SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of April, 2015

Commission File Number 1-15106

PETRÓLEO BRASILEIRO S.A. - PETROBRAS

(Exact name of registrant as specified in its charter)

Brazilian Petroleum Corporation - PETROBRAS

(Translation of Registrant's name into English)

Avenida República do Chile, 65

20031-912 - Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Names of candidates appointed by non-controlling shareholder

to the Board of Directors

Rio de Janeiro, April 10, 2015 - Petróleo Brasileiro S.A. – Petrobras, as stated in Circular Letter CVM/SEP/Nº02/2015, informs that has received appointment of candidates to the Board of Directors (BoD) for the election to be held at the Ordinary General Meeting on April 29, 2015.

Shareholder BRAM – Bradesco Asset Management S.A. Distribuidora de Títulos e Valores Mobiliários is appointing the following candidates:

|

Candidate |

Position |

|

Eduardo Bunker Gentil |

BoD member – Minority common shareholders |

|

Otávio Yazbek |

BoD member – Preferred shareholders |

In accordance to the provision set forth in CVM Instruction No. 481/09, we inform that the above candidates:

· Have not been subject, for the last 5 years, to criminal conviction, conviction in a CVM administrative procedure and unappeallable conviction, within the judicial or administrative scope, which has suspended or disqualified them to perform any professional or commercial activity.

· Do not have any marital relation, stable relation or relatives liable to information as provided for in item 12.9 in the Reference Form.

Find below the resumes of the appointed candidates:

Eduardo Bunker Gentil, American and Brazilian citizen, widow, business manager, RG n° 3361829, CPF n° 001.067.468-39, with address at Praça Libertador Simon Bolívar, 17 – Jardim América, CEP 01436-060, São Paulo – SP.

Board Member: Ecorodovias (since 2012), RBS (since 2014), and Évora (since 2012).

November 2009 – 2015 – Cambridge Family Enterprise Group (Boston). Joined as partner responsible for developing the presence in Brasil. Cambridge Advisors is a consulting group founded by Prof John Davis of Harvard Business School which focuses on the family controlled business systems, and provides high level advisory services to family enterprises across a range of issues, including governance, succession, strategy, financial planning.

2008 – August 2009 - Managing Director – ItaúBBA. Responsible for the Project Finance and M&A areas, following the merger of Itaú and Unibanco. Joined Unibanco in April 2008 to help reposition Unibanco’s investment bank as a separate entity in a partnership structure.

2007-2008: Managing Director/Advisor, Credit Suisse. Joined CS Brasil as senior banker in charge of Financial Institutions Group as well as other key relationships and initiatives.

2004-2007: General Manager Visa do Brasil. Managed Visa do Brasil office and oversaw the Visa investments in Brasil, including Visanet (now called Cielo) and Visa Vale. As General Manager of Visa do Brasil, developed initiatives with the major issuing banks and Visanet to increase the Visa presence; served as chairman of both Visanet and Visa Vale.

2002: Director BNDES (Banco Nacional de Desenvolvimento Economico e Social). Appointed Director in January 2002, responsible for the BNDESPAR and structured finance activity of the BNDES. Led several financial restructurings of major companies during second semester 2002 (Globo, Net, Klabin, Varig, Braskem, CPFL) and served on boards of Klabin, and Net TV on behalf of BNDES as shareholder.

1994-2002: Managing Director, Goldman Sachs. Joined Goldman in 1994 in New York with objective of starting Goldman’s operations in Brasil. Spent two years in NY with GS and returned in 1996 to open the office in Sao Paulo. Responsible for developing the investment banking business and the representative office until 2002. Developed relationships with Brasil´s largest companies, and led several M&A projects. Served on the boards of two private equity investments made by GS (Arisco, Multishopping). During this period the office grew to a full banco multiplo with over 100 people.

1983-1994: Managing Director, JPMorgan. Joined JPMorgan as an associate in 1983, worked in New York for 2 years and returned to Brasil in 1986 to join the recently established corporate finance team. Promoted to Vice President and then to Managing Director in 1993. Worked in New York in 1989 in the US M&A Group in preparation for assuming responsibility of the M&A activity in Brasil. Led this activity from 1990 until 1994.

Education: New York University – MBA – 1983; Princeton University – BA in History and Economics (cum laude) – 1977; Executive courses at Harvard and IBGC. Teaches modules at Insper and IBGC.

Brazilian and US Citizen, Born in 1955 in São Paulo, father of 3 boys.

Otavio Yazbek, Brazilian, married, lawyer, OAB/SP 144506, RG 25.188.557-4, SSP-SP, CPF n° 163.749.928-06, with address at Alameda Jauaperi, 1778, CEP 04523-016, São Paulo – SP.

Lawyer in São Paulo. Former Commissioner of the Securities and Exchange Commission of Brazil (2009-2013). Former Member of the Financial Stability Board’s Standing Committee on Supervisory and Regulatory Cooperation (2009-2013). Former Self-Regulation Director of the BM&FBovespa Supervisão de Mercados (BSM) (2008). Former Regulation Director of the Bolsa de Mercadorias e Futuros (BM&F) (2006-2008). Professor of the Continuing Legal Education and Specialization Program of Fundação Getúlio Vargas School of Law. Holds a Bachelor's degree and a Doctorate in Economic Law by the University of São Paulo. Author of “Regulação do mercado financeiro e de capitais”, currently in its second edition, and of various papers and articles on Corporate Law and financial and capital markets regulation.

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS | Investor Relations Department I e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – B – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies. A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2013, and the Company’s other filings with the U.S. Securities and Exchange Commission.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

PETRÓLEO BRASILEIRO S.A--PETROBRAS |

|

|

|

|

By: |

/S/ Ivan de Souza Monteiro

|

|

| |

Ivan de Souza Monteiro

Chief Financial Officer and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended (Exchange Act) that are not based on historical facts and are not assurances of future results. These forward-looking statements are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

All forward-looking statements are expressly qualified in their entirety by this cautionary statement, and you should not place reliance on any forward-looking statement contained in this press release. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

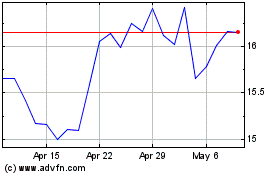

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

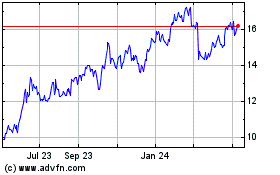

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Apr 2023 to Apr 2024