UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

Under the Securities Exchange Act of 1934

For the month of April, 2015

Cameco

Corporation

(Commission file No. 1-14228)

2121-11th Street West

Saskatoon, Saskatchewan, Canada S7M 1J3

(Address of Principal Executive Offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ¨ Form 40-F x

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No

x

If “Yes” is marked, indicate below the file number assigned to the registrant in

connection with Rule 12g3-2(b):

Exhibit Index

|

|

|

|

|

| Exhibit

No. |

|

Description |

|

Page No. |

|

|

|

| 99.1 |

|

Notice of 2015 Annual Meeting of Shareholders |

|

|

|

|

|

| 99.2 |

|

Cameco Corporation Management Proxy Circular |

|

|

|

|

|

| 99.3 |

|

Cameco Corporation Proxy Form |

|

|

|

|

|

| 99.4 |

|

Cameco Corporation 2014 Annual Report |

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

| Date: April 8, 2015 |

|

|

|

Cameco Corporation |

|

|

|

|

|

|

|

By: |

|

|

|

|

|

|

|

“Sean A. Quinn” |

|

|

|

|

Sean A. Quinn |

|

|

|

|

Senior Vice-President, Chief Legal Officer and Corporate Secretary |

Page 2

Exhibit 99.1

Notice of our 2015 annual meeting of shareholders

You are invited to our 2015 annual meeting:

When

Friday, May 22, 2015

10 a.m.

CST

Where

Cameco Corporation

2121 - 11th Street West

Saskatoon, Saskatchewan

Your vote is important

If you held Cameco common

shares on March 24, 2015, you are entitled to receive notice of and to vote at this meeting.

You can vote in person at the meeting or by proxy.

See pages 5 through 10 of the attached management proxy circular for information about what the meeting will cover, who can vote and how to vote.

By order of the board of directors,

Sean Quinn

Senior Vice-President,

Chief Legal Officer and Corporate Secretary

Saskatoon, Saskatchewan

April 8, 2015

|

|

|

|

|

|

|

|

|

FOR MORE INFORMATION |

|

|

| |

|

|

|

| |

|

Read about the business of the meeting beginning

on page 5 of the attached management proxy circular. |

|

|

| |

|

The deadline for submitting a shareholder

proposal for our 2016 annual meeting is January 11, 2016 and we require advance notice for nominating directors (see page 93 for details). |

|

|

| |

|

Access our 2014 annual report and other documents

online: |

|

|

| |

|

· cameco.com |

|

|

| |

|

· sedar.com (SEDAR) |

|

|

| |

|

· sec.gov/edgar.shtml (EDGAR) |

|

|

| |

|

See page

93 for more information. |

|

|

|

|

|

|

|

|

|

|

|

TOTAL COMMON SHARES OUTSTANDING |

|

|

| |

|

|

|

| |

|

395,792,522 |

|

December 31, 2014 |

|

|

| |

|

395,792,522 |

|

March 9, 2015 |

|

|

| |

|

CST Trust

Company is our transfer agent and registrar (see page 10 for details). |

|

|

Exhibit 99.2

Management Proxy Circular

clean

Notice of Annual Meeting of Shareholders to be held May 22, 2015

Cameco

Cameco is one of the world’s largest uranium producers, accounting for about 16% of the

world’s production.

We also supply much of the world’s reactor fleet with the fuel to generate one of the cleanest sources

of electricity available today.

You have received this document because you are a Cameco shareholder and are entitled to vote at our

2015 annual meeting of shareholders. Please remember to vote.

|

|

|

|

|

|

|

|

|

|

|

Cameco has been widely recognized for excellence

in corporate governance and best practices in building and sustaining shareholder value |

|

|

|

|

·

|

|

winner of the 2014 New York Stock Exchange

inaugural leadership award for exemplary CD&A disclosure by a compensation committee |

|

|

|

|

·

|

|

our best-ever ranking of 8th in the Globe and Mail Board Games

in 2014, a governance ranking of 247 Canadian issuers |

|

|

|

|

·

|

|

two-time winner of the Governance Gavel award from the Canadian Coalition for Good Governance:

|

|

|

|

|

|

|

·

|

|

2009: Best disclosure for approach to executive compensation

|

|

|

|

|

|

|

·

|

|

2010: Best disclosure of board governance practices and director qualifications for governance

|

|

|

|

|

|

|

|

|

|

| TSX: |

|

CCO |

|

|

|

Cameco Corporation 2121-11th Street West Saskatoon, Saskatchewan

S7M 1J3 |

| NYSE: |

|

CCJ |

|

|

|

| cameco.com |

|

|

|

Letter to shareholders

Dear fellow shareholder,

On behalf of Cameco’s board of directors, I am pleased to invite you to the

2015 annual meeting of shareholders.

The meeting will be held on Friday, May 22, 2015 in Saskatoon, and you

can read about each item of business in the management proxy circular, which begins on page 4.

The circular also

provides important information about voting your shares, the nominated directors, our governance practices and director and executive compensation. The report by the chair of the human resources and compensation committee (see page 50) gives

important insights into the nuclear industry, executive compensation at Cameco and decisions by the committee and board on executive pay for 2014.

The board has worked diligently over the past year to oversee Cameco’s affairs and work with management on the

company’s strategic direction, with a focus on achieving steady progress on Cameco’s four measures of success. Similar to 2013, the board’s priorities included strategic focus and value creation, risk oversight and board governance

because they are fundamental to Cameco’s future growth and success.

Strategic focus

We address corporate strategy at every regular board meeting and work with the management team to ensure the strategy addresses

the near- and medium-term challenges in the nuclear industry and positions Cameco to benefit from the strong demand

we anticipate over the long term. This focus has resulted in an adjustment to Cameco’s growth plans to better match market opportunities that we believe will position Cameco to deliver the

best value to shareholders.

Risk oversight

Strong risk oversight is also important. Management provides quarterly updates on all our risks and regularly presents to the

board and committees on our top-tier risks, resulting in a deeper analysis of our significant risks. We also dedicated time this past year to a board workshop on evaluating risk appetite and tolerance. All of this work has helped the board develop a

solid understanding of Cameco’s key risks, and we plan to continue our emphasis on risk oversight into 2015.

Sound governance

We also devoted considerable time to having a strong and diverse board to carry out our duties and responsibilities. We

implemented a board diversity policy in early 2014 and undertook a rigorous review of our skills matrix to make sure we assemble the right mix of skills, experience and qualities, and achieve gender balance (see page 28).

We implemented a tenure policy that includes term limits to support ongoing refreshment and renewal of the board (see page 27)

and a rotation policy for committee chair and member assignments. Our goal in implementing these new policies on a staggered basis is to balance the need for board renewal with continuity of knowledge and experience.

|

|

|

|

|

|

|

|

|

|

|

|

|

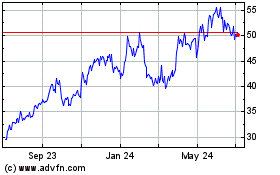

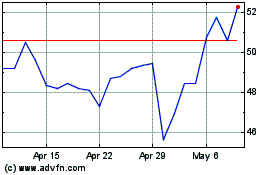

| Despite challenging market conditions, Cameco performed well in 2014, exceeding its

production guidance,

delivering on its financial guidance and achieving record annual

revenue from its uranium segment. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Annual revenue of

$2.4 billion |

|

|

|

Started up the Cigar Lake mine and produced 340,000 lbs of packaged

uranium concentrate

(100% basis) |

|

|

|

Record average realized uranium price of

$52.37 ($Cdn) |

|

|

|

|

LETTER TO SHAREHOLDERS 1

We conduct annual board assessments to increase the effectiveness of the board,

committees and individual directors. In 2014 we implemented an independent third-party director assessment process to augment these annual assessments. The first third-party review will take place in 2017 (see page 34).

All members of the board are Cameco shareholders and we continue to build our equity ownership. In 2014, we increased the share

ownership requirement for directors to highlight its importance and reinforce our commitment to our role as directors.

Looking ahead

Despite the prolonged weakness in the uranium market and downward pressure on

Cameco’s share price toward year-end, we remain confident of a bright future and strong growth for both Cameco and the nuclear industry.

This year we have 11 candidates who have been nominated for election to the board, all of whom currently serve as directors.

Three of the nominees (27%) are women.

Two of our current directors are retiring this year. On behalf of the

board, I want to thank Victor Zaleschuk and Joe Colvin for their wisdom, judgment and contributions over many years of service. The board

benefited from Victor’s vast experience in the resource sector, and he served

as our board chair for 10 of his 14 years as a Cameco director. Joe completes 15 years on the Cameco board, and brought extensive knowledge and understanding of the nuclear industry. He served as chair of the safety, health and environment committee

for 14 years.

Please take some time to read the attached management proxy circular and decide how you want to vote

your shares. Your vote is important.

The board and management thank you for your continued confidence, and we look

forward to seeing you on May 22, 2015.

|

| Sincerely, |

|

|

| Neil McMillan |

| Chair of the board |

| Cameco Corporation |

|

|

|

|

|

|

|

|

|

|

2014 AWARDS

|

|

|

| — |

|

Top 100 Employers in Canada

(Mediacorp) |

|

— |

|

Canada’s Top Employers for People

over 40 (Mediacorp) |

|

|

|

|

|

|

|

| — |

|

Saskatchewan’s Top Employers |

|

— |

|

Environmental and Social Responsibility Award

(Prospectors and Developers Association of Canada) |

|

|

| — |

|

Canada’s Best Diversity Employers (Mediacorp) |

|

|

|

|

|

|

|

|

|

|

| — |

|

Canada’s Top Employers for Young People (Mediacorp) |

|

— |

|

Supply Chain Management Association

Sustainability Award |

|

|

2 CAMECO CORPORATION

Notice of our 2015 annual meeting of shareholders

You are invited to our 2015 annual meeting:

When

Friday, May 22, 2015

10 a.m. CST

Where

Cameco Corporation

2121 - 11th

Street West

Saskatoon, Saskatchewan

Your vote is important

If you held Cameco common shares on March 24, 2015, you are entitled to receive notice of and

to vote at this meeting.

You can vote in person at the meeting or by proxy.

See pages 5 through 10 of the attached management proxy circular for information about what the meeting will cover, who can vote and how to vote.

By order of the board of directors,

Sean Quinn

Senior Vice-President,

Chief Legal Officer and

Corporate Secretary

Saskatoon, Saskatchewan

April 8, 2015

|

|

|

|

|

|

|

|

|

FOR MORE INFORMATION |

|

|

| |

|

|

|

| |

|

Read about the business of the meeting beginning

on page 5 of the attached management proxy circular. |

|

|

| |

|

The deadline for submitting a shareholder

proposal for our 2016 annual meeting is January 11, 2016 and we require advance notice for nominating directors (see page 93 for details). |

|

|

| |

|

Access our 2014 annual report and other documents

online: |

|

|

| |

|

— |

|

cameco.com |

|

|

| |

|

— |

|

sedar.com (SEDAR) |

|

|

| |

|

— |

|

sec.gov/edgar.shtml (EDGAR) |

|

|

| |

|

See page

93 for more information. |

|

|

|

|

|

|

|

|

|

|

|

TOTAL COMMON SHARES OUTSTANDING |

|

|

| |

|

|

|

| |

|

395,792,522 |

|

December 31,

2014 |

|

|

| |

|

395,792,522 |

|

March 9, 2015 |

|

|

| |

|

CST Trust

Company is our transfer agent and registrar (see page 10 for details). |

|

|

NOTICE OF 2015 ANNUAL MEETING OF SHAREHOLDERS 3

Management proxy circular

You have received this circular because you owned Cameco common shares on March 24, 2015. Management is soliciting your proxy for

our 2015 annual meeting of shareholders.

As a shareholder, you have the right to attend the annual meeting of shareholders on

May 22, 2015 and to vote your shares in person or by proxy.

The board of directors has approved the contents of this

document and has authorized us to send it to you. We have also sent a copy to each of our directors and to our auditors.

Your

package may also include our 2014 annual report (if you requested a copy or one was otherwise required to be sent to you). This information is also available on our website (cameco.com).

|

|

|

|

|

|

|

|

|

|

|

THINGS TO NOTE |

|

|

|

|

| |

|

|

|

|

|

| |

|

Key terms in this document |

|

|

|

|

| |

|

— you and your refer to the shareholder |

|

|

| |

|

— we, us, our and Cameco mean Cameco

Corporation |

|

|

| |

|

— shares and Cameco shares mean Cameco’s common shares,

unless indicated otherwise |

|

|

| |

|

— all dollar amounts are in Canadian dollars, unless indicated

otherwise |

|

|

| |

|

— information is as of March 9, 2015, unless indicated

otherwise. |

|

|

| |

|

Your vote is important |

|

|

| |

|

This circular describes what the meeting will cover and how to vote. Please read it carefully and vote, either by completing the form included with this package or voting in person at the

meeting. |

|

|

| |

|

To encourage you to vote, Cameco employees or

representatives of Kingsdale Shareholder Services (Kingsdale) may contact you. If you have any questions or need more information about voting your shares, call Kingsdale at 1.888.518.1558 (toll free in North America) or 416.867.2272 (collect calls

accepted) outside of North America. Or send an email to contactus@kingsdaleshareholder.com. |

|

|

| |

|

We are

paying Kingsdale approximately $47,500 for their services. |

|

|

4 CAMECO CORPORATION

About our shareholder meeting

|

|

|

|

|

|

|

|

|

|

|

|

|

| You can vote on items of Cameco business, receive an update on the company, meet face to face with management and interact with our board

of directors. We require majority approval on the items of business, except for the election of

directors (see Our policy on majority voting on page 11). |

|

|

|

|

|

|

|

The board, on the recommendation of the audit and finance committee, has proposed that KPMG LLP (KPMG) be reappointed as our auditors

until the end of our next annual meeting. KPMG, or its predecessor firms, have been our auditors since we incorporated. You can vote for reappointing KPMG, or you can withhold your vote.

KPMG provides us with three types of services:

• audit

services — generally relate to the audit and review of annual and interim financial statements and notes, conducting the annual audits of affiliates, auditing our internal controls over financial reporting and providing other services that

may be required by regulators. These may include services for registration statements, prospectuses, reports and other documents that are filed with securities regulators, or other documents issued for securities offerings.

• audit-related services — include advising on accounting matters,

attest services not directly linked to the financial statements that are required by regulators and conducting audits of employee benefit plans.

• tax services — relate to tax compliance and tax advice that are

beyond the scope of the annual audit. These include reviewing transfer-pricing documentation and correspondence with tax authorities, preparing corporate tax returns, and advice on international tax matters, tax implications of capital market

transactions and capital tax. The table below shows the fees we paid to KPMG and its affiliates

for services in 2013 and 2014. The board has invited a representative of KPMG to attend the meeting.

We recommend you vote for reappointing KPMG as our auditors. |

|

|

| |

|

WE NEED A QUOROM |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

We can only hold the meeting and transact business if we have a quorum at the beginning of the meeting — when the

people at the meeting hold, or represent by proxy, at least 25% of our total common shares issued and outstanding. |

|

|

|

|

|

|

|

|

| Business of the

meeting 1. DIRECTORS

You will elect 11 directors to our board to serve for a term of one year. All of the nominated

directors currently serve on the board. You can vote for all of the nominated directors, vote for some of them and withhold votes for others, or withhold votes for all of them (see page 11).

The director profiles starting on page 12 tell you about their background and experience and

membership on Cameco board committees. We recommend you vote for all of the

nominated directors. 2. AUDITORS

You will vote on reappointing the auditors. Auditors reinforce the importance of a diligent and

transparent financial reporting process. They strengthen investor confidence in our financial reporting. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2014 ($) |

|

|

% OF TOTAL FEES (%)

|

|

|

2013 ($) |

|

|

% OF TOTAL FEES (%)

|

|

|

| Audit fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cameco |

|

|

1,743,300 |

|

|

|

48.7 |

|

|

|

1,443,700 |

|

|

45.9 |

|

|

| Subsidiaries |

|

|

798,900 |

|

|

|

22.4 |

|

|

|

879,500 |

|

|

28.0 |

|

|

| Total audit fees |

|

|

2,542,200 |

|

|

|

71.1 |

|

|

|

2,323,200 |

|

|

73.9 |

|

|

| |

|

|

| Audit-related fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Translation services |

|

|

178,500 |

|

|

|

5.0 |

|

|

|

67,200 |

|

|

2.1 |

|

|

| Pensions and other |

|

|

177,800 |

|

|

|

5.0 |

|

|

|

104,300 |

|

|

3.3 |

|

|

| Total audit-related fees |

|

|

356,300 |

|

|

|

10.0 |

|

|

|

171,500 |

|

|

5.4 |

|

|

| |

|

|

| Tax fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Compliance |

|

|

307,800 |

|

|

|

8.6 |

|

|

|

252,500 |

|

|

8.0 |

|

|

| Planning and advice |

|

|

367,400 |

|

|

|

10.3 |

|

|

|

398,600 |

|

|

12.7 |

|

|

| Total tax fees |

|

|

675,200 |

|

|

|

18.9 |

|

|

|

651,100 |

|

|

20.7 |

|

|

| |

|

|

| All other fees |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

– |

|

|

| |

|

|

| Total fees |

|

|

3,573,700 |

|

|

|

100.0 |

|

|

|

3,145,800 |

|

|

100.0 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2015 MANAGEMENT PROXY CIRCULAR 5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FINANCIAL STATEMENTS |

|

|

|

|

|

|

|

|

|

MORE ABOUT ‘SAY ON PAY’ |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your package includes our 2014 annual report (which includes our consolidated financial statements for the year ended December 31, 2014

and the auditors’ report) if you requested a copy or one was otherwise required to be sent to you. You can also download a copy from our website (cameco.com/invest/financial-information).

3. ‘SAY ON PAY’

You will vote on our approach to executive compensation as disclosed in this circular. This is a

non-binding advisory vote that will provide the board and the human resources and compensation committee with important feedback. |

|

|

|

|

|

|

|

We introduced ‘say on pay’ in 2010 and have held an advisory vote every year since. We continue to monitor

developments in executive compensation and evolving best practices to make sure our programs and decisions are appropriate. We do a comprehensive risk assessment of our executive compensation program every three years.

Preliminary work has started for the review in 2015. You can write to the board or committee chair about your views on executive compensation. See page 23 for details on our accessible board. |

|

|

| |

The board believes it is important for shareholders to have a timely and

effective way to provide input on this matter. This is the sixth year that shareholders will have an opportunity to have a ‘say on pay’.

The board and the human resources and compensation committee discussed last year’s results and the trend since 2010 on shareholders’ views on our approach to

executive compensation. These discussions provided important background information and insights for our 2014 compensation review and our ongoing efforts to encourage dialogue and outreach with shareholders generally (see page 23).

Following this year’s vote, the board will again examine the level of interest and nature of

shareholder comments and evolving best practices by other companies. Please take some time to

read about our compensation strategy and how we assess performance, make compensation decisions and manage compensation risk (see page 55 and pages 61 through 72).

Vote for or against our approach to executive compensation by voting on the following resolution:

Resolved, on an advisory basis and not to diminish the role and responsibilities of the board of

directors, that the shareholders accept the approach to executive compensation disclosed in Cameco’s management proxy circular delivered in advance of the 2015 annual meeting of shareholders.

We recommend you vote for our approach to executive compensation.

|

|

|

|

|

|

OTHER

BUSINESS We did not receive any shareholder proposals for this

meeting, and are not aware of any other items of business to be considered at the meeting.

If other items of business are properly brought before the meeting, you (or your proxyholder) can vote as you see fit.

Voting results

We will disclose the voting results on the items of business in our report on

the 2015 annual meeting voting results, available on our website (cameco.com/invest/events-presentations/2015- annual-meeting-of-shareholders) and on SEDAR. |

|

|

|

|

6 CAMECO CORPORATION

Who can vote

|

|

|

|

|

|

|

|

|

|

|

|

|

| We have common shares and one class B share, but only holders of our common shares have full voting rights.

|

|

|

|

|

|

|

|

|

|

WHY RESIDENCY IS IMPORTANT |

|

|

|

|

|

|

|

|

|

|

|

|

|

| If you held common shares at the close of business on March 24, 2015 (the record date), you or the person you appoint as your

proxyholder can attend the annual meeting and vote your shares. Each Cameco common share you own represents one vote, except where ownership and voting restrictions apply.

As of March 9, 2015, we had 395,792,522 common shares issued and outstanding.

Ownership and voting restrictions

There are restrictions on owning, controlling and voting Cameco common shares whether you own the shares as a registered shareholder, hold them beneficially, or control

your investment interest in Cameco directly or indirectly. These are described in the Eldorado Nuclear Limited Reorganization and Divestiture Act (Canada) (ENL Reorganization Act) and our company articles.

The following is a summary of the limitations listed in our company articles. See Appendix A on

page 94 for the definitions in the ENL Reorganization Act, including definitions of resident and non-resident.

RESIDENTS

A Canadian resident, either individually or together with associates, cannot hold, beneficially own or control shares or other Cameco securities, directly or

indirectly, representing more than 25% of the total votes that can be cast to elect directors. NON-RESIDENTS A non-resident of Canada, either individually or

together with associates, cannot hold, beneficially own or control shares or other Cameco securities, directly or indirectly, representing more than 15% of the total votes that can be cast to elect directors.

VOTING RESTRICTIONS

All votes cast at the meeting by non-residents, either beneficially or controlled directly or

indirectly, will be counted and pro-rated collectively to limit the proportion of votes cast by non-residents to no more than 25% of the total shareholder votes cast at the meeting. |

|

|

|

|

|

|

|

Cameco shares have restrictions on ownership and voting for residents and non-residents of Canada. Ownership restrictions were put in place so that Cameco would remain Canadian controlled. The uranium mining industry has

restrictions on ownership by non-residents. A

non-resident is: • an individual, other than a Canadian citizen,

who is not ordinarily resident in Canada • a corporation

• that was incorporated, formed or otherwise organized outside Canada, or

• that is controlled by non-residents, either directly or indirectly

• a trust

• that was established by a non-resident, other than a trust for the administration of a

pension fund for individuals where the majority of the individuals are residents or

• where non-residents have more than 50% of the beneficial interest

• a foreign government or foreign government agency.

Anyone not included in the above description of

non-resident is considered a resident. Residents can be individuals, corporations, trusts and governments or government agencies. |

|

|

|

|

|

|

|

RESIDENCY

DECLARATIONS We require shareholders to declare their residency,

ownership of Cameco shares, and other things relating to the restrictions, so we can verify compliance with the ownership and voting restrictions on our shares.

Nominees such as banks, trust companies, securities brokers or other financial institutions who hold the shares on behalf of non-registered

shareholders need to make the declaration on their behalf. If you own the

shares in your name, you will need to complete the residency declaration on the enclosed proxy form. Copies will be available at the meeting if you are planning to attend the meeting. If we do not receive your residency declaration, we may consider

you to be a non-resident of Canada. The chair of the meeting may ask

shareholders and their nominees for additional information to verify compliance with our ownership and voting restrictions. The chair of the meeting will use the declarations and other information to decide whether our ownership restrictions have

been complied with. |

|

|

|

|

|

|

|

|

|

|

|

|

2015 MANAGEMENT PROXY CIRCULAR 7

|

|

|

|

|

| ENFORCEMENT |

| The company articles allow us to enforce the ownership and

voting restrictions by: |

| • |

|

suspending voting rights |

| • |

|

forfeiting dividends |

| • |

|

prohibiting the issue and transfer of Cameco shares |

| • |

|

requiring the sale or disposition of Cameco shares |

| • |

|

suspending all other shareholder rights. |

| Principal holders of common

shares |

| Based on Schedule 13G filings made with the US Securities Exchange

Commission, our principal holders of common shares as of December 31, 2014 are: |

| • |

|

BlackRock, Inc. of New York, NY – held 24,338,452 common shares (including its subsidiaries), or approximately 6.1% of our total common shares outstanding |

| • |

|

Wellington Management Group LLP of Boston, MA – held 21,120,750 common shares (including its subsidiaries), or approximately 5.3% of our total common shares outstanding. |

|

|

|

|

|

| Management is not aware of any other shareholder who holds 5% or more of our common shares. |

|

| Our class B share |

| The province of Saskatchewan holds our one class B share. This

entitles the province to receive notices of and attend all meetings of shareholders, for any class or series. |

| The class B shareholder can only vote at a meeting of class B

shareholders, and votes as a separate class if there is a proposal to: |

| • |

|

amend Part 1 of Schedule B of the articles, which states that: |

|

|

• |

|

Cameco’s registered office and head office operations must be in Saskatchewan |

|

|

• |

|

the vice-chairman of the board, chief executive officer (CEO), president, chief financial officer (CFO) and generally all of the senior officers (vice-presidents and above) must live in Saskatchewan |

|

|

• |

|

all annual meetings of shareholders must be held in Saskatchewan |

| • |

|

amalgamate, if it would require an amendment to Part 1 of Schedule B, or |

| • |

|

amend the articles in a way that would change the rights of class B shareholders. |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

HOW CAMECO WAS FORMED |

|

|

| |

|

|

|

|

|

| |

|

|

|

Cameco Corporation was formed in 1988 by

privatizing two Crown corporations, combining the uranium mining and milling operations of Saskatchewan Mining Development Corporation and the uranium mining, refining and conversion operations of Eldorado Nuclear Limited. |

|

|

| |

|

|

|

Cameco received these assets in exchange

for: |

|

|

| |

|

|

|

• |

|

assuming substantially all of the current liabilities and certain other liabilities of the two companies |

|

|

| |

|

|

|

• |

|

issuing common shares |

|

|

| |

|

|

|

• |

|

issuing one class B share |

|

|

| |

|

|

|

• |

|

issuing promissory notes. |

|

|

| |

|

|

|

The company was incorporated under the Canada Business Corporations Act.

|

|

|

| |

|

|

|

You can find more information about our history in our most recent

annual information form, which is available on our website (cameco.com/investors). |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

QUESTIONS? |

|

|

| |

|

|

|

|

|

| |

|

|

|

If you have questions about voting, completing

the proxy form or residency declaration, or about the meeting in general, please contact our proxy solicitation agent, Kingsdale Shareholder Services. |

|

|

| |

|

|

|

Phone: 1.888.518.1558

(toll free within North America)

1.416.867.2272 (collect from outside North America)

Email contactus@kingsdaleshareholder.com.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

8 CAMECO CORPORATION

How to vote

|

|

|

|

|

| You can vote by proxy, or you can attend the meeting and vote your shares in person.

Voting by proxy

Voting by proxy is the easiest way to vote. It means you are giving someone else the authority to

attend the meeting and vote for you (called your proxyholder). Tim Gitzel, president and

CEO of Cameco, or in his absence Sean Quinn, senior vice-president, chief legal officer and corporate secretary (the Cameco proxyholders), have agreed to act as proxyholders to vote your shares at the meeting according to your instructions.

Or, you can appoint someone else to represent you and vote your shares at the meeting.

If you appoint the Cameco proxyholders but do not tell them how you want to vote your shares, your shares will be voted:

— for electing each nominated director — for appointing KPMG LLP as auditors

— for the advisory vote on our

approach to executive compensation.

If for any reason a nominated director becomes unable to serve, the Cameco proxyholders have the right to vote for another nominated director at their discretion,

unless you have indicated that you want to withhold your shares from voting on the election of directors.

If there are amendments or other items of business that properly come before the meeting, your proxyholder can vote on each matter as he or she sees fit, as permitted

by law, whether or not it is a routine matter, an amendment or contested item of business. |

| |

|

ARE YOU A REGISTERED OR A NON-REGISTERED SHAREHOLDER? |

|

|

| |

|

|

|

|

You are a registered shareholder if your name appears on your share certificate.

You are a non-registered (beneficial) shareholder if

your bank, trust company, securities broker, trustee or other financial institution holds your shares (your nominee). This means the shares are registered in your nominee’s name, and you are the beneficial shareholder. Many of our

shareholders are non-registered shareholders.

The voting process is different depending on whether you are a registered or non-registered shareholder (see below for

details). |

|

|

|

|

|

| |

|

WAYS TO VOTE BY PROXY

Registered shareholders can vote in one of four ways. 1 On the

internet Go to cstvotemyproxy.com and follow the instructions on screen. You will need your 13-digit control number, which appears below your name and address

on your proxy form. 2 By fax

Complete the enclosed proxy form, including the residency declaration, sign and date it and fax both pages of the form to:

CST Trust Company Attention: Proxy department

1.866.781.3111 (toll free within North America) 1.416.368.2502 (from outside North

America) 3 By mail

Complete your proxy form, including the residency declaration, sign and date it, and send it to our transfer agent in the envelope provided or to the following

address: CST Trust Company Attention: Proxy department

P.O. Box 721 Agincourt, Ontario M1S 0A1

4 By appointing someone else to attend the meeting and vote your shares for you

Print the name of the person you are appointing as your proxyholder in the space provided. This person does not need to be a shareholder.

Make sure your appointee is aware and attends the meeting for you as your vote will not be counted

unless this person attends. Your proxyholder will need to check in with a CST Trust Company representative when they arrive at the meeting. |

| |

|

| |

Non-registered

shareholders: Submit your voting instructions by following the instructions on the enclosed voting instruction form. In most cases, you can send your voting instructions via the internet or by fax or mail.

|

| |

Send your completed proxy form right away.

Make sure you allow enough time for it to reach our transfer agent if you are sending it by mail. CST Trust Company must receive your proxy voting instructions

before 10 a.m. CST on Wednesday, May 20, 2015 for it to be valid. |

| |

Non-registered

shareholders: Submit your voting instructions right away to give your nominee enough time to receive them and send them to our transfer agent in time for the meeting. Your nominee will likely need to receive instructions from you at least one

business day before Wednesday, May 20, 2015. |

| |

|

|

| |

|

|

2015 MANAGEMENT PROXY CIRCULAR 9

|

| If the meeting is postponed or adjourned, CST Trust Company must receive your voting instructions at least 48 hours (excluding Saturdays, Sundays and

statutory holidays) before the reconvened meeting. If you are an administrator, trustee,

attorney or guardian for a person who beneficially holds or controls Cameco shares, or an authorized officer or attorney acting on behalf of a corporation, estate or trust that beneficially holds or controls our common shares, follow the

instructions on the proxy form. The notice can be from you or your attorney, if they have your

written authorization. If the shares are owned by a corporation, the written notice must be from its authorized officer or attorney.

The chair of the meeting has the discretion to accept or reject any late proxies, and can waive or extend the deadline for the receipt of proxy voting instructions

without notice. VOTING IN PERSON

Do not complete the enclosed proxy form if you are a registered shareholder and want to vote in

person. Your vote will be taken and counted at the meeting. |

| Non-registered

shareholders: If you want to vote in person at the meeting, follow the instructions on the enclosed voting instruction form to appoint yourself as proxyholder, or to appoint someone else to attend the meeting and vote for you.

If you appoint yourself or someone other than the Cameco

proxyholders and do not specify how your shares are to be voted, you or your appointee will have full discretionary authority to vote at the meeting. |

|

|

|

|

|

|

|

| |

|

If you change your mind

If you change your mind about how you want to vote your shares, you can revoke your proxy or voting instructions. Instructions provided on a proxy form or voting

instruction form with a later date, or at a later time if you are voting on the internet, will revoke any prior instructions.

Any new instructions will only take effect if they are received by CST Trust Company before 10 a.m. CST on Wednesday, May 20, 2015. If the meeting is postponed or

adjourned, CST Trust Company must receive your new voting instructions at least 48 hours (excluding Saturdays, Sundays and statutory holidays) before the meeting is reconvened for your new voting instructions to be valid. If you are a registered

shareholder, you can revoke your proxy without providing new voting instructions by: |

| |

|

— |

|

sending a notice in writing to the corporate secretary at Cameco, at 2121 - 11th Street West, Saskatoon, Saskatchewan S7M 1J3, so he receives it by 5 p.m. CST on Thursday, May 21, 2015. If the meeting is postponed or adjourned, the

corporate secretary must receive the notice by 5 p.m. CST on the day before the meeting is reconvened. |

|

|

| |

|

— |

|

giving a notice in writing to the chair of the meeting before the start of the meeting. |

|

|

| |

|

— |

|

responding in any other manner permitted by law. |

|

|

| |

|

|

|

|

| |

|

|

| |

|

Non-registered shareholders: Contact your nominee if you need help

providing new voting instructions, if you want to revoke your voting instructions (without giving new instructions) or you want to vote in person instead. |

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

VOTING RESULTS |

|

|

| |

|

|

|

|

|

| |

|

|

|

CST Trust Company, our transfer agent and registrar, receives

the votes and counts them on our behalf. We report on voting results

shortly after the meeting. Go to cameco.com/invest/events-presentations/2015-annual-meeting-of-shareholders or sedar.com following the meeting to see the voting results. |

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

10 CAMECO CORPORATION

About the nominated directors

|

|

|

|

|

| Our board of directors is responsible for overseeing management and our business affairs. As shareholders, you elect the board to act in

the best interests of Cameco. This year the board has nominated 11 directors. They all

currently serve on the board and have agreed to stand for re-election: |

| Ian Bruce |

|

Tim Gitzel |

| Daniel Camus |

|

James Gowans |

| John Clappison |

|

Nancy Hopkins |

| James Curtiss |

|

Anne McLellan |

| Donald Deranger |

|

Neil McMillan |

| Catherine Gignac |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Directors who are elected will serve until the end of the next annual meeting, or until a successor is elected or appointed.

You can vote for all of the nominated directors, vote for some of them and

withhold votes for others, or withhold votes for all of them. Unless otherwise instructed, the named proxyholders will vote for each of the nominated directors (see pages 12 to 17 for details).

The director profiles tell you about each of them, including their qualifications, background,

experience, committee membership, meeting attendance and voting results. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WHERE TO FIND IT |

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

• Director profiles |

|

12 |

|

|

|

|

| |

|

• Meeting attendance |

|

18 |

|

|

|

|

| |

|

• Director development |

|

19 |

|

|

|

|

| |

|

• About the board |

|

26 |

|

|

|

|

|

|

|

| |

|

OUR POLICY ON MAJORITY VOTING

Under corporate law, a nominated director can be elected with a single for vote, no matter how many votes were withheld.

We adopted a majority voting policy in 2006 to govern the election of directors in an uncontested

election (where the number of nominated directors equals the number of board positions). It requires each director to receive a majority of for votes in order to be elected.

Any director who receives more withhold than for votes, in an uncontested election

must offer to resign immediately. Our nominating, corporate governance and risk committee will

review the voting result and recommend to the board whether to accept the resignation or not. Unless there are exceptional circumstances, the committee and the board will accept the resignation and it will take effect when accepted by the board. The

resigning director does not participate in any board or committee deliberations on the matter.

The board will announce its decision within 90 days of the meeting. If it rejects the resignation, it will explain why. If it accepts the resignation, it may appoint a

new director to fill the vacancy. |

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

2015 MANAGEMENT PROXY CIRCULAR 11

|

|

|

| Director profiles |

| The following pages tell you about each nominated director as of

March 9, 2015, including their background, experience and memberships on other public company boards. Nine of the 11 nominated directors (82%) are independent. |

| The profiles include the voting results for each director at last

year’s annual meeting and information about their meeting attendance in 2014. Each director has provided the information about the Cameco shares they own or exercise control or direction over. Their holdings of Cameco shares and deferred share

units (DSUs) is as of December 31, 2014. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-executive directors receive part of their compensation in DSUs, aligning the interests of our directors and shareholders. We

calculated the total value of their shares and DSUs below using $19.05 for 2014 and $22.04 for 2013, the year-end closing prices of Cameco shares on the Toronto Stock Exchange (TSX). All non-executive directors are in compliance with our share

ownership guidelines for directors. Tim Gitzel is our only executive director, and he does not receive DSUs or any other director compensation.

When reviewing compliance, we value each director’s holdings at the price they were acquired or the year-end closing price of Cameco shares on the TSX, whichever

is higher, in accordance with our share ownership guidelines. |

|

|

|

|

|

|

|

DIRECTOR SHARE OWNERSHIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

We increased our share ownership requirements for directors and the board chair from three times to four times their annual retainer in 2014 (see page 46).

Directors continued to build their share ownership in 2014

and each director increased the number of Cameco DSUs and/or shares held. |

|

|

|

|

| See page 48 for the proportion of the total retainer that each non-executive director received in DSUs in 2014. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Neil McMillan (63) | Chair of the board (since May 2013) | Independent

|

|

Neil McMillan is the former president and CEO of Claude Resources Inc., a Saskatchewan-based gold mining company. Neil previously served on the board of Atomic Energy Canada Ltd., a

Canadian government nuclear reactor production and services company. |

|

Neil holds a bachelor of arts degree from the University of Saskatchewan, and is a former member of the Saskatchewan legislature.

Neil’s CEO experience gives the board access to a ground level view of many of the daily mining risks and opportunities faced by Cameco. His background as an investment adviser and legislator, and his knowledge of the political and business

environment in Saskatchewan, are valuable when the board is reviewing investment opportunities. In addition to his extensive experience as a senior executive, he has served on the compensation and audit committees of other public company boards and

served two years on Cameco’s human resources and compensation committee. Neil served as a director of Philom Bios Inc. from 1997 to 2003 and as a director of Claude Resources Inc. from 1995 to 2014.

|

|

2014

VOTING RESULTS |

|

|

|

|

|

2014

ATTENDANCE |

| |

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE

MEMBERSHIP |

|

IN PERSON |

|

TELECONFERENCE

|

|

OVERALL*

|

| |

|

|

99.0% for |

|

|

|

Board of directors (chair) |

|

6 of 6 |

|

5 of 5 |

|

100% |

|

1.0% withheld

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Director since 2002 Saskatoon, SK

Canadian

Experience • CEO experience

• Executive compensation

• Government relations

• Investment industry • Mining

• Risk management |

|

* As board chair, Neil also attended 27 committee meetings in an

ex-officio capacity. |

|

OTHER PUBLIC COMPANY BOARDS

AND COMMITTEE MEMBERSHIPS |

| |

|

|

Shore Gold Inc.

|

|

Audit, Compensation |

|

|

|

|

|

SECURITIES HELD

|

| |

|

|

Year |

|

Cameco shares

|

|

DSUs

|

|

Total shares and DSUs

|

|

Total value of shares and DSUs

|

|

In compliance with

ownership guidelines |

| |

|

|

2014

2013 Change |

|

600

600 – |

|

49,959

44,842 5,117 |

|

50,559

45,442 5,117 |

|

963,149

$1,001,542 $(38,393) |

|

Yes (as he has until May 2018 to acquire additional shares

and DSUs to meet his new target)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Options held: nil

|

| |

12 CAMECO CORPORATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director since 2012 Calgary, AB |

|

Ian Bruce (61) | Independent |

|

Ian Bruce is the former co-chairman of the board of Peters & Co. Limited, an independent investment dealer, where he served as vice chairman, president and CEO, and CEO and co-chairman. |

|

Ian is a fellow of the Chartered Professional Accountants of

Alberta, a recognized Specialist in Valuation under Canadian CPA rules, and has his Corporate Finance Specialist designation in Canada and the UK. He is a past member of the Expert Panel on Securities Regulation for the Minister of Finance of

Canada. Ian is also a past board member and chair of the Investment Industry Association of Canada. |

|

In addition to the public company boards listed below, Ian is a

director of the private companies Laricina Energy Ltd., Pumpwell Solutions Ltd. and TriAxon Oil Corp. He was a director of the public company Hardy Oil & Gas plc from 2008 to 2012.

|

|

2014 VOTING RESULTS |

|

|

|

|

|

|

|

|

|

|

|

2014 ATTENDANCE |

| |

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE MEMBERSHIP

|

|

IN PERSON

|

|

TELECONFERENCE

|

|

OVERALL

|

| |

|

|

99.2% for |

|

Board of directors |

|

|

|

|

|

6 of 6 |

|

5 of 5 |

|

100% |

|

0.8% withheld |

|

Audit and finance |

|

|

|

|

|

6 of 6 |

|

2 of 2 |

|

100% |

|

|

|

Human resources and compensation |

|

|

|

|

|

4 of 4 |

|

|

|

100% |

|

|

|

Reserves oversight |

|

|

|

|

|

3 of 3 |

|

|

|

100% |

|

|

|

Safety, health and environment |

|

|

|

|

|

1 of 1 |

|

|

|

100% |

|

OTHER PUBLIC COMPANY BOARDS

AND COMMITTEE MEMBERSHIPS |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Canadian

Experience |

|

Logan International Inc.

Northern Blizzard Resources Inc. |

|

Audit

Lead director, Audit (chair), Compensation |

| — —

—

—

— |

|

CEO experience Finance

Investment banking Mergers and acquisitions

Risk management |

|

SECURITIES HELD

|

| |

|

|

|

|

Year |

|

Cameco shares |

|

DSUs |

|

Total shares and

DSUs |

|

Total value of shares

and DSUs

|

|

In compliance with

ownership guidelines

|

| |

|

|

|

|

2014 |

|

75,000 |

|

13,118 |

|

88,118 |

|

$1,678,648 |

|

Yes |

|

|

2013 |

|

75,000 |

|

7,913 |

|

82,913 |

|

$1,827,406 |

|

|

|

|

|

|

Change |

|

– |

|

5,205 |

|

5,205 |

|

$(148,758) |

|

|

|

|

|

|

|

|

|

|

|

Options held: nil

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Daniel Camus (62) | Independent |

|

Daniel Camus is the CFO of the humanitarian finance organization, The Global Fund to Fight AIDS, Tuberculosis and Malaria. He is the former group CFO and head of strategy and international activities of

Electricité de France SA (EDF). Based in France, EDF is an integrated energy operator active in the generation (including nuclear generation), distribution, transmission, supply and trading of electrical energy with international

subsidiaries. |

|

Daniel holds a PhD in Economics from Sorbonne University, and an MBA

in finance and economics from the Institute d’Études Politiques de Paris. Over the past 25 years, he has held various senior roles with the Aventis and Hoechst AG Groups in Germany, the US, Canada and France. He has been chair of several

audit committees and brings to Cameco’s board his experience in human resources and executive compensation through his senior executive roles at international companies where he worked on business integrations in Germany, the US, Canada and

France. |

|

2014 VOTING RESULTS |

|

|

|

|

|

|

|

|

|

|

|

2014 ATTENDANCE |

| |

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE MEMBERSHIP

|

|

IN PERSON

|

|

TELECONFERENCE

|

|

OVERALL

|

| |

|

|

92.2% for |

|

Board of directors |

|

|

|

|

|

6 of 6 |

|

5 of 5 |

|

100% |

|

7.8% withheld |

|

Audit and finance |

|

|

|

6 of 6 |

|

2 of 2 |

|

100% |

|

|

|

Human resources and compensation |

|

|

|

|

|

5 of 5 |

|

1 of 1 |

|

100% |

|

|

|

Safety, health and environment |

|

|

|

|

|

5 of 5 |

|

|

|

100% |

|

OTHER PUBLIC COMPANY BOARDS

AND COMMITTEE MEMBERSHIPS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Director since 2011 Geneva, Switzerland

Canadian and French |

|

Morphosys AG, Munich*

Valeo SA, Paris Vivendi SA, Paris

SGL Carbon AG, Wiesbaden |

|

|

Audit (chair)

Audit and risks (chair) Audit (chair)

Nomination, Strategy/technology |

|

|

|

|

|

| Experience |

|

* Daniel retires from the board of Morphosys AG on May 8,

2015. |

| —

—

—

—

—

—

— |

|

Electricity industry

Executive compensation Finance

International Mergers and acquisitions

Nuclear industry Risk management |

|

SECURITIES HELD

|

| |

|

|

|

|

Year |

|

Cameco shares |

|

DSUs |

|

|

Total shares and

DSUs

|

|

Total value of shares

and DSUs

|

|

In compliance with

ownership guidelines

|

| |

|

|

|

|

2014 |

|

– |

|

|

39,012 |

|

|

39,012 |

|

$743,179 |

|

Yes |

|

|

2013 |

|

– |

|

|

26,277 |

|

|

26,277 |

|

$579,143 |

|

|

|

|

Change |

|

– |

|

|

12,735 |

|

|

12,735 |

|

$164,036 |

|

|

|

|

|

|

|

|

|

|

|

Options held: nil

|

| |

2015 MANAGEMENT PROXY CIRCULAR 13

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director since 2006 Toronto, ON

Canadian |

|

John Clappison (68) | Independent |

|

John Clappison is the former managing partner of the Greater Toronto Area office of PricewaterhouseCoopers LLP, where he spent 37 years. He is a fellow of the Chartered Professional Accountants of Ontario. |

|

In addition to his extensive financial experience, John brings to Cameco’s board his experience in human resources, risk management, executive compensation and international business as a senior member of the PwC

executive team. He is also a former member of the compensation committee at Canadian Real Estate Investment Trust. |

|

In addition to the public company boards listed below, John serves as a director of the private company, Summitt Energy Holdings GP Inc. and was a director of the public companies Inmet Mining Corporation from 2010 to

2013 and Canadian Real Estate Investment from 2007 to 2011. He is actively involved with the Face the Future Foundation, the Shaw Festival Theatre Endowment Foundation and the Corporation of Roy Thomson Hall and Massey Hall Foundation. John also

serves as a member of the CFO of the Year selection committee. |

|

2014 VOTING RESULTS |

|

|

|

|

|

|

|

|

|

|

|

2014 ATTENDANCE |

| |

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE MEMBERSHIP

|

|

IN PERSON

|

|

TELECONFERENCE

|

|

OVERALL

|

| |

|

|

99.4% for |

|

Board of directors |

|

|

|

|

|

6 of 6 |

|

5 of 5 |

|

100% |

|

0.6% withheld |

|

Audit and finance (chair) |

|

|

|

|

|

6 of 6 |

|

2 of 2 |

|

100% |

|

|

|

Nominating, corporate governance and risk |

|

|

|

|

|

5 of 5 |

|

|

|

100% |

|

OTHER PUBLIC COMPANY BOARDS

AND COMMITTEE MEMBERSHIPS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Experience |

|

Rogers Communications Inc. Sun Life Financial

Inc. |

|

Audit (chair), Pension, Corporate governance Risk

review (chair), Audit |

| — —

—

—

— |

|

Finance Risk management

Corporate governance

Executive compensation International |

|

SECURITIES HELD

|

| |

|

|

|

|

Year |

|

Cameco shares |

|

DSUs |

|

|

Total shares and

DSUs |

|

Total value of shares

and DSUs

|

|

In compliance with

ownership guidelines |

| |

|

|

|

|

2014 |

|

4,200 |

|

|

35,699 |

|

|

39,899 |

|

$760,076 |

|

Yes |

|

|

2013 |

|

4,200 |

|

|

30,802 |

|

|

35,002 |

|

$771,444 |

|

|

|

|

|

|

Change |

|

– |

|

|

4,897 |

|

|

4,897 |

|

$(11,368) |

|

|

|

|

|

|

|

|

|

|

|

Options held: nil |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director since 1994 Wagener, SC, USA

American |

|

James Curtiss (61) | Independent |

| |

James Curtiss has been the principal of Curtiss Law since 2008. Prior to this, he was a partner with the law firm Winston & Strawn LLP in Washington, DC, where he concentrated on energy policy and nuclear regulatory

law. He was a commissioner with the US Nuclear Regulatory Commission from 1988 to 1993. |

| |

James received a bachelor of arts and a juris doctorate from the University of Nebraska. He is a frequent speaker at nuclear industry conferences and has spoken on topics such as licensing and regulatory reform,

advanced reactors and fuel cycle issues. He brings his legal experience in this field to the board. In addition to his extensive energy and nuclear regulatory experience as a lawyer, he has served on our human resources and compensation committee

for the past 15 years and as the committee chair since 2002. James is a director of the private company, Baltimore Gas and Electric, and served on the board of Constellation Energy Group from 1994 to 2012. He is also a director of the Citizens for

Nuclear Technology Awareness. |

| |

2014 VOTING RESULTS |

|

|

|

|

|

|

|

|

|

|

|

2014 ATTENDANCE |

|

|

|

|

|

BOARD AND COMMITTEE MEMBERSHIP AND ATTENDANCE

|

|

IN PERSON

|

|

TELECONFERENCE

|

|

OVERALL

|

| |

|

|

92.9% for |

|

Board of directors |

|

|

|

|

|

6 of 6 |

|

5 of 5 |

|

100% |

|

7.1% withheld |

|

Human resources and compensation (chair) |

|

|

|

5 of 5 |

|

1 of 1 |

|

100% |

|

|

|

Nominating, corporate governance and risk |

|

|

|

5 of 5 |

|

|

|

100% |

|

|

|

|

|

| |

|

|

|

Other public company boards and committee memberships: none

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Experience |

|

|

|

|

| —

—

—

—

— |

|

Executive compensation

Government relations

Legal Nuclear industry

Risk management |

|

SECURITIES HELD

|

| |

|

|

|

|

Year |

|

Cameco shares |

|

DSUs |

|

|

Total shares and

DSUs

|

|

Total value of shares

and DSUs

|

|

In compliance with

ownership guidelines

|

| |

|

|

|

|

2014 |

|

17,321 |

|

|

110,059 |

|

|

127,380 |

|

$2,426,589 |

|

Yes |

|

|

2013 |

|

17,321 |

|

|

108,028 |

|

|

125,349 |

|

$2,762,698 |

|

|

|

|

|

|

Change |

|

– |

|

|

2,031 |

|

|

2,031 |

|

$(336,109) |

|

|

|

|

|

|

|

|

|

|

|

Options held: nil |

| |

14 CAMECO CORPORATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director since 2009 Prince Albert, SK

Canadian |

|

Donald Deranger (59) | Not independent |

|

Donald Deranger is an advisor to the Athabasca Basin Development Corporation and non-executive chair of the board of Points Athabasca Contracting Limited Partnership, a northern Saskatchewan aboriginal contractor, which

does business with Cameco. He is the past president of Learning Together, a non-profit aboriginal organization that works to build relationships with the mining industry and continues to assist in an ex-officio capacity. He was the Athabasca Vice

Chief of the Prince Albert Grand Council from 2003 to 2012. Donald also serves as a director of the Tazi Twe Hydroelectric Project and Sylvia Fedorchuk Centre for Nuclear Innovation. |

|

An award-winning leader in the Saskatchewan aboriginal community, Donald brings to the board a deep understanding of the culture and peoples of northern Saskatchewan where our richest assets are located. Donald has not

served on any other public company boards over the past five years. |

|

2014 VOTING RESULTS |

|

|

|

|

|

|

|

|

|

|

|

2014 ATTENDANCE |

| |

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE MEMBERSHIP

|

|

IN PERSON

|

|

TELECONFERENCE

|

|

OVERALL

|

| |

|

|

98.5% for |

|

Board of directors |

|

|

|

|

|

6 of 6 |

|

5 of 5 |

|

100% |

|

1.5% withheld |

|

Reserves oversight |

|

|

|

|

|

3 of 3 |

|

|

|

100% |

|

|

|

Safety, health and environment |

|

|

|

|

|

5 of 5 |

|

|

|

100% |

|

Other public company boards and committee memberships: none

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Experience |

|

|

|

|

| — —

— |

|

Aboriginal affairs

First Nations

governance

Corporate governance |

|

SECURITIES HELD

|

| |

|

|

|

|

Year |

|

Cameco shares

|

|

DSUs |

|

|

Total shares and

DSUs

|

|

Total value of shares

and DSUs

|

|

In compliance with ownership

guidelines |

| |

|

|

|

|

2014 |

|

– |

|

|

24,710 |

|

|

24,710 |

|

$470,726 |

|

Yes (as he has until July |

|

|

2013 |

|

– |

|

|

20,015 |

|

|

20,015 |

|

$441,135 |

|

2016 to acquire additional |

|

|

Change |

|

– |

|

|

4,695 |

|

|

4,695 |

|

$29,591 |

|

shares and DSUs to meet

his new target) |

|

|

|

|

|

|

|

|

|

Options held: nil

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director since 2014 Mississauga, ON

Canadian

Experience — Mining, exploration and operations

— Investment

industry

— Mineral

resource estimation

— Project value

analysis |

|

Catherine Gignac (53) | Independent |

|

Catherine Gignac is the principal of Catherine Gignac & Associates since 2011. Formerly, she was a mining equity research analyst

with NCP Northland Capital Partners from 2009 to 2011 and prior to that she held the same position with Wellington West Capital Markets. She has more than 30 years’ experience as a mining equity research analyst and geologist. She held senior

positions with leading firms, including Merrill Lynch Canada, RBC Capital Markets, UBS Investment Bank and Dundee Capital Markets Inc. and Loewen Ondaatje McCutcheon Limited.

|

|