Report of Foreign Issuer (6-k)

December 12 2014 - 6:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6 - K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

|

For the month of December 2014

|

Commission File Number 001-33159

|

AERCAP HOLDINGS N.V.

(Translation of Registrant’s Name into English)

Stationsplein 965, 1117 CE Schiphol Airport, The Netherlands, +31-20-655-9655

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Other Events

On December 10, 2014, AerCap Holdings N.V. issued a press release announcing that it has completed an amendment and upsize of its revolving warehouse facility. A copy of the press release is attached hereto as Exhibit 99.1.

The information contained in this Form 6-K is incorporated by reference into the Company’s Form F-3 Registration Statement File No. 333-177659 and Form S-8 Registration Statements File Nos. 333-180323, 333-154416, 333-165839, 333-194637 and 333-194638, and related Prospectuses, as such Registration Statements and Prospectuses may be amended from time to time.

Exhibits

99.1 AerCap Holdings N.V. Press Release.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

AERCAP HOLDINGS N.V.

|

|

| |

|

|

|

|

|

By:

|

/s/ Aengus Kelly |

|

| |

|

Name: |

Aengus Kelly |

|

| |

|

Title: |

Authorized Signatory

|

|

| |

|

|

|

EXHIBIT INDEX

99.1 AerCap Holdings N.V. Press Release.

Exhibit 99.1

AerCap Announces Amendment and Increase of Revolving Debt Facility to $2.2 Billion

Amsterdam, The Netherlands; December 10, 2014 - AerCap Holdings N.V. (“AerCap”, NYSE: AER) today announced that it has completed an amendment and upsize of its revolving warehouse facility.

The non-recourse facility, which was originally put in place in 2006, has been amended to increase the transaction size from $1.6 billion to $2.2 billion and to allow for an additional three year revolving period with a two year term-out period, extending the transaction to December 2019.

Credit Suisse acted as lead arranger and structuring agent on the transaction. The facility, which currently finances 29 aircraft, continues to allow for the acquisition of a range of aircraft types, and provides AerCap committed financing and significant flexibility to purchase aircraft.

In addition to Credit Suisse, Bank of America Merrill Lynch, Morgan Stanley and ING Bank acted as joint lead arrangers on the transaction. RBC Capital Markets, RBS, Scotiabank, Natixis and Citi acted as co-arrangers. Fifth Third Bank and HSBC were documentation agents. Other lenders include BNP Paribas, Everbank Commercial Finance, Key Corporate Bank, and Siemens. Four new lenders joined the transaction.

Paul Rofe, Group Treasurer of AerCap said: “We are delighted with the successful extension and significant upsize of our warehouse transaction, which continues to be a hugely important facility for AerCap. We appreciate the support from our banking partners in bringing about this strong result.”

The total amount of financing transactions completed in 2014 by AerCap is now $12 billion.

About AerCap

AerCap is the global leader in aircraft leasing with 1,300 owned and managed aircraft in its current fleet and a highly attractive portfolio of 400 high-demand, fuel-efficient aircraft on order. AerCap serves over 200 customers in 90 countries with comprehensive fleet solutions. AerCap is listed on the New York Stock Exchange (AER) and has its headquarters in Amsterdam with offices in Los Angeles, Shannon, Dublin, Fort Lauderdale, Singapore, Shanghai, Abu Dhabi, Seattle and Toulouse.

__________________________________________________________________

This press release may contain forward-looking statements that involve risks and uncertainties. In most cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of such terms or similar terminology. Such forward-looking statements are not guarantees of future performance and involve significant assumptions, risks and uncertainties, and actual results may differ materially from those in the forward-looking statements.

|

For Media:

Frauke Oberdieck

Tel. +31 20 655 9616

foberdieck@aercap.com

|

For Investors:

John Wikoff

Tel. +31 6 3169 9430

jwikoff@aercap.com

|

www.aercap.com

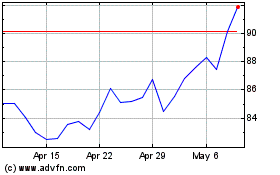

Aercap Holdings NV (NYSE:AER)

Historical Stock Chart

From Mar 2024 to Apr 2024

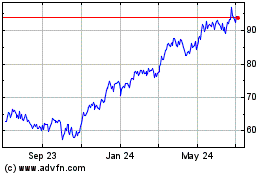

Aercap Holdings NV (NYSE:AER)

Historical Stock Chart

From Apr 2023 to Apr 2024