SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of January, 2015

Commission File Number 1-15236

Advantest Corporation

(Translation of Registrant’s Name Into English)

Shin Marunouchi Center Building

1-6-2, Marunouchi

Chiyoda-ku

Tokyo 100-0005

Japan

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F x Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

Materials Contained in this Report:

|

|

1.

|

English translation of the Japanese-language FY2014 Third Quarter Consolidated Financial Results for the period ended December 31, 2014, as filed by the registrant with the Tokyo Stock Exchange on January 29, 2015.

|

|

|

2.

|

English translation of the press release dated January 29, 2015 concerning Revisions of Earnings Forecast and Dividends Forecast for the Fiscal Year Ending March 31, 2015.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Advantest Corporation |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

|

|

By:

|

/s/ Hiroshi Nakamura |

|

| |

Name: Hiroshi Nakamura |

|

| |

Title: Director, Managing Executive Officer |

|

Advantest Corporation (FY2014 Q3)

FY2014 Third Quarter Consolidated Financial Results

(Advantest’s consolidated financial statements are prepared in accordance with U.S. GAAP)

(Period ended December 31, 2014)

(Unaudited)

January 29, 2015

|

Company name

|

:

|

Advantest Corporation

|

| |

|

(URL http://www.advantest.com/US/investors)

|

|

Stock exchange on which shares are listed

|

:

|

First section of the Tokyo Stock Exchange

|

|

Stock code number

|

:

|

6857

|

|

Company representative

|

:

|

Shinichiro Kuroe, Representative Director, President and CEO

|

|

Contact person

|

:

|

Hiroshi Nakamura, Director, Managing Executive Officer and Executive Vice President, Corporate Administration Group

|

| |

|

(03) 3214-7500

|

|

Quarterly Report Filing Date (as planned)

|

:

|

February 13, 2015

|

|

Quarterly Results Supplemental Materials

|

:

|

Yes

|

|

Quarterly Results Presentation Meeting

|

:

|

Yes

|

|

|

(Rounded to the nearest million yen)

|

1. Consolidated Results of FY2014 Q3 (April 1, 2014 through December 31, 2014)

(1) Consolidated Financial Results(Accumulated)

(% changes as compared with the corresponding period of the previous fiscal year)

|

|

Net sales

|

Operating income

(loss)

|

Income (loss) before

income taxes and

equity in earnings (loss) of affiliated company

|

Net income

(loss)

|

|

|

Million yen

|

% increase

(decrease)

|

Million yen

|

% increase

(decrease)

|

Million yen

|

% increase

(decrease)

|

Million yen

|

% increase

(decrease)

|

|

FY2014 Q3

|

119,902

|

51.3

|

9,811

|

-

|

13,305

|

-

|

9,241

|

-

|

|

FY2013 Q3

|

79,251

|

(18.5)

|

(34,404)

|

-

|

(34,321)

|

-

|

(34,148)

|

-

|

(Note) Quarterly comprehensive income (loss): FY2014 Q3 (Y) 28,163 million (-%); FY2013 Q3 (Y) (18,893) million (-%)

|

|

Net income (loss) per share - basic

|

Net income (loss) per share - diluted

|

|

|

|

|

Yen

|

|

Yen

|

|

|

FY2014 Q3

|

53.05

|

|

47.96

|

|

|

|

FY2013 Q3

|

(196.12)

|

|

(196.12)

|

|

|

(2) Consolidated Financial Position

|

|

Total assets

|

Net assets

|

Stockholders’ Equity

|

Equity-to-assets ratio

|

|

|

|

Million yen

|

|

Million yen

|

|

Million yen

|

|

%

|

|

FY2014 Q3

|

264,961

|

|

142,766

|

|

142,766

|

|

53.9

|

|

|

FY2013

|

229,856

|

|

116,252

|

|

116,252

|

|

50.6

|

|

|

|

Dividend per share

|

|

(Record Date)

|

First quarter end

|

Second quarter end

|

Third quarter end

|

Year end

|

Annual total

|

|

|

yen

|

yen

|

yen

|

yen

|

yen

|

|

FY2013

|

-

|

10.00

|

-

|

5.00

|

15.00

|

|

FY2014

|

-

|

5.00

|

-

|

N/A

|

N/A

|

|

FY2014

(forecast)

|

N/A

|

N/A

|

N/A

|

10.00

|

15.00

|

(Note) Revision of dividends forecast for this period: Yes

Advantest Corporation (FY2014 Q3)

3. Projected Results for FY2014 (April 1, 2014 through March 31, 2015)

|

|

(% changes as compared with the corresponding period of the previous fiscal year)

|

| |

Net sales

|

Operating income

|

Income before income taxes and equity in earnings of affiliated company

|

Net income

|

Net income per share

|

|

FY2014

|

Million yen

|

%

|

Million yen

|

%

|

Million yen

|

%

|

Million yen

|

%

|

Yen

|

|

162,000

|

44.8

|

14,000

|

-

|

17,500

|

-

|

12,500

|

-

|

71.76

|

(Note) Revision of projected results for this period: Yes

Please see “(3) Prospects for the Current Fiscal Year” on page 6 for details.

4. Others

|

(1)

|

Material changes in subsidiaries during this period (changes in scope of consolidation resulting from changes in subsidiaries): No

|

|

(2)

|

Use of simplified accounting method and special accounting policy for quarterly consolidated financial statements: Yes

|

(Note) Please see “2. Others” on page 7 for details.

| |

1)

|

Changes based on revisions of accounting standard: No

|

| |

2)

|

Changes other than 1) above: No

|

|

(4)

|

Number of issued and outstanding stock (common stock):

|

| |

1)

|

Number of issued and outstanding stock at the end of each fiscal period (including treasury stock):

|

FY2014 Q3 199,566,770 shares; FY2013 199,566,770 shares.

| |

2)

|

Number of treasury stock at the end of each fiscal period:

|

FY2014 Q3 25,291,042 shares; FY2013 25,368,828 shares.

| |

3)

|

Average number of outstanding stock for each period (cumulative term):

|

FY2014 Q3 174,199,488 shares; FY2013 Q3 174,113,609 shares.

Status of Quarterly Review Procedures

This quarterly financial results report is not subject to quarterly review procedures by independent auditors under Japan’s Financial Instruments and Exchange Law. At the time of release of this report, such quarterly review procedures under the Financial Instruments and Exchange Law have not been completed.

Explanation on the Appropriate Use of Future Earnings Projections and Other Special Instructions

This document contains “forward-looking statements” that are based on Advantest’s current expectations, estimates and projections. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause Advantest’s actual results, levels of activities, performance or achievements to be materially different from those expressed or implied by such forward-looking statements. These factors include: (i) changes in demand for the products and services produced and offered by Advantest’s customers, including semiconductors, communications services and electronic goods; (ii) circumstances relating to Advantest’s investment in technology, including its ability to timely develop products that meet the changing needs of semiconductor manufacturers, communications network equipment and components makers and service providers; (iii) significant changes in the competitive environment in the major markets where Advantest purchases materials, components and supplies for the production of its products or where its products are produced, distributed or sold; and (iv) changes in economic conditions, currency exchange rates or political stability in the major markets where Advantest procures materials, components and supplies for the production of its principal products or where its products are produced, distributed or sold. A discussion of these and other factors which may affect Advantest’s actual results, levels of activities, performance or achievements is contained in the “Operating and Financial Review and Prospects”, “Key Information - Risk Factors” and “Information on the Company” sections and elsewhere in Advantest’s annual report on Form 20-F, which is on file with the United States Securities and Exchange Commission.

Advantest Corporation (FY2014 Q3)

|

1.

|

Business Results

|

P. 4

|

| |

(1)

|

Analysis of Business Results

|

P. 4

|

| |

(2)

|

Analysis of Financial Condition

|

P. 6

|

| |

(3)

|

Prospects for the Current Fiscal Year

|

P. 6

|

|

2.

|

Others

|

P. 7

|

| |

(1)

|

Use of Simplified Accounting Method and Special Accounting Policy for Quarterly Consolidated Financial Statements

|

P. 7

|

|

3.

|

Consolidated Financial Statements and Other Information

|

P. 8

|

| |

(1)

|

Consolidated Balance Sheets (Unaudited)

|

P. 8

|

| |

(2)

|

Consolidated Statements of Operations (Unaudited)

|

P.10

|

| |

(3)

|

Consolidated Statements of Comprehensive Income (Loss) (Unaudited)

|

P.12

|

| |

(4)

|

Consolidated Statements of Cash Flows (Unaudited)

|

P.13

|

| |

(5)

|

Notes to Consolidated Financial Statements

|

P.14

|

| |

|

(Notes on Going Concern)

|

P.14

|

| |

|

(Notes on Significant Changes to Stockholders’ Equity)

|

P.14

|

| |

|

(Segment Information)

|

P.14

|

Advantest Corporation (FY2014 Q3)

1. Business Results

(1) Analysis of Business Results

Consolidated Financial Results of FY2014 Q3 (April 1, 2014 through December 31, 2014)

| |

|

|

(in billion yen) |

| |

Nine months ended

December 31, 2013

|

Nine months ended

December 31, 2014

|

As compared to the

corresponding period of

the previous

fiscal year

increase (decrease)

|

|

Orders received

|

88.3

|

126.1

|

42.7%

|

|

Net sales

|

79.3

|

119.9

|

51.3%

|

|

Operating income (loss)

|

(34.4)

|

9.8

|

-

|

|

Income (loss) before income taxes and equity in earnings (loss) of affiliated company

|

(34.3)

|

13.3

|

-

|

|

Net income (loss)

|

(34.1)

|

9.2

|

-

|

During the nine-month period ended December 31, 2014, the global economy overall saw a continuing gradual recovery, supported by sustained solid recovery in the American economy.

In the semiconductor market, semiconductor manufacturers actively promoted capital investments in production capacity expansion as a result of increasing demand for chips to be used in mobile handsets for the Chinese market following the launch of LTE services in China in late 2013, and as a result of continuing ramp-up in production of chips for new-model high-end smartphones.

Amid this business environment, Advantest sought to expand its business with a focus on test systems for smartphone chips. As a result, orders received were (Y) 126.1 billion (a 42.7% increase in comparison to the corresponding period of the previous fiscal year) and net sales were (Y) 119.9 billion (a 51.3% increase in comparison to the corresponding period of the previous fiscal year). In addition to year-on-year growth in net sales, higher ratio of sales of products with higher margin contributed to a significant improvement in profit and loss. Operating income was (Y) 9.8 billion, income before income taxes and equity in earnings of affiliated company was (Y) 13.3 billion, and net income was (Y) 9.2 billion. The percentage of net sales to overseas customers was 91.7% (90.4% in the corresponding period of the previous fiscal year).

Conditions of business segments are described below.

Advantest Corporation (FY2014 Q3)

<Semiconductor and Component Test System Segment>

| |

|

|

(in billion yen)

|

| |

Nine months ended

December 31, 2013

|

Nine months ended

December 31, 2014

|

As compared to the

corresponding period of

the previous

fiscal year

increase (decrease)

|

|

Orders received

|

56.2

|

87.8

|

56.1%

|

|

Net sales

|

51.5

|

80.1

|

55.6%

|

|

Operating income (loss)

|

(27.0)

|

10.3

|

-

|

The Semiconductor and Component Test System Segment continued to see increased sales of the V93000 non-memory test system due to higher demand for semiconductors that was spurred by the expansion of LTE base station infrastructure in China, increased production of smartphones for the Chinese market and the launch of new high-end smartphones. Demand for test systems for MPUs also increased.

As a result of the above, orders received were (Y) 87.8 billion (a 56.1% increase in comparison to the corresponding period of the previous fiscal year), net sales were (Y) 80.1 billion (a 55.6 % increase in comparison to the corresponding period of the previous fiscal year), and operating income was (Y) 10.3 billion.

< Mechatronics System Segment>

| |

|

|

(in billion yen) |

| |

Nine months ended

December 31, 2013

|

Nine months ended

December 31, 2014

|

As compared to the

corresponding period of

the previous

fiscal year

increase (decrease)

|

|

Orders received

|

12.8

|

20.5

|

59.3%

|

|

Net sales

|

10.0

|

20.2

|

101.4%

|

|

Operating income (loss)

|

(4.5)

|

2.6

|

-

|

The Mechatronics System Segment saw higher demand for device interfaces and test handlers that was correlated to increased demand for test systems. Customer demand in nanotechnology business also steadily increased due to continuing miniaturization of semiconductors.

As a result of the above, orders received were (Y) 20.5 billion (a 59.3% increase in comparison to the corresponding period of the previous fiscal year), net sales were (Y) 20.2 billion (a 101.4% increase in comparison to the corresponding period of the previous fiscal year), and operating income was (Y) 2.6 billion.

<Services, Support and Others Segment>

(in billion yen)

| |

Nine months ended

December 31, 2013

|

Nine months ended

December 31, 2014

|

As compared to the

corresponding period of

the previous

fiscal year

increase (decrease)

|

|

Orders received

|

19.5

|

17.9

|

(8.1%)

|

|

Net sales

|

17.9

|

19.7

|

10.0%

|

|

Operating income

|

2.1

|

2.4

|

16.4%

|

The Services, Support, and Others Segment saw a fall in orders received in comparison to the corresponding period of the previous fiscal year as demand for leases struggled to grow, but initiatives to increase profitability of field services continued to progress smoothly.

As a result of the above, orders received were (Y) 17.9 billion (a 8.1% decrease in comparison to the corresponding period of the previous fiscal year), net sales were (Y) 19.7 billion (a 10.0% increase in comparison to the corresponding period of the previous fiscal year), and operating income was (Y) 2.4 billion (a 16.4% increase in comparison to the corresponding period of the previous fiscal year).

Advantest Corporation (FY2014 Q3)

(2) Analysis of Financial Condition

Total assets at December 31, 2014 amounted to (Y) 265.0 billion, an increase of (Y) 35.1 billion compared to March 31, 2014, primarily due to an increase of (Y) 16.1 billion, (Y) 8.8 billion and (Y) 7.8 billion in cash and cash equivalents, trade receivables and goodwill, respectively. The amount of total liabilities was (Y) 122.2 billion, an increase of (Y) 8.6 billion compared to March 31, 2014, primarily due to an increase of (Y) 3.5 billion, (Y) 2.2 billion and (Y) 1.5 billion in income taxes payable, trade accounts payable and accrued expenses, respectively.

Stockholders’ equity was (Y) 142.8 billion. Equity to assets ratio was 53.9%, an increase of 3.3 percentage points from March 31, 2014.

(Cash Flow Condition)

Cash and cash equivalents held at December 31, 2014 were (Y) 85.1 billion, an increase of (Y) 16.1 billion from March 31, 2014. Significant cash flows during the nine-month period of this fiscal year and their causes are described below.

Net cash provided by operating activities was (Y) 12.5 billion (net cash outflow of (Y) 0.2 billion in the corresponding period of the previous fiscal year). This amount was primarily attributable to an increase of (Y) 3.2 billion in income taxes payable and offset by an increase of (Y) 5.6 billion in trade receivables, and adjustments of non cash items such as depreciation and amortization in addition to the net income of (Y) 9.2 billion.

Net cash used in investing activities was (Y) 0.9 billion (net cash outflow of (Y) 4.9 billion in the corresponding period of the previous fiscal year). This amount was primarily attributable to payments for acquisition of tangible fixed assets in the amount of (Y) 2.5 billion, offset by proceeds from sale of available-for-sale securities of (Y) 1.8 billion.

Net cash used in financing activities was (Y) 1.6 billion (net cash outflow of (Y) 2.9 billion in the corresponding period of the previous fiscal year). This amount was primarily attributable to dividends paid of (Y) 1.7 billion.

(3) Prospects for the Current Fiscal Year

The greater functionality and increasing global adoption of smartphones, as well as growth in demand for semiconductors for data centers, are expected to drive growth in semiconductor-related markets going forward. Thus, in 2015, Advantest expects DRAM and NAND flash memory for smartphones and data centers to lead growth in the semiconductor market. In such environment, Advantest foresees continued firm demand for its memory test systems.

Advantest continues to strive to complete the two structural transition initiatives launched in FY2013, building a cost structure that ensures profitability notwithstanding market fluctuations and building a business structure in which resources are reallocated to growth markets in an agile manner. By doing so, Advantest aims to further strengthen its profitability base and grow income streams.

Based on recent market trends, Advantest has revised its forecast for the full year of FY2014 as follows, with figures in brackets those announced in October 2014. Advantest now expects net sales of (Y) 162.0 billion ((Y) 152.0 billion); operating income of (Y) 14.0 billion ((Y) 12.0 billion); income before income taxes and equity in earnings of affiliated company of (Y) 17.5 billion ((Y) 13.7 billion), based on cumulative other income (expenses) through the third quarter of the fiscal year; and net income of (Y) 12.5 billion ((Y) 8.0 billion).

Advantest Corporation (FY2014 Q3)

2. Others

(1) Use of Simplified Accounting Method and Special Accounting Policy for Quarterly Consolidated Financial Statements

Tax expense is measured using an estimated annual effective tax rate. Advantest makes, at the end of the cumulative third quarter, its best estimate of the annual effective tax rate for the full fiscal year and uses that rate to provide for income taxes on a current year-to-date basis. The estimated effective tax rate includes the deferred tax effects of expected year-end temporary differences and carryforwards, and the effects of valuation allowances for deferred tax assets.

Advantest Corporation (FY2014 Q3)

|

3. Consolidated Financial Statements and Other Information

|

| |

|

|

|

|

|

|

|

|

|

|

(1) Consolidated Balance Sheets (Unaudited)

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Yen (Millions)

|

|

|

Assets

|

|

March 31, 2014

|

|

|

December 31, 2014

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

¥ |

68,997 |

|

|

|

85,145 |

|

|

Trade receivables, net

|

|

|

20,404 |

|

|

|

29,231 |

|

|

Inventories

|

|

|

30,200 |

|

|

|

33,852 |

|

|

Other current assets

|

|

|

5,218 |

|

|

|

5,475 |

|

| |

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

124,819 |

|

|

|

153,703 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Investment securities

|

|

|

3,741 |

|

|

|

2,393 |

|

|

Property, plant and equipment, net

|

|

|

39,925 |

|

|

|

39,334 |

|

|

Intangible assets, net

|

|

|

3,545 |

|

|

|

3,324 |

|

|

Goodwill

|

|

|

46,846 |

|

|

|

54,657 |

|

|

Other assets

|

|

|

10,980 |

|

|

|

11,550 |

|

| |

|

|

|

|

|

|

|

|

|

Total assets

|

|

¥ |

229,856 |

|

|

|

264,961 |

|

Advantest Corporation (FY2014 Q3)

| |

|

Yen (Millions)

|

|

|

Liabilities and Stockholders’ Equity

|

|

March 31, 2014

|

|

|

December 31, 2014

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

Trade accounts payable

|

|

¥ |

12,353 |

|

|

|

14,543 |

|

|

Accrued expenses

|

|

|

6,775 |

|

|

|

8,268 |

|

|

Income taxes payable

|

|

|

1,089 |

|

|

|

4,591 |

|

|

Accrued warranty expenses

|

|

|

1,589 |

|

|

|

1,446 |

|

|

Corporate bonds - current portion

|

|

|

— |

|

|

|

10,000 |

|

|

Customer prepayments

|

|

|

2,488 |

|

|

|

3,013 |

|

|

Other current liabilities

|

|

|

2,313 |

|

|

|

3,537 |

|

| |

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

26,607 |

|

|

|

45,398 |

|

| |

|

|

|

|

|

|

|

|

|

Corporate bonds

|

|

|

25,000 |

|

|

|

15,000 |

|

|

Convertible bonds

|

|

|

30,149 |

|

|

|

30,126 |

|

|

Accrued pension and severance costs

|

|

|

28,641 |

|

|

|

29,285 |

|

|

Other liabilities

|

|

|

3,207 |

|

|

|

2,386 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

113,604 |

|

|

|

122,195 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingent liabilities

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Common stock

|

|

|

32,363 |

|

|

|

32,363 |

|

|

Capital surplus

|

|

|

43,906 |

|

|

|

43,864 |

|

|

Retained earnings

|

|

|

130,740 |

|

|

|

138,002 |

|

|

Accumulated other comprehensive income

|

|

|

5,326 |

|

|

|

24,248 |

|

|

Treasury stock

|

|

|

(96,083 |

) |

|

|

(95,711 |

) |

| |

|

|

|

|

|

|

|

|

|

Total stockholders’ equity

|

|

|

116,252 |

|

|

|

142,766 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity

|

|

¥ |

229,856 |

|

|

|

264,961 |

|

Advantest Corporation (FY2014 Q3)

|

(2) Consolidated Statements of Operations (Unaudited)

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

Yen (Millions)

|

|

| |

|

Nine months ended

|

|

|

Nine months ended

|

|

| |

|

December 31, 2013

|

|

|

December 31, 2014

|

|

| |

|

|

|

|

|

|

|

Net sales

|

|

¥ |

79,251 |

|

|

|

119,902 |

|

|

Cost of sales

|

|

|

45,913 |

|

|

|

53,342 |

|

| |

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

33,338 |

|

|

|

66,560 |

|

| |

|

|

|

|

|

|

|

|

|

Research and development expenses

|

|

|

25,294 |

|

|

|

22,814 |

|

|

Selling, general and administrative expenses

|

|

|

29,380 |

|

|

|

33,724 |

|

|

Impairment charge

|

|

|

13,068 |

|

|

|

211 |

|

| |

|

|

|

|

|

|

|

|

|

Operating income (loss)

|

|

|

(34,404 |

) |

|

|

9,811 |

|

| |

|

|

|

|

|

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

Interest and dividend income

|

|

|

169 |

|

|

|

150 |

|

|

Interest expense

|

|

|

(104 |

) |

|

|

(103 |

) |

|

Gain on sale of investment securities

|

|

|

778 |

|

|

|

677 |

|

|

Other, net

|

|

|

(760 |

) |

|

|

2,770 |

|

| |

|

|

|

|

|

|

|

|

|

Total other income (expense)

|

|

|

83 |

|

|

|

3,494 |

|

| |

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes and equity

|

|

|

|

|

|

|

|

|

|

in earnings (loss) of affiliated company

|

|

|

(34,321 |

) |

|

|

13,305 |

|

| |

|

|

|

|

|

|

|

|

|

Income taxes (benefit)

|

|

|

(171 |

) |

|

|

4,064 |

|

|

Equity in earnings (loss) of affiliated company

|

|

|

2 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

¥ |

(34,148 |

) |

|

|

9,241 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

Yen

|

|

| |

|

Nine months ended

|

|

|

Nine months ended

|

|

| |

|

December 31, 2013

|

|

|

December 31, 2014

|

|

| |

|

|

|

|

|

|

|

|

|

Net income (loss) per share:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

¥ |

(196.12 |

) |

|

|

53.05 |

|

|

Diluted

|

|

|

(196.12 |

) |

|

|

47.96 |

|

Advantest Corporation (FY2014 Q3)

| |

|

Yen (Millions)

|

|

| |

|

Three months ended

|

|

|

Three months ended

|

|

| |

|

December 31, 2013

|

|

|

December 31, 2014

|

|

| |

|

|

|

|

|

|

|

Net sales

|

|

¥ |

19,613 |

|

|

|

40,959 |

|

|

Cost of sales

|

|

|

15,120 |

|

|

|

17,645 |

|

| |

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

4,493 |

|

|

|

23,314 |

|

| |

|

|

|

|

|

|

|

|

|

Research and development expenses

|

|

|

7,886 |

|

|

|

7,792 |

|

|

Selling, general and administrative expenses

|

|

|

9,949 |

|

|

|

11,892 |

|

|

Impairment charge

|

|

|

13,068 |

|

|

|

211 |

|

| |

|

|

|

|

|

|

|

|

|

Operating income (loss)

|

|

|

(26,410 |

) |

|

|

3,419 |

|

| |

|

|

|

|

|

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

Interest and dividend income

|

|

|

69 |

|

|

|

62 |

|

|

Interest expense

|

|

|

(34 |

) |

|

|

(35 |

) |

|

Gain on sale of investment securities

|

|

|

202 |

|

|

|

118 |

|

|

Other, net

|

|

|

(761 |

) |

|

|

1,724 |

|

| |

|

|

|

|

|

|

|

|

|

Total other income (expense)

|

|

|

(524 |

) |

|

|

1,869 |

|

| |

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes and equity

|

|

|

|

|

|

|

|

|

|

in earnings (loss) of affiliated company

|

|

|

(26,934 |

) |

|

|

5,288 |

|

| |

|

|

|

|

|

|

|

|

|

Income taxes (benefit)

|

|

|

(2,125 |

) |

|

|

632 |

|

|

Equity in earnings (loss) of affiliated company

|

|

|

0 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

¥ |

(24,809 |

) |

|

|

4,656 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

Yen

|

|

| |

|

Three months ended

|

|

|

Three months ended

|

|

| |

|

December 31, 2013

|

|

|

December 31, 2014

|

|

| |

|

|

|

|

|

|

|

|

|

Net income (loss) per share:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

¥ |

(142.42 |

) |

|

|

26.73 |

|

|

Diluted

|

|

|

(142.42 |

) |

|

|

24.15 |

|

Advantest Corporation (FY2014 Q3)

(3) Consolidated Statements of Comprehensive Income (Loss) (Unaudited)

| |

|

Yen (Millions)

|

|

| |

|

Nine months ended

|

|

|

Nine months ended

|

|

| |

|

December 31, 2013

|

|

|

December 31, 2014

|

|

| |

|

|

|

|

|

|

|

Comprehensive income (loss)

|

|

|

|

|

|

|

|

Net income (loss)

|

|

¥ |

(34,148 |

) |

|

|

9,241 |

|

|

Other comprehensive income (loss), net of tax

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments

|

|

|

15,147 |

|

|

|

18,440 |

|

|

Net unrealized gains (losses) on investment securities

|

|

|

(294 |

) |

|

|

(302 |

) |

|

Pension related adjustments

|

|

|

402 |

|

|

|

784 |

|

| |

|

|

|

|

|

|

|

|

|

Total other comprehensive income (loss)

|

|

|

15,255 |

|

|

|

18,922 |

|

| |

|

|

|

|

|

|

|

|

|

Total comprehensive income (loss)

|

|

¥ |

(18,893 |

) |

|

|

28,163 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

Yen (Millions)

|

|

| |

|

Three months ended

|

|

|

Three months ended

|

|

| |

|

December 31, 2013

|

|

|

December 31, 2014

|

|

| |

|

|

|

|

|

|

|

|

|

Comprehensive income (loss)

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

¥ |

(24,809 |

) |

|

|

4,656 |

|

|

Other comprehensive income (loss), net of tax

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments

|

|

|

9,428 |

|

|

|

11,779 |

|

|

Net unrealized gains (losses) on investment securities

|

|

|

2 |

|

|

|

69 |

|

|

Pension related adjustments

|

|

|

31 |

|

|

|

252 |

|

| |

|

|

|

|

|

|

|

|

|

Total other comprehensive income (loss)

|

|

|

9,461 |

|

|

|

12,100 |

|

| |

|

|

|

|

|

|

|

|

|

Total comprehensive income (loss)

|

|

¥ |

(15,348 |

) |

|

|

16,756 |

|

Advantest Corporation (FY2014 Q3)

(4) Consolidated Statements of Cash Flows (Unaudited)

| |

|

Yen (Millions)

|

|

| |

|

Nine months ended

|

|

|

Nine months ended

|

|

| |

|

December 31, 2013

|

|

|

December 31, 2014

|

|

| |

|

|

|

|

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

Net income (loss)

|

|

¥ |

(34,148 |

) |

|

|

9,241 |

|

|

Adjustments to reconcile net income (loss) to net cash

|

|

|

|

|

|

|

|

|

|

provided by (used in) operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

6,831 |

|

|

|

3,769 |

|

|

Deferred income taxes

|

|

|

(2,048 |

) |

|

|

(75 |

) |

|

Stock option compensation expense

|

|

|

870 |

|

|

-

|

|

|

Impairment charge

|

|

|

13,495 |

|

|

|

211 |

|

|

Gain on sale of investment securities

|

|

|

(778 |

) |

|

|

(677 |

) |

|

Changes in assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Trade receivables

|

|

|

15,651 |

|

|

|

(5,617 |

) |

|

Other account receivable

|

|

|

(126 |

) |

|

|

779 |

|

|

Inventories

|

|

|

311 |

|

|

|

(1,551 |

) |

|

Trade accounts payable

|

|

|

(79 |

) |

|

|

718 |

|

|

Other account payable

|

|

|

61 |

|

|

|

953 |

|

|

Accrued expenses

|

|

|

(1,310 |

) |

|

|

1,096 |

|

|

Income taxes payable

|

|

|

(631 |

) |

|

|

3,208 |

|

|

Accrued warranty expenses

|

|

|

(269 |

) |

|

|

(216 |

) |

|

Customer prepayments

|

|

|

(662 |

) |

|

|

493 |

|

|

Accrued pension and severance costs

|

|

|

1,207 |

|

|

|

323 |

|

|

Other

|

|

|

1,458 |

|

|

|

(180 |

) |

| |

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) operating activities

|

|

|

(167 |

) |

|

|

12,475 |

|

| |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Proceeds from sale of available-for-sale securities

|

|

|

1,418 |

|

|

|

1,806 |

|

|

Acquisition of subsidiary, net of cash acquired

|

|

|

(1,272 |

) |

|

-

|

|

|

Purchases of property, plant and equipment

|

|

|

(5,096 |

) |

|

|

(2,486 |

) |

|

Purchases of intangible assets

|

|

|

(648 |

) |

|

|

(307 |

) |

|

Other

|

|

|

650 |

|

|

|

86 |

|

| |

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) investing activities

|

|

|

(4,948 |

) |

|

|

(901 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Dividends paid

|

|

|

(3,369 |

) |

|

|

(1,666 |

) |

|

Other

|

|

|

501 |

|

|

|

114 |

|

| |

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) financing activities

|

|

|

(2,868 |

) |

|

|

(1,552 |

) |

| |

|

|

|

|

|

|

|

|

|

Net effect of exchange rate changes on cash and cash equivalents

|

|

|

4,436 |

|

|

|

6,126 |

|

| |

|

|

|

|

|

|

|

|

|

Net change in cash and cash equivalents

|

|

|

(3,547 |

) |

|

|

16,148 |

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at beginning of period

|

|

|

45,668 |

|

|

|

68,997 |

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at end of period

|

|

¥ |

42,121 |

|

|

|

85,145 |

|

Advantest Corporation (FY2014 Q3)

|

(5)

|

Notes to Consolidated Financial Statements

|

(Notes on Going Concern): None

(Notes on Significant Changes to Stockholders’ Equity): None

(Segment Information)

| |

|

Yen (Millions)

|

|

| |

|

Nine months ended December 31, 2013

|

|

| |

|

Semiconductor and Component Test System Business

|

|

|

Mechatronics System Business

|

|

|

Services, Support and Others

|

|

|

Elimination and Corporate

|

|

|

Total

|

|

|

Net sales to unaffiliated customers

|

|

¥ |

51,299 |

|

|

|

10,031 |

|

|

|

17,921 |

|

|

-

|

|

|

|

79,251 |

|

|

Inter-segment sales

|

|

|

161 |

|

|

|

8 |

|

|

-

|

|

|

|

(169 |

) |

|

-

|

|

|

Net sales

|

|

|

51,460 |

|

|

|

10,039 |

|

|

|

17,921 |

|

|

|

(169 |

) |

|

|

79,251 |

|

|

Operating income (loss) before stock option compensation expense

|

|

|

(26,960 |

) |

|

|

(4,530 |

) |

|

|

2,095 |

|

|

|

(4,139 |

) |

|

|

(33,534 |

) |

|

Adjustment:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock option compensation expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

870 |

|

|

Operating income (loss)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

¥ |

(34,404 |

) |

| |

|

Yen (Millions)

|

|

| |

|

Nine months ended December 31, 2014

|

|

| |

|

Semiconductor and Component Test System Business

|

|

|

Mechatronics System Business

|

|

|

Services, Support and Others

|

|

|

Elimination and Corporate

|

|

|

Total

|

|

|

Net sales to unaffiliated customers

|

|

¥ |

79,972 |

|

|

|

20,217 |

|

|

|

19,713 |

|

|

-

|

|

|

|

119,902 |

|

|

Inter-segment sales

|

|

|

80 |

|

|

-

|

|

|

-

|

|

|

|

(80 |

) |

|

-

|

|

|

Net sales

|

|

|

80,052 |

|

|

|

20,217 |

|

|

|

19,713 |

|

|

|

(80 |

) |

|

|

119,902 |

|

|

Operating income (loss) before stock option compensation expense

|

|

|

10,255 |

|

|

|

2,620 |

|

|

|

2,440 |

|

|

|

(5,504 |

) |

|

|

9,811 |

|

|

Adjustment:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock option compensation expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

|

|

|

Operating income (loss)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

¥ |

9,811 |

|

Advantest Corporation (FY2014 Q3)

| |

|

Yen (Millions)

|

|

| |

|

Three months ended December 31, 2013

|

|

| |

|

Semiconductor and Component Test System Business

|

|

|

Mechatronics System Business

|

|

|

Services, Support and Others

|

|

|

Elimination and Corporate

|

|

|

Total

|

|

|

Net sales to unaffiliated customers

|

|

¥ |

10,086 |

|

|

|

3,244 |

|

|

|

6,283 |

|

|

-

|

|

|

|

19,613 |

|

|

Inter-segment sales

|

|

|

70 |

|

|

|

8 |

|

|

-

|

|

|

|

(78 |

) |

|

-

|

|

|

Net sales

|

|

|

10,156 |

|

|

|

3,252 |

|

|

|

6,283 |

|

|

|

(78 |

) |

|

|

19,613 |

|

|

Operating income (loss) before stock option compensation expense

|

|

|

(23,175 |

) |

|

|

(2,042 |

) |

|

|

923 |

|

|

|

(1,684 |

) |

|

|

(25,978 |

) |

|

Adjustment:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock option compensation expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

432 |

|

|

Operating income (loss)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

¥ |

(26,410 |

) |

| |

|

Yen (Millions)

|

|

| |

|

Three months ended December 31, 2014

|

|

| |

|

Semiconductor and Component Test System Business

|

|

|

Mechatronics System Business

|

|

|

Services, Support and Others

|

|

|

Elimination and Corporate

|

|

|

Total

|

|

|

Net sales to unaffiliated customers

|

|

¥ |

25,047 |

|

|

|

9,117 |

|

|

|

6,795 |

|

|

-

|

|

|

|

40,959 |

|

|

Inter-segment sales

|

|

|

14 |

|

|

-

|

|

|

-

|

|

|

|

(14 |

) |

|

-

|

|

|

Net sales

|

|

|

25,061 |

|

|

|

9,117 |

|

|

|

6,795 |

|

|

|

(14 |

) |

|

|

40,959 |

|

|

Operating income (loss) before stock option compensation expense

|

|

|

2,351 |

|

|

|

1,906 |

|

|

|

872 |

|

|

|

(1,710 |

) |

|

|

3,419 |

|

|

Adjustment:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock option compensation expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

|

|

|

Operating income (loss)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

¥ |

3,419 |

|

(Notes)

|

|

1.

|

Adjustments to operating income (loss) in Corporate principally represent corporate general and administrative expenses and research and development expenses related to fundamental research activities that are not allocated to operating segments.

|

|

|

2.

|

Advantest uses the operating income (loss) before stock option compensation expense for management’s analysis of business segment results.

|

FOR IMMEDIATE RELEASE

January 29, 2015

ADVANTEST CORPORATION

Shinichiro Kuroe, Representative Director, President & CEO

(Stock Code Number: 6857, TSE first section)

(Ticker Symbol: ATE, NYSE)

CONTACT:

Hiroshi Nakamura

Director, Managing Executive Officer &

Executive Vice President, Corporate Administration Group

Phone: +81-(0)3-3214-7500

Revisions of Earnings Forecast and Dividends Forecast for the Fiscal Year Ending March 31, 2015

In light of recent changes in business performance, we announce revisions to the consolidated earnings forecast and the dividends forecast announced on October 28, 2014 for the fiscal year ending March 31, 2015 as follows:

1. Revised consolidated earnings forecast for the fiscal year ending March 31, 2015 (April 1, 2014 to March 31, 2015)

(US GAAP)

| |

Net Sales

|

Operating

income (loss)

|

Income (loss) before

income taxes and equity

in earnings (loss) of

affiliated company

|

Net income

(loss)

|

Net income

(loss) per share

- (basic)

|

|

FY2014 forecast (A)

(announced October 28, 2014)

|

Million yen

152,000

|

Million yen

12,000

|

Million yen

13,700

|

Million yen

8,000

|

Yen

45.93

|

|

FY2014 forecast (B)

(announced January 29, 2015)

|

162,000

|

14,000

|

17,500

|

12,500

|

71.76

|

|

Difference (B-A)

|

10,000

|

2,000

|

3,800

|

4,500

|

-

|

|

Percentage change

|

6.6%

|

16.7%

|

27.7%

|

56.3%

|

-

|

|

(Reference)

FY2013 actual

|

111,878

|

(36,369)

|

(35,501)

|

(35,540)

|

(204.10)

|

<Reasons for the earnings forecast revisions>

Based on robust demand for test systems for processors and DRAMs driven by increasing adoption of smartphones, as well as the Japanese yen being weaker than expected, we have revised upward as above our consolidated earnings forecast for the fiscal year ending March 31, 2015 that was previously announced on October, 2014.

2. Revised Forecast of Dividends for the fiscal year

| |

Dividend per share (yen)

|

|

Record date

|

First

Quarter-end

|

Second

Quarter-end

|

Third

Quarter-end

|

Year-end

|

Annual

total

|

|

Previous forecast

(announced October 28, 2014)

|

―

|

|

―

|

5.00

|

10.00

|

|

Current forecast

(announced January 29, 2015)

|

―

|

|

―

|

10.00

|

15.00

|

|

Dividends paid for FY2014

|

―

|

5.00

|

―

|

―

|

―

|

|

Dividends paid for FY2013

|

―

|

10.00

|

―

|

5.00

|

15.00

|

<Reasons for the dividends forecast revisions>

We aim to make consistent dividend distributions, following a target dividend payout ratio of 20% or more. We have revised our year-end dividend forecast to ¥10.00 from the previous forecast ¥5.00, and our annual total dividend forecast to ¥15.00, based on this target and the upward revisions to the consolidated earnings forecast for the fiscal year ending March 31, 2015 as described above.

Cautionary Statement with Respect to Forward-Looking Statements

This document contains “forward-looking statements” that are based on Advantest’s current expectations, estimates and projections. These statements include, among other things, the discussion of Advantest’s business strategy, outlook and expectations as to market and business developments, production and capacity plans. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “project,” “should” and similar expressions. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause Advantest’s actual results, levels of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking statements, including:

|

|

•

|

changes in demand for the products and services produced and offered by Advantest’s customers, including semiconductors, communications services and electronic goods;

|

|

|

•

|

circumstances relating to Advantest’s investment in technology, including its ability to timely develop products that meet the changing needs of semiconductor manufacturers and communications network equipment and components makers and service providers;

|

|

|

•

|

the environment in which Advantest purchases materials, components and supplies for the production of its products, including the availability of necessary materials, components and supplies during a significant expansion in the market in which Advantest operates; and

|

|

|

•

|

changes in economic conditions, competitive environment, currency exchange rates or political stability in the major markets where Advantest produces, distributes or sells its products.

|

These risks, uncertainties and other factors also include those identified in “Operating and Financial Review and Prospects,” “Key Information—Risk Factors” and “Information on the Company” set forth elsewhere in Advantest’s annual report on Form 20-F, which is on file with the United States Securities and Exchange Commission.

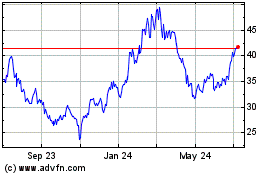

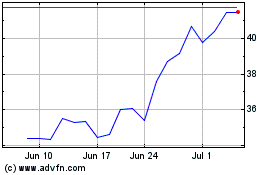

Advantest (PK) (USOTC:ATEYY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Advantest (PK) (USOTC:ATEYY)

Historical Stock Chart

From Apr 2023 to Apr 2024