Report of Foreign Issuer (6-k)

January 22 2015 - 10:40AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month: January, 2015

Commission File Number: 001-13422

AGNICO EAGLE MINES LIMITED

(Translation of registrant’s name into English)

145 King Street East, Suite 400, Toronto, Ontario M5C 2Y7

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F o Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b)( 1): o

Note: Regulation S-T Rule 101 (b)( 1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b)(7): o

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

EXHIBITS

|

Exhibit No. |

|

Exhibit Description |

|

99.1 |

|

Press Release dated January 21, 2015 announcing the Corporation’s sale of Probe Mines Limited shares and warrants. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

AGNICO EAGLE MINES LIMITED |

|

|

(Registrant) |

|

|

|

|

|

|

|

Date: January 22, 2015 |

By: |

/s/ R. Gregory Laing |

|

|

|

R. Gregory Laing |

|

|

|

General Counsel, Sr. Vice President, Legal |

|

|

|

and Corporate Secretary |

2

Exhibit 99.1

|

Stock Symbol: |

AEM (NYSE and TSX) |

AGNICO EAGLE ANNOUNCES SALE OF PROBE SHARES AND WARRANTS

Toronto (January 21, 2015) — Agnico Eagle Mines Limited (NYSE: AEM, TSX: AEM) (“Agnico Eagle” or the “Company”) announced today that it has entered into an agreement (the “Purchase Agreement”) to sell to Goldcorp Inc. (“Goldcorp”) (i) 7,320,200 common shares (the “Purchased Shares”) of Probe Mines Limited (“Probe”) for cash consideration of C$5.00 per Purchased Share, and (ii) 2,347,951 common share purchase warrants of Probe (the “Purchased Warrants”) for cash consideration of C$2.90 per Purchased Warrant. Each Purchased Warrant entitles the holder to purchase one common share of Probe (each a “Share”) at a price of C$2.10 until May 28, 2015. The Purchased Shares represent approximately 8.1% of the issued and outstanding Shares on a non-diluted basis. The Purchased Shares and the Purchased Warrants collectively represent approximately 10.4% of the issued and outstanding Shares assuming exercise of the Purchased Warrants.

Upon the closing of the transaction, which is expected to occur on or about January 28, 2015, Agnico Eagle will hold (i) no Shares, and (ii) 3,277,049 common share purchase warrants of Probe (the “Remaining Warrants”), each exercisable on the same terms as the Purchased Warrants. The Remaining Warrants represent approximately 3.5% of the issued and outstanding Shares assuming exercise of the Remaining Warrants.

Agnico Eagle disposed of the Purchased Shares and the Purchased Warrants in the ordinary course of business as they were a non-core asset of Agnico Eagle.

About Agnico Eagle

Agnico Eagle is a senior Canadian gold mining company that has produced precious metals since 1957. Its nine mines are located in Canada, Finland and Mexico, with exploration and development activities in each of these regions as well as in the United States. The Company and its shareholders have full exposure to gold prices due to its long-standing policy of no forward gold sales. Agnico Eagle has declared a cash dividend every year since 1983. Agnico Eagle’s head office is located at 145 King Street East, Suite 400, Toronto, Ontario, M5C 2Y7.

Forward-Looking Statements

The information in this news release has been prepared as of January 21, 2015. Certain statements contained in this news release constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward looking information” under the provisions of Canadian provincial securities laws and are referred to herein as “forward-looking statements”. When used in this document, words such as “expected”, “will” and similar expressions are intended to identify forward-looking statements or information.

Such statements and information include, without limitation, statements relating to the date of closing of the sale of the Purchased Shares and the Purchased Warrants and Agnico Eagle’s ownership of Shares and Remaining Warrants following that date. The material factors and assumptions used in the preparation of forward-looking statements contained herein, which may prove to be incorrect include, but are not limited to, that the purchase and sale of the Purchased Shares and the Purchased Warrants will occur in accordance with and on the timing currently contemplated by Agnico Eagle.

These forward-looking statements are subject to numerous risks, uncertainties and assumptions, certain of which are beyond the control of Agnico Eagle. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise except as required by applicable securities laws.

Further Information

For further information regarding Agnico Eagle, contact Investor Relations at info@agnicoeagle.com or call (416) 947-1212.

To obtain a copy of the early warning report filed by Agnico Eagle with the Canadian securities regulatory authorities relating to the sale of the Purchased Shares and the Purchased Warrants, contact David Wong, Manager, Investor Relations at (416) 947-1212.

2

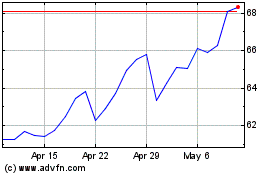

Agnico Eagle Mines (NYSE:AEM)

Historical Stock Chart

From Mar 2024 to Apr 2024

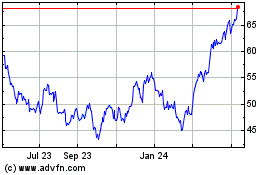

Agnico Eagle Mines (NYSE:AEM)

Historical Stock Chart

From Apr 2023 to Apr 2024