Report of Foreign Issuer (6-k)

January 14 2015 - 10:11AM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16 of

the Securities Exchange Act of 1934

|

For the month of: January, 2015 |

Commission File Number: 1-12384 |

SUNCOR ENERGY INC.

(Name of registrant)

150 – 6th Avenue S.W.

P.O. Box 2844

Calgary, Alberta

Canada, T2P 3E3

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

SUNCOR ENERGY INC. |

|

|

|

|

|

|

|

Date: |

By: |

|

|

|

|

|

|

|

January 13, 2015 |

|

|

“Shawn Poirier” |

|

|

|

|

Shawn Poirier

Assistant Corporate

Secretary |

EXHIBIT INDEX

|

Exhibit |

|

Description of Exhibit |

|

|

|

|

|

99.1 |

|

News Release dated January 13, 2015, Suncor Energy announces acceleration of spending reductions in response to lower crude price environment |

EXHIBIT 99.1

News Release dated January 13, 2015, Suncor Energy announces acceleration of spending reductions in response to lower crude price environment

|

|

News Release |

|

|

|

FOR IMMEDIATE RELEASE

Suncor accelerates spending reductions in response to lower crude price environment

Calgary, Alberta (Jan. 13, 2015) – Suncor Energy Inc. announced today significant spending reductions to its 2015 budget in response to the current lower crude price environment. The cuts include a $1 billion decrease in the company’s capital spending program, as well as sustainable operating expense reductions of $600 million to $800 million to be phased in over two years offsetting inflation and growth.

“Our integrated model and strong balance sheet have positioned us well for the price downturn,” said Steve Williams, president and chief executive officer. “Cost management has been an ongoing focus, with successful efforts to reduce both capital and operating costs well underway before the decline in oil prices. However, in today’s low crude price environment, it’s essential we accelerate this work. Today’s spending reductions are consistent with our commitment to spend within our means and maintain a strong balance sheet. We will monitor the pricing environment and take further action as required.”

Suncor is implementing a number of initiatives to achieve the cost reduction targets. These include deferral of some capital projects that have not yet been sanctioned, such as MacKay River 2 and the White Rose Extension, as well as reductions to discretionary spending. Budgets affecting the company’s safety, reliability and environmental performance have been specifically excluded from the cost reduction program.

Suncor has also implemented a series of workforce initiatives that will reduce total workforce numbers in 2015 by approximately 1000 people, primarily through its contract workforce, in addition to reducing employee positions. There will also be an overall hiring freeze for roles that are not critical to operations and safety.

Major projects in construction such as Fort Hills and Hebron will move forward as planned and take full advantage of the current economic environment. These are long-term growth projects that are expected to provide strong returns when they come online in late 2017.

Suncor has issued an update to its 2015 guidance to reflect, among other items, reduced spending and lower pricing and related assumptions. Production guidance for 2015 has not changed.

Suncor’s fundamental goals remain the same, with operational excellence, capital discipline and profitable growth remaining key to its business strategy. In fact, today’s announcement reflects the application of these principles, in the context of the current low price environment.

“The strategic decisions we’ve made are consistent with our unwavering focus on capital discipline and operational excellence,” said Williams. “We will continue to carefully manage our spending priorities: sustaining safe, reliable and environmentally responsible operations, providing a meaningful, competitive dividend for our shareholders and investing in profitable growth.”

For further detail on Suncor’s outlook and capital spending plan, see suncor.com/guidance.

|

|

Suncor Energy

150 6 Avenue S.W. Calgary, Alberta T2P 3E3

suncor.com |

Legal Advisory – Forward-Looking Information

This news release contains certain forward-looking information and forward-looking statements (collectively referred to herein as “forward-looking statements”) within the meaning of applicable Canadian and U.S. securities laws. Forward-looking statements are based on Suncor’s current expectations, estimates, projections and assumptions that were made by the company in light of information available at the time the statement was made and consider Suncor’s experience and its perception of historical trends, including expectations and assumptions concerning: the accuracy of reserves and resources estimates; commodity prices and interest and foreign exchange rates; capital efficiencies and cost savings; applicable royalty rates and tax laws; future production rates; the sufficiency of budgeted capital expenditures in carrying out planned activities; the availability and cost of labour and services; and the receipt, in a timely manner, of regulatory and third-party approvals. In addition, all other statements and information about Suncor’s strategy for growth, expected and future expenditures or investment decisions, commodity prices, costs, schedules, production volumes, operating and financial results and the expected impact of future commitments are forward-looking statements.

Forward-looking statements in this news release include references to: Suncor’s anticipated significant capital spending reductions to its 2015 budget in response to the current lower crude price environment, which includes a $1 billion decrease in the company’s capital spending program, as well as sustainable and operating expense reductions of $600 to $800 million to be phased in over two years offsetting inflation and growth; Suncor’s commitment to spend within its means and maintain a strong balance sheet; the expectation that Suncor will monitor the pricing environment and take further action as required; expectations around workforce initiatives; the expectation that major projects in construction such as Fort Hills and Hebron will move forward as planned and take full advantage of the current economic environment, and that they are expected to provide strong returns when they come online in late 2017; Suncor’s fundamental goals; Suncor’s commitment to carefully manage its spending priorities, provide a meaningful, competitive and sustainable dividend and invest in profitable growth.

Forward-looking statements and information are not guarantees of future performance and involve a number of risks and uncertainties, some that are similar to other oil and gas companies and some that are unique to Suncor. Suncor’s actual results may differ materially from those expressed or implied by its forward-looking statements, so readers are cautioned not to place undue reliance on them.

Additional risks, uncertainties and other factors that could influence the financial and operating performance of all of Suncor’s operating segments and activities include, but are not limited to, changes in general economic, market and business conditions, such as commodity prices, interest rates and currency exchange rates; fluctuations in supply and demand for Suncor’s products; the successful and timely implementation of capital projects, including growth projects and regulatory projects; competitive actions of other companies, including increased competition from other oil and gas companies or from companies that provide alternative sources of energy; labour and material shortages; actions by government authorities, including the imposition or reassessment of taxes or changes to fees and royalties, such as the Notices of Reassessment (NORs) received by Suncor from the Canada Revenue Agency, Ontario and Quebec relating to the settlement of certain derivative contracts, including the risk that: (i) Suncor may not be able to successfully defend its original filing position and ultimately be required to pay increased taxes, interest and penalty as a result, and (ii) Suncor may be required to post cash instead of security in relation to the NORs, and changes in environmental and other regulations; the ability and willingness of parties with whom we have material relationships to perform their obligations to us; outages to third-party infrastructure that could cause disruptions to production; the occurrence of unexpected events such as fires, equipment failures and other similar events affecting Suncor or other parties whose operations or assets directly or indirectly affect Suncor; the potential for security breaches of Suncor’s information systems by computer hackers or cyberterrorists, and the unavailability or failure of such systems to perform as anticipated as a result of such breaches; our ability to find new oil and gas reserves that can be developed economically; the accuracy of Suncor’s reserves, resources and future production estimates; market instability affecting Suncor’s ability to borrow in the capital debt markets at acceptable rates; maintaining an optimal debt to cash flow ratio; the success of the company’s risk management activities using derivatives and other financial instruments; the cost of compliance with current and future environmental laws; and the accuracy of cost estimates, some of which are provided at the conceptual or other preliminary stage of projects and prior to commencement or conception of the detailed engineering that is needed to reduce the margin of error and increase the level of accuracy. The foregoing important factors are not exhaustive.

Suncor’s MD&A and Suncor’s Annual Information Form, Form 40-F and Annual Report to Shareholders, each dated February 28, 2014, and other documents it files from time to time with securities regulatory authorities describe the risks, uncertainties, material assumptions and other factors that could influence actual results and such factors are incorporated herein by reference. Copies of these documents are available without charge from Suncor at 150 6th Avenue S.W., Calgary, Alberta T2P 3E3, by calling 1-800-558-9071, or by email request to info@suncor.com or by referring to the company’s profile on SEDAR at sedar.com or EDGAR at sec.gov. Except as required by applicable securities laws, Suncor disclaims any intention or obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

– 30 –

For more information about Suncor Energy visit our web site at suncor.com, follow us on Twitter @SuncorEnergy, read our blog, OSQAR or come and See what Yes can do.

|

Investor inquiries: |

Media inquiries: |

|

800-558-9071 |

403-296-4000 |

|

invest@suncor.com |

media@suncor.com |

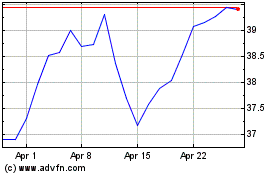

Suncor Energy (NYSE:SU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Suncor Energy (NYSE:SU)

Historical Stock Chart

From Apr 2023 to Apr 2024