UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March

31, 2015

Commission File Number 001-34984

FIRST

MAJESTIC SILVER CORP.

(Translation of registrant's name into English)

925 West Georgia Street,

Suite 1805, Vancouver BC V6C 3L2

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

SUBMITTED HEREWITH

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| FIRST MAJESTIC SILVER CORP. |

|

| |

|

| By: |

|

| |

|

| /s/ Connie Lillico |

|

| Connie Lillico |

|

| Corporate Secretary |

|

| |

|

| March 31, 2015 |

|

Exhibit 99.1

Form 51-102F3

Material Change Report

| Item 1. |

Name and Address of Company |

| |

|

| |

FIRST MAJESTIC SILVER CORP. (the “Company”) |

| |

1805 - 925 West Georgia Street |

| |

Vancouver, BC V6C 3L2 CANADA |

| |

Telephone: (604) 688-3033 |

| |

Facsimile: (604) 639-8873 |

| |

|

| Item 2. |

Date of Material Change |

| |

|

| |

March 31, 2015 |

| |

|

| Item 3. |

News Release |

| |

|

| |

The press release was disseminated through the services of CNW Group. |

| |

|

| Item 4. |

Summary of Material Change |

| |

|

| |

The Company announced a new NI 43-101 Technical Report and the initial Mineral Reserve and Resource estimate for the La Guitarra Silver Mine located in the State of Mexico. |

| |

|

| Item 5. |

Full Description of Material Change |

| |

|

| |

5.1 Full Description of Material Change |

| |

|

| |

See Schedule “A” attached hereto. |

| |

|

| |

5.2 Disclosure for Restructuring Transactions |

| |

|

| |

Not applicable. |

| |

|

| Item 6. |

Reliance on subsection 7.1(2) or (3) of National Instrument 51-102 |

| |

|

| |

Not applicable |

| |

|

| Item 7. |

Omitted Information |

| |

|

| |

Not applicable. |

| |

|

| Item 8. |

Executive Officer |

| |

|

| |

Keith Neumeyer, President & CEO |

| |

Telephone: (604) 688-3033 Facsimile: (604) 639-8873 |

| |

|

| Item 9. |

Date of Report |

| |

|

| |

March 31, 2015 |

SCHEDULE “A”

FIRST MAJESTIC SILVER CORP.

Suite 1805

- 925 West Georgia Street

Vancouver, B.C., Canada V6C 3L2

Telephone: (604) 688-3033 Fax: (604) 639-8873

Toll Free: 1-866-529-2807

Web site: www.firstmajestic.com; E-mail: info@firstmajestic.com

NEWS RELEASE

| New York - AG |

March 31, 2015 |

Toronto

- FR

Frankfurt

- FMV

Mexico - AG

Announces New

La Guitarra NI 43-101 Technical Report

FIRST MAJESTIC SILVER CORP. (the "Company"

or “First Majestic”) is pleased to provide a new NI 43-101 Technical Report and the initial Mineral Reserve and Resource

estimate for the La Guitarra Silver Mine located in the State of Mexico. All amounts are in U.S. dollars unless stated otherwise.

REPORTED HIGHLIGHTS

| • | Proven and Probable Reserves totalling 11.8 million ounces of silver equivalent ounces, including

9.4 million ounces of pure silver |

| • | Measured and Indicated Resources of 15.2 million ounces of silver equivalent ounces, including

11.7 million ounces of pure silver |

| • | Inferred Resources totalling 6.3 million silver equivalent ounces, including 4.7 million ounces

of pure silver |

| • | Average Reserve silver grade of 223 g/t; and an average gold grade of 1.06 g/t |

| • | Life of Mine (LOM) of 7.0 years producing an estimated total of 9.3 million ounce of silver and

45 thousand ounces of gold |

| • | LOM operating cost per tonne estimated at $48.31 per tonne, excluding G&A, sustaining costs

and exploration |

Keith Neumeyer, CEO and President, states: “since

purchasing the La Guitarra mine over two years ago, our geological and technical teams have been working diligently examining over

900 historical drill holes and drilling several additional holes in order to create what is now our new base line Reserve and Resource

estimate which now gives us a very good starting point to build on in the coming years. This large property has extremely exciting

geological potential and this first Technical Report prepared by our team points to the reason why we first decided to buy this

mine in 2012.”

The La Guitarra Silver Mine, located in historical

Temascaltepec mining district in the State of Mexico, consisting of 43 mining concessions covering 39,714 hectares (98,135 acres).

La Guitarra is comprised of two operating mines, La Guitarra and Coloso, and three past producing areas, the Nazareno, Mina de

Agua and El Rincón, which are now considered as exploration areas.

The new Mineral Resource and Mineral Reserve

estimates for La Guitarra are shown below and are classified in accordance with the CIM Definition Standards for Mineral Resources

and Mineral Reserves (May 10, 2014). Please note, First Majestic is reporting Mineral Resources inclusive of Mineral Reserves.

| LA GUITARRA MINERAL RESERVES WITH AN EFFECTIVE DATE OF DECEMBER, 31, 2014 |

| |

|

|

|

|

|

|

|

|

| Mine |

Category |

Mineral Type |

k tonnes |

Ag (g/t) |

Au (g/t) |

Ag-Eq (g/t) |

Ag (k Oz) |

Ag-Eq (k Oz) |

| |

|

|

|

|

|

|

|

|

| LA GUITARRA |

Proven (UG) |

Sulphides |

91 |

153 |

1.84 |

256 |

446 |

745 |

| Probable (UG) |

Sulphides |

1,217 |

228 |

1.00 |

284 |

8,911 |

11,098 |

| Total Proven and Probable (UG) |

Sulphides |

1,308 |

223 |

1.06 |

282 |

9,358 |

11,843 |

(1) Mineral Reserves have been classified in

accordance with the CIM Definition Standards on Mineral Resources and Mineral Reserves, whose definitions are incorporated by reference

into NI 43-101.

(2) Cut-off grade considered for sulphides was

200 g/t Ag-Eq and is based on actual and budgeted operating and sustaining costs.

(3) Metallurgical recovery used was 85% for silver

and 79% for gold.

(4) Metal payable used was 95% for silver and

95% for gold.

(5) Metal prices considered were $20 USD/oz Ag,

$1,200 USD/oz Au.

(6) Silver equivalent grade is estimated as:

Ag-Eq = Ag Grade + (Au Grade x Au Recovery x Au Payable x Au Price) / (Ag Recovery x Ag Payable x Ag Price).

(7) Tonnage is expressed in thousands of tonnes,

metal content is expressed in thousands of ounces.

(8) Totals may not add up due to rounding.

| LA GUITARRA MEASURED AND INDICATED MINERAL RESOURCES WITH AN EFFECTIVE DATE OF DECEMBER 31, 2014 |

| |

|

|

|

|

|

|

|

|

|

| Mine / Project |

Category |

Mineral Type |

k tonnes |

Ag (g/t) |

Au (g/t) |

Ag-Eq (g/t) |

Ag (k Oz) |

Ag-Eq (k Oz) |

|

| |

|

|

|

|

|

|

|

|

|

| LA GUITARRA |

Measured (UG) |

Sulphides |

121 |

170 |

2.37 |

305 |

660 |

1,185 |

|

| Indicated (UG) |

Sulphides |

1,029 |

335 |

1.56 |

424 |

11,078 |

14,029 |

|

| Total Measured and Indicated (UG) |

Sulphides |

1,150 |

318 |

1.65 |

412 |

11,738 |

15,214 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| LA GUITARRA INFERRED MINERAL RESOURCES WITH AN EFFECTIVE DATE OF DECEMBER 31, 2014 |

|

| |

|

|

|

|

|

|

|

|

|

| Mine / Project |

Category |

Mineral Type |

k tonnes |

Ag (g/t) |

Au (g/t) |

Ag-Eq (g/t) |

Ag (k Oz) |

Ag-Eq (k Oz) |

|

| |

|

|

|

|

|

|

|

|

|

| LA GUITARRA |

Inferred Total (UG) |

Sulphides |

739 |

197 |

1.23 |

267 |

4,674 |

6,343 |

|

(1) Mineral Resources have been classified in

accordance with the CIM Definition Standards on Mineral Resources and Mineral Reserves, whose definitions are incorporated by reference

into NI 43-101.

(2) Cut-off grade considered for sulphides was

180 g/t Ag-Eq and is based on actual and budgeted operating and sustaining costs.

(3) Metallurgical recovery used was 85% for silver

and 79% for gold.

(4) Metal payable used was 95% for silver and

95% for gold.

(5) Metal prices considered were $22 USD/oz Ag,

$1,350 USD/oz Au.

(6) Silver equivalent grade is estimated as:

Ag-Eq = Ag Grade + (Au Grade x Au Recovery x Au Payable x Au Price) / (Ag Recovery x Ag Payable x Ag Price).

(7) Tonnage is expressed in thousands of tonnes,

metal content is expressed in thousands of ounces.

(8) Totals may not add up due to rounding.

(9) Measured an Indicated Mineral Resources are

reported inclusive or Mineral Reserves.

Since taking control of the property in July

2012, to the effective date of December 31, 2014 used for the Mineral Resources and Mineral Reserve estimates, First Majestic has

led an aggressive exploration program at La Guitarra which has included an extensive 35,575 metres of diamond drilling over 262

holes. The Company also commenced a plan to expand the operation from 200 tonnes per day (tpd) to 520 tpd in late 2012. This expansion

was completed in May 2013 following the installation of a spare ball mill from the La Parrilla Silver Mine and some spare flotation

tanks from the La Encantada Silver Mine.

The LOM plan is based on an annual processing

rate of 190,000 tonnes of plant feed, corresponding to approximately 520 tpd. Considering the Mineral Reserves presented above

it represents a mine life of 7 years producing an estimated 9.3 million ounces of silver plus 45 thousand ounces of gold.

LIFE OF MINE

| |

|

LOM Plan |

|

| La Guitarra Silver Mine |

|

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

Total |

| ROM Mine Production |

kt |

187 |

190 |

190 |

190 |

190 |

190 |

171 |

1,308 |

| Silver grade |

g/t Ag |

189 |

185 |

203 |

237 |

265 |

263 |

206 |

223 |

| Gold grade |

g/t Au |

0.91 |

1.00 |

0.97 |

1.40 |

1.28 |

1.14 |

0.84 |

1.06 |

| Silver-Equivalent grade |

g/t Ag-Eq |

239 |

241 |

257 |

315 |

336 |

327 |

253 |

282 |

| Silver metal content |

M oz Ag |

1.13 |

1.13 |

1.24 |

1.45 |

1.62 |

1.61 |

1.14 |

9.31 |

| Gold metal content |

k oz Au |

5.46 |

6.13 |

5.91 |

8.53 |

7.80 |

6.96 |

4.60 |

45.40 |

| Silver-Equivalent metal content |

M oz Ag-Eq |

1.44 |

1.47 |

1.57 |

1.92 |

2.05 |

2.00 |

1.39 |

11.84 |

In late 2013, the Company started the development

of the Coloso mine incurring in expansionary capital expenditures in the areas of mine development, mine infrastructure and a 5

km power line. Sustaining capital expenditures throughout the projected life of mine are assumed to average $4.26 million per year,

including maintenance of the processing plant, equipment replacement in the mine, mine development, for tailings facility expansions

and infill exploration.

The sustaining capital budget includes an allocation

of an estimate of $1.0 million for the development of an 800 metre tunnel to connect the Coloso mine with the Nazareno area, in

addition, an estimate of $1.5 million for mine developing and preparation in Nazareno to bring this mine into production as a replacement

of the La Guitarra mine production after the depletion of current reserves in this area.

The Company’s

Qualified Persons recommend going forward with infill exploration works required for Nazareno and the permitting and exploration

works required for Mina de Agua in order to upgrade current resources and generate additional resources. The Company’s Qualified

Persons are of the opinion that La Guitarra property has the potential for hosting additional resources laterally at the Guitarra

vein, at depth at Coloso and laterally and at depth at, Nazareno, Mina de Agua and El Rincón. Further

exploration at Nazareno and Coloso areas may result in a near term increase in the recognized resources from this area.

Furthermore, the Mina de Agua and El Rincón

areas are highly prospective given the history of production from these areas. In the 18th century, the Mina de Agua mine and surrounding

areas were one of México's largest silver producers, generating approximately 10% of the country's total mineral wealth.

The Company’s Qualified Persons recommend the development of a 2 km tunnel from Mina de Agua to El Rincón plus a comprehensive

exploration program to develop the resources and potentially increase the delineation of resources and reserves in these areas.

In addition, a series of conceptual studies

have been conducted to investigate the potential of increasing the throughput capacity of the current La Guitarra processing plant

to 1,000 tpd. Preliminary estimates indicate a potential reduction of the operating costs driven by the economy of scale, mainly

in the processing and general and administration areas; however, the economics of the mine capacity expansion and the plant expansion

have not been completed. An increase in the annual throughput could reasonably be expected to increase the total costs but to reduce

unit operating costs. The Company’s Qualified Persons recommend continuing the conceptual studies and progressing to an internal

pre-feasibility level study to assess the economic viability of this expansion.

Mineral Resources

for the Coloso area have been estimated by Amec Foster Wheeler Americas Ltd. under the supervision of Greg Kulla, P.Geo. Mineral

Resources for La Guitarra, Nazareno and Mina de Agua areas have been estimated by First Majestic. Mineral Reserves for La Guitarra,

Coloso and Nazareno areas have been estimated by First Majestic under the supervision of Jesus M. Velador Beltran, PhD Geology.

Mineral Reserves for La Guitarra, Coloso and Nazareno areas have been estimated by First Majestic under the supervision of Ramon

Mendoza Reyes, P.Eng. Mr. Ramon Mendoza Reyes, Vice President Technical Services for First Majestic, is a "qualified person"

as such term is defined under National Instrument 43-101, and has reviewed and approved the technical information disclosed in

this news release.

First Majestic is a mining company focused on

silver production in México and is aggressively pursuing the development of its existing mineral property assets and the

pursuit through acquisition of additional mineral assets which contribute to the Company achieving its corporate growth objectives.

FOR FURTHER INFORMATION contact info@firstmajestic.com,

visit our website at www.firstmajestic.com or call our toll free number 1.866.529.2807.

FIRST MAJESTIC SILVER CORP.

“signed”

Keith Neumeyer, President & CEO

SPECIAL NOTE REGARDING FORWARD-LOOKING INFORMATION

This news release includes certain "Forward-Looking

Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian

securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”,

“expect”, “target”, “plan”, “forecast”, “may”, “schedule”

and similar words or expressions, identify forward-looking statements or information. These forward-looking statements or information

relate to, among other things: the price of silver and other metals; the accuracy of mineral reserve and resource estimates and

estimates of future production and costs of production at our properties; estimated production rates for silver and other payable

metals produced by us, the estimated cost of development of our development projects; the effects of laws, regulations and government

policies on our operations, including, without limitation, the laws in Mexico which currently have significant restrictions related

to mining; obtaining or maintaining necessary permits, licences and approvals from government authorities; and continued access

to necessary infrastructure, including, without limitation, access to power, land, water and roads to carry on activities as planned.

These statements reflect the Company’s

current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered

reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social uncertainties

and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially

different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements

or information and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include,

without limitation: fluctuations in the spot and forward price of silver, gold, base metals or certain other commodities (such

as natural gas, fuel oil and electricity); fluctuations in the currency markets (such as the Canadian dollar and Mexican peso versus

the U.S. dollar); changes in national and local government, legislation, taxation, controls, regulations and political or economic

developments in Canada, Mexico; operating or technical difficulties in connection with mining or development activities; risks

and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial

accidents, unusual or unexpected formations, pressures, cave-ins and flooding); risks relating to the credit worthiness or financial

condition of suppliers, refiners and other parties with whom the Company does business; inability to obtain adequate insurance

to cover risks and hazards; and the presence of laws and regulations that may impose restrictions on mining, including those currently

enacted in Mexico; employee relations; relationships with and claims by local communities and indigenous populations; availability

and increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development, including

the risks of obtaining necessary licenses, permits and approvals from government authorities; diminishing quantities or grades

of mineral reserves as properties are mined; the Company’s title to properties; and the factors identified under the caption

“Risk Factors” in the Company’s Annual Information Form, under the caption “Risks Relating to First Majestic's

Business”.

Investors are cautioned against attributing

undue certainty to forward-looking statements or information. Although the Company has attempted to identify important factors

that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated

or intended. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information

to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other

than as required by applicable law.

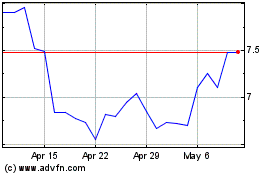

First Majestic Silver (NYSE:AG)

Historical Stock Chart

From Mar 2024 to Apr 2024

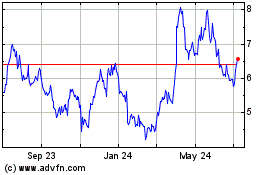

First Majestic Silver (NYSE:AG)

Historical Stock Chart

From Apr 2023 to Apr 2024