SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2014

TRINITY

BIOTECH PLC

(Name of Registrant)

IDA Business

Park

Bray, Co. Wicklow

Ireland

(Address of

Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if

the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No

x

If “Yes” is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): 82-

Press Release dated October 23, 2014

|

|

|

|

|

| Contact: |

|

Trinity Biotech plc |

|

Lytham Partners LLC |

|

|

Kevin Tansley |

|

Joe Diaz, Joe Dorame & Robert Blum |

|

|

(353)-1-2769800 |

|

602-889-9700 |

|

|

E-mail: kevin.tansley@trinitybiotech.com |

|

|

Trinity Biotech announces Quarter 3 Financial Results

and temporary suspension of Meritas Troponin trials

DUBLIN, Ireland (October 23, 2014)…. Trinity Biotech plc (Nasdaq: TRIB), a leading developer and manufacturer of diagnostic products for the

point-of-care and clinical laboratory markets, today announced results for the quarter ended September 30, 2014. In addition, it announced that it was temporarily suspending its FDA trials for its Meritas Troponin test.

Quarter 3 Results

Total revenues for Q3, 2014 were

$27.2m which compares to $24.1m in Q3, 2013, an increase of 12.6%.

Point-of-Care revenues for Q3, 2014 increased by 2.8% when compared to Q3, 2013. This

increase was attributable to growth in HIV revenues in the USA.

Clinical Laboratory revenues increased from $18.8m to $21.7m, which represents an

increase of 15.4% compared to Q3, 2013. This increase was primarily attributable to continued growth in the Premier business plus the impact of acquisitions.

Revenues for Q3, 2014 were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2013

Quarter 3 |

|

|

2014

Quarter 3 |

|

|

Increase |

|

| |

|

US$’000 |

|

|

US$’000 |

|

|

% |

|

| Point-of-Care |

|

|

5,315 |

|

|

|

5,463 |

|

|

|

2.8 |

% |

| Clinical Laboratory |

|

|

18,806 |

|

|

|

21,698 |

|

|

|

15.4 |

% |

| Total |

|

|

24,121 |

|

|

|

27,161 |

|

|

|

12.6 |

% |

Gross profit for Q3, 2014 amounted to $13.0m representing a gross margin of 47.9%, which is lower than the 49.7% achieved in

Q3, 2013. This decrease is mainly due to the impact of lower margins on the higher level of Premier instrument sales coupled with a lower level of higher margin Lyme revenues. It was also impacted by final closure costs in relation to the blood bank

screening manufacturing facilities in the United Kingdom. These costs included building restitution, disposal of hazardous waste and transport costs for production equipment and inventories.

Research and Development expenses have increased to $1.1m from $0.9m when compared to the equivalent quarter last year. Meanwhile, Selling, General and

Administrative (SG&A) expenses have increased from $5.9m to $7.0m over the same period. This is partly due to the impact of the Immco acquisition which was made during Q3 last year plus additional sales and marketing costs associated with the

national roll-out of our new test for Sjögren’s syndrome in addition to Meritas related sales and marketing expenses.

Operating profit has decreased from $4.8m to $4.6m for the quarter. However, if UK related closure costs and

Meritas sales and marketing expenses are excluded, operating profit would have increased from $4.8m in Q3, 2013 to $5.0m this quarter.

Similar to Q2,

2014 financial income was broadly offset by financial expenses resulting in a negligible net expense for the quarter. This compares to net financial income of approximately $0.2m earned in Q3, 2013. This is due to lower funds being placed on deposit

following the utilisation of funds for acquisitions and lower prevailing deposit interest rates.

Profit before tax was $4.6m compared to $5.0m in the

equivalent period last year. The tax charge for Q3, 2014 was $0.3m which represents an effective tax rate of 6.0% compared to 10.2% in Q3, 2013.

Profit

after tax for the period was $4.4m which, after excluding the impact of UK and Meritas costs, equates to approximately $4.8m – an increase of 7% compared to Q3, 2013. Earnings per ADR were 19 cents for the quarter.

The abovementioned comparative numbers are before the impact of the once-off charges and related tax credits recognised in Q3, 2013.

Earnings before interest, tax, depreciation, amortisation and share option expense for the quarter was $6.2m.

Other Recent Developments

Cardiac Update

Today Trinity Biotech is announcing that it is temporarily suspending enrolment into its Troponin clinical trials. The reason for this temporary suspension is

that in the past number of days, the company became aware of increased scatter (higher CV’s) in whole blood data. Immediately, an investigation was initiated to determine the cause. The failure has now been positively identified as being

attributable to a format change in a chemical raw material which is purchased from a third party supplier. This change caused instability in the product’s performance, which only became apparent over a period of time.

The offending version of the chemical was first introduced into manufacturing during the week of July 14, 2014. All clinical trial sites which have

received batches of product manufactured since that date have been instructed to discontinue their use. Any clinical data generated using the impacted batches has now been identified and will be excluded from the clinical trial. Trial sites which

did not receive the problem batches continue to recruit patients, although these sites will run out of product shortly.

Meanwhile, having identified the

source of the problem, we have now manufactured a pilot batch of product using the original format of the chemical. This pilot batch demonstrates performance characteristics identical to product batches previously made and successfully used in our

CE marking trials and in the independent USA study presented at AACC last July. The supplier has now committed to supplying new batches of the chemical in its original format. This material will be received in four weeks time, upon which, new

batches of the Meritas Troponin product will be manufactured. The production cycle for the new batches will then take eight weeks to complete.

Enrolment to the trials will then recommence in mid-February, 2015. The clinical trials will be conducted at

multiple US hospital sites during the months of February, March, April and May. Data compilation and cardiologist adjudication will be completed during the months of June and July and it is anticipated that a final submission will be made in August,

2015. We confidently believe that the product will receive FDA clearance thereafter.

Premier Sales

Sales of Trinity’s diabetes instrument, Premier, continued to perform strongly during Q3 when 120 instruments were sold or placed with customers. This

compares to 106 in Q2, 2014 and 81 in Q3, 2013. Whilst all markets performed well, Brazil was exceptionally strong with 41 instruments being placed during the quarter.

On a cumulative basis, sales of Premier instruments for the year to date are 327 which is 43% higher than the 228 instruments sold in the same period last

year. Management remains confident of meeting its target of 460 instruments for the year as a whole.

Immco Update

One of the principal rationales underpinning the Immco acquisition was its access to its own reference laboratory in Buffalo. As well as the extensive range of

autoimmune testing being carried out in the facility, it was also identified as an ideal platform for launching laboratory-developed tests in the autoimmune field. The first such test to be launched is for Sjögren’s syndrome, a very

prevalent though widely under-diagnosed debilitating condition, of which dry eye is one of the primary symptoms. This test is being sold under the name Sjö™ and marketed in conjunction with our partner, Nicox, a French-based ophthalmic

specialist. Following a successful partial launch in a number of test markets earlier this year, it received its nationwide launch late in June, 2014 thus making Q3, 2014 effectively the first full quarter of sales. To date the test has been well

received in the market and revenues to date have been exceeding expectations.

Comments

Commenting on the results, Kevin Tansley, Chief Financial Officer, said “Profits this quarter were $4.4m which equates to an EPS of 19 cents. These

profits were impacted by two principal factors. Firstly, we closed two manufacturing facilities in the UK associated with our blood bank screening business at the end of July. As a direct result, we incurred premises restitution fees, transportation

costs for production equipment and inventories as well as disposal costs for hazardous and other unusable production materials. Secondly, we recorded an increase in sales and marketing expenses as we continue to build up our sales and marketing

function for Meritas and incur expenses for our new test for Sjögren’s syndrome which has recently been fully launched on a nationwide basis in the USA. The impact of these factors during the quarter was approximately $0.4m, which if they

were to be excluded would have resulted in profits of $4.8m and EPS of 21 cents”.

Ronan O’Caoimh, CEO of Trinity said “From an operations

point of view we had a very solid quarter. We shipped a record number of Premier instruments (120) this quarter and remain on course to meet our target of 460 units for 2014. We closed our two blood bank screening facilities in the UK and

transferred production to our other facilities in Jamestown, New York and Bray, Ireland on schedule. We will benefit from the resultant operating efficiencies from next quarter onwards. Meanwhile, in conjunction with our partner, Nicox, we have now

rolled-out our test for Sjögren’s syndrome nationwide in the USA. Prior to this, it had only been sold in a limited number of test markets and already revenues are exceeding expectations.

While we are disappointed at the temporary suspension of our Troponin trials, the positive is that we caught the

problem early, identified the source of the problem and fixed it. The trials will recommence in mid-February and we will submit to the FDA in August, 2015. At the point-of-care, our product has unrivalled precision and unrivalled time-zero high

sensitivity (with attaching very high specificity) – thereby giving the product great clinical utility”.

Litigation Reform Act of 1995.

Investors are cautioned that such forward-looking statements involve risks and uncertainties including, but not limited to, the results of research and development efforts, the effect of regulation by the United States Food and Drug Administration

and other agencies, the impact of competitive products, product development commercialisation and technological difficulties, and other risks detailed in the Company’s periodic reports filed with the Securities and Exchange Commission.

Trinity Biotech develops, acquires, manufactures and markets diagnostic systems, including both reagents and instrumentation, for the point-of-care and

clinical laboratory segments of the diagnostic market. The products are used to detect infectious diseases and to quantify the level of Haemoglobin A1c and other chemistry parameters in serum, plasma and whole blood. Trinity Biotech sells direct in

the United States, Germany, France and the U.K. and through a network of international distributors and strategic partners in over 75 countries worldwide. For further information please see the Company’s website: www.trinitybiotech.com.

Trinity Biotech plc

Consolidated Income Statements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (US$000’s except share data) |

|

Three Months

Ended

September 30,

2014

(unaudited) |

|

|

Three Months

Ended

September 30,

2013

(unaudited) |

|

|

Nine Months

Ended

September 30,

2014

(unaudited) |

|

|

Nine Months

Ended

September 30,

2013

(unaudited) |

|

| Revenues |

|

|

27,161 |

|

|

|

24,121 |

|

|

|

78,191 |

|

|

|

65,761 |

|

| Cost of sales |

|

|

(14,150 |

) |

|

|

(12,143 |

) |

|

|

(40,510 |

) |

|

|

(33,169 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

13,011 |

|

|

|

11,978 |

|

|

|

37,681 |

|

|

|

32,592 |

|

| Gross profit % |

|

|

47.9 |

% |

|

|

49.7 |

% |

|

|

48.2 |

% |

|

|

49.6 |

% |

| Other operating income |

|

|

91 |

|

|

|

90 |

|

|

|

339 |

|

|

|

285 |

|

| Research & development expenses |

|

|

(1,138 |

) |

|

|

(876 |

) |

|

|

(3,329 |

) |

|

|

(2,655 |

) |

| Selling, general and administrative expenses |

|

|

(6,995 |

) |

|

|

(5,885 |

) |

|

|

(19,726 |

) |

|

|

(16,420 |

) |

| Indirect share based payments |

|

|

(326 |

) |

|

|

(519 |

) |

|

|

(1,223 |

) |

|

|

(1,457 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating profit |

|

|

4,643 |

|

|

|

4,788 |

|

|

|

13,742 |

|

|

|

12,345 |

|

| Financial income |

|

|

9 |

|

|

|

226 |

|

|

|

93 |

|

|

|

1,169 |

|

| Financial expenses |

|

|

(15 |

) |

|

|

(23 |

) |

|

|

(79 |

) |

|

|

(75 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net financing income |

|

|

(6 |

) |

|

|

203 |

|

|

|

14 |

|

|

|

1,094 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit before tax |

|

|

4,637 |

|

|

|

4,991 |

|

|

|

13,756 |

|

|

|

13,439 |

|

| Income tax expense |

|

|

(276 |

) |

|

|

(509 |

) |

|

|

(667 |

) |

|

|

(961 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit for the period before once off charges |

|

|

4,361 |

|

|

|

4,482 |

|

|

|

13,089 |

|

|

|

12,478 |

|

| Once off charges

Tax credit on once off charges |

|

|

—

— |

|

|

|

(8,187

716 |

)

|

|

|

—

— |

|

|

|

(8,187

716 |

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit/(loss) for the period after once off charges |

|

|

4,361 |

|

|

|

(2,989 |

) |

|

|

13,089 |

|

|

|

5,007 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per ADR (US cents) |

|

|

19.0 |

|

|

|

(13.6 |

) |

|

|

57.7 |

|

|

|

22.9 |

|

| Diluted earnings per ADR (US cents) |

|

|

18.4 |

|

|

|

(12.8 |

) |

|

|

55.2 |

|

|

|

21.8 |

|

| Earnings per ADR excluding once off charges (US cents) |

|

|

19.0 |

|

|

|

20.4 |

|

|

|

57.7 |

|

|

|

57.2 |

|

| Diluted earnings per ADR excluding once off charges (US cents) |

|

|

18.4 |

|

|

|

19.2 |

|

|

|

55.2 |

|

|

|

54.2 |

|

| Weighted average no. of ADRs used in computing basic earnings per ADR |

|

|

22,907,333 |

|

|

|

22,012,412 |

|

|

|

22,693,552 |

|

|

|

21,827,150 |

|

| Weighted average no. of ADRs used in computing diluted earnings per ADR |

|

|

23,674,859 |

|

|

|

23,369,678 |

|

|

|

23,719,930 |

|

|

|

23,007,085 |

|

The above financial statements have been prepared in accordance with the principles of International Financial Reporting

Standards and the Company’s accounting policies but do not constitute an interim financial report as defined in IAS 34 (Interim Financial Reporting).

Trinity Biotech plc

Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

September 30,

2014 US$ ‘000

(unaudited) |

|

|

June 30,

2014 US$ ‘000

(unaudited) |

|

|

March 31,

2014 US$ ‘000

(unaudited) |

|

|

Dec 31,

2013 US$ ‘000

(audited) |

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-current assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Property, plant and equipment |

|

|

15,782 |

|

|

|

14,784 |

|

|

|

13,841 |

|

|

|

12,991 |

|

| Goodwill and intangible assets |

|

|

141,815 |

|

|

|

137,848 |

|

|

|

133,881 |

|

|

|

128,547 |

|

| Deferred tax assets |

|

|

10,066 |

|

|

|

9,082 |

|

|

|

7,570 |

|

|

|

7,044 |

|

| Other assets |

|

|

1,276 |

|

|

|

1,222 |

|

|

|

1,131 |

|

|

|

1,162 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total non-current assets |

|

|

168,939 |

|

|

|

162,936 |

|

|

|

156,423 |

|

|

|

149,744 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Inventories |

|

|

33,779 |

|

|

|

33,109 |

|

|

|

30,864 |

|

|

|

29,670 |

|

| Trade and other receivables |

|

|

25,190 |

|

|

|

27,163 |

|

|

|

24,130 |

|

|

|

24,268 |

|

| Income tax receivable |

|

|

139 |

|

|

|

88 |

|

|

|

493 |

|

|

|

487 |

|

| Cash and cash equivalents |

|

|

8,949 |

|

|

|

15,153 |

|

|

|

17,008 |

|

|

|

22,317 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

68,057 |

|

|

|

75,513 |

|

|

|

72,495 |

|

|

|

76,742 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL ASSETS |

|

|

236,996 |

|

|

|

238,449 |

|

|

|

228,918 |

|

|

|

226,486 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EQUITY AND LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity attributable to the equity holders of the parent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share capital |

|

|

1,203 |

|

|

|

1,202 |

|

|

|

1,187 |

|

|

|

1,170 |

|

| Share premium |

|

|

12,295 |

|

|

|

12,097 |

|

|

|

9,731 |

|

|

|

8,842 |

|

| Accumulated surplus |

|

|

178,960 |

|

|

|

179,137 |

|

|

|

174,023 |

|

|

|

168,670 |

|

| Other reserves |

|

|

2,321 |

|

|

|

3,672 |

|

|

|

4,073 |

|

|

|

4,329 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total equity |

|

|

194,779 |

|

|

|

196,108 |

|

|

|

189,014 |

|

|

|

183,011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax payable |

|

|

555 |

|

|

|

1,036 |

|

|

|

998 |

|

|

|

770 |

|

| Trade and other payables |

|

|

15,151 |

|

|

|

16,106 |

|

|

|

15,679 |

|

|

|

20,131 |

|

| Provisions |

|

|

75 |

|

|

|

75 |

|

|

|

75 |

|

|

|

75 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

15,781 |

|

|

|

17,217 |

|

|

|

16,752 |

|

|

|

20,976 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other payables |

|

|

4,676 |

|

|

|

4,665 |

|

|

|

4,634 |

|

|

|

4,596 |

|

| Deferred tax liabilities |

|

|

21,760 |

|

|

|

20,459 |

|

|

|

18,518 |

|

|

|

17,903 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total non-current liabilities |

|

|

26,436 |

|

|

|

25,124 |

|

|

|

23,152 |

|

|

|

22,499 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES |

|

|

42,217 |

|

|

|

42,341 |

|

|

|

39,904 |

|

|

|

43,475 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL EQUITY AND LIABILITIES |

|

|

236,996 |

|

|

|

238,449 |

|

|

|

228,918 |

|

|

|

226,486 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The above financial statements have been prepared in accordance with the principles of International Financial Reporting

Standards and the Company’s accounting policies but do not constitute an interim financial report as defined in IAS 34 (Interim Financial Reporting).

Trinity Biotech plc

Consolidated Statement of Cash Flows

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (US$000’s) |

|

Three Months

Ended

September 30,

2014

(unaudited) |

|

|

Three Months

Ended

September 30,

2013

(unaudited) |

|

|

Nine Months

Ended

September 30,

2014

(unaudited) |

|

|

Nine Months

Ended

September 30,

2013

(unaudited) |

|

| Cash and cash equivalents at beginning of period |

|

|

15,153 |

|

|

|

66,164 |

|

|

|

22,317 |

|

|

|

74,947 |

|

| Operating cash flows before changes in working capital |

|

|

6,068 |

|

|

|

5,823 |

|

|

|

16,979 |

|

|

|

15,887 |

|

| Changes in working capital |

|

|

(538 |

) |

|

|

(2,290 |

) |

|

|

(10,108 |

) |

|

|

(7,634 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash generated from operations |

|

|

5,530 |

|

|

|

3,533 |

|

|

|

6,871 |

|

|

|

8,253 |

|

| Net Interest and Income taxes received/(paid) |

|

|

(324 |

) |

|

|

(125 |

) |

|

|

290 |

|

|

|

673 |

|

| Capital Expenditure & Financing (net) |

|

|

(6,380 |

) |

|

|

(4,641 |

) |

|

|

(15,499 |

) |

|

|

(14,569 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Free cash flow |

|

|

(1,174 |

) |

|

|

(1,233 |

) |

|

|

(8,338 |

) |

|

|

(5,643 |

) |

| Cash paid to acquire Immco and Blood Bank Screening Business |

|

|

— |

|

|

|

(39,217 |

) |

|

|

— |

|

|

|

(39,217 |

) |

| Net cash acquired on acquisition |

|

|

— |

|

|

|

1,092 |

|

|

|

— |

|

|

|

1,092 |

|

| Dividend payment |

|

|

(5,030 |

) |

|

|

— |

|

|

|

(5,030 |

) |

|

|

(4,373 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of period |

|

|

8,949 |

|

|

|

26,806 |

|

|

|

8,949 |

|

|

|

26,806 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The above financial statements have been prepared in accordance with the principles of International Financial Reporting

Standards and the Company’s accounting policies but do not constitute an interim financial report as defined in IAS 34 (Interim Financial Reporting).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

| TRINITY BIOTECH PLC |

| (Registrant) |

|

|

| By: |

|

/s/ Kevin Tansley |

|

|

Kevin Tansley |

|

|

Chief Financial Officer |

Date: October 23, 2014.

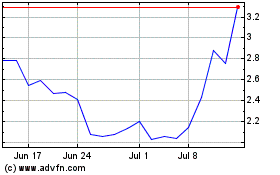

Trinity Biotech (NASDAQ:TRIB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trinity Biotech (NASDAQ:TRIB)

Historical Stock Chart

From Apr 2023 to Apr 2024