UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the Month of April 2015

Commission file number 0-30070

AUDIOCODES LTD.

(Translation of registrant’s name

into English)

1 Hayarden Street • Airport City,

Lod 7019900 • ISRAEL

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

ý Form 40-F

¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Note: Regulation S-T Rule 101(b)(1) only permits the

submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Note: Regulation S-T Rule 101(b)(7) only permits the

submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer

must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized

(the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities

are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed

to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission

or other Commission filing on EDGAR.

EXPLANATORY NOTE

On April 2, 2015, AudioCodes Ltd. issued

a press release entitled, “AudioCodes Announces Authorization of Additional Share Repurchase Program.”

The following document

is attached hereto and incorporated by reference herein:

Exhibit 99.1. Press

release, dated April 2, 2015, entitled “AudioCodes Announces Authorization of Additional Share Repurchase Program.”

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

AUDIOCODES LTD. |

| |

(Registrant) |

| |

|

| |

By: |

/s/ ITAMAR

ROSEN |

| |

|

Itamar Rosen, Advocate

Chief Legal Officer and Company Secretary |

Dated: April 2, 2015

EXHIBIT INDEX

|

Exhibit No. |

|

Description |

| 99.1 |

|

Press release, dated April 2, 2015, entitled “AudioCodes Announces Authorization of Additional Share Repurchase Program.” |

Exhibit 99.1

P R E S S R E L E A S E

| Company Contact |

|

IR Agency Contact |

|

Shirley Nakar,

Director, Investor Relations

AudioCodes

Tel: +972-3-976-4000

shirley@audiocodes.com

|

|

Philip Carlson/Chris Harrison

KCSA Strategic Communications

Tel: +1-212-896-1233

audc@kcsa.com

|

AudioCodes

Announces Authorization of Additional Share Repurchase Program

Lod, Israel

– AudioCodes Ltd. – April 2, 2015 – AudioCodes (NasdaqGS: AUDC), a leading provider of converged voice solutions

that enable enterprises and service providers to transition to all-IP voice networks, today announced that its Board of Directors

has approved a program to repurchase up to an additional $15 million of its Ordinary Shares, NIS 0.01 nominal value. This follows

a repurchase program that was initiated last year, pursuant to which AudioCodes has repurchased approximately $7 million out of

the $15 million of its Ordinary Shares targeted for repurchase, under the court approval. The court approval for that repurchase

program is scheduled to expire in late May 2015, and therefore AudioCodes will file today a motion seeking court approval for repurchases

of up to an additional $15 million of its Ordinary Shares once the previous plan expires or is exhausted. As of March 20, 2015,

AudioCodes had approximately 41.6 million Ordinary Shares outstanding.

Shabtai Adlersberg, Chairman of the Board,

President and Chief Executive Officer of AudioCodes said: “This share repurchase program, coming on the heels of our existing

share repurchase program, represents the continuing confidence we have in the Company and its long-term growth prospects, and is

consistent with management’s goal of increasing shareholder value.”

Share purchases will take place in open

market transactions or in privately negotiated transactions and may be made from time to time depending on market conditions, share

price, trading volume and other factors. Such purchases will be made in accordance with all applicable securities laws and regulations.

For all or a portion of the authorized repurchase amount, AudioCodes may enter into a plan that is compliant with Rule 10b5-1 of

the United States Securities Exchange Act of 1934 that is designed to facilitate these purchases. The repurchase program does not

require AudioCodes to acquire a specific number of shares, and may be suspended from time to time or discontinued.

The share repurchases will be funded from

available working capital. AudioCodes expects that the court approval process for the additional repurchase program will take

approximately three months.

Except for historical information, the

matters discussed in this press release are forward-looking statements. The Company assumes no obligation to update the information

in this press release.

| |

|

| AudioCodes

Announces Authorization of Additional Share Repurchase Program |

Page

1 of 2 |

About AudioCodes

AudioCodes Ltd. (NasdaqGS, TASE: AUDC)

designs, develops and sells advanced Voice-over-IP (VoIP) and converged VoIP and Data networking products and applications to

Service Providers and Enterprises. AudioCodes is a VoIP technology market leader, focused on converged VoIP and data communications,

and its products are deployed globally in Broadband, Mobile, Enterprise networks and Cable. The Company provides a range of innovative,

cost-effective products including Media Gateways, Multi-Service Business Routers, Session Border Controllers (SBC), Residential

Gateways, IP Phones, Media Servers, Value Added Applications and Professional Services. AudioCodes’ underlying technology,

VoIPerfectHD™, relies on AudioCodes’ leadership in DSP, voice coding and voice processing technologies. AudioCodes’

High Definition (HD) VoIP technologies and products provide enhanced intelligibility and a better end user communication experience

in Voice communications. For more information on AudioCodes, visit http://www.audiocodes.com.

To download AudioCodes investor relations

app, which offers access to its SEC filings, press releases, videos, audiocasts and more, please visit Apple's App

Store for the iPhone and iPad or Google Play for Android mobile devices.

Statements

concerning AudioCodes' business outlook or future economic performance; product introductions and plans and objectives related

thereto; and statements concerning assumptions made or expectations as to any future events, conditions, performance or other

matters, are "forward-looking statements'' as that term is defined under U.S. Federal securities laws. Forward-looking statements

are subject to various risks, uncertainties and other factors that could cause actual results to differ materially from those

stated in such statements. These risks, uncertainties and factors include, but are not limited to: the effect of global economic

conditions in general and conditions in AudioCodes' industry and target markets in particular; shifts in supply and demand; market

acceptance of new products and the demand for existing products; the impact of competitive products and pricing on AudioCodes'

and its customers' products and markets; timely product and technology development, upgrades and the ability to manage changes

in market conditions as needed; possible need for additional financing; the ability to satisfy covenants in the Company’s

loan agreements; possible disruptions from acquisitions; the ability of AudioCodes to successfully integrate the products and

operations of acquired companies into AudioCodes’ business; and other factors detailed in AudioCodes' filings with the U.S.

Securities and Exchange Commission. AudioCodes assumes no obligation to update the information in this release.

©2015

AudioCodes Ltd. All rights reserved. AudioCodes, AC, HD VoIP, HD VoIP Sounds Better, IPmedia, Mediant, MediaPack, OSN, SmartTAP,

VMAS, VoIPerfect, VoIPerfectHD, Your Gateway To VoIP, 3GX and One Box 365 are trademarks or registered trademarks of AudioCodes

Limited All other products or trademarks are property of their respective owners. Product specifications are subject to change

without notice.

| |

|

| AudioCodes

Announces Authorization of Additional Share Repurchase Program |

Page

2 of 2 |

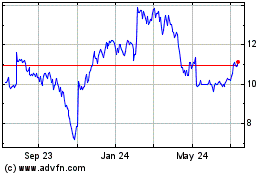

AudioCodes (NASDAQ:AUDC)

Historical Stock Chart

From Mar 2024 to Apr 2024

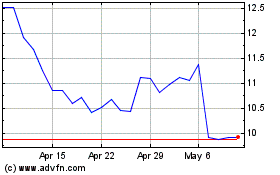

AudioCodes (NASDAQ:AUDC)

Historical Stock Chart

From Apr 2023 to Apr 2024