.9 |

% |

14.4 |

% |

|

|

|

Delivered EBIT |

|

282 |

|

285 |

|

-1.1 |

% |

Key metrics Dialysis Care Services

|

|

|

Three months ended March 31, 2015 |

|

|

unaudited |

|

Clinics |

|

Growth

in % |

|

De novos |

|

Patients |

|

Growth

in % |

|

Treatments |

|

Growth

in % |

|

|

Total |

|

3,396 |

|

4 |

% |

42 |

|

286,768 |

|

6 |

% |

10,771,402 |

|

7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North America |

|

2,189 |

|

2 |

% |

32 |

|

176,326 |

|

3 |

% |

6,634,922 |

|

4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMEA |

|

643 |

|

1 |

% |

8 |

|

52,790 |

|

1 |

% |

1,989,057 |

|

2 |

% |

|

Asia-Pacific |

|

318 |

|

26 |

% |

2 |

|

25,684 |

|

42 |

% |

919,163 |

|

38 |

% |

|

Latin America |

|

246 |

|

6 |

% |

— |

|

31,968 |

|

10 |

% |

1,228,260 |

|

11 |

% |

Key metrics Care Coordination

|

|

|

Three months ended March 31 |

|

|

unaudited |

|

2015 |

|

2014 |

|

Growth

in % |

|

|

North America |

|

|

|

|

|

|

|

|

Member months under medical cost management |

|

4,268 |

|

1,790 |

|

138 |

% |

|

Medical cost under management (in US$) |

|

35,981,554 |

|

15,505,840 |

|

132 |

% |

|

Care Coordination patient encounters |

|

1,272,052 |

|

79,396 |

|

1502 |

% |

11

Member Months Under Medical Cost Management

Member months under medical cost management is calculated by multiplying the number of members who are included in value and risk-based reimbursement programs, such as Medicare Advantage plans or other value-based programs in the U.S., by the corresponding number of months these members participate in those programs (“Member Months”). An increase in patient membership may indicate future earnings or losses as our performance is determined through these managed care programs.

Medical Cost Under Management

Medical cost under management represents the management of medical costs associated with our patient membership in value and risk-based programs. For ESCO, BPCI and other shared savings programs, this is calculated by multiplying the Member Months in each program by the benchmark of expected medical cost per member per month. The sub-capitation and MA-CSNPs calculation multiplies the premium per member of the program per month by the number of Member Months associated with the plan, as noted above.

Care Coordination Patient Encounters

Care Coordination patient encounters represents the total patient encounters and procedures conducted by certain of our Care Coordination activities. Specifically, Care Coordination Patient Encounters is the sum of all encounters and procedures completed during the period by Sound Inpatient Physicians, Inc (“Sound”), MedSpring Urgent Care (“MedSpring”), Fresenius Vascular Care, and National Cardiovascular Partners (“NCP”) as well as patients in our Fresenius Medical Care Rx Bone Mineral Metabolism program.

Quality data

|

|

|

North America |

|

EMEA |

|

Latin America |

|

Asia-Pacific |

|

|

in % of patients |

|

Q1 2015 |

|

Q4 2014 |

|

Q1 2015 |

|

Q4 2014 |

|

Q1 2015 |

|

Q4 2014 |

|

Q1 2015 |

|

Q4 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Clinical Performance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Single Pool Kt/v > 1.2 |

|

97 |

|

96 |

|

96 |

|

96 |

|

80 |

|

80 |

|

97 |

|

97 |

|

|

No catheter (> 90 days) |

|

85 |

|

83 |

|

83 |

|

83 |

|

82 |

|

82 |

|

92 |

|

92 |

|

|

Hemoglobin = 10-12 g/dl |

|

72 |

|

74 |

|

76 |

|

77 |

|

50 |

|

50 |

|

59 |

|

60 |

|

|

Hemoglobin = 10-13 g/dl |

|

77 |

|

80 |

|

77 |

|

77 |

|

65 |

|

66 |

|

67 |

|

69 |

|

|

Albumin > 3.5 g/dl1) |

|

83 |

|

83 |

|

91 |

|

92 |

|

89 |

|

90 |

|

91 |

|

91 |

|

|

Phosphate < 5.5 mg/dl |

|

64 |

|

64 |

|

79 |

|

79 |

|

74 |

|

75 |

|

68 |

|

70 |

|

|

Calcium = 8.4-10.2 mg/dl |

|

84 |

|

85 |

|

75 |

|

76 |

|

76 |

|

76 |

|

75 |

|

76 |

|

|

Hospitalization days |

|

9.0 |

|

9.1 |

|

9.6 |

|

9.4 |

|

3.2 |

|

3.2 |

|

4.2 |

|

4.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demographics |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average age (in years) |

|

62 |

|

62 |

|

65 |

|

64 |

|

58 |

|

58 |

|

64 |

|

64 |

|

|

Average time on dialysis (in years) |

|

4.1 |

|

4.0 |

|

5.5 |

|

5.5 |

|

4.9 |

|

5.9 |

|

4.8 |

|

4.9 |

|

|

Average body weight (in kg) |

|

82 |

|

82 |

|

72 |

|

72 |

|

68 |

|

68 |

|

60 |

|

60 |

|

|

Prevalence of diabetes (in%) |

|

60 |

|

60 |

|

28 |

|

28 |

|

19 |

|

19 |

|

40 |

|

39 |

|

1) International standard BCR CRM470

12

Reconciliation of non U.S. GAAP financial measures to the most directly comparable U.S. GAAP financial measures

|

|

|

Three months ended

March 31 |

|

|

in US$ million, unaudited |

|

2015 |

|

2014 |

|

|

Delivered EBIT reconciliation |

|

|

|

|

|

|

Total |

|

|

|

|

|

|

Operating income (EBIT) |

|

504 |

|

445 |

|

|

less noncontrolling interests |

|

(54 |

) |

(42 |

) |

|

Delivered EBIT |

|

450 |

|

403 |

|

|

|

|

|

|

|

|

|

North America |

|

|

|

|

|

|

Operating income (EBIT) |

|

340 |

|

336 |

|

|

less noncontrolling interests |

|

(52 |

) |

(41 |

) |

|

Delivered EBIT |

|

288 |

|

295 |

|

|

|

|

|

|

|

|

|

Care Coordination |

|

|

|

|

|

|

Operating income (EBIT) |

|

15 |

|

13 |

|

|

less noncontrolling interests |

|

(9 |

) |

(3 |

) |

|

Delivered EBIT |

|

6 |

|

10 |

|

|

|

|

|

|

|

|

|

Dialysis |

|

|

|

|

|

|

Operating income (EBIT) |

|

325 |

|

323 |

|

|

less noncontrolling interests |

|

(43 |

) |

(38 |

) |

|

Delivered EBIT |

|

282 |

|

285 |

|

|

|

|

|

|

|

|

|

International |

|

|

|

|

|

|

Operating income (EBIT) |

|

244 |

|

180 |

|

|

less noncontrolling interests |

|

(2 |

) |

(1 |

) |

|

Delivered EBIT |

|

242 |

|

179 |

|

|

|

|

|

|

|

|

|

EMEA |

|

|

|

|

|

|

Operating income (EBIT) |

|

141 |

|

128 |

|

|

less noncontrolling interests |

|

— |

|

(1 |

) |

|

Delivered EBIT |

|

141 |

|

127 |

|

|

|

|

|

|

|

|

|

Asia-Pacific |

|

|

|

|

|

|

Operating income (EBIT) |

|

85 |

|

33 |

|

|

less noncontrolling interests |

|

(2 |

) |

— |

|

|

Delivered EBIT |

|

83 |

|

33 |

|

|

|

|

|

|

|

|

|

Latin America |

|

|

|

|

|

|

Operating income (EBIT) |

|

18 |

|

19 |

|

|

less noncontrolling interests |

|

— |

|

— |

|

|

Delivered EBIT |

|

18 |

|

19 |

|

|

|

|

|

|

|

|

|

Corporate |

|

|

|

|

|

|

Operating income (EBIT) |

|

(80 |

) |

(71 |

) |

|

less noncontrolling interests |

|

— |

|

— |

|

|

Delivered EBIT |

|

(80 |

) |

(71 |

) |

|

|

|

|

|

|

|

|

Reconciliation of net cash provided by operating activities to EBITDA1) |

|

|

|

|

|

|

Total EBITDA |

|

680 |

|

612 |

|

|

Interest expense, net |

|

(102 |

) |

(96 |

) |

|

Income tax expense |

|

(138 |

) |

(102 |

) |

|

Change in working capital and other non-cash items |

|

7 |

|

(302 |

) |

|

Net cash provided by operating activities |

|

447 |

|

112 |

|

|

|

|

|

|

|

|

|

Annualized EBITDA2) |

|

|

|

|

|

|

Operating income (EBIT) |

|

2,373 |

|

2,208 |

|

|

Depreciation and amortization |

|

719 |

|

659 |

|

|

Non-cash charges |

|

62 |

|

67 |

|

|

Annualized EBITDA |

|

3,154 |

|

2,934 |

|

1) EBITDA is the basis for determining compliance with certain covenants in Fresenius Medical Care’s long-term debt instruments.

2) EBITDA: including largest acquisitions

13

Disclosure Changes

|

Old |

|

New |

|

|

|

|

|

|

|

|

|

1.) Segment reporting |

|

|

|

|

|

|

|

|

|

|

|

Total |

|

Total |

|

Plus delivered EBIT |

|

Revenue |

|

Revenue |

|

|

Operating income (EBIT) |

|

Operating income (EBIT) |

|

|

Operating income margin |

|

Operating income margin |

|

|

./. |

|

Delivered EBIT |

|

|

Days sales outstanding (DSO) |

|

Days sales outstanding (DSO) |

|

|

Employees (full-time equivalents) |

|

Employees (full-time equivalents) |

|

|

|

|

|

|

|

|

North America |

|

North America |

|

|

|

Revenue |

|

Revenue |

|

Changes in data in North America (no revenue & cost per treatment, but delivered EBIT) |

|

Operating income (EBIT) |

|

Operating income (EBIT) |

|

|

Operating income margin |

|

Operating income margin |

|

|

./. |

|

Delivered EBIT |

|

|

Revenue per treatment |

|

./. |

|

|

Cost per treatment |

|

./. |

|

|

Days sales outstanding |

|

Days sales outstanding (DSO) |

|

|

|

|

|

|

|

|

U.S. |

|

U.S. |

|

Now revenue/tmt only reflecting the dialysis treatments |

|

Revenue per treatment |

|

Revenue per dialysis treatment |

|

|

Cost per treatment |

|

Cost per dialysis treatment |

|

|

|

|

|

|

|

|

International |

|

EMEA |

|

|

|

Revenue |

|

Revenue |

|

The segment International is now sub-divided into the segments EMEA, Asia-Pacific and Latin America (excluding revenue per treatment, including delivered EBIT) to reflect changes in the way we manage our business. |

|

Operating income (EBIT) |

|

Operating income (EBIT) |

|

|

Operating income margin |

|

Operating income margin |

|

|

./. |

|

Delivered EBIT |

|

|

Days sales outstanding (DSO) |

|

Days sales outstanding (DSO) |

|

|

Revenue per treatment |

|

./. |

|

|

|

|

|

|

|

|

|

Asia-Pacific |

|

|

|

|

Revenue |

|

|

|

|

Operating income (EBIT) |

|

|

|

|

Operating income margin |

|

|

|

|

Delivered EBIT |

|

|

|

|

Days sales outstanding (DSO) |

|

|

|

|

|

|

|

|

|

Latin America |

|

|

|

|

Revenue |

|

14

|

|

|

Operating income (EBIT) |

|

|

|

|

|

Operating income margin |

|

|

|

|

|

Delivered EBIT |

|

|

|

|

|

Days sales outstanding (DSO) |

|

|

|

|

|

|

|

|

|

Corporate |

|

Corporate |

|

|

|

Revenue |

|

Revenue |

|

Plus delivered EBIT so that delivered EBIT adds up |

|

Operating income |

|

Operating income (EBIT) |

|

|

./. |

|

Delivered EBIT |

|

|

|

|

|

|

|

|

2.) Additional information North America segment: |

|

|

|

|

|

|

|

|

|

North America |

|

North America |

|

|

|

Dialysis products revenue |

|

Dialysis products revenue |

|

Further breakdown of Revenue, Operating Income (EBIT) and delivered EBIT into Care Coordination and Dialysis |

|

Net Health Care revenue |

|

Net Health Care revenue |

|

|

-Thereof Care Coordination revenue |

|

-Thereof Net Care Coordination revenue |

|

|

-Thereof Net Dialysis Care revenue |

|

-Thereof Net Dialysis Care revenue |

|

|

|

|

|

|

|

./. |

|

Net Care Coordination revenue |

|

|

./. |

|

Net Dialysis revenue |

|

|

|

|

|

|

|

Operating income (EBIT) |

|

Operating income (EBIT) |

|

|

./. |

|

-Care Coordination operating income (EBIT) |

|

|

./. |

|

-Dialysis operating income (EBIT) |

|

|

|

|

|

|

|

Operating income margin |

|

Operating income margin |

|

|

./. |

|

-Care Coordination operating income margin |

|

|

./. |

|

-Dialysis operating income margin |

|

|

|

|

|

|

|

./. |

|

Delivered EBIT |

|

|

./. |

|

-Care Coordination Delivered EBIT |

|

|

./. |

|

-Dialysis Delivered EBIT |

|

|

|

|

|

|

|

|

3.) North America Care Coordination - new business metrics: |

|

|

|

|

|

|

|

|

./. |

|

Member months under medical cost management |

|

New business metrics that we think reflect the development of Care Coordination most approriate |

|

./. |

|

Medical cost under management (in US$) |

|

|

./. |

|

Care Coordination patient encounters (in US$) |

|

15

CONTACT

Fresenius Medical Care AG & Co. KGaA

Investor Relations

61352 Bad Homburg v. d. H.

Germany

www.freseniusmedicalcare.com

Oliver Maier

Head of Investor Relations &

Corporate Communications

Tel. +49 6172 609 2601

Fax +49 6172 609 2301

email: ir@fmc-ag.com

Published by

Fresenius Medical Care AG & Co. KGaA

Investor Relations

Annual reports, interim reports and further

information on the company is also available on our website.

Please visit us at www.freseniusmedicalcare.com

For printed material, please contact Investor Relations.

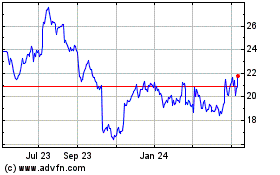

Fresenius Medical Care (NYSE:FMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

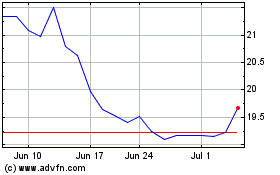

Fresenius Medical Care (NYSE:FMS)

Historical Stock Chart

From Apr 2023 to Apr 2024