SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of January, 2015

(Commission File No. 001-32221) ,

GOL LINHAS AÉREAS INTELIGENTES S.A.

(Exact name of registrant as specified in its charter)

GOL INTELLIGENT AIRLINES INC.

(Translation of Registrant's name into English)

Praça Comandante Linneu Gomes, Portaria 3, Prédio 24

Jd. Aeroporto

04630-000 São Paulo, São Paulo

Federative Republic of Brazil

(Address of Regristrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form20-F X Form 40-F

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes No X

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

|

Material Event Notice

|

|

São Paulo, January 21, 2015 – GOL Linhas Aéreas Inteligentes S.A. (BM&FBOVESPA: GOLL4 and NYSE: GOL), (S&P: B, Fitch: B-, Moody’s: B3), (“GOL” or the “Company”), the largest low-cost and best-fare airline in Latin America, hereby publishes its management’s proposal to improve the Company’s capitalization capacity and corporate governance (the “Transaction”). The Transaction will be submitted to the Company’s shareholders for approval.

The Transaction represents a long-term structural solution to improve the Company’s capacity to raise equity capital, enabling GOL to compete on even terms in this regard. The airline sector and the Company’s investment plan demand significant capital resources. In the last five years, GOL made capital expenditures in excess of R$5.5 billion (including aircraft acquisitions).

The Company will expand its capacity to raise equity capital by increasing its ability to issue more preferred shares without needing to issue common shares simultaneously, as the transfer and ownership of common shares are subject to restrictions under Brazilian airline industry laws and regulations.

The Transaction contemplates an amendment to the Company’s Bylaws to:

(1) Increase economic rights of preferred shares in the ratio of 35 to one and split common shares in the same ratio, both steps being together economically neutral to shareholders;

(2) Improve corporate governance and strengthen the alignment of interests among shareholders, which, depending on the percentage of economic rights held by the Controlling Shareholder, may include the representation of preferred shareholders on the Board of Directors and a separate vote for preferred shareholders in Extraordinary Meetings on certain matters, as detailed in the Bylaws;

(3) Restrict the sale of shares held by the Controlling Shareholder (the “Controlling Shareholder Lock-Up”); and

(4) Create an obligation to launch a public tender offer for all shares if any person acquires 30% or more of the Company’s economic rights.

The Company’s shareholders will vote on the Transaction at a shareholders’ meeting (the “Shareholders’ Meeting”) to be convened in due course. All of the Company’s shareholders, including holders of preferred shares, will be entitled to participate and vote in the Shareholders’ Meeting. Following best corporate governance practices, the approval of the Transaction is being made dependent on the vote of a majority of the preferred shareholders in attendance at the Shareholders’ Meeting, excluding the votes of the Controlling Shareholder.

The Controlling Shareholder will vote in accordance with the majority of the non-controlling preferred shareholders in order not to influence the outcome of the voting.

Dissenting shareholders will not have withdrawal rights as a result of the approval of the Transaction, as the Transaction does not reduce the economic rights of shareholders and, therefore, is not within the scope of article 137 of Brazilian Corporate Law.

Transaction Context

The Company is effectively at the legal limit of the preferred shares it can issue, which is fixed at 50% of the Company’s total shares. If the Company issues preferred shares in excess of this limit, the Controlling Shareholder will be obligated to purchase an equal number of common shares. As a result, the Company’s capacity to raise equity capital necessarily depends on the Controlling Shareholder.

Any significant purchase of common shares by a third party other than the Controlling Shareholder is subject to approval by the National Civil Aviation Agency (Agência Nacional de Aviação Civil) and to restrictions imposed by the Brazilian Aeronautical Code (Código Brasileiro de Aeronáutica). In particular, common shares may not in practice be listed or traded on a stock exchange, given legal restrictions on the ownership and transfer of voting shares by foreign investors.

Description of the Transaction

Increase in economic rights of preferred shares and split of common shares

Each preferred share will be entitled to 35 times the dividends received per common share, as well as 35 times the price paid per common share in public tender offers and tag-along tender offers. The economic rights of the preferred shares will be similarly increased in the case of capital reductions or liquidation. Additionally, any conversion of common shares into preferred shares will be at a ratio of 35 to one.

Simultaneously with the increase in economic rights of preferred shares, each common share will be split into 35 common shares. As a result, GOL’s capital stock will be comprised of the same number of preferred shares currently outstanding and 35 times the number of common shares currently outstanding.

The increase in economic rights of preferred shares along with the split of common shares will not affect, in practice, the current dividends and other economic rights of each shareholder.

Corporate governance improvements

The Company’s corporate governance may be improved, depending on a change in the percentage of economic interest of the Controlling Shareholder in the Company:

(1) Seats on the Board of Directors for representatives of preferred shareholders;

(2) Separate voting for the preferred shares in an extraordinary meeting of preferred shareholders as a condition for the approval of certain matters;

(3) Increased independent director membership on the Board of Directors of the Company; and

(4) Creation via a charter amendment of a permanent Audit Committee, and a Governance Committee with increased responsibilities.

Controlling Shareholder Lock-Up

The Controlling Shareholder will be subject to certain lock-up restrictions on the sale of currently owned common and preferred shares, as follows:

30% Tender Offer

If a person acquires an interest representing 30% of the Company’s economic rights (except for the current Controlling Shareholder in certain cases), the acquirer will be obligated to launch a public tender offer for any and all outstanding shares, at the highest price paid by such shareholder in the preceding twelve months.

Preservation of Preferred Shareholder Rights

To preserve current preferred shareholder’s rights, the Transaction contemplates the addition to the Company’s Bylaws of a provision that will grant preferred shareholders, based only on their economic interests, certain rights that are generally provided under Brazilian corporate

law only as a result of the ownership of a percentage of the Company’s total number of shares. This provision ensures that the Transaction will not limit or eliminate any of the Company’s preferred shareholders’ governance rights.

The above Bylaws amendments may only be changed upon the prior approval by preferred shareholders in order to further align the interests of the Controlling Shareholder and all other shareholders of the Company.

Other Information

More detailed information on the Transaction, the Shareholders’ Meeting and the proposed amendments to the Bylaws will be available when the Shareholders’ Meeting is convened. A draft of the Bylaws showing the changes proposed in the Transaction, a Q&A and further information on the Transaction are available on the Company’s website: www.voegol.com.br/ir. The Company will also hold a conference call to present the Transaction.

ABOUT GOL LINHAS AÉREAS INTELIGENTES S.A.

GOL Linhas Aéreas Inteligentes S.A. (BMF&BOVESPA: GOLL4 and NYSE: GOL), the largest low-cost and best-fare airline in Latin America, offers around 910 daily flights to 69 destinations, 15 international, in South America, the Caribbean and the United States, using a young, modern fleet of Boeing 737-700 and 737-800 Next Generation aircraft, the safest, most efficient and most economical of their type. The SMILES loyalty program allows members to accumulate miles and redeem tickets to more than 700 locations around the world via flights with foreign partner airlines. The Company also operates Gollog, a logistics service which retrieves and delivers cargo and packages to and from more than 3,500 cities in Brazil and six abroad. With its portfolio of innovative products and services, GOL Linhas Aéreas Inteligentes offers the best cost-benefit ratio in the market.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: January 21, 2015

|

GOL LINHAS AÉREAS INTELIGENTES S.A. |

|

| |

|

|

| By: |

/S/ Edmar Prado Lopes Neto |

|

| |

|

|

| |

Name: Edmar Prado Lopes Neto |

|

| |

Title: Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

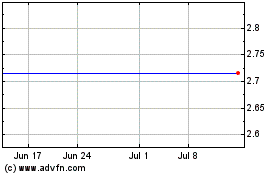

Gol Linhas Aereas Inteli... (NYSE:GOL)

Historical Stock Chart

From Mar 2024 to Apr 2024

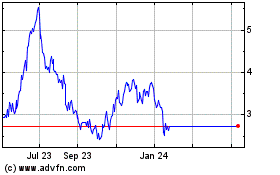

Gol Linhas Aereas Inteli... (NYSE:GOL)

Historical Stock Chart

From Apr 2023 to Apr 2024