SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of December, 2014

Commission File Number 1-15106

PETRÓLEO BRASILEIRO S.A. - PETROBRAS

(Exact name of registrant as specified in its charter)

Brazilian Petroleum Corporation - PETROBRAS

(Translation of Registrant's name into English)

Avenida República do Chile, 65

20031-912 - Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Third Quarter 2014 Condensed Information

Rio de Janeiro, December 12, 2014 – Petróleo Brasileiro S.A. – Petrobras announces that today, in light of new facts that occurred after November 13, 2014, directly or indirectly related to the “Lava Jato Operation”, it decided not to file its consolidated interim financial statements for the 3rd quarter 2014 not reviewed by the independent auditors. These facts are set out below:

| (i) |

Obtained a waiver for its earliest financial reporting covenants that allows the Company to release its interim financial statements for the 3rd quarter 2014 by January 31, 2015, with no risk of acceleration of its finance debt by its creditors; |

| (ii) |

On November 21, 2014, Petrobras received a subpoena from the U.S. Securities and Exchange Commission (SEC) requesting certain documents relating to an investigation of the Company by the SEC; |

| (iii) |

On December 3, 2014, Petrobras gained access to the depositions of Mr. Julio Gerin de Almeida Camargo (Grupo Toyo) and Mr. Augusto Ribeiro de Mendonça Neto (Grupo Setal) given as state’s evidence to prosecutors; |

| (iv) |

On December 9, 2014, the Company was served with a class-action complaint filed by Mr. Peter Kaltman before the U.S. Court (United States District Court, Southern District of New York). We expect additional complaints to be filed, which could potentially be consolidated with Kaltman’s complaint; |

| (v) |

On November 11, 2014, criminal charges were filed by the Brazilian Public Prosecutor’s Office against several individuals, including the Former Director of Downstream, Paulo Roberto Costa, and managers of other companies for active corruption, passive corruption, organized crime, money-laundering and falsification of documents. |

However, in order to comply with its responsibility to inform and to foster diligence and transparency the Company is releasing information regarding its operational performance and certain other financial information that Petrobras believes would not be affected by the potential adjustments to its financial statements resulting from the “Lava Jato Operation”. This information has not been reviewed by our independent auditors.

|

Amounts in millions of Reais (R$) |

|

|

|

|

|

|

Jan - Sep |

|

|

3Q-2014 |

2Q-2014 |

3Q-14 X 2Q-14 (%) |

3Q-2013 |

|

2014 |

2013 |

2014 x 2013 (%) |

|

|

|

|

|

|

|

|

|

|

88,378 |

82,298 |

7 |

77,700 |

Sales Revenues |

252,221 |

223,862 |

13 |

|

62,409 |

58,140 |

7 |

39,350 |

Cash and Cash Equivalents |

62,409 |

39,350 |

59 |

|

2,746 |

2,600 |

6 |

2,522 |

Total crude oil and natural gas production (Mbbl/day) |

2,627 |

2,542 |

3 |

|

261,445 |

241,349 |

8 |

192,987 |

Net debt |

261,445 |

192,987 |

35 |

|

4,249 |

(2,625) |

− |

(5,232) |

Free cash flow |

(9,154) |

(12,820) |

− |

|

70,259 |

66,363 |

6 |

57,879 |

Adjusted Cash and Cash Equivalents |

70,259 |

57,879 |

21 |

|

229,723 |

217,725 |

6 |

229,078 |

Market capitalization (Parent Company) |

229,723 |

229,078 |

− |

|

|

|

|

|

|

|

|

|

Sales Revenues reached R$ 88,378 million and Cash and Cash Equivalents reached R$ 62,409 million in the 3Q-2014.

Sales revenues were 7% higher when compared to the 2Q-2014, resulting from higher crude oil exports and increased domestic demand, mainly diesel, which was mostly met by domestic output of oil products. When compared to Jan-Sep/2013, the 13% increase in sales revenues is attributable to higher oil product prices in the domestic market resulting from the impact in the full year of 2014 of diesel and gasoline price adjustments in 2013 and the impact of foreign currency depreciation (8%) over the price of oil products that are adjusted to reflect international prices and export prices, as well as higher electricity and natural gas prices. Domestic demand for

oil products increased by 3%, mainly diesel (2%), gasoline (5%) and fuel oil (21%), and crude oil exports volume was 12% higher, partially offset by a decrease in fuel oil exports volume (14%).

1

Our Executive Officers recently approved the implementation of a series of actions that will be undertaken in order to maintain our cash level, which was R$ 62.4 billion as of September 30, 2014, and the liquidity of the Company. These actions include, for example, discounting receivables, reducing the level of capital expenditures, reviewing product pricing strategies and reducing operating costs in activities that were out of the scope of our structuring cost reduction programs; and assure positive free cash flow next year, considering crude oil prices of around U.S.$ 70/bbl and foreign exchange rate of R$ 2.60/U.S.$; thus eliminating the need for additional financing in the capital markets next year.

2

OPERATIONAL HIGHLIGHTS

|

|

|

|

|

|

Jan-Sep |

|

3Q-2014 |

2Q-2014 |

3Q14 X 2Q14 (%) |

3Q-2013 |

Domestic production (Mbbl/day) |

2014 |

2013 |

2014 x 2013 (%) |

|

|

|

|

|

|

|

|

|

|

2,090 |

1,972 |

6 |

1,924 |

Crude oil and NGLs |

1,995 |

1,922 |

4 |

|

441 |

411 |

7 |

390 |

Natural gas |

418 |

392 |

7 |

|

2,531 |

2,383 |

6 |

2,314 |

Total |

2,413 |

2,314 |

4 |

|

|

|

|

|

|

|

|

|

|

(3Q-2014 x 2Q-2014): The 6% increase in crude oil and NGL production is attributable to the ramp-up of P-55 (Roncador), P-62 (Roncador), P-58 (Parque das Baleias) and FPSO Cidade de Paraty (Lula NE), along with the start-up of the extended well test of Iara Oeste and of the Anticipated Production System of Tartaruga Verde.

Natural gas production increased by 7% due to a higher production in P-53 (Marlim Leste), P-54 (Roncador), P-55 (Roncador), P-62 (Roncador), P-58 (Parque das Baleias), FPSOs Cidade de Santos (Uruguá-Tambaú) and Cidade de Paraty (Lula NE).

|

|

(Jan-Sep/2014 x Jan-Sep/2013): Crude oil and NGL production increased by 4% in Jan-Sep/2014 resulting from the start-up of Stationary Production Units P-63 (Papa-Terra), P-55 (Roncador), P-62 (Roncador) and P-58 (Parque das Baleias) and from the ramp-up of FPSO Cidade de Itajaí (Baúna), Cidade de Paraty (Lula NE) and Cidade de São Paulo (Sapinhoá). The natural decline of fields partially offset these effects.

The 7% increase in natural gas production is attributable to a higher production in Mexilhão, Parque das Baleias, Uruguá-Tambaú, Sapinhoá and Lula Nordeste fields.

|

|

|

|

|

|

|

Jan - Sep |

|

|

3Q-2014 |

2T-2014 |

3Q14 X 2T14 (%) |

3Q-2013 |

Sales volumes – Thousand barrels/day |

2014 |

2013 |

2014 x 2013 (%) |

|

|

|

|

|

|

|

|

|

|

1,049 |

999 |

5 |

1,031 |

Diesel |

998 |

977 |

2 |

|

616 |

619 |

− |

587 |

Gasoline |

612 |

583 |

5 |

|

126 |

114 |

11 |

71 |

Fuel oil |

117 |

97 |

21 |

|

160 |

162 |

(1) |

172 |

Naphtha |

167 |

174 |

(4) |

|

247 |

237 |

4 |

243 |

LPG |

235 |

230 |

2 |

|

110 |

108 |

2 |

108 |

Jet fuel |

110 |

105 |

5 |

|

225 |

204 |

10 |

210 |

Others |

210 |

203 |

3 |

|

2,533 |

2,443 |

4 |

2,422 |

Total oil products |

2,449 |

2,369 |

3 |

|

98 |

88 |

11 |

95 |

Ethanol, nitrogen fertilizers, renewables and other products |

94 |

86 |

9 |

|

449 |

451 |

− |

392 |

Natural gas |

442 |

415 |

7 |

|

3,080 |

2,982 |

3 |

2,909 |

Total domestic market |

2,985 |

2,870 |

4 |

|

496 |

309 |

61 |

402 |

Exports |

392 |

392 |

− |

|

567 |

598 |

(5) |

505 |

International sales |

574 |

498 |

15 |

|

1,063 |

907 |

17 |

907 |

Total international market |

966 |

890 |

9 |

|

4,143 |

3,889 |

7 |

3,816 |

Total |

3,951 |

3,760 |

5 |

|

|

|

|

|

|

|

|

|

|

(3Q-2014 x 2Q-2014): Our domestic sales volumes increased by 3% when compared to the 2Q-2014, primarily resulting from:

· Diesel (a 5% increase) – due to seasonal demand to support summer grain seeding and industrial activity, as well as higher consumption by thermoelectric plants;

· Fuel oil (an 11% increase) – due to higher consumption by thermoelectric plants; and

· LPG (a 4% increase) – due to the lower average temperatures and higher economic activity. |

|

(Jan-Sep/2014 x Jan-Sep/2013): Our domestic sales volumes increased by 4% in Jan-Sep/2014 when compared to Jan-Sep/2013, primarily resulting from:

· Diesel (a 2% increase) – due to higher consumption by infrastructure construction work and an increase in the Brazilian diesel-fueled light vehicle fleet (vans, pick-ups and SUVs);

· Gasoline (a 5% increase) – due to an increase in the automotive fleet attributable to the competitive advantage of gasoline prices relatively to ethanol prices in most Brazilian states and to a higher household consumption. An increase in the anhydrous ethanol mandatory content in Type C gasoline from 20% to 25% partially offset these effects; and

· Fuel oil (a 21% increase) – higher demand by ancillary thermoelectric plants in several Brazilian states when compared to Jan-Sep/2013. |

3

OPERATIONAL HIGHLIGHTS

|

|

|

|

|

|

Jan-Sep |

|

3Q-2014 |

2Q-2014 |

3Q14 X 2Q14 (%) |

3Q-2013 |

Imports and Exports of Crude Oil and Oil Products (Mbbl/day) |

2014 |

2013 |

2014 x 2013 (%) |

|

|

|

|

|

|

|

|

|

|

303 |

534 |

(43) |

334 |

Crude oil imports |

399 |

421 |

(5) |

|

410 |

407 |

1 |

493 |

Oil product imports |

414 |

377 |

10 |

|

713 |

941 |

(24) |

827 |

Imports of crude oil and oil products |

813 |

798 |

2 |

|

323 |

138 |

134 |

206 |

Crude oil exports |

219 |

195 |

12 |

|

168 |

170 |

(1) |

196 |

Oil product exports |

170 |

195 |

(13) |

|

491 |

308 |

59 |

402 |

Exports of crude oil and oil products |

389 |

390 |

− |

|

(222) |

(633) |

65 |

(425) |

Exports (imports) net of crude oil and oil products |

(424) |

(408) |

(4) |

|

5 |

1 |

− |

− |

Other exports |

3 |

2 |

50 |

|

|

|

|

|

|

|

|

|

|

(3Q-2014 x 2Q-2014): Crude oil exports were higher, due to an increase in crude oil production and to the realization of exports that were in transit on June 30.

The decrease in crude oil imports is attributable to the higher import volume in the 2Q-2014 attributable to economic signals of trading opportunities. |

|

(Jan-Sep/2014 x Jan-Sep/2013): Crude oil exports and refining throughput were higher, resulting from an increase in crude oil production, which helped reduce crude oil imports.

Oil product imports were higher and oil product exports were lower in Jan-Sep/2014 when compared to Jan-Sep/2013 to meet an increase in domestic demand.

|

|

|

|

|

|

|

Jan-Sep |

|

3Q-2014 |

2Q-2014 |

3Q14 X 2Q14 (%) |

3Q-2013 |

Refining Operations (Mbbl/day) |

2014 |

2013 |

2014 x 2013 (%) |

|

|

|

|

|

|

|

|

|

|

2,204 |

2,180 |

1 |

2,128 |

Output of oil products |

2,170 |

2,131 |

2 |

|

2,102 |

2,102 |

− |

2,102 |

Reference feedstock |

2,102 |

2,102 |

− |

|

100 |

98 |

2 |

96 |

Refining plants utilization factor (%) |

98 |

97 |

1 |

|

2,094 |

2,064 |

1 |

2,027 |

Feedstock processed (crude oil) - Brazil |

2,059 |

2,041 |

1 |

|

2,138 |

2,101 |

2 |

2,072 |

Feedstock processed (crude oil and NGL) - Brazil |

2,099 |

2,086 |

1 |

|

80 |

82 |

(2) |

82 |

Domestic crude oil as % of total feedstock processed |

82 |

81 |

1 |

|

|

|

|

|

|

|

|

|

|

(3Q-2014 x 2Q-2014): Daily feedstock processed increased by 2% due to lower maintenance stoppages in the 3Q-2014. |

|

(Jan-Sep/2014 x Jan-Sep/2013): Daily feedstock processed was 1% higher in Jan-Sep/2014 when compared to Jan-Sep/2013, resulting from a sustainable improvement of the performance of our refineries. The 2% increase in our output of oil products is attributable to the higher conversion of intermediate products.

|

4

OPERATIONAL HIGHLIGHTS

|

|

|

|

|

|

Jan-Sep |

|

3Q-2014 |

2Q-2014 |

3Q14 X 2Q14 (%) |

3Q-2013 |

Physical and Financial Indicators – Gas & Power |

2014 |

2013 |

2014 x 2013 (%) |

|

|

|

|

|

|

|

|

|

|

1,196 |

1,157 |

3 |

1,873 |

Electricity sales (Free Contracting Environment - ACL) - average MW |

1,201 |

2,026 |

(41) |

|

2,671 |

2,453 |

9 |

1,798 |

Electricity sales (Regulated contracting environment - ACR) - average MW |

2,341 |

1,798 |

30 |

|

4,789 |

4,690 |

2 |

3,483 |

Electricity Generation - average MW |

4,534 |

4,359 |

4 |

|

671 |

649 |

3 |

180 |

Spot Prices (difference settlement price) - R$/MWh |

657 |

252 |

161 |

|

116 |

150 |

(23) |

84 |

Imports of LNG (Mbbl/day) |

128 |

102 |

25 |

|

210 |

205 |

2 |

197 |

Imports of natural gas (Mbbl/day) |

206 |

197 |

5 |

|

|

|

|

|

|

|

|

|

|

(3Q-2014 x 2Q-2014): Electricity sales volumes were 3% higher in the Free Contracting Environment – ACL due to seasonal long-term agreements and to higher sales volumes in the spot market.

Electricity sales volumes were 9% higher in the Regulated Contracting Environment – ACR due to the full impact of the 574 average MW sold in the A0/2014 electricity auction, which was delivered as from May 2014.

The 2% increase in electricity generation is attributable to higher thermoelectric demand in August, setting a monthly record level for 2014, compared to a lower level in June, resulting from higher rainfall levels in the Southern region of Brazil.

The 23% decrease in LNG imports was due to a higher supply of domestic natural gas attributable to an increase in natural gas production.

The 2% increase in natural gas imports from Bolivia was due to higher thermoelectric demand. |

|

(Jan-Sep/2014 x Jan-Sep/2013): Electricity sales volumes were 41% lower in Jan-Sep/2014 when compared to Jan-Sep/2013 resulting from the shift of a portion of our available capacity (574 average MW) towards the regulated contracting environment in the domestic market (Regulated Contracting Environment – ACR). The termination of our lease agreement for UTE Araucária, which reduced the availability of electricity for trading (349 average MW) and the lower demand in the spot market, attributable to higher spot prices, also reduced our sales volumes.

Electricity generation was 4% higher and spot prices increased by 161% due to lower rainfall levels in the period.

LNG imports and natural gas imports from Bolivia were 25% and 5% higher, respectively, to meet a higher thermoelectric demand. |

5

FINANCIAL HIGHLIGHTS

Main Items and Consolidated Economic Indicators

|

In millions of Reais (R$) |

|

|

|

|

|

|

Jan - Sep |

|

|

3Q-2014 |

2Q-2014 |

3Q14 X 2Q14 (%) |

3Q-2013 |

|

2014 |

2013 |

2014 x 2013 (%) |

|

|

|

|

|

|

|

|

|

|

88,378 |

82,298 |

7 |

77,700 |

Sales Revenues |

252,221 |

223,862 |

13 |

|

|

|

|

|

Sales Revenues by business area |

|

|

|

|

39,763 |

39,290 |

1 |

39,495 |

· E&P |

118,625 |

107,450 |

10 |

|

69,131 |

64,950 |

6 |

61,129 |

· RTM |

198,227 |

176,309 |

12 |

|

10,566 |

10,372 |

2 |

7,087 |

· Gas & Power |

30,491 |

23,160 |

32 |

|

179 |

142 |

26 |

198 |

· Biofuels |

436 |

655 |

(33) |

|

25,436 |

23,872 |

7 |

21,266 |

· Distribution |

72,807 |

63,245 |

15 |

|

8,182 |

8,672 |

(6) |

8,472 |

· International |

25,175 |

25,926 |

(3) |

|

|

|

|

|

|

|

|

|

|

101.85 |

109.63 |

(7) |

110.37 |

Brent crude (US$/bbl) |

106.57 |

108.45 |

(2) |

|

2.27 |

2.23 |

2 |

2.29 |

U.S. dollar average commercial selling rate (R$) |

2.29 |

2.12 |

8 |

|

2.45 |

2.20 |

11 |

2.23 |

U.S. dollar period-end commercial selling rate (R$) |

2.45 |

2.23 |

10 |

|

11.3 |

(2.7) |

− |

0.6 |

U.S. dollar period-end commercial selling rate variation (%) |

4.6 |

9.1 |

− |

|

10.90 |

10.89 |

− |

8.51 |

Selic interest rate - average (%) |

10.74 |

7.74 |

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average price indicators |

|

|

|

|

224.52 |

225.36 |

− |

210.00 |

Domestic basic oil products price (R$/bbl) |

225.74 |

207.04 |

9 |

|

|

|

|

|

Sales price - Brazil |

|

|

|

|

90.73 |

99.02 |

(8) |

98.87 |

. Crude oil (U.S. dollars/bbl) |

95.77 |

98.64 |

(3) |

|

49.28 |

49.58 |

(1) |

46.35 |

. Natural gas (U.S. dollars/bbl) |

48.76 |

48.51 |

1 |

|

|

|

|

|

Sales price - International |

|

|

|

|

84.05 |

87.91 |

(4) |

85.97 |

. Crude oil (U.S. dollars/bbl) |

85.46 |

90.65 |

(6) |

|

19.16 |

20.36 |

(6) |

18.38 |

. Natural gas (U.S. dollars/bbl) |

20.83 |

20.88 |

− |

|

|

|

|

|

|

|

|

|

6

Consolidated finance debt

|

|

R$ million |

|

|

|

|

|

|

|

09.30.2014 |

12.31.2013 |

Δ% |

|

|

|

|

|

|

Current debt |

28,243 |

18,782 |

50 |

|

Non-current debt |

303,461 |

249,038 |

22 |

|

Total |

331,704 |

267,820 |

24 |

|

Cash and cash equivalents |

62,409 |

37,172 |

68 |

|

Government securities (maturity of more than 90 days) |

7,850 |

9,085 |

(14) |

|

Adjusted cash and cash equivalents |

70,259 |

46,257 |

52 |

|

Net debt |

261,445 |

221,563 |

18 |

|

|

U.S.$ million |

|

|

|

|

|

|

|

09.30.2014 |

12.31.2013 |

Δ% |

|

|

|

|

|

|

Current debt |

11,523 |

8,017 |

44 |

|

Non-current debt |

123,811 |

106,308 |

16 |

|

Total |

135,334 |

114,325 |

18 |

|

Net debt |

106,668 |

94,579 |

13 |

|

|

R$ million |

|

|

|

|

|

|

|

09.30.2014 |

12.31.2013 |

Δ% |

|

Summarized information on financing |

|

|

|

|

Floating rate debt |

169,554 |

138,463 |

22 |

|

Fixed rate debt |

161,947 |

129,148 |

25 |

|

Total |

331,501 |

267,611 |

24 |

|

By Currency |

|

|

|

|

Reais |

63,087 |

53,465 |

18 |

|

US Dollars |

233,616 |

191,572 |

22 |

|

Euro |

24,599 |

14,987 |

64 |

|

Other currencies |

10,199 |

7,587 |

34 |

|

Total |

331,501 |

267,611 |

24 |

|

By Period |

|

|

|

|

2014 |

13,293 |

18,744 |

(29) |

|

2015 |

19,390 |

17,017 |

14 |

|

2016 |

31,421 |

29,731 |

6 |

|

2017 |

29,792 |

20,331 |

47 |

|

2018 |

45,017 |

37,598 |

20 |

|

2019 and thereafter |

192,588 |

144,190 |

34 |

|

Total |

331,501 |

267,611 |

24 |

|

|

|

|

|

Our consolidated net debt in Reais increased by 18% as of September 30, 2014, when compared to December 31, 2013, resulting from additional long-term financing and from the impact of the 4.6% depreciation of the Real against the U.S. dollar. Net debt includes finance lease obligations of R$ 203 million as of September 30, 2014, and R$ 209 million as of December 31, 2013.

7

Measures to improve corporate governance and internal controls

The Company has undertaken the following initiatives to improve its corporate governance system:

- on November 25, 2014 the Board of Directors approved the creation of the position of Executive Director of Governance, Risk and Compliance, replacing the position of Executive Director of the International business area, with the aim of supporting the Company’s compliance programs and to mitigate risks in its activities, including fraud and corruption. The new Director will serve a three-year term and will only be removed if determined by the Board of Directors, with quorum including the vote of at least one Board Member elected by the minority or by the preferred shareholders. Before being presented to the Executive Board, matters regarding corporate governance, risk management and compliance shall be approved by the new Director. The Board of Directors will appoint the new Director from a list of three professionals, previously selected by an executive search firm. By the end of January, the new Director will have been appointed and will be undertaking its duties;

- the development and implementation, between 2012 and 2014, of 66 measures to improve corporate governance, risk management and control, which are documented in standards and minutes of management meetings that establish procedures, methods, responsibilities and other guidelines to integrate such measures into the Company’s practices;

- implemented changes in Company management as a result of the findings from the Internal Investigative Committees due to failures to comply with internal policies. It is important to note that the Company has not dismissed any personnel, because the reports from the Internal Investigative Committees have not yet provided evidence of fraudulent intent, bad faith or receipt of improper advantages with respect to the employees named therein.

The Company continues to assess the effectiveness of internal controls over financial reporting mainly considering the conclusions reached thus far by the Internal Investigative Committees, and any necessary changes to its control environment will be implemented.

8

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

PETRÓLEO BRASILEIRO S.A--PETROBRAS |

|

|

|

|

By: |

/S/ Almir Guilherme Barbassa

|

|

| |

Almir Guilherme Barbassa

Chief Financial Officer and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended (Exchange Act) that are not based on historical facts and are not assurances of future results. These forward-looking statements are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results o f operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

All forward-looking statements are expressly qualified in their entirety by this cautionary statement, and you should not place reliance on any forward-looking statement contained in this press release. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

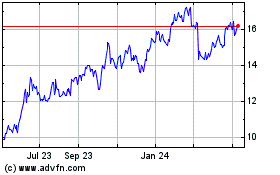

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

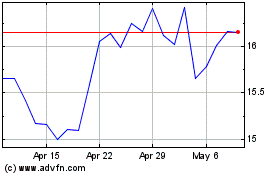

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Apr 2023 to Apr 2024